Disclaimer: One of us owns this stock.

2020 has been a TOUGH year. I always thought I wouldn’t like a pandemic and it turns out I was right. There’s a lot of pain to go around, but not everyone is hurting.

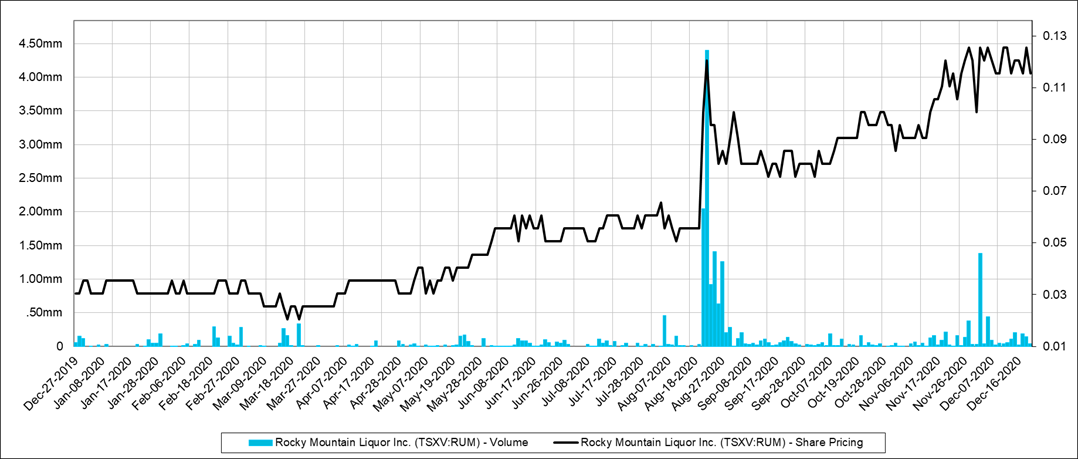

Does society drink more when you lock everyone at home? The research is in. The answer is yes. This Alberta-based liquor store chain has seen sales up and its stock go up four times this year. Is this just a COVID bump and rally or is there something else happening here? One of us argues it could still be as dirt cheap as a $9 rosé but without the awful hangover.

Rocky Mountain Liquor (TSX Venture) is the parent to a wholly owned subsidiary, Andersons Liquor Inc. (“Andersons”), acquired through a reverse takeover (“RTO”) in 2008. Before we get into the Company though, lets cover off the industry.

Quick Background: Alberta Booze 101

All of their stores are in Alberta and it’s important to understand the nuances of the liquor laws in the province. Alberta, the Texas of the north, has an independence get-outa-my-way-gubment mindset - sometimes. So, in 1993, Alberta became the first Canadian province to privatize liquor retailing. According to the government, “this created an open and competitive market, giving businesses the opportunity to thrive. As a result, Albertans continue to enjoy competitive prices and great product selection.” Freedom to do what you want the way you want. Sort of.

The thing is, the “AGLC [Alberta Gaming Liquor and Cannabis] controls the importation, manufacture, sale, possession, storage, distribution, and use of liquor in Alberta. We establish and enforce liquor policies. We also license businesses in which liquor is sold or consumed.” They set prices and every liquor store pays the same price regardless of volume to have a level playing field. You’re free to do what you want so long as you buy from me. AGLC site/background here - https://aglc.ca/liquor/about-liquor-alberta

Now this sounds like there are no benefits to scale, and technically there aren’t. However, the companies that do have an advantage are those that have the capital to buy large volumes of products when they go on sale and also run efficiently and buy the right stock. The AGLC/their suppliers run promotions on products and give everyone advanced notice. A smart buying well capitalized chain can then take advantage of these sales to stock up.

Rocky Mountain Liquor: The Rise and Fall of the Store Count

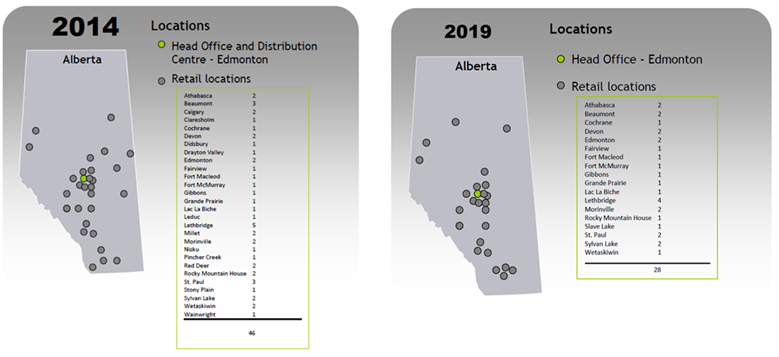

RML IPO’d and was growing stores year-over-year through to 2014. But then a few things changed…

There were two big changes. 1) A tough energy economy and 2) the growth of the grocery store liquor store (Like Costco - The liquor store where you buy a couple jugs of whiskey at a time and don’t feel weird about it). In response, RML started to close and sell off smaller stores in very competitive areas and rebrand most of their larger stores as Great Canadian Liquor. Small stores remain general stores and the larger ones focus on higher volume lower margin business.

[2016 annual report] “We have identified a number of target stores and are currently developing and implementing a plan to offset current economic challenges and the effects of competitive pressures we have been facing. We are undertaking store renovations, new pricing strategies and a branding culture, designed to address changes in consumer buying preferences. Five locations are near completion and are scheduled for grand opening in May 2017. We are planning to transition up to five additional locations during this fiscal year. While our main focus is on the new initiatives, we are continuing to evaluate new greenfield and acquisition opportunities. We also plan to continue to sell stores in markets that are not compatible with our current business plans, ensuring the most effective use of our capital. We expect this approach will be sustainable in the long term with economy improvement and increased consumer spending.”

[2017] “For the fourth quarter of 2017, operating and administrative expenses as a percent of sales reduced from 23.2% to 21.7%. We expect it to continue to decrease as more stores are rebranded to GCL. Rebranding includes store renovations, changes in labour planning to achieve a balance between costs and customer experience, competitive pricing strategies, and establishing a consistent brand message that appeals to our existing customers and is attractive to new customers. As part of the strategy, the Company has launched a new website and digital advertising platform to support the introduction of the brand. Stores not compatible with our current business plan may be offered for sale, ensuring the most effective use of our capital.”

“The Company has focused on locations largely outside of the major urban centers (Edmonton and Calgary) and on specific sites with maximum traffic and minimal competition. In addition, the Company has integrated inventory and warehousing systems into its retail operations, allowing it to take advantage of procurement opportunities.”

And sell they did. They are now down to 26 vs 2019 (latest map is 2019).

The Results

This big reset has resulted in average sales per store increasing from ~$1.1MM to $1.5-1.7MM and operating margin growing along the way too (talk about Operating Leverage). They have also kept inventory moving along nicely, averaging much better than certain other public liquor store chains who shall be shamed by category and not by name.

Most tables are clickable for an expanded view.

“The increase to profitable income operations after adjustment for rent expenses for the 12-month period ending Dec 31, 2019 are a result of the strategic initiative that occurred during 2017 and 2018 to rebrand fifteen of its stores to Great Canadian Liquor (“GCL”) and from ongoing investments in related sales and marketing programs.”

Now returns on invested capital and TA assets have improved a bit, but ROE has improved a lot. On to part two…

Item Number Two: The Capital Structure Reset

Not only were they facing an operational reset, they were also dealing with a bit of a capital structure problem. They had senior bank debt but they also had a painful convertible debenture that was eating up $560,000 of cash flow. They fully converted this to equity in 2019 and, through the sales of stores, they also unlocked working capital and used it to pay down bank debt. This has pulled total debt down from ~$15MM to $6MM.

This summer they renegotiated their banking arrangement with TD, replacing their previous bank line with an operating line and amortizing term loan. Realistically, it seems that they were quite stretched in the mid-2010s and are now getting to a normal senior debt level.

An estimate of their actual liquidity is as follows:

Valuation

The most important question here at CVI is always what is it worth? Key to this story is sales and that massive operating leverage, and possibly the pandemic. Maybe those out there holding airline stocks (like this author) can use it as a hedge against COVID-19 not being solved overnight by vaccines? Time to go survey some CFAers on diversification…