What can you learn from Warren Buffet and friends over at Berkshire Hathaway on how to respond to a market panic? We’ll give you a hint - Focus More. Panic less.

How did Berkshire react to the downturn? (Lesson 1: Panic Less)

We always track BRK’s trades in their $250+ billion portfolio, which can be found in their 13-F filings. For those new to the game: 1) Berkshire Hathaway is required to disclose their trades in publicly listed stocks and 2) Trades consist of Warren Buffet, but also Ted Weschler and Todd Combs, who each run separate standalone portfolios. To know who is buying what can often be figured out, but we will leave that for another day.

Here’s the raw data (Note: these tables are through Q3 as Q4 isn’t available yet and won’t be for awhile, but reflects the full initial panic-period of COVID-19):

How does this compare to historical activity? Well, they’re active, but it really isn’t significantly different than previous years. Compare this to a lot of other active investors reacting to COVID-19 and it looks downright boring.

When you strip out trades related to existing positions (i.e., removing trades that are adding to an existing position or continuing to reduce an existing position) it is even lower, with the big BRK only trading stock in 27 net companies so far this year. It’s even less when you consider some trades can be grouped and be considered one trade, like Berkshire’s sale of the airlines were also bought as a group – We covered this back in 2018 http://www.canadianvalueinvestors.com/home/2018/6/4/investing-in-north-american-airlines-why-did-berkshire-hathaway-buy-airlines-anyway

Finally, keep in mind this is the trading activity of three separate money managers. Ted and Todd run their own separate portfolios while the OG Buffett makes the big-time decisions, like Berkshire’s $120 billion Apple inc. position.

Lesson Two: Focus More (Concentration is Key) – What does Buffett do all day anyway?

When we say focus, we don’t mean that you should invest in a zen-like meditative state. We mean that you should focus your investing into fewer concentrated positions (assuming you really do know what you’re doing). We’ll walk you through why.

“The strategy we’ve adopted precludes our following standard diversification dogma. Many pundits would therefore say the strategy must be riskier than that employed by more conventional investors. We disagree. We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it. In stating this opinion, we define risk, using dictionary terms, as “the possibility of loss or injury.” — Warren Buffett, 1993

Despite Berkshire Hathaway’s absolutely massive size, they run an extremely concentrated portfolio when you compare it to the average active fund, even a small fund. As shown in the chart below, their top ten positions typically account for 80% of the value of the entire portfolio. To contrast that with a “active fund”, we took a look at [SHAME BY CATEGORY] ~$10 billion Active ETF, and their top 10 holdings accounted for ~20% of the portfolio, and the next 10 were much less. The opposite approach of Berkshire – being extreme diversification, or closet index investing – is a great way to reduce volatility versus the market while collecting fees but doesn’t add any value. We’ll show you why.

Why run a concentrated portfolio?

You need to concentrate on your best ideas where you have an edge - If Warren Buffett is coming up with only a few a year (and a major one even less so), I think it is unlikely I will find significantly more. As Charlie Munger has said, “How could one man know enough [to] own a flowing portfolio of 150 securities and always outperform the averages? That would be a considerable stump.”

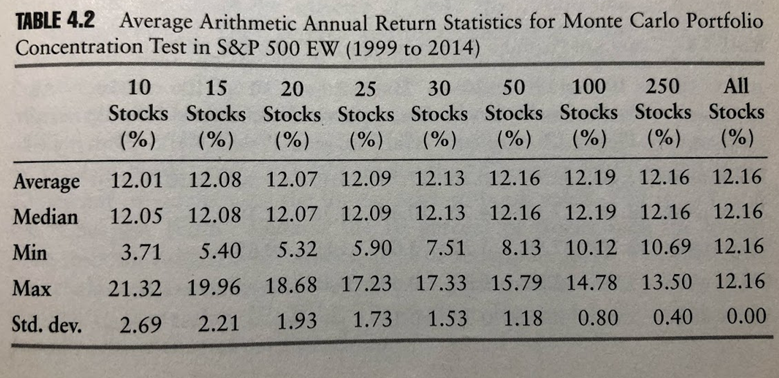

If you do not concentrate, it becomes statistically improbable, if not impossible, to outperform the market – We recommend you read Concentrated Investing, Strategies of the World’s Greatest Concentrated Investors. It has a lot of great stories of great investors (including Warren and Charlie), but the following two charts are key (apologies for the potato-image-from-paper-copy quality).

The lesson is clear – The more positions, the harder it is to outperform and quickly becomes statistically impossible. Of course, it means that you will have higher volatility versus the market, and a greater chance of blowing up. The key is to buy a few things you know extremely well.

“My own inquiries on that subject were just to assume that I could find a few things, say three, each which had a substantial statistical expectancy of outperforming averages without creating catastrophe. If I could find three of those, what were the chances my pending record wouldn’t be pretty damn good. I just sort of worked that out by iteration. That was my academic study – high school algebra and common sense… It would not be too much to say it was obvious to me that I could not have a big edge over everybody else and all securities. In other words, it was also obvious to me that if I worked at it, I would find a few things in which I had an unusual degree of competence.” – Charlie Munger

Indeed Charlie.

For more, check out our Value Investing 101 Page - http://www.canadianvalueinvestors.com/value-investing-101