Provided to subscribers Aug 17

Here’s the latest from Canadian Value Investors!

American Coastal Insurance Corporation – A hidden gem, or hiding in the eye of a hurricane?

Suncor Q2 update; Petrobras note

Other ideas from around the world

Michael Burry is shorting, but what is he buying?

Berkshire Q2 update and Buffett’s 44% CAGR

American Coastal – A hidden gem, or hiding in the eye of a hurricane?

Disclosure: We own this one.

Sohra Peak Capital Partners recently posted a pitch on American Coastal Insurance Corporation (NASDAQ: ACIC). What are your thoughts on investing in a growing insurance company focused on niche insurance for smaller multi-unit complexes with a great reputation and a very nice twenty-year track record? What if this was an insurance company that provides hurricane insurance in Florida and was a subsidiary of a recently bankrupt parent?

[ACIC] a commercial property & casualty insurance carrier in the state of Florida that exclusively insures garden-style condominium and homeowner association properties against hurricanes and other catastrophe risks. American Coastal is a gem of a business hiding in plain sight. Since its founding in 2007, American Coastal has dominated its niche and captured 40% of its TAM. It has also delivered an average ROE of 23.1%, has demonstrated exceptional loss and profitability ratios, and has never had an unprofitable year despite withstanding several major hurricanes.

Shares appear exceptionally undervalued based on our EPS estimates of $1.89-$2.86/share over FY24-29 vs. share price of $5.63. Our estimates imply a FY24E P/E of 2.9x, FY25E P/E of 1.9x, and a P/BV and P/TBV of <1x by mid-FY25 while delivering 53% ROE. From FY25 onward, with a healthy capital surplus, American Coastal should return 100% of its incremental net profits to shareholders, which would imply a ~50% dividend yield and/or significant share repurchases. We see an asymmetric path for to appreciate from $5.63 today to $16.00 $22.00 over the next 24-36 months.

It is one of the better reports we have come across. Here is the write up. https://t.co/zWkMGn97AN

Here is the post - https://twitter.com/JonCukierwar/status/1689225931636809729

A key part of the thesis is that competitors have been leaving the space, which should help maintain and even grow underwriting margins. Some competitors have indeed left (https://www.nbcmiami.com/responds/another-insurer-is-withdrawing-part-of-business-from-florida-what-happens-next/3070500/ ) while the Florida state-backed insurer (meant to be a last resort and primarily provides insurance to homes) is now the biggest (

https://www.bloomberg.com/news/articles/2023-08-10/hurricane-season-2023-florida-s-biggest-property-insurer-is-nonprofit-citizens ) and is trying to stop growing ( https://www.nbcmiami.com/news/local/floridas-largest-property-insurer-shifting-184000-homeowner-policies-from-citizens-to-private-insurers/3087706/ ).

We do not feel we have a lot to add beyond the write up and we do have a long position. If any readers have particular expertise in this niche, please reach out. Of course, as always, do your own due diligence.

Suncor Q2 Update

-FFO of ~$3B+ YTD on lower than today oil pricing is not so bad. YTD brent was $79.80, and every dollar higher is $180MM AFFO, so with spot at $87 or so it would be another $600MM YTD. Refining is doing great.

-CEO Richard Kruger’s comments on the “refocus” is appropriate to us. https://www.cbc.ca/news/canada/calgary/suncor-too-focused-on-energy-transition-rich-kruger-says-1.6937360 Suncor got a bit lost, and I am glad they divested their renewables businesses that they had absolutely no competitive advantage in. Per the transcript: “The lack of emphasis on today's business drivers and while important, we have a bit of a disproportionate emphasis on the longer term energy transition. Today, we win by creating value through our large integrated asset base underpinned by oil sands. Discussions have occurred with our board of directors who are supportive of our revised direction and tone. And I would just leave this with more to come, but you can expect a sharper, clearer, more tangible articulation of how Suncor plans to win.”

-Importantly, we think the transition efforts are going to be forced anyway via things like the Pathways Alliance. We are still viewing the transition costs as either being $5-6B of hidden debt or a few hundred million of hidden annual capex.

-Repurchases are fantastic. What a table. We understand them slowing down on the repurchases; debt providers are not friendly and we would assume debt capital will be continually less available (coal is the canary). We are not too worried about it as they might hit their $12B net debt target early next year, and then they will switch to 75% of surplus FCF to repurchases.

As for Petrobras

We are still more bullish on Petrobras; seems like a better risk/reward (we own both, but a bit more PBR than SU). Petrobras just announced a big gas/diesel price hike, which them not doing was one of the biggest things I was worried about. https://www.energyportal.eu/news/brazils-petrobras-hikes-fuel-prices-after-abrupt-global-spike/163566/ We are keeping close tabs on this one. The CEO noted the increase on Twitter and is implying that gas station owners are to blame for high prices!

Other ideas from around the world

We have no positions in these companies but are evaluating.

“Cigar butt za Price/Earnings 2x” - SigmaTron International Inc. NASDAQ:SGMA is a circuit board assembly company that has made it to our screens a few times but we never had a chance to look into trading at a very low P/E. But is all as it seems? Currently do not own. Current market cap of $141MM. Great write up here (we suggest Google translate) - https://jakubkriz.substack.com/p/sigmatron-international-inc-cigar

Housing shortage? Why not look at engineered wood products? Atlas Engineered Wood Products TSXV:AEP “There’s no doubt that Canada is currently in the midst of a housing supply crunch and Atlas Engineered Products would be there to capitalize on this opportunity. $AEP.V is an ambitious growth company focused on acquiring and operating well-established, profitable businesses in Canada's truss and engineered wood products industry. The company's strategy involves both consolidating the fragmented industry through acquisitions and pursuing organic growth and efficiency improvements.” https://thechopwoodcarrywater.substack.com/p/strong-future-in-canadas-wood-products

Speaking of homebuilding.

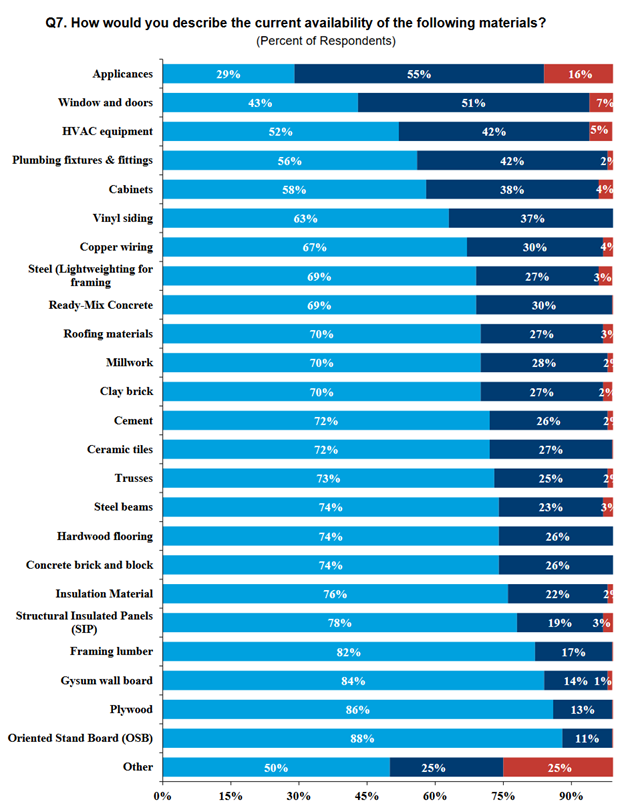

If you are interested in staying on top of the housing industry, we suggest keeping tabs on the National Association of Home Builders. Here’s the latest on availability of materials for example.

https://www.nahb.org/news-and-economics/housing-economics/indices/remodeling-market-index

Michael Burry is shorting, but what is he buying?

We saw the headlines about Michael B of The Big Short fame’s new bet on the market crashing - https://www.telegraph.co.uk/investing/shares/michael-burry-big-short-stock-market-crash-wall-street/

Mr Burry’s firm, Scion Asset Management, has bought $866m in “put options” against a fund that tracks the S&P 500, the American benchmark index. These give investors the right to sell shares at a fixed price in the future and means that he could make a profit if shares fall.

Bearish news, of course, but the real story is more nuanced. He also went long bulk shippers and a whole of other things like WBD. With indexes dominated by a few very high multiple companies (see “The problem with the S&P” https://www.canadianvalueinvestors.com/cvi-club-ideas/2023/7/9/2023-mid-year-portfolio-update ), going short the index and long companies you believe are undervalued is a neat approach.

Berkshire Q2 update and Buffett's 44% CAGR

Here are the latest purchases at Berkshire in Q2. The Japan trade is amazingly timed and well done.

It brings to mind this article from Base Hit Investing we came across. https://basehitinvesting.substack.com/p/buffetts-44-cagr-and-various-types

“I've noticed three common themes with Buffett's recent investments in energy and Japan: low valuations, improving capital allocation, and rising ROIC's.

Warren Buffett initially invested in 5 Japanese stocks in 2020 and I don't think many people realize how successful this investment has been so far: That initial basket investment is up over 200%: a 3x in 3 years, or 44% CAGR on that initial investment. Each stock is up over 2x, one is up 5x, and the basket in aggregate up 3x.”

I see three things that Buffett probably saw (among other things) in Japan and also in energy:

1. Cheap valuations

2. Rising ROIC's

3. Significant change in capital allocation policies

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one here guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).