Here’s is the latest from Canadian Value Investors!

Portfolio Update – Current Holds

The problem with the S&P

Astrotech special situation recap with links to filings

Want an oil royalty? Check out North European Royalty Trust

Interesting reads from around the web – Brazilian laser hair removal, Lebanese robbing their own banks, and more

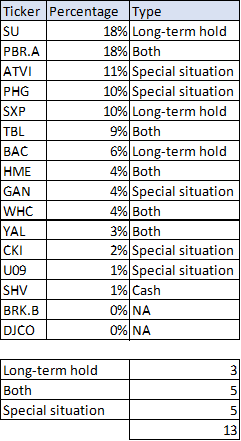

We have had a few emails asking about what our portfolio looks like today, and here it is. We note that we find ourselves in a bit of an odd spot and asking ourselves existential questions like what are long-term holds anyway?

The majority of our positions are true special situations (CKI, GAN; waiting for buyouts) or a bit of both, like Taiga Building Products, which could in theory stay in the portfolio awhile. Even Suncor is something that we are very price sensitive about and could be quick to sell if the right price came along.

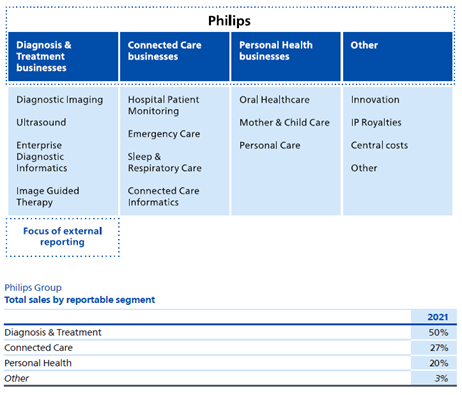

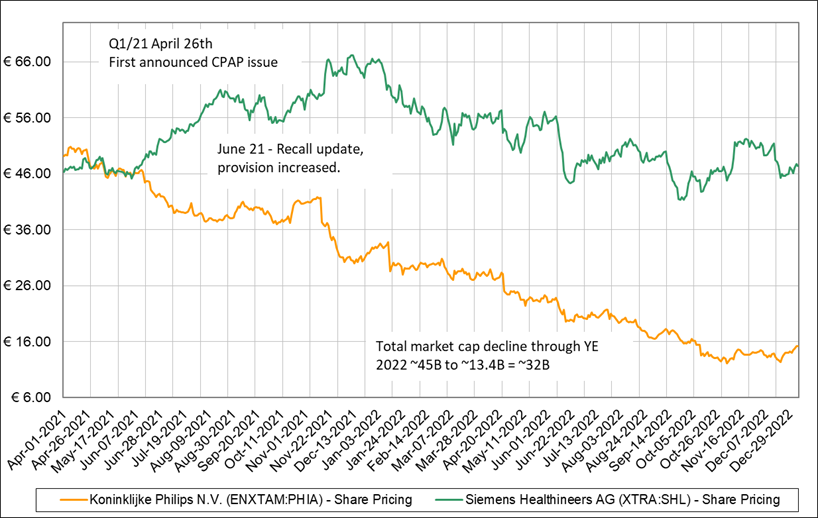

Some ideas – like ATVI and PHG – were meant to be short-term plays. ATVI’s accumulation of cash and strong underlying business performance since the Microsoft offer (and subsequent potential failure) has made this interesting. PHG is up 40%, but is now too early to sell while the recalls and operations stabilize? Hmm.

So, this means that our portfolio could turn over in a short period of time, or very little. This, in turn, has made allocating capital among ideas at this moment particularly difficult.

We also have one company we working on taking a position in and will disclose later due to its low trading volume.

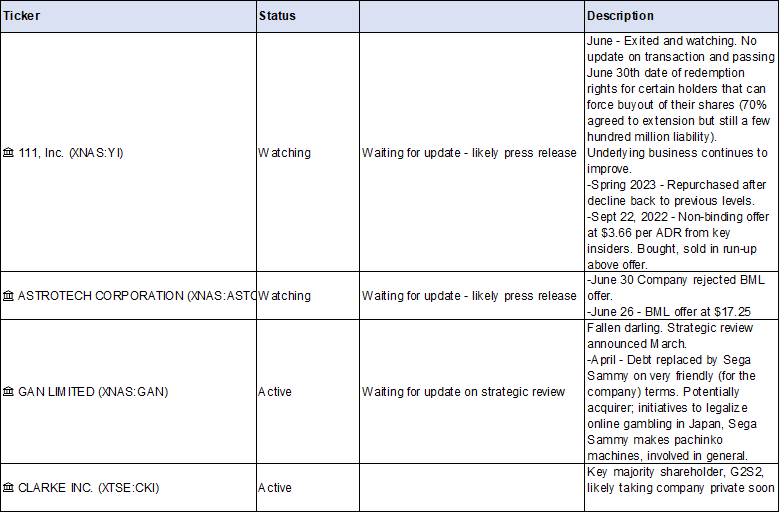

Here’s a high-level summary of the more active special situations.

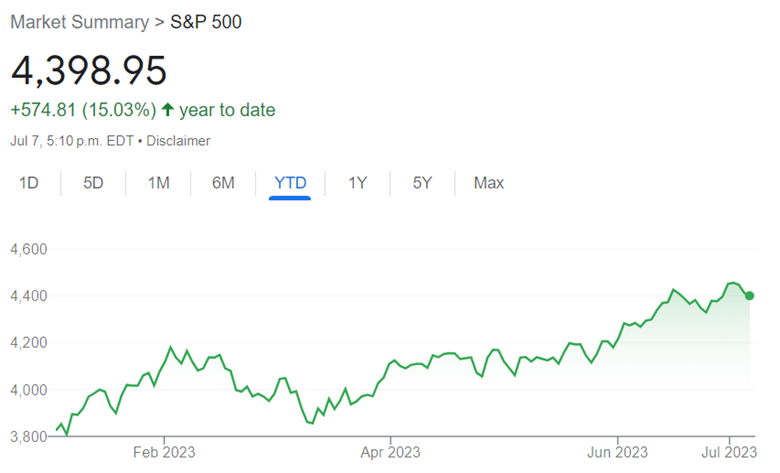

The problem with the S&P

The S&P had a fantastic start to the year, up approximately 15% YTD. However, only a few companies at (or now at) high multiples are driving the run.

Big Tech is largely fueling the S&P 500's positive performance in 2023, with investors buying just seven stocks and selling pretty much everything else.

Those seven stocks — Apple Inc., Alphabet Inc., Meta Platforms Inc. Microsoft Corp., NVIDIA Corp., Amazon.com Inc. and Tesla Inc. — have seen significant gains after a bleak 2022, and the collective gains have kept the S&P 500 in positive territory in 2023, with the overall index rising about 7% since the start of the year. Without these seven stocks, which make up nearly 26% of the large-cap index's total weight, the S&P 500 would be down 0.8% on the year, through May 16.

The S&P index is market cap weighted, causing these companies to have an outsized impact on returns, more so going forward if they keep running up. In fact, if you take an equal-weighted approach, like the Invesco S&P 500 equal-weighted ETF, your return would be closer to 5%. We do wonder if it is time for the approach to “best practice” low cost index investing to be reviewed, but this is a problem we will leave for others to solve.

Astrotech special situation recap with links to filings

Disclosure: We do not currently own this but are watching.

And here is an example of the problem with intrenched management. This might still come to something; we are not sure what BML’s play is here, and the company’s stock offering really was cancelled. We will wait on the sidelines.

Company prospectus https://www.sec.gov/Archives/edgar/data/1001907/000143774923017741/astc20230614_424b5.htm

BML Offer - https://www.sec.gov/Archives/edgar/data/1001907/000156761923006436/doc1.htm

Company rejection https://www.sec.gov/ix?doc=/Archives/edgar/data/1001907/000143774923019047/astc20230629_8k.htm

Want an oil royalty? Check out North European Royalty Trust

We have been looking at purchasing oil and gas royalties on the side, but have not been able to close on a deal. We continue to find better opportunities in the market and you also benefit from liquidity. North European Royalty is a fun comparable we have been using. We wrote about this back in September of 2022 (see archives), but did not and have never purchased. We continue to look. Since then, Douglas McKenny posted about this. A bit light on oil and gas details (like reserve life), but a helpful overview.

Summary

The North European Oil Royalty Trust offers a simple business model with low risk and potential for high returns.

The Trust has grown distributions at over 20% a year in the last five years and has a free cash flow yield of 22.95%.

The Trust's business model allows it to avoid the boom and bust cycle typical of the oil and gas sector, providing investors with stability and certainty.

https://seekingalpha.com/article/4613977-north-european-oil-royalty-trust-more-certainty

Fun read: Espaco Laser - Did you know 79% of Brazilian women (and 9% of men) use some type of laser hair removal?

The Company is “the largest laser hair removal company in Latin America. They have 764 stores in Brazil and are also present in Colombia, Argentina, Chile, and Paraguay.

The company has expanded extremely quickly, growing its store count organically and via acquisition from only 49 stores in 2014. This culminated in an IPO in 2021. But this growth is not without its growing pains, which now manifest as significant risk for equity holders.

Espaço Laser stock is one of the risker companies I have covered in this newsletter. The company is in a perilous financial situation. They have a huge debt cliff in 2024 and 2025 and I believe they will not be able to repay this debt from existing cash flows. Meaning dilution and/or bankruptcy are real possibilities.

That being said, there is a real turnaround effort underway. If management can resolve the company’s debt problem, Espaco Laser’s equity investors would be left with a solid operating business that is well positioned as the clear market leader in Latam’s cosmetic hair removal market.

https://latamstocks.substack.com/p/espaco-laser-latam-stocks-investment

Desperate Lebanese Are Robbing Their Own Banks to Get Savings

Wielding real or toy guns, angry Lebanese have forced their way into as many as seven banks this week to access trapped savings, as the country’s crippling financial crisis pushes people to take the law into their own hands.

Informal capital controls are in place across Lebanon -- blocking bank customers from withdrawing foreign currencies and savings in full -- as an economic implosion that began three years ago shows no sign of easing.

Unable to pay for basic necessities, account holders are taking desperate measures to get hold of their money.

…

The spate of incidents began two days ago when a woman brandishing a toy gun and accompanied by social activists stormed a bank in Beirut. She briefly held employees hostage while taking $13,000 from her account to pay for a sister’s cancer treatment.

That’s all for now. Thank you for subscribing!