Disclosure: Before reading this article, you should know it is written by someone who bought Air Canada stock in March of 2020 and sold out in January of 2021.

Well folks, we are over a year past March 2020 and COVID-19 is still sticking around, but vaccine optimists say we are in the clear. We’re not so sure. In fact, we think stock prices completely ignore the tail risk of this COVID fiasco not actually getting fixed immediately via vaccines.

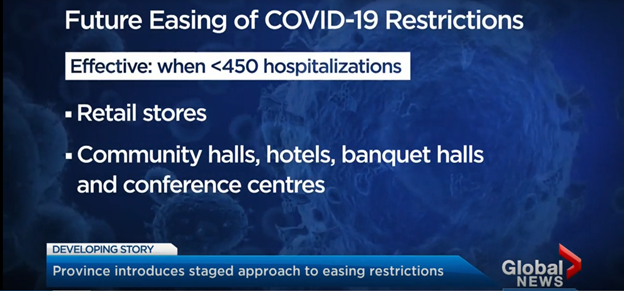

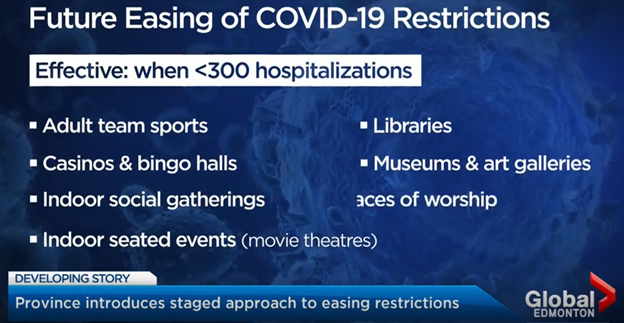

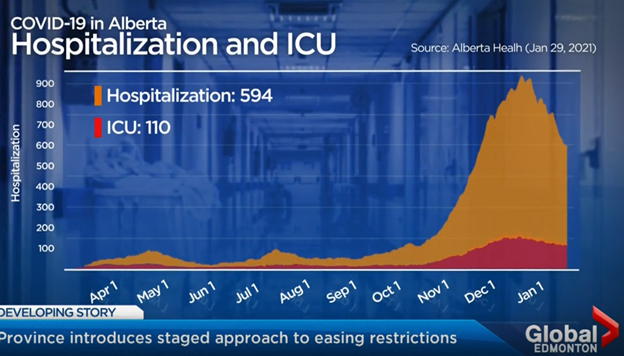

Alberta's previous plans (April 2020, January 2021). Looking forward to the next one!

Let us recap where we are today. We have vaccines now, and they are being pitched as being the golden ticket getting us out of this live action Groundhog Day we are all collectively experiencing. But, some people are getting COVID twice, some even after being vaccinated, and dying. And some.. (maybe many?) do not want a vaccine, and governments around the world remain scared and still clueless about what to do a year later. Some places have decided that one case is one too many while others have decided COVID does not matter. The beaches are open in Miami, population ~450,000, and the party is on (woohoo!), even though new cases are at over 500 a day, while Halifax, population ~430,000, decided it needs to be in complete lockdown while averaging ~100 cases a day. On the other side of the world, New Zealand remains cut off from the world a year later, except for their travel bubble which might be on the verge of popping (see below).

At the beginning of March 2020 the world was wild and full of panic, and in the midst of this I did some analysis around COVID-19 to get comfortable enough to buy Air Canada. A year later, deaths and illnesses are – so far – thankfully significantly below my expectations. However, in spite of my investment in Air Canada “being a good trade”, my thesis broke (see Air Canada article part two coming soon). The investing mistake I made was this: the issue is not how bad is COVID, the issue is how do people react to what is happening. I dramatically underestimated how governments and people would react, how long this would go on, and how diverse and inconsistent reactions worldwide would be. Over a year later the world is still going through on and off lockdowns, unclear health guidance, and an unclear path forward. Entire industries are a nightmare to operate in today, depending where they operate. Halifax and Miami might as well be on different planets.

Now, people are extremely optimistic about vaccines, but there are worrying signs of breakthrough cases, vaccine hesitancy, and a whole host of other issues (like how will governments react if there is another surge).

Do you buy gold and guns, or do you buy airline stocks? How do you invest? In the midst of this vaccine optimism, I think it is important to remember that things can always get worse.

“We hear a lot about ‘worst-case’ projections, but they often turn out not to be negative enough. I tell my father’s story of the gambler to who lost regularly. One day he heard about a race with only one horse in it, so he bet the rent money. Halfway around the track, the horse jumped over the fence and ran away.” Invariably things can get worse than people expect. – The Most Important Thing Illuminated – Howard Marks

Before we continue, I want to detour into a bit of history about the Roman Empire.

The Antonine Plague

COVID-19 is a tragedy, but it is pretty mild compared to some past pandemics, including the Antonine Plague. It is suspected to be a smallpox or measles virus that was spread throughout the Roman Empire by troops returning from the East. It began in 165 AD and lasted fifteen years, caused an estimated 5-10 million deaths, devastated the Roman army, and led to Emperor Marcus Aurelius personally heading up north to push back pesky advancing barbarians with only limited success.

For the worst afflicted, it was not uncommon that they would cough up or excrete scabs that had formed inside their body. Victims suffered in this way for two or even three weeks before the illness finally abated. Perhaps 10 percent of 75 million people living in the Roman Empire never recovered. “Like some beast,” a contemporary wrote, the sickness “destroyed not just a few people but rampaged across whole cities and destroyed them.”

But smallpox was different. Rome’s first smallpox epidemic began as a terrifying rumor from the east, spreading through conversations that often simultaneously transmitted both news of the disease and the virus itself. The pathogen moved stealthily at first, with people first showing symptoms two weeks or so after contracting it. https://www.smithsonianmag.com/history/what-rome-learned-deadly-antonine-plague-165-d-180974758/

The Roman people persevered, for a time, but I still do not think I would have wanted to run a restaurant in Rome or a travel service through this period.

What’s different than the Antonine Plague?

First of all, COVID-19 and its descendant strains – so far – are not nearly as deadly. I realize it is a bit silly to even compare, but the point is to remember when investing that things can get worse and go on for a much longer time, and to completely ignore this potential is extremely dangerous.

Mitigating much of the panic is the fact that we have much better technology to fight diseases today. If you walked up to a Roman citizen and told them they could have a fast tracked MRNA vaccine injection with a high probability of helping (and a small chance of side effects), they would have no idea what you are talking about and ask you “how did you get here without a horse?”

However, what about the downsides of our modern world?

First, we travel fast. A Roman legion has nothing on us. A well-trained legion could go 25 miles in a day. What a joke. Imagine a few degenerate gamblers from Taber, Alberta (the place of the best corn in the world). They catch a COVID strain, fly in an airplane at 575 miles per hour to Las Vegas next Friday, gamble with a few Chinese nationals who fly home Saturday, and end up indirectly causing an outbreak in Beijing the following Sunday. Pandemic panic ensues again.

Secondly, certain aspects of technology are also the enemy of returning to normal. Humans are great at collecting data and not so great at interpreting due to a number of biases. In fact, Charlie Munger covers this under his Standard Causes of Human Misjudgment #16 – “Bias from the non-mathematical nature of the human brain in its natural state as it deals with probabilities employing crude heuristics, and is often misled by mere contrast, a tendency to over-weight conveniently available information and other psychologically misrouted thinking tendencies on this list.” https://www.canadianvalueinvestors.com/charlie-mungers-list

Did you hear that there were 2,012.4 new cases in the 90210 postal code in the last 32.4 hours? Is that a lot? Is that a little? Whatever it is, it sounds important. We get caught up in data and get easily distracted by it. In general, the human mind is not very good at understanding numbers because we think in relative terms (elected officials included). If you place a hand in cold water and a hand in slightly hotter water, we are exceptionally good at knowing which one it hotter but will fail to notice that both will boil our skin. And we just like to look at shiny countable things.

From an investing standpoint, the question is not “are these statistics we need worry about?”. The real question is are these statistics that society at large will worry about? If so, how will it react?

Breakthrough Canary Cases in the Coal Mine?

The CDC has reported breakthrough cases – i.e. people getting COVID in spite of being vaccinated – throughout the United States.

https://www.cdc.gov/vaccines/covid-19/health-departments/breakthrough-cases.html

Then there is the Chile surge. Despite initially being ahead of most of the world vaccine-wise they are going through another wave. https://www.bbc.com/news/world-latin-america-56731801

And then there is the COVID-canary island of Seychelles – It currently has the highest percentage of population vaccinated in the world, and is now closing schools and reintroducing restrictions due to a surge of infections. More than 60% of the population is vaccinated. 1/3 of active cases are people who are fully vaccinated; 20% of hospitalizations are people who are fully vaccinated. https://www.bloomberg.com/news/articles/2021-05-04/world-s-most-vaccinated-nation-reintroduces-curbs-as-cases-surge https://www.nytimes.com/2021/05/12/business/economy/covid-seychelles-sinopharm.html

If It Is Just Too Hard… Simplify Your Portfolio

How will the COVID-panic-crisis progress from today? Will variants get stronger? More importantly, how are governments going to react? Will they get more or less concerned about each COVID case? Will there be travel restrictions next month, in a year from now? Will I be free to travel from Canada to Omaha in May 2022 for the Berkshire Hathaway AGM? These questions are all in the too hard pile. For example, in Alberta’s last new relaunch plan (looking forward to the new one!), the threshold for complete re-opening was less than 150 hospitalizations in a province of 4.4 million. That’s just not a lot of people, and if we stick to this mindset, we could end up quite stuck even with very effective vaccines.

I thought the world was too pessimistic last spring, and I have realized now as the bull market roars it was actually me being too optimistic and blind to potential tail risk last spring. Now, I think stock prices completely ignore the tail risk of this COVID-fiasco not actually getting fixed immediately via vaccines. Companies I have looked at that are negatively affected by COVID-19 do not seem to be pricing much if any of this despite there being a few canaries not looking too healthy.

So, all of the holdings in my personal portfolio at this moment (likely) have neutral to positive impact if COVID-19/20/30 decides to 1) be around and 2) cause mass hysteria. It’s not that I am worried about COVID, it’s that I don’t want to worry about COVID. It’s just a lot easier. You don’t have to swing at every pitch in investing.

As Remo Gaggi said in Casino (1995) - “Why take a chance? At least that’s the way I feel about it.”

As we have talked about previously, Berkshire Hathaway has sold all of their airline holdings (owned ~10% of each of the big four pre-COVID). - https://www.canadianvalueinvestors.com/home/berkshire-hathaway-2021-highlights-notes

A Look Back at COVID-19 – How are things compared to expectations?

April 19, 2021 (a year later) – “Entry to New Zealand from all countries remains strictly controlled to help prevent the spread of COVID-19. If you are not in a Quarantine-free Travel Zone you still have to go through Managed Isolation”.

Alberta’s spring 2020 Plan

Here was the plan in April 2020. May 2021 we are in an effective lockdown.