Provided to subscribers September 25th.

Here is the latest from Canadian Value Investors!

New idea – Ammo Inc. POWW – Do you feel lucky, punk?

Ideas from around the web - Crowdsourcing

Microcap conference highlight - How do you make 100x?

Our portfolio impact score

Ammo Inc. POWW – Do you feel lucky, punk?

Disclosure: We own this one.

Do we like AMMO, Inc. because of its ticker, POWW? We do like fun tickers (PBR is still our favourite). However, we do try to not be biased by these things. Instead, we think that POWW is potentially significantly under-valued, definitely under-followed, and underlying improvements are hidden by accounting. It is a story of two companies, the first in turnaround and the Ebay-of-guns – gunbroker.com - hiding underneath with a new CEO focusing on the right things. This is our kind of story.

TLDR: Market cap is $234MM at $1.99 share price - Gunbroker throws off roughly $30MM (ignoring upside from new initiatives) and if valued at a high single digit multiple, of say 8x, you would get you a $100-200MM revenue ammo business and ~$40MM of cash for free.

We always seek feedback on our articles, but more so than usual here. If you have any insight into this idea, send us a note! We currently have a relatively small position for the reasons noted below.

What is Ammo, Inc.?

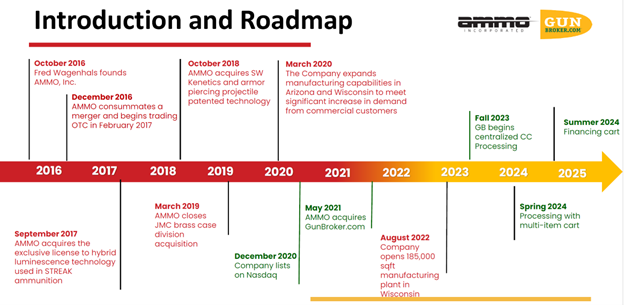

We would like to start by saying this has a bit of a complicated history that we will attempt to explain briefly. It really is a tale of two companies, the original ammo company started in 2016 and then later the acquired gunbroker.com website.

Ammo came into existence in 2016 and prior to this was a shell/failed company:

“-On this date, our CEO and Chairman, Fred Wagenhals, acquired the outstanding shares of the former Company, resulting in a change of control

-The name of the company was changed to AMMO, Inc.

-The OTC trading symbol was changed to POWW

-As the sole director, Mr. Wagenhals approved a 1-for-25 reverse stock split

-A plan of merger was filed to re-domicile and change the state of incorporation from California to Delaware

-Under the domicile change, a new certificate of incorporation was filed increasing the number of authorized shares of common stock from 15.0 million to 100 million; establishing a par value of $0.001

On March 17, 2017, AMMO Inc. acquired all of the outstanding shares of a private company incorporated in the State of Delaware, using the same trade name "AMMO, Inc.". The combined operations for AMMO, Inc. was reorganized as a designer, manufacturer, and marketer of performance-driven, high-quality and innovative ammunition products.

The Ammo Business

The original vision for Ammo, Inc. seems to have taken a shotgun approach. The idea was to purchase and/or make partnerships with companies and inventors to produce unique proprietary products, like streak visual ammunition (licensed from University of Louisiana at Lafayette). What is “streak visual ammunition” anyway? https://youtu.be/uT7kdJq4bZA?si=TY-crshbIwnvukWm

Overall, this has been a bit painful so far. However, there have been two recent changes that are unfolding: 1) The Company opened a new manufacturing plant in Wisconsin in August 2022 and 2) Ammo is streamlining its product offerings to focus on higher margin products with lower working capital needs (e.g. making just shell casings instead of a complete bullet) instead of chasing volumes.

Unfortunately, similar to some other industries, the U.S. ammo industry is working through inventory overhang and customer over purchasing during COVID. An interesting case study is ammo.com (see chart below) - https://ammo.com/coronavirus-impact-on-ammunition-sales This macro environment has not been helpful.

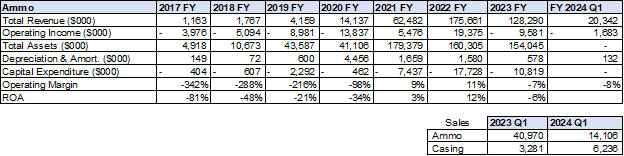

Note: Financials are off-cycle, with FY2023 ending March 31, 2023 (i.e. the new plant opened mid-FY2023).

Gunbroker.com

What is gunbroker.com? The website was launched in 1999 by Steve Urvan. Over the years it became the eBay of guns (and was actually created because eBay banned gun sales). It is by far the largest online gun website in the U.S. and has the same network effects of eBay while also benefitting from regulatory red tape slowing down competitors. 38% of FFL (Federal Firearms License) holders (think stores) use the site. An individual lists their gun and can sell it to anyone in the U.S. However, guns can only be picked up by purchasers at a FFL, which does a background check through the National Instant Criminal Background Check System (NICS) before handing it off.

We want to pause here on the potential value of the platform. It takes a bit of time to understand gun culture if you are not in it and we imagine some of our Canadian readers might be particularly unaccustomed. It is not just utility. Not all guns are equal. There are many types of buyers; many customize their guns and some collect antiques. Ever seen a Martini-Henry? https://en.wikipedia.org/wiki/Martini%E2%80%93Henry This makes an eBay platform very valuable for some buyers and it does not necessarily compete against the gun-Walmarts of the world.

The site takes a percentage of every sale and has 50% operating margins (~$30MM on a market cap of $234MM for the whole business). More importantly, it has these margins while not having any credit card processing, shipping assistance/service, or even a shopping cart. You literally have to buy one gun at a time and ammo and accessories are not to be found on the site, yet. See the plan below.

It was opportunistically purchased by Ammo in the middle of COVID. They acquired it for $240MM, albeit in a complicated deal structure that led to two years of board battles after Steve joined the Board. - https://www.globenewswire.com/en/news-release/2021/05/03/2221342/0/en/AMMO-Inc-Announces-Closing-of-Acquisition-of-GunBroker-com.html The two key issues were the vision for gunbroker (whether it should be a neutral platform or promote Ammo ammo) and Steve’s compensation for the sale (significant stock, which declined in price after the deal). It is a bit awkward that the combined entity’s market cap approximates the purchase price.

The Board problems appear to be largely settled (see background notes below), with the new CEO coming in a few months after the Settlement Agreement.

The Bull and Bear Cases

Crowdsourcing Ideas

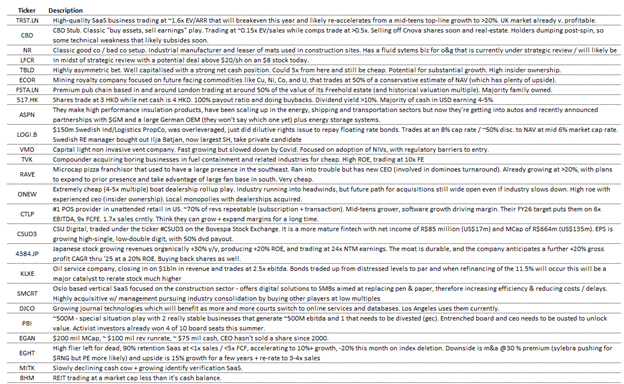

We are always looking for new ideas. Here’s a great list we are looking through ourselves. https://x.com/ClarkSquareCap/status/1704297844402713043

See post for more ideas.

How do you make 100x?

This was one of our favourite talks at the recent Planet Microcap showcase. https://youtu.be/8oVfaLurCVI?si=ulmRga2xgzIznIQj

Our portfolio impact score

Unfortunately, our concentrated portfolio of things like coal, oil, and canned vegetables does not pass the impact test.