Provided to subscribers July 19, 2023. Disclosure: We own both GRVY and ATVI at time of posting.

What is Gravity Co? It was founded in April 2000 and is known for its popular online role-playing game (RPG) called "Ragnarok Online." Ragnarok Online was one of the first successful Korean MMORPGs (Massively Multiplayer Online Role-Playing Games) and gained significant popularity both in South Korea and internationally. However, is a bit of an orphan, being controlled by its ~60% shareholder GungHo Online Entertainment, Inc. (also publicly listed and in Japan). The world thought GRVY had a tired franchise, Ragnarok Online, and was in decline. However, over the last few years they have launched several sequels to the original, as well as other unrelated games, and have ramped up annual revenues to the US$400MM range from ~$40MM in the 2010s. Now they are sitting on a few hundred million dollars while their market cap is only a few hundred million more.

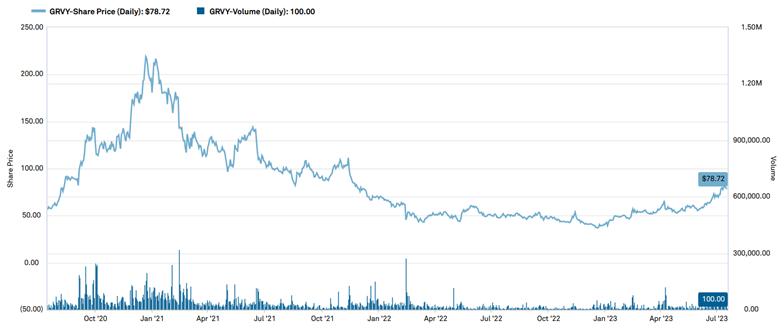

When you see a company with a market cap of $555MM (at $79), $287MM of cash, ~$75MM of annual FCF, and a growing twenty-year-old franchise, we take a look.

We only came across this company very recently (we don’t spend much time on Korean ADRs), and find the timing a bit prophetic. One of our largest holds, Activision-Blizzard, looks to finally be crossing over and will become part of Microsoft shortly. Here is a comparison of where they are today; is GRVY trading at the right relative price? We do not think so.

First - Quick update on ATVI

-The FTC tried to block the merger and lost - https://www.bloomberg.com/news/articles/2023-07-12/ftc-to-appeal-judge-s-go-ahead-for-microsoft-activision-deal

-The FTC tried to appeal, and was blocked https://www.bloomberg.com/news/articles/2023-07-14/ftc-loses-appeals-court-bid-to-pause-microsoft-activision-deal “Court ruling is a blow to the US agency and Chair Lina Khan” – We agree. It is probably better that the FTC focuses on more important things than many gaming consoles kids can play Call of Duty on.

-Last stop is the UK Competition and Markets Authority CMA. This is a very awkward stop, given they initially tried to block the deal (assuming FTC would have some success), but are now the last regulator standing in the world. https://www.eurogamer.net/microsoft-and-uks-cma-get-two-more-months-to-reach-agreement-in-activision-blizzard-deal

-The deadline for the deal was July 18th and was extended by both parties. In consideration, MSFT is letting $0.99 out the door as a dividend in August. “On July 18, 2023, the Company’s Board of Directors declared a cash dividend of $0.99 per share of the Company’s outstanding common stock, payable on August 17, 2023, to shareholders of record at the close of business on August 2, 2023.” The termination fee also increased – “the Company waived any right to the Parent Termination Fee during the Waiver Period, after which the Parent Termination Fee, if payable under the Merger Agreement after (x) August 29, 2023, shall be increased from $3,000,000,000 to $3,500,000,000 and (y) September 15, 2023, shall be increased from $3,500,000,000 to $4,500,000,000;” https://www.sec.gov/ix?doc=/Archives/edgar/data/0000718877/000162828023025102/atvi-20230719.htm Amended agreement - https://www.sec.gov/ix?doc=/Archives/edgar/data/0000718877/000110465923082205/tm2321522d1_8k.htm

ATVI is trading at ~$92 vs the offer of $95 plus $0.99 dividend. With an expected timeline of three months or less your IRR is ~17% if you buy today.

Ragnarok

Gravity Co is most famous for Ragnarok online and it is long-lived. My goodness. Originally released in 2002 (and continually updated), the game is still played.

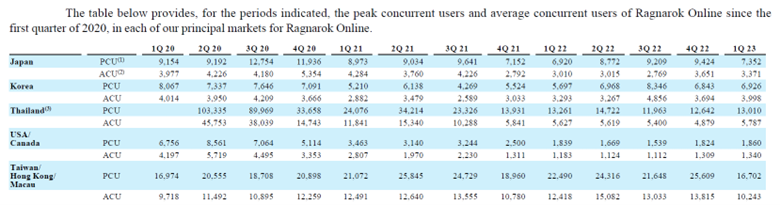

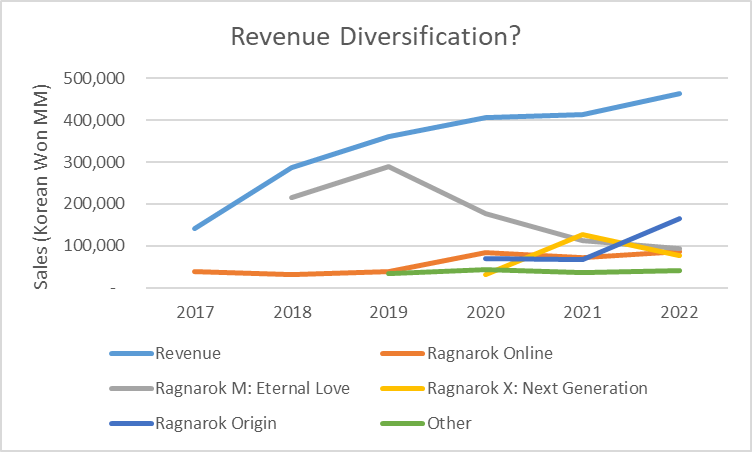

But they are also working on sequels that have been successful (see chart below). They have moved from being a one trick pony in 2018 to having several revenue generating games on the go. Is this revenue diversification? We acknowledge it is still driven by their one key franchise. But, they are also working on new games and franchises. Our favorite is their just released Whale in the High (WITH). We downloaded the game and can confirm it is extremely cute. https://apps.apple.com/us/app/with-whale-in-the-high/id6446757241 To be clear, their products are an Asia phenomenon, originally Korea/Japan/Taiwan, but now also Thailand is material (see sales breakdown by sales by country at end).

On to the actual numbers. Ragnarok is now a franchise with multiple offshoots. Revenue is growing, revenue is coming from more games, and the margins are holding. An important thing to keep in mind is net income is not bad at approximating free cash flow as R&D development is expensed and not capitalized. In fact, net income can arguably be understated as some of that R&D is for the future growth, but we won’t get into this. The nice thing is you do not have to worry about these details if something is cheap.