Disclosure: One of us owns this stock and likes it. You should always do your own due diligence.

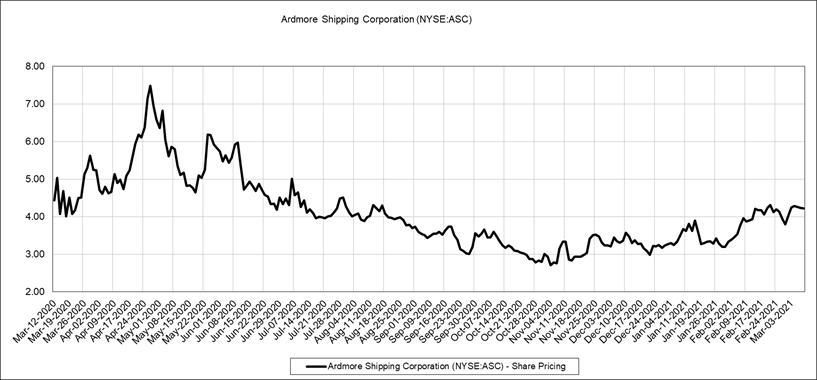

COVID-19 did a number on many industries, including bulk shippers of essential things like oil and diesel. Ardmore Shipping Corp. is one of these. It’s a straightforward company that owns about two dozen ships that transport refined products and chemicals. It was trading at 1/3 a reasonable NAV not long ago and still is at about half, and there’s an actual business here too. Is this warranted? Let’s take a look at the industry first.

Brief Bulk Shipping 101 – How Things Move Across the Ocean

Oil and refined products are shipped around the world using a standard classification system of ship sizes. Thankfully, the EIA has provided a nice little chart below. Full background is here https://www.eia.gov/todayinenergy/detail.php?id=17991

Globalization has been a remarkable force, and back in 2002-2008 it caused a lot of excitement in the shipper space. Order books increased dramatically in product and chemical tankers and also in other segments like container ships. Although shippers were right about the demand side of the equation – i.e. global trade going up, up and away - unfortunately it seems like everyone was not paying attention to the supply side of the equation. It led to a massive overbuild that popped around the financial crisis and it has taken a decade for things to normalize. And now you have the industry orderbook for new ships at very now levels.

The dynamics of each market niche are very different. For example, container shipping has become quite consolidated and we are big fans of container-ship-to-other-niches Atlas Corp. (where David Sokol of MidAmerican/Berkshire fame is involve), but this is a story for another day. For some discussion of that story check out the Berkshire/Fairfax forum - https://www.cornerofberkshireandfairfax.ca/forum/investment-ideas/ssw-seaspan/550/

Ardmore operates in the Medium Range refined products/chemicals market, which is different than the massive oil ships chugging from Saudi Arabia to the U.S. that most people think about. It is not consolidated, with many market participants.

The segment was finally starting to turn after a number of years of pain and things were looking up in January 2020. Unfortunately, COVID-19 hit and along with that a crash in shipping stocks and also actual rates.

This panel discussion (which included Ardmore) on the current state of the market is a good place to start getting up to speed. 2021 - 15th Annual International Shipping Forum - Product Tanker Shipping: Sector Trends & Outlook

- https://www.youtube.com/watch?v=W_ZtUlhW62s&t=2s

Ardmore Valuation – The Fleet

Before I continue, I want to stress that there is a business here and the analysis of the business should be done, but is beyond the scope of this article. The thesis here is Ardmore is trading for less than their ships are worth, and you get a business thrown in for free.

Ardmore breaks down their fleet in their annual report and company presentations. Ships are like cars. The newer the better and they depreciate over time. In Ardmore’s case, their fleet is relatively new at an average age of 7 years.

Note they sold Seamariner at year-end for $10MM. Completed the sale of the Ardmore Seamariner (2006 built) for $10 million in January. Net cash proceeds from sale of $5.4 million after prepayment of debt.

Is book value fair value? Ardmore thinks so.

“At December 31, 2020, we estimate that the aggregate carrying value of our owned vessels exceeded their aggregate basic market value by approximately $60.7 million as at December 31, 2020. At December 31, 2019, we estimate that the aggregate basic market value of our owned exceeded their aggregate carrying value by approximately $11.6 million as at December 31, 2019. We believe that 21 of our vessels’ carrying values exceeded the basic market value as of December 31, 2020 and 10 of our vessels’ carrying values exceeded the basic market value as of December 31, 2019. We did not record an impairment of any vessels due to our impairment accounting policy, as future undiscounted cash flows expected to be earned by such vessels over their operating lives exceeded the vessels’ carrying amounts. In addition to carrying out our impairment analysis, we performed a sensitivity analysis for a 10% reduction in forecasted vessel utilization, a 10% reduction in time charter rates and third party forward rates and, in each scenario, the future undiscounted cash flows significantly exceeded the carrying value of each of our vessels.”

Is it fair though? They did take a write down on their sale of Seamariner after all.

Of course, you should always do your own work. A great source of information is Clarkson Research, which specializes in research on global shipping. They track the value of ships over time among other things. Unfortunately, the report I have is not public and so I cannot share. Instead, I have included below a high-level summary of the 10-year high and low price ranges for MR ships that are 5 and 10-years old. I encourage you to find your own sources (like maybe the local university’s business school Bloomberg terminal 😊 ).

The Company’s balance sheet is relatively straightforward. You have cash, ships, and financing for the ships.

Unfortunately, the margin of safety is much lower today and it is not nearly as attractive as my acquisition price. I promise to write faster next time.

Trigger – Stabilized Rates or Just Time

Ultimately, I think the gap to fair value will decrease as COVID-panic stabilizes. I should note that you need to take off your panicky-Canadian toque; this is primarily Not-North-American-driven business.

Again, the analysis above just focuses on the value of the ships. Let’s not forget that there is an actual business here and management team that has successfully managed through a very tough period for shipping. I stress you should look at their day rates, cash breakeven vs current rates, and other factors.

I am not the only person that has noticed this discount. For example, Ardmore already had to deal with an unsolicited acquisition proposal from Hafnia Limited in July 2020. I am personally glad they did in this case as it was an all-stock transaction and could have been a bit messy. I would not be surprised if another offer came along. Press release here -

Secondly, a nice but not necessary tail-wind is the significant increase in steel prices over the past year. This is beneficial for two reasons: 1) It incentivizes the long-awaited scrapping of older ships, which will help improve rates, and 2) it increases the costs of new ships, which also indirectly helps support asset values of older ships. https://tradingeconomics.com/commodity/steel

Other Options – The Basket Approach

A rising tide lifts all boats as they say. So, I considered doing more of a basket approach for this. However, I ran into challenges falling into two buckets: 1) Other companies were not as straightforward (e.g., higher leverage, older fleet, weaker track record, etc) or , 2) More well recognized companies are not trading at enough of a discount to book value.

The bucket approach works better for heavily consolidated industries, like Buffett’s purchase of the main U.S. airlines (pre-COVID) as a basket. We covered that back in 2018 here - http://www.canadianvalueinvestors.com/home/2018/6/4/investing-in-north-american-airlines-why-did-berkshire-hathaway-buy-airlines-anyway

Maybe I should have just put everything into GameStop instead. Only time will tell. Happy fishing!