We have had a lot of people ask us over the years about how to get started in investing. We don’t mean how to value a stock. We mean actually setting up an account that you put a few dollars a month into. This article is intended for these people who are just starting to save and invest (which is a bit different than our core audience). If you are one of these people, read on! Link to the article below.

What is Berkshire Hathaway buying and selling during a pandemic? (And really, how busy is Warren Buffett anyway?)

What can you learn from Warren Buffet and friends over at Berkshire Hathaway on how to respond to a market panic? We’ll give you a hint - Focus More. Panic less.

How did Berkshire react to the downturn? (Lesson 1: Panic Less)

We always track BRK’s trades in their $250+ billion portfolio, which can be found in their 13-F filings. For those new to the game: 1) Berkshire Hathaway is required to disclose their trades in publicly listed stocks and 2) Trades consist of Warren Buffet, but also Ted Weschler and Todd Combs, who each run separate standalone portfolios. To know who is buying what can often be figured out, but we will leave that for another day.

Here’s the raw data (Note: these tables are through Q3 as Q4 isn’t available yet and won’t be for awhile, but reflects the full initial panic-period of COVID-19):

How does this compare to historical activity? Well, they’re active, but it really isn’t significantly different than previous years. Compare this to a lot of other active investors reacting to COVID-19 and it looks downright boring.

When you strip out trades related to existing positions (i.e., removing trades that are adding to an existing position or continuing to reduce an existing position) it is even lower, with the big BRK only trading stock in 27 net companies so far this year. It’s even less when you consider some trades can be grouped and be considered one trade, like Berkshire’s sale of the airlines were also bought as a group – We covered this back in 2018 http://www.canadianvalueinvestors.com/home/2018/6/4/investing-in-north-american-airlines-why-did-berkshire-hathaway-buy-airlines-anyway

Finally, keep in mind this is the trading activity of three separate money managers. Ted and Todd run their own separate portfolios while the OG Buffett makes the big-time decisions, like Berkshire’s $120 billion Apple inc. position.

Lesson Two: Focus More (Concentration is Key) – What does Buffett do all day anyway?

When we say focus, we don’t mean that you should invest in a zen-like meditative state. We mean that you should focus your investing into fewer concentrated positions (assuming you really do know what you’re doing). We’ll walk you through why.

“The strategy we’ve adopted precludes our following standard diversification dogma. Many pundits would therefore say the strategy must be riskier than that employed by more conventional investors. We disagree. We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it. In stating this opinion, we define risk, using dictionary terms, as “the possibility of loss or injury.” — Warren Buffett, 1993

Despite Berkshire Hathaway’s absolutely massive size, they run an extremely concentrated portfolio when you compare it to the average active fund, even a small fund. As shown in the chart below, their top ten positions typically account for 80% of the value of the entire portfolio. To contrast that with a “active fund”, we took a look at [SHAME BY CATEGORY] ~$10 billion Active ETF, and their top 10 holdings accounted for ~20% of the portfolio, and the next 10 were much less. The opposite approach of Berkshire – being extreme diversification, or closet index investing – is a great way to reduce volatility versus the market while collecting fees but doesn’t add any value. We’ll show you why.

Why run a concentrated portfolio?

You need to concentrate on your best ideas where you have an edge - If Warren Buffett is coming up with only a few a year (and a major one even less so), I think it is unlikely I will find significantly more. As Charlie Munger has said, “How could one man know enough [to] own a flowing portfolio of 150 securities and always outperform the averages? That would be a considerable stump.”

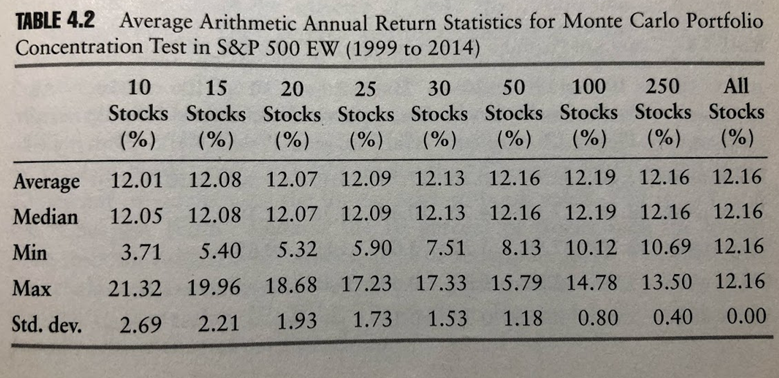

If you do not concentrate, it becomes statistically improbable, if not impossible, to outperform the market – We recommend you read Concentrated Investing, Strategies of the World’s Greatest Concentrated Investors. It has a lot of great stories of great investors (including Warren and Charlie), but the following two charts are key (apologies for the potato-image-from-paper-copy quality).

The lesson is clear – The more positions, the harder it is to outperform and quickly becomes statistically impossible. Of course, it means that you will have higher volatility versus the market, and a greater chance of blowing up. The key is to buy a few things you know extremely well.

“My own inquiries on that subject were just to assume that I could find a few things, say three, each which had a substantial statistical expectancy of outperforming averages without creating catastrophe. If I could find three of those, what were the chances my pending record wouldn’t be pretty damn good. I just sort of worked that out by iteration. That was my academic study – high school algebra and common sense… It would not be too much to say it was obvious to me that I could not have a big edge over everybody else and all securities. In other words, it was also obvious to me that if I worked at it, I would find a few things in which I had an unusual degree of competence.” – Charlie Munger

Indeed Charlie.

For more, check out our Value Investing 101 Page - http://www.canadianvalueinvestors.com/value-investing-101

Daily Journal 2019 AGM Meeting Video and Notes

Some spent Valentine’s Day with their partner after winning them over with roses and chocolates. Others (understandably so) went to see our favorite 95 year-old Charlie Munger talk about business, investing, and life for 2 hours. This year, CNBC taped the Daily Journal AGM on February 14, 2019.

Below are some of our notes:

The Daily Journal’s newspaper business is earning approximately $1m pretax but will decline for the foreseeable future. The other side of the business is software that automate courts processes from different jurisdictions around the world. This software business is very difficult because it involves dealing with different bureaucracies and is very customer service centric, but can also be an enormous market. On the flip side, most big companies aren’t interested in it because it is so difficult to do. Main competitor is Tyler Technologies which is a large public company.

In the world of disruption this and innovation that, we thought this quote was notable: “The idea of taking on the whole world when the Chairman is 95, the Vice Chairman is 89, and the Chief Executive is 80 and uses a cane – it’s a very peculiar place.”

Munger discussed a large investment fund company, which created a new fund with every manager’s best idea. While it sounded great in theory, it turned out poorly, even though they tried it many times. Why did it fail? Why wouldn’t an intelligent group of people coming together with their best ideas result in success?

Munger does not answer, but he later gives a hint: if anyone asked Buffett every year for his best ideas, he might only have 1 or 2, and if you followed just those you would do very well.

Our thoughts: An individual’s best idea might not be the best overall idea, particularly since most fund managers specialize in certain industries that might not be attractive altogether (never mind office politics). Therefore, the best ideas get drowned out and watered down.

On education - “By the way, my definition of being properly educated is being right when the professor is wrong. Anyone can spit back what the professor tells you. The trick is to know when they are right and they are wrong.”

Active Investing VS Passive – “If everyone did index investing it won’t work but for another considerable period index investing is going to work better than active stock picking where you try to know a lot. Now a place like Berkshire Hathaway or even the Daily Journal we have done better than average. Why has that happened? And the answer is pretty simple; we tried to do less. We never had the illusion that we could just hire a bunch of bright young people and they would know more anybody about canned soup and aerospace and utilities and so on and so on. We never had that dream. We never thought we could get really useful information on all subjects, like Jim Cramer pretends to have. We always realized that if we worked very hard we could find a few things where we are right and that a few things were enough and that was a reasonable expectation. That is a very different way to approach the process. If you had asked Warren Buffett the same thing that this investment counsel had did, “give me your best idea this year”, you would have found it worked perfectly. He wouldn’t try to know a whole lot, he would give you one or two stocks. He had more limited ambitions.”

Investment management business - Munger thinks most fund managers get basically paid to do nothing vs ETFs. Fund managers might say their job is to save their clients from actively trading. Munger agrees they are probably still saving some people from the “hustling stock broker.” But it is very peculiar that the whole profession is paid to do that. Despite lots of IQ in there, they typically can’t outperform indexes.

Munger views the industry’s rationalization as a state of denial. No solution he can think of, but noted that admirable value investors just quit instead of staying in denial.

Told the story of an old woman in Omaha that sold her soap company in the 30s during Great Depression. She had a big mansion and $300k. She split most of the $300k into 5 stocks, of which 3 were GE, Dupont and Dow, and bought some muni bonds. She just figured electricity and chemicals were an up and coming thing, then just didn’t do anything after that. When she died in the 1950s, she had $1.5m (probably around ~10% CAGR since she was living off the muni bonds).

Peter Kaufman always says “If the crooks only knew how much money you could make by being honest, they would behave differently.” Warren says “Always take the high road because it’s never crowded.”

Daily Journal: Could have easily raised prices during Great Recession because of all the foreclosure notices. Should they have raised prices? No, not the right way to run a business especially if you’re already rich.

Similar to Vitreous Glass when their customers were struggling in from 2008 through the early 2010s.

Someone asked if you look at banks with $1b+ of assets up to the super-regional banks, there are around ~250, and asked are there 1-2 that might be good buys? Munger answered yes.

What made the Buffett/Munger partnership so successful? Two talented people working well together.

China’s stock market: Some very smart people are starting to wade in.

2018 Year-End Value Investing Note - Use your own compass

Investing-wise this year was likely exciting for you - it was for us. Whether you owned Canadian oil and gas stocks (yikes), were riding the marijuana train, or just paying plain old large caps swinging 20% month-over-month, your portfolio was likely… movin’. Of course there are those that bet their life savings on Bitcoins (yuck) or CryptoKitties (at least cute) and were hoping to pay their rent with it must have had even more excitement (but are likely not readers here).

2018 Lesson - Have your own compass

Recently we mentioned Guy Spier, friend of Mohnish Pabrai and manager of the Aquamarine Fund.

He is quite a prolific speaker but according to himself he is “probably best known for having lunch with Warren Buffett”. Back in 2008 he (along with Mohnish) paid $650,100 to have lunch with Warren Buffett (as part of the annual charity lunch auction). You can read his thoughts about the lunch here - https://observer.com/2015/12/my-lunch-with-warren-buffett-changed-my-life

His key takeaway was this:

The most memorable piece of wisdom that Warren shared that day was about the need to live by an “inner scorecard,” instead of worrying how others think of you. He illustrated this by asking: “Would you prefer to be considered the best lover in the world and know privately that you’re the worst—or would you prefer to know privately that you’re the best lover in the world, but be considered the worst?” It was clear that he operates entirely according to his inner scorecard, living and investing in ways that perfectly suit his personality and his values. For me, this was his greatest lesson.

2018 was a wild ride. And as we go through waves of fads, booms and busts it is important to have a central compass. The core theme of my own investing to date is having to go against the grain to find things that truly are cheap and not just a value trap. Of course, some out there rode Bitcoin and marijuana into the sunset and of course I wish them the best on their beach adventures. But I know I wouldn’t have been “right” or “wrong” but just lucky if I made money on those. And that’s just fine with me.

“It’s not greed that drives the world, but envy.” - Warren Buffett

Guy Spier 101

Guy Spier gives a good overview of his views on value investing in a 2016 talk and we definitely recommend you take a look. This was at the Ben Graham Centre for Value Investing.