Cloning Investments 101

(Bowling with Bumpers)

What and Why?

The concept of cloning investments is simple. You select stocks that have been purchased by investors that have extremely good long-term track records. We have come to strongly support this concept and the reason is simple:

The approach he takes is straightforward.

It is unbelievably simple and makes sense, but it is just hard to do emotionally. And it’s because we all believe – particularly A-types who plan to pick stocks to get rich – that we are all snowflakes with unique insights. Even us here – about half of one of our portfolios are not cloned ideas (and we have stubborn justifications for this).

To be clear, this is not a “put your blinders on” approach, where you max out the portfolio on whatever Mr. B’s latest purchase is and hope for the best. It is about creating a systematic approach. Specifically, we advocate buying and selling a stock:

based on following specific investors who have a very long track record;

show conviction in their idea – demonstrated by being a large percentage of the portfolio, and;

where it is a company you actually understand.

We cover these items in detail and have a full checklist in the Step-by-Step Guide below.

But how does this give you an advantage over the majority of investors, including those that also clone others?

The cloning technique relies on trusting who you are copying. How do we then identify the next funds to clone? What would you say that is the minimum number of years for you say is the minimum number of years that you would need to see strong performance to actually trust those to adequately copy them?

Sometimes the SEC allows an investor to not file a purchase temporarily (as was done by Warren Buffett when he was buying $10+ billion of IBM). How does this affect your process?

What constitutes understanding the business? How do you distinguish between thinking you understand the business and actually understanding it? How can you distinguish?

The Practical Guide to Cloning

Step 1: Read 13Fs

Oh America. The land of bureaucracy and disclosure rules.

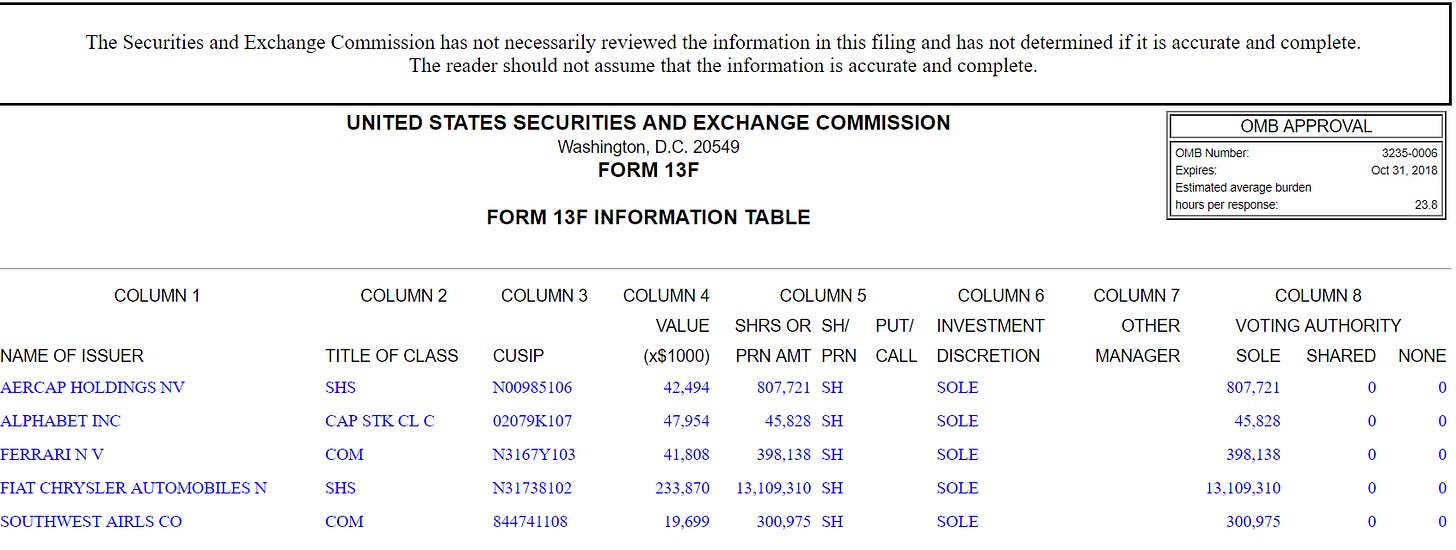

In the United States, any institutional investment manager that manages over $100 million or more in Section 13(f) securities (explained below) must report its holdings on Form 13F with the Securities and Exchange Commission (SEC).

As defined by the SEC:

So what this means is that effectively every major money manager and firm has to disclose their holdings quarterly.

Filings can be found by going here: https://www.sec.gov/edgar/searchedgar/companysearch.html

Example: Mohnish Pabrai

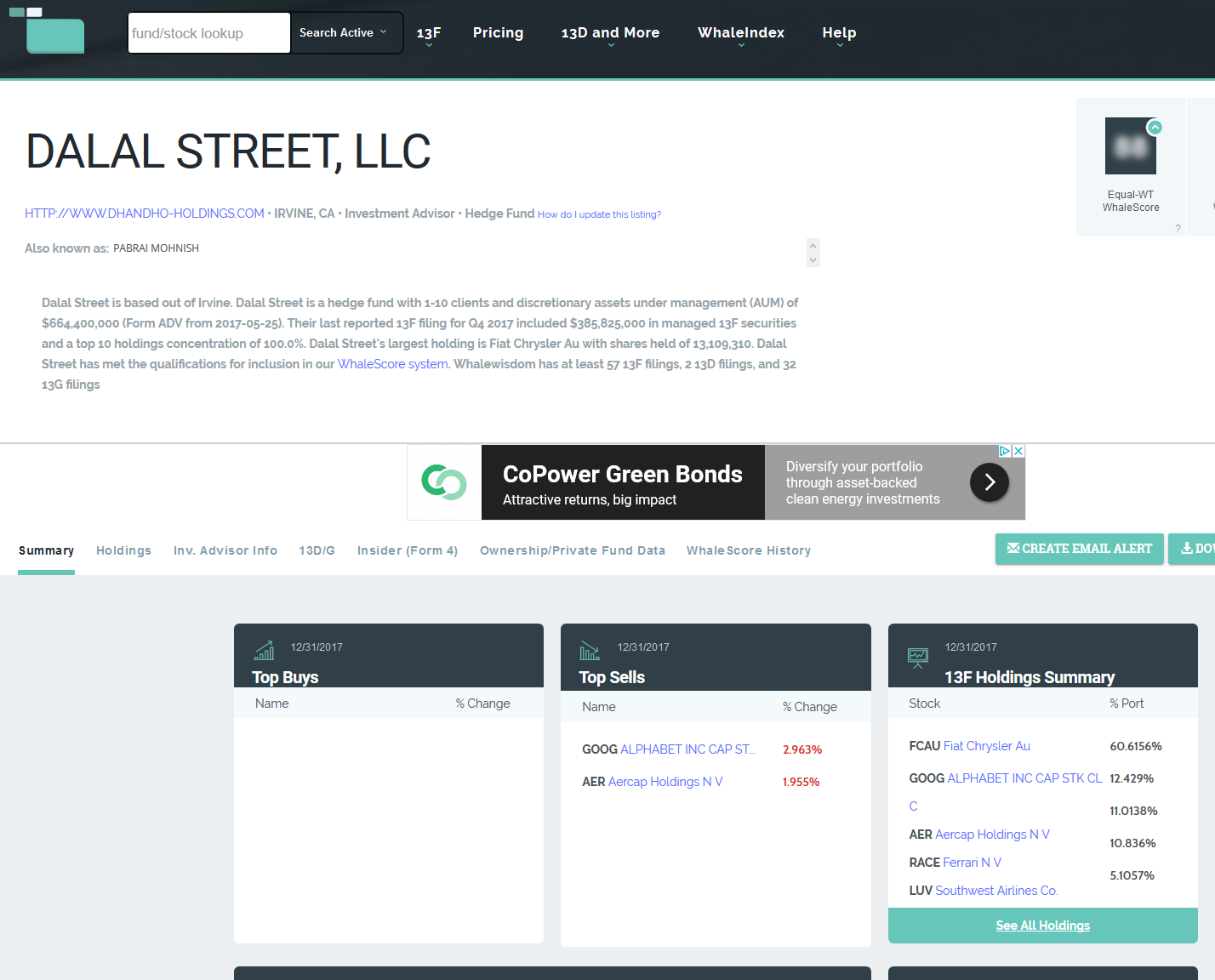

Mohnish files under Dalal Street, LLC.

This, of course, is a lot of work.

There are two alternatives that we are aware of: Whale Wisdom and Guru Focus

Gurufocus has a nicer look to it and is quite easy to use. However, Whale Wisdom has some pretty snazzy paid packages if you are interested (including an Excel add-in). We don’t currently subscribe to either but have come across people who have to both, they seemed pretty happy (your mileage may vary).

https://www.gurufocus.com/holdings.php?GuruName=Mohnish+Pabrai

https://whalewisdom.com/filer/dalal-street-llc

Step 2: Copy

Now, the following applies to those out there who really enjoy investing, have time do it, and have a desire to understand how things work. We have built the following simple mini-checklist to check copy ideas.

To properly copy, you need to buy ideas that:

1) Are from a fund manager with a long history of success – 15-20+ years is ideal.

2) Represent high conviction by the fund manager – Fiat represented ~60% of Pabrai Holdings’ US investments at the end of December 2017. This is definitely high conviction but very few fund managers run this concentrated. But realistically a meaningful hold – 20+% ideally, is sufficient to qualify.

3) Can be bought at a price similar to what they bought it at – Mohnish bought Fiat in 2014 at an average price less than $8. Fiat currently trades at around ~$21. – Buying at 2.5x does not pass this test as their own investment thesis might not hold at this higher price from a risk/return standpoint. However, if they recently bought a meaningful additional stake recently (which does not apply in this case) that would be considered.

4) Stick to your circle of competence – Focus on ideas you can understand and spend as much time as you can learning to increase your circle of competence.

For a practical real life example, see our post on Berkshire Hathaway’s investment in Liberty Sirius SIRI.