Disclosure – We bought this one. Buy at your own risk and, as always, do your own due diligence.

What would you want to do with an oil Company without any oil and a bunch of cash? Well, it depends who you are.

Earlier this year, we wrote about Kobex Capital (formerly TSX Venture), which was a shell company trading at a discount to its mostly-cash NAV that had a near-term catalyst. It was ultimately bought out in a reverse takeover the worked out quite well (recap coming soon). We have found another, maybe.

Today, we are writing about Alberta Oilsands ("AOS" or the "Company"), which is also another cash-rich company (but with a bunch of exploration assets all over the world) trading at a discount. It has a concentrated group of activist shareholders owning over 30% of shares pushing hard for a cash distribution.

AOS – A Brief History

In October 2013, AOS received notice from the Province of Alberta that its oil sands leases on 4.3k hectares were to be cancelled. As a result of this, AOS applied for compensation and received $35.1MM in May 2015. The cash has been sitting on its balance sheet since then (less expenses, which we will get into).

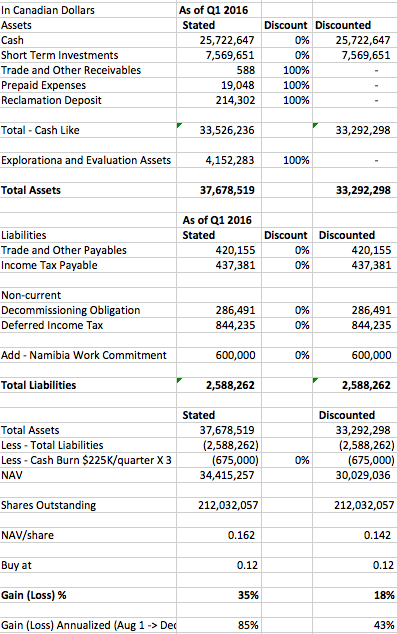

Fast-forward to Q1 2016, and AOS now has $31.3mm of cash, net of all on-balance sheet liabilities. Quarterly cash burn is currently around ~$0.4mm, which is primarily G&A. Considering the lack of meaningful operations, we view this as high though some of this is likely due to the strategic review they are currently undertaking. Enter the activist shareholders.

The Catalyst

Current activists who are publicly pushing for a dividend of all liquid assets are Bruce Mitchell (15.9% ownership), Smoothwater Capital (13.8%), Goodwood Inc (4%), and Walied Soliman (1.9%). They have all pushed for a special meeting of shareholders, which the Company has finally agreed to, for September 23, 2016.

The Risks

Risk #1 - Not many people want to sell themselves out of their own job, and this applies to management teams too. While we are sure the managers at AOS are pleasant folk, we also know you should always beware when someone is losing a paycheque. In this case, should AOS be wound up their jobs (and the fees Directors get) go away, which provides plenty of incentive to “strategically review” the landscape (more money out the door) or even buy something (blowing up the wind up idea). It should be noted that OAS recently hired its second investment bank in the last year. That said, although there are 2 executives and 7 Board members' positions at stake, we believe the activist shareholders that together own ~36% of AOS stock reduces this probability.

Risk #2 – Namibia. The Company has various exploration assets around the world (of which we assign no value to, see valuation below), but as part of the Company’s global gallivanting they agreed to capital commitments in Namibia for which AOS itself has guaranteed 10%. It originally appeared to be $600K of guarantees per the initial purchase press release in January 2013, but later annual reports imply that it adds up to $6MM "subject to terms and conditions to be agreed to between Alberta Oilsands and the government of Namibia" and may have to be spent some time between Dec 2016 and Dec 2018. It is hard to believe that an under negotiation project of this type would go ahead today given where oil prices are but it is a tool management can use to keep the wheels turning. This is somewhat complicated by a somewhat-ominous news release on March 22 where AOS stated that under the Alberta Business Corporations Act, it may be restricted to pay dividends if it would impede its ability to meet any obligations (supposedly very standard wording in business corporations acts across all provinces). Perhaps some comfort can be taken by one of the key shareholders, who is the co-chair of a bulge bracket law firm's special situations team in Canada.

Upside and downside

The upside is quite simple. At the special meeting of shareholders in late September, a full cash distribution is announced, and all that is left in AOS is exploration assets that may or may not be worth anything (we assume they are not). Assuming this is completed in a couple of quarters, ~$30MM will be paid out assuming the current cash burn rate, which is already high and we believe is conservative. There are some options outstanding, but they have an average strike price of $0.12, so dilution will be minimal. All in, it's ~20% upside in about 6 months.

The downside is anything besides that. We will likely hold on but sell out if it looks like there will be a protracted battle and/or if AOS ends up buying something (in which case, a loss is likely).

Valuation

A few quick assumptions – We assume it will take until the end of 2016 to wind up (and cash burn stays as bad as it is), its international assets have no value (i.e. additional upside for optimists), and it is bought at $0.12/share.