Provided to subscribers June 11th.

Here is the latest from Canadian Value Investors!

An odd lot trade - DND

What is an odd lot trade?

ATVI merger failing? Maybe not so bad…

DND Odd Lot trade

Thank you for subscribing! Here’s $150 - Dye & Durham TSX:DND Odd Lot Trade - $15.36 vs $17-$20, return of ~$150 or 10% for a few minutes of work.

FYI this gets complex for non-Canadian investors and there is always uncertainty of completion; do your own due diligence (as always).

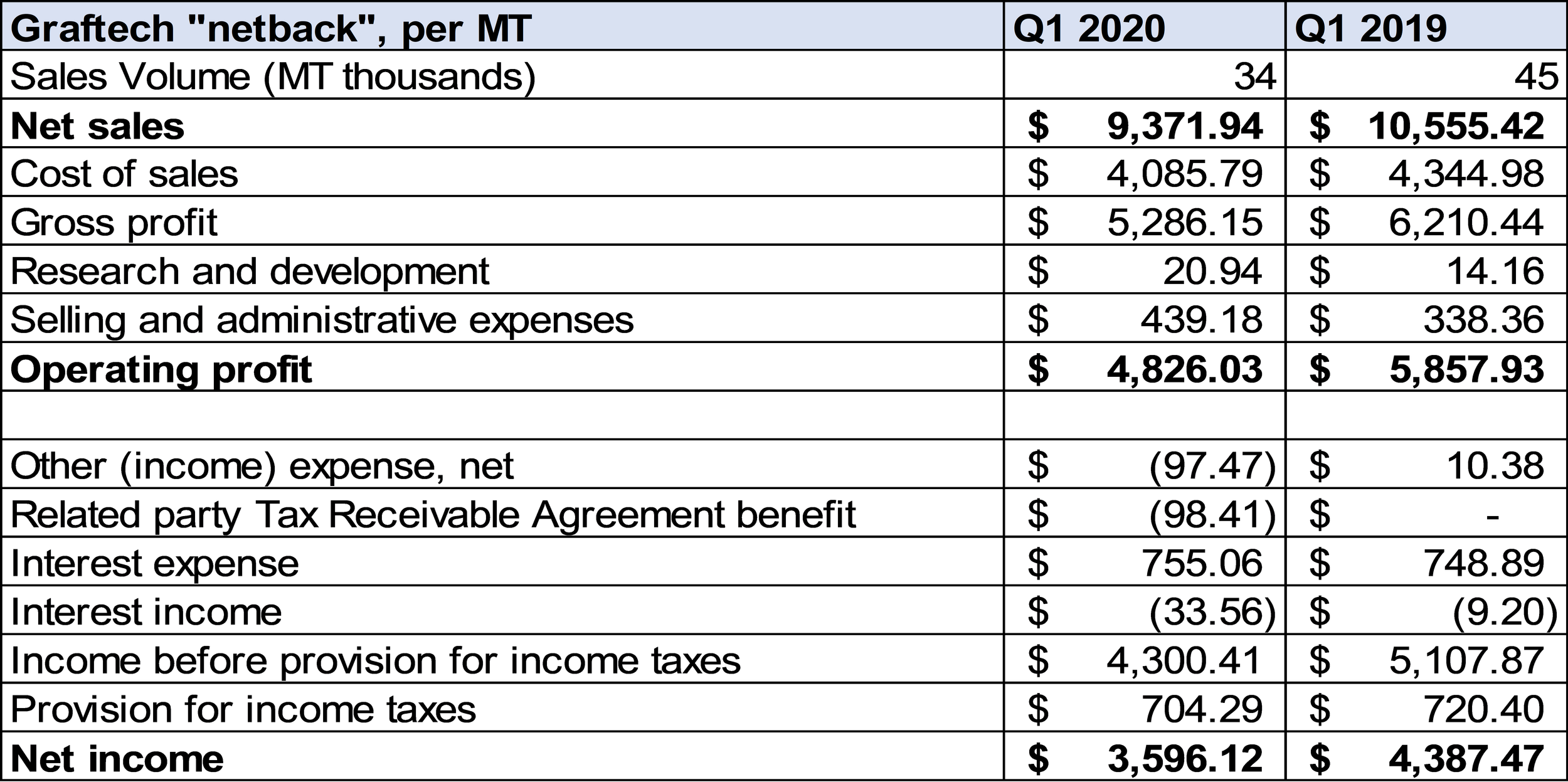

DND is doing a share repurchase and they have an odd lot provision (if you’re not familiar see next). Details below from their proxy; you have until June 16th to purchase, settle, and submit your shares and make sure your trade has settled before then.

The Offer will commence on the date set forth above and expires at 5:00 p.m. (Eastern time) on June 16, 2023 or at such later time and date to which the Offer may be extended by Dye & Durham (the “Expiration Date”). Per their disclosures:

Holders of Common Shares (“Shareholders”) who wish to accept the Offer may do so in one of two ways: (a) by making an auction tender (“Auction Tender”) pursuant to which they agree to sell to the Company at a specified price per Common Share (not less than $17.00 and not more than $20.00 and in increments of $0.10 within that range) a specified number of Common Shares owned by them; or (b) by making a purchase price tender in which the tendering Shareholders do not specify a price per Common Share, but rather agree to have a specified number of Common Shares purchased at the Purchase Price (as defined below), to be determined pursuant to the Offer (“Purchase Price Tender”), understanding that if they make a Purchase Price Tender, for the purpose of determining the Purchase Price, such Common Shares will be deemed to have been tendered at the minimum price of $17.00 per Common Share.

…

Shareholders validly depositing Common Shares pursuant to Auction Tenders at $17.00 per Common Share (the minimum purchase price under the Offer) and Shareholders validly depositing Common Shares pursuant to Purchase Price Tenders can reasonably expect to have all or a portion of such Common Shares purchased at the Purchase Price if any Common Shares are purchased under the Offer (subject to provisions relating to proration and the preferential acceptance of Odd Lot Holders described below).

…

For the purposes of the foregoing, an odd lot deposit is a deposit by a Shareholder owning in the aggregate fewer than 100 Common Shares as of the close of business on the Expiration Date

WHAT DOES A SHAREHOLDER DO IF THAT SHAREHOLDER OWNS AN “ODD LOT” OF COMMON SHARES?

If a Shareholder owns in the aggregate fewer than 100 Common Shares as of the close of business on the Expiration Date and that Shareholder validly deposits all such Common Shares pursuant to an Auction Tender at a price equal to or less than the Purchase Price or pursuant to a Purchase Price Tender, the Company will purchase all of those Common Shares without proration (but otherwise subject to the terms and conditions of the Offer) if the Company purchases any Common Shares pursuant to the Offer. This proration preference is not available to holders of 100 or more Common Shares even if holders have separate share certificates, ownership statements or DRS positions for fewer than 100 Common Shares or hold fewer than 100 Shares in different accounts. Odd Lot Holders making an Auction Tender or a Purchase Price Tender will be required to tender all Common Shares owned by the Shareholder. Partial tenders will not be accepted from Odd Lot Holders.

What is an Odd Lot Trade?

When companies repurchase shares they use various repurchase strategies. They set a target dollar amount of shares to repurchase. The strategies companies use for repurchasing is for another day (and probably another blog), but the important thing for value investors is that they sometimes offer a small but extremely high return on capital at very low risk.

Companies sometimes incorporate odd lot provisions in their repurchases, which means (typically) that if an investor has 99 shares or less (i.e. not holding a lot of shares) they will get repurchased first. Companies do this for a few reasons, primarily to simplify shareholder communication and stockholder structure.

How does this benefit you? Well, if a firm repurchase comes up and the stock is trading below the repurchase price or range, you can buy 99 shares and know you will be bought out by the company first so long as the repurchase goes through.

To submit your shares you just have to reach out to your broker. Sophisticated brokers that are used to this kind of thing (hi Interactive Brokers) let you do this online easily. Others might require you to email them and (George Carlin voice) the worst… make you call!

Here’s how it works with Interactive Brokers – After your trade settles (or if you already owned the company) you can head to your notifications and let them know what you want to do. As shown below, you indicate that you want to tender your full position. If you use Qtrade this can be done with a secure email through their online account. If you use a brokerage account at a chartered Canadian bank, you should switch to something better immediately.

It’s not big money, but we still take the time to pick up $100 bills we see on the sidewalk.

ATVI merger failing? Maybe not so bad

Disclosure: We still own ATVI

We have been following (and posting about) Microsoft’s acquisition of Activision-Blizzard for the past year. Unbeknownst to us until 13-F day, we bought ATVI alongside Warren Buffet last year, only to have the odds of the trade blow out the wrong way near the end of this April. But… maybe the merger failing would not be so terrible for a cash flow positive company with a couple great franchises. Especially if you have $12-14 billion saved up by the time it fails. We argue that there might be a golden egg regardless of what happens. “Heads you win, tails you don’t lose (much?)”

Merger Update

As noted in several posts (see archives), the Microsoft-ATVI merger has been dealing with antitrust reviews around the world. Our main concern was the U.S. Federal Trade Commission (FTC) and Linda over there blazing a trail https://www.bloomberg.com/news/articles/2023-06-06/lina-khan-is-upending-wall-street-s-merger-arbitrage-playbook , but out of left field came the CMA. Per their Q1/23 release:

“On April 26, 2023, the United Kingdom Competition and Markets Authority ("CMA") announced a decision to block the merger, stating that competition concerns arose in relation to cloud gaming and that Microsoft’s remedies addressing any concerns in cloud gaming were not sufficient. Activision Blizzard considers that the CMA’s decision is disproportionate, irrational and inconsistent with the evidence. Microsoft has announced its decision to appeal the CMA’s ruling, and Activision Blizzard intends to fully support Microsoft’s efforts on this appeal. Activision Blizzard continues to believe that the deal is pro-competitive, will bring Activision Blizzard content to more gamers, and will result in substantial benefits to consumers and developers in the UK and globally. The parties continue to fully engage with other regulators reviewing the transaction to obtain any required regulatory approvals.”

How often have companies been able to successfully challenge the CMA? “Essentially, there has never been a successful appeal in the UK on an antitrust decision,” said Aaron Glick, a merger arbitrage strategist at TD Cowen. “There does not appear to be a path forward for Microsoft.” https://www.bloomberg.com/news/articles/2023-04-26/microsoft-s-69-billion-activision-deal-blocked-by-uk-watchdog

Oof.

The merger is not off, but the odds have changed. But, this brings two interesting things into play if it fails: 1) Underlying business performance of the company since the announcement (how much is it worth), and 2) the Microsoft break fee.

First, let’s deal with the easier question. If the merger fails due to a regulatory hiccup, The Termination Fee Microsoft would owe to Activision is straightforward and quite material. Microsoft’s deal team and lawyers seemed confident in anti-trust rulings going their way and did not give themselves an out we can find. Per the deal disclosures:

Reverse Termination Fee If the merger agreement is terminated in specified circumstances, Microsoft has agreed to pay Activision Blizzard a reverse termination fee of (i) $2,000,000,000, if the termination notice is provided prior to January 18, 2023, (ii) $2,500,000,000, if the termination notice is provided after January 18, 2023 and prior to April 18, 2023 or (iii) $3,000,000,000, if the termination notice is provided after April 18, 2023. [CVI editor: the merger deal being $68.7 billion]

Activision Blizzard will be entitled to receive the reverse termination fee from Microsoft if the merger agreement is terminated: by either Microsoft or Activision Blizzard due to (1) a permanent injunction or other judgment or order arising from antitrust laws having been issued by a court or other legal or regulatory restraint or prohibition arising from antitrust laws preventing the consummation of the merger being in effect, or any action having been taken by a governmental authority arising from antitrust laws that, in each case, prohibits, makes illegal…

The Board of ATVI also stopped allocating surplus capital as their hands have understandably been tied by the merger agreement. Cash and short-term investments at the end of the first quarter stood at $12.6 billion, and Activision Blizzard ended the quarter with a net cash position of approximately $8.9 billion. This, plus expected free cash flow throughout the year results in about $12-14 billion of surplus cash by the end of the year (our timeline for final failure and assuming they keep $3-4 billion back) to use for repurchases (more likely) or dividends (less). This cash is only available to shareholders if the merger fails. With a market cap of ~$60 billion, that’s material.

How’s the business?

At the same time, they had a blow out quarter and the latest flagship game (the sequel to one of our childhood favorites) is selling like gangbusters.

Diablo® IV Launches, Immediately Sets New Record as Blizzard Entertainment’s Fastest-Selling Game of All Time

From: Business Wire

Jun-06-2023 9:06 AMIn just four days of early access, players have already enjoyed the latest installment of the iconic game for over 93 million hours, or over 10,000 years

IRVINE, Calif.--(BUSINESS WIRE)--

Diablo® IV, the highly anticipated new installment of the iconic Diablo series, is now live. Already, it is Blizzard Entertainment’s fastest-selling game of all time, with Blizzard’s highest pre-launch unit sales ever on both console and PC*. In the four days since early access started on June 1, Diablo IV has been played for 93 million hours, or over 10,000 years --- the equivalent playing 24 hours a day since the beginning of human civilization.

View the full release here: https://www.businesswire.com/news/home/20230606005812/en/

The Company has a few key franchises broken up between Activision, Blizzard, and King. We find it pretty amazing how resilient these franchises are. They can get tired and be broken; just look at what EA has done with numerous franchises like Sim City.

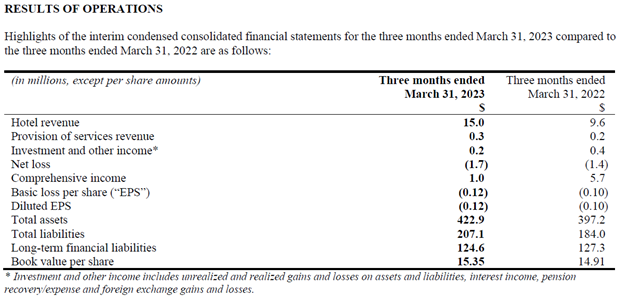

Key figures and charts below. Various reports we have read (before Diablo launching) put free cash flow in the range of $3-4 billion annually over the next few years. It currently trades at ~$80 or a market cap of about $63 billion. Netting out the surplus cash gets you a mid to high teens P/E multiple.

We want to point out that the merger is not quite dead. It is still quite possible (experts betting a bit less than 50/50 it seems based on recent reports we have read) that you get bought out at $95 sometime over the next year or so. Heads you win, tails you might not lose?