Only a week ago we posted about Alberta Oilsands, that oil company without any oil. Well now they might have some, maybe, and sparks are flying. That underpriced cash rich company just got a lot more interesting.

On Friday the Company announced a merger proposal with Marquee Energy Ltd., an unknown to us but probably troubled small oil and gas company. Under the terms of the Arrangement Agreement, common shareholders of Marquee will receive, for each Marquee Share held, 1.67 common shares in the capital of Alberta Oilsands. On completion of the Arrangement, Marquee Shareholders will own approximately 49% of the common shares of New Marquee.

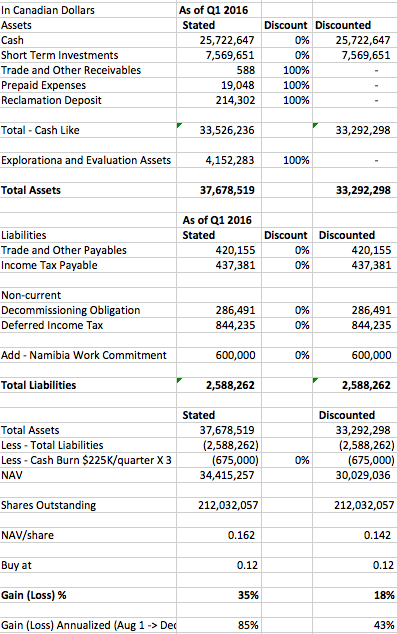

After a year and a half “strategic review” shareholders of AOS end up losing their cash and owning half of a tiny upstart oil and gas company in the middle of the worst energy downturn in a generation. Not exactly a fantastic outcome. Management also agreed to a $1.5 million break fee if the deal doesn’t go through.

On top of this, management is trying to complete the transaction without even having a shareholder vote! They have stated that the merger is “subject to receipt of the approval of the Alberta Court of Queen's Bench”. Unbelievable.

Enter Smoothwater Capital Corporation; That Canadian activist shareholder that claims to own 16.6% of AOS along with another key party. They issued a press release just today stating that they “will not support the proposed merger (original emphasis) by way of a plan of arrangement as it would significantly destroy value for all AOS shareholders by effectively using its risk free cash to bailout a distressed junior energy company with little prospects of success unless energy prices increase dramatically.” They even stated that “either the AOS board and management are hiding important facts from shareholders or are incompetent – or both".

What’s the next step? It’s straight from Smoothwater’s press release. “…Smoothwater has contacted the Venture Exchange to ensure that the exchange requires a vote of two thirds of the shareholders of both AOS and Marquee to approve the arrangement. Smoothwater also intends to appear before the Alberta Court of Queen's Bench to request an AOS shareholder vote as a key determinant of the fairness of the arrangement.”

What a show with a thrilling and unexpected twist. It’s rare to get this kind of excitement in finance. We will be watching this closely and are off to make some popcorn.

Press releases can be found via - https://www.google.ca/finance?cid=704980