NASDAQ:CROX for Christmas and other gifts for NFI and POWW shareholders

Welcome to Canadian Value Investors holiday edition! We have one fun year-end investment gift idea for you. But before we get into Crocs, we first have updates on two companies we cover and hold. It looks like shareholders at NFI Group and Outdoor Holdings (POWW) received great gifts this year for Christmas. We remain long on both.

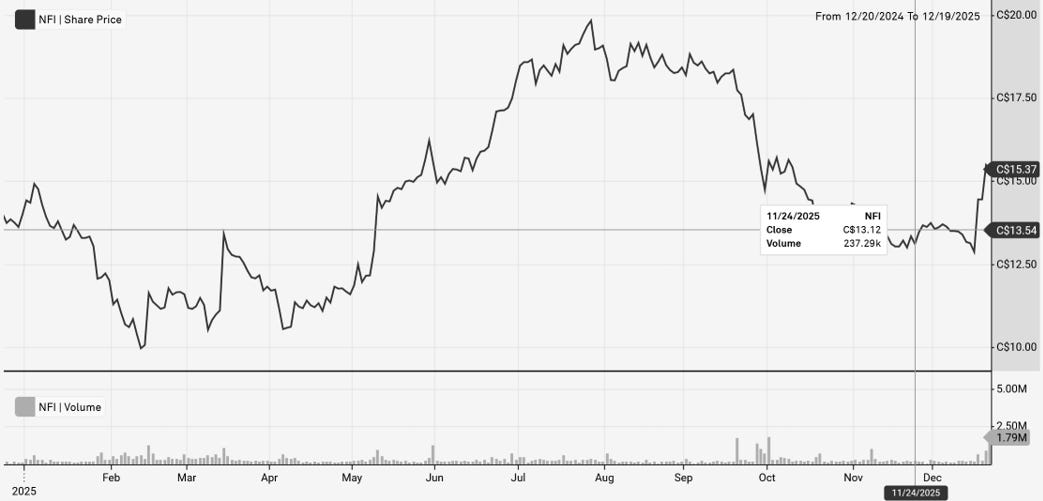

NFI Group TSX:NFI Year-end Christmas Gift

We recently provided an update on NFI Group. A key issue was the major very expensive $230MM electric bus battery recall. As we wrote then, “The charge NFI is taking seems very conservative…the parent of XALT is not going bankrupt, so there is potentially some recoverable amount.”

It turns out to not be such a bad deal for NFI, with the costs largely recovered and some intellectual property to boot. We view this as an excellent outcome.

NFI Announces Battery Recall Agreement with XALT

December 16, 2025

Cooperative resolution expands NFI’s zero-emission bus capabilities and strengthens financial capacity to perform battery recall campaign

WINNIPEG, Manitoba, Dec. 16, 2025 (GLOBE NEWSWIRE) -- (TSX: NFI, OTC: NFYEF, TSX: NFI.DB) NFI Group Inc. (”NFI” or the “Company”), a leader in propulsion-agnostic bus and coach mobility solutions, today announced that it has signed a master settlement agreement (“MSA” or the “Settlement”) with XALT Energy, LLC and its subsidiaries (collectively “XALT”) regarding costs related to the recall on Generation 3 batteries and estimated future costs associated with supporting buses operating with other types of XALT batteries (collectively the “Recall”) described in NFI’s third quarter earnings release on November 6, 2025.

The Settlement is comprised of cash payments, the transfer of certain personnel, and the contribution of relevant assets including battery cells, systems, equipment, and intellectual property, that in aggregate provide approximately 75% to 80% recovery against NFI’s original $229 million provision. The Settlement fully resolves all disputes between NFI and XALT with no admission of fault, wrongdoing, or liability by either party

The CEO has also just announced his retirement. Maybe not such a bad thing to have a fresh set of eyes in the top seat. We remain long. Some others are bullish it seems, including their largest shareholder.

NFI Group Amends Agreement with Coliseum Capital Management

December 19, 2025

Provides Coliseum flexibility to increase its ownership up to 25% of NFI’s outstanding shares

Reflects long-term support and confidence of NFI’s largest shareholder

WINNIPEG. Manitoba, Dec. 19, 2025 (GLOBE NEWSWIRE) -- (TSX: NFI, OTC: NFYEF, TSX: NFI.DB) NFI Group Inc. (“NFI” or the “Company”), a leader in bus and coach mobility solutions, today announced that its Board of Directors (the “Board”) has approved an amendment to its existing Investment Agreement entered into in May 2023 (as amended, the “Amended Agreement”) with Coliseum Capital Management, LLC, as manager of certain funds and accounts (collectively, “Coliseum”).

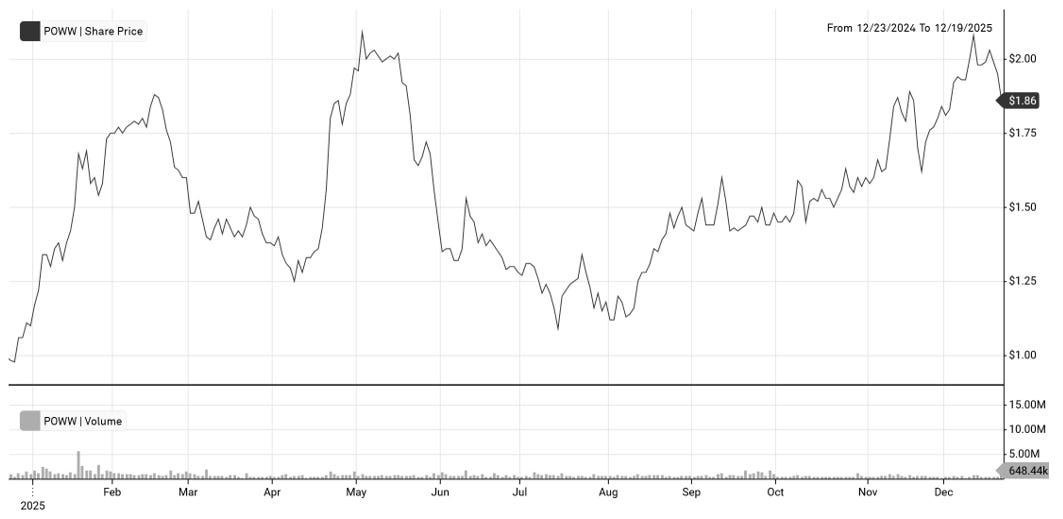

Outdoor Holdings Company (previously Ammo Inc.) NASDAQ: POWW shareholders get a gift too

Outdoor holdings shareholders received a gift from the SEC.

Atlanta, GA., Dec. 16, 2025 (GLOBE NEWSWIRE) -- Outdoor Holding Company (Nasdaq: POWW, POWWP) (“OHC,” “we,” “us,” “our” or the “Company”), the owner of GunBroker.com, the largest online marketplace for firearms, hunting and related products, today announced that it has reached a settlement with the U.S. Securities and Exchange Commission (“SEC”) to resolve its previously disclosed investigation. “We are pleased to have reached a resolution with the SEC which does not include a civil penalty or monetary sanction. The Company has worked hard to put this chapter behind us,” said Steve Urvan, Chairman and Chief Executive Officer of Outdoor Holding Company.

Without admitting or denying the SEC’s findings except as to jurisdiction, the Company agreed to cease and desist from future violations of the antifraud and numerous other provisions of the federal securities laws stemming from, among other things: (i) failure to disclose a former executive officer’s employment and role; (ii) failure to disclose related party transactions involving that former executive officer; (iii) improper capitalization of certain equity issuance costs; (iv) understatement of stock compensation expenses; (v) disclosure concerning the calculation of Adjusted EBITDA; and (vi) inadequate internal accounting controls. The Order acknowledged that the Company is now operating under new senior management that is different from those responsible for the conduct leading to the violations described in the Order.

The turnaround continues. We remain long.

NASDAQ:CROX for Christmas

Disclosure: We now own some Crocs and CROX for the first time in our lives. Position size: Small. Article: Fun.

“What market cap size do you look at?” We have been asked this question many times over the years, and the answer has always been we do not have one. Our core investing philosophy is that anything can be mispriced, it is just that we believe small caps are the most likely place that we will find mispricings. But, that does not mean we just fish there. Frankly, we think many investors, in general, box themselves in unnecessarily and value-oriented investors seem to be particularly prone to this.

“You have to fish where the fish are” as Charlie Munger said. We think he meant that you had to spend your time on areas where the opportunities are greatest, rather than in crowded ponds. However, we think that his quote and mindset is greatly misunderstood. The thing is that sometimes large caps and mega caps also go through market gyrations too, and the easiest time we have found to fish is at peak pessimism. The key is that 1) it does not happen very often, but 2) the nice thing about this strategy is that it does not take much time to look through these ideas.

We usually find one every few years, and often around Christmas it seems. Today we cover Crocs, the most controversial footwear in the world. While it is not a large position, we wanted to end 2025 on a fun note. Maybe this year for Christmas you should get your family a bit of CROX as a stocking stuffer.

Previous large cap checks – Philips CPAP Fiasco

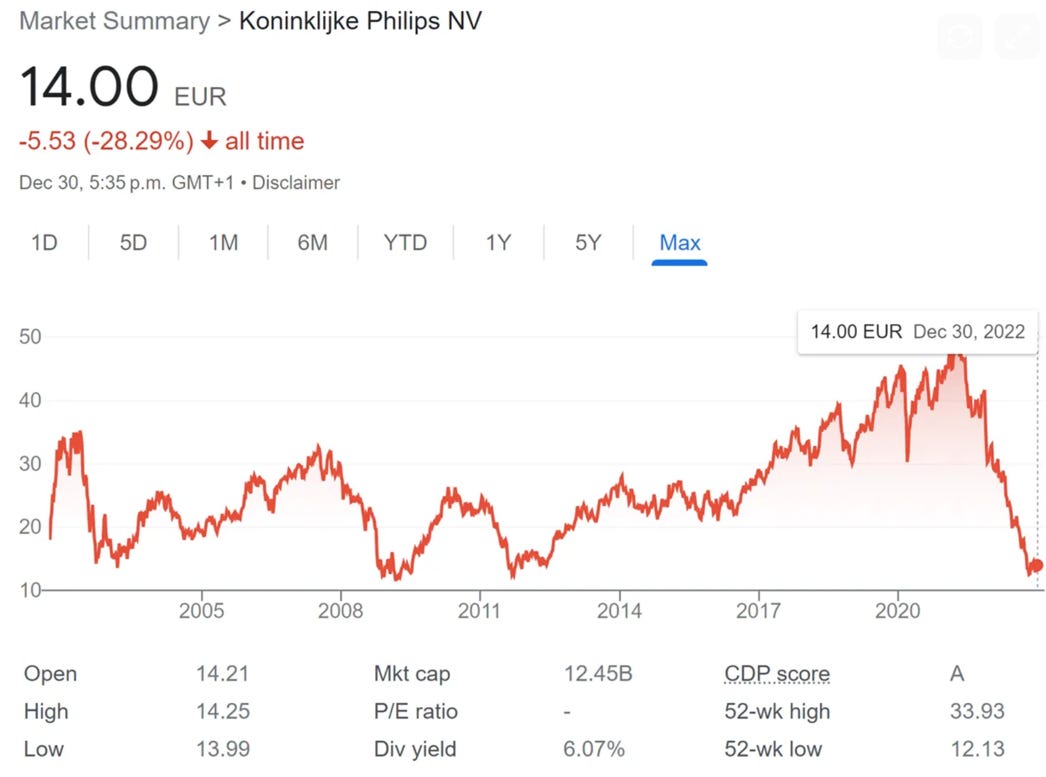

One of our favourite large cap stories was Koninklijke Philips of CPAP machine and toothbrush fame. In late 2022/2023 they were facing serious concerns. As we wrote then:

Is Koninklijke Philips (NYSE:PHG, AS:PHIA) a wonderful Christmas gift, or a lump of coal?

What a stock chart. Philips is a name that you are bound to know. What you might not know is that they are in the middle of a major recall of their sleep apnea CPAP machines and their stock has declined dramatically due to potential ranges of the final total costs, compounded by ongoing supply chain disruptions affecting the whole business. We think Philips is trading at a great value, even under a bearish scenario, and could be considered a bargain purchase in a few years.

While not a holding or active idea for us today, Philips’ history is worth spending some time on. One particularly interesting tidbit is that Philips was one of the original investors in Taiwan Semiconductor TSMC. They did well on the sales of their interests (staggered process), but if they kept the originally owned 28% of TSMC, it would be worth about $100 billion at the time of our original article, dwarfing the remaining Philips healthcare business (~$20 billion and change). TSMC is up another 200% since then.

The core thesis was around CPAP concerns. After talking with various clinics and CPAP users, we concluded it was indeed a serious problem, but overly priced in.

Our time horizon is 3-5 years. We expect the ride to be rocky in the meantime as the company goes through various lawsuits. Also, unless there is a material improvement in underlying operations we would likely seek to sell around EUR 30 (depending on other opportunities at the time of course).

Subsequently, Philips agreed to a US$1.1B settlement for personal injury and medical monitoring claims, on the low end of our range. https://www.philips.com/a-w/about/news/archive/corpcomms/news/press/2024/philips-first-quarter-results-2024.html

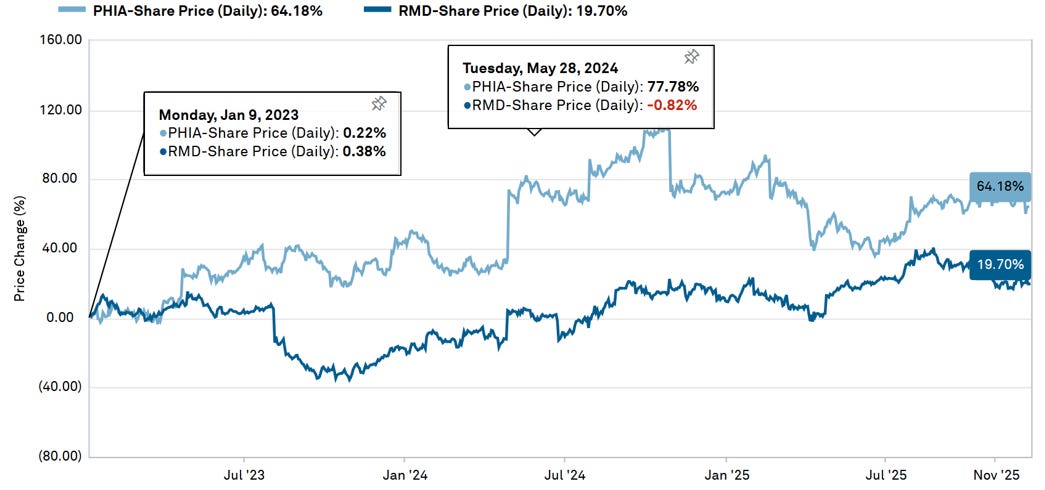

We got our exit. Our original timeline was 3-5 years, but it was much faster than that. Importantly, the stock outperformed the key CPAP competitor Resmed over the same period, i.e. it was not external factors raising all ships.

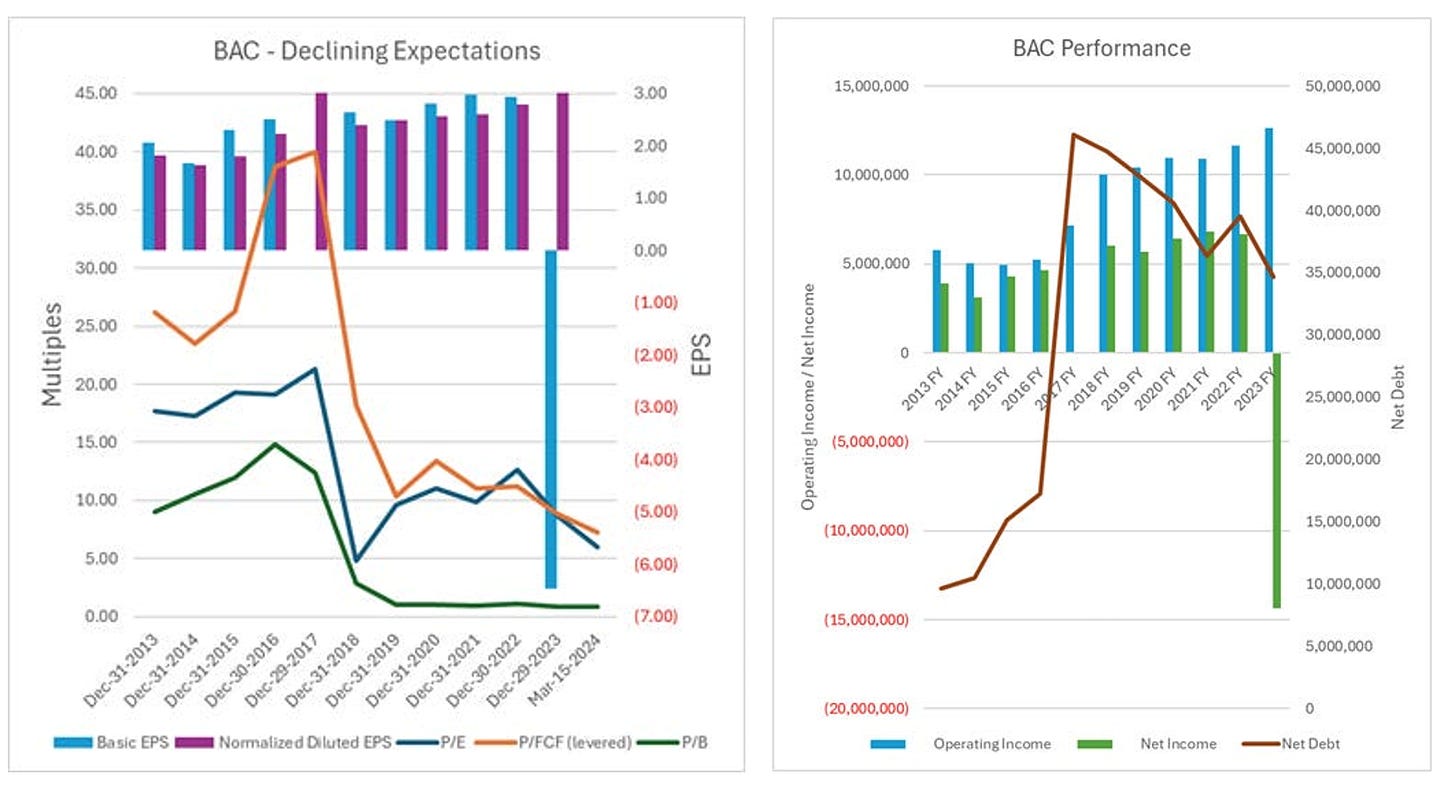

Another example is British American Tobacco, which we covered in March of 2024.

In 2016 BATS made a ~$50 billion takeover of U.S. rival Reynolds American, creating the world’s biggest listed tobacco company. Subsequent to the merger, a combination of high leverage and market headwinds caused a significant decline in the stock price. The decline was driven by a collapse of expectations as shown below.

Again, real concerns about the core business, but priced in in our view, supported by significant additional cash coming in from sales of their stake in ITC, share repurchases, and also potential tailwinds from the pouch business. Subsequent stock performance was quite neat and resulted in a good exit.

Now about Crocs

Recent weakness and investor skepticism are rooted in real issues. In Crocs case, we think:

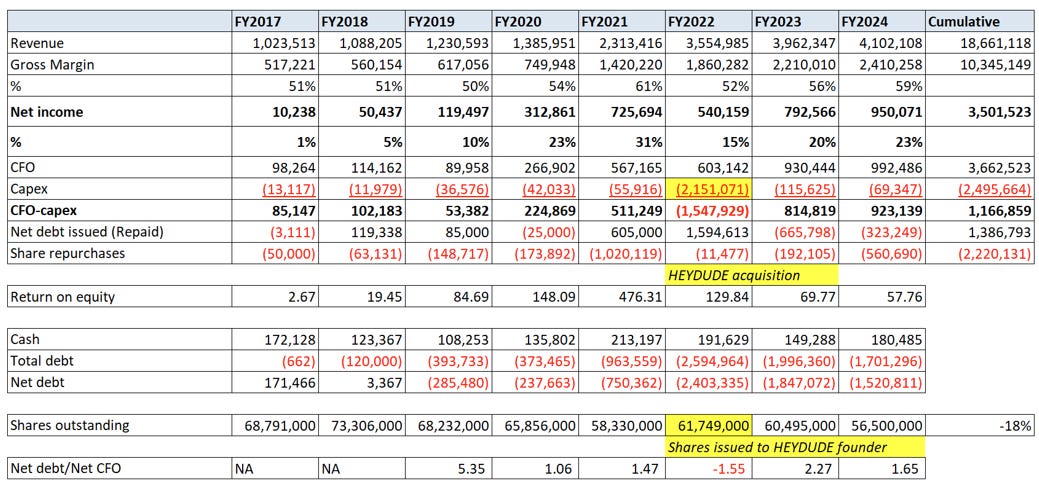

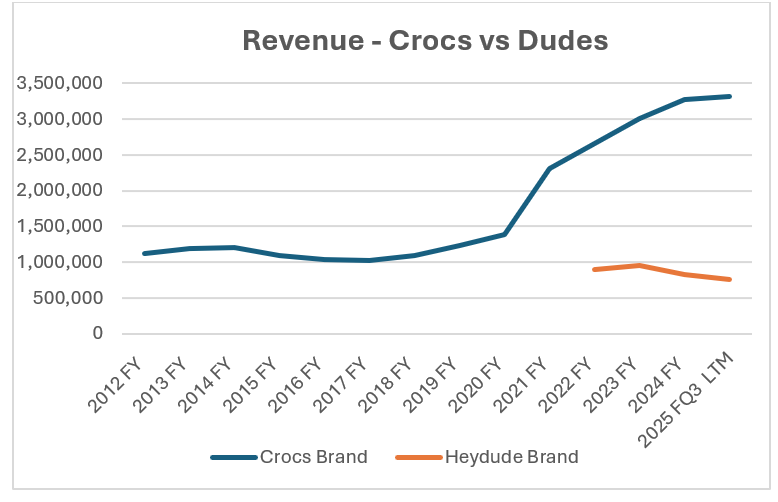

The HEYDUDE acquisition in 2022 for $2.5 billion really does not seem to have gone well.

Weakness in HEYDUDE and U.S. fears of tariffs are real. HEYDUDE has stumbled quite hard, while Crocs North American sales are down single digits recently.

Tariffs and some inventory overhang have been painful.

However, we think pessimism is overblown. Concerns are obfuscating brand resiliency and growing overseas sales. Significant share repurchases are also creating a tailwind for shareholders. Market pessimism and a low share price combined with share repurchases is a wonderful combination for longer-term holders.

History does not repeat itself, but opportunities rhyme. How did Crocs get where it is today?

2002–2004: Crocs launches the original “Beach” clog and sells out at the Fort Lauderdale Boat Show, with early adoption driven by comfort, water-friendly design, and ease of use.

2005–2007: The brand breaks into the mainstream through marketing, goes public in 2006, and adds Jibbitz charms, turning Crocs into a customizable, collectible product. Sales also start in China through a distributor, but real overseas success remains elusive until much later.

2008–2013: Rapid over-expansion collides with weaker demand, forcing store closures, restructuring, and a prolonged survival phase.

2016–2019: Crocs regains cultural relevance through high-profile collaborations, including Post Malone, reframing the brand from novelty to fashion statement.

2020: Pandemic-era demand for comfort and the “Free Pair for Healthcare” initiative sharply boost visibility and brand goodwill. They also refocus on overseas markets, pivoting from generic Crocs to region-specific offerings. Overseas sales subsequently start to accelerate.

2018–2022: Luxury and runway exposure supposedly legitimizes Crocs within a few parts of high fashion, extending the brand beyond utilitarian footwear.

2021–2022: Crocs acquires HEYDUDE for $2.5 billion to diversify its portfolio and scale a second casual footwear growth platform.

On the ground research

Something we like doing here at Canadian Value Investors is hands on research and keeping our feet to the ground. How can you understand Crocs… without wearing them? And so, we ordered Classic Clogs for myself and my wife. Look at these beauties.

His and hers.

Importantly, they are actually very comfortable. We understand why healthcare workers wear them. While we are not fashion experts, Crocs must be the most controversial fashion trend outside of real fur.

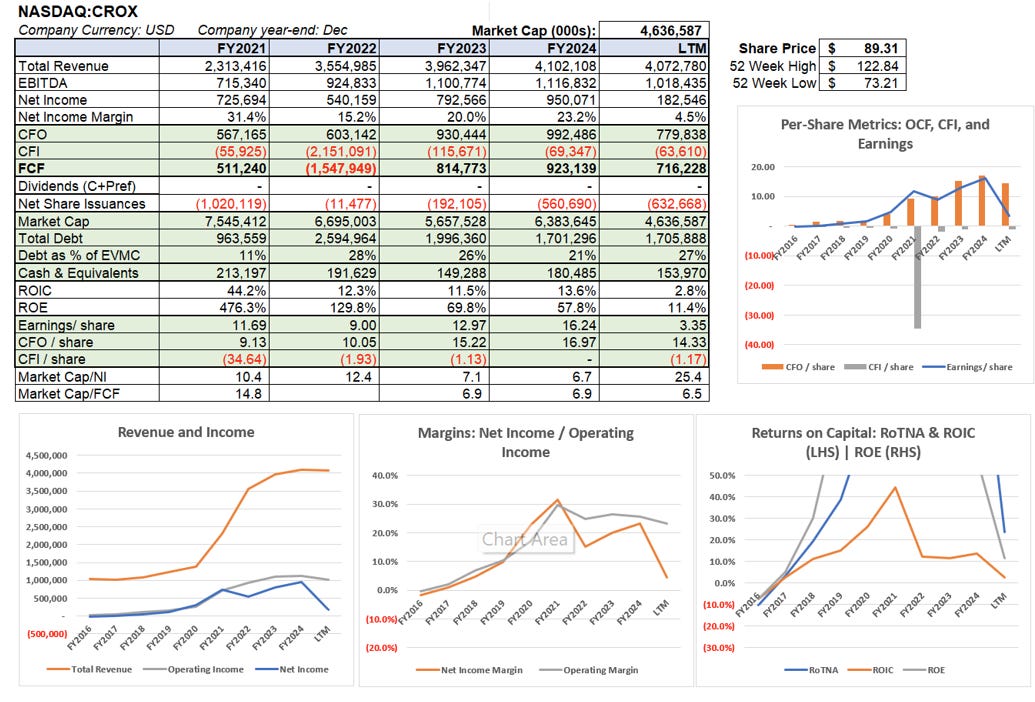

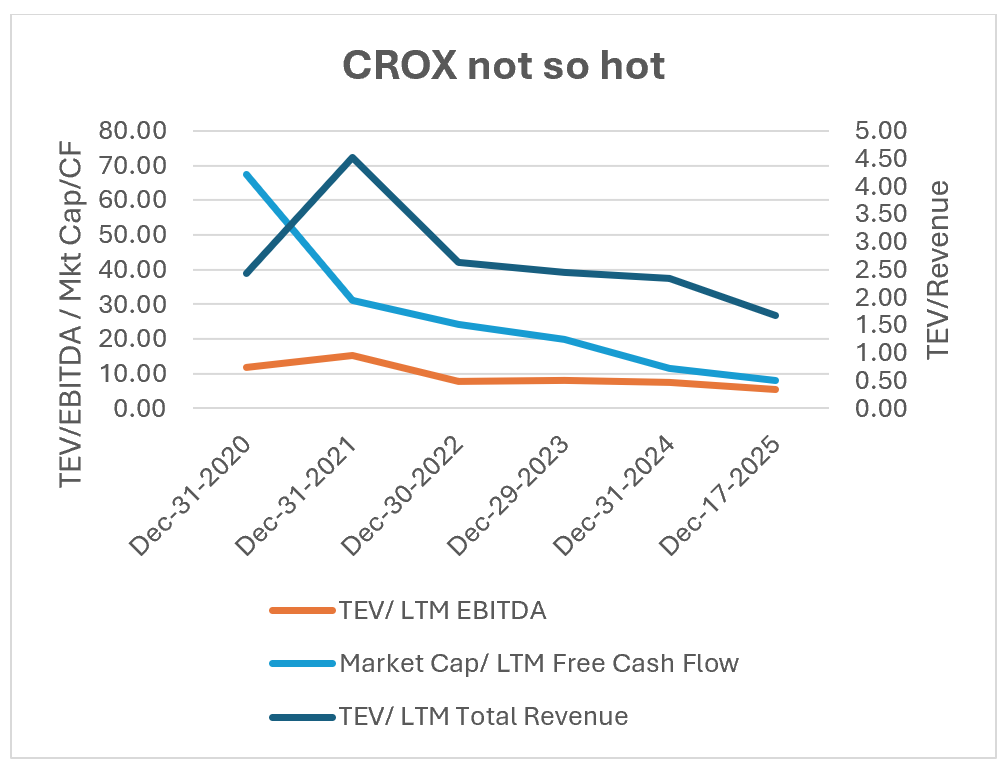

CROX not so hot

Key problems include:

Tariffs - Tariffs have not been helpful, with the estimated run rate impact being ~$100MM a year per management with margin compression.

Brand health efforts – Management is trying to reduce Crocs promotional activity and remove aged old inventory in the market while increasing promotions at HEYDUDE.

General mixed bag of performance, with growing international Crocs sales and small decline/flat in North America. Q3 was interesting, with international sales growing 23% year-over-year while Crocs declined ~9% and HEYDUDE declined ~20% (oof).

And yet, there are a few things to celebrate.