Ammo Inc. no longer - Outdoor Holding Company NASDAQ: POWW hits the reset button at the AGM

A case study on how screens can mislead you and how disputes can destroy value

Disclosure: We are long. Position weighting LOW, Risk HIGH, but what a story

We have followed POWW for a few years now. They own and operate the eBay of guns, gunbroker.com, and their multi-year Board/management fight officially came to a close at the AGM last week. Boy was it expensive…

We have made recent purchases at ~$1.30s/$1.40s as part of our basket of special situations. You have a high margin, low capital business that trades at a reasonable multiple based on reasonable expectations of new (returning?) management. It appears to have its issues behind it, but uncertainty remains high.

As we noted in May, in the Steve Urvan Coup: To recap, AMMO Inc. acquired gunbroker.com, America’s legal eBay of guns, from creator Steve Urvan during the boom times of COVID for US$240MM in a needlessly complex mix of cash, debt, and equity. AMMO’s core business prior to this was a massive-loss-making ammunition division with a long questionable history. They subsequently announced the sale of the ammunition division (a good outcome) and now just have Gunbroker run by its founder after a long drawn-out coup. See archives for full background.

Since our last update, their have now issued clean financials with the sold ammunition division removed as discontinued operations and, separately, resolved former management’s accounting issues, received shareholder approval for the proposed settlement agreement with Steve, and regained Nasdaq compliance - https://outdoorholding.com/news/news-details/2025/Outdoor-Holding-Company-Regains-Full-Compliance-with-Nasdaq-Rule-Following-Successful-Annual-Stockholder-Meeting/default.aspx

Will POWW be a big winner for shareholders? If you are willing to look through the noise, you will see a high margin niche business with the founder of it given the mandate to run it. For everyone else, this has turned into two stories. The first is how stock screens can fail you. The second is how wild Board fights can waste unbelievable amounts of time and money.

Will Steve Urvan right the ship? Let’s find out.

The quiet AGM

The AGM last week had a laundry list of items to approve. The most important was #4 – the warrants. All items were approved.

Chairman and Chief Executive Officer Steve Urvan said, “We are very pleased to regain full compliance with Nasdaq Listing Rule 5620(a). We received a series of deficiency notices starting over 9 months ago, and the board and management team has worked tirelessly to resolve these deficiencies. In the remediation process, we have dramatically improved our internal corporate processes and governance to position the Company for the future. Witha new board of seasoned veterans, we can now focus fully on our mission as a pure-play online marketplace for firearms and outdoor enthusiasts. Our primary mandate will be accelerating growth in our core online business and enhancing long-term stockholder value. I look forward to working with our newly elected board on achieving these goals.”

At the Annual Meeting, the Company’s stockholders approved the following matters, each of which is described in greater detail in the Company’s proxy statement filed with the Securities and Exchange Commission on July 14, 2025:

1. Election of Steve F. Urvan, Christos Tsentas, Wayne Walker, Houman Akhavan, and David Douglas as directors of the Company through the 2026 annual meeting of stockholders.

2. Ratification of Withum Smith & Brown, PC as our independent registered public accounting firm for the fiscal year ending March 31, 2026.

3. Approval of the Outdoor Holding Company 2025 Long-Term Incentive Plan.

4. Approval of the Warrant Share Issuance Proposal.

5. Approval of a Reverse Stock Split of the Common Stock at a ratio in the range of 1-for-5 to 1-for-10, with the exact ratio to be determined at the discretion of the Company’s board within one year of the Annual Meeting.

6. Approval, on an advisory basis, of the compensation of the Company’s named executive officer compensation.

7. Approval, on an advisory basis, of the frequency of future advisory votes on named executive officer compensation in one-year intervals.

The mechanics of the note issue vote is interesting as the size of the settle triggered a Nasdaq rule, specifically:

If the Warrants vest in full and the holder exercises the Warrants to purchase all of the Warrant Shares and Additional Warrant Shares subject to the Warrants (and sells none of its existing holdings), Mr. Urvan would become a beneficial owner of approximately 26.9% of the outstanding shares of Common Stock (immediately after the issuance of such shares and based on the number of shares of Common Stock outstanding as of the Signing Date).

…

As a result, our issuance of Common Stock pursuant to the Additional Warrant, if issued and exercised in full, would cause Mr. Urvan to own 20% or more of our Common Stock and remain our largest stockholder, which may be deemed a “change of control” for purposes of Nasdaq Rule 5635(b).

…

Nasdaq Rule 5635(b) requires stockholder approval prior to an issuance of securities when the issuance or potential issuance will result in a “change of control” of a listed company, which for Nasdaq purposes is generally deemed to occur when, as a result of an issuance, an investor or a group of investors would own, or would have the right to acquire, 20% or more of the outstanding shares of common stock or voting power of a company and such ownership or voting power would be the company’s largest ownership position.

As a result, our issuance of Common Stock pursuant to the Additional Warrant, if issued and exercised in full, would cause Mr. Urvan to own 20% or more of our Common Stock and remain our largest stockholder, which may be deemed a “change of control” for purposes of Nasdaq Rule 5635(b).

We note that there can still be some shenanigans. Technically, based on our interpretation, they could repay the majority of the notes and then still issue the full amount of the warrants, subject to the independent directors voting for this to happen. Questions of independence aside, we view that as unlikely if Steve really does want to hit the reset button as he indicates in his recent shareholder letter (see Appendix).

With respect to Note 2, the Company also has the unilateral option, at any time prior to May 30, 2026, to prepay all, but not less than all, of the then-outstanding principal amount of Note 2 and accrued and unpaid interest thereon in exchange for the issuance the Additional Warrant (the Additional Warrant together with the Warrant, the “Warrants”) to purchase 13,000,000 shares of Common Stock, provided that the Company must first obtain stockholder approval of the issuance of the Additional Warrant and the Additional Warrant Shares pursuant to Nasdaq Listing Rule 5635.

Upon issuance of the Additional Warrant, all remaining obligations under Note 2 would be deemed satisfied with the same force and effect as a prepayment of all principal and accrued and unpaid interest under Note 2. To the DLSC, this unilateral Company right to exchange the Note for the Additional Warrant was a material term in the settlement negotiation; its inclusion significantly reduced the present economic value of Note 2 to the holder at the time of the Settlement Agreement and could, depending on the Company’s share price at the relevant time, extinguish the Company’s obligations under Note 2 for substantially less than the face or present value of Note 2. Any optional prepayment by the Company, whether in cash or by issuance of the Additional Warrant, must be approved by a majority vote of the disinterested and independent members of the Board as then constituted.

The virtual AGM itself was quiet, with only one question. The question:

Richard Leza, inspector of election: Steve, we have received one question from a shareholder. The question is when can we have open quarterly conference calls where we can ask a lot of questions?

Answer – Steve Urvan: We have not at this time made that determination, but we are working toward that. What we want to be is a very open, very transparent company. And we want to have an open dialogue with the Street and with our shareholders. So, we will be heading in that path. I just can't give you a firm date as to when that will begin.

There were no further questions, so we've now concluded the shareholder question-and-answer session. Thank you for attending the Outdoor Holding Company 2025 Annual Meeting of Stockholders

We look forward to the promised increased transparency going forward.

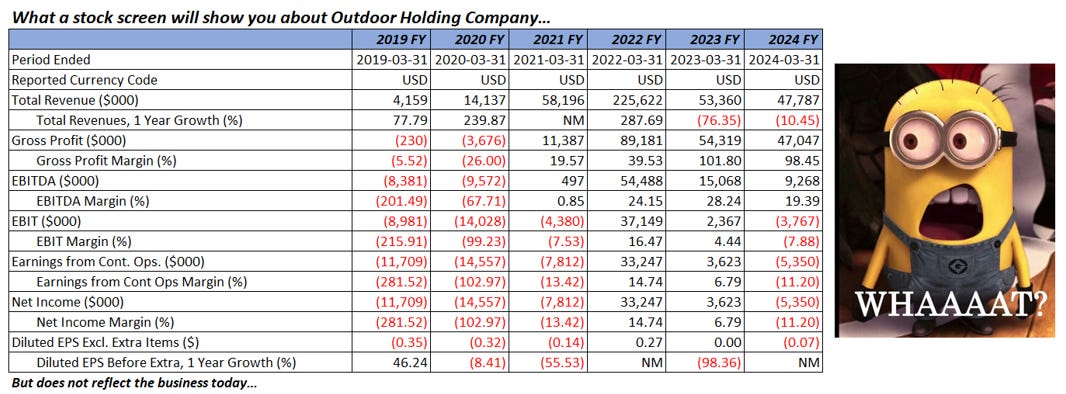

POWW Case study: How screens can fail you

We know that a lot of investors including ourselves use screens to find opportunities. Of course, with some situations the high level snapshot can be very misleading. In the case of POWW, the output you get really has nothing to do with what Outdoor Holding is today, and what it would have been yesterday had the now-sold ammunition division and multi-year insider battle never existed. That said, top line performance for gunbroker.com has been challenged, which can be at least partially be explained by the macro background. We do not doubt that the distractions of the last few years have also had an impact though.

Quick Macro

If you estimated U.S. gun sales based on the level of panic in CNN and Fox News headlines, one could reasonably assume that guns would be flying off the shelves. Interestingly, that is not the case. After a COVID boom, sales are continuing to slide back to pre-pandemic levels. Manufacturers indicate similarly. For example, we show Smith and Wesson sales decline shown below. Gunbroker’s revenue softness is in line with the macro and seems to indicate that they are maintaining market share. https://www.safehome.org/data/firearms-guns-statistics

The RemainCo post-value destruction

We want to pause for a moment and make note of how destructive this multi-year battle has been. If you add up all the legal costs and the actual settlement, the cost exceeds US$100MM, which is remarkable for a company with an enterprise value of less than US$200MM. The ultimate outcome was largely in line with our optimistic expectations (ammo gone, old guard gone), but the cost to get here was not. Thank goodness the loss-making ammunition division was worth something to someone.

There remains significant uncertainty: