Velan Inc. TSX:VLN – All polished up and ready for sale part 2: The RemainCo Statements

An investment banker's wet dream

Disclosure: We still own this one.

Greetings investment bankers. Have you ever wanted the opportunity to sell a company with niche products, macro tailwinds, operational improvements, completely de-levered and with a majority-owned founding family that is ready to sell? Do we have the deal for you!

As we wrote about previously, Velan Inc. is a niche manufacturer of valves for refineries, nuclear power plants, U.S. nuclear submarines and carriers, and LNG terminals. And now, it is all polished up and ready for sale.

The Company tried to sell itself before and found a buyer, but the deal was blocked in 2023 by the French government due to Velan’s division in France (TLDR: The buyer was not French enough). For full background on the previous sale process and the subsequent successful sale process of the French division and offloading of their asbestos liability see archives - https://www.canadianvalueinvestors.com/t/vln

Our core thesis remains the same:

Business improvements appear to have taken hold, while

The core industries they serve have increasing tailwinds (see macro tailwinds)

We believe the family still wants to sell

And now, the successful closing of the French and asbestos liabilities transactions is the catalyst

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Table of Contents:

Deal Updates

The Accounting

Macro Tailwinds

Another Bid? An updated table for Velan’s investment bankers

Strategic Synergies / Buyers

Does the family still want to sell?

Deal Updates

Since our last update, the French division sale to a government-approved buyer closed, and proceeds were used to completely offload their asbestos liabilities – a problem for many interested parties in the last sale process – with significant cash left over. Net proceeds resulted in pro-forma cash of $55MM.

On January 14, 2025, the Company announced two major strategic initiatives. First, Velan entered into definitive agreement with an affiliate of Global Risk Capital (“Global Risk”) to divest its asbestos-related liabilities at a cost of US$143 million (the “Asbestos Divestiture Transaction”). Secondly, Velan entered into exclusive negotiations with Framatome SAS, a world leader in nuclear energy, for the sale of its French subsidiaries, Segault and Velan S.A.S., for a purchase price of €170 million, with the benefit of the transfer of an intercompany loan of €22.5 million, for total consideration to Velan of €192.5 million (the “France Transaction”).

On March 31, 2025, Velan announced the closing of the France Transaction, for a purchase price of US$184.1 million (€170 million), with the benefit of the transfer of an intercompany loan of US$24.4 million (€22.5 million), for total consideration to the Company of US$208.4 million (€192.5 million).

On April 3, 2025, Velan used a portion of the proceeds from the France Transaction to fund the Asbestos Divestiture Transaction, which closed on the same date.

….

The Asbestos Divestiture Transaction, completed on April 3, 2025, was achieved by Velan Inc. creating a new subsidiary and selling its existing U.S. subsidiary, Velan Valve Corp, which was capitalized with $143.0 million from Velan Inc. and $7.0 million from the Buyer. The Asbestos Divestiture Transaction has permanently removed all asbestos-related liabilities and obligations from Velan Inc.’s balance sheet and indemnified the Company for all legacy asbestos liabilities.

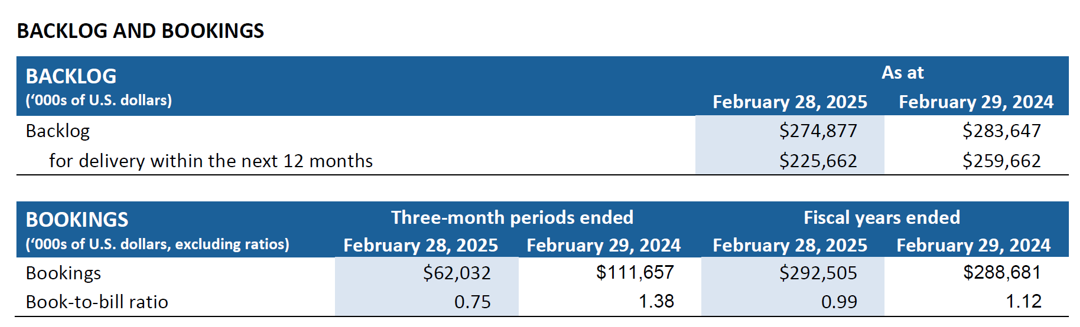

The key question was what was the true cash flows of the standalone post-transactions business as they did not have divisional reporting, and how much might these be worth to a strategic buyer? Since then, they provided their audited financials with the sold division as a discontinued business. The remaining business footprint remains diversified.

The Accounting

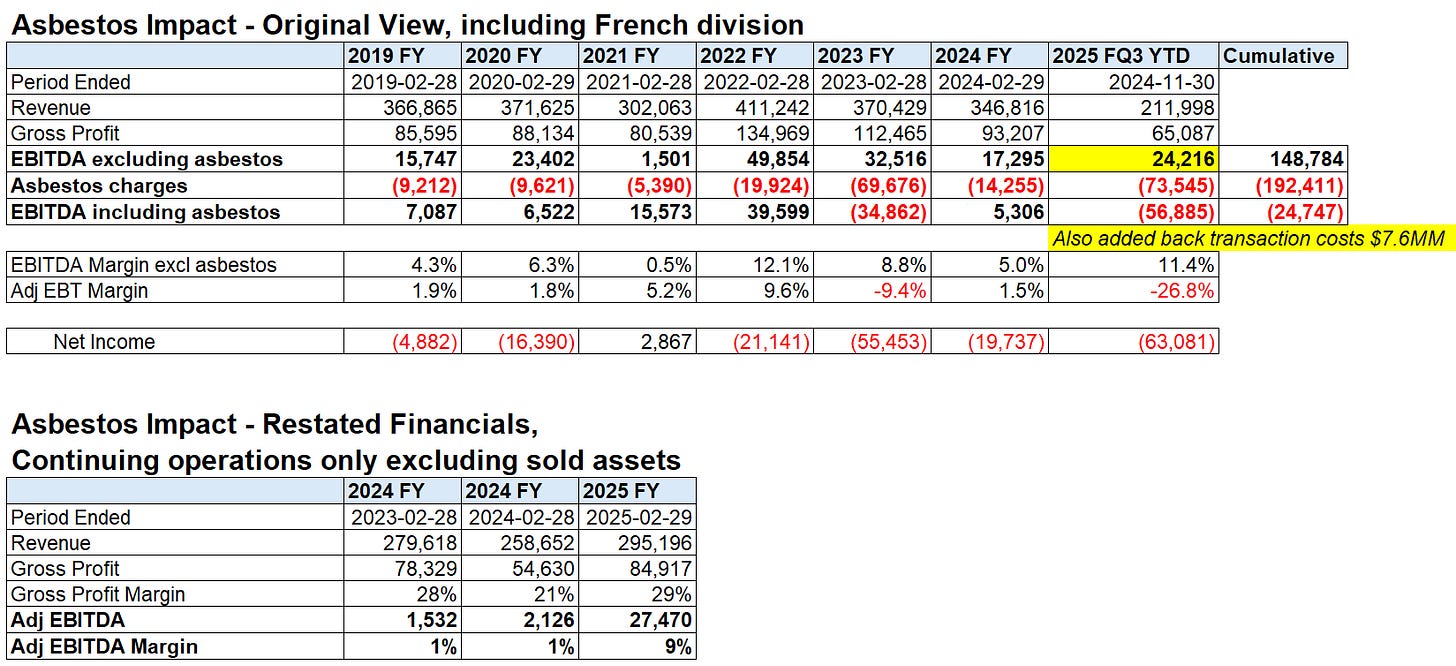

If anything, Velan is a great case study of how a legacy liability can get out of hand. In this case, the affect of their asbestos liabilities dating back to long ago valves is remarkable (see Asbestos - https://www.canadianvalueinvestors.com/i/159434824/asbestos-impact )

Year-end results are out and, in true Québécois fashion, they say it was a “vintage year” and probably celebrated with wine from Bordeau. For our international readers, it is important to note that Velan’s head office is based in Quebec, Canada, though their footprint is global.

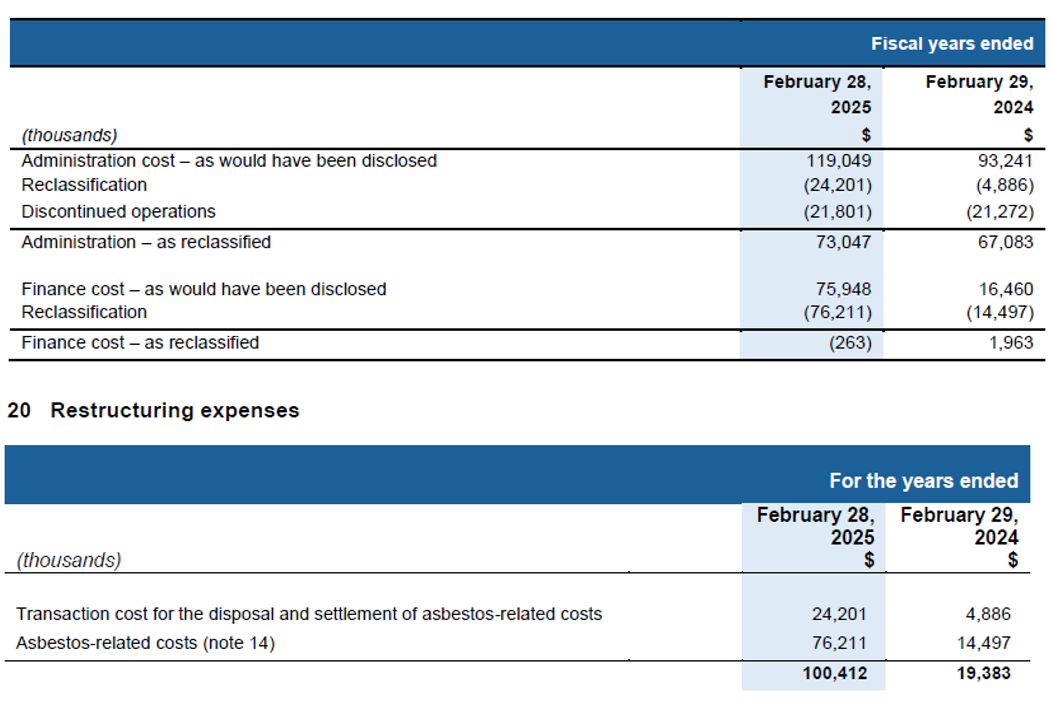

It is also important to understand the underlying accounting first given all of the noise; specifically notes 4, 5 and 20 are key.

Note 4. Reclassification of comparative figures [i.e. the asbestos liability]

As described in note 14 Provisions, the Company settled its current and future exposure to asbestos-related litigation. As these expenses were significant, management considered that the historical information needed to be presented separately to best depict the past performance of the Company, and it reclassified the element of the expenses in “Restructuring expenses” as follows, and related note 20:

Note 5 Disposal of Velan S.A.S. and Segault S.A.S. [i.e. the French subsidiary]

On March 31, 2025, the Company announced the closing sale of its French subsidiaries Velan S.A.S. and Segault S.A.S. (the disposal group) for a total consideration of €192,500 ($208,227). Management of the Company concluded that the criteria for presentation of asset held for sale in the consolidated financial statements have been met before the end of the third quarter and this disposal also meets the criteria for presentation of the results of operation and cash flows as discontinued operations.

Based on the estimated net book value at the closing of the transaction and the related costs, a gain estimated to $96,100 will be recorded in the first quarter of fiscal year 2026.

Macro Tailwinds

Their core business is valves, including coker ball valves. What is a coker ball valve? See Appendix: Speaking of Coker Ball Valves.

Velan is a world leader in ball valves for delayed coking units, one of the toughest applications in an oil refinery. Since they were first introduced to the market in 1983, more than 3,000 Velan coker valves have been installed in 180 refineries across the globe.

They also make valves for other markets that have significant tail winds, such as:

Defense

Valen is a provider of critical valves for defense purposes including U.S. nuclear submarines and aircraft carriers. The positive outlook for defense spending is self-explanatory.

LNG

Valves in LNG (liquefied natural gas) terminals are critical components used to control the flow, pressure, and direction of cryogenic fluids throughout the liquefaction, storage, and regasification processes. These valves must operate reliably at extremely low temperatures (as low as -162°C) and withstand thermal cycling, pressure fluctuations, and potential corrosion from LNG and associated gases. Common valve types include ball, gate, globe, and check valves, often made from stainless steel or other cryogenic-rated alloys. Tolerances are tight—valves must maintain leak rates near zero.

Nuclear

They are a major supplier of valves to nuclear power plants including Canadian CANDUs, with long relationships in the industry including GE and Hitachi, and Bruce Power. They were just selected to support small nuclear reactors. This could become a significant tailwind with recent political changes in both the U.S. and Canada making nuclear green again as we discuss further in Appendix: Politics - Nuclear is green again.

MARKHAM, Ontario (October 10, 2024) - GE Vernova’s Nuclear business (NYSE: GEV), GE Hitachi Nuclear Energy (GEH), today announced it has selected Velan Inc, a Montreal-based company, to provide engineering support and manufacture valves for the first BWRX-300 small modular reactor.

“Our collaboration with Velan will further strengthen the robust and experienced Canadian nuclear supply chain and bring economic benefits to the country,” said Sean Sexstone, Executive Vice President, Advanced Nuclear, GEH. “It also positions Velan to be a strategic supplier as our technology is deployed globally. We will continue to look for opportunities to work with Canadian suppliers to support the deployment of the BWRX-300.”

“Velan’s involvement in this project highlights our decades-long leadership in the nuclear power sector,” said James A. Mannebach, Chairman and CEO of Velan Inc. “As we approach our 75th anniversary in 2025, we are remarkably well-positioned to support this landmark project and help shape the future of Canada’s nuclear energy landscape through Small Modular Reactor technology.”

GEH and Ontario Power Generation are developing the first BWRX-300 at OPG’s Darlington site.

We note that Velan also recently won a major new contract with Bruce Power.

Another Bid? An updated table for Velan’s investment bankers