Velan Inc. TSX:VLN – All polished up and ready for sale

Disclosure: We own this one.

Market Cap: ~$300MM

To put it simply, Velan Inc. has been making valves since 1950, and they no longer want to be a public company. These valves are not for your garden hose. They supply niche valves for 90% of the refineries in North America, Canadian and American nuclear reactors, LNG terminals, and even the U.S. navy among other customers. The Company transitioned from family to non-family management and went through a successful multi-year restructuring (partially obscured by COVID and asbestos liabilities). Post-COVID, the family put it up for sale and got a great offer from Flowserve (NYSE:FLS), only to have it blocked by the French government in 2023 (it’s French division makes nuclear plant values among other things). Now, the French division is being sold to a French-friendly company while the asbestos liability is finally being fully resolved through an agreement with a reputable party, fully paid for by the French asset sale with some cash leftover.

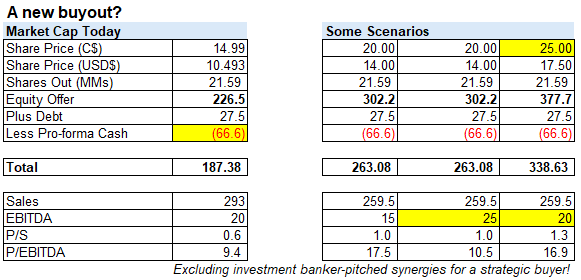

It now trades at a low pro-forma multiple and after the shareholder “vote” on March 20th, the Company will be ready for a sale and we expect it will be sold soon. But at what price? We think the business is misunderstood given the significant impact the asbestos liability has had.

The 2023 Offer that Failed – Flowserve Inc.

The Asbestos Impact

The Asbestos Origin

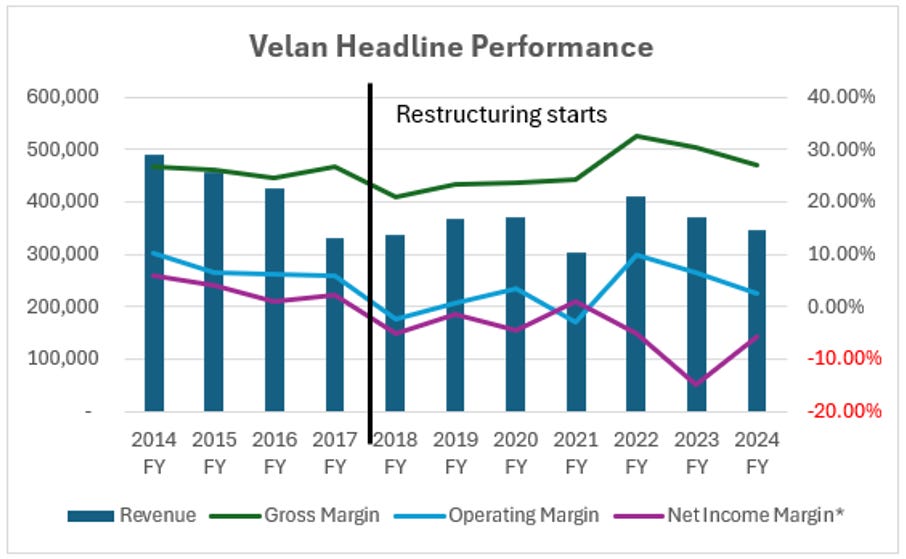

The Turnaround

January 2025 Announcement

The Family Shuffles Out: The timeline

The Value Today: Pro-forma of the transactions

Appendices: Asbestos background, why Flowserve tried to buy, shareholder vote background, Flowserve deal timeline and details

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The 2023 Offer that Failed – Flowserve Inc.

Flowserve Inc. (NYSE:FLS, market cap ~US$7 billion) sells primarily pumps, valves, seals to the same industries as Velan. We note that the industry is still very fragmented. The acquisition would have brought Flowserve’s share of the global industrial valve market to just over 1%. However, all valves are not the same. Both Velan and Flowserve have focused on building niche products for certain subsectors.

Flowserve was quite bullish:

[Flowserve presentation] In fact, [Velan is] in 90% of refineries. Supplier to Canadian and U.S. nuclear plants, supplier to U.S. navy including nuclear submarines, supplier to LNG. – Per Q3 “As you know, we're well positioned for the multi-year nuclear power growth cycle with our proprietary valves offering for small modular reactors or SMRs, along with our global installed base of valves that exist in nuclear reactors. Velan has been actively involved in the nuclear space for more than 50 years, and we continue to get a growing momentum, as reflected by recently announced exclusive agreements and other alliances signed with the world's leading players in nuclear power, including GE-H, Westinghouse, Bruce Power and CANDU, from which we expect to generate significant order intake well into the future. In other energy-related markets such as oil and gas and LNG, we continue to benefit from global transition trends as customers move worldwide to reach their own net zero objectives. Here also, we have wider market penetration with a customer base spanning approximately 90% of North America's oil refineries and a growing presence throughout the world.”

For additional background comments from Flowserve, see Appendix – Why Flowserve Tried to Buy: Flowserve comments on Velan.

The Flowserve offer:

https://www.flowserve.com/en/node/4286/

· Accelerates Flowserve’s 3D Strategy and provides meaningful aftermarket revenues

· Velan brings a highly complementary valve portfolio to Flowserve’s FCD segment

· Transaction expected to be accretive to Flowserve’s Adjusted EPS in first full year after close

· Transaction provides compelling value to Velan shareholders following an extensive and robust review of strategic options

· Velan shareholders to receive C$13.00 in cash per multiple voting and subordinate voting share, representing a significant premium to Velan’s 30-day volume weighted price

DALLAS & MONTREAL--(BUSINESS WIRE)--Feb. 10, 2023--Flowserve Corporation (“Flowserve”) (NYSE: FLS), a leading provider of flow control products and services for the global infrastructure markets, and Velan Inc. (“Velan”) (TSX: VLN), a leading manufacturer of highly engineered industrial valves, today announced that they have entered into a definitive agreement (the “Arrangement Agreement”) under which Flowserve will acquire Velan in an all cash transaction (the “Transaction”) valued at approximately $245 million (C$329 million), including the purchase of all of the issued and outstanding Velan equity for approximately $209 million (C$281 million) and the assumption of approximately $36.3 million (C$48.9 million) in outstanding gross debt as of November 30, 2022. Flowserve will also assume Velan’s $31.4 million (C$42.2 million) of cash and cash equivalents, also as of November 30, 2022. The Transaction is expected to close by the end of the second quarter of 2023.

Most analysis we read of the deal did not seem to fully appreciate the asbestos impact. We argue you need to account for the asbestos liability, which was significant. Using the amount they are getting rid of the liability for today is a good proxy we think.

We note that there was a lot of interest in Velan in the last process, but the asbestos liability created significant noise.

As part of Phase 1 of the auction process, 11 non-binding proposals were received from potential purchasers. In particular, on July 14, 2022, the Purchaser submitted an initial non-binding conditional letter of intent to potentially acquire all of the assets of the Company in an all-cash transaction for an implied Share price ranging from $9.89 to $15.89 depending on whether the Purchaser would assume the asbestos-related liabilities or not (the “Purchaser Initial Offer”).

The parties ultimately settled on the final C$13 per share offer.

As previously mentioned, the deal failed as a result of the French government. The deal failure press release is here - https://ir.flowserve.com/news-events/news-details/2023/Flowserve-Announces-French-Regulatory-Rejection-of-Velan-Transaction-10-05-2023/default.aspx

Asbestos Impact

The effect this liability had on the original sales process was significant. As per the Notice to Shareholders about the sale process:

As part of Phase 1 of the auction process, 11 non-binding proposals were received from potential purchasers. In particular, on July 14, 2022, the Purchaser submitted an initial non-binding conditional letter of intent to potentially acquire all of the assets of the Company in an all-cash transaction for an implied Share price ranging from $9.89 to $15.89 depending on whether the Purchaser would assume the asbestos-related liabilities or not (the “Purchaser Initial Offer”).

For details on the process, see Appendix – Flowserve Deal Pipeline, Due Diligence

In the deal, the assumptions were:

Purchaser to Assume the Company’s Asbestos-related Liabilities. By purchasing all of the Shares, the Purchaser will assume the asbestos-related liabilities arising from legal proceedings against certain of the Company’s affiliates and has a plan to manage those liabilities following closing of the Arrangement. Velan has experienced an increase in asbestos-related costs over time. There were 2,039 claims outstanding at the end of the year ended February 28, 2023 (2022 – 2,071, 2021 – 1,696, 2020 – 1,561). During the year ended February 28, 2023, the Company resolved 674 claims (2022 – 315, 2021 – 388, 2020 - 436), The Company was the subject of 642 new claims during the year ended February 28, 2023 (2022 – 690, 2021 – 523, 2020 - 648). For each of the years ended February 28, 2021 and 2020, the Company recorded legal and settlement cash costs for such liabilities of approximately $11 million and $9.6 million, respectively. For the year ended February 28, 2022, the asbestos-related expenses totalled $25.1 million, including legal and settlement cash costs of $12 million and an initial long-term provision of approximately $13 million for claims outstanding but not yet settled at that time. For the year ended February 28, 2023, the asbestos-related expenses totalled $13.8 million, including legal and settlement cash costs of $11.9 million and approximately $1.9 million of additional long-term provision for claims currently outstanding but not yet settled in comparison with the previous year’s provision. The $14.9-million provision is solely related to claims outstanding and does not consider nor is quantifying any future potential new claims.

The Asbestos Origin

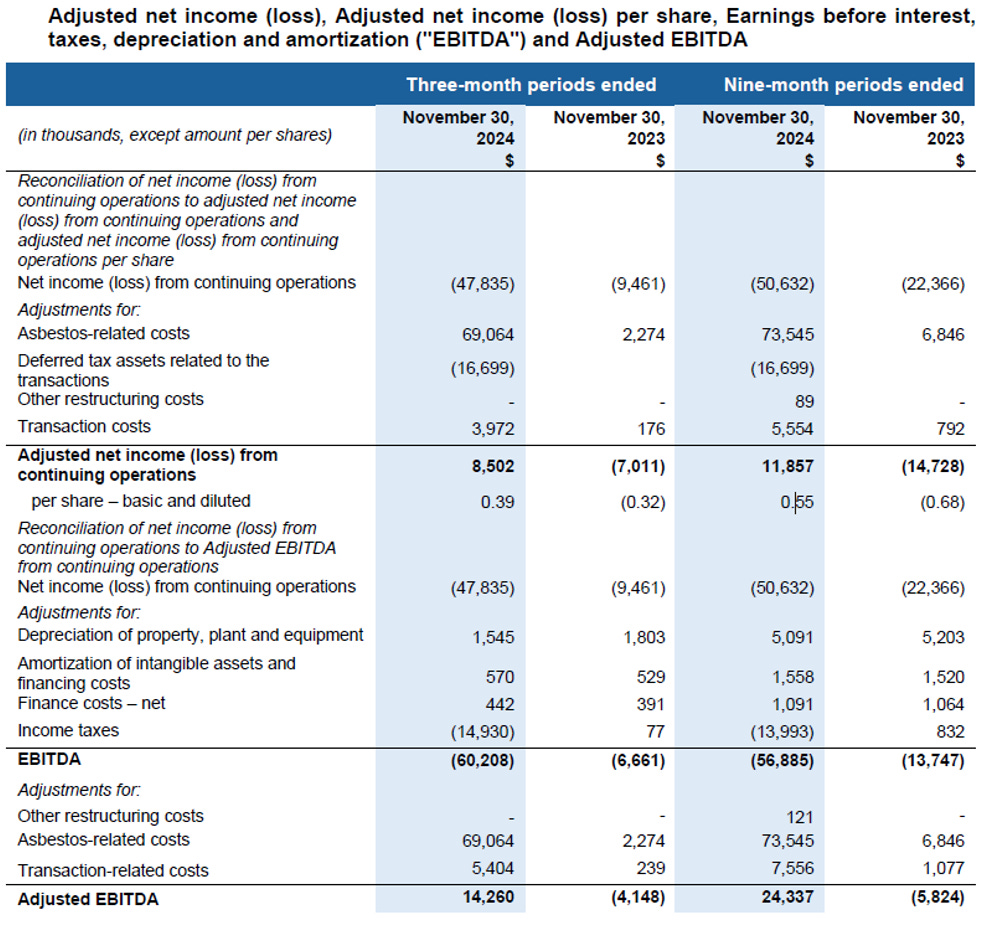

The impact of asbestos has been significant and became much worse over time to the point it offset all of EBITDA as shown below. Per Q1 2019:

Answer – John D. Ball: The Navy business was the source of most of our asbestos lawsuits, but it went back to their practices back in the 1970s and 1980s of using asbestos packing. And as we've discussed on past calls, you can't sue the U.S. Navy. So...what happened over the last 30 years, 40 years, most of the companies that manufacture the asbestos have been sued into oblivion, and then the attention shifted probably about 20 years ago to the companies whose valves were protected by the asbestos. Appendix – Asbestos background

See Appendix – Asbestos background for additional detail.

The sale involves numerous steps (further outlined in the March 20th meeting materials):

The Asbestos Divestiture Transaction consists of the proposed sale by the Company of its U.S. wholly-owned subsidiaries Velan Valve Corp. (“Velan U.S.”) and Velan Steam Trap Corporation (“Velan Steam Trap”) to an affiliate of Global Risk Capital LLC (the “Asbestos Purchaser”), at a cost to the Company of US$143 million (subject to certain adjustments). The Asbestos Divestiture Transaction will be achieved in several steps, including by (1) extracting the equity interests of certain non-U.S. subsidiaries from Velan U.S. and Velan Steam Trap, (2) creating a new U.S. subsidiary, Velan Valve United States OpCo, Inc. (“VVUSO”) to service customers of Velan U.S. on an uninterrupted basis, (3) vesting VVUSO with the current operating assets of Velan U.S., (4) selling Velan U.S. and Velan Steam Trap to the Asbestos Purchaser, which the Company will have capitalized with US$143 million (subject to certain adjustments) and which the Asbestos Purchaser will further capitalize with US$7 million upon closing, for a total of US$150 million…

The turnaround

What COVID and the asbestos problem hide is the improvements from their significant restructuring they started in 2017, including:

-Closing multiple plants, particularly in Quebec, to consolidate production into fewer, more efficient locations. The Williston, Vermont plant became a center of excellence for Navy and nuclear products.

-Shifted production of lower-margin valves to their Indian operations, leveraging lower costs while maintaining quality.

-New software systems, ERP, concentration of distribution centers, while focusing on building niche valves.

For example, in Q2 2020:

Our average days of lateness have gone down by 20% this year versus a target of 25%. We're seeing project management to deliver increasingly on time the project orders that we take… And the percentage of those line orders that are green, in other words, are absolutely on track to be delivered on schedule are over 80%.

A perfect example of the new capabilities in managing complex projects is the recent delivery of a 34-inch, high-pressure, 60,000-pound valve. This is a milestone achievement…the first 34-inch, 9-chrome, super high-pressure steam valve has successfully left Velan on September 24, and ETA China is on October 21. This is even ahead to the contractual delivery date of October 11 by three weeks

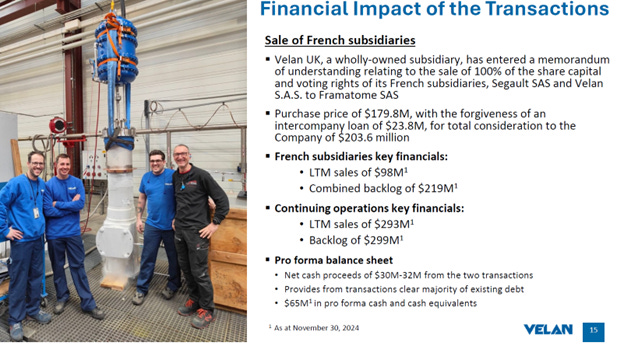

January 2025 Announcement - French division sold and asbestos deal in place

The “vote” on the sale of the French division is March 20th.

[Consider the sale] of its direct French wholly-owned subsidiaries, Segault and Velan S.A.S. (“Velan France”), to Framatome SAS, for a purchase price of US$177.6 million (€170 million), with the benefit of the transfer by Velan France of an intercompany loan receivable from the Company of US$23.5 million (€22.5 million), for total consideration to the Company of US$201.1 million (€192.5 million)(the “France Transaction”),

…

the proceeds of the France Transaction are intended in part to finance the resolution of the Company’s asbestos-related liabilities, through the divestiture of the Company’s existing U.S. subsidiaries to an affiliate of Global Risk Capital LLC (the “Asbestos Purchaser”), at a cost to the Company of US$143 million (subject to certain adjustments), pursuant to the terms of a previously-announced share purchase agreement made as of January 14, 2025

…

While it is required under the CBCA that the Meeting be held, the Required Shareholder Approval is already effectively secured, as Velan Holding Co. Ltd., the Company’s controlling shareholder and the sole holder of the Multiple Voting Shares, representing approximately 72% of the total Shares issued and outstanding and of the aggregate voting rights attached to all of the Shares, has entered into a support and voting agreement pursuant to which it has agreed to vote all of its Shares in favour of the Special Resolution.

…

Healthy Post-Transactions Financial Position. The Company will emerge from the Transactions with a healthy, positive pro-forma net-cash position balance sheet of approximately US$66.6 million, including the net proceeds of the Transactions and, as at November 30, 2024, an executable backlog of US$298.7 million, gross margins in the low-30%’s, positive net income and positive cash flow generation – all with a global leading position in the supply of nuclear, defense and convention power valves to capture continued market growth and opportunities.

The Family Shuffles Out: The timeline

We believe that the family (72% owner) still wants to sell and this is the perfect setup to sell the remaining Velan. It will have the two pain points removed: asbestos and France. Velan would be a stronger company as part of a larger entity.

A.K. Velan Founder passes away at 99 Q2 2018 October 2017 Yves Leduc

“Last but not least, I want to say a few words about A.K. Velan, founder of Velan, who passed away last week at the age of 99 after a full and absolutely extraordinary life… A.K. built the company into the global valve industry leader it is today, and he will continue to be an inspiration to the many people whose lives he touched through his irresistible passion and energy.

Last family CEO, Thomas Velan, retires Q1 2017 (July 2016)

“As you may have read, we announced that effective March 1, 2017, I am retiring from my role as CEO and Yves Leduc will become President and CEO. I will continue to serve as Chairman of the Board.

At the time I retire, I will be 65 years old, having worked at the company for 44 years, the last 14 years as the leader. I believe that I've succeeded to transition the company from the leadership of my father, a founding entrepreneur and longtime leader of the company, to a more global company with a strong executive team ready to move ahead with independent non-family professional leadership.

After I will retire, I will continue to be closely involved with the company, both as Chairman and as an advisor to Yves and his executive team. I believe strongly that Yves is the right person to lead the company into the future. And on that note, I am asking Yves to talk about the outlook.”

Independent Chairman in Q2 2021, family management ends

We're announcing that we're appointing James Mannebach as the new Chairman of the Board. The outgoing Chairman of the Board, Tom Velan, will continue to serve as a director of the company. Mr. Mannebach joined the board in 2018 and he is the first Independent Chairman of the company. His experience in the valve and flow control industry is impressive. He's worked at Emerson Process management, Xomox, Fisher Control (sic) [Controls] and Roper Technologies and IMI as well.

Rob Velan has been appointed Vice Chairman of the Board as the Velan family continues to move from the second generation leadership to third generation and independent leadership.

In addition, their previous CEO Bruno Carbonaro left to go to Caise de Depot CDPQ as Operating Partner.

The Value Today: Pro-forma of the transactions

What is interesting is that all of this noise has hid the fact that this is the Company’s best year since 2022 and also the fact that financials are in USD, while the Company trades in Canada in CAD and underfollowed given the low liquidity and family ownership. The Canadian dollar has depreciated meaningfully since the last offer while most sales are outside of Canada.

We note that Velan does not break out EBITDA by division, only revenue (~25% is the French division), and so conservatism around the remain-co performance is prudent. However, Velan’s position in refining, LNG and nuclear to a strategic buyer is an investment banker’s dream pitch. As an engineer told us, “Velan is good at what they do, especially in downstream”.

To put it another way, they sold 25% of the Company for ~$200MM and will have completely removed the asbestos uncertainty. Could the remaining business be worth a lot more? We think it just might, to the right buyer.

Appendices

Appendix – Why Flowserve Tried to Buy: Flowserve comments on Velan

Stiefel Conference July 2023

Question – Nathan Jones: So, maybe you can talk about these opportunities, how meaningful they are to Flowserve, and what the outlook is for these various markets.

Answer – Robert Scott Rowe: Yeah. So, I'll start with the energy security and we'll go to some of the decarbonization and the new energy stuff. But on energy security, it's substantial. And, one data point is we were booking work this year for a German coal-fired power plant, which, you would not have expected 2 years ago or even 12 months ago. And so, folks are different parts of the world are very, very focused on maintaining energy security. And so, they've got to find a way to make sure that they're providing energy for their people.

And whether that's a nation state or a region or even a company, and so we're seeing all kinds of different things here. And so, for Flowserve, any time there's a flow control aspect, then we're putting pumps and valves into that application. And I'll start with kind of the bigger markets, and I'll work my way down, the nuclear kind of renaissance, and nuclear is substantial.

The EU is now considering that green, and so we're seeing substantial investment in France. France will have greenfield, the rest of the Europe is pushing for life extensions. And so when they do those things, they're adding pumps and valves, they're replacing things, they're upgrading with their aftermarket. This is a big business for Flowserve. It's roughly $300 million today in the nuclear side. It's growing substantially. Our funnel is up 40% to 50% year-to-date, and the Velan acquisition on the valve side adds to our valve nuclear portfolio substantially.

…

Question – Nathan Jones: Okay. Let's jump into the last one. Cash generation had improved significantly in recent years with 95% conversion over the four years, 2018 to 2021, having averaged 66% for the prior decade. I'll leave out 2022, because I think that's...

Answer – Robert Scott Rowe: Right. I appreciate that.

Question – Nathan Jones: Improvements in working capital, structural and sustainable and Flowserve should be able to maintain this improved free cash flow conversion going forward after the disruption in 2022 that's related to COVID, enabling capital deployment opportunities that have been absent the last few years.

Answer – Robert Scott Rowe: Yeah. No. I appreciate you pointing this out. And it has been – it's been a big win. Historically, this business hasn't done well with cash. We were moving that up nicely into this kind of 95% range. And I'd say, where we're at today in our path forward, that's the target. And it just depends, if we're growing substantially, working capital is going to build as we grow, and it might be 85%. But if it flattens out or comes down, we can generate over 100%, which we were doing before.

So, there's a massive focus on receivables and collections. I think we've got that dialed in tight. We've got a shared service center. It's working around the world, and I'm not worried about that. Our challenge of late has been on the inventory side. And so, with lead times extending from our foundries, motor suppliers and people like that, it's just been harder and we're in a growth environment. But I think, our targets for working capital as a percentage of revenue are in kind of the mid- to high-20s. We're just now coming under 30%. I feel like we'll continue to make progress there, and then that will allow us to convert free cash flow, this kind of 85% to 95%.

And so, then what that does and to the last point here is, now it puts us back on our front foot, thinking about capital allocation. And so, I touched on this Investor Day in the third quarter. In the third quarter, we'll come out with a very formal capital allocation policy. But I feel I'm just excited to be able to talk about it. I wasn't able to do that last year. And we know that's important part of what investors want from us. And so, we'll come out with a very thoughtful approach to how we redeploy capital. But, again, we're fortunate to be in that position now right now.

Question – Nathan Jones: Yeah. Well, you've got a good backlog margins going up, so you've got EBITDA increasing, you've got cash coming in, so you've got the debt decreasing, which is getting you into a position where leverage is going to be the spot where you can deploy more capital. Maybe you can talk about Velan a little bit...

Answer – Robert Scott Rowe: Yeah. No, that's a good one.

Question – Nathan Jones: ...and then what the strategic priorities are for capital deployment.

Answer – Robert Scott Rowe: Sure. I'll touch on Velan. So, we announced the transaction with Velan. It's a $400 million revenue valve business out of Montreal, Canada, but a big international business. Purchase price was just over $200 million, and so we like the ability to get $400 million of revenue at that price. I was just up there yesterday. The team's super excited. We're working through the regulatory process in Europe right now, but we very much expect to close this in Q3. And we're excited about it. It rounds out our valve portfolio. They've got a heavy nuclear position, and then they've got a cryogenic position for LNG and hydrogen. And so, we really like how it fits the 3D strategy, and we're excited about the team, their customer – they've got good customer relationships, and they're very technical on what they can do. And so, it fits really well.

And then, on capital allocation, again, we'll get real tight on this in the third quarter, but I'd say, to start on a positive, we kept our dividend through the COVID, through the recession, through everything, and so we see that as a commitment to our shareholders. Traditionally, we would buy back shares at a minimum to offset dilution, and over time, we've done a lot of share repurchases. So, we'll get back on the – at a minimum offsetting dilution and then evaluating additional share purchases.

And then, the other one we think about would be the M&A. And so, we like these bolt-on M&A, we like the more programmatic. So, anywhere in that range of kind of $200 million to $500 million of revenue makes a lot of sense for us. And so, that would be the balance of additional share repurchases versus programmatic M&A. But again, we're just excited to be back in that position to do this.

Goldman Sachs Conference May 2023

Question – Joe Ritchie: And improving. Profitable and improving. You guys did an acquisition recently. You want to talk about how that came together 'What attracted you to the – is it Velan, am I pronouncing it right?

Answer – Amy B. Schwetz: Yeah.

Question – Joe Ritchie: Yeah. So what attracted you to that asset specifically?

Answer – Amy B. Schwetz: Sure. So as we talk about the 3D strategy, I've talked about nuclear and LNG as being part of that strategy. And Velan has long been a name with sort of respected products in that space. This is largely a family run business. They have a portion of their shares that are publicly traded on the Toronto Stock Exchange as well. But this was a process that was run that we were involved in, and ultimately we're the winner in the process. But it's one that the more we looked into, the more excited we got about the fit with our portfolio. One very little overlap.

So, even when we're involved in the same industry, the valves that we supply to the nuclear industry are different than the valves that are part of their product portfolio. So, we saw a real opportunity to expand our presence within that nuclear space in a way that wasn't cannibalistic. So, a real opportunity to grow revenue with respected names. We think they do R&D well. We're excited about the reach that it gives us. And I think that we're also pretty confident that there are synergies between the two businesses that we can capitalize on.

So, we've talked about $20 million of run rate cost synergies. We also think there's an opportunity over time to drive higher revenues via the use of our QRC network and really think about that aftermarket a little bit differently than they might have with their resources. So, Really excited. We're anticipating that will close in the third quarter of this year. And we're using what is a little bit extra time to continue to progress our integration planning, make sure that we hit the ground running on day one and can absorb this as part of our portfolio. But I think there's a lot of excitement and a lot that we really like about this acquisition.

Question – Joe Ritchie: That's great. It seems to me like this is predominantly an OE business and they haven't really maybe focused as much on the aftermarket. Is that a fair assessment?

Answer – Amy B. Schwetz: That's a fair assessment. And I mean, to be fair, they've done nicely from a margin standpoint with that OE element of the business. And I think that this is just being part of a larger company will allow us to utilize the network that we already have in place. So, it won't require additional investment, and will allow kind of that strength in OE to become a strength in the aftermarket moving forward.

Flowserve Q1 2023 Call

Great. Thank you, Amy. I'd like to provide a brief update on the Velan transaction. Our integration planning efforts with Velan are progressing well. The more we interact with Velan's associates and sites, our confidence only increases that this is the right acquisition for Flowserve to create substantial shareholder value.

We are eager to begin the integration of the Velan associates, products and sites into Flowserve. We're meeting many committed and talented associates around the world with a passion for providing solutions into challenging applications like nuclear, defense, and civil service. We continue to believe significant opportunities exist with the combined portfolio, and we remain fully committed to delivering at least $20 million of annualized cost synergies to be achieved by the end of year one. Additionally, we expect the transaction to be accretive to our adjusted EPS in the first full year following close.

While we're making significant progress with the regulatory approvals, there are certain agencies in Europe that are taking longer than our original expectations, and we now believe that we'll close the transaction in the third quarter versus our prior expectation of closing late in the second quarter.

Appendix – Asbestos background

Note actual asbestos costs in G&A are higher for the last two years than their EBITDA addback reflects the valuation adjustment.

Asbestos origin per Q2 2019

Answer – John D. Ball: Well, it's a good question. The Navy business was the source of most of our asbestos lawsuits, but it went back to their practices back in the 1970s and 1980s of using asbestos packing. And as we've discussed on past calls, you can't sue the U.S. Navy. So...

Question – Robert J. Beutel: Right.

Answer – John D. Ball: ... what happened over the last 30 years, 40 years, most of the companies that manufacture the asbestos have been sued into oblivion, and then the attention shifted probably about 20 years ago to the companies whose valves were protected by the asbestos. The trend so far this year is favorable, but we have up years and down years, and there's no rhyme or reason to it that we can see. It's not tailed off, but it's eased up a little bit this year.

The new business for the Navy has none of the asbestos because I think they've learned lesson. So, asbestos is not an issue going forward on Navy contracts, but the current asbestos lawsuits are a result of contracts 40 years ago.

Question – Robert J. Beutel: And in no way does the new business enable you to contain, control, or mitigate anything that happened 40 years ago? I mean...

Answer – John D. Ball: No, unfortunately.

Question – Robert J. Beutel: Okay.

Answer – John D. Ball: Until we have tort reform – I mean, we have some pretty strong feelings about some of these law firms in the States. Until we have tort reform to clean up the legal environment of the States, I think it's safe to say we're still going to be sued even if it's completely without justification. It's almost like legal blackmail.

Gets worse, increasing liabilities – Q1 2021

Answer – Pierre Yves Leduc: So, on the second part of your question, unfortunately, it's one of our costs in (28:49) doing business. We're not seeing asbestos – signs of the asbestos litigation go down. It's been fairly stable over the last three, four years and you have spikes here and there, but we're dealing with it, so don't expect us to go down. That's all I'll say at this stage and it's something we're managing very tightly. John?

Answer – John David Ball: Yeah. And you'll see more information on the MD&A, which we filed on SEDAR. There's a section on Contingencies. We talk about both the dollars and the number of cases and the location of those cases in the United States. So, this is a purely American issue. We don't have a problem with asbestos anywhere else, but the United States. It's a significant amount per year. Quarter-on-quarter, Q1-on-Q1, it's pretty much flat by coincidence. So it was $2,046,000 versus $2,028,000 last year. The number of outstanding claims is pretty much flat. We had 1,583 claims outstanding at the end of Q1 versus 1,561. It dates back to the 1970s and 1980s, principally in respect of work valves that we supply to the U.S. Navy. The U.S. Navy specified asbestos packing to protect against fires on ships. And at that time, I don't think people were fully aware of all the risks of asbestos. That was a U.S. Navy requirement. The people who supplied the asbestos have all been sued into bankruptcy years and years ago. So they're coming after companies like the Velan that supplied the valves that had the asbestos packing on there.

You would think this problem would decrease over time. However, the lawyers out there seem to find new and ingenious arguments for continuing to sue, so there's a concept of secondary exposures. So even if many of the people who worked on these shipyards back in the 1970s have passed on, the next generations, their kids and grandkids, who might have bounced on their grandfather's knee after he came home from work, they're continuing to sue for it. We have not actually gone to court and settled. We haven't had judgments rendered against us. It's a little bit like an extortion where you try to place your arguments and then you negotiate the best possible settlement, given the cost of going all the way to at work with the additional legal fees and the possibility of a judgment that goes against you.

So in short, there is...

Answer – Pierre Yves Leduc: John, just to summarize, as I said, it's a fairly stable concept we're learning to live with. But in answer to your first question, sir, the reduction in administrative cost is not the result of a reduction in asbestos. It's the consequence of actions we took and also focus on SG&A. And as I said earlier, the wage subsidy has helped in the first quarter as well mile down the impact on our overall structural cost.

Q1 2022 gets worse

Question – Robert J. Beutel: Okay. My question this morning was – my first question this morning is really on your admin costs. And with respect to the asbestos, the $2.1 million increase in asbestos litigation expenses, you used the expression that it's a timing matter and that there was no change in the long-term trend. Do I have that correct?

Answer – PierreYves Leduc: Yeah, I said that because it's very difficult to read – to see into what those increased costs, a change in trends. The reality is that in the last five, six years, we've seen up and downs. This is the higher up that I've seen. Situation is the same. There's a number of claimants out there that look for what I'd like to refer to as the last man standing given that the original manufacturer of asbestos product that truly created the issues, most of them actually gone bankrupt. So, the attorneys are looking for companies that were present and did have asbestos in their product in the 1980s. And even if the causal relationship is very thin or nonexistent, it will – if we fit that profile, we'll be sued, and that's what's happening right now. So does that mean that we're going to see the costs continue to go up? We're trying to see clearly through it. It's not a situation we like at all, but we're managing it very tightly. So, for example, we changed our approach and hired new lawyers in the US. We believe that might help us in terms of the efficiency of the legal costs. But it's a problem and that's always been there. The only thing I can tell you is that we're managing it tightly with the highest possible level of oversight.

Answer – John David Ball: And Yves pointed out the timing related to the change of law firms. So, we had an overlap of law firms and that was probably the biggest part of the increase that we had in Q1.

Q4 2024 overview

Answer – Benoit Alain: Yeah. Well, in the asbestos, there's three components, there's the claims that we know we will settle, claims that we know that – well, the chance of settling or low number is high. And the third one is all the future claims. This year we took a more conservative approach versus previous year. You see the total expense for the full year is $25 million asbestos, $12 million is related to the same as last year. So essentially we pick a provision on the first category I mentioned. But this year we decided to, as I said, take a more conservative approach and we took a provision on the first two. We still don't make any provision for future claims that we didn't receive yet, so that's the current situation. But again, this is definitely a lot more conservative than previously, and those number, those extra expenses are part of our EBITDA this year.

Question – Unidentified speaker: Understood. So the expenses going forward should go down but not disappear. Is that the right way to think about it?

Answer – Benoit Alain: You are absolutely right.

Liability sold Jan 2025

Finally they enter into definitive agreement with an affiliate of Global Risk Capital to divest its asbestos-related liabilities at a cost of US$143 million.

Velan has entered into an agreement (the “Asbestos Divestiture Agreement”) with an affiliate of Global Risk Capital (the “Buyer”) to permanently divest its asbestos-related liabilities (the “Asbestos Divestiture Transaction”). Global Risk Capital is a long-term liability management company specializing in the acquisition and management of legacy corporate liabilities. The Asbestos Divestiture Transaction will be achieved by Velan selling its existing U.S. subsidiary, Velan Valve Corp., which will have been capitalized with US$143 million (subject to certain adjustments) from Velan and US$7 million from the Buyer. The Asbestos Divestiture Transaction will permanently remove all asbestos-related liabilities and obligations from Velan’s balance sheet and will indemnify Velan for all legacy asbestos liabilities. Velan plans to fund the Asbestos Divestiture Transaction by using available cash and a portion of proceeds from the sale of its French subsidiaries.

Appendix - Shareholder vote March 20th meeting

to consider and, if thought advisable, to pass, with or without variation, a special resolution (the “Special Resolution”) approving the proposed sale by the Company’s U.K. direct wholly-owned subsidiary, Velan Valves Limited, of its direct French wholly-owned subsidiaries (being the Company’s indirect wholly-owned subsidiaries), Segault and Velan S.A.S. (“Velan France”), to Framatome SAS, for a purchase price of US$177.6 million (€170 million), with the benefit of the transfer by Velan France of an intercompany loan receivable from the Company of US$23.5 million (€22.5 million), for total consideration to the Company of US$201.1 million (€192.5 million)(the “France Transaction”), as outlined in the full text of the Special Resolution provided in Appendix B to the accompanying management information circular (the “Circular”);

Specific details of the matters proposed to be put before the Meeting are set forth in the Circular which accompanies and is deemed to form part of this notice of Meeting (this “Notice of Meeting”). Among other considerations, the proceeds of the France Transaction are intended in part to finance the resolution of the Company’s asbestos-related liabilities, through the divestiture of the Company’s existing U.S. subsidiaries to an affiliate of Global Risk Capital LLC (the “Asbestos Purchaser”), at a cost to the Company of US$143 million (subject to certain adjustments), pursuant to the terms of a previously-announced share purchase agreement made as of January 14, 2025 among the Company, its U.S. wholly-owned subsidiary, Velan Valve Corp., and the Asbestos Purchaser (the “Asbestos Divestiture Transaction”).

The France Transaction requires approval by not less than two-thirds of the votes cast at the Meeting by Shareholders virtually present or represented by proxy and entitled to vote at the Meeting (the “Required Shareholder Approval”) pursuant to subsection 189(3) of the Canada Business Corporations Act (the “CBCA”). While it is required under the CBCA that the Meeting be held, the Required Shareholder Approval is already effectively secured, as Velan Holding Co. Ltd., the Company’s controlling shareholder and the sole holder of the Multiple Voting Shares, representing approximately 72% of the total Shares issued and outstanding and of the aggregate voting rights attached to all of the Shares, has entered into a support and voting agreement pursuant to which it has agreed to vote all of its Shares in favour of the Special Resolution. Accordingly, subject to the entering into of the definitive share purchase agreement and the satisfaction of customary closing conditions, the France Transaction will proceed. Although the Asbestos Divestiture Transaction does not require Shareholder approval under the CBCA, it is discussed in this Notice of Meeting and the Circular due to its interconnectedness with the France Transaction.

Reasons for transaction

Extensive and Robust Processes. In 2024, with the assistance of its financial advisors BMO Capital Markets and Ducera, the Company launched targeted processes for the sale of each of its French Subsidiaries and the divestment of its asbestos liability exposure, engaging with select groups of bidders. See “The Transactions – Background to the Transactions”.

The France Transaction represents the best and highest proposal for the French Subsidiaries received by the Company, free of financing or regulatory conditions, and ensures that the French Subsidiaries can be monetized, which is in the best interest of the Company and its Shareholders. BMO Capital Markets recommended to the Board of Directors that it enter into the France Transaction.

The Asbestos Divestiture Transaction represents the most compelling asbestos divestiture proposal received by the Company, from a financial standpoint and from a deal certainty and structuring standpoint, with an experienced asbestos divestiture partner identified by the Company and its advisors. Ducera, similarly, recommended to the Board of Directors that it enter into the Asbestos Divestiture Transaction.

…

Healthy Post-Transactions Financial Position. The Company will emerge from the Transactions with a healthy, positive pro-forma net-cash position balance sheet of approximately US$66.6 million, including the net proceeds of the Transactions and, as at November 30, 2024, an executable backlog of US$298.7 million1, gross margins in the low-30%’s, positive net income and positive cash flow generation – all with a global leading position in the supply of nuclear, defense and convention power valves to capture continued market growth and opportunities.

Asbestos sale process

The Asbestos Divestiture Transaction consists of the proposed sale by the Company of its U.S. wholly-owned subsidiaries Velan Valve Corp. (“Velan U.S.”) and Velan Steam Trap Corporation (“Velan Steam Trap”) to an affiliate of Global Risk Capital LLC (the “Asbestos Purchaser”), at a cost to the Company of US$143 million (subject to certain adjustments). The Asbestos Divestiture Transaction will be achieved in several steps, including by (1) extracting the equity interests of certain non-U.S. subsidiaries from Velan U.S. and Velan Steam Trap, (2) creating a new U.S. subsidiary, Velan Valve United States OpCo, Inc. (“VVUSO”) to service customers of Velan U.S. on an uninterrupted basis, (3) vesting VVUSO with the current operating assets of Velan U.S., (4) selling Velan U.S. and Velan Steam Trap to the Asbestos Purchaser, which the Company will have capitalized with US$143 million (subject to certain adjustments) and which the Asbestos Purchaser will further capitalize with US$7 million upon closing, for a total of US$150 million (subject to the aforementioned adjustments), and (5) obtaining an indemnity covering the Company’s entire corporate group, including its directors and officers, following the Asbestos Divestiture Transaction with respect to the asbestos-related liabilities. The closing of the Asbestos Divestiture Transaction is subject to the availability of financing, which may consist of or include the France Transaction Proceeds, and other customary closing conditions. If the France Transaction is not completed, the Company anticipates seeking alternative financing options for the Asbestos Divestiture Transaction.

…

The Asbestos Divestiture Transaction provides a solution to the Company’s asbestos liability exposure, and any risks in respect of the Asbestos Purchaser have been mitigated because: (a) the Company chose an experienced purchaser with a meaningful track record in respect of such transactions, (b) the Company has negotiated customary dividend restrictions for a period of 10 years during which time dividends from Velan U.S. cannot be made or are otherwise restricted, (c) the Company has received a solvency opinion from Kroll, LLC (“Kroll”) in respect of the Asbestos Divestiture Transaction, and (d) the Company has also negotiated an indemnity covering its entire corporate group, including its directors and officers, following the Asbestos Divestiture Transaction.

French sale process

Under the France Transaction SPA, Framatome will acquire the French Subsidiaries from the Seller, for a purchase price of US$177.6 million (€170 million). The proposed sale is structured as a locked box transaction, with a locked box date of December 1, 2024. As such, the purchase price is final and binding, with no post-closing working capital adjustments, subject only to potential adjustments for leakage. Leakage notably refers to any unauthorized distributions, payments, or transfers of assets from the French Subsidiaries to the Seller or its affiliates between the Locked Box Date and the Closing Date. Permitted leakage includes specific payments and transactions that are allowed under the France Transaction SPA, such as payments under existing intra-group agreements, remuneration under existing employment agreements, and the benefit of the transfer of an intercompany loan of US$23.5 million (€22.5 million). Any leakage identified other than a permitted leakage must be repaid by the Seller to Framatome, reducing the purchase price accordingly.

Post-Flowserve timeline

On October 5, 2023, despite diligent efforts to secure this approval, the Company was informed by the French Ministry of Economy that the required approval had not and would not be granted. Consequently, Flowserve terminated the Arrangement Agreement for failure to meet the closing conditions before the outside date provided thereunder, which the parties had already extended twice up to that point.

Following the termination of the Arrangement Agreement, the Board of Directors continued its review of strategic alternatives to create value for Shareholders, bearing in mind certain of the risks facing the Company, including as regards its exposure to asbestos liability in the U.S. The Board of Directors was also mindful, in its review, of potential regulatory challenges and risks in France surrounding any monetization of the French Subsidiaries, individually, or as part of a larger go-private transaction such as the Arrangement.

Appendix – Flowserve Deal Pipeline, Due Diligence

Per the Notice to Velan Shareholders as part of the Flowserve sale.

The Special Committee first met in March 2021. Throughout its mandate of reviewing and assessing Strategic Alternatives, the Special Committee held formal meetings on 37 occasions, and held numerous discussions with the Company’s senior management and its legal advisors, in addition to consulting with its own financial and legal advisors on numerous occasions.

In May 2021, the Special Committee retained NRF to act as its independent legal counsel. Throughout the process, NRF has provided guidance and counsel to the Special Committee on the importance of ensuring that an independent and rigorous process be put in place for the review of any Strategic Alternatives and reminded the members of the Special Committee of their duties and responsibilities in their review and evaluation of any potential transaction, as well as their ability to rely on external legal and financial advisors in discharging such duties.

On May 25, 2021, the Special Committee received a letter from Velan Holding to express the support of the Velan Holding board of directors for the launch of a process to receive offers for the sale of all or substantially all of the Company’s assets.

Throughout 2021 and early 2022, as part of its mandate, the Special Committee, with the assistance of BMO, NRF and when requested, Davies, and with the support and input of management of the Company, also explored and considered various specific Strategic Alternatives that could be effected by the Company on a stand-alone basis, as well as the status quo.

In January 2022, following the conclusion of such targeted review, the Special Committee recommended that the Company re-initiate the process to approach potential purchasers with respect to a change of control transaction and began preparations to do so with support from BMO, NRF and, as required, senior management of the Company.

In May 2022, following the preparation of the relevant documentation and process with the input of the Special Committee and a recommendation of the Special Committee, the Board of Directors authorized BMO to commence outreach to potential purchasers through a confidential auction process to gauge interest in a potential change of control transaction, although alternative transaction structure proposals were welcomed as part of such process. Between May 31 and July 25, 2022, 101 potential purchasers were solicited. In the context of such solicitation, interested parties were sent a form of non-disclosure and standstill agreement (“NDA”) for review and execution prior to receipt of any bid information. Where applicable or necessary, Davies assisted in the negotiation of any such NDAs with BMO acting as intermediary between the parties. Of those potential purchasers solicited, 65 executed an NDA. Each party that executed an NDA had access to a Phase 1 preliminary data room which allowed such party to evaluate the opportunity to submit an initial non-binding proposal by no later than July 18, 2022 (the “Phase 1 Deadline”). Once these proposals were received, the Special Committee then determined which interested parties would be allowed to access a Phase 1.5 data room to enable the completion of more fulsome due diligence and the submission of revised proposals by such interested parties.

On June 9, 2022, the Company entered into an NDA with Flowserve Corporation, being the ultimate parent of the Purchaser.

Based on feedback received from interested potential purchasers and to bolster the robustness of the auction process, the Company authorized BMO to accept initial non-binding proposals for a reasonable period of time following the Phase 1 Deadline. The last initial non-binding proposal received in respect of Phase 1 was submitted on July 25, 2022.

As part of Phase 1 of the auction process, 11 non-binding proposals were received from potential purchasers. In particular, on July 14, 2022, the Purchaser submitted an initial non-binding conditional letter of intent to potentially acquire all of the assets of the Company in an all-cash transaction for an implied Share price ranging from $9.89 to $15.89 depending on whether the Purchaser would assume the asbestos-related liabilities or not (the “Purchaser Initial Offer”). On August 8, 2022, further to discussions between BMO and the Purchaser, the Purchaser confirmed the higher range indicated in the Purchaser Initial Offer, being an implied Share price of $12.89 to $15.89. Following extensive review of the proposals received by the Special Committee (with the assistance of BMO, NRF and Davies), six potential purchasers were selected to proceed to Phase 1.5 of the auction process and were asked to submit revised proposals by no later than October 25, 2022.

On October 25, 2022, the Purchaser reconfirmed its interest in pursuing a potential transaction with the Company by submitting a revised, non-binding indication of interest to acquire either all of the issued and outstanding Shares in the capital of the Company or all of the assets of the Company for a price in the range of $12.30 to $13.60 per Share in cash (the “Purchaser First Revised Offer”) under which the Purchaser would assume the asbestos-related liabilities of the Company and requested a 45-day exclusivity period. The Company also received another offer from a potential purchaser as part of Phase 1.5 with an inferior implied value per Share and an alternative transaction structure involving certain assets of the Company. The four other potential purchasers that were selected to submit a revised proposal as part of Phase 1.5 of the auction process decided, following significant due diligence efforts and allocation of resources, not to submit a revised offer.

On October 28, 2022, the Special Committee met to consider each of the two revised offers received as part of Phase 1.5 of the auction process. To assist in its review, BMO presented a reasonably detailed summary of the revised offers to the Special Committee, including a series of relevant comparative factors. Based on such analysis, BMO representatives indicated that they were of the view that (i) the Purchaser First Revised Offer was an attractive offer and superior to the other offer and (ii) the Special Committee should consider making a recommendation to the Board of Directors to further engage and negotiate with the Purchaser on an exclusive basis. Based on the foregoing and other factors, the Special Committee agreed that the Purchaser First Revised Offer should be presented to the Board of Directors along with a recommendation to further engage with the Purchaser on an exclusive basis, subject to, and conditional upon, confirming support from Velan Holding in respect of such further engagement.

Also on October 28, 2022, the Special Committee agreed to retain the services of Richter as an independent financial advisor to the Special Committee for purposes of delivering a formal fairness opinion in connection with the Arrangement and thereafter, entered into a formal engagement letter with Richter to that effect. Prior to executing the engagement letter, Richter confirmed to the Special Committee that it was free of conflicts to act as independent financial advisor to the Special Committee.

On November 7, 2022, at a meeting of the Board of Directors, the Chair of the Special Committee presented to the Board of Directors, on behalf of the Special Committee, (i) a report with respect to the conclusion of Phase 1.5 of the auction process and (ii) subject to receipt of confirmation of support from Velan Holding, a recommendation that the Company further engage with the Purchaser, on an exclusive basis, with respect to the Purchaser First Revised Offer. Following the recommendation by the Special Committee, a statement was provided to the Board of Directors on behalf of Velan Holding confirming that the board of directors of Velan Holding was supportive in principle of: (i) the Special Committee continuing discussions with the Purchaser under the terms presented in the Purchaser First Revised Offer; (ii) the Special Committee granting exclusivity to the Purchaser with a view to finalize all definitive agreements; and (iii) the Special Committee negotiating a price per Share towards the top of the range submitted by the Purchaser. Such agreement in principle was only verbal at that time and Velan Holding was in the process of preparing relevant documentation for execution by relevant stakeholders in accordance with the Velan the Qualifying Holdco transaction structure receiving potentially less consideration than other shareholders was not acceptable to Velan Holding nor to the Special Committee.

After careful review and consideration, it was agreed that the Company would, submit a counter-offer to the Purchaser for a purchase price per Share of $13.60 without any escrow feature. Velan Holding and the Special Committee confirmed that they were supportive of this counter-offer.

On January 16, 2023, the Chair of the Special Committee presented the Company’s counter-offer to the CEO and President of the Purchaser, who indicated that the Purchaser was not supportive of the revised purchase price under the revised terms, but confirmed that there was still a strong interest in completing a potential transaction between the Purchaser and the Company. Discussions and negotiations between the parties ensued thereafter.

On January 18, 2023, at a meeting of the Special Committee, the Chair of the Special Committee provided an update to the Special Committee and its advisors regarding the current status of the negotiations and discussions between the parties.

On January 19, 2023, the Purchaser provided a verbal revised non-binding offer at a purchase price of $13.00 per Share to be paid in cash (the “Final Purchase Price”), with equal treatment to all Shareholders (i.e. without any amount being placed in escrow) (the “Purchaser Final Offer”), the whole subject to completing all diligence and finalizing definitive binding agreements. The Special Committee and Velan Holding confirmed that they were supportive of moving forward with a transaction on the basis of the Purchaser Final Offer (including the Final Purchase Price), subject to the ongoing negotiation and finalization of the definitive agreements. In addition to the Final Purchase Price, Velan Holding considered many other factors in its decision to support the Purchaser Final Offer, including the robust auction process that was conducted, the Company’s ongoing asbestos claims and ligations as disclosed in the Company’s public record and the benefits for Velan and its stakeholders as part of a global flow control leader like Flowserve.

Between January 19, 2023 and February 8, 2023, the parties exchanged and negotiated drafts of the Arrangement Agreement and the Plan of Arrangement and the Purchaser exchanged and negotiated drafts of the Support and Voting Agreements with each of Velan Holding (and its legal advisors) and Kernwood, respectively. Kernwood is an affiliate of Edward Kernaghan, a director of the Company and member of the Special Committee.

Throughout this period, the Board of Directors and the Special Committee were kept informed on a timely basis of the ongoing negotiations and status of the definitive agreements.

On February 8, 2023, when it became apparent that the transaction was close to a successful conclusion and that the current version of the definitive agreements were nearly settled upon by all parties, the Special Committee met to consider the proposed Arrangement and to conduct a final review of its material terms and conditions as set out in the definitive agreements and to receive the advice of Richter, BMO, Davies and NRF.

See filings for additional background.