SmallCap Discoveries Vancouver September 2025 Cheatsheet

Here's an overview of every company attending

August 28, 2025 (UPDATED: September 27th for late additions Cybeats and Tribe)

SmallCap Discoveries is holding their investment conference September 29th-30th in Vancouver, Canada. There is a fantastic selection of companies presenting and we have put together a cheatsheet of every company attending for our readers.

We also covered this conference last year, which was held in partnership with Planet MicroCap. See here -

Even if you cannot attend, we think it is a worthwhile list of interesting companies to go through, with several potentially at an inflection point.

The list of companies is great, but it is also a bit long at about 50 in total. How do you get up to speed? To help, we put together the following summaries outlining financial performance and recent developments. It is presented in alphabetical order. We hope you find this helpful!

We also provide paying subscribers a PDF (see end of post).

For conference information see here - https://www.meetmax.com/sched/event_122453/conference_home.html?bank_access=0&event_id=122453

Information about SmallCap Discoveries can be found here -

https://smallcapdiscoveries.com/

Their YouTube channel is also a great source of interviews - https://www.youtube.com/@Smallcapdiscoveries/videos

Disclaimer – This post is longer than usual and so is this disclaimer. The following company summaries are provided with absolutely no claim of accuracy. There might be errors that are numerous, material, and possibly even glaring. The information provided is our notes of our interpretation of publicly available information and should absolutely not be relied upon for any purpose.

The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Company List

As of August 28th. Subject to change.

Alchemy Nanotechnology (Private)

Aluula Composites Inc. (TSX:AUUA)

Atlas Engineered Products (TSX.V: AEP)

Avante Corp (TSX.V: XX)

BeWhere Holdings (TSX.V: BEW)

Boardwalktech Software (TSX.V: BWLK)

Cannara Biotech Inc. (TSX: LOVE)

Char Technologies (TSX.V: CHAR)

Cheelcare (TSX.V: CHER)

Cleantek Industries (TSX.V: CTEK)

Cybeats Technologies Corp. (CNSX:CYBT)

Decibel Cannabis Company (TSX.V: DB)

DIRTT Environmental Solutions (TSX: DRT)

Eastside Games Group (TSX.V: EAGR)

EnWave Corporation (TSX.V: ENW)

Everyday People Financial (TSX.V: EPF)

Glow Lifetech (CSE: GLOW)

Grey Wolf Animal Health (TSX.V: WOLF)

Hydreight Technologies (TSX.V: NURS)

HyperCharge Networks (CSE: HC)

IC Group Holdings Inc. (private)

Innovotech (TSX.V: IOT)

Itafos (TSX: IFOS)

Kelso Technologies (TSX.V: KLS)

McCoy Global (TSX: MCB)

Nanalysis Scientific Corp (TSX.V: NSCI)

Neupath Health Inc. (TSX.V: NPTH)

Nevis Brands (CSE: NEVI)

NexLiving Communities (TSX.V: NXLV)

NTG Clarity Networks (TSX.V: NTG)

Paragon Advanced Labs (Private)

Progressive Planet Solutions (TSX.V: PLAN)

PUDO Inc (CSE: PDO)

Reklaim (TSX.V: MYID)

Renoworks Software (TSX.V: RW)

Revolve Renewable (TSX.V: REVV)

RIWI Corp. (TSX.V: RIWI)

Rubicon Organics (TSX.V: ROMJ)

Rumbu Holdings (TSX.V: RMB)

Sangoma Technologies (TSX: STC)

Simply Solventless Concentrates (TSX.V: HASH)

Snipp Interactive (TSX.V: SPN)

Telescope Innovations Corp (CNSX: TELI

Thermal Energy (TSX: TMG)

Thinkific (TSX: THNC)

Tribe Property Technologies (CVE:TRBE)

Zedcor (TSX.V: ZDC)

ZTEST Electronics (TSX.V: ZTE)

Aluula Composites Inc. (TSX:AUUA)

Aluula Composites Inc. develops and manufactures advanced soft composite materials engineered for strength, lightness, and recyclability. Its proprietary fabric technologies—such as Aeris™, Gold™, and Durlyte™—are used in high-performance applications across windsports, outdoor gear, aerospace, defense, and industrial markets. The company’s materials are valued for their extreme strength-to-weight ratio, UV resistance, and environmental sustainability, with a focus on replacing conventional laminated fabrics.

It completed a 20-for-1 share consolidation in March and raised approximately $2.5 million through a rights offering. Strategic initiatives included deeper expansion into maritime and defense markets, including supplying material for wind-powered commercial shipping systems. The company also announced board and management changes to support its evolving commercial focus and long-term growth strategy.

Atlas Engineered Products (TSX.V: AEP)

Atlas Engineered Products is a Canadian manufacturer and supplier of engineered wood products and prefabricated structural components, primarily serving the residential, commercial, and agricultural construction sectors. Its offerings include roof and floor trusses, wall panels, and floor systems, along with complementary design and engineering services. Operating through a network of regional facilities, the company focuses on delivering localized solutions while pursuing an acquisition-driven growth strategy to consolidate a fragmented industry. Atlas differentiates itself through its technical capabilities, customization options, and emphasis on operational efficiency.

The Company continues to focus on automation and acquisitions. In 2025, Atlas expanded its footprint through two notable acquisitions that signal a continuation of its consolidation strategy. In June, the company completed the acquisition of Truss-Worthy Construction Systems Inc., a truss manufacturer based in Colborne, Ontario, and in late July, Atlas acquired Penn-Truss MFG Inc., a manufacturer based in Saltcoats, Saskatchewan.

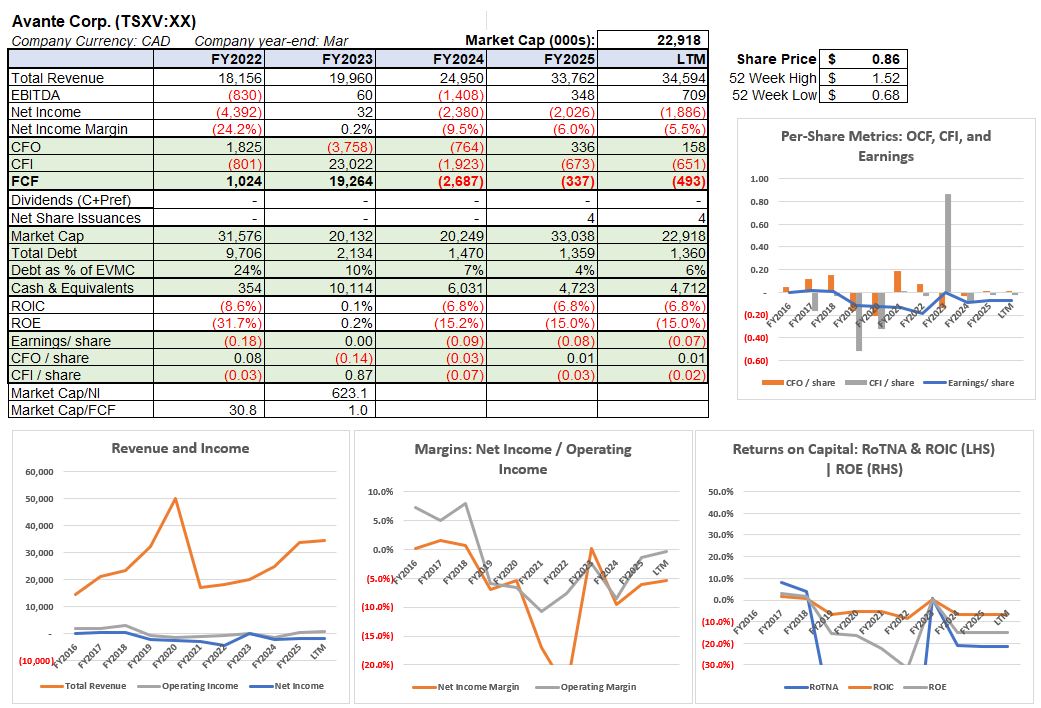

Avante Corp. (TSXV: XX)

Avante Corp. is a Toronto-based provider of integrated security solutions, specializing in premium physical security, remote monitoring, and cybersecurity for high-net-worth individuals, commercial enterprises, and institutional clients. Its business segments include Avante Security, Avante Black, and Avante Verified, each delivering customized services backed by proprietary technologies and high-touch client engagement. The company has historically grown both organically and through targeted acquisitions, with an emphasis on recurring revenue and innovation in AI-driven surveillance.

The company recently launched WALL-E, an AI-powered mobile surveillance unit for use in remote or sensitive locations, as well as the Verified Response Program, targeting school safety markets with a human-in-the-loop AI model.

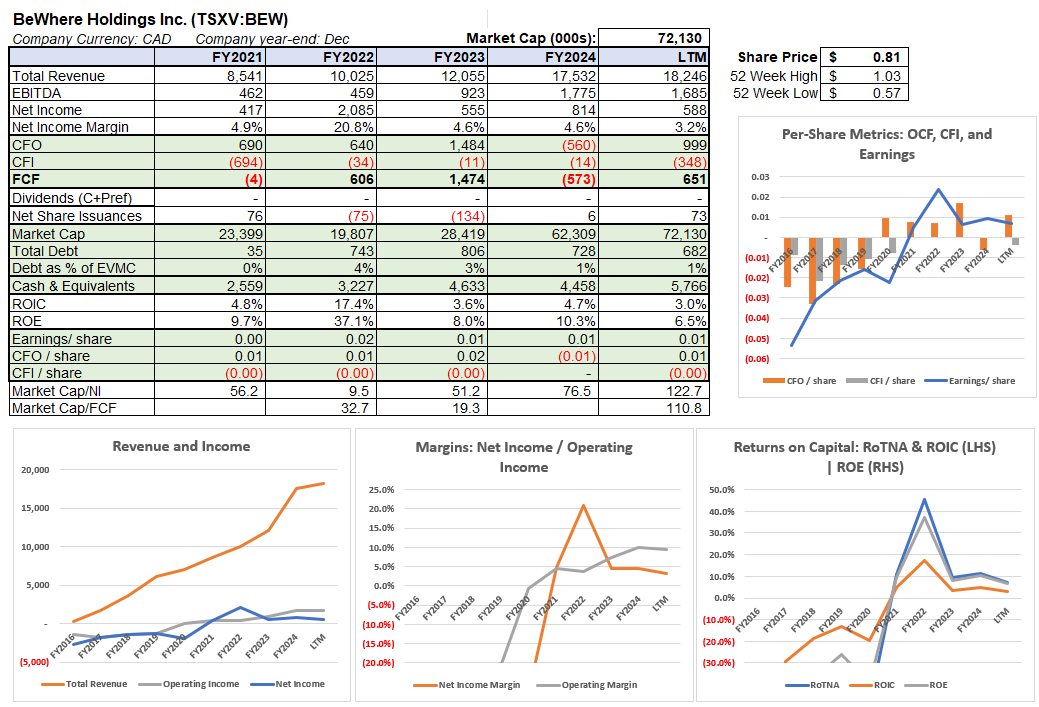

BeWhere Holdings Inc. (TSXV: BEW)

BeWhere Holdings Inc. is a Canadian Mobile Internet of Things (M-IoT) company that designs and manufactures low-cost, low-power GPS tracking and environmental sensing devices. Its technology enables real-time monitoring of non-powered assets such as trailers, equipment, and tools, serving industries like transportation, construction, logistics, and emergency services. BeWhere offers vertically integrated solutions, including its proprietary hardware, cloud-based dashboards, and mobile applications, with an emphasis on long battery life and cellular or satellite connectivity.

In early 2025, the company acquired a U.S.-based installation and logistics firm for US$600,000—paid in a mix of cash and equity—to expand its footprint and service capacity in the United States. BeWhere continued to build customer traction, highlighted by case studies featuring its BeMini 5G tracker deployed in North American paramedic services and solar-powered BeSol trackers used by California Freight in dairy logistics, which led to a multi-year leasing contract.

Case study here - https://bewhere.com/bewhere-holdings-inc-and-hglobal-transform-emergency-services-with-low-power-5g-asset-tracking/

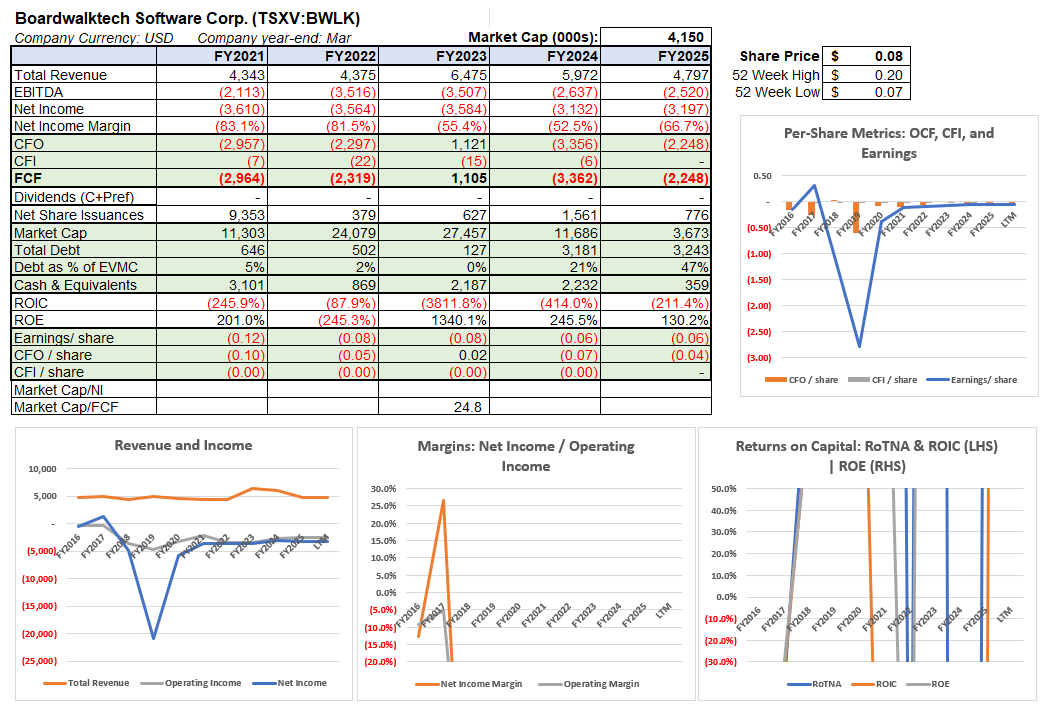

Boardwalktech Software Corp. (TSXV: BWLK)

Boardwalktech Software Corp. provides digital ledger technology and enterprise software platforms designed to improve data governance, workflow automation, and compliance in large-scale organizations. Its flagship product, Velocity, is focused on End-User Computing (EUC) risk remediation—particularly for clients in highly regulated industries like banking and financial services. The company's patented technology enables structured collaboration and version control of critical business processes, and it generates revenue primarily through SaaS licenses and implementation services.

In June 2025, it renewed a multi-year license agreement with a top-five U.S. bank, showing continued deployment of its Velocity platform and reinforcing the value of its enterprise relationships. The company also launched a new EUC Asset Tracker and entered proof-of-concept phases with a major Mexican bank and an additional U.S. financial institution.

Cannara Biotech Inc. (TSXV: LOVE)

Cannara Biotech Inc. is a vertically integrated cannabis producer headquartered in Quebec, focused on cultivating and processing premium-grade cannabis for the Canadian recreational market. The company operates over 1.6 million square feet of licensed indoor cultivation space across two facilities, offering dried flower, pre-rolls, and oils under brands such as Tribal, Nugz, and Orchid CBD. Cannara emphasizes cost efficiency, quality control, and innovation, positioning itself as a low-cost producer with premium positioning.

In 2025, Cannara has continued to streamline its operations and strengthen its financial position. In August, the company announced the sale of a non-core building under construction, along with adjacent land, for total gross proceeds of $5.5 million.

We covered them here - https://www.canadianvalueinvestors.com/p/the-curious-case-of-canadian-cannabis

CHAR Technologies Ltd. (TSXV:YES)

CHAR Technologies specializes in sustainable energy solutions centered around its proprietary high-temperature pyrolysis (HTP) technology. This innovation converts unmerchantable wood and organic waste into renewable energy streams—namely biocarbon and renewable natural gas (or green hydrogen)—designed to support decarbonization efforts in heavy industries such as steelmaking. The company targets both biocarbon production and RNG generation, leveraging renewable feedstocks and advanced engineering to deliver carbon-neutral alternatives to traditional energy sources.

In 2025, CHAR has been busy. In May, it announced a binding letter of intent and completed a $2 million non‑brokered private placement with BMI Group’s subsidiary, Bioveld Canada Inc., raising funds to advance the Thorold Renewable Energy Facility and granting BMI rights to nominate a board director. Following that, in July, CHAR and BMI formalized agreements for an $8 million project-level equity investment—resulting in joint ownership of the Thorold facility and enabling Phase 1 commercial biocarbon production by Q4 2025.

Cheelcare Inc. (TSXV:CHER)

Cheelcare Inc. develops innovative mobility technologies aimed at enhancing independence and quality of life for individuals with physical disabilities. The company designs and manufactures solutions such as robotic power wheelchairs (e.g., the Curio), power add-ons for manual wheelchairs (e.g., Companion), and orthopedic accessories—all engineered from R&D through to commercial deployment, leveraging expertise in complex rehabilitation mobility technologies.

Cheelcare recently went public on the TSX through business combination agreement with Departure Bay Capital Corp. to complete a qualifying transaction via amalgamation. In July, the company officially closed this qualifying transaction, rebranded from Departure Bay Capital to Cheelcare, completed a share consolidation, raised approximately $3.5 million through a private placement and began trading on the TSX Venture Exchange under the symbol CHER.

No table. Recently public.

Cleantek Industries Inc. (TSXV:CTEK)

Cleantek Industries provides patented clean-technology solutions focused on wastewater treatment and industrial lighting. Its product portfolio includes solutions like HaloSE and EcoSteam that aim to reduce both operational costs and carbon intensity across commercial, industrial, and municipal applications. Headquartered in Calgary, Cleantek emphasizes innovation and sustainable deployment of its lighting and steam technologies.

In 2025, Cleantek has delivered strong revenue growth. Cleantek’s revenue is generated primarily from the rental and service of sustainable lighting solutions, including solar hybrid lighting towers and HALO lighting systems and ZeroE dehydration units. In early May, it secured a new contract for the supply and installation of five Halo SE Crown Mount lighting systems and three stadium light towers, supporting its international market expansion. Their tower lighting systems are bright - https://cleantekinc.com/stadium-lighting/

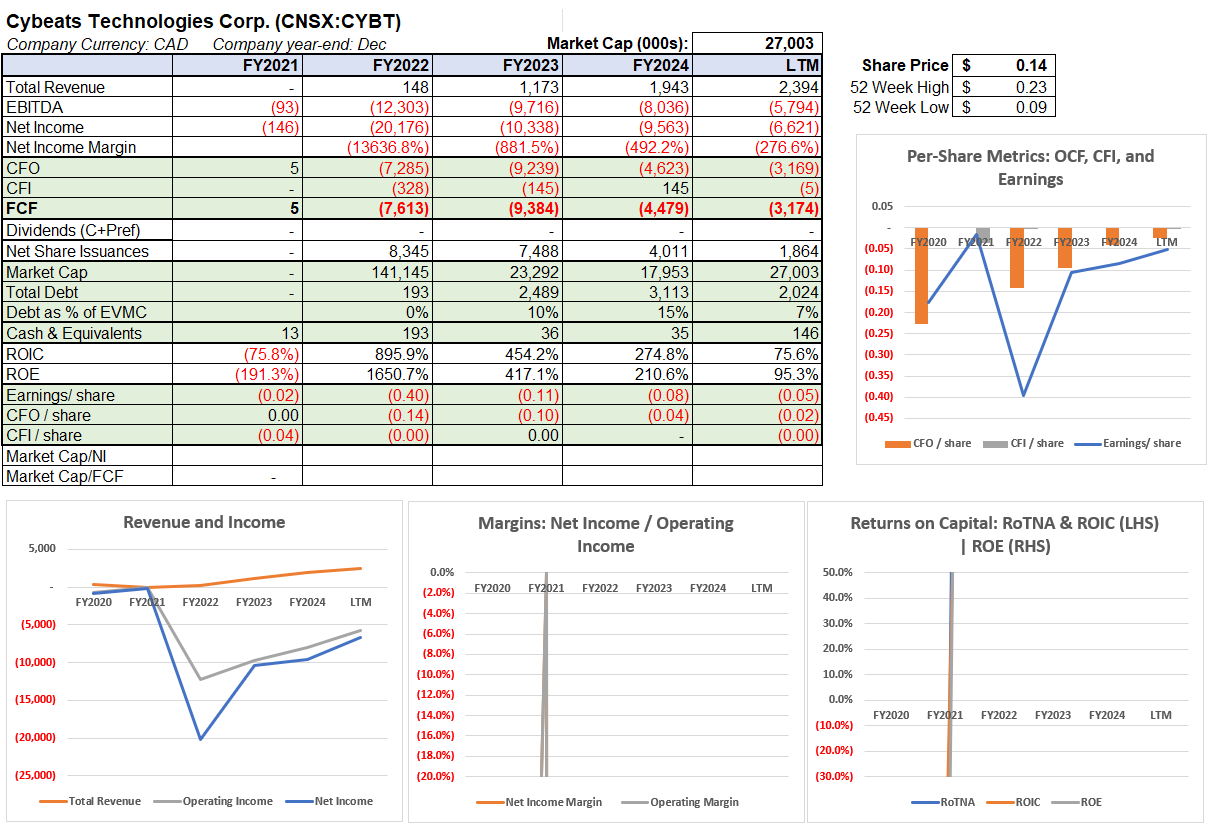

Cybeats Technologies Corp. (TSX:CYBT)

Cybeats Technologies Corp.

Cybeats is a cybersecurity and software supply‑chain security company that focuses on managing and securing Software Bills of Materials (SBOMs). It provides tools and platforms (e.g. SBOM Studio, SBOM Consumer) enabling organizations to monitor, validate, remediate, and manage vulnerabilities across software supply chains, particularly in hardware, embedded systems, IoT, industrial control, and mission‑critical environments. The company positions itself at the intersection of compliance, DevSecOps, and software risk management.

In January, it secured a multi‑year contract with Rockwell Automation, a major industrial automation company, expanding its footprint into the ICS (Industrial Control Systems) vertical. In July, the company announced a “LIFE” private placement led by Beacon Securities to raise capital for scaling its operations and accelerating adoption of its software supply chain security tools.

Tribe Property Technologies (CVE:TRBE)

Tribe Property Technologies develops technology-enabled solutions for the multi-family residential property sector, integrating software, operations, and services across the lifecycle of a property. Its “Build, Manage, Live” model supports everything from pre and post-construction workflows, property management operations, tenant experience platforms, to service and engagement solutions. The company seeks to digitize and modernize property operations through data, access, and workflow automation.

In May, the company acquired Ace Agencies Ltd., a B.C.-based single‑unit rental property manager. In July, Tribe completed a public unit offering raising ~$5.75MM to fund growth, tech investment, and working capital. In Q2, revenue reached $8.1MM, a 32% increase year-over-year, while adjusted EBITDA losses narrowed.

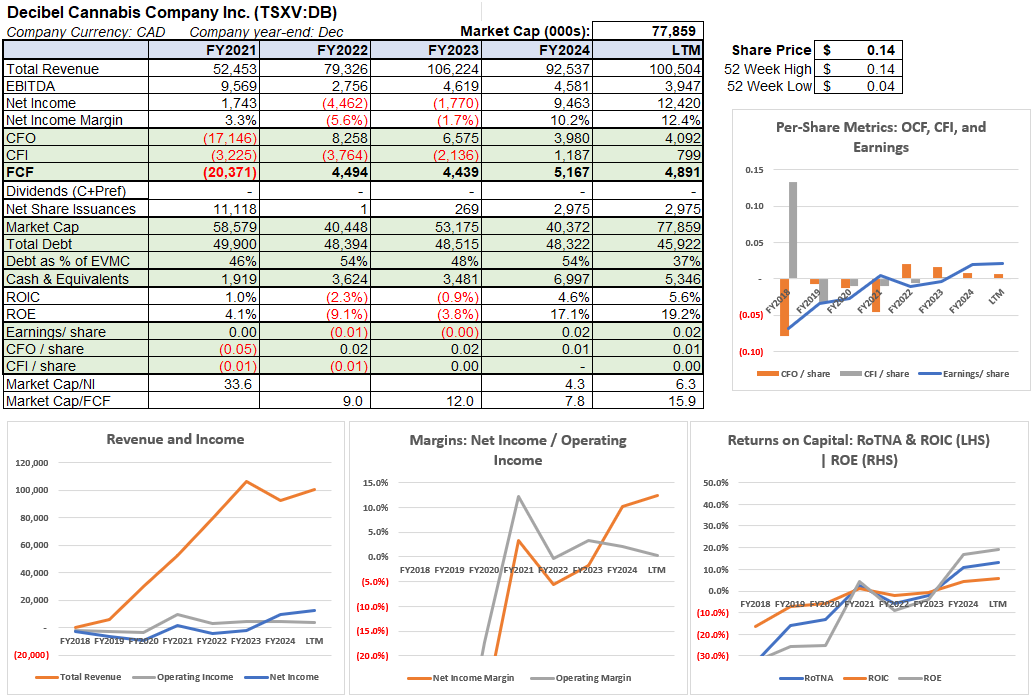

Decibel Cannabis Company Inc. (TSXV:DB)

Decibel Cannabis is a vertically integrated cannabis company known for its portfolio of premium brands—such as General Admission, Qwest, and VOX—and its vertically integrated operations spanning cultivation, processing, and manufacturing across Canada. The company recently expanded its reach through the acquisition of AgMedica, adding an EU‑GMP‑certified facility and elevating its capacity for global distribution.

In 2025, Decibel has been executing on its revenue growth and expanding overseas. In February, it entered a supply and trademark license agreement to distribute its General Admission dried medical cannabis products overseas.

DIRTT Environmental Solutions Ltd. (TSX:DRT)

DIRTT Environmental Solutions is a Calgary‑based leader in industrialized, technology‑driven interior construction. Its integrated approach combines physical modular components with its proprietary ICE® design‑to‑delivery software, enabling adaptive, efficient, and sustainable solutions for sectors including healthcare, education, commercial, and public spaces.

In 2025, DIRTT has navigated macroeconomic headwinds—particularly rising tariffs—while advancing its strategic transformation. Despite trade challenges, DIRTT’s 12‑month forward pipeline surpassed US$300 million, its strongest in over two years, and new products like its one‑hour fire‑rated wall opened access to sectors such as healthcare and hospitality.

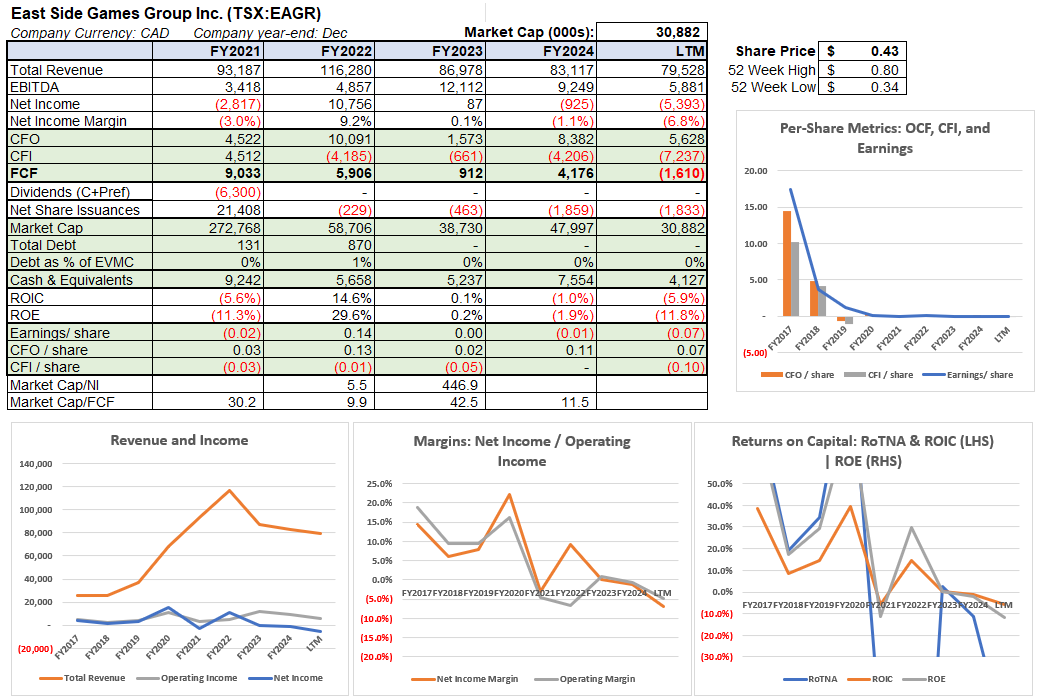

East Side Games Group Inc. (TSX:EAGR)

East Side Games Group is a Vancouver-based free‑to‑play mobile game publisher and developer, known for creating both original and licensed IP games. The company operates through its in‑house studios and its GameKit™ platform, and monetizes via in‑game purchases and advertising.

In 2025, the launch of RuPaul’s Drag Race Match Queen quickly became the company’s top‑grossing Match‑3 title, and it continued its momentum with a global launch planned for Squishmallows Match in Q3. The company has maintained a clean balance sheet with zero debt while continuing to repurchase shares.

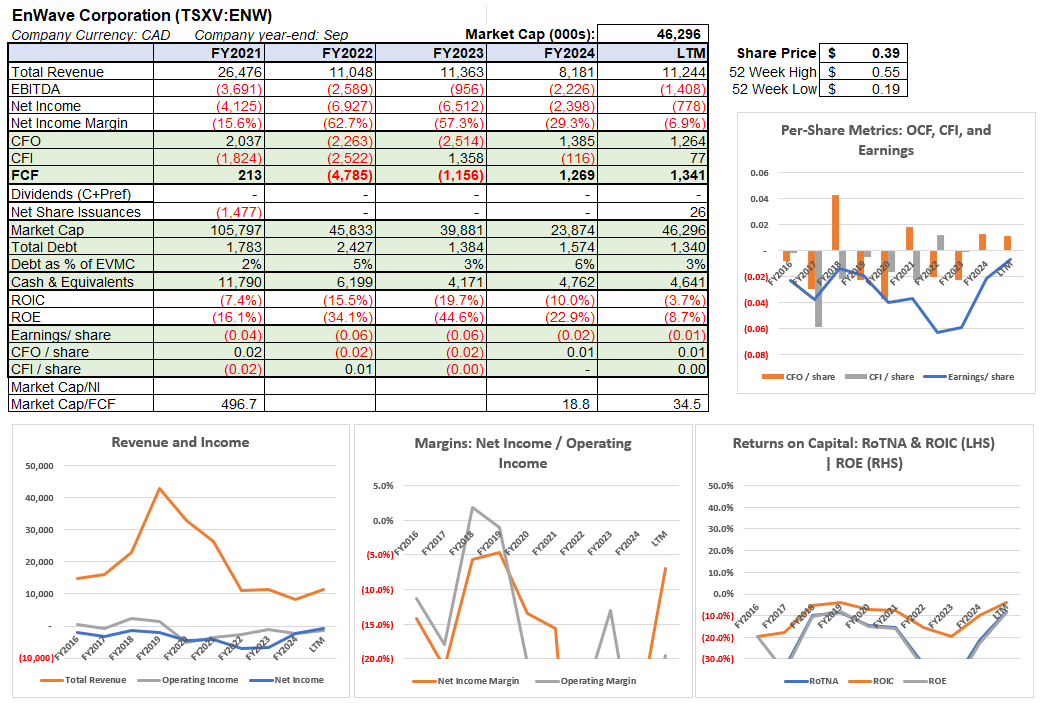

EnWave Corporation (TSXV:ENW)

EnWave Corporation develops and licenses its proprietary Radiant Energy Vacuum (“REV™”) dehydration technology, which enables rapid, low-heat drying of a wide range of food, pharmaceutical, and agricultural products. Their scalable systems support both large- and small-scale commercial deployment, offering clients efficiency gains, lower operating costs, and nutrient retention benefits through vacuum-microwave dehydration and associated royalty streams.

In August 2025, the company closed a non‑brokered LIFE private placement to fund the construction of two new REV™ systems to accelerate machine delivery and meet rising demand.

Everyday People Financial Corp. (TSXV:EPF)

Everyday People Financial operates as a capital-light, technology-driven financial services firm focused on revenue cycle management (RCM) and innovative borrower programs. Through acquisitions and organic growth, it consolidates small RCM service providers and offers fee-based lending solutions, aiming to deliver recurring revenue streams with lower capital intensity.

In 2025, growth has been driven by RCM gains (including the acquisition of Commercial Collection Services Limited) and in its Borrowed Down Payment Program. In July, the company also completed the sale of its legacy home inventory, enabling retirement of USD 3 million in debt and finalizing its pivot to a pure fee-for-service model.

Glow Lifetech Corp. (CNSX:GLOW)

Glow Lifetech produces and distributes high-margin plant-based wellness products, including its proprietary MOD™ and .decimal™ cannabis oil lines. The company emphasizes rapid product innovation, distribution scale, and branding to capture market momentum in Ontario’s regulated cannabis sector.

In 2025, it has expanded its retail distribution to more than 1,000 Ontario stores—a ~45% increase—and secured the #2 oil brand ranking in the province for its MOD™ line. The firm also commissioned a new automated bottling line to support scaling and launched a CBG-based product in Ontario.

Grey Wolf Animal Health Corp. (TSXV:WOLF)

Grey Wolf Animal Health is a Canadian veterinary health company focused on the development, acquisition, and commercialization of animal health products and services. It offers a broad portfolio that includes pharmaceuticals, nutraceuticals, and medical devices, serving both companion and production animal markets. The company distributes its products through veterinary clinics, hospitals, and retailers, and also provides support services such as pet telehealth and mobile veterinary care.

In 2025, Grey Wolf delivered strong growth across its business, with first-quarter revenue rising 31% year-over-year, supported by both organic expansion and stronger uptake of its core veterinary offerings. It continues to build its presence across Canada, focusing on under-served segments such as rural veterinary services. Grey Wolf has also been gradually scaling its mobile care and retail partnerships.

Hydreight Technologies Inc. (TSXV:NURS)

Hydreight Technologies is a U.S.-focused, digital health and wellness company offering a telemedicine-enabled platform that connects healthcare professionals with patients for services such as IV therapy, medical aesthetics, and wellness treatments. The platform integrates mobile clinical service delivery with back-end infrastructure, including medical oversight, insurance, and digital recordkeeping, effectively turning practitioners into mobile clinics under a compliant framework.

The Company reported a 34% year-over-year increase in first-quarter revenue and achieved positive net income and adjusted EBITDA for the period. The company launched its new VSDHOne platform, a white-label direct-to-consumer solution for the mobile health market in all U.S. states. In August, Hydreight announced a $10 million convertible debenture raise to support its product development and platform scaling initiatives.

Hypercharge Networks Corp. (TSXV:HC)

Hypercharge Networks is a Canadian EV infrastructure company providing end-to-end charging solutions including hardware, network software, installation, and maintenance. The company targets commercial, multi-unit residential, and public spaces, offering flexible deployment options through either direct sales or recurring revenue models such as charging-as-a-service.

In 2025, Hypercharge has experienced substantial growth and has deployed over 5,900 charging ports. Major project wins included a rollout of 500 chargers at a large mixed-use development in Vancouver and a multi-year agreement to install 444 chargers across residential properties in Western Canada. The company also launched its next-generation Level 2 charger, the Hypercharge Halo™, aimed at further penetrating the multi-family and commercial segments.

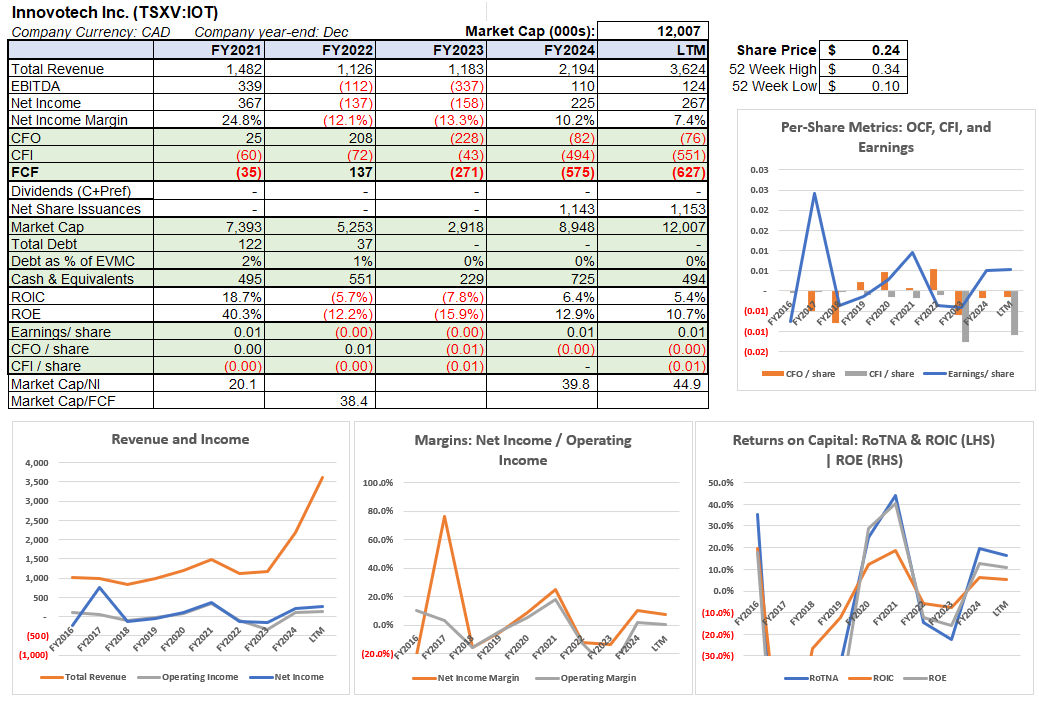

Innovotech Inc. (TSXV:IOT)

Innovotech Inc. specializes in contract research services focused on antimicrobial effectiveness and microbial interactions with biosurfaces. Its offerings include validating products for antimicrobial claims—frequently supporting FDA 510(k) submissions—as well as producing MBEC Assay® kits and pursuing commercialization of its InnovoSIL™ antimicrobial silver technology through subsidiary operations such as Innovotech Labs and Keystone Labs.

In 2025, Innovotech posted record first-quarter revenue of approximately CAD 1.16 million, driven by increased contract research activity, particularly through its Innovotech Labs subsidiary and contributions from Keystone Labs following its late-2024 acquisition.

Itafos Inc. (TSXV:IFOS)

Itafos Inc. is a phosphate and specialty fertilizer producer operating assets such as the Conda phosphate operations and the now-divested Araxá mine. The company focuses on phosphorus products—including MAP and SSP—geared toward agricultural and industrial markets, leveraging its processing infrastructure and global distribution capabilities.

In 2025, the Company has advanced the infrastructure build-out of our Husky 1 / North Dry Ridge (“H1/NDR”) mines in Idaho with first ore shipments to the Conda plant scheduled for later this year and announced a magnesium-reduction project at Conda to maintain production capacity. In Q2, Itafos added to its U.S. shareholder presence by adding a OTCQX listing.

Kelso Technologies Inc. (TSX:KLS)

Kelso Technologies designs proprietary components for the safe transport of hazardous materials by rail, including specialized tank car valves and related systems. It serves niche industrial markets, working under tight regulatory frameworks while focusing on product innovation and reliability.

In 2025, Kelso achieved its first profitable quarter since early 2020 supported by a 19% year-over-year increase in revenue and improved gross margins. The company is positioning itself for modest sales growth in 2025 (0–5%) while exercising strict cost discipline in anticipation of an upturn in tank car demand in 2026–2027. It also pursued AAR approval for its new Bottom Outlet Valve and Angle Valve products, established a new credit line for liquidity, and realigned its board.

McCoy Global Inc. (TSX:MCB)

McCoy Global supplies advanced tools and digital technologies—including its smartProduct portfolio and smarTR™ system—for the oil and gas sector, enabling automation, safety improvements, and wellbore integrity enhancements across land and offshore operations.

In 2025, McCoy has reported robust growth. Q2 revenue rose 21% year-over-year to approximately USD 24.1 million, with smartProduct offerings accounting for 58% of total sales.

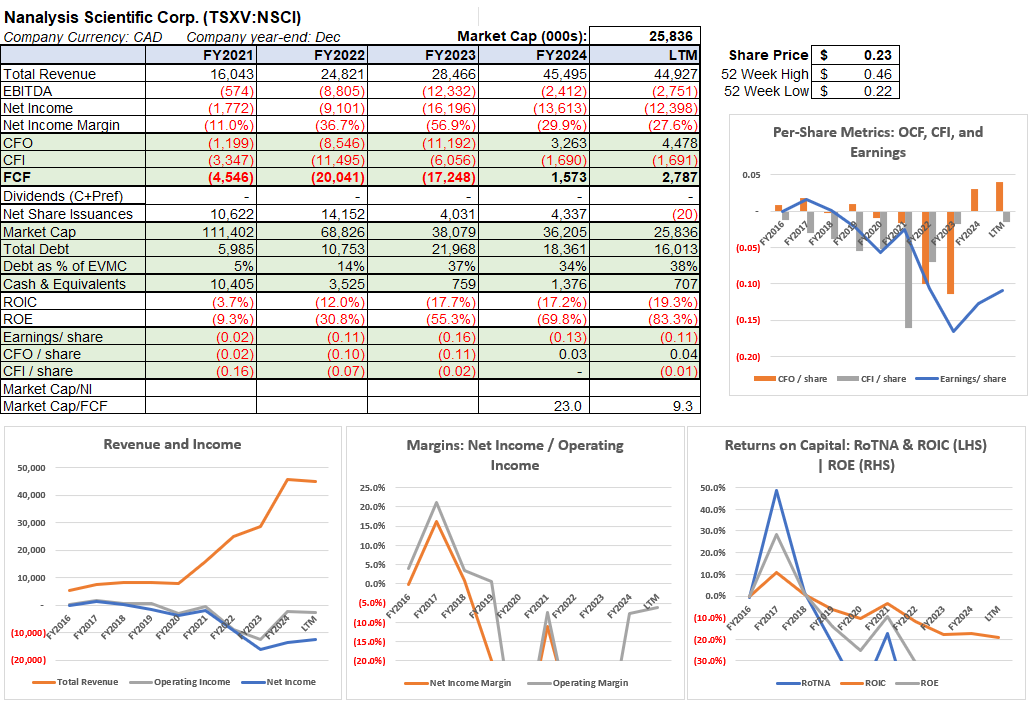

Nanalysis Scientific Corp. (TSXV:NSCI)

Nanalysis Scientific develops and manufactures portable nuclear magnetic resonance (NMR) spectrometers and imaging (MRI) systems for industrial, academic, and research applications. The Company also has a significant role in airport operations in Canada as the contractor providing maintenance services for security screening and imaging equipment at all 89 designated Canadian airports. Their benchtop NMR units—such as the NMReady‑60™—stand out for delivering compact, high-resolution functionality without cryogens, enabling use across sectors like pharmaceuticals, food science, mining, and forensics. The company also operates global sales and service infrastructure, offering both instruments and maintenance support to markets worldwide.

In 2025, Nanalysis achieved operational momentum and began showing tangible profitability progress. In the first quarter, the company delivered positive adjusted EBITDA and operating cash flow of CAD 2.7 million, marking a significant EBITDA turnaround. Additionally, they launched their next-generation 60 MHz benchtop NMR platform and advanced automation tools targeted at pharmaceutical and chemical markets.

NeuPath Health Inc. (TSXV:NPTH)

NeuPath Health is a vertically integrated healthcare services provider operating a network of clinics specializing in chronic pain, spinal injuries, concussion, and sports medicine treatment. They offer services to both patients and institutional clients—such as employers and insurers—and increasingly engage in contract research offerings. Their model emphasizes interdisciplinary, data-driven care and expanding access across Ontario and Alberta.

In 2025, NeuPath made a management change adding a new President role to accelerate inorganic and organic growth and optimize margins. They also secured a new credit facility providing additional flexibility. In the first quarter, revenue climbed approximately 11% year-over-year, and adjusted EBITDA rose nearly 50%. the Q2 results—setting a clear path toward growth and operational scaling.

Nevis Brands Inc. (OTCQB:NEVI.F)

Nevis Brands is a beverage-centric cannabis company that licenses and markets well-known branded products, such as Major™ and Happy Apple™ hemp-derived THC drinks. Rather than owning production facilities, the company employs an asset-light model—licensing manufacturing and distribution—providing agility, strong margins, and reduced capital commitments.

In 2025, Nevis delivered steady top-line growth while continuing to scale its beverage offering. In Q2, quarterly revenue edged up slightly from Q1, supported by stability in legacy core markets and growing traction in new territories like New Jersey and Missouri. Notably, the company recorded its first revenue from the Happy Apple™ hemp-derived THC beverage, marking expansion into new consumption formats.

NexLiving Communities Inc. (TSXV:NXLV)

NexLiving Communities is a Canadian multi-residential real estate company that acquires, owns, and manages recently built or refurbished rental properties in secondary and tertiary markets. Focused on delivering quality, modern living solutions at accessible price points, the company couples high occupancy strategies with dividend distribution to enhance investor returns.

In 2025, NexLiving operations have performed with occupancy rates exceeding 97%. The company also expanded its portfolio with a strategic investment in a 169‑unit property, while at the same time paying a dividend and renewal of its share buyback program.

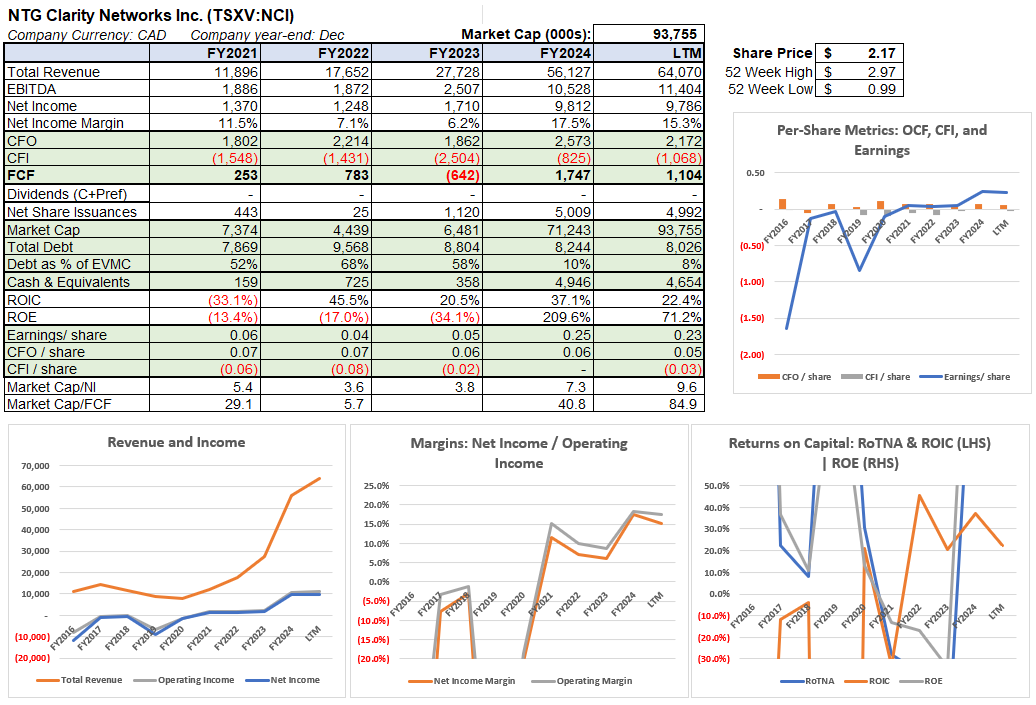

NTG Clarity Networks Inc. (TSXV:NCI)

NTG Clarity Networks is a digital transformation services provider delivering software development, IT infrastructure, and network engineering solutions to enterprise and public-sector clients. Leveraging both onsite and offshore delivery models, the company supports clients across financial services, telecommunications, and other industries with their proprietary NTGapps platform and customized software solutions.

In 2025, NTG Clarity has seen considerable momentum, beginning with a strong Q1 where revenue surged 68% year-over-year to approximately CAD 19.7 million, boosting gross profit by 51%. In March, NTG raised its full-year guidance, citing a backlog exceeding CAD 105 million, of which around CAD 80 million is from multi-year agreements. The company also launched a brokered LIFE private placement in July, raising $9 million to fund expansion and working capital.

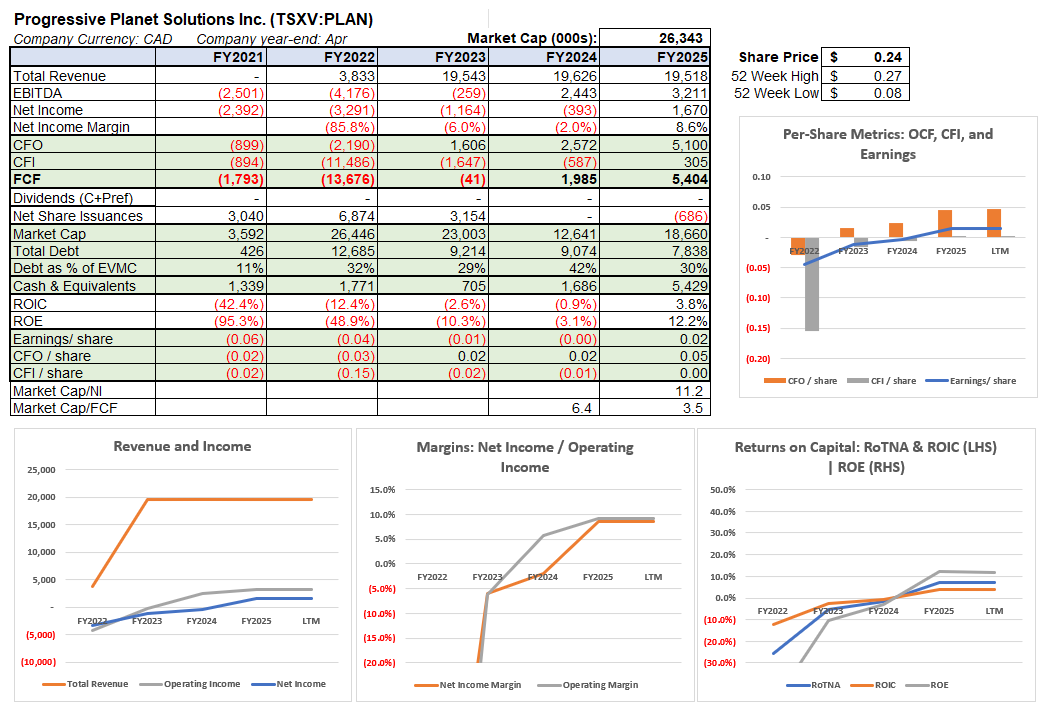

Progressive Planet Solutions Inc. (TSXV:PLAN)

Progressive Planet Solutions manufactures and markets mineral-based products derived from diatomaceous earth, zeolite, and bentonite, with applications spanning environmental remediation, agriculture, and construction. The company owns or operates key mineral assets and is innovating in low-carbon and sustainability-enhanced product lines, including its PozGlass™ offering for cement and sorbent markets.

In 2025, the company made strategic strides on both innovation and financial fronts. In March, it secured up to CAD 4.64 million in non-dilutive funding from Sustainable Development Technology Canada (SDTC) to build a pilot plant for its PozGlass™ technology. It has acquired mineral rights for their Ferguson Creek Pozzolan property in BC, and announced in July it was entering the lightweight litter market.

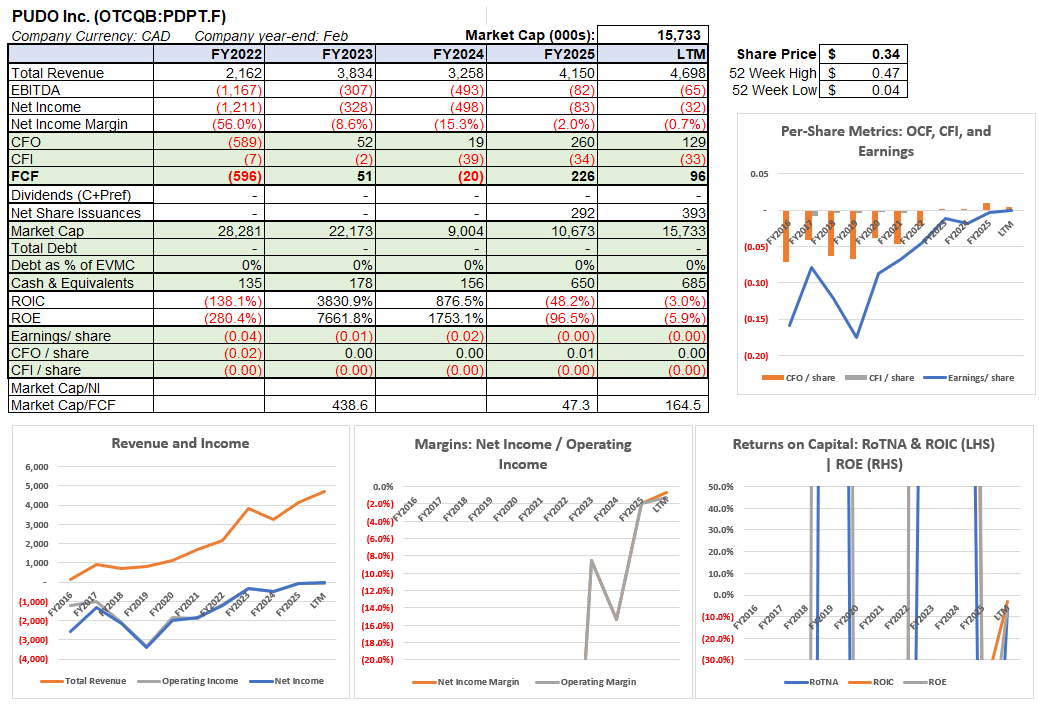

PUDO Inc. (OTCQB:PDPT.F)

PUDO Inc. operates a North American e‑commerce pickup/drop‑off network by establishing “PUDOpoint” counters in retail, logistics, and courier locations. The company licenses its software and manages network logistics to enable seamless parcel delivery and return experiences for retailers and consumers across Canada and the U.S.

In 2025, revenue growth has continued. In August, PUDO struck a partnership with Annex Brands, significantly expanding its U.S. footprint by adding PUDOpoint counters at more than 570 new retail locations, doubling its total U.S. coverage from around 800 to roughly 1,370.

Reklaim Ltd. (TSXV:MYID)

Reklaim operates a privacy-forward platform that empowers consumers to reclaim, manage, and monetize their personal data in compliance with growing privacy regulations. The company collaborates with brands and platforms to offer users transparency and control over data usage and introduces privacy-aligned monetization options.

In 2025, growth has continued. In Q1 it achieved a 73% increase in revenue compared to the prior year driven by platform data sales. It recently launched Reklaim Protect, a subscription-based privacy service enabling users to remove personal data from brokers, monitor dark-web exposure, and access an AI-powered privacy assistant. In June, it introduced a “Consumer Ownership Program” allowing Canadian users to redeem loyalty points for shares.

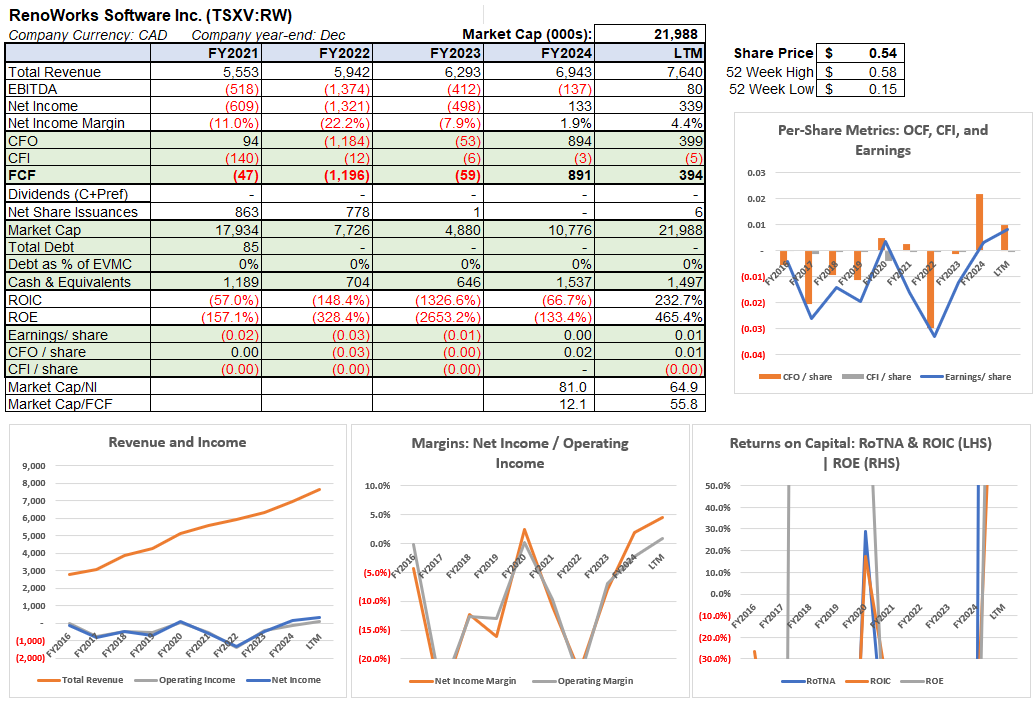

RenoWorks Software Inc. (TSXV:RW)

RenoWorks Software Inc. specializes in digital visualization and lead-generation technology tailored to the home renovation and new construction industry. Its product suite includes interactive home visualizers, product configurators, digital libraries, analytics tools, and design services used by contractors, manufacturers, distributors, and homeowners. The company provides immersive browsing experiences that enhance sales and marketing workflows by helping clients visualize products in real-time.

In 2025, RenoWorks reported its fifth consecutive profitable quarter in Q2, with continued revenue growth and strong gross margins. It also expanded its product offerings, launching new enterprise visualizers to support sales teams and improve lead conversion.

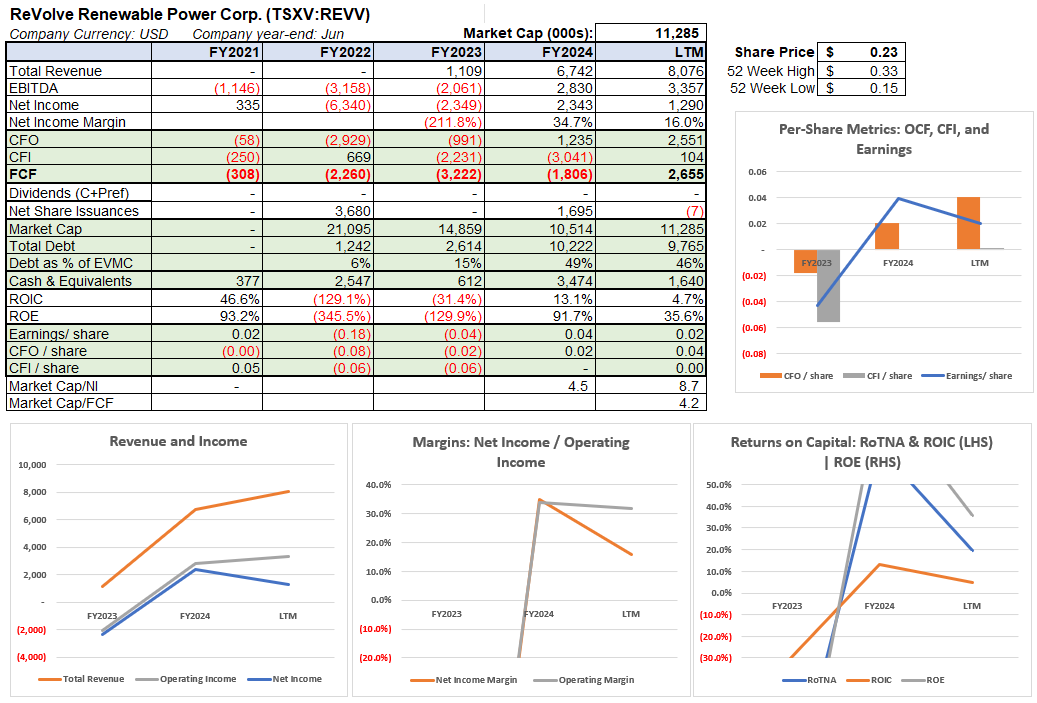

ReVolve Renewable Power Corp. (TSXV:REVV)

ReVolve Renewable Power Corp. is a developer, owner, and operator of renewable energy projects including run-of-river hydro, wind, solar, and hybrid systems focused on delivering both long-term operating assets and development-stage opportunities across North America. The company operates an “own & operate” portfolio while monetizing higher-capacity utility-scale assets through its “develop and sell” model.

In 2025, recurring revenue from operating assets has continued to increase with new operating projects coming on line. They completed a fully subscribed non-brokered $1.2MM LIFE equity offering in June to fund further growth.

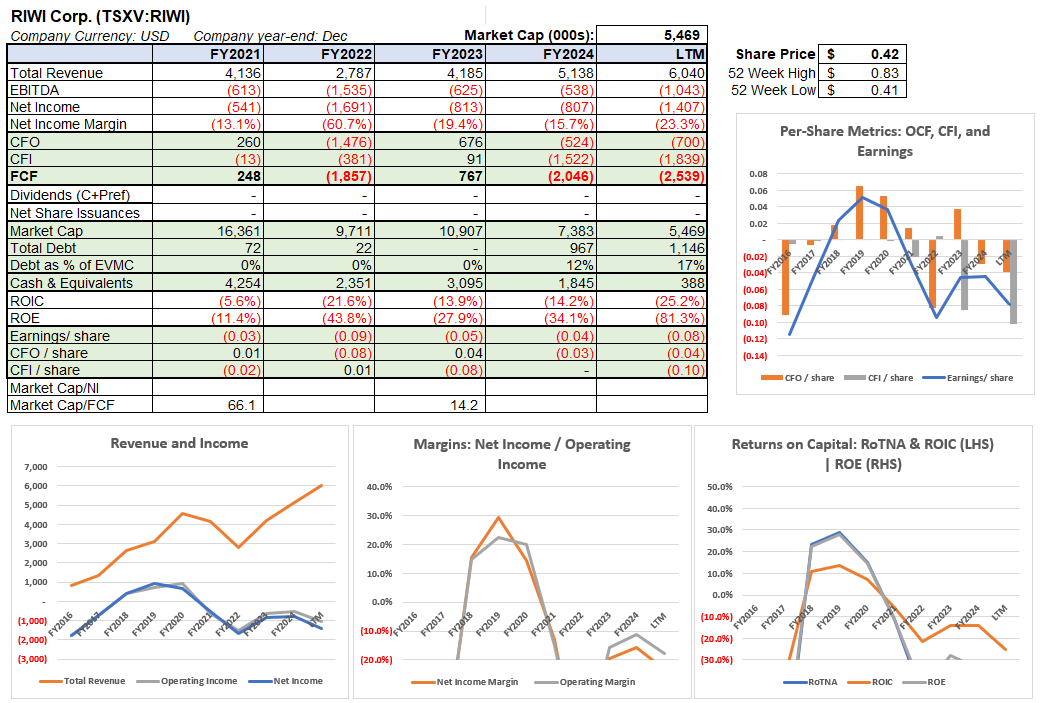

RIWI Corp. (TSXV:RIWI)

RIWI Corp. is a global technology company that delivers real-time predictive insights through anonymized, opt-in survey data, using its proprietary Random Domain Intercept Technology (RDIT™). It serves clients across sectors needing sentiment tracking, trend analysis, and behavioral research at scale, offering timely data for market intelligence, risk, and decision-making.

In 2025, RIWI completed the integration of its TheoremReach acquisition delivering stated cost synergies via consolidated staffing and systems. It has launched new offerings like a premium packaging solution and high-efficiency sample management tools.

Rubicon Organics Inc. (TSXV:ROMJ)

Rubicon Organics Inc. is a licensed producer specializing in organic-certified and premium cannabis products, including dried flower, pre-rolls, and oils. The company emphasizes vertically integrated operations and brand positioning in the wellness segment of the Canadian cannabis market.

In 2025, Rubicon has delivered meaningful progress. Q2 revenue climbed 24% year-over-year and recently acquired a 47,500 sq. ft. facility in Hope, British Columbia, to scale premium production capacity. The company closed a CA$4.5 million non-brokered private placement to support its growth capex and new facility.

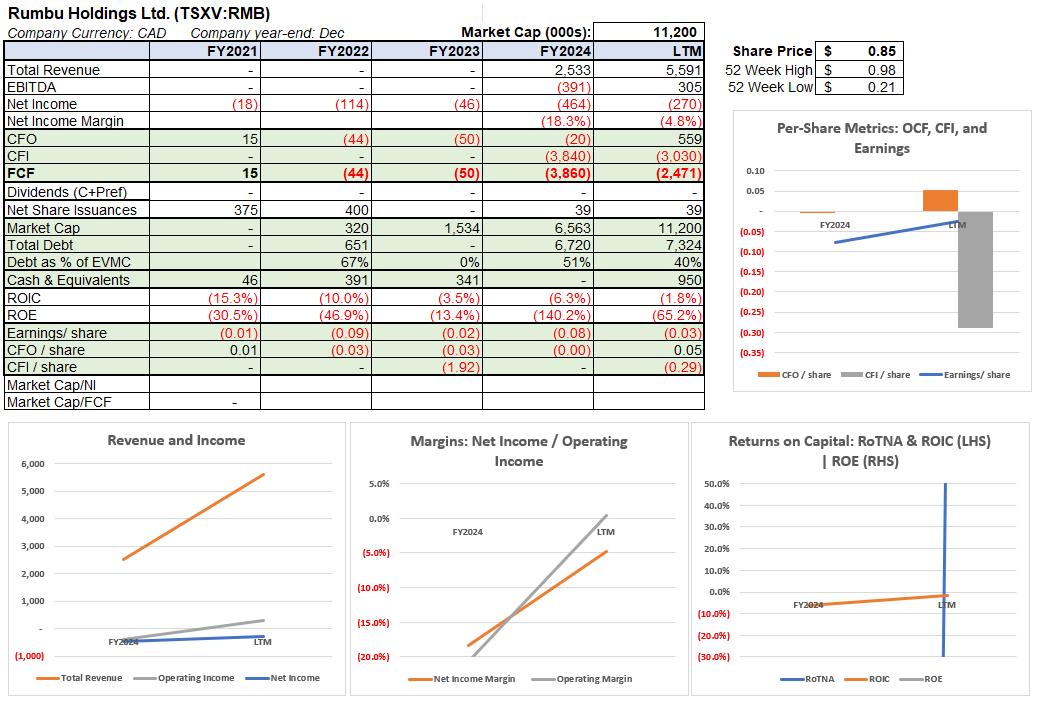

Rumbu Holdings Ltd. (TSXV:RMB)

Rumbu Holdings Ltd. is a Canadian consolidator of funeral homes, crematoriums, and aquamation services across Western Canada. Operating an asset-light, community-focused acquisition model, it transitions legacy operators into modern service delivery while partnering with local funeral professionals for continuity.

In 2025, Rumbu has continued it ongoing acquisition activity of additional funeral home locations.

Sangoma Technologies Corporation (TSX:STC)

Sangoma Technologies delivers unified communications solutions for businesses, offering both on‑premises and cloud‑based products such as PBX systems, VoIP gateways, and contact center platforms. A longstanding player in open‑source communications, its portfolio spans the Asterisk and FreePBX ecosystems, and its revenue model combines licensing, hardware, and subscription services aimed at small to mid‑sized enterprises globally.

In 2025, Sangoma continued to grow cash flow and reduce debt. It has initiated a shift away from lower‑margin third‑party hardware resales in favor of strengthening its higher‑value offerings.

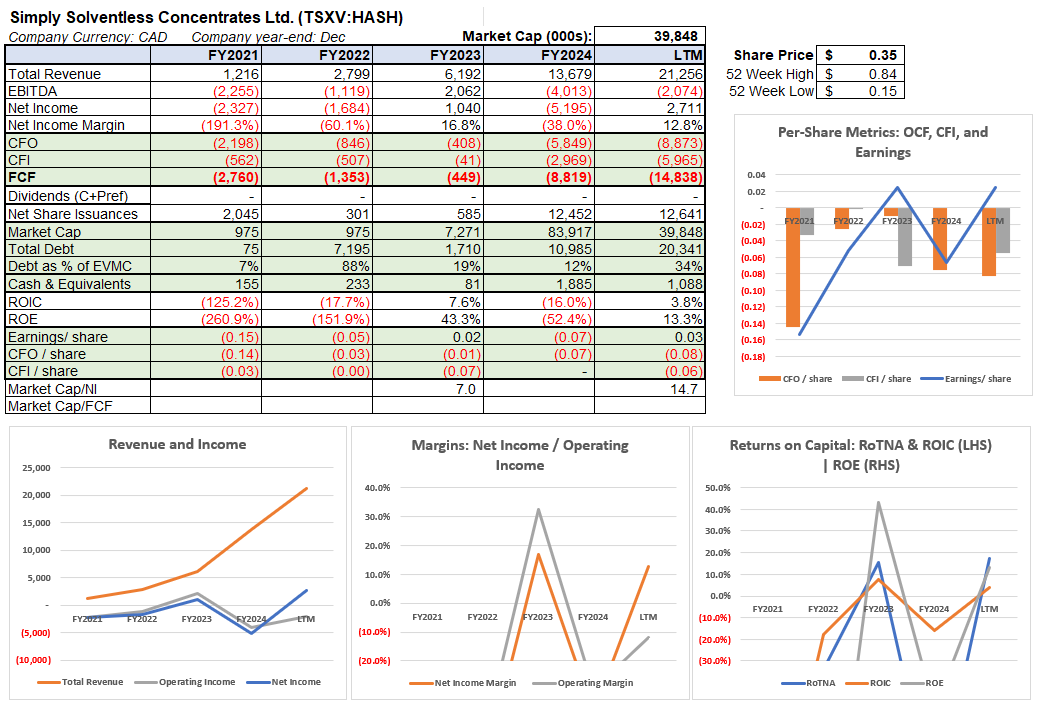

Simply Solventless Concentrates Ltd. (TSXV:HASH)

Simply Solventless Concentrates operates as a producer and distributor of terpene-rich, solventless cannabis concentrates. With vertically integrated cultivation, extraction, and branded product lines, the company serves both retail and wholesale channels—targeting discerning consumers seeking premium, craft-oriented cannabis solutions.

Snipp Interactive Inc. (TSXV:SPN)

Snipp Interactive offers digital marketing, promotions, and loyalty software as a service. Its modular platform enables brands to run personalized sweepstakes, rebates, and loyalty programs with AI-powered engagement and fraud protection, serving clients across industries ranging from retail to telecommunications.

In June, Snipp secured a new contract with a leading North American satellite TV provider to manage their loyalty engagement campaigns.

Telescope Innovations Corp (CNSX:TELI)

Telescope Innovations develops AI‑driven automation tools—especially its Self‑Driving Lab (SDL) platform for accelerating chemical and pharmaceutical research. Its DirectInject‑LC™ system and robotics‑powered SDLs aim to transform R&D through high‑throughput experimentation, automation, and digital analysis.

The company is advancing its automation platform and continues pursuing partnerships with industry leaders, positioning itself to drive efficiency in scientific discovery.

Thermal Energy International Inc. (TSXV:TMG)

Thermal Energy International provides engineering-based energy-efficiency and emission-reduction solutions like heat recovery, steam traps, and boiler optimization to industrial clients across sectors including manufacturing, food & beverage, and pharmaceuticals. The company operates globally, offering turnkey systems that deliver cost savings and decarbonization benefits by recovering waste fuel and thermal energy from steam systems.

In 2025, Thermal Energy secured several new contracts including a heat-recovery expansion project with a major food and beverage client in the U.S., and a European malted barley producer. The company also announced a Normal Course Issuer Bid to repurchase shares and participated in the 2025 Canadian Climate Investor Conference.

Thinkific Labs Inc. (TSX:THNC)

Thinkific Labs is a leading "learning commerce" platform that enables creators, educators, and businesses to build, market, and sell online learning and membership experiences. Its tools integrate course creation, community building, and commerce workflows into a unified, scalable SaaS platform—serving markets in both Canada and globally.

In 2025, Thinkific has focused on improving its product and cost control. The company also announced a strategic rebrand centered on AI-powered "learning commerce" capabilities, launched new platform features, and converted all multiple-voting shares into single common shares to streamline its capital structure.

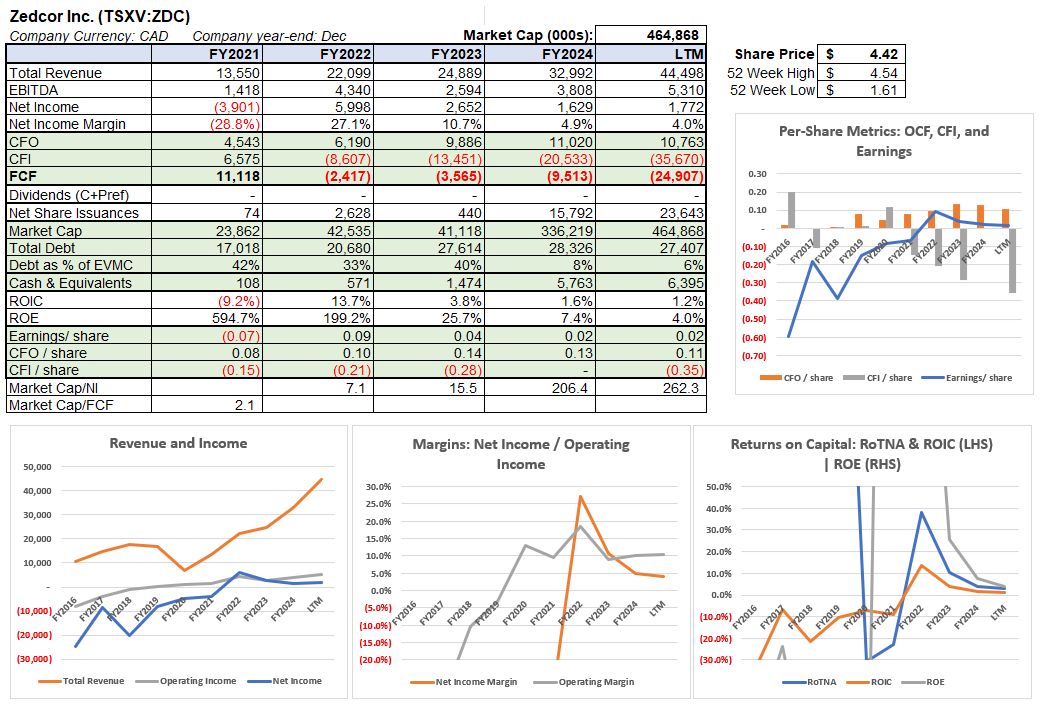

Zedcor Inc. (TSXV:ZDC)

Zedcor Inc. operates a fleet of AI-enabled mobile surveillance solutions—including security towers—under its MobileyeZ™ brand. It provides physical security and remote monitoring services to clients across North America, offering both hardware and monitoring services in high-performance, scalable deployment formats.

In 2025, Zedcor’s growth has continued with high fleet utilization. The company scaled production to 25 towers per week early in the year and further increased capacity to 30–35 per week to meet demand, targeting a total deployment of 1,200–1,400 towers for the year.

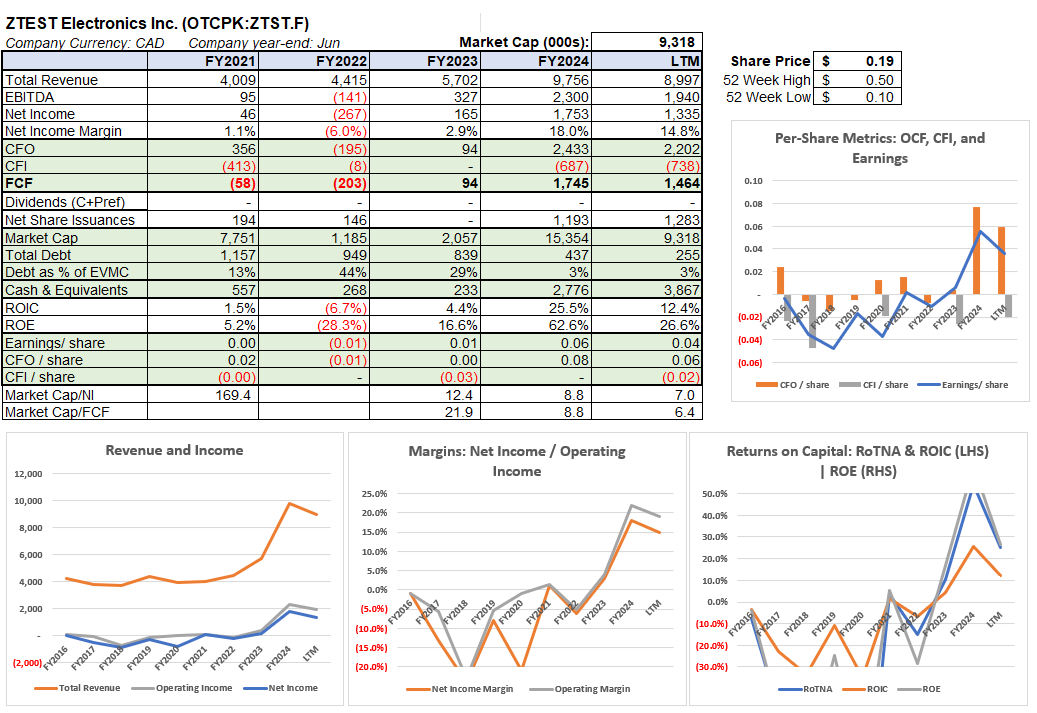

ZTEST Electronics Inc. (OTCPK:ZTST.F)

ZTEST Electronics Inc. is a technology company focused on testing, diagnostics, and quality assurance technologies—commonly serving the electronics, energy, and manufacturing sectors. The company enables its clients to streamline complex testing workflows through both hardware and software-enabled diagnostic solutions.

SmallCap Discoveries Conference 2025 Cheatsheet PDF