The Curious Case of Canadian Cannabis

Is the industry really turning the corner, or will this be the greatest value trap of all?

Disclosure: We own a basket of cannabis stocks, primarily LOVE, ROMJ, and HITI.

To say the legal Canadian cannabis industry has been “challenging” is like saying open-heart surgery is a mild inconvenience. In reality, the value destruction has been devastating and widespread. Since legalization in 2018, a remarkable boom of unrealistic expectations and overbuilding led to a bust that is still ongoing. But something has changed; there appears to be green shoots.

We want to start by saying that we did not invest in the boom. Companies were trading at dotcom-like multiples of metrics like expected future production, never mind revenue. Cash flow did not exist. In the classic sign of a bubble, one of us actually had a barber recommending a few of their top cannabis picks, unprompted, in the heyday.

However, since the bust, the industry has been starved of capital and speculation. There have been a lot of bankruptcies (see below). The remaining companies are shellshocked and some are now talking about things like free cash flow. And starting to show it.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Table of Contents:

-The boom and bust: A case study of Aurora and Canopy

-Has something changed?

-One of our holdings

The Boom and Bust

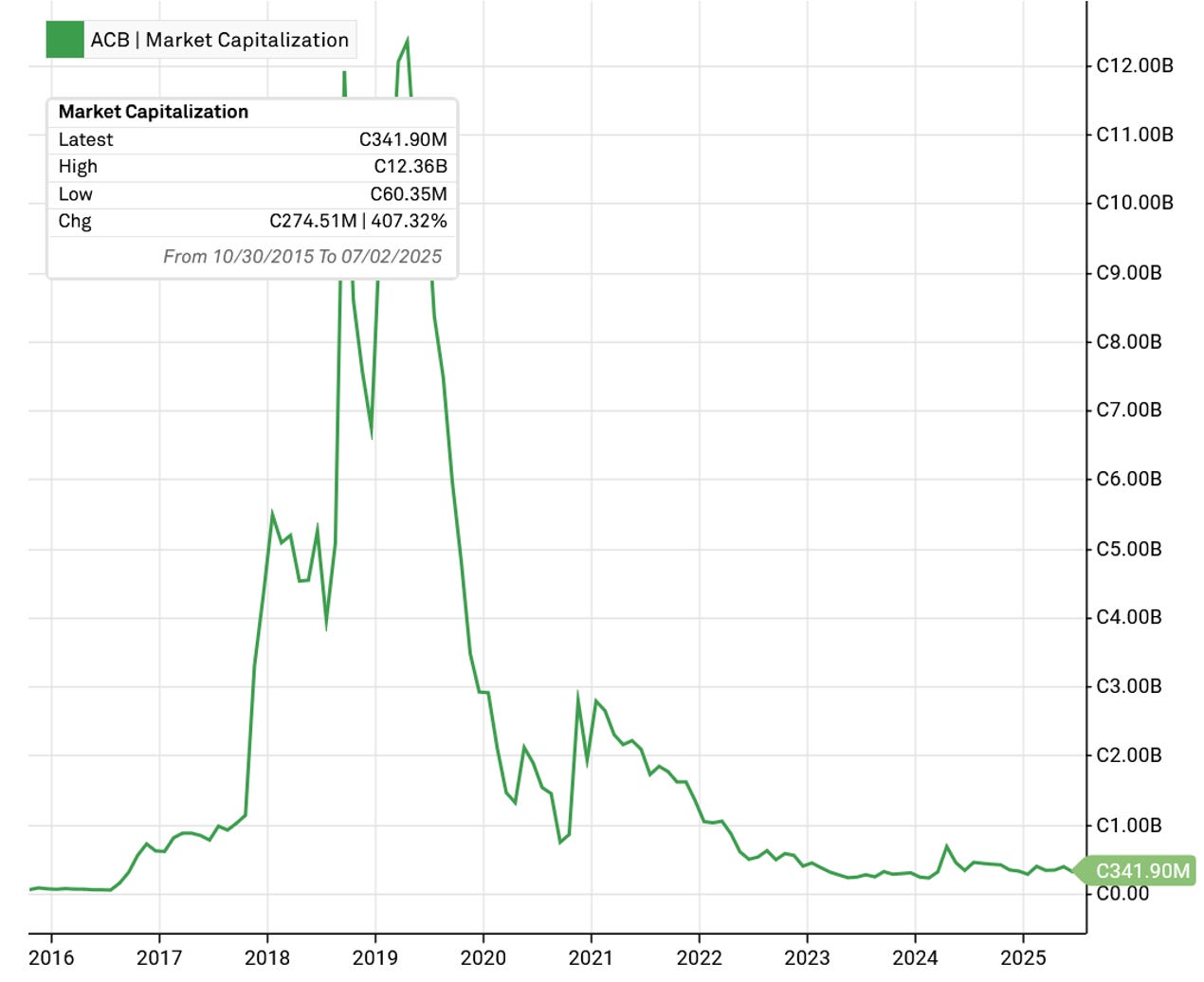

While we do not mean to pick on Aurora Cannabis Inc. (TSX:ACB, no position), it is just such a great case study of what has happened and why the industry is viewed as untouchable.

Aurora peaked at ~$12 billion in market capitalization. Since 2017 they have generated a negative billion dollars of cash flow while spending another billion on cash capex. Cash acquisition spending was low, only because many acquisitions were done with equity, increasing the share count by 1,741%.

Example acquisitions include CanniMed Therapeutics Inc. for ~$1.1 billion, and MedReleaf Corp. for ~$3.2 billion. The dollars and deals were big.

On March 9, 2018, the Company completed a private placement of two-year unsecured convertible debentures in the aggregate principal amount of $230,000,000. The debentures bear interest at 5% per annum, payable semi-annually. The debentures are convertible into Common Shares at a price of $13.05 per Common Share subject to a forced conversion if the VWAP of the Common Shares exceeded $17.00 per Common Share for 10 consecutive trading days.

On March 15, 2018, Aurora completed its initial take-up of the common shares of CanniMed pursuant to its offer to purchase all of the issued shares of CanniMed. Aurora took up 21,309,517 CanniMed shares representing 86.8% of the total outstanding CanniMed shares on a fully diluted basis which, together with the 700,600 CanniMed shares purchased in the market prior to the expiry of the CanniMed offer by Aurora, represents 87.2% of the outstanding CanniMed shares. In consideration for the CanniMed shares taken up on March 15, 2018, Aurora issued 62,833,216 Common Shares and paid cash consideration of $130,979,347. On March 26, 2018, Aurora completed its second take-up of CanniMed shares, acquiring an additional 8.7% or 2,202,970 of CanniMed shares for consideration of approximately 6,495,679 Common Shares and $12,558,534 cash. On May 1, 2018, Aurora completed the purchase all of the issued and outstanding CanniMed shares by purchasing the remaining outstanding CanniMed shares.

As we know, this did not go well. Valuations collapsed and it even led to a share consolidation for Aurora.

EDMONTON, AB, Feb. 20, 2024 - Share Consolidation

Aurora also announces the completion of its previously announced consolidation of the common shares of the Company (the "Common Shares") on a 10 to 1 basis (the "Consolidation"). The Common Shares will begin trading on a post-Consolidation basis on the NASDAQ Capital Market (the "NASDAQ") and the Toronto Stock Exchange (the "TSX") under the symbol "ACB" at the opening of trading today.

To be fair to Aurora, others did not fare better. Another example is Canopy Growth Corporation (TSX:WEED). Dreams were big in 2019 when they had a market cap of over $20 billion. EV/revenue was astronomical and there was no cash flow, not even EBITDA, to make a chart out of.

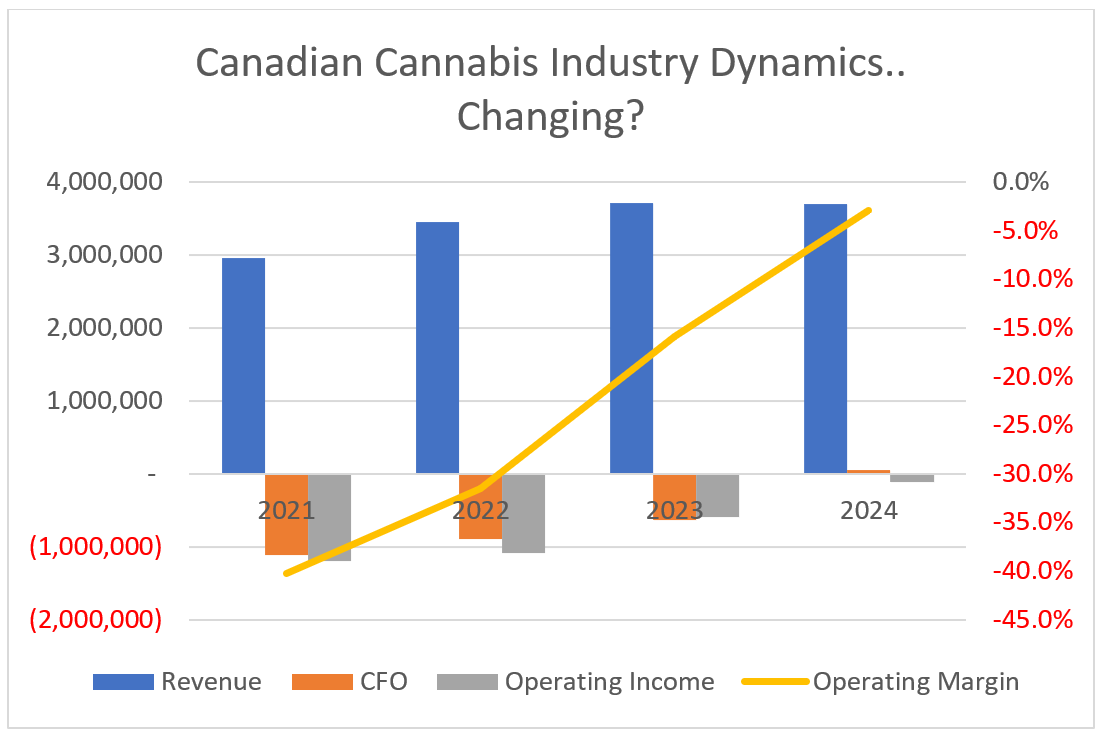

Has Something Changed?

We first started looking at cannabis stocks last year, but have been slow and only started purchasing a basket this year. Most investors and bankers we have talked to still view it as untouchable (usually stating this without checking any numbers), while the underlying results of the industry appear to be getting… less-worse. In fact, when we put together charts combining the results of a pool of the surviving Canadian companies it creates something interesting; EBITDA/cash flow/margins are improving while market expectations (i.e. the combined EV/market cap) have continued to decline.

This is our kind of party.

It appears that