SmallCap Discoveries 2025 Recap: Top Picks Part 1

Disclosure: We own all of the following companies mentioned with recent purchases in all except KITS (we still like them a lot and it remains a top hold).

The SmallCap Discoveries 2025 conference was an excellent event. It is not very often that you get to spend a few days in a room filled with great management teams and investors.

But the important question is, were there companies worth investing in?

Top picks out of the SmallCap Discoveries 2025 cohort

There were many interesting companies, but we are focusing today on a few that we spent some time with and think are at a particularly interesting juncture. The list this year is long enough that we are breaking it up into three groups:

Cannabis Corner

The Scalers

Fallen Darlings

Here is part 1 – Cannabis Corner. We hope you enjoy.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious bias and conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. In addition, no one guarantees the accuracy of any information provided and none of the information should be construed as investment advice or any other kind of advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose, except for entertainment (and we hope you enjoy).

Looking back at the 2024 conference - KITS keeps kicking it, our Smallcap Discoveries 2024 top find

From the 2024 cohort, a few companies have done exceptionally well. Our favourite last year was KITS, which we have highlighted and owned since last fall. See our article “”I see the light, and it only cost me $28” - https://www.canadianvalueinvestors.com/p/planet-microcap-vancouver-2024-highlights

The stock is “up” 70% or so, but the more important thing, to us, is that the actual business continues to scale and perform. It remains one of our largest holds.

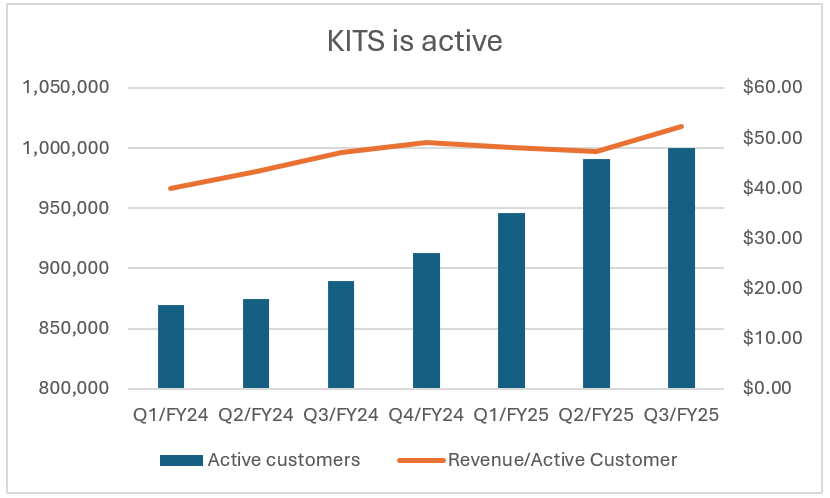

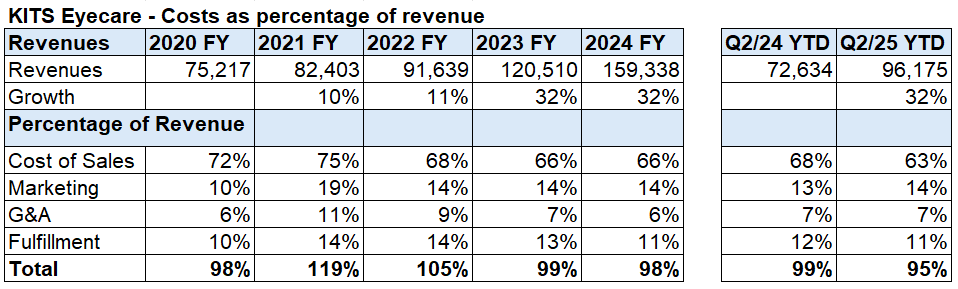

They continue to grow active customers (as defined below, now over one million), are growing revenue per customer, and have continued without any incremental capital required. Our thesis remains that the business is being run to maximize growth while ensuring it is self-funded. Marketing spend and product promotions are the key levers. We agree with this strategy. Secondly, we think the market is underestimating their ability to scale; the market is huge and they are still a very tiny fish. And despite issues like tariffs and a Canada Post strike, they continue to execute. We look forward to them hitting two million customers.

See full archive here - https://www.canadianvalueinvestors.com/t/kits

Active Customers Definition per Company – “As of the last date of each reporting period, we determine our number of active customers by counting the total number of individual customers who have ordered, and for whom an order has shipped, at least once during the preceding stated period. We introduced this number for a 2-year period to provide greater visibility in measuring our business performance as a 2-year period more closely reflects the frequency of repeat purchases in the eyecare sector. The change in active customers in the reporting period captures both the inflow of new customers and the outflow of customers who have not made a purchase in the stated period.”

SmallCap Discoveries 2025 Recap: Part 1 – Cannabis Corner

Much like Julius Caesar’s decision in 49 BCE to cross the Rubicon with his army, we have crossed the value investing Rubicon into Canadian cannabis. There remains few value-oriented fans of the industry, and for good reason. The Canadian legalization boom was awesome in the traditional sense of the word, with billions of dollars vaporized.

We did not participate in the initial boom and bust. However, as we have written about before, Canadian cannabis appears to be at an interesting inflection point. The effect of years of constrained capital, consolidation, and bankruptcies are starting to show signs through improved product pricing and margins. While many companies in the industry are still struggling, we are focused on the scrappy survivors who we think have interesting set ups.

To be clear, we remain cautious and cannabis remains a relatively small position at a combined exposure less than 10%. Potential issues abound; perhaps additional capacity destroys the pricing improvements we have seen. At this point, we do not think we truly know who “the winners” will be, and so a pooled bet on the best finds is our approach. We have focused down to two producers, Cannara and Rubicon, as well as retailer High Tide, have a small holding in Decibel, and are evaluating others.

We consider Cannara Biotech (East Coast LOVE, our first and larger hold) and Rubicon (ROMJ, our newer, smaller hold West Coast champion) to be premium scrappy operators with different approaches and regional exposure. Decibel is differentiated by its export strategy and exposure as currently Cannara does not seek to export while Rubicon is exploring exports in the future. We do not know if focusing on exports or not is the “right” approach, but it does appear that exports can help all domestic producers by creating a release valve for domestic production.

Where they were

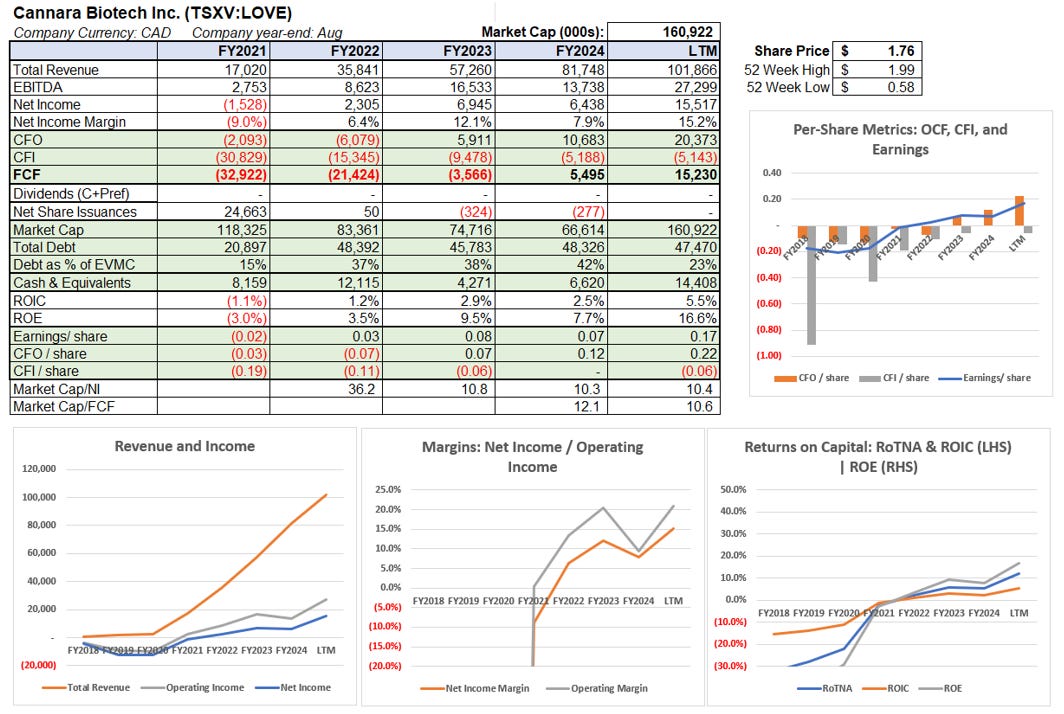

While these names have had a good run this year, we think it is important to understand the full cycle. The entire industry remains well below previous unbelievably frothy levels, but now there is real revenue and cash flow. For Cannara and Rubicon, margins have improved and revenue has continued to increase, albeit more so with Cannara as they ramp up their facility (Rubicon will also soon with their recently purchased facility).

Cannara Cannabis – Our first holding

We had a chance to sit down with Cannara for an update. It was the first company we purchased in the space and our overall exposure remains weighted heavily to it. We will not rehash our previous coverage, but want to remind readers of their Valleyfield asset, as something similar has happened at Rubicon.

Valleyfield was purchased in 2021 from The Green Dutchman’s Organics (subsequently BZAM Ltd.). We note BZAM ultimately failed via a CCAA filing in 2024. The asset was a distressed sale and was a $200MM+ build-out by the end. Cannara acquired it for ~$30MM, well below replacement cost. Our Cannara overview and initial coverage of the industry is here - https://www.canadianvalueinvestors.com/p/the-curious-case-of-canadian-cannabis

After following up with management again, we are increasingly comfortable with their approach. They are laser focused on being a best-in-class operator and continue to (in our view) have a regulatory advantage in Quebec. They have lots of space and continue to open up additional rooms at their facility. Revenue and cash flow should continue to grow accordingly.

Decibel Cannabis

Decibel is the newest name to us, and we are still digesting. Decibel has taken a different approach than both Cannara and Rubicon. Cannara is focused exclusively on Canada, with advantages in Quebec, and Rubicon is focusing on the domestic market as well at least in the interim (currently supply constrained). For Decibel, export markets are a pillar. They are a producer of cannabis and extracts whose roots trace to Westleaf Inc. Westleaf agreed to combine with We Grow BC Ltd. (producer of the Qwest brand) in late 2019.

A key differentiator is their ability to export with their 2024 acquisition of AgMedica. They have EU-GMP (Good Manufacturing Practice) certification. In addition to exporting their own cannabis to markets like Germany, they can also uplift other producers’ production by processing it through their certified facility.

We view Decibel as a bit behind Cannara and Rubicon given their relatively recent transactions, while Cannara and Rubicon have been standalone scrappy companies from the start.

We have a relatively small position and are watching closely.

Rubicon Organics – Scrappy, premium, and heading to the next level

We had a management meeting and facility tour of Rubicon’s Delta B.C. facility. They provided a great update of their branding and facilities and we have put together our key highlights.

Thinking about branding

Rubicon is the largest organic cannabis producer at this scale and focus on premium “B.C. bud”. All steps of their process focus on quality, such as drying harvested plants slowly to protect turpines, and a more labour-intensive process to ensure consistency and quality. New product development and quality is supported by significant testing as well as large consumer studies.

Their brand strategy is thoughtful and breaks down into four separate logical brands: