Planet MicroCap Toronto 2025 Cheatsheet

Here is an overview of every company attending

Here we go! Another fantastic investing conference is coming up next week. Planet MicroCap is hosting its Toronto Showcase on October 21–23, 2025 in partnership with MicroCapClub.

The list of companies presenting is great, but it is also a bit long at 77 in total. How do you get up to speed? To help, we put together the following summaries outlining financial performance and recent developments of every company attending. It is presented in alphabetical order. We hope you find this helpful and even if you cannot attend, this is a great list of companies to dig into. We have also put together a printable version for our full subscribers at the bottom of this page.

We also covered the best West Coast Canadian investing event just last month - see our SmallCap Discoveries Vancouver 2025 summary here: https://www.canadianvalueinvestors.com/p/smallcap-discoveries-conference-vancouver-2025

Let’s dig in!

Attendees as of October 13th (subject to change).

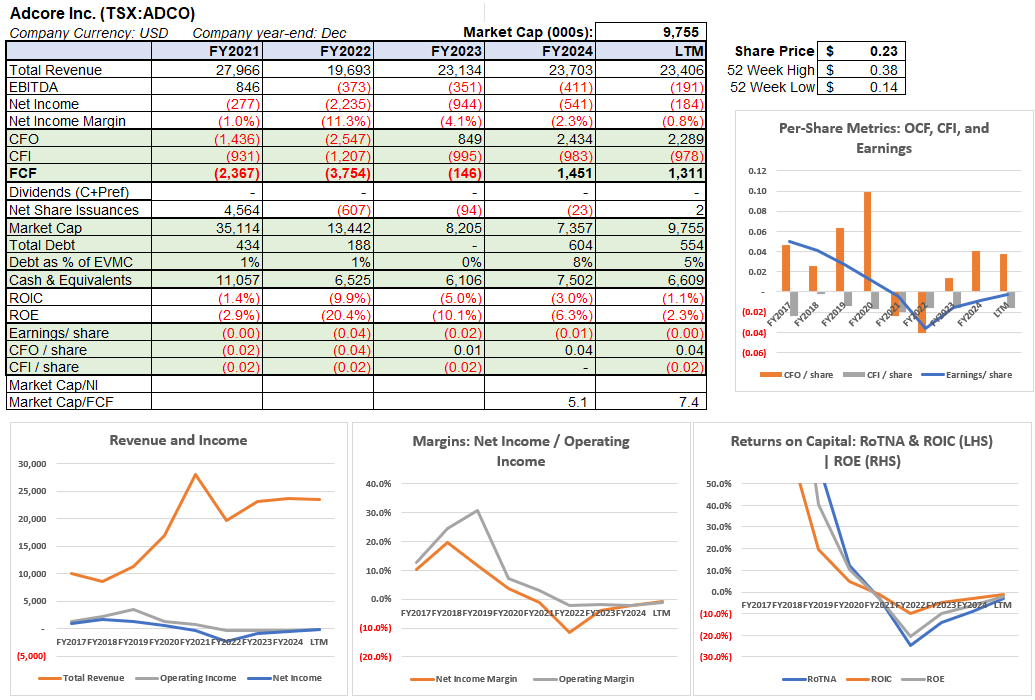

Adcore Inc. (TSX: ADCO)

Adcore provides performance marketing technology and agency services that help advertisers automate and optimize campaigns across channels such as Google, Meta, Microsoft, and e-commerce marketplaces. Its platform stack (including automation, bid/rule engines, and data feeds) targets SMBs and agencies looking to scale ROAS efficiently, complemented by managed services for campaign strategy and execution.

In 2025, Adcore has emphasized pipeline expansion in North America and EMEA, with continued development of its automation suite to address rising acquisition costs and privacy changes.

Aluula Composites Inc. (TSXV: AUUA)

Aluula develops ultra-light, high-strength, and recyclable soft composite materials used in windsports, outdoor gear, sailing/maritime, and industrial applications. The company’s films and fabrics (e.g., Aeris™, Gold™, Durlyte™) aim to replace laminated textiles by delivering superior strength-to-weight ratios, abrasion/UV resistance, and circularity.

In 2025, Aluula has advanced commercialization and financing. It reported stronger mid-year momentum with improving gross margins, closed near-full warrant exercises for additional capital, and continued diversifying beyond windsports into performance outdoor, maritime, and defense.

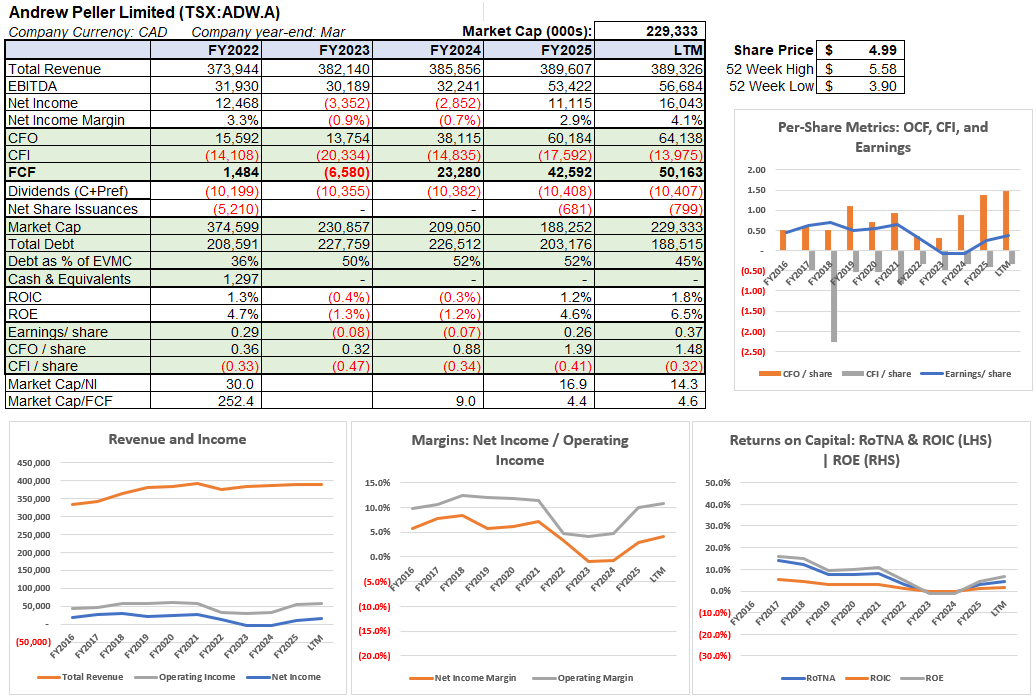

Andrew Peller Limited (TSX: ADW.A)

Andrew Peller is a leading Canadian vintner, producing and marketing wines, RTDs, and spirits through brands such as Peller Estates, Trius, Wayne Gretzky, and more. It operates wineries, hospitality venues, and distribution across Canada, with a mix of own retail, provincial liquor boards, and on-premise channels.

In 2025, the company has shown margin recovery and earnings improvement, reporting a stronger fiscal Q1-2026 (quarter ended June 30, 2025) with higher gross margin and positive net income versus a loss a year earlier. The company has kept dividend payments in place while signaling ongoing focus on cost discipline and brand mix optimization.

Atlas Salt Inc. (TSXV: SALT)

Atlas Salt is advancing the Great Atlantic Salt Project in western Newfoundland, a proposed underground rock-salt mine positioned to supply eastern North American de-icing markets. The project targets low-cost bulk production with marine access, leveraging proximity to key demand centers.

In 2025, Atlas has progressed project de-risking and corporate housekeeping. The company communicated timing and then results of an updated feasibility study for Great Atlantic.

Auxly Cannabis Group Inc. (TSX: XLY)

Auxly is a Canadian consumer packaged goods cannabis company with a portfolio spanning vapes, pre-rolls, edibles, and beverages, supported by internal cultivation and processing. Its brand architecture targets mainstream value and mid-premium segments, with national distribution through provincial boards.

In 2025, Auxly has highlighted record profitability, noting leading share positions in certain categories and brands. The company continued balance-sheet cleanup and debt reduction, and outlined priorities around cash generation, market share, and disciplined innovation.

Aytu BioPharma, Inc. (NASDAQCM: AYTU)

Aytu BioPharma develops and commercializes prescription therapeutics addressing pediatric and pediatric-onset conditions, with a portfolio spanning both commercial products and late-stage development assets. The business emphasizes focused specialty sales coverage and lifecycle management.

In 2025, management has continued to emphasize operating discipline and capital allocation to support late-stage assets and targeted commercial execution.

Baylin Technologies Inc. (TSX: BYL)

Baylin designs and manufactures wireless antenna and RF components through brands such as Galtronics, serving mobile devices, networking/CPE, infrastructure, and IoT/embedded markets. It operates design centers and manufacturing across North America, Asia, and Europe.

In 2025, Baylin announced successful live-network trials with a Tier-1 European carrier for next-gen dual-band antennas and continued to highlight multi-year design wins tied to Wi-Fi 7 gateways and extenders.

BioRem Inc. (TSXV: BRM)

BioRem provides biofiltration and air-emissions abatement systems for municipal and industrial clients, integrating engineered media and turnkey solutions to remove odors and VOCs. Its backlog and installed base span North America and international markets.

In 2025, BioRem has reported continued record backlog levels following a strong 2024 and delivered Q2 results showing growth in revenue and EBITDA alongside an approved normal course issuer bid. Management emphasized execution on large municipal/industrial projects and disciplined capital deployment.

BluMetric Environmental Inc. (TSXV: BLM)

BluMetric is an environmental engineering and water technology firm providing consulting, remediation, and turnkey water/wastewater systems to government, defense, mining, and industrial clients. It combines services with proprietary systems for potable, process, and contaminated water.

In 2025, BluMetric posted Q3-2025 results and advanced defense-sector initiatives, signing an MoU with DNG Defence to collaborate on sovereign, sustainable solutions. The company is emphasizing a healthy pipeline across government and industrial verticals and continued operating discipline.

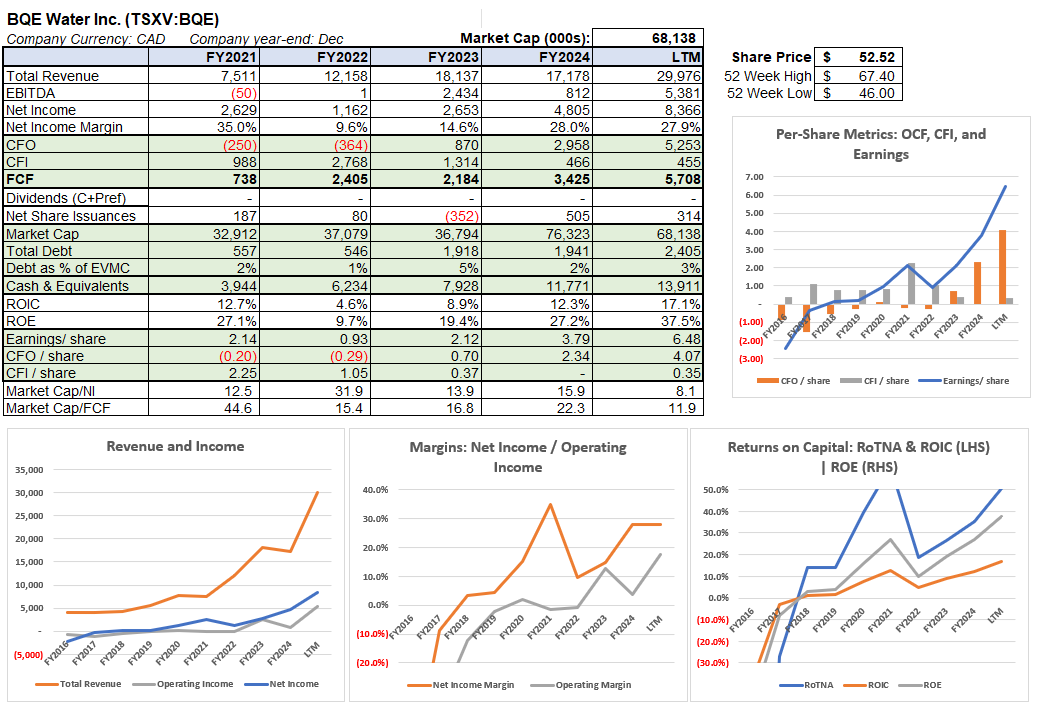

BQE Water Inc. (TSXV: BQE)

BQE Water designs, implements, and operates mine-water treatment solutions, including SART and Sulfide-based processes, delivering metals recovery and water compliance for mining companies globally. Revenue is generated from engineering, plant operations, and performance-based contracts.

In 2025, BQE has announced its third SART plant in China entering full production, expanding its operating footprint.

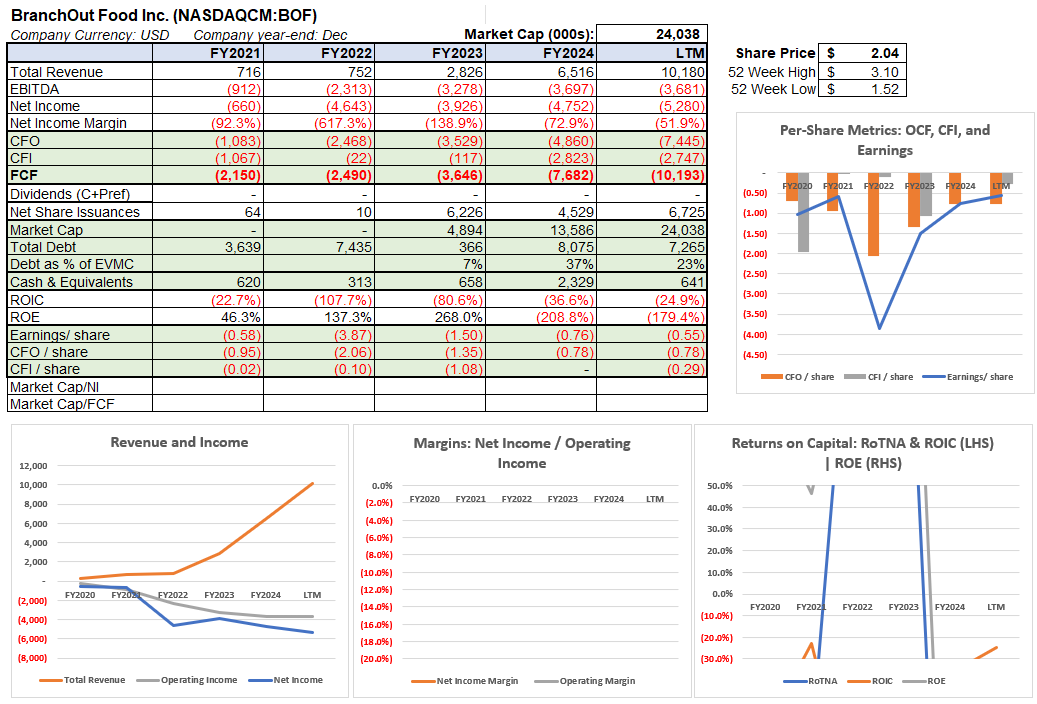

BranchOut Food Inc. (NASDAQCM: BOF)

BranchOut produces dehydrated fruit and vegetable snacks and ingredients using proprietary GentleDry™ technology, supplying both branded CPG products and bulk ingredients to retailers and food manufacturers. The company’s model blends private-label, wholesale, and branded channels.

In 2025, BranchOut continues to expand retail placements and scale production to meet growing private-label demand, while updating investors on capacity additions and distribution wins. Management emphasized focus on gross-margin expansion through automation, SKU mix, and long-term supply contracts.

BuildDirect.com Technologies Inc. (TSXV: BILD)

BuildDirect operates a digital-first marketplace for home-improvement products, primarily flooring, serving pros and homeowners through an omnichannel model with regional warehouses and last-mile delivery. The company complements marketplace listings with owned-brand offerings.

In 2025, BuildDirect has concentrated on profitability initiatives including rationalizing SKUs, optimizing freight/fulfillment, and expanding pro-contractor engagement while communicating quarterly results that highlighted improved gross margin dollars and opex discipline.

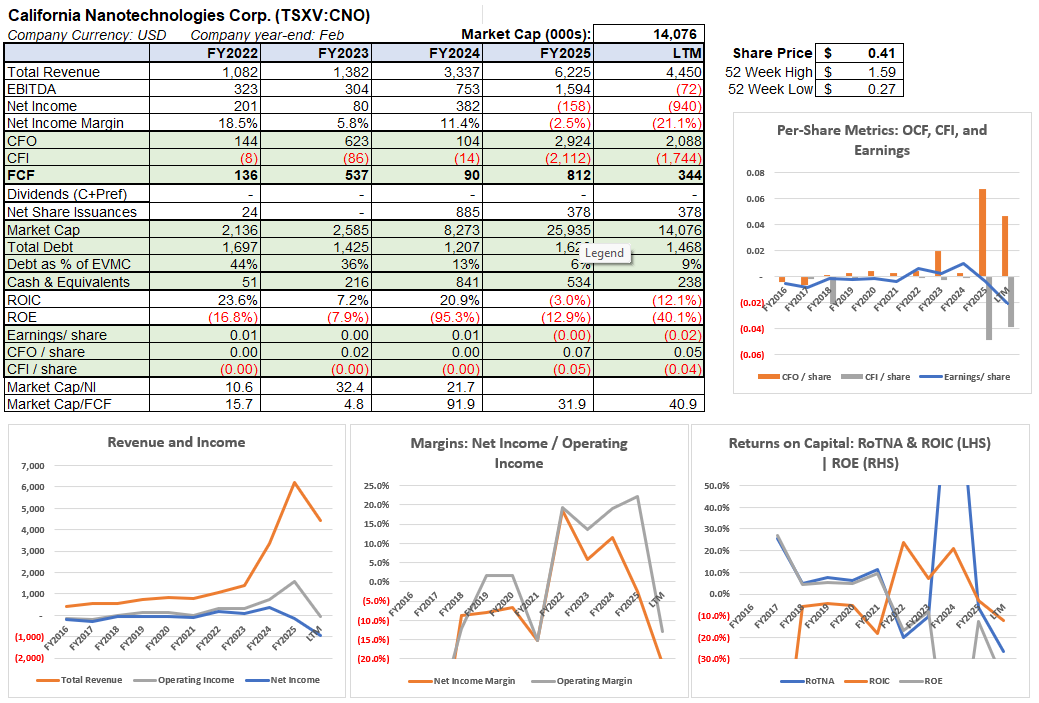

California Nanotechnologies Corp. (TSXV: CNO)

Cal Nano provides advanced materials engineering services, specializing in spark plasma sintering (SPS) and cryogenic milling to produce high-performance metals, ceramics, and composites for aerospace, defense, energy, and semiconductors. Revenue comes from R&D services, parts production, and equipment.

In 2025, Cal Nano has reported sustained backlog growth and additional multi-phase programs with Tier-1 customers, supported by capacity expansions around equipment and shifts. The company highlighted higher-margin production work transitioning from prior R&D engagements and continued hiring to support throughput.

Cannara Biotech Inc. (TSXV: LOVE)

Cannara is a vertically integrated cannabis company operating large indoor cultivation facilities in Quebec, selling premium dried flower, pre-rolls, and oils under brands such as Tribal, Nugz, and Orchid CBD. The strategy emphasizes low-cost production with premium quality.

In 2025, Cannara strengthened its balance sheet by selling a non-core property and using proceeds to reduce debt, added a new director to its board, and delivered record operating performance with growing share in key provinces. Management reiterated focus on cash generation, selective innovation, and disciplined capex.

CHAR Technologies Ltd. (TSXV: YES)

CHAR develops high-temperature pyrolysis projects that convert wood and organic residues into biocarbon and renewable gases, serving steelmaking and energy markets seeking decarbonization. The company builds, owns, and operates facilities like the Thorold Renewable Energy facility.

In 2025, CHAR has advanced project financing and partnerships at Thorold, securing strategic equity from BMI Group at the project level and setting the path to initial commercial biocarbon output in late 2025.

Cizzle Brands Corporation (NEOE: CZZL)

Cizzle Brands operates a branded CPG platform focused on cannabis-adjacent and wellness categories, leveraging contract manufacturing and distribution partners. The model targets rapid product iteration and provincial listings without heavy in-house capex.

In 2025, the company has pursued new provincial listings, streamlined SKUs for margin improvement, and refreshed brand/packaging to support retail velocity. Management has emphasized a path to positive cash flow through disciplined operating spend and targeted launches.

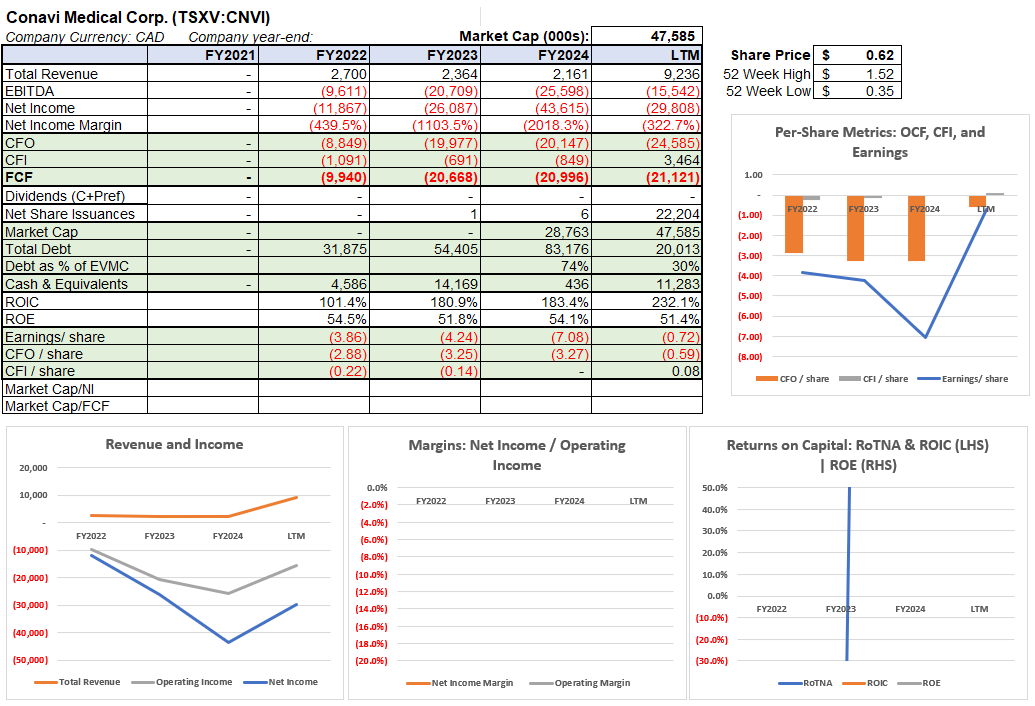

Conavi Medical Corp. (TSXV: CNVI)

Conavi develops image-guided technologies for cardiovascular procedures, notably its Novasight Hybrid™ IVUS-OCT system designed to provide simultaneous intravascular ultrasound and optical coherence tomography imaging. The platform targets improved decision-making in PCI and structural heart interventions.

In 2025, Conavi states it has progressed regulatory and commercialization activities, with ongoing clinical collaborations and installations to support adoption ahead of broader market rollout. The company has communicated operating updates around manufacturing readiness and financing initiatives to fund commercialization.

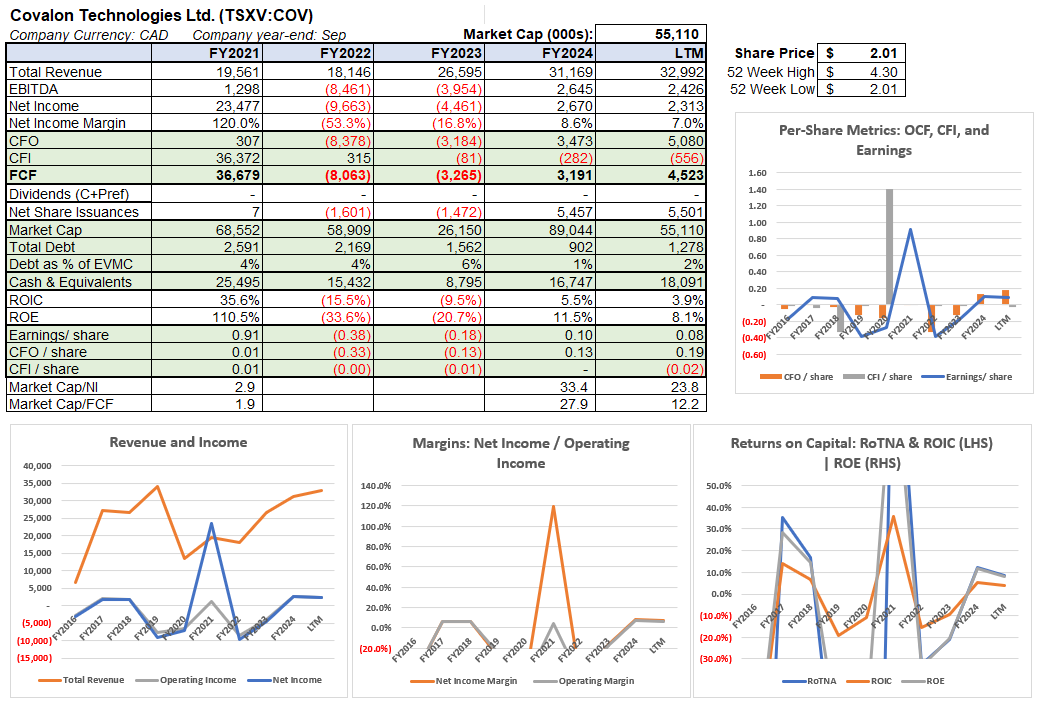

Covalon Technologies Ltd. (TSXV:COV)

Covalon Technologies develops and markets advanced wound care dressings and infection prevention products for hospitals and clinics worldwide. Its portfolio includes antimicrobial silicone adhesives, collagen dressings, vascular access line protection, and perioperative skin products designed to reduce infections and improve patient outcomes. The company sells through direct channels and distribution partners, with a growing emphasis on the U.S. market and specialty care settings.

In 2025, Covalon highlighted has favorable U.S. tariff developments that improve competitive positioning for its imported products and margins, and it continued to broaden distribution in key U.S. hospital systems.

CTW Cayman (NASDAQCM:CTW)

CTW Cayman is a mobile and online game developer and publisher known for free‑to‑play titles distributed through web and app channels. The company focuses on live‑ops, user acquisition efficiency, and monetization across Asia and global markets, leveraging data-driven content updates and community engagement to extend game lifecycles.

In 2025, CTW Cayman completed its U.S. listing on the Nasdaq Capital Market. Post‑listing, the company emphasized pipeline launches and marketing investments to scale internationally, while communicating a disciplined approach to user acquisition amid platform privacy changes and competitive intensity across the mobile gaming ecosystem.

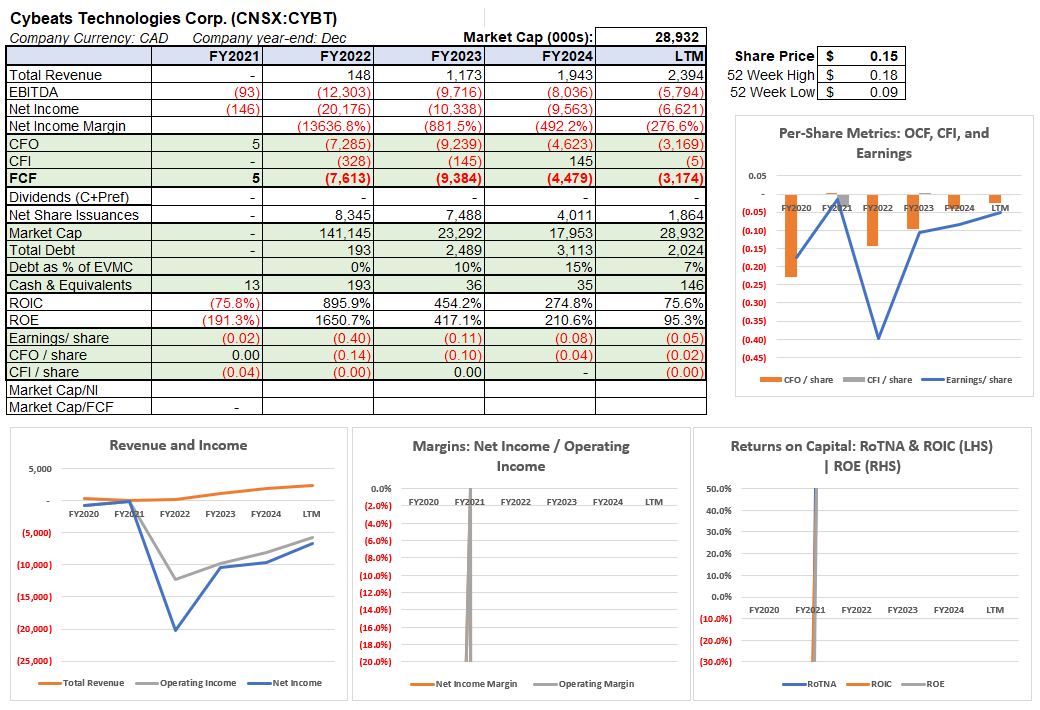

Cybeats Technologies Corp. (CNSX:CYBT)

Cybeats Technologies provides software supply chain security solutions, with a focus on Software Bill of Materials (SBOM) management, vulnerability monitoring, and compliance for organizations producing or integrating complex software and firmware. Its SBOM Studio and related modules target regulated and mission‑critical sectors including industrial automation, medical devices, and critical infrastructure.

During 2025, Cybeats has secured and expanded enterprise and government contracts including wins in industrial automation and renewals with a U.S. government security agency while rolling out new AI‑enabled features to automate vulnerability triage and asset intelligence across IT and OT environments. The company also reported year‑over‑year revenue growth with improving operating losses and completed equity financing under the LIFE exemption to support sales expansion and product development.

DAVIDsTEA Inc. (OTCPK:DTEA.F)

DAVIDsTEA is a specialty tea and beverage retailer offering a wide assortment of loose‑leaf teas, blends, and accessories through e‑commerce and a focused store footprint in Canada. The brand emphasizes seasonal innovation, wellness‑oriented blends, and direct‑to‑consumer engagement via subscription, loyalty, and digital marketing.

In 2025, the company has continued executing on simplification and online growth initiatives. The year was marked by the passing of founder Herschel Segal, with management reiterating strategic priorities around product innovation, fulfillment efficiencies, and cost discipline ahead of second‑quarter earnings in September.

Decibel Cannabis Company Inc. (TSXV:DB)

Decibel Cannabis is a vertically integrated Canadian cannabis company focused on premium flower and derivative products under brands such as Qwest and General Admission. Operations span cultivation, processing, and manufacturing, complemented by domestic wholesale and growing international export channels.

Through 2025, Decibel executed on international expansion and integration initiatives, including expanded export programs and the contribution from a recently acquired EU‑GMP facility supporting overseas sales. Management provided 2025 guidance emphasizing revenue and EBITDA growth, reported covenant compliance, and highlighted brand momentum domestically; equity incentives were granted early in the year to align employees with long‑term objectives.

DIRTT Environmental Solutions Ltd. (TSX:DRT)

DIRTT Environmental Solutions designs and manufactures prefabricated, software‑driven interior construction systems for commercial, healthcare, education, and public spaces. Its ICE® technology links design directly to manufacturing, enabling rapid, customizable, and sustainable build‑outs with reduced waste and lifecycle costs.

In 2025, DIRTT has reported mixed quarterly results amid tariff and macro pressures but continued to build its sales pipeline, adding multi‑million‑dollar projects and new product certifications, including fire‑rated walls that open additional verticals.

Dr. Phone Fix Canada Corporation (TSXV:DPF)

Dr. Phone Fix is a Canadian consumer tech services company specializing in smartphone and electronics repair, device refurbishment, and retail sales of accessories and certified pre‑owned devices. The company operates a growing store network complemented by partnerships with carriers, OEMs, and corporate clients.

In 2025, Dr. Phone Fix reported improved quarterly results with revenue growth and positive operating trends, citing expanding strategic partnerships that increased device intake and service volumes. The company announced a non‑brokered private placement to fund network expansion and working capital, while continuing to onboard enterprise clients for repair and trade‑in programs across Canada.

Edgewater Wireless Systems Inc. (TSXV:YFI)

Edgewater Wireless develops Wi‑Fi Spectrum Slicing™ technology and multi‑channel access point solutions designed to improve capacity, latency, and interference management in high‑density environments. The company licenses its technology and works with chipset partners and service providers to integrate spectrum slicing into next‑generation Wi‑Fi networks.

In 2025, Edgewater advanced commercialization with technical milestones, partner demonstrations, and investor outreach, and reported fiscal 2025 results focusing on cost actions to extend runway, noting it has positioned Spectrum Slicing for Wi‑Fi 7 era deployments and expanded proof‑of‑concept activity with ecosystem partners.

EMERGE Commerce Ltd. (TSXV:ECOM)

EMERGE Commerce operates a portfolio of digital commerce brands in North America across subscription and marketplace verticals, with current focus areas in grocery and golf. The model centralizes shared services to drive scalable, multi‑brand unit economics.

In 2025, EMERGE reported improved quarterly results with year‑over‑year revenue growth and stronger adjusted EBITDA as cost‑reduction programs took hold.

EnWave Corporation (TSXV:ENW)

EnWave develops and licenses Radiant Energy Vacuum (REV™) dehydration technology used by food and pharmaceutical producers to dry products rapidly at low temperatures. The business model combines machine sales with royalties from licensees commercializing REV™ products.

In 2025, EnWave posted a sharp year‑over‑year improvement in quarterly revenue and gross margins, driven by large‑scale machine deliveries and higher royalty income. The company completed a fully subscribed LIFE private placement in August to accelerate fabrication of additional REV™ units and subsequently released third‑quarter results and hosted an investor call as demand indicators for new systems strengthened.

Finseta Plc (AIM:FIN)

Finseta is a UK‑based foreign exchange and payments platform serving SMEs and high‑net‑worth clients with multi‑currency accounts, cross‑border payments, and embedded corporate FX solutions. The company operates regulated payments infrastructure and a proprietary front‑end for customer onboarding and risk controls.

In 2025, Finseta reported mid‑teens revenue growth for the first half on rising active customers and transaction volumes, expanded into new markets including the UAE and Canada, and maintained product investment in platform features. Subsequent guidance updates tempered full‑year expectations, which weighed on shares, as management has prioritized margin discipline and scalability ahead of further geographic rollout.

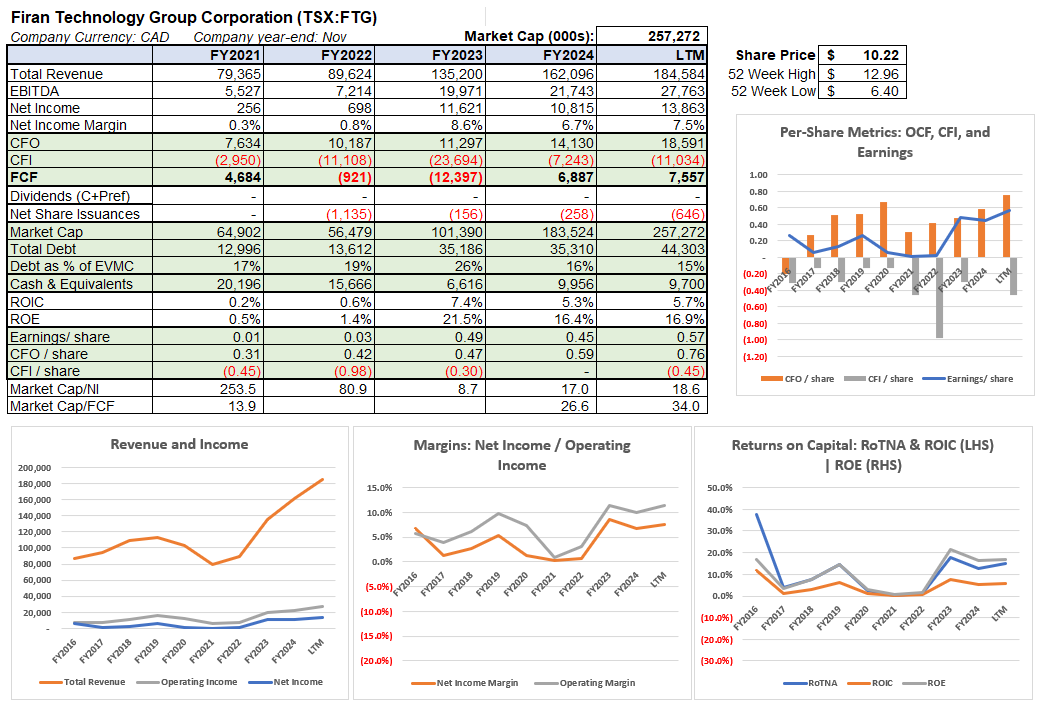

Firan Technology Group Corporation (TSX:FTG)

Firan Technology Group designs and manufactures high‑reliability printed circuit boards and cockpit display products for aerospace and defense customers. Its FTG Circuits and FTG Aerospace divisions serve commercial, business, and military aviation programs globally.

In 2025, FTG has delivered sequential and year‑over‑year growth and reported third‑quarter results highlighting margin improvement and strong cash generation. The company continued capacity investments, progressed certifications, and advanced integration initiatives to support backlog execution across key aerospace platforms, while maintaining a disciplined capital allocation framework.

Fortune Bay Corp. (TSXV:FOR)

Fortune Bay is a Canadian exploration and development company advancing gold and uranium projects in Saskatchewan, including the Goldfields gold project and the Murmac uranium project. The company pursues value through resource growth, technical studies, and partnerships on its Athabasca‑area assets.

In 2025, Fortune Bay has advanced technical work on Goldfields, with an updated study supporting an improved project value case amid strong gold prices, and progressed its Murmac uranium joint‑venture program with continued drilling and evaluations.

Golconda Gold Ltd. (TSXV:GG)

Golconda Gold is a junior gold producer and explorer focused on precious metals projects in Africa and the Americas. The company targets production growth and reserve expansion through mine optimization, selective exploration, and disciplined capital allocation.

In 2025, Golconda has continued its operational updates centered on mine planning, cost controls, and grade improvement initiatives while advancing exploration near-mine targets.

Haivision Systems Inc. (TSX:HAI)

Haivision provides mission‑critical video networking solutions including low‑latency encoders/decoders, bonded cellular transmitters, and IP video distribution used in broadcast, enterprise, defense, and public safety. Its technologies power contribution, cloud workflows, and secure real‑time video over wired and wireless networks.

In 2025, Haivision has released product refreshes across mobile transmitters and cloud orchestration, announced customer wins in live sports and government, and highlighted recurring software and services growth in its quarterly updates.

High Tide Inc. (TSXV:HITI)

High Tide operates a retail‑focused cannabis ecosystem in Canada with its Canna Cabana stores, e‑commerce platforms, and accessories distribution. The model emphasizes everyday low prices, loyalty programs, private‑label products, and ancillary revenues.

In 2025, High Tide reported continued same‑store sales growth and new store openings in priority provinces, advanced private‑label and membership initiatives, and communicated ongoing free‑cash‑flow focus. The company refinanced/extended facilities and reiterated priorities around profitability and disciplined expansion.

Hydreight Technologies Inc. (TSXV:NURS)

Hydreight offers a telehealth‑enabled platform that powers mobile, on‑demand health and wellness services for licensed medical professionals across the U.S. The platform integrates clinical governance, e‑prescribing, payments, and compliance with a marketplace for IV therapy and related services.

In 2025, Hydreight has posted year‑over‑year revenue growth with positive adjusted EBITDA in early quarters, launched new white‑label and DTC offerings to support partners in all 50 states, and raised growth capital to scale technology and marketing. Management highlighted expanding practitioner counts and improving unit economics.

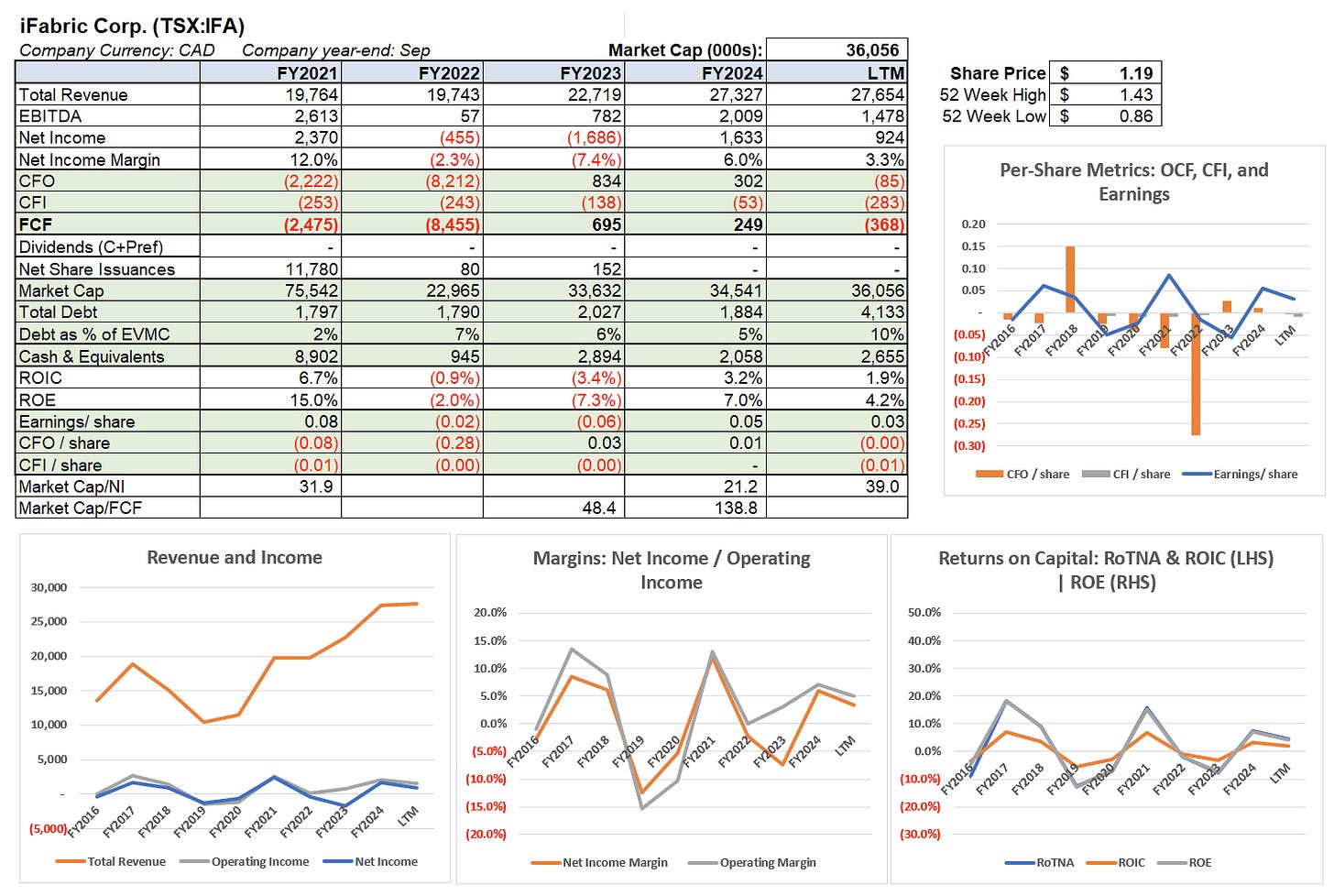

iFabric Corp. (TSX:IFA)

iFabric develops and markets specialty textiles and chemical formulations for healthcare, consumer, and industrial applications, including antimicrobial, water‑repellent, flame‑resistant, and performance fabric treatments. Its divisions serve apparel brands, medical textiles, and PPE markets.

In 2025, iFabric has reported progress commercializing new chemistries with brand partners, expanded regulatory clearances for select formulations, and advanced cost initiatives following prior supply‑chain volatility. The company has continued to invest in R&D partnerships and targeted growth in healthcare and performance wear.

Intermap Technologies Corporation (TSX:IMP)

Intermap provides 3D geospatial data, analytics, and elevation‑as‑a‑service solutions used in aviation, insurance, telecom, government, and infrastructure planning. Its offerings include NEXTMap elevation datasets and custom collections/derivatives.

In 2025, Intermap announced multi‑year contract wins and renewals with government and commercial customers, progressed aviation‑charting programs, and emphasized subscriptions/recurring revenue in quarterly communications. The company also advanced large opportunity pursuits in defense and telecom planning.

Intouch Insight Ltd. (TSXV:INX)

Intouch Insight delivers customer experience management solutions, including mystery shopping, auditing, and a SaaS platform for surveys, CX analytics, and compliance. It serves multi‑location enterprises across retail, hospitality, and services.

In 2025, Intouch Insight has highlighted ARR growth, new multi‑year enterprise wins, and expanded upsells to existing customers through additional modules. The company states it is balancing investment in product roadmap and AI features with operating profitability goals.

Ispire Technology Inc. (NASDAQCM:ISPR)

Ispire designs, manufactures, and distributes branded cannabis vaping hardware and related technologies, with a growing international footprint and white‑label partnerships. The company focuses on quality, reliability, and compliance in regulated markets.

In 2025, Ispire expanded distribution in new U.S. states and international markets, deepened OEM/customer partnerships, and introduced next‑generation devices aimed at performance and safety. Quarterly updates have emphasized gross‑margin improvement initiatives and capacity planning to support demand.

Kidoz Inc. (OTCQB:KDOZ.F)

KIDOZ operates a global contextual mobile advertising network and kid‑safe content platform used by brands and app publishers to reach family and youth audiences. Its technology delivers COPPA/GDPR‑K compliant ads across apps and connected platforms.

In 2025, KIDOZ has reported seasonal strength, added new blue‑chip advertisers, and expanded programmatic integrations to improve fill and yield. The company states it has continued investment in AI‑driven targeting and measurement while maintaining cost controls and positive cash generation in peak quarters.

kneat.com, inc. (TSX:KSI)

kneat.com provides digital validation software for regulated industries such as pharmaceuticals and medical devices, replacing paper‑based validation with configurable e‑workflows, audit trails, and analytics. The platform supports computer system, process, cleaning, and equipment validation at global scale.

In 2025, Kneat sustained high ARR growth, added marquee enterprise customers, and expanded deployments within existing accounts, driving net revenue retention. Management reported improving gross margins, a strong sales pipeline, and continued investments in product, security, and compliance certifications.

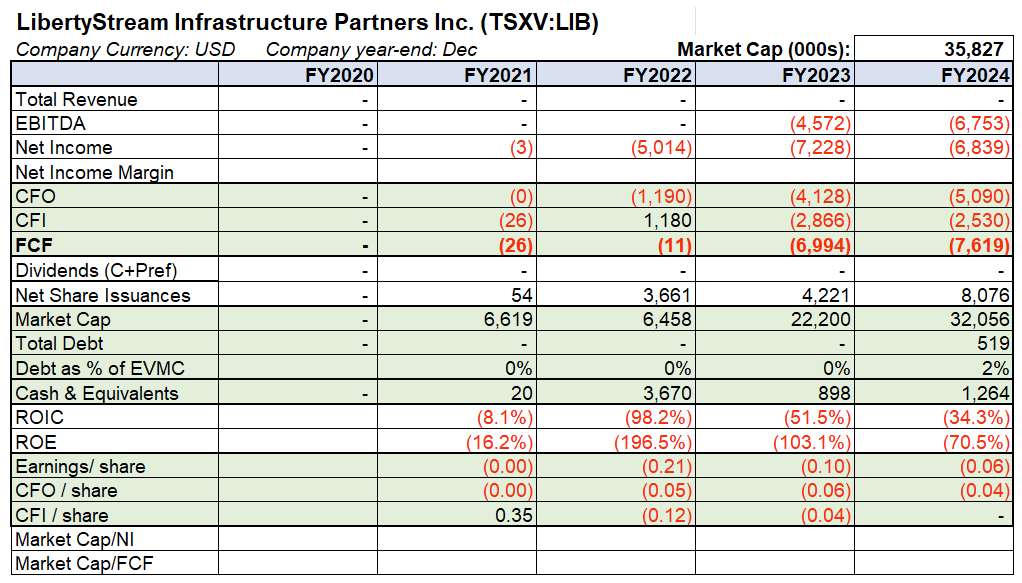

LibertyStream Infrastructure Partners Inc. (TSXV:LIB)

LibertyStream invests in and develops energy and infrastructure assets under a returns‑focused model, targeting long‑lived, cash‑generating projects across North America. The platform combines operating expertise with capital markets capabilities.

In 2025, LibertyStream advanced its initial portfolio construction, announced project acquisitions/partnerships, and established credit facilities to support transactions. The company provided first‑year guidance tied to project cash yields and targeted distributions as assets ramp.

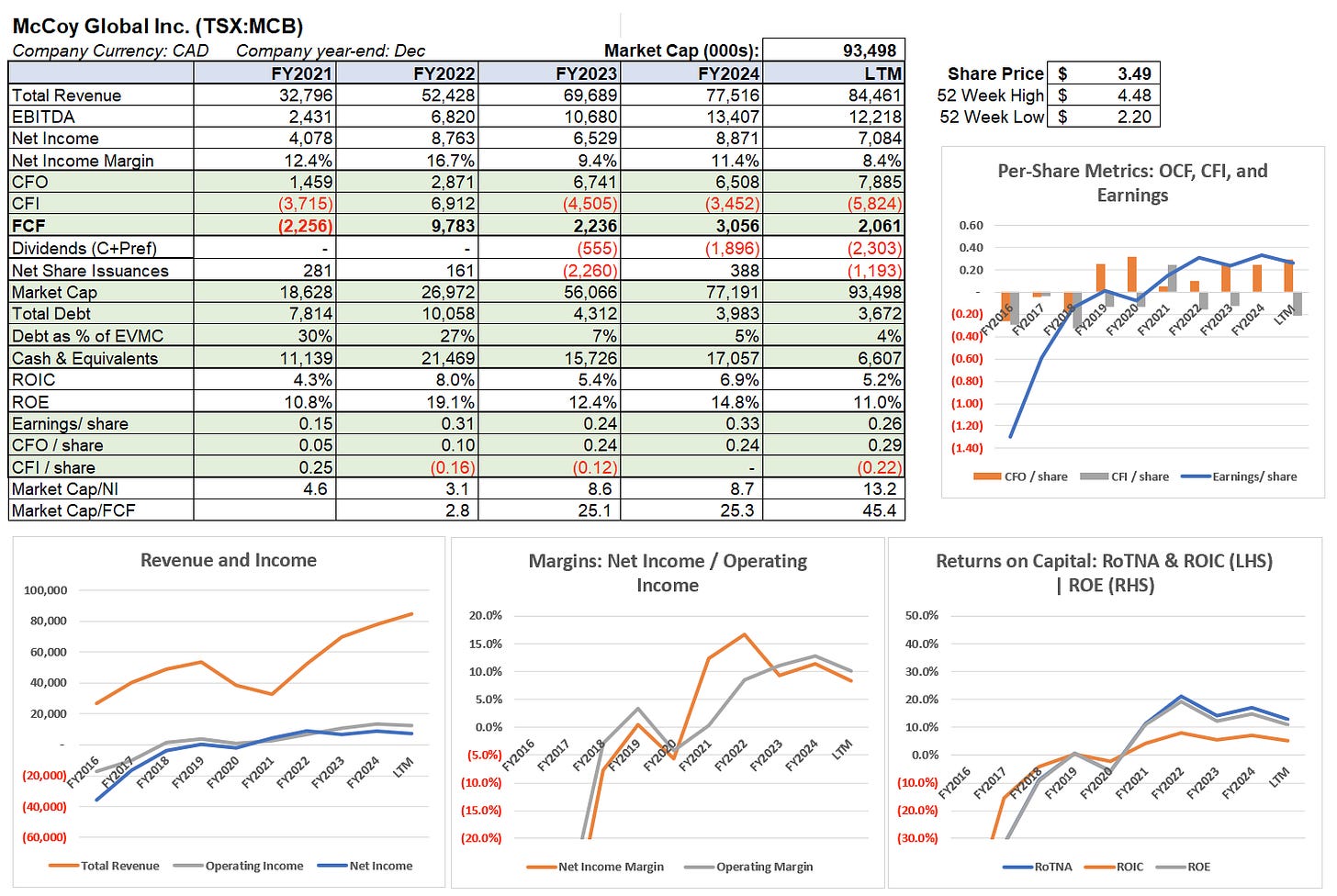

McCoy Global Inc. (TSX:MCB)

McCoy Global supplies torque/tong systems, data analytics, and automation solutions for tubular running services in the energy industry, with a growing smartProduct line that enhances safety and accuracy at the wellsite.

In 2025, McCoy reported double‑digit revenue growth with strong smartProduct adoption, improved gross margins, and solid cash generation. The company maintained dividends, invested in product development, and expanded international sales channels to support backlog conversion.

Medexus Pharmaceuticals Inc. (TSX:MDP)

Medexus is a specialty pharma company commercializing rare‑disease and specialty medicines in North America, spanning hematology, oncology, rheumatology, and pediatrics. It leverages focused sales teams and in‑licensing to build its portfolio.

In 2025, Medexus has delivered record quarterly revenue and EBITDA from its core franchises, advanced label and lifecycle initiatives, and refinanced debt on improved terms. The company also reported supply stabilization and pursued business development to add near‑term accretive assets.

Medicenna Therapeutics Corp. (TSX:MDNA)

Medicenna is a clinical‑stage immunotherapy company developing engineered cytokines (Superkines) and immuno‑oncology candidates targeting solid tumors. Its pipeline includes programs designed to enhance anti‑tumor immunity while minimizing toxicity.

In 2025, Medicenna reported clinical progress across lead assets with updated data readouts at oncology conferences, initiated/expanded studies in combination settings, and strengthened its balance sheet through equity financing and non‑dilutive grants. The company continued partnering discussions to support late‑stage development.

NamSys Inc. (TSXV:CTZ)

NamSys provides cloud software for currency management, including smart-safe, cash‑in‑transit, and vault automation systems used by banks, retailers, and cash logistics providers. Its SaaS solutions improve visibility, reconciliation, and route optimization.

In 2025, NamSys has grown ARR via new wins in North America and international markets, released product enhancements for analytics and APIs, and maintained profitability and cash generation.

NeuPath Health Inc. (TSXV:NPTH)

NeuPath operates a network of clinics focused on chronic pain, concussion, and musculoskeletal care, offering interdisciplinary treatment and employer/insurer services. The company combines clinical services with diagnostics and rehabilitation programs.

In 2025, NeuPath appointed new senior leadership to accelerate execution, secured expanded credit facilities, and reported year‑over‑year revenue and EBITDA growth with improved clinic utilization. Management has highlighted pipeline acquisitions/clinic expansions and continued operational efficiency initiatives.

New Horizon Aircraft Ltd. (NASDAQCM:HOVR)

New Horizon Aircraft (Horizons) is an advanced air mobility company developing hybrid‑electric vertical takeoff and landing (eVTOL) aircraft aimed at regional transport and logistics. The design targets lower operating costs and extended range versus battery‑only eVTOLs.

In 2025, the company has advanced subscale and component testing, progressed certification engagement with regulators, and announced strategic partnerships for propulsion and avionics.

NewLake Capital Partners, Inc. (OTCQX:NLCP)

NewLake Capital is a cannabis real estate investment trust that acquires, owns, and manages industrial properties leased to state‑licensed operators under long‑term, triple‑net leases. The portfolio generates predictable rental income with embedded escalators.

In 2025, NewLake has maintained high occupancy and collected contractual rent, executed selective sale‑leasebacks and tenant improvements, and repurchased shares under its buyback authorization. The REIT has emphasized conservative leverage and dividend coverage in its quarterly communications.

NexLiving Communities Inc. (TSXV:NXLV)

NexLiving acquires and operates multi‑family residential properties in secondary markets, focusing on modern, affordable rentals with high occupancy and low turnover. The strategy pairs disciplined acquisitions with active asset management and a sustainable dividend.

In 2025, NexLiving has delivered strong FFO growth, expanded its portfolio with additional units, and continued share repurchases under its NCIB. The company has noted improved operating efficiency, stabilized occupancy above 97%, and modest rent growth through suite upgrades.

Nova Leap Health Corp. (TSXV:NLH)

Nova Leap provides home health care services across the U.S. and Canada, focusing on personal care, skilled nursing, and dementia care. Growth is driven by acquisitions and organic initiatives within fragmented local markets.

In 2025, Nova Leap has completed additional tuck‑in acquisitions in select states, reported sequential revenue growth and improved EBITDA margins.

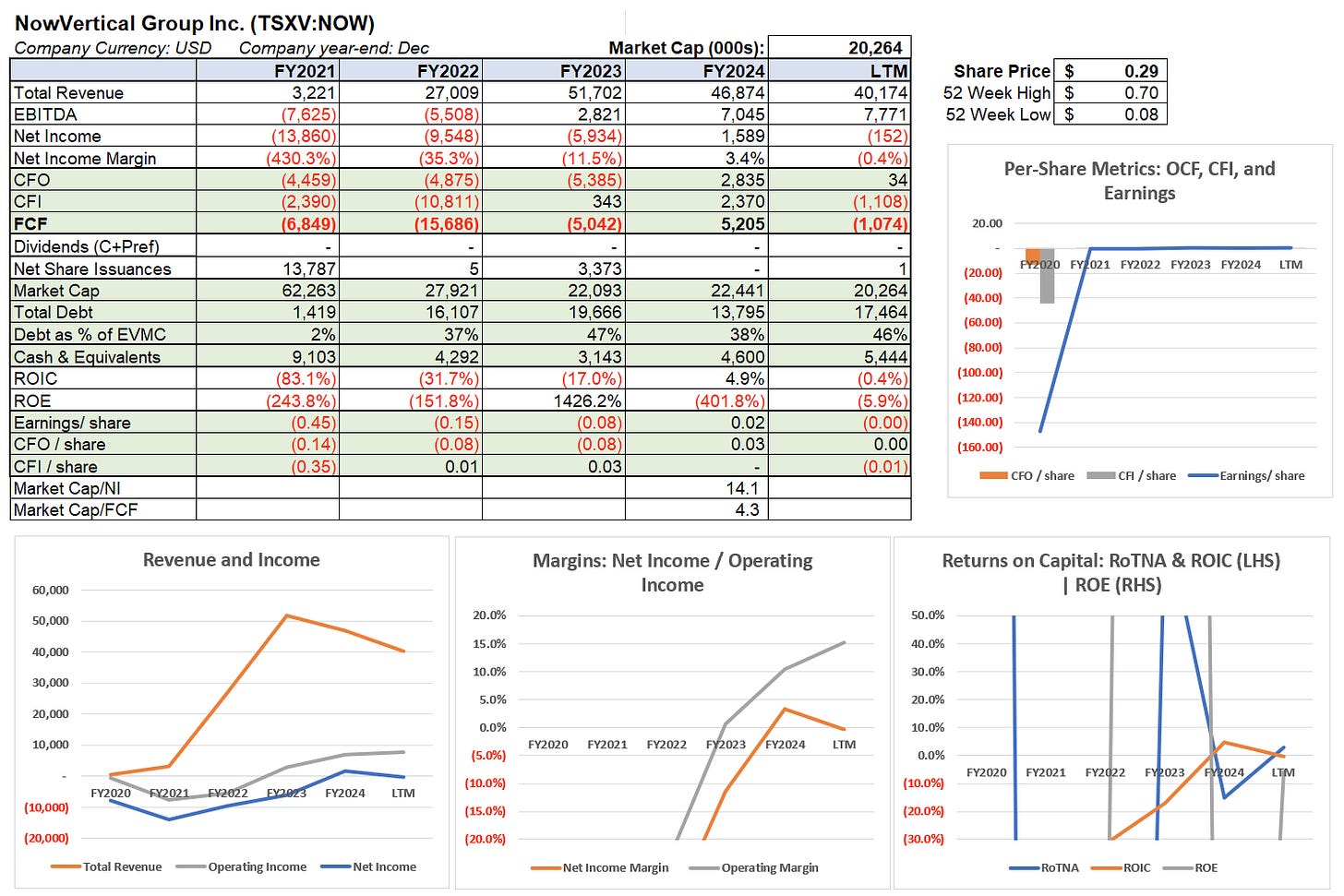

NowVertical Group Inc. (TSXV:NOW)

NowVertical delivers data analytics and software solutions for enterprise and government clients, offering vertical‑specific applications and services across security, marketing, and operations. The company blends SaaS products with consulting to drive outcomes.

In 2025, NowVertical has stated it continues to streamline its portfolio, exiting non‑core operations, and focused on higher‑margin contracts, which contributed to improved adjusted EBITDA.

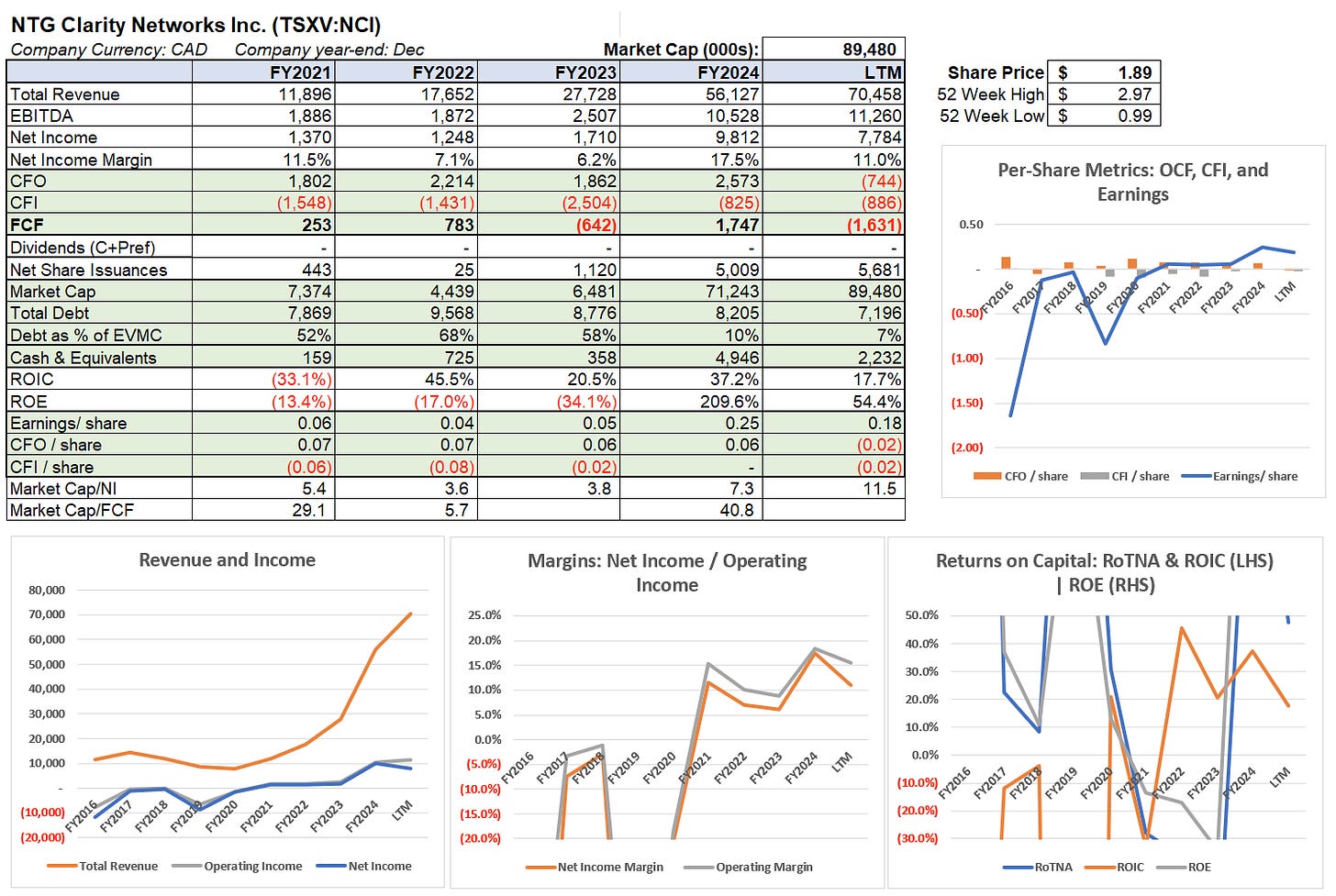

NTG Clarity Networks Inc. (TSXV:NCI)

NTG Clarity provides digital transformation, software development, and network engineering services to telecom, financial services, and public‑sector clients, leveraging blended onshore/offshore delivery and its NTGapps platform.

In 2025, NTG has reported record quarterly revenue, announced sizable new purchase orders and contract extensions in the Middle East, and raised growth capital under a LIFE financing to scale delivery. Management has increased hiring to meet demand.

NXT Energy Solutions Inc. (OTCQB:NSFD.F)

NXT Energy offers SFD® (Stress Field Detection) airborne geophysical surveys that help energy companies identify potential subsurface traps for hydrocarbons and geothermal resources. The proprietary method aims to reduce exploration risk and costs.

In 2025, NXT announced new survey contracts and progressed repeat work with prior customers, while pursuing geothermal and carbon‑storage applications. The company stated it has implemented cost controls and sought strategic partnerships to expand commercialization globally.

Omni-Lite Industries Canada Inc. (TSXV:OML)

Omni‑Lite designs and manufactures precision, cold‑formed metal components and assemblies for aerospace, defense, and industrial customers, emphasizing lightweight, high‑strength parts. It operates advanced forming and machining capabilities in North America.

In 2025, Omni‑Lite has booked new aerospace and defense awards, invested in capacity and automation to support backlog, and delivered margin improvement initiatives in quarterly updates. The company continued its shift toward higher‑value programs and long‑term agreements.

Peraso Inc. (NASDAQCM:PRSO)

Peraso is a fabless semiconductor company specializing in mmWave (60/28 GHz) wireless chipsets and modules used in fixed wireless access, consumer electronics, and industrial applications. Its technology enables multi‑gigabit connectivity at low latency.

In 2025, Peraso has introduced new reference designs and customer platforms, secured design‑in wins for FWA and consumer peripherals, and prioritized gross‑margin improvement through portfolio focus.

Perimeter Medical Imaging AI, Inc. (TSXV:PINK)

Perimeter Medical develops optical coherence tomography (OCT) imaging tools with AI decision support for real‑time margin assessment during breast‑conserving surgery. The platform aims to reduce re‑operation rates and improve patient outcomes.

In 2025, Perimeter has advanced its pivotal clinical study, expanded clinical sites, and reported interim adoption feedback from early users. The company stated it has strengthened its balance sheet through equity/grant funding and progressed reimbursement and commercialization groundwork in the U.S.

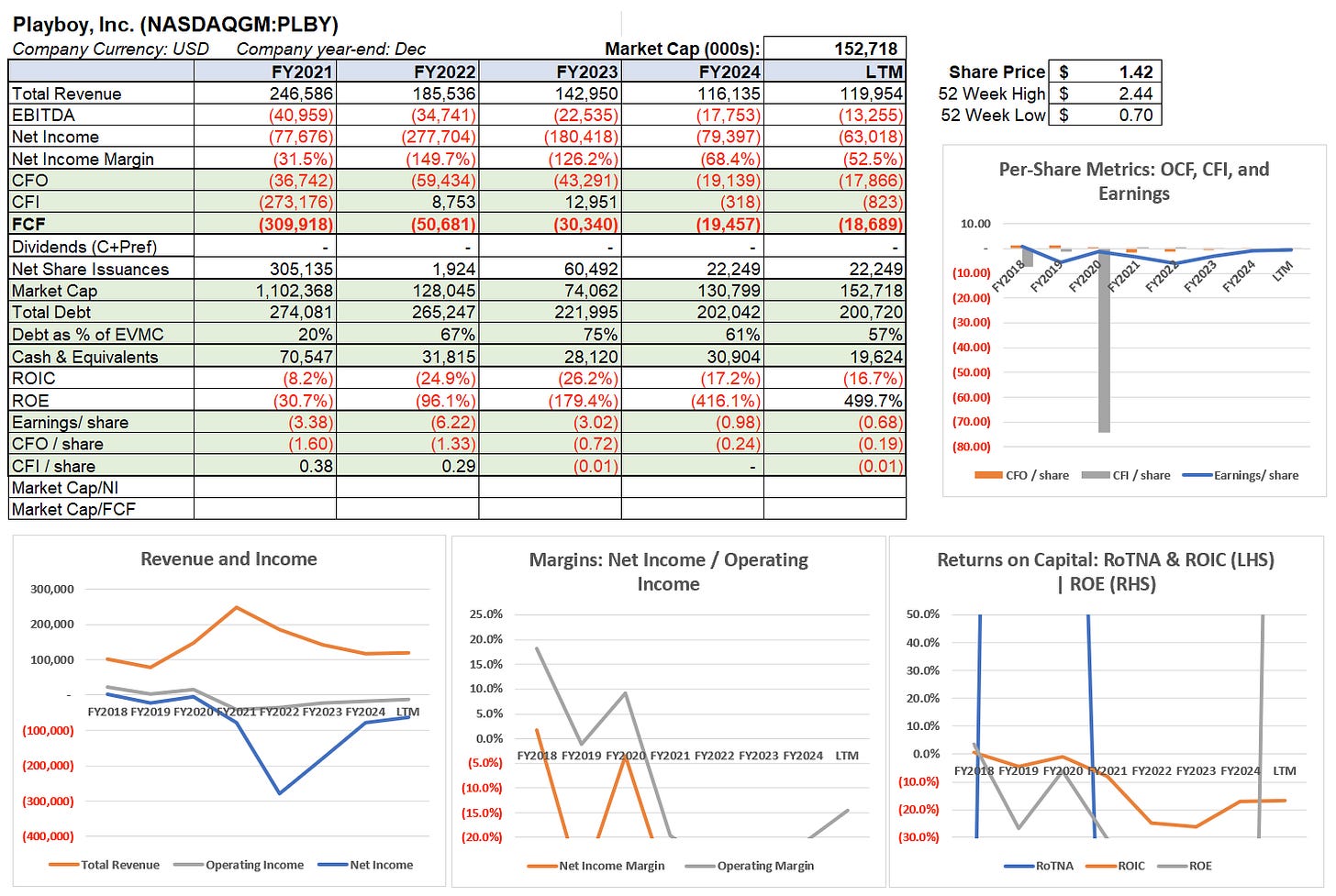

Playboy, Inc. (NASDAQGM:PLBY)

Playboy is a lifestyle and entertainment brand that monetizes IP across digital, creator platforms, and consumer products, including licensing, e‑commerce, and collaborations. The company is repositioning toward asset‑light, brand‑led growth.

In 2025, Playboy has continued its restructuring to streamline operations, executed licensing partnerships, and prioritized digital subscriptions and creator monetization. Management is focused on debt reduction efforts and asset sales designed to simplify the capital structure.

Progressive Planet Solutions Inc. (TSXV:PLAN)

Progressive Planet develops low‑carbon mineral products for cement, agriculture, and environmental applications, leveraging pozzolans, zeolites, and glass‑based technologies to reduce CO₂ intensity and enhance performance.

In 2025, the company secured non‑dilutive funding for a PozGlass™ pilot, advanced pilot‑plant procurement, and expanded its raw‑material position. It introduced new product lines including lightweight litter and progressed commercialization partnerships while granting equity incentives tied to execution milestones.

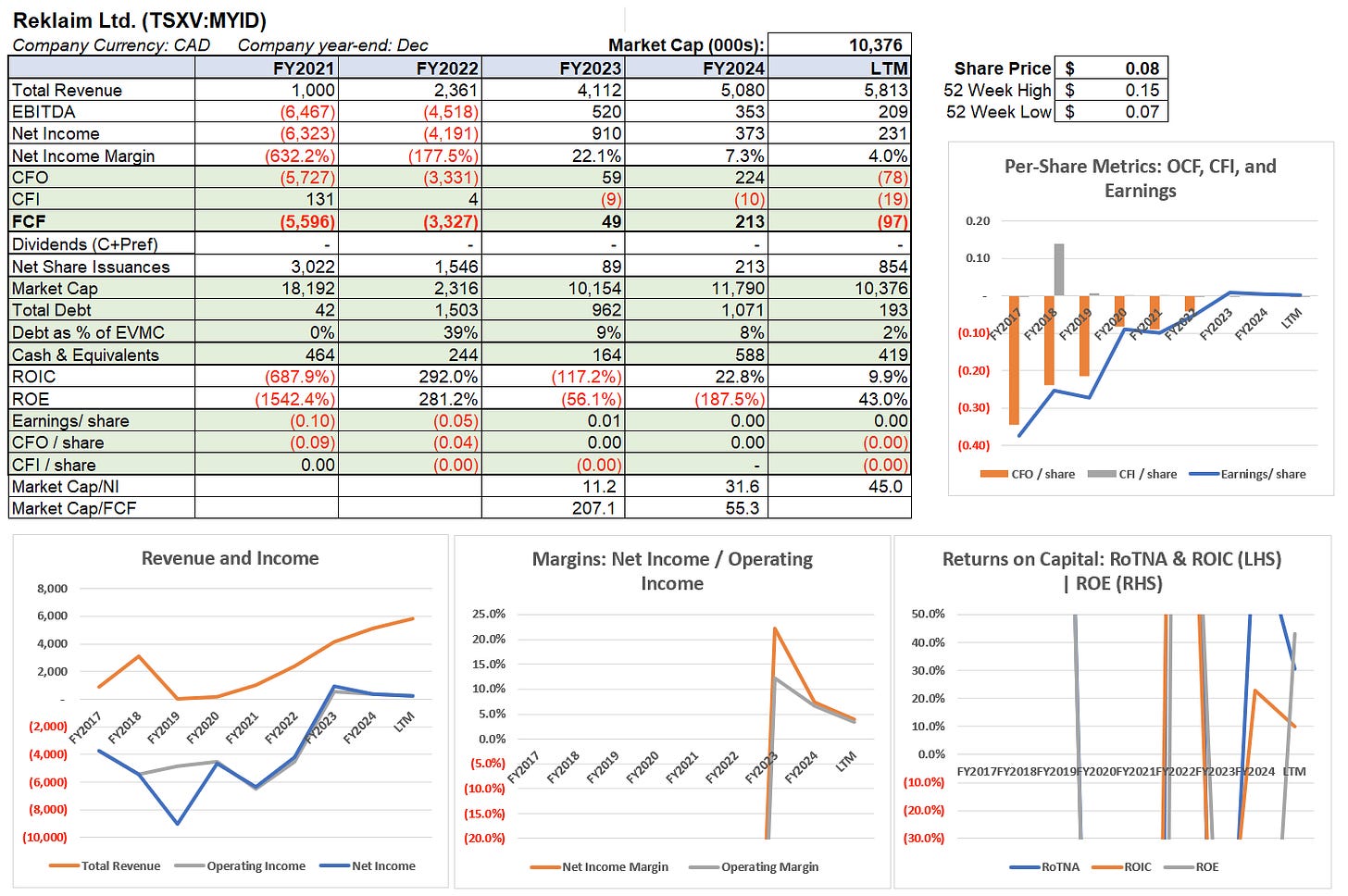

Reklaim Ltd. (TSXV:MYID)

Reklaim operates a privacy‑centric data platform that enables consumers to control and monetize their data while providing compliant audience segments and solutions to advertisers. The company also offers a subscription consumer privacy service.

In 2025, Reklaim has reported record quarterly revenue growth driven by platform sales, launched Reklaim Protect as a recurring subscription, and reduced debt through debenture repayments. It introduced a consumer ownership program to deepen engagement and broaden distribution channels.

ReVolve Renewable Power Corp. (TSXV:REVV)

ReVolve develops, owns, and operates renewable energy assets across wind, solar, battery storage, and run‑of‑river hydro, with a hybrid model of selling development projects and building an operating portfolio.

In 2025, ReVolve has increased quarterly revenue and turned profitable as operating assets scaled, raised equity under a LIFE financing to fund growth, and signed agreements to acquire additional operating capacity.

Royalty Pharma plc (NASDAQGS:RPRX)

Royalty Pharma acquires biopharmaceutical royalties and funds innovation by providing capital to R&D organizations in exchange for royalty interests on blockbuster therapies. Its diversified portfolio spans multiple therapeutic areas and stages.

In 2025, Royalty Pharma has deployed capital into new royalty transactions, refinanced portions of its debt at attractive rates, and reaffirmed guidance with growth driven by key marketed assets. The company has continued to return capital via dividends and buybacks while maintaining a pipeline of potential deals.

Rubicon Organics Inc. (TSXV:ROMJ)

Rubicon Organics is a Canadian producer of premium, organic‑certified cannabis, offering flower, pre‑rolls, and oils across provincial markets. The company focuses on quality, brand building, and operational efficiency.

In 2025, Rubicon has reported year‑over‑year revenue growth, closed a financing to support its recently acquired second facility and to scale premium production.

Rumbu Holdings Ltd. (TSXV:RMB)

Rumbu Holdings is building a network of funeral homes, crematoriums, and aquamation services across Western Canada through acquisitions and operational improvements. The platform partners with local operators to ensure continuity and community presence.

In 2025, Rumbu has continued M&A activity to add locations, and reported improving run‑rate revenues and integration progress. Shares reached new highs as the company advanced its pipeline and standardized operations across the portfolio.

Sabio Holdings Inc. (TSXV:SBIO)

Sabio provides connected TV (CTV) and mobile advertising solutions, combining a DSP, analytics, and proprietary audience data to help brands reach diverse consumers across screens.

In 2025, Sabio has expanded CTV client wins, improved gross margins through supply path optimization, and rolled out AI tools for creative and measurement. They state they are focused on operating profitability and cash generation while investing in sales coverage.

Sangoma Technologies Corporation (TSX:STC)

Sangoma delivers unified communications and contact center solutions across cloud and on‑premises deployments, complemented by hardware, software, and managed services for SMBs and mid‑market enterprises.

In 2025, Sangoma has reported sequential revenue growth in core platforms, generated strong free cash flow enabling debt reduction, and maintained adjusted EBITDA margins near target levels. The company states they have de‑emphasized lower‑margin third‑party resales in favor of higher‑value offerings.

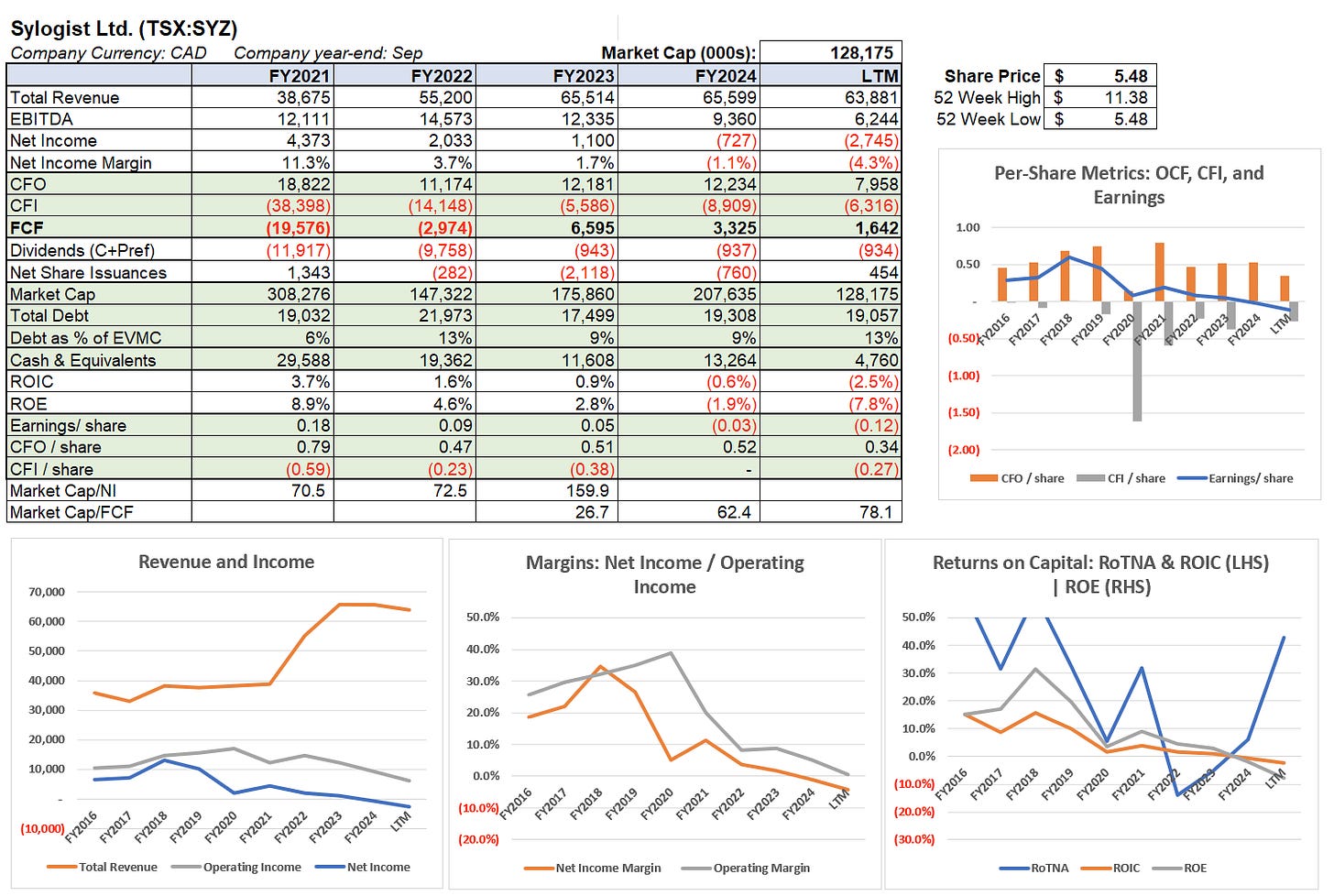

Sylogist Ltd. (TSX:SYZ)

Sylogist provides mission‑critical ERP and CRM software solutions to public‑sector and non‑profit organizations, delivered primarily as SaaS with long‑term recurring revenue.

In 2025, Sylogist has delivered ARR growth with improved profitability, completed tuck‑in acquisitions to expand its vertical suite, and initiated a refinancing that lowered interest expense. The company states it has continued product modernization and cross‑sell within its installed base.

Tantalus Systems Holding Inc. (TSX:GRID)

Tantalus delivers smart grid solutions—including AMI, grid sensors, and utility data platforms—that help public power utilities improve reliability, efficiency, and DER integration.

In 2025, Tantalus has expanded deployments with municipal and cooperative utilities, grown software and analytics revenue, and introduced new grid edge devices to support EV and solar adoption. The company has reported backlog growth and improving gross margins.

Thermal Energy International Inc. (TSXV:TMG)

Thermal Energy provides industrial energy‑efficiency and emissions‑reduction solutions including heat recovery systems and GEM™ steam traps, delivering turnkey projects to global manufacturers.

In 2025, the company has secured new multi‑site contracts across food & beverage and industrial customers, increased order intake and backlog, and highlighted margin expansion on recent installations.

Tigo Energy, Inc. (NASDAQCM:TYGO)

Tigo provides solar module‑level power electronics, monitoring, and safety solutions, including TS4 optimizers and rapid shutdown devices for residential and commercial PV systems.

In 2025, Tigo has introduced product updates to enhance reliability, expanded distribution in key regions, and emphasized cost reduction and cash discipline in quarterly results.

TRX Gold Corporation (TSX:TRX)

TRX Gold is a gold producer advancing and expanding the Buckreef Gold Project in Tanzania, combining open‑pit production with ongoing resource development to scale output and mine life.

In 2025, TRX has increased plant throughput and gold production, progressed drilling to expand resources, and advanced studies for further expansion phases.

Turnium Technology Group Inc. (TSXV:TTGI)

Turnium offers software‑defined wide area networking (SD‑WAN) solutions delivered through a channel‑first model to service providers and enterprises, enabling resilient, optimized connectivity.

In 2025, Turnium has signed new service‑provider partnerships, expanded ARR from existing channels, and launched feature upgrades focused on security and cloud access.

Upexi, Inc. (NASDAQCM:UPXI)

Upexi operates a portfolio of consumer brands across wellness, pet, and household categories, leveraging Amazon/e‑commerce channels, in‑house marketing, and data analytics to scale sales.

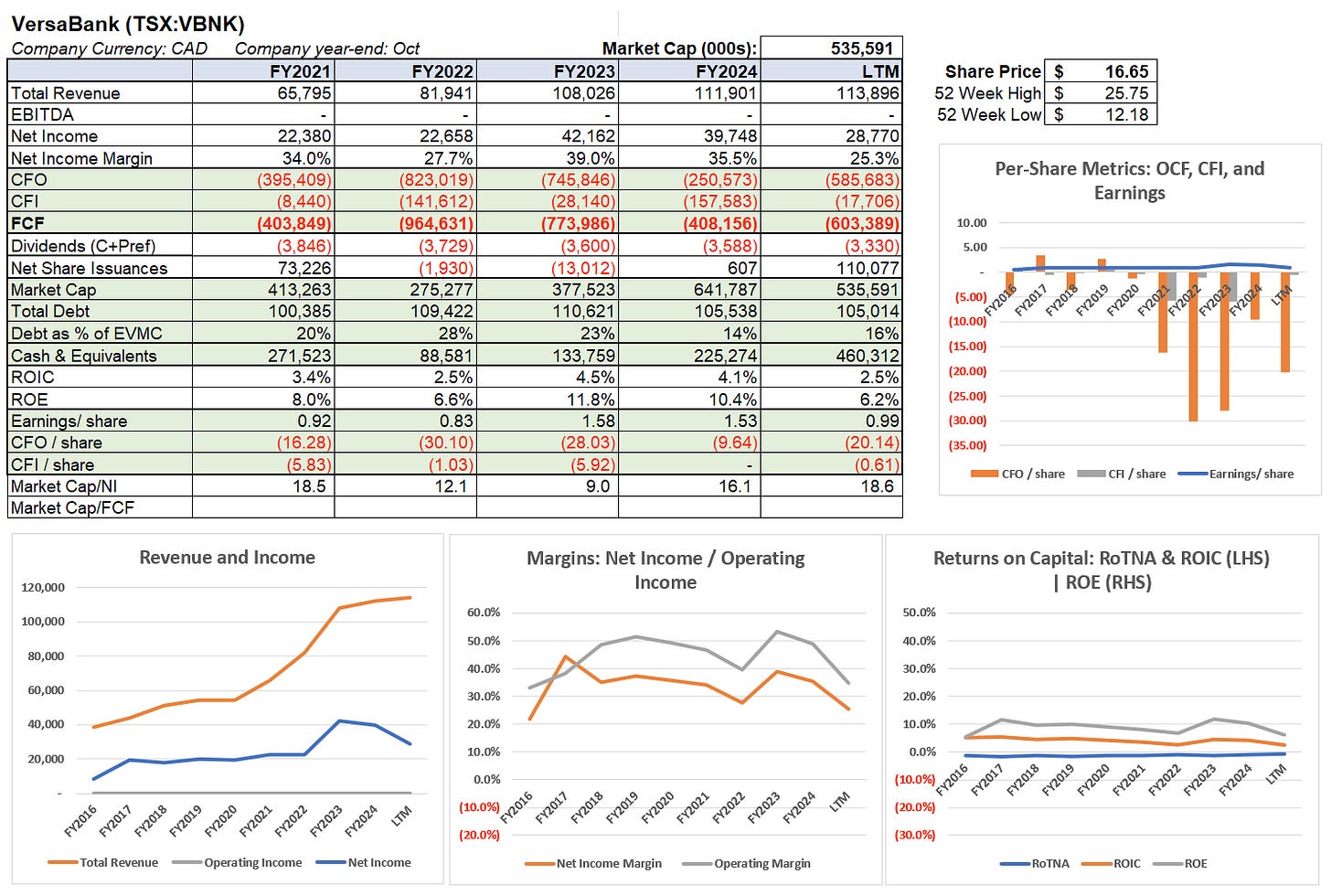

VersaBank (TSX:VBNK)

VersaBank is a digital‑only Canadian Schedule I bank offering specialized commercial lending, structured finance, and deposit solutions, as well as cybersecure digital vault technology through DRT Cyber.

In 2025, VersaBank has expanded its point‑of‑sale financing and BaaS partnerships, and improved NIM while maintaining strong capital ratios.

VerticalScope Holdings Inc. (TSX:FORA)

VerticalScope owns and operates a portfolio of enthusiast community websites and marketplaces across automotive, powersports, and hobbyist verticals, monetized through advertising, subscriptions, and commerce.

In 2025, VerticalScope has continued to advance its forum modernization and AI tooling, stabilized traffic trends, and expanded commerce integrations. The company delevered through free cash flow and asset optimization.

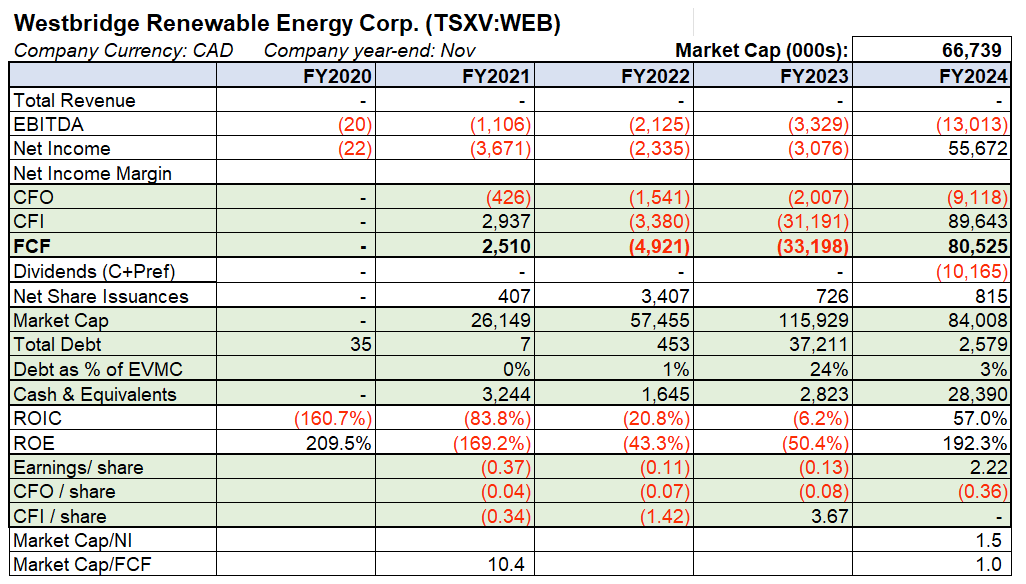

Westbridge Renewable Energy Corp. (TSXV:WEB)

Westbridge originates, develops, and monetizes utility‑scale solar PV, battery storage, and greenfield renewable projects across North America and Europe. The model emphasizes capital‑light development with asset sales at NTP/RTB stages.

In 2025, Westbridge has advanced multiple projects toward interconnection and permitting milestones, executed project sales/JV options, and expanded its pipeline in key provinces and U.S. states.

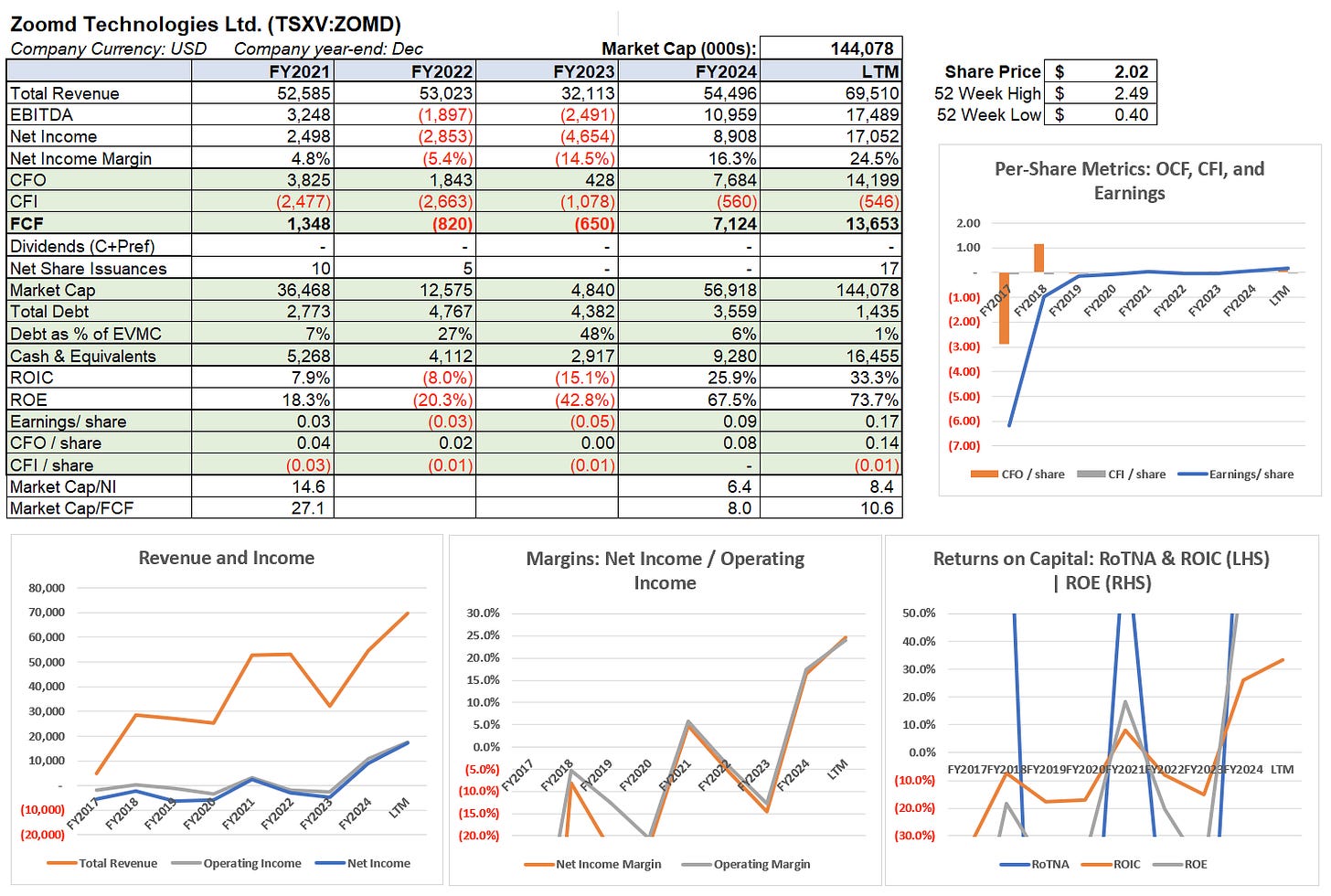

Zoomd Technologies Ltd. (TSXV:ZOMD)

Zoomd provides user‑acquisition and performance marketing technology for mobile apps and advertisers, offering a unified platform across media sources with AI optimization.

In 2025, Zoomd has won new enterprise contracts, launched automation features to improve ROAS, and reported improved profitability from cost reductions and mix shift to SaaS.

ZTEST Electronics Inc. (OTCPK:ZTST.F)

ZTEST Electronics focuses on testing and quality‑assurance technologies serving electronics and industrial customers, with solutions that automate complex diagnostic workflows.

In 2025, ZTEST announced a share repurchase program and upgraded its U.S. listing tier to enhance visibility and liquidity.

Downloadable Version