Cloning Investments: 13F news and dangers

And our portfolio today

Here is the latest from Canadian Value Investors!

Portfolio Today

Cloning Investments: 13F news

The dangers of 13F filings: John Hempton NVDI / Nano-X

Clarke Inc. (TSX:CKI) – We’re off the ferry

Portfolio Today

Some readers were asking for an update of what we own today and here it is. We note we just exited CKI for a nice return without a buyout needing to happen (see last article). There might be some more room to run but we will leave that for others.

Cloning Investments: 13F news

We view 13F filings as a great source of investing ideas. The concept of cloning investments is simple. You select stocks that have been purchased by investors that have extremely good long-term track records. We have come to strongly support this concept and the reason is simple:

“When you only basically buy ideas that other great investors have already bought after studying them, the error rate you will have will be a small fraction of what you would have if you went out on the prairie on your own. If you go out on your own and look at 10,000 stocks and pick ten – trust me – your error rate will be off the charts. But if you pick ten out of the 40 that great investors have bought and you have looked into why they bought them, it’s like bowling with bumpers…Never bowl without bumpers when they offer you bowling with bumpers. ” — Mohnish Pabrai, Ben Graham Value Investing Talk 2012

To properly copy, we think you need to buy ideas that:

1) Are from a fund manager with a long history of success – 15-20+ years is ideal.

2) Represent high conviction by the fund manager – Realistically a meaningful hold – 20+% ideally, but 10% might be sufficient to qualify depending on their portfolio strategy.

3) Can be bought at a price similar to what they bought it at.

4) The idea is within you circle of competence – Focus on ideas you can understand and spend as much time as you can learning to increase your circle of competence.

Most funds fail our tests, but we are looking for easy high conviction ideas. There are no points for difficulty in investing. You can see our full background including what 13Fs are here - https://www.canadianvalueinvestors.com/cloning-investments-101

Q4 2023 Findings

13Fs are typically filed on the deadline being 45 days after the quarter, so 13F day was February 15th. We did not find anything actionable unfortunately, but we did find a few things that we thought were worth writing about.

#1 Berkshire Hathaway continues to demonstrate concentrated investing, despite its size –Apple is now almost 50% of the stock portfolio and the top five positions make up 80% of value. Berkshire tweaked some holdings (noting that small holdings are likely Ted Weschler or Todd Coombs) and we are holding hands with them on Liberty (disclosed above; long LSXMA).

Another example continues to be Li Lu at Himalaya (the only person outside of Buffett who managed money for Charlie Munger). Note that 13F disclosures only capture U.S. listed stocks.

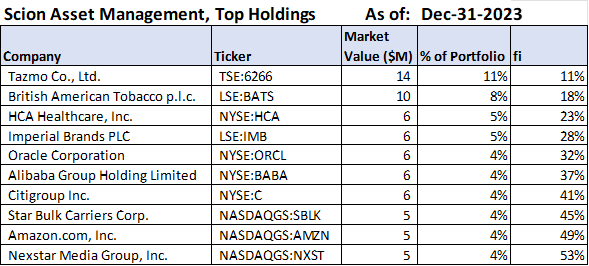

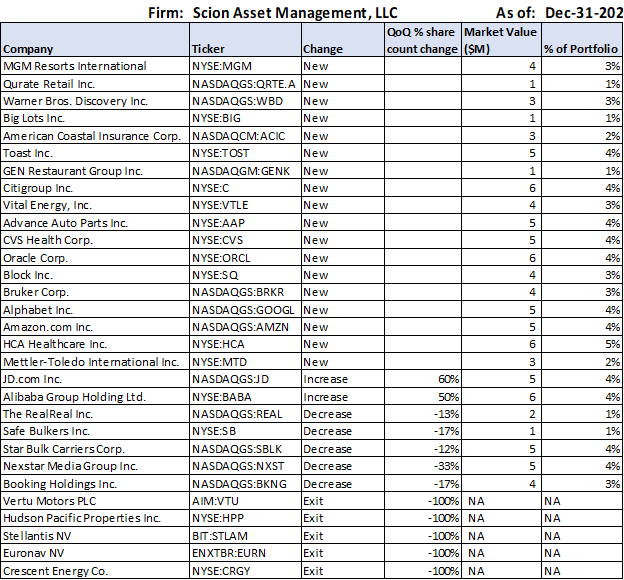

And Michael Burry of Big Short fame via his firm Scion is always a fun look. He can definitely be described as… active. He has many smaller trades in and out, but does have some material counter-consensus investments like BAT and Alibaba currently.

Fishing your own book of holdings and ideas - We wrote about Strattec last year - Strattec Security Corp NASDAQ:STRT – Hidden value of their JV unlocked.. now what? (Disclosure: Currently no position but are evaluating) https://canadianvalueinvestors.substack.com/p/security-corp-nasdaq-strt-hidden

GAMECO is doing a Board push there, but using their filings to find other ideas just gives you noise. They have over 1,800 holdings and things like Strattec just get lost. However, another strategy we use is to look into the funds that own shares in ideas that we like and then see what else the own.

An example of this is Gate City Capital Management and their holding in Strattec, which is meaningful in their relatively concentrated book. Here is an interview with their founder Michael Melby.

The dangers of 13F filings: John Hempton NVDI / Nano-X

There are a lot of potential dangers when copying 13F filings (somewhat mitigated by our checklist). One of the most hilarious situations we have read about the market misreading the tealeaves is this article by John Hempton.

Nvidia - the dominant maker of graphics and artificial intelligence chips - has a holding in Arm Holdings - the owner of patents around reduced instruction set chips used in mobile phones. Arm stock has risen 100 percent in the past six months. I make no comment about the valuation of Arm or Nvidia - both of which are wonderful companies.

One consequence of Arm’s rise is that the value of the stake held by Nvidia tripped over $100m. This means that Nvidia - like an institutional investor - has to file a 13F which details all their holdings. There are not many - a grand total of five shares have been held.

One of those shares is Nano-X imaging and Nvidia holds a grand total of $380 thousand dollars worth. The market is presuming that Nvidia consciously purchased that (trivial) stake and thus Nano-X is worthy of attention from the giant Nvidia. Nano-X stock is up 50 percent today to a market cap of $550 million. This seems an extreme move - hundreds of millions in additional market cap for a trivial purchase.

But it is even more extreme when you work out where and why Nvidia obtained the Nano-X position.

Clarke Inc. TSX:CKI – We’re off the ferry

Disclosure: We are no longer long the stock

Clarke Inc. TSX: CKI is a neat collection of businesses and assets (including a ferry mini-monopoly carried on the books at next to nothing). We wrote in the summer of 2023 (“Sailing on the go-private ferry”) that it is also probably being taken private shortly and also had a secondary special situation trade at the time. What’s the deal?

It was trading at below its stated book value (which seemed reasonable and likely had suppressed value).

They are several years into a business simplification. They have sold off/dividended-out various public holdings (TerraVest and Trican; both interesting investments) and are now focusing on their three business units.

They have been consistently repurchasing shares for the last three years (15% cumulatively) and just renewed their NCIB. Now that they have cleared up the convertible debentures (see next), it is likely that they are going to be taken private soon.

We first looked at Clarke back in 2021. At the time their operations were messier and the majority of their business at the time (hotels and a ferry) were severely impacted by COVID.

They key 75% shareholder, G2S2 (run by Clarke’s Chairman) just put in the funds to repurchase the debentures. This is his party – “On June 30, 2020, Michael Rapps, former President and Chief Executive Officer of the Company, resigned and George Armoyan, Clarke’s Chairman, was appointed President and Chief Executive Officer.”

The only other large shareholder is 13% owner Letko Brosseau & Associates Inc. This might provide some comfort for small shareholders getting a fair deal (unless they also continue holding with G2S2 in a go-private transaction).