Velan Inc. TSX:VLN Update – Just send the cheque Flowserve

A failed merger might bring the bidder back

Disclosure: We remain long.

We have been writing about the Velan Inc. saga since March, most recently in “All polished up and ready for sale part 2: The RemainCo Statement”. https://www.canadianvalueinvestors.com/p/velan-inc-tsxvln-all-polished-up

To summarize our thesis, they are our favourite valve company making valves since 1950. They are performing well, have a spotless balance sheet, and they no longer want to be a public company. Their business is an investment banker’s dream pitch deck; niche products being used for 90% of the refineries in North America, in Canadian and American nuclear reactors, LNG terminals, and even the U.S. navy among other customers. They are sitting on net cash after offloading their troublesome asbestos liability as well as selling their French division to a French-approved bidder (who blocked the acquisition of Velan by Flowserve last time).

How could you not make an offer? Well now Flowserve, the most likely buyer, received a small windfall of cash after their own failed merger, roughly equalling the EV of Velan. We hope they do not miss out on Velan while they “take a moment to breathe”.

Flowserve’s failed 2023 bid

Chart Industries: Flowserve left at the altar

Flowserve’s post-deal feelings

Meanwhile at Velan Inc.

Full archive - https://www.canadianvalueinvestors.com/t/vln

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious bias and conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. In addition, no one guarantees the accuracy of any information provided and none of the information should be construed as investment advice or any other kind of advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose, except for entertainment (and we hope you enjoy).

Flowserve’s failed 2023 bid

With Velan Inc. all cleaned up and free of France we had hoped that Flowserve would come back and make another bid after their last one was blocked by the French government. Back in 2023:

Flowserve intends to [Editor: and subsequently did] terminate the Arrangement Agreement as Regulatory Approval from France will not be obtained

MONTREAL, Oct. 05, 2023 (GLOBE NEWSWIRE) -- Velan Inc. (“Velan”) (TSX: VLN) today announces, in connection with the arrangement agreement made as of February 9, 2023, among Velan, 14714750 Canada Inc. (“Purchaser”) and Flowserve US Inc. (“Parent” and, together with Purchaser, “Flowserve”), as amended by the first amendment to the arrangement agreement dated March 27, 2023 (the “Arrangement Agreement”), that it has been informed by Flowserve of its intent to, following the occurrence of the Outside Date on October 7, 2023, and in accordance with the terms of the Arrangement Agreement, send a notice to Velan to terminate the Arrangement Agreement, considering that the Regulatory Approval (as such term is defined in the Arrangement Agreement) from France has not and will not be obtained.

As previously disclosed, the conclusion of the transactions set out in the Arrangement Agreement was conditional on the Regulatory Approvals, including one from France. In order to meet that key condition, Flowserve offered a package of remedies and undertakings to the French Authorities. The French Authorities have now informed the parties that they will not provide the requisite Regulatory Approval for the sale to Flowserve regardless of such remedies or otherwise. Flowserve has consequently informed Velan of its intention to terminate the Arrangement Agreement following the Outside Date. According to the terms of the Arrangement Agreement, no termination fee will be payable by either party.Velan will resume operations as an independent business, free of the covenants and other restrictions of the Arrangement Agreement.

Note: For further background around the strategic rational for Flowserve see here - https://www.canadianvalueinvestors.com/i/159434824/appendix-why-flowserve-tried-to-buy-flowserve-comments-on-velan

Chart Industries: Flowserve left at the altar

Instead of another Velan bid, this June Flowserve entered into a definitive all‑stock “merger of equals” agreement with Chart Industries to “bring together Chart’s leading expertise in process technologies across compression, thermal, cryogenic and specialty solutions and Flowserve’s leading capabilities in flow management.” The proposed combined enterprise value was about US$19 billion.

However, in late July 2025 Baker Hughes made an offer for Chart, a $13.6 billion all‑cash bid. Chart’s board deemed it a “superior proposal”, triggering termination of its merger agreement with Flowserve.

Per the merger agreement, Flowserve received a $266 million break-up fee. Flowserve’s board decided not to submit a revised offer, citing confidence in its standalone strategy. The Baker Hughes deal aims to close mid-2026. We do not think Flowserve would wait to see if it runs into regulatory trouble, sour grapes and all.

“The termination follows the Flowserve Board of Directors’ decision not to submit a revised offer to merge with Chart, after being notified that Chart’s Board of Directors had determined that a recent unsolicited acquisition proposal from Baker Hughes (NASDAQ: BKR) constituted a “superior proposal” under the terms of the merger agreement. In accordance with the terms of the merger agreement, Flowserve will receive a $266 million termination payment.”

Flowserve’s post-deal feelings

How they talked about it in their conference call:

Great. Thank you, Brian. Good morning, everyone. Before we talk about our outstanding second quarter results, I want to provide an update on the Chart merger. As we announced yesterday, we reached an agreement to terminate the proposed merger with Chart Industries. When we were first approached by Chart about the potential merger, we took a very disciplined approach to the discussion with a focus on ensuring the strong value creation opportunities offered by Flowserve would continue in the merger. This disciplined approach guided us through our decision-making process following the subsequent all-cash offer for Chart from Baker Hughes.

Based on our assessment, further pursuing the merger would have been value diminishing to Flowserve shareholders, given the additional cash, leverage and diluted ownership required to continue the process. While we are disappointed in this outcome, we are confident that this decision was in the best interest of our shareholders and our company.

As a result, Flowserve received a $266 million termination payment in accordance with our signed agreement. Near term, we'll evaluate opportunities to deploy this capital to create value for our shareholders, including through share repurchases. Over time, we remain committed to a disciplined approach to capital allocation, including M&A.

While the outcome wasn't what we wanted, we have no regrets in our decision to pursue this opportunity or move with our decision to terminate the agreement. The Flowserve team and our board of directors were thoughtful, disciplined and focused on our stakeholders throughout this engagement, and I believe we're in a better place today than ever before to capitalize on the opportunities in front of us.

…

Question – Deane Dray: Hey, I want to go through kind of the implications of this whole Chart experience, if I can call it that. So, look, in our view, the deal made sense when it was announced. The deal termination also makes complete sense. So that chapter gets closed. But now we do know more about Flowserve's growth ambitions. So does that growth ambition get put the genie back in the bottle or are you in the hunt for another deal? I love hearing that you can focus now 100% back on the business. And you're going to spend time at FCD. That makes sense. But what about this growth ambition and how does that play out? And how can – what can you say about it today?Answer – Robert Scott Rowe: Sure. Deane, let me just start with a couple of comments that you said at the beginning, because I do think they're important. And I put this in the prepared remarks. And while we are disappointed in the outcome, we believe this business is in a really good place. We were always bought into the strategic logic and the combination, right, the flow and the thermal management. And there was something there that we thought we could do that was truly transformational in the space.

I am proud of our team and our board to remain disciplined in the early negotiations and getting to a deal, but also in our ability to exit and terminate the deal in a successful way. And obviously that results in a $266 million breakup fee that enhances our balance sheet. And we've received that money to-date. And so that's in our bank account. And we are looking to how to deploy that properly. Additionally, we were able to secure a supply agreement with Chart that really was kind of on the back of some of the revenue synergies that we were talking about with the combination. We wanted to make sure the Flowserve product got pulled through. And so we've got a multi-year supply agreement to progress that forward.

And so as we think forward, right, we're not going to shy away from M&A. And I'm going to let Amy talk about kind of how we think about that and what it looks like. But what I'd say is the other thing that we demonstrated here is that we can make progress while the corporate team looks at mergers and acquisitions. And we delivered an incredibly strong quarter despite the fact that we were in – a small group of our corporate team was involved in pulling off a transaction and starting to build a very robust integration plan. And so that gives me confidence that we can do things a little bit differently here, that we can lean in. But I'd also say we're going to do that incredibly thoughtfully, and we're going to be incredibly disciplined.

But Amy, you want to pick up on that?

Answer – Amy B. Schwetz: Yeah, so I would say, Deane, the filter which we are going to use M&A to really drive shareholder value is unchanged from before the time that we announced the acquisition. So we look for transactions that fit our strategy around diversification, decarbonization and digitization. And ideally, that comes with an attractive aftermarket component or opportunity for us to build on. We want to see attractive financials that drive accretion at both the margin and the cash flow level. And we want to maintain our healthy balance sheet and investment grade rating. And so we've proven to be pretty disciplined in this approach. And you can certainly expect that as we go forward. And I think that the – it's important – we're going to take a moment to breathe...

Answer – Robert Scott Rowe: Absolutely.

Answer – Amy B. Schwetz: ...after this, but I think that the Chart transaction demonstrates three elements of our process, and that although the majority of our opportunities going forward are going to be bolt-ons, we will look at larger transactions if the value creation is compelling. And I think that that is sort of a risk-reward proposition that we look to fully understand. We're going to be disciplined in our approach as evidenced by our desire to pursue – to not pursue this deal at any cost. And finally, I just want to point out that we were able to progress the deal announce and begin integration planning while delivering what was really an outstanding quarter in Q2.

And I think that's evidence the Flowserve Business System is mature enough to allow parts of the organization to spend time on strategic opportunities while not impeding the progress of our organic business. And so it's one of the reasons why we feel confident in M&A being part of our strategy going forward.

Meanwhile at Velan Inc.

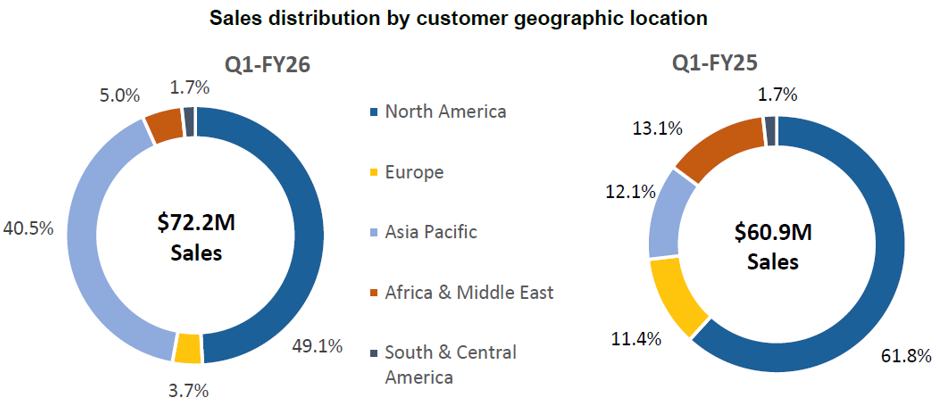

We were relatively pleased with Q1 (ending May 31st). Sales up 18%, gross profit up a bit, decent sales bookings and backlog (up 4% QoQ), and a dividend increase.

On July 10, 2025, the Board of Directors of Velan modified the Company’s dividend policy by approving a significant increase in the Company’s recurring quarterly dividend payment from CA$0.03 to CA$0.10 per common share. This increase reflects Velan’s growing backlog and the Board’s confidence in the Company’s future financial performance, including generating strong cash flow.

So, here Velan sits with a single digit EV/EBITDA multiple, the best operational performance in years, and a clean balance sheet all polished up ready for sale, while Flowserve itself has the best balance sheet it has had in years, further helped by the windfall from the Chart deal that is larger than Velan’s EV (~US$188MM). Maybe Flowserve should not sit too long taking “a moment to breathe”. It would be a shame if… someone else came along and swept away yet another great-strategic-fit deal from Flowserve.

We remain long and will collect our dividend in the meantime.

Full archive - https://www.canadianvalueinvestors.com/t/vln