Slate Office REIT (TSX:SOT) Convertible Debentures: Will a key shareholder make these a bargain or a loss making boondoggle?

Disclosure: We own Slate Office REIT Debentures, but not the stock.

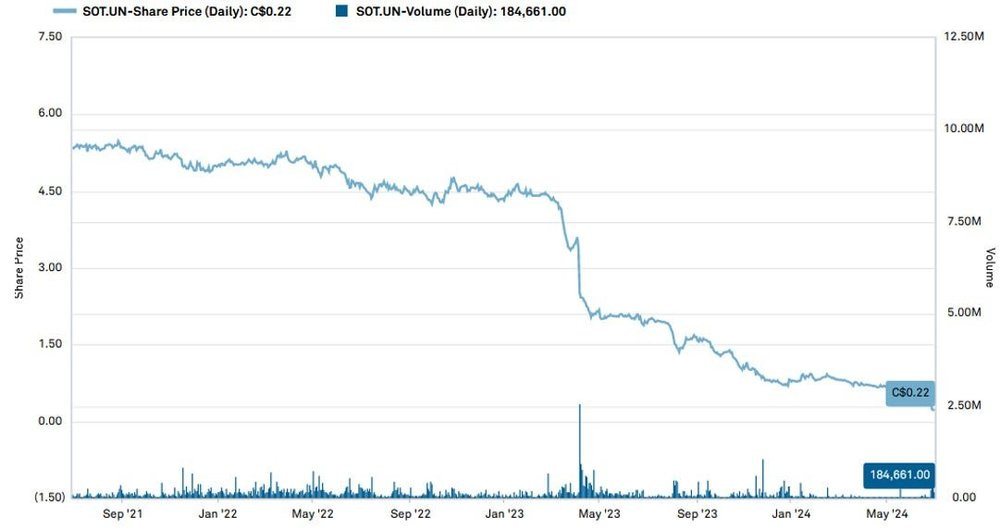

For those not following the office space real estate market, things are not going very well. For Slate Office REIT (TSX:SOT), things have been going particularly poorly. On June 25th, the Company, which owns ~50 of mostly office properties spread out across Eastern Canada, Chicago, and Ireland, announced that payments on their convertible debentures are now being blocked by senior lenders. However, what makes this situation interesting to us is a key investor, G2S2, has just taken over the Board after a two-year battle and has a track record of creative turnarounds. The publicly traded convertible debentures now trading at 20 cents on the dollar provide (we think) an interesting opportunity. But is it too late for G2S2 to fix this?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The story:

-Slate has faced high vacancy and lease rate pressure in their properties, high G&A, higher interest rates, and is running out of liquidity and support from increasingly frustrated senior lenders.

-G2S2, a key shareholder and convertible debenture noteholder, has been publicly fighting with Slate management since 2022 when they said “we have watched as SLAM has mismanaged this REIT over the past number of years. Transactions that don't add value, slashing the distribution by 50%, fees on top of fees," said George Armoyan, Executive Chairman of G2S2. "SLAM owns less than 10% of the REIT but they have set it up to have complete control. They are the only unitholder that is making any money from this investment."

-The Company then started on a strategic plan to sell non-core properties and streamline the business, but progress has been slow in a challenging office real estate market. An interim settlement agreement did not go far enough and G2S2 kept fighting.

-Subsequent to the default, Charles Pellerin joined the Board on June 27th (Principal Partner and President of Pellerin Potvin Gagnon S.E.N.C.R.L., one of the largest independent accounting firms in Quebec, and long-time connection of G2S2), leaving the Board in G2S2’s hands:

Charles Pellerin – New, G2S2 connected

Samuel Altman – New, Board Chair

George Armoyan – G2S2 Chairman, key man

Brian Luborsky – New, G2S2 connected

Blair Welch - Slate

Brady Welch - Slate

Where will they take shareholders in this bad office tower market? They have a history of dealing with distressed situations, and we think that G2S2’s investment in Bonavista Energy (a billion dollar turnaround) is a telling tale of what might happen.

We cover the full background of G2S2’s relationship with Slate, where we are at today, and what happened with Bonavista, but before all of that we want to cover off how we first came across G2S2.