Seneca Foods NASDAQ: SENE.A – Canning Cash

Note: This article was originally posted at www.canadianvalueinvestors.com on August 27, 2023. We owned a position at time of posting and continue to hold.

Seneca is our kind of boring company. It produces canned and frozen vegetables and fruits and has been operating since 1947. It has historically not been a great business to be in, but recent performance, share buybacks, and industry dynamics have made it interesting. We argue:

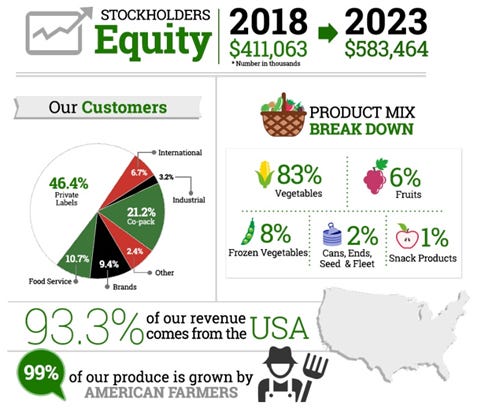

The industry has continued to consolidate, and it appears that competitors are becoming a bit more rational. The Company, and industry in general, have been acquiring competitors and then consolidating operations to improve costs (in fact, Seneca is one of two companies making up 90% of canned vegetable production in the U.S.). For example, at Senenca, full-time and seasonal staff headcounts are down 15% and 50% since 2010 on higher sales.

The Company’s LIFO accounting obscures underlying performance.

It is trading at low adjusted earnings multiple, can be argued to be a net-net depending on your perspective of inventory and physical assets. More importantly, with continued share buybacks this might be quite good. But, earnings volatility and tough industry dynamics do give us pause.

Seneca 101

There are two pitches we want to point you to:

-Overview of the idea -

-Harris Perlman notes and related X thread -

https://twitter.com/OtterMarket/status/1687608891348025344

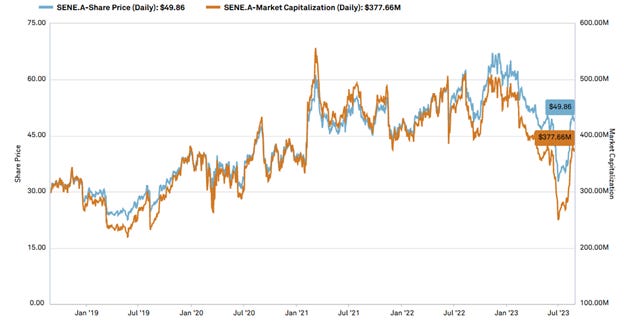

This article is meant to supplement their work. Now let’s get into the details. Here’s the last decade of performance. What is our adjusted P/E? See next.

The Company and industry in general have been acquiring competitors and then consolidating operations to improve cost. There have been a lot of acquisitions and a lot of plant closures.

“In August 2006, the Company acquired Signature Fruit Company, LLC, a leading producer of canned fruits located in Modesto, California which was sold during 2019. In 2013, the Company completed its acquisition of 100% of the membership interest in Independent Foods, LLC. In April 2014, the Company purchased a 50% equity interest in Truitt Bros. Inc. In 2016, the Company acquired Gray & Company and Diana Foods Co., Inc., each leading providers of maraschino cherries and other cherry products. The plants acquired are in Hart, Michigan and Dayton, Oregon. During 2018, the Company purchased the remaining 50% equity interest in Truitt Bros., Inc. making it a wholly-owned subsidiary. During 2019, the Company sold its Lebanon frozen packaging operation and its Marion Can Plant. During 2020, the Company sold part of its Rochester, Minnesota Plant and exchanged its Sunnyside, Washington Plant for part of its investment in CraftAg. Also during 2020, the Company acquired a plant from Del Monte Foods in Cambria, Wisconsin”

As noted by Harris Perlman, a key competitor seems to be getting smarter (see article for additional discussion of competition).

After a few years of [aggressive pricing/promotion] Del Monte Pacific had managed to nearly kill itself in an effort to win market share. It had taken on a lot of debt to buy the US business, and by 2017/2018 the US business was making an operating loss. Something had to change. The company brought in new leadership, and started restructuring. They stopped competing against Seneca in private-label manufacturing. In 2019 they closed some of their plants, and even sold a couple to Seneca. New management raised prices and turned their focus towards higher-value packaged foods. See the “new” Del Monte turnaround pitch per their IR team. https://www.delmontepacific.com/hubfs/pdf/DMFI_presentation_FINAL.pdf

Adjusted earnings – “LIFO Reserve Adjustment”

Seneca uses last-in-first-out accounting for their financial statements and taxes, while they use FIFO for financial covenants and management compensation.

An overview of LIFO vs FIFO be found here, but effectively this means that in an inflationary environment it helps Seneca reduce/delay cash taxes while understating the current earnings power of the business. https://www.investopedia.com/articles/02/060502.asp

The impact is meaningful, particularly with the recent COVID inflationary bulge. Of course, this means that if tax rules change there is a tax bill due, and as of this spring, “should LIFO be repealed, the $41.4 million of postponed taxes, plus any future benefit realized prior to the date of repeal, would likely have to be repaid over some period of time.”

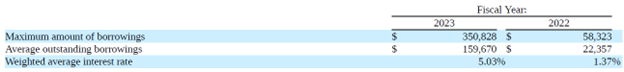

Interest rate risk real life example

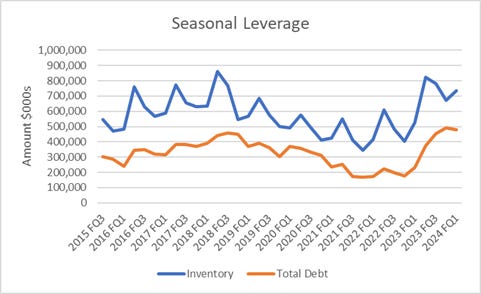

They are being impacted by higher rates, but it appears manageable. Leverage is seasonal and the recent bulge, and leverage in general, is driven primarily by inventory and secondarily by acquisitions (more so in the 2000s).

Where does that leave us?

There are issues:

-The industry is extremely volatile and very low margin. It does not take much to eliminate profitability.

-Frozen and canned goods are very mature businesses (some lines in decline).

-Competitors might be dumb. Customers are getting smarter and stronger (see Costco note next).

-Higher interest rates are impacting profitability.

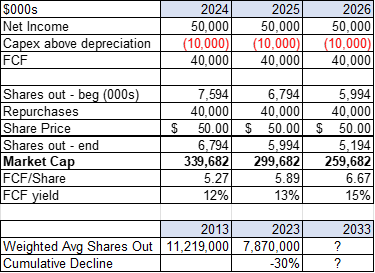

What if things normalize, margins really aren’t that great, but management keeps repurchasing shares? Here’s what it might look like. We note that cash capex on average exceeds depreciation and that earnings could never reasonably be assumed to be smooth over several years, but might just work out on average. This also ignores the underlying argument that there is value in the underlying physical assets. Stated book value is ~$70s, and $90s when adjusting for real life inventory value, while various owned facilities and land are likely held much below current replacement cost/market value. Maybe not so bad indeed.

Additional Notes

Thinking of customer risk - Costco case study

One issue is the strength of Seneca’s customers is getting stronger, likely offsetting some of the benefits of consolidation. When the benefits of consolidation get too strong, they can even collapse by their customers insourcing now. For example, Costco cut out the middle-people on chicken and now raises 100 million plus chickens a year to ensure you get that cheap cheap rotisserie chicken.

“Costco is not only Charlie Munger’s favorite company of all time (plus he’s on the board), it’s an absolutely fascinating study in how seemingly opposite characteristics can combine to create incredible company value.” How Costco works -

LIFO accounting hiccup 2023

2. Restatement of Previously Issued Financial Statements

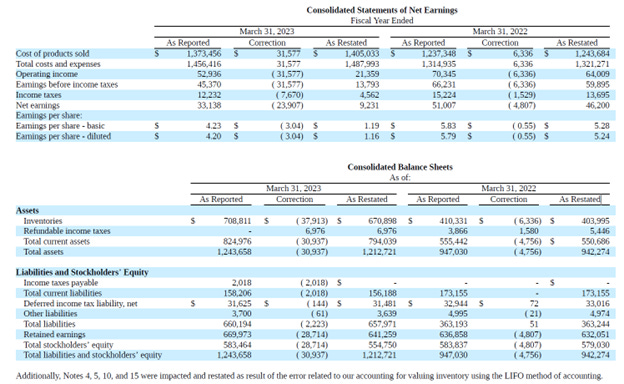

On July 25, 2023, we reported that we had identified an error related to our accounting for valuing inventory using the LIFO method of accounting as of March 31, 2023 and 2022. An actual valuation of inventory under the LIFO method is made at the end of each fiscal year based on the inventory levels and costs at that time. During the formulaic valuation of actual inventory values at fiscal year end, incorrect quantities were applied to the calculation which resulted in an understatement of the LIFO reserve as of March 31, 2023 and 2022. Management determined that correct LIFO quantities were applied to the actual valuation of LIFO at year end prior to fiscal year 2022, as only trivial differences were noted during Management's examination. In contrast, interim LIFO calculations are based on management’s estimates of expected year-end inventory levels, production pack yields, sales and the expected rate of inflation or deflation for the year. The interim LIFO calculations are subject to adjustment in the final year-end LIFO inventory valuation.

The Consolidated Statements of Cash Flows are not presented in the following tables because there is no impact on total cash flows from operating activities, investing activities and financing activities. The impact from the restatements within the operating activities section of the cash flow statement are illustrated in the balance sheet and net earnings adjustments below. The following tables present a summary of the effects of these restatements:

Employee Seasonal Staffing

2010 - At the end of our 2010 fiscal year, we had approximately 3,300 employees of which 2,800 full time and 400 seasonal employees worked in food processing and 100 employees worked in other activities. During the peak summer harvest period, we hire approximately 6,500 seasonal employees to help process fruits and vegetables. Many of our processing operations are located in rural communities that may not have sufficient labor pools, requiring us to hire employees from other regions. An inability to hire and train sufficient employees during the critical harvest period could materially and adversely affect our business, financial condition and results of operations.

2023 - As of March 31, 2023, Seneca Foods employed 2,809 full-time employees and averaged approximately an additional 3,600 seasonal employees during the Company’s peak summer harvest season. 100% of our employees are located in the United States, distributed across the Company’s facilities.

History Rhymes – Is today really that different?

2005 AR - Cost of product sold as a percentage of sales increased from 92.2% in 2004 to 92.6% in 2005. The increase in the percentage of the cost of product sold reflects higher production costs in fiscal 2005 associated with unfavorable manufacturing variances principally the result of commodity inflation in key inputs such as steel, natural gas, and fuel. In addition, last summer and fall, we experienced a difficult growing season due to lower average temperatures in August which impacted crop yields, plant recovery rates and further resulted in certain contracted raw produce being unable to be harvested

The “Jet Problem” - Adding this must have been annoying for the CFO.

2005 AR - On June 15, 2004, an accident occurred at the Company's aircraft hangar located at the Yates County Airport in Penn Yan, New York. A collision occurred between an automobile owned by an employee of an aircraft service company doing contract work at the Company's hangar and two jet aircraft standing in the hangar. The incident caused minor damage to the hangar and one of the airplanes and substantial damage to the wing of the second airplane. A corporate customer of the Company's Flight Division shares ownership with the Company of the less-damaged aircraft and has sole ownership of the more-damaged aircraft. The Company does not believe that any ultimate settlement will have a material impact on its financial position or results of operations.