Quick Note: Taiga Building Products TSX:TBL – A guide on TSX Due Bill Trading

Disclosure: We are still long.

A we noted in our last post, Taiga Building Products finally decided what they were going to do with all that cash – a big dividend, being ~$180MM vs their market cap at the time of ~$400MM. Post-announcement it is trading at ~$500MM inclusive of the yet to be paid dividend. Archives here - https://www.canadianvalueinvestors.com/t/tbl

The distribution was so big it created some technical noise last week, all because of Due Bill Trading rules on the TSX.

As a side note, it is trading at an ex-dividend value of ~$3.25/share, resulting in a mid 7 P/E ratio (by our estimates). We continue to hold at these prices. Maybe the parent, Avarga, will pay us out with all that cash they have now. Only another ~26% to go until wholly-owned.

What is Due Bill Trading?

In Taiga’s original press release they said:

BURNABY, BC, May 27, 2025 /CNW/ - Taiga Building Products Ltd. ("Taiga" or the "Company") announced today a special dividend of $1.6675 CDN per common share of the Company to be paid on June 23, 2025 to holders of record of common shares on June 6, 2025.

The board of directors has authorized this one-time dividend. There are no current plans to issue regular dividends, and no long-term dividend policy has been established.

However, Due Bill Trading applied. As per TSX listing rules:

Due Bill Trading

Sec. 429.1.

For the purposes of this Section 429.1, "distribution" means any dividend, distribution, interest, security or right to which holders of listed securities have an entitlement, based on a specific record date.

Due Bill trading may be used at the discretion of the Exchange based on various relevant factors. However, the Exchange will normally defer ex-distribution trading and use Due Bills when the distribution per listed security represents 25% or more of the value of the listed security on the declaration date. Without the use of Due Bills, trading on an ex-distribution basis would commence at the opening of trading one trading day prior to on the record date for the distribution and could result in a significant adjustment of the market price of the security. Security holders will then be deprived of the value of the distribution between the ex-distribution date and the payment date. By deferring the ex-distribution date through the use of Due Bills, sellers of the listed securities during this period can realize the full value of the listed securities they hold, by selling the securities with the Due Bills attached. The use of Due Bills will also avoid confusion regarding the market value of the listed securities.

Due Bill trading was amended last year as part of the TSX switch to T+1 (1 day after trading) settlement.

429.1 -- Due Bill Trading Amend language to indicate that trading on an ex-distribution basis, without the use of Due Bills, will commence at the opening of trading on the record date of the distribution.

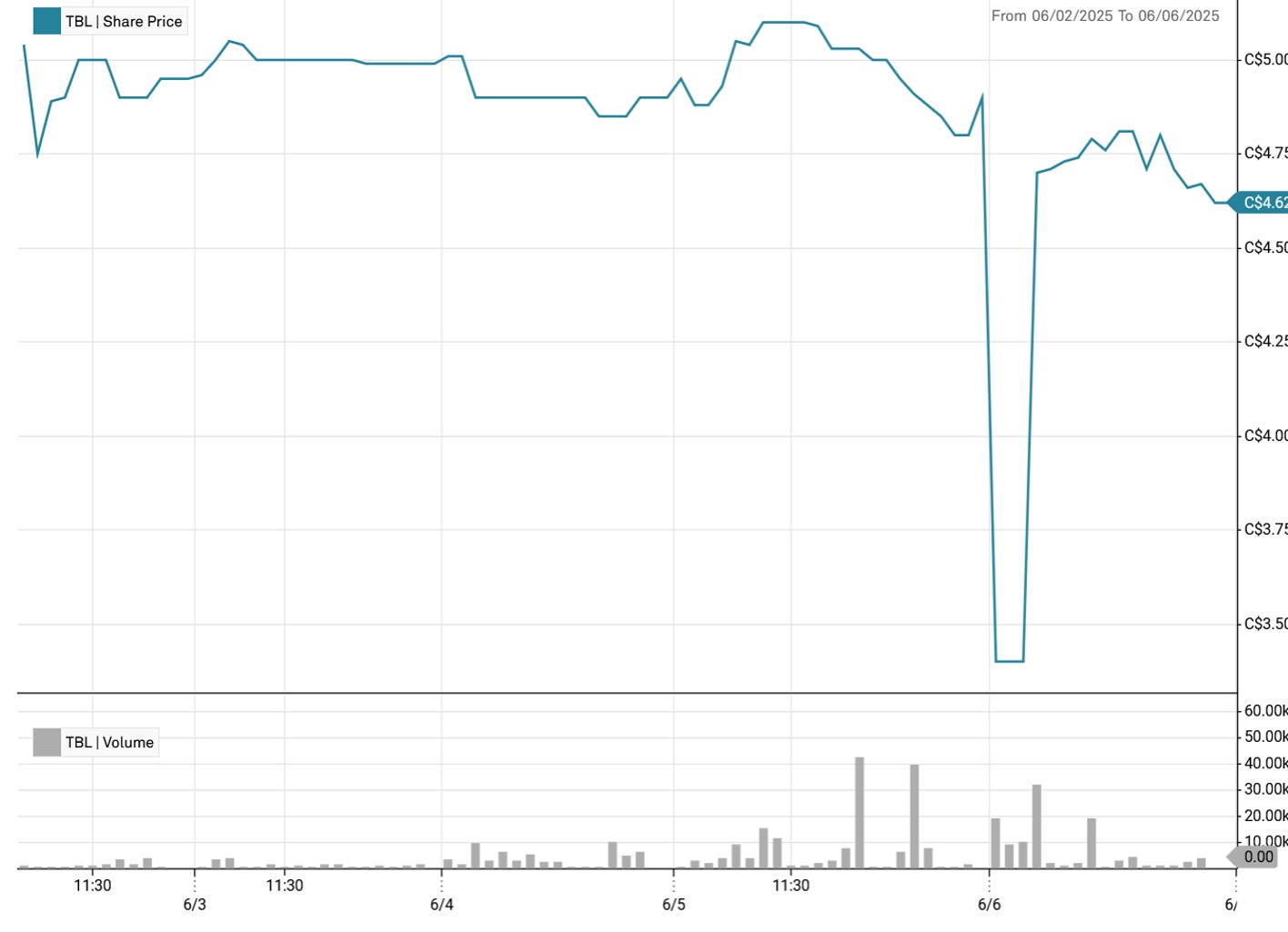

In Taiga’s case, the dividend they announced was almost half their market cap at the time, and even today is ~35%, meeting the criteria for the TSX to “normally defer ex-distribution trading and use Due Bills”. So, was this a normal case? Friday morning trades showed confusion, with Taiga trading down to the $3.50s (albeit at low volumes). It was confusing enough that it resulted in a trading halt and clarification press release. We had a bid in ourselves, but were too greedy with our bid price.

Taiga will actually trade ex-dividend on June 24th.

As announced by the Toronto Stock Exchange (TSX) in its dividend notice dated Friday, May 30, 2025, due bill trading will commence on June 6, 2025, and continue through to June 23, 2025, inclusively. Common shares will begin trading on an ex-dividend basis at the open of markets on June 24, 2025. This means that anyone who buys Taiga shares between June 6 and June 23, 2025, will still receive the dividend, even though the official record date is June 6.

Halt Time (ET): 10:02 AM Resumption (ET): 1:00 PM