Portfolio Updates: Taiga dividend, NFI financing, and the POWW Coup

TBL NFI POWW

Here is the latest from Canadian Value Investors!

Today we have important updates about three companies we follow closely, own, and have done deep dives on. See archives here - https://www.canadianvalueinvestors.com/p/directory

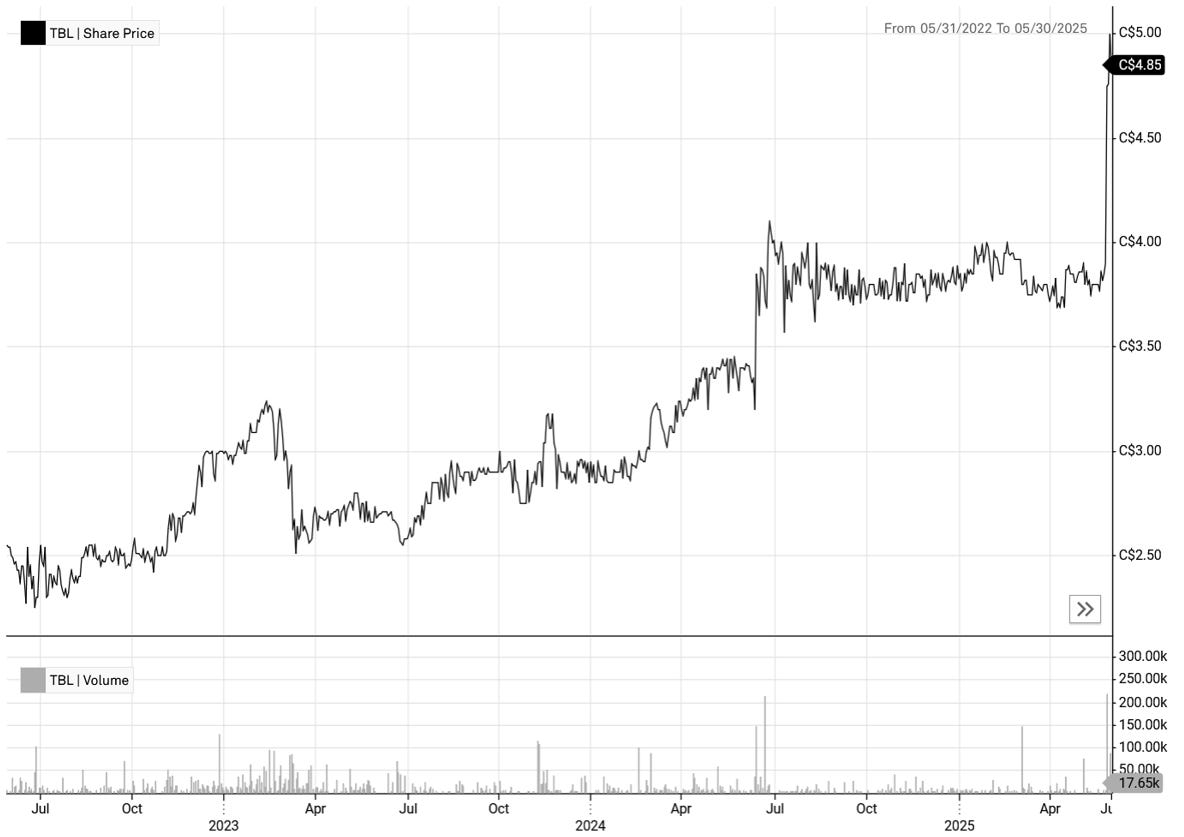

Taiga Building Products TSX:TBL – It really did have too much cash (conviction high)

NFI Group TSX:NFI- Improved financing in place, turnaround continues (now largest position)

Ammo Inc. NASDAQ:POWW…. -> Outdoor Holding Company Update: The Steve Urvan Coup (Position size SMALL, Conviction LOW, but what a story)

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Taiga Building Products TSX:TBL – It really did have too much cash

Disclosure: We remain long.

We have written about Taiga for a few years now. Returns have been good, though lumpy. The key question was, what are they going to do with all of their surplus cash? Well, we just found out. They just announced a special distribution of ~$180MM. We estimated surplus cash at ~$200MM.

BURNABY, BC, May 27, 2025 /CNW/ - Taiga Building Products Ltd. ("Taiga" or the "Company") announced today a special dividend of $1.6675 CDN per common share of the Company to be paid on June 23, 2025 to holders of record of common shares on June 6, 2025.

The board of directors has authorized this one-time dividend. There are no current plans to issue regular dividends, and no long-term dividend policy has been established.

Although the share price popped on the news, we estimate the company is trading at a reasonable ~7x PE net of the distribution. Cash at Q1 2025 was $119MM and this is the seasonal peak for working capital needs (YE 2024 cash of $192MM).

The question remains what will the publicly listed Singaporean parent, Avarga, do long-term. Avarga just increased its stake in Taiga in April (through Avarga Canada Limited) from ~72% to ~74% through the purchase of 2.4 million shares at $4.20 in a block private transaction (above pre-dividend recent prices, trading at ~$3.70 at the time of transaction). The key owner remains stuck with two public companies he almost wholly owns (see archives). And now has cash… We remain long.

NFI Group TSX:NFI Update – Improved financing in place, turnaround continues

Disclosure: We still own this one. Largest position.

Disclosure: We remain long.

Our favourite bus manufacturer NFI released their Q1 results and, more importantly, announced new credit facilities and a note issuance. Our February 9th thesis remains the same; NFI Group is a mispriced turnaround play with a dominant market position, recovering operations, and a record backlog, benefitting from industry consolidation and Buy America compliance. Full story here - https://www.canadianvalueinvestors.com/p/nfi-group-inc-tsxnfi-is-this-our

The bank line was extended and increased to provide more liquidity (~$128MM total liquidity before following note issuance).

Winnipeg, Manitoba, Canada – May 7, 2025: (TSX: NFI, OTC: NFYEF, TSX: NFI.DB) NFI Group Inc. (NFI), a leader in propulsion-agnostic bus and coach mobility solutions, today announced that it and certain of its subsidiaries (collectively, the Company) have entered into a new revolving credit facility (the First Lien Facility) with a total borrowing limit of $845 million, which includes $300 million in letter of credit availability.

And then they announced and just priced their $600MM note issuance.

The Company has agreed to issue and sell to the initial purchasers $600 million in aggregate principal amount of 9.250% second lien senior secured notes due 2030 (the Notes).

The offering is expected to close on June 13, 2025 subject to customary closing conditions.

NFI intends to use the net proceeds from the offering of the Notes to repay certain indebtedness under the Company’s existing credit facilities, including a portion of the amounts outstanding under the First Lien Senior Credit Facility, its existing $180 million second lien credit facility and certain other existing indebtedness, and to pay certain related fees and expenses.

…

Upon the completion of the Notes offering, the Company’s existing first lien senior credit facility (the “First Lien Senior Credit Facility”) will be automatically extended to May 7, 2029, and the maximum commitments under it will be reduced to $700 million, which includes $300 million in letter of credit availability. The First Lien Senior Credit Facility will be available to be drawn on a revolving basis for general corporate purposes. The minimum liquidity covenant of $50 million under the First Lien Senior Credit Facility will no longer apply and certain additional enhancements will become operative

They also finally tipped into positive free cash flow. Some supplier issues remain like seats (we think the entire management team is likely suffering from post-traumatic seat disorder PTSD by now), but things are moving in the right direction.

Two related concerns. The backlog has reached an all-time high of ~$13.6 billion with 6,236 firm / 10,291 options and their book-to-bill ratio remaining well above 100%. We think the robust pipeline could turn into a risk if they fall too far behind on orders.

Some highlights from the last call:

New Flyer, as you know, is the vast majority of our backlog. This year is effectively sold out. We are at this point for 2026 and 2027 well ahead of booking slots than we've ever been in our history. So, feeling really good. And of course, the margin profile is notably healthier than it was over the last couple of years.

…

Line entries [deliveries] saw decline from the previous quarter for two primary reasons, deliberately operating at lower rates as we aim to improve on seat supply performance and lower UK production.

…

It is important to reiterate that changing a seat supplier once a bus has been engineered, is on the production line or nearly complete and offline is not an option, as each bus order and the parts related to the seats are very different. We had originally hoped for a full require from the supplier by the end of the second quarter. But unfortunately, as expected, this may drag a bit longer. This supplier issue does not change our overall expectations or guidance for our 2025 results.

On government funding

Earlier this week on May 5, the Federal Transit Administration, or FTA, announced the fiscal year 2025 funding apportionments to states, urbanized areas and tribal government based on the established statutory formulas. This critical step enables many of NFI's US customers to start their application process, as they do every year to the FTA to obtain funding for capital purchase of new buses and the related infrastructure.

NFI anticipates that these funding allocations will directly support future orders in our bus deliveries that begin in 2026 and beyond, based on this available money, which also strengthens our role in modernizing America's public transit systems. The evolving market may result in changes to funding going forward, which could impact future orders and option conversions, especially as it relates to our zero-emission buses. This may result in a change to the models of our incoming orders, and thankfully our propulsion-agnostic offering on common production line helps offset concerns here.

We can provide whatever products make sense for our customers and generally, internal combustion engine production historically and currently has been less demanding than building zero-emission buses, which provides an opportunity to increase throughput should we see a shift in propulsion system model demand.

On tariffs

Our ability to pivot is more of a long-term issue than it is a short-term supply impact that we can adjust, which goes back to we've put all of our customers on notice. We've communicated both verbally and in writing twice that they will be subject to tariffs. We have started to see steel literally up for a couple of months now, steel and aluminum tariffs, where we actually know the direct impact. Those secondary or indirect tariffs are now the ones that are starting to flow through, but we are very transparent and open with all of our customers that it's coming.

And the likelihood is that the invoices to our customers will include the original price of the bus and probably a secondary or potentially even a third invoice to address those tariffs.

As you can imagine, the direct tariffs to us are relatively little. I mean they are there, but they're not massive. It's the indirect, you know, an engine that we buy from a supplier in the US, that is built in the US, a lot of those components come from other countries. And therefore, it's the secondary indirect tariffs, which increase the cost of our inputs, which we don't actually control.

So, in many cases, we're digging down two or three levels within the supply chain to understand the indirect impact. And look, there's, I don't know, 8,000 to 10,000 parts on a bus. So, it's not like it's a simple calculation and every customer has a different level of sophistication. Cummins or Allison are well-sophisticated, being able to tell us and advise us of a tariff impact, where smaller, privately-owned businesses don't have that level of sophistication.

AMMO Inc. NASDAQ:POWW… we mean Outdoor Holding Company Update: The Steve Urvan Coup

Disclosure: We are long. Position size SMALL, Conviction LOW, but what a story

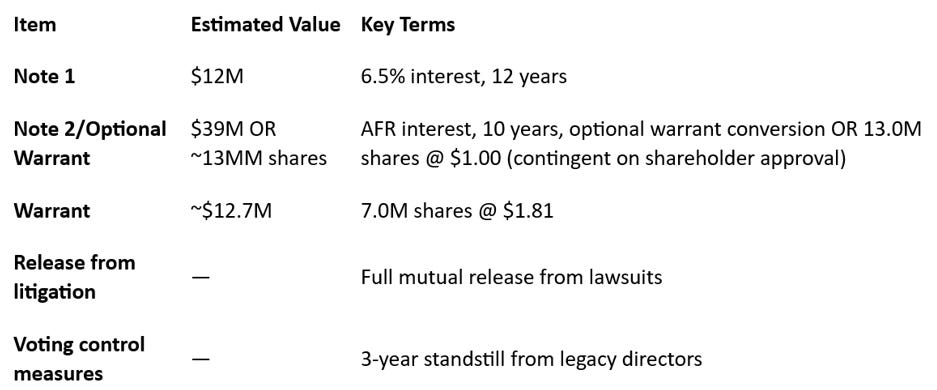

The drama continues since we did our January post, and this remains one of the wildest stories we have ever followed. To recap, AMMO was the owner of GunBroker, America’s legal eBay of guns, that it acquired from creator Steve Urvan and AMMO also had a loss-making ammunition division with a long history. They subsequently announced the sale of the ammunition division (a good outcome). See archives for full background.

Since our April update, they finally issued their long-delayed financials with accounting issues resolved and another major change; they settled the lawsuit with Steve Urvan resulting in a coup. Steve Urvan, the founder of GunBroker is now in as CEO and the founder of AMMO, Fred Wagenhals, is out along with the CEO and most of the Board. Now what?

The Urvan Coup

The ongoing lawsuit with

the founder of Gunbroker, Steve Urvan, who was/is the largest shareholder of POWW is finally settled. Urvan alleged that he was fraudulently induced into entering the 2021 merger due to misrepresentations in the Merger Agreement by AMMO and its directors. It turns out that there was some substance, or at least the Board thought there was enough to justify an expensive settlement. We estimated the total cost of settlement to be $20MM. He actually received:

As partial consideration for the settlement, the Company agreed to issue to Urvan, or an affiliated designee of Urvan, a warrant (the “Warrant”) to purchase 7.0 million shares (the “Warrant Shares”) of the Company’s common stock… will have a five-year term from the date of the Effective Date and an exercise price of $1.81 per share.

In addition to the Warrant, as partial consideration for the settlement, the Company agreed to issue to Urvan, or his affiliated designee, an unsecured promissory note in a principal amount of $12.0 million (“Note 1”). Note 1 will bear interest at 6.50% per annum… the Company is required to make annual prepayments such that $1,000,000

Pursuant to the Settlement Agreement, the Company also agreed to issue to Urvan, or his affiliated designee, an unsecured promissory note in a principal amount of $39.0 million (“Note 2” and together with Note 1, the “Notes”). Note 2 will bear interest at a rate per annum equal to the applicable federal rate for long-term loans in effect on the Effective Date [~5%]… the Company is required to make annual prepayments of the outstanding principal amount on Note 2 equal to $1.95 million on each Interest Payment Date…The unpaid principal balance of Note 2 and all accrued and unpaid interest thereon is due on the 10th anniversary of the Effective Date (the “Note 2 Maturity Date”).

The twist on Note 2

The Company also has the option, at any time prior to the first anniversary of the Effective Date (unless extended by mutual consent of the holder and the Company), to prepay all, but not less than all, of the then-outstanding principal amount of Note 2 and accrued and unpaid interest thereon in exchange for the issuance of a warrant (the “Additional Warrant”) to purchase 13.0 million shares of Common Stock (the “Additional Warrant Shares”), provided that the Company must first obtain stockholder approval of the issuance of the Additional Warrant and the Additional Warrant Shares pursuant to Nasdaq Listing Rule 5635… Upon issuance of the Additional Warrant, all remaining obligations under Note 2 would be deemed satisfied… The Additional Warrant, if issued, would have a five-year term and an exercise price of $1.00 per share.

Editor note: The Company could technically repay the majority of the loan and then still issue 13 million warrants.

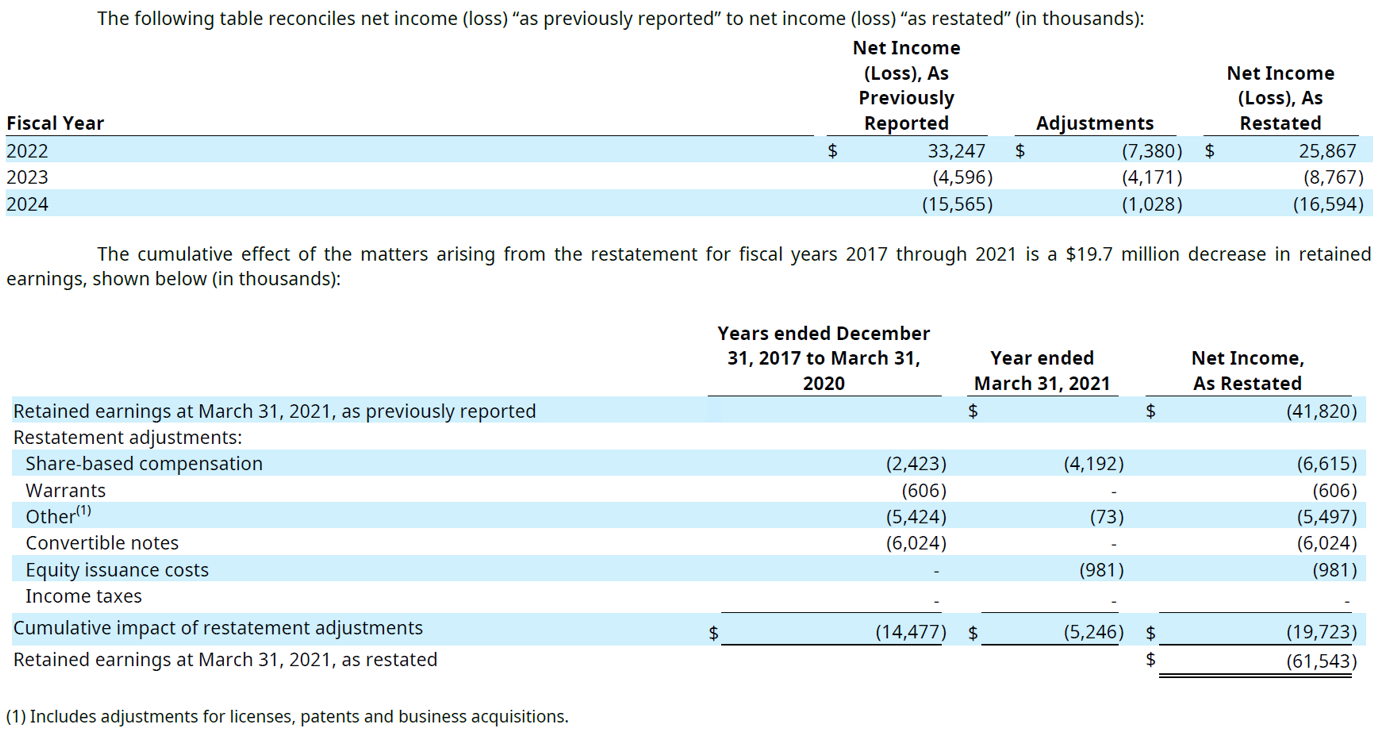

Accounting issues

The accounting issue turned out to be in line with expectations (though we were increasingly concerned given the length of time it took to resolve). The restatement of the financials stemmed from three primary accounting issues, all of which do not concern us given they were largely technical i.e. not operations related and under the former management and Board:

Share-Based Compensation Errors - The company inaccurately valued and accounted for equity awards issued to employees, directors, and service providers. This included both overstatements and misclassifications, especially for shares issued in exchange for services.

Improper Capitalization of Equity Issuance Costs - Certain costs associated with issuing shares were inappropriately capitalized rather than expensed, leading to incorrect asset and equity balances.

Misaccounting for Convertible Notes and Warrants - There were errors in how the company recorded convertible debt and warrants, likely relating to embedded derivative features, fair value estimates, or classification between equity and liabilities.

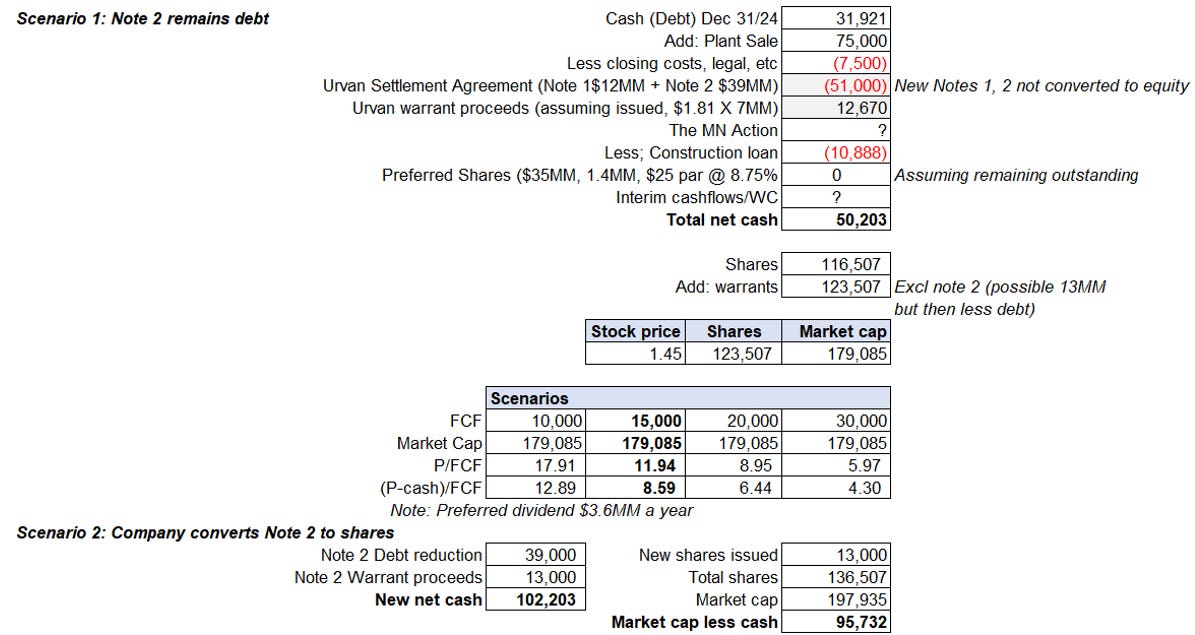

Pro-forma today?

The following is based on the ammunition sale as well the settlement agreement and actuals to Q3 2025 being December 2024. All in, we are not quite sure what to do with this. Uncertainty remains high. What will normalized G&A be? Will new leadership lead to new shenanigans or create value? On the positive side, it must be acknowledged that Steve Urvan’s Gunbroker has been the only thing that created value at AMMO. One concern is that revenue continues to decline at Gunbroker year-over-year. Perhaps with all of this noise behind them, they can re-focus on the website and the long-promised improvements.

Mr. Urvan commented:

“I am excited to step into the executive role to drive the core GunBroker business and lead the Company’s recent repositioning of the publicly traded holding company as Outdoor Holding Company. Although there is a lot of hard work ahead, we are going to build a winning culture and set clear operating principles to guide us to success. I look forward to providing updates to all of my fellow shareholders and stakeholders in the coming quarters in a renewed spirit of openness and transparency.”

The Company’s Board of Directors (the “Board”) determined that Mr. Urvan is the right leader for the Company given his extensive expertise in building, growing and investing in technology and e-commerce companies, which he developed in part founding GunBroker.com and leading that business for 22 years. As part of the leadership transition, Mr. Urvan will also be assuming the Chairman role on the Board.

Fred Wagenhals, the Company’s founder and former Executive Chairman, commented:

“As I have stepped into retirement, I have continued to stay focused the performance of Outdoors Online from my position as a large shareholder. Steve’s upcoming appointment, along with the recent rebrand, reflects a continued dedication to accelerating and supporting the Company’s strategic focus on growing its profitable e-commerce segment. I look forward to offering whatever support I can from the shareholder perspective as Steve leverages his significant experience to refocus on capital allocation and ideas that will generate shareholder value for all.”

…

Additionally, to ensure that his focus is on delivering shareholder value, and to effectively align his compensation with performance, Mr. Urvan will take a salary of just $1 in his first year – with bonus or equity grants to be determined by the Compensation Committee of the Board as it deems appropriate.

Thank you for subscribing!