Portfolio Update: Concentrated investing in practice and pricing political risk

And another odd lot trade that can pay for an annual CVI subscription

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Portfolio Update: Concentrated investing in practice

“The idea of diversification makes sense to a point - if you don't know what you're doing. If you want the standard result and don't want to end up embarrassed - then of course, you should widely diversify. But nobody is entitled to a lot of money for holding this view. It's like knowing 2 plus 2 is 4. Any idiot can diversify a portfolio.” – Charlie Munger

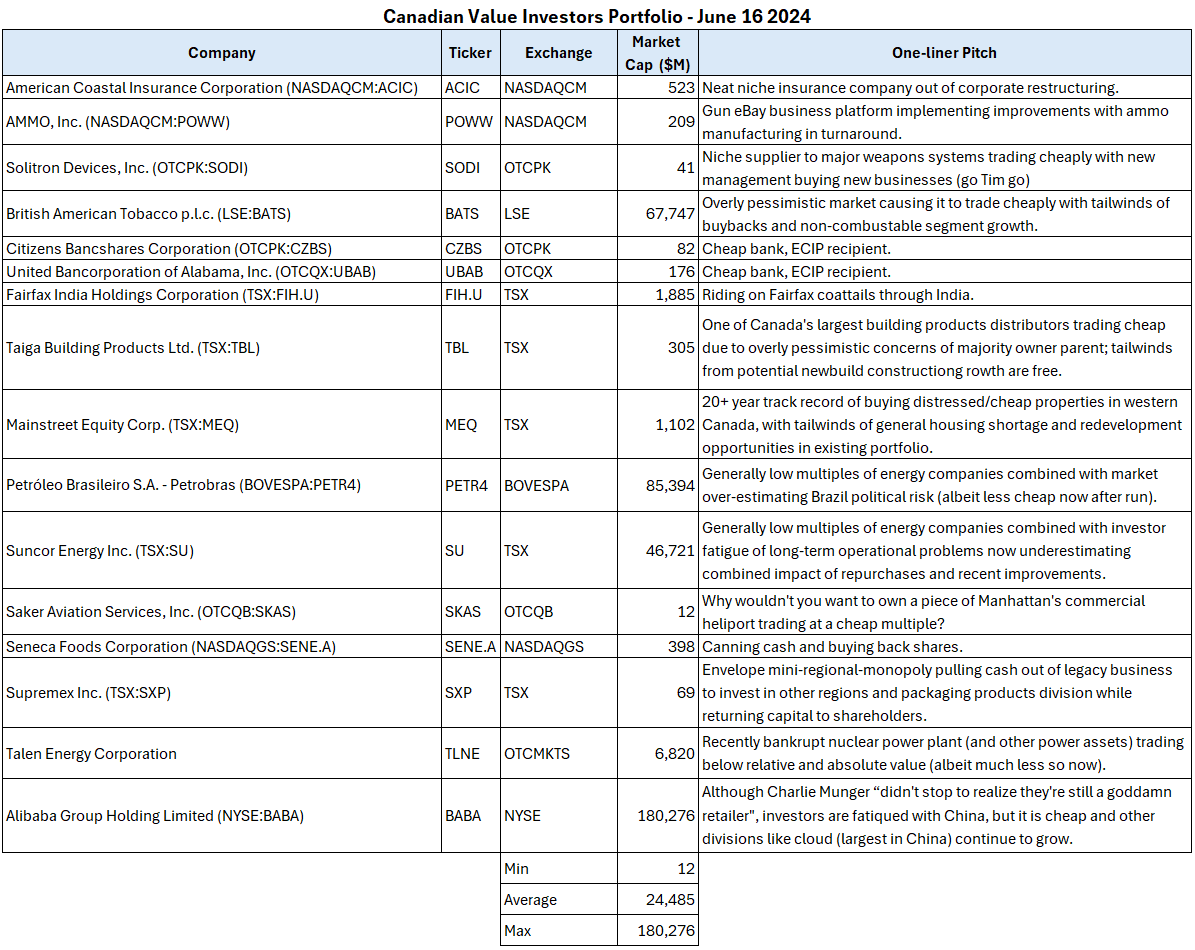

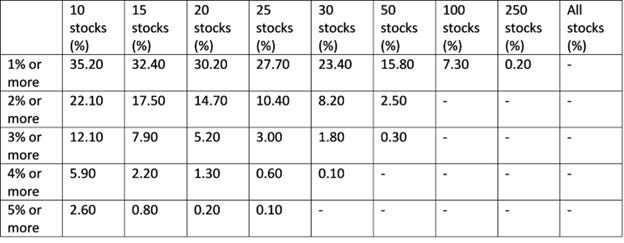

We believe that having a concentrated portfolio is essential, simply because the math makes it so as we discuss below. The following is a list of the majority of our main holdings (though not absolutely everything as we work through a few new ideas). Previously when our portfolio was dominated by holdings in guns, oil, and canned vegetables, we felt calling it a “prepper’s portfolio” was appropriate. We think that small caps are the best hunting ground for ideas, but we do not limit ourselves to “being a small cap investor” blindly and try to price things we come across (including political risk as discussed below). We admit that some newer holdings are not exactly optimistic bets on humanity (hi BATS). We are trying, but you have to hunt where the truffles are and these are just the bargains we are finding

However, we are less excited today about our holdings in general than we were a year or two ago and have reduced our concentration accordingly. We think our holdings will provide a reasonable return, but we do not think any of them are no-brainers at today’s prices. We hope to find a no-brainer soon.

Unfortunately, for those that worry about these things, this portfolio gets a “needs improvement” grade when it comes to ESG according to our broker.

What we find interesting is that the underlying drivers of most of these businesses are all very different from each other, except for the ones that obviously are connected (e.g. Suncor and Petrobras).

Some even counter-balance another. For example, if Canada can get its act together and actually significantly increase new homebuilding, Taiga would benefit (higher sales) and Mainstreet would not (downward rent pressure). Of course, if housing remains constrained, it will continue to provide a tailwind for Mainstreet. More importantly, our theses for either do not rely on Canadian housing going in one direction or another. In our view, they both are resilient businesses that will perform just fine in most tides.

Although it is a concentrated portfolio, the outcome of our holdings is unlikely to be highly correlated and is diversified enough for us.

The math behind concentrated investing

The best book we have found about concentrated investing is the creatively named book Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors.

The book covers several investors (like Warren and Charlie as well as Lou Simpson and John Maynard Keynes among others) and also the statistics behind concentration (we encourage you to read it!). Intuitively, the fewer stocks you own, the more your portfolio can deviate from the benchmark’s performance. But how different could it be? What’s the difference between 10 and 30 and 250?

The authors conducted a Monte Carlo simulation where they randomly built portfolios from the S&P 500 from 1999 to 2014. In each year in the sample they randomly chose a portfolio of stocks, with 1,000 sample portfolios each year for a total of 120,000 portfolios over the 15 year period.

How did they do? 35.2% of the 10 stock portfolios outperformed the benchmark by 1% or more and 2.6% outperformed by 5% or more. At 30, it goes down to 23.4% and zero. Of course, concentration also increases your chances of underperforming the market.

Chance of Portfolio Outperforming S&P 500 Equal Weight (1999 to 2014)

Source: Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors

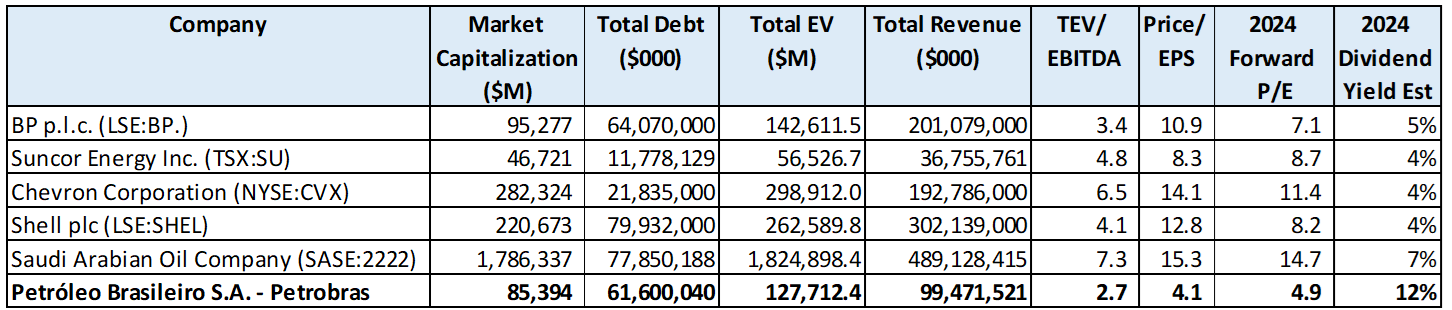

Petrobras - Pricing political risk

Disclosure: We still own this one, albeit a lot less.

“I would never invest that.” Since we purchased the Brazilian oil and gas behemoth Petrobras (specifically their ADR PBR.A), we do not believe a single person in our personal investing network has also bought the company. And how could you with headlines like these?

Rio de Janeiro, May 14, 2024 - Petróleo Brasileiro S.A – Petrobras informs that it has received Official Letter No. 214/2024/GM-MME, through which the Ministry of Mines and Energy (MME), after being informed of Mr. Jean Paul Prates' request for early termination of his term as CEO of Petrobras through negotiation and, if approved, his intention to subsequently resign from the position of member of the Board of Directors of the company, appoints Ms. Magda Maria de Regina Chambriard to then hold the positions of CEO of the company and member of the Board of Directors of Petrobras

Rio de Janeiro, May 15, 2024 - Petróleo Brasileiro S.A – Petrobras, following up on the Material Facts disclosed on 05/14/2024 and 05/15/2024, clarifies that the appointment of Ms. Magda Maria de Regina Chambriard to the positions of CEO of the company and member of the Board of Directors of Petrobras, within the company's governance process, will undergo analysis of the integrity and human resources areas of Petrobras and will then be submitted for evaluation by the People Committee (COPE) of the Board of Directors, a process that generally takes up to 15 days.

Rio de Janeiro, May 31, 2024 - Petróleo Brasileiro S.A – Petrobras informs that it has received correspondence from minority shareholders of the Company requesting the convening of an Extraordinary General Meeting ("EGM") for the election of members of the Board of Directors ("BoD") and for the chairmanship of the BoD, under the argument that there would have been dismissal of a member of the BoD, which does not correspond to the facts, as disclosed by the Company in the Releases of May 14 and 15, 2024.

Rio de Janeiro, June 7, 2024 – Petróleo Brasileiro S.A – Petrobras, following up on the release disclosed on May 31, 2024, informs that its Board of Directors, at a meeting held today, decided by majority not to accept the shareholders' requests to call an Extraordinary General Meeting ("EGM"), due to the failure to meet the requirements of subparagraph "c" of article 123 of the Law No. 6,404/1976.

However, we have trouble with using words like “never” and “no matter what price” when it comes to investing. Petrobras is not nearly as cheap as it used to be and the political risk is real as the recent CEO ousting has shown, but the ~35% in dividends received so far relative to our cost has provided some comfort at night and helped pay for a few PBR beers to get us through all of their press releases. How could there not be a price for political risk?

The relative and absolute discount has decreased meaningfully with the increase in price and we have adjusted our holding accordingly.

Would you rather own NVIDIA or ~10% of America’s total debt? – Our new NVIDIA Tracker

Disclosure: We have no horse in this race.

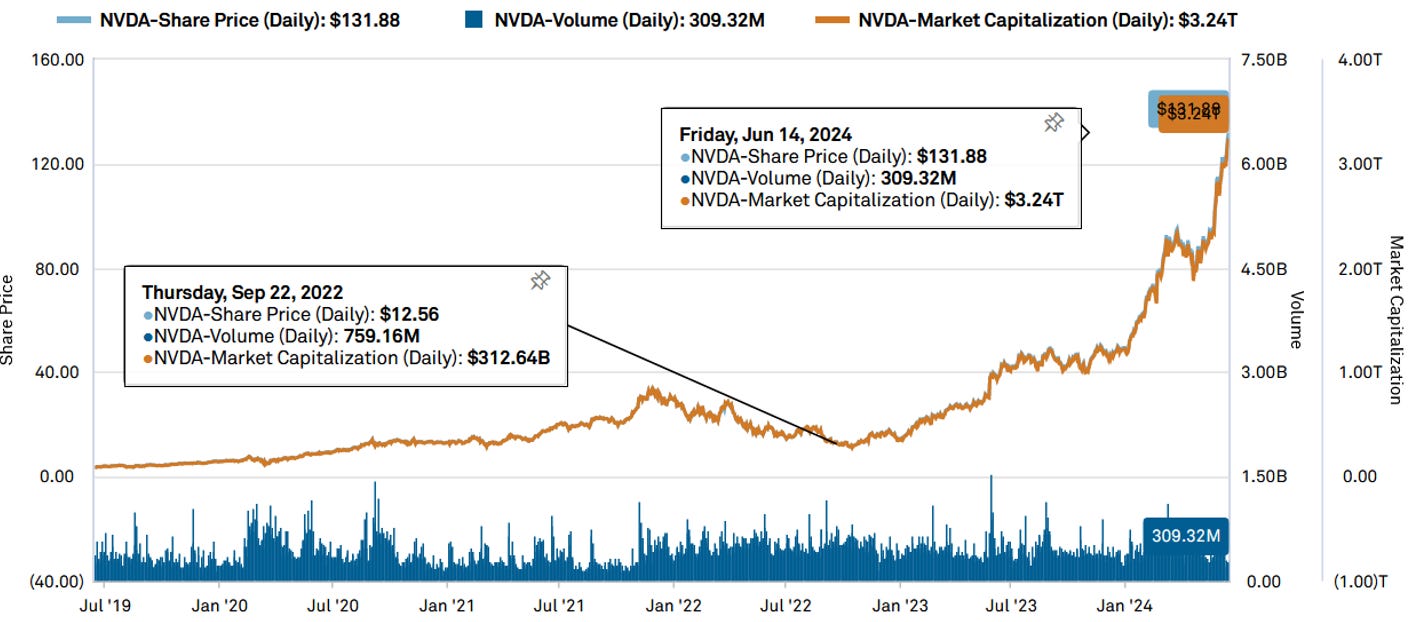

NVIDIA’s performance both as a company and a stock has been quick remarkable. Revenue and Net Income have increased from $10.9B and $2.8B in 2020 to $61B and $29.8B in FY 2024, and the excitement continues. Is NVIDIA fairly valued today at a market cap of $3.2 trillion? We will leave this to others as we want simpler investing problems to solve (“there are no points for difficulty” as Buffett says). However, we have asked ourselves... would we rather own NVIDIA today, or outright own most of every public company in Canada? You could also have the equivalent of ~10% of total United States government debt paying you ~$157 billion a year in interest.

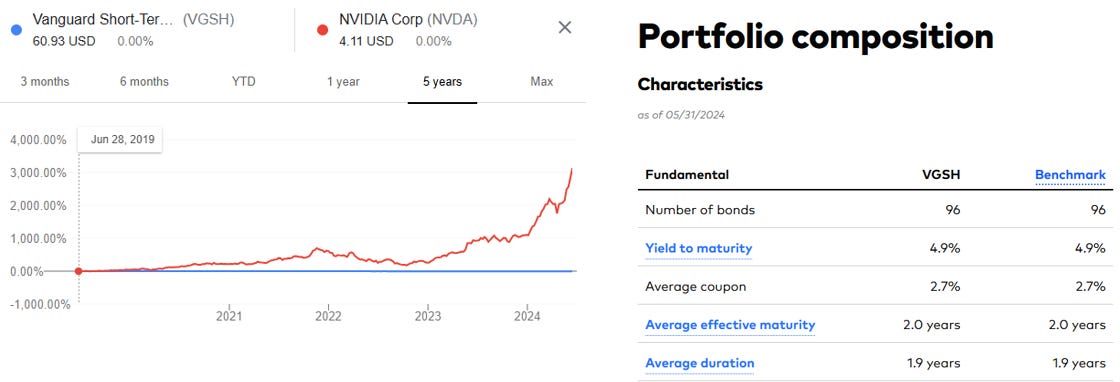

NVIDIA has, of course, dramatically outperformed U.S. Treasuries over the last five years (chart below excluding dividends). Will it over the next five, or will cash in hand from some government bonds win? Starting today, we will be tracking the race with Vanguard’s Short-Term Treasury ETF standing in for us having to track actual T-bills. And they’re off!

And finally, another odd lot trade that can pay for an annual subscription