Navigating uncertainty (and an update on POWW)

And the Art of the Deal

Here’s the latest from Canadian Value Investors!

Stock Markets: Navigating uncertainty (by fishing in still waters with companies… like TBL?)

Galaxy gaming GLXZ – A finance professor’s nightmare

Ammo Inc. Update (POWW) – Sparks flying at our special situation

Thinking about leverage in the system

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Stock Markets: Navigating Uncertainty (by fishing in still waters)

We have to be honest. When the tariff stock meltdown happened earlier this month, we spent more time refreshing Edgar filing links for some of our special situations than we did worrying about macro news.

We of course think that things like tariffs and a potential recession are important, it is just that these issues are not core to the theses of our holdings and/or the prices they are trading at more than offsets most expected outcomes. Thinking about what won’t change is easier than thinking about what will. And secondly, as Charlie Munger used to say, the key to a happy life is low expectations. That said, there have definitely been opportunities more nimble traders have taken advantage of.

No major rebalances here, but we did buy a bit more: NFI, DRT, VLN, and HASH.

We have geared our portfolio to try to be neutral or positive to issues we foresee, like Trump and tariffs and a lot of things are in the too hard pile. The only thing certain is uncertainty. Does no one remember Trump’s first term or, more importantly, has no one read his book? For those that skipped class, the 11 business rules of Trump from the Art of the Deal are in the appendix (our favorite, #11: Have fun!).

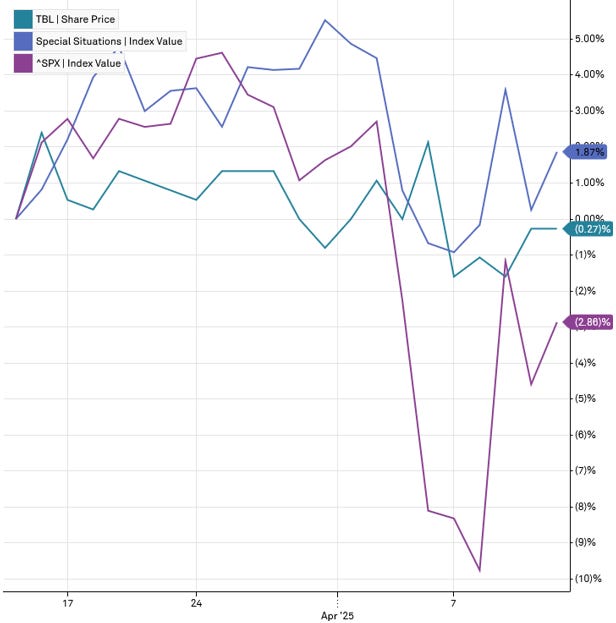

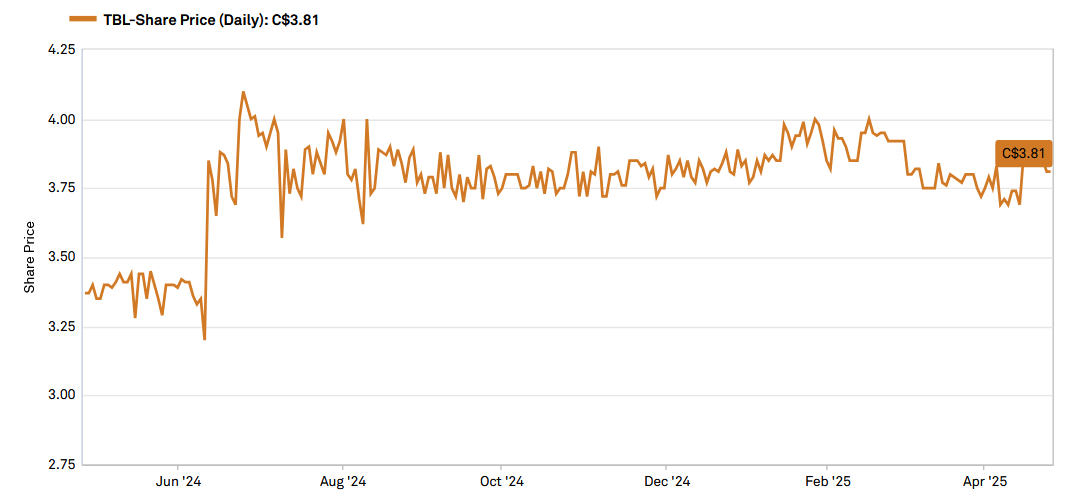

Taiga Building Products TSX:TBL – the immovable

One extreme example that we frankly cannot really explain is Taiga Building Products TSX:TBL (Disclosure: We are still long, see archives https://www.canadianvalueinvestors.com/t/tbl ), which at this point we view as a quasi-special situation. As we have written about them many times, they are one of Canada’s largest building products distributors, the kind of business you would think would be impacted by speculation or actual impact of things like Trump, tariffs, housing starts, and the Canadian election. But no. The stock has traded rangebound since the summer. It helps that they are debt free and cash rich (~50% of market cap). The parent, Avarga, will likely be handling their privatization shortly before doing something with Taiga.

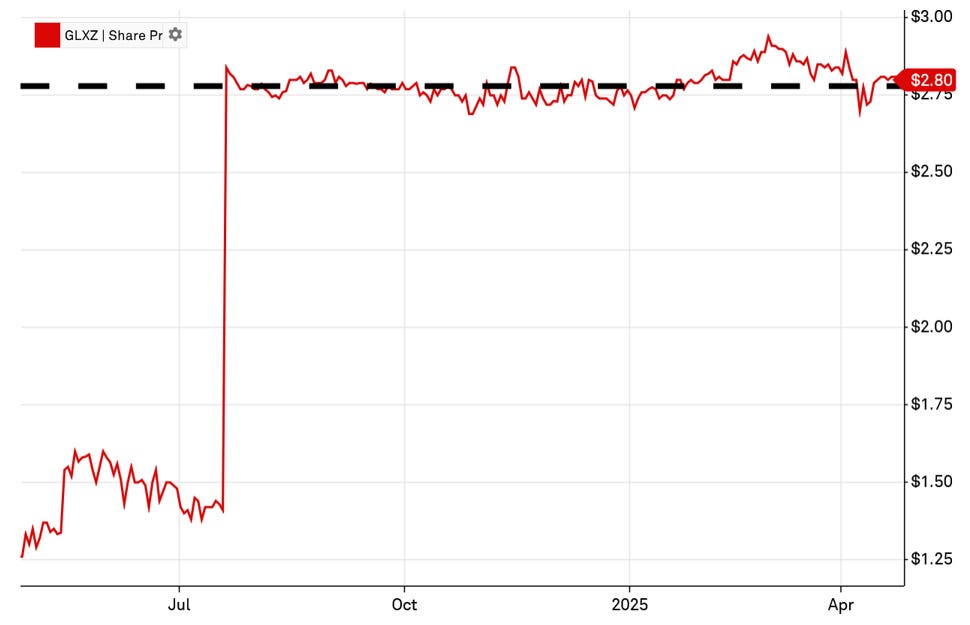

Galaxy gaming – A finance professor’s nightmare

Disclosure: We have a small position as part of our pooled special situations.

As a quick summary, Galaxy Gaming has received a $3.20 offer from a reputable buyer, Evolution AB (Swedish gaming company) and there is concern about the regulatory approvals. We are not confident enough to make it a write it up given our limited expertise in this niche of regulatory law. However, it is a fun chart.

Based on what we remember from Finance 101, it appears that the probability of the $GLXZ Galaxy Gaming transaction closing is declining and exactly offsetting the market’s official time value of money Discount Rate (as per the table in Appendix A of the World Finance handbook we all carry around all day).

Ammo Inc. Update (POWW) – Sparks flying at our special situation

Disclosure: We remain long.

The drama continues since we did our January post. To recap, Ammo owns GunBroker, America’s legal eBay of guns, and also a loss-making ammunition division with a long history. The accounting issues are still not fully resolved, but the announced sale of the ammunition division is moving forward.