Nathan’s Famous Hot Dogs (NASDAQ: NATH) on sale. Get them while they’re hot

A 25-50% offer above the current share price would not be unreasonable and appears like it will happen soon.

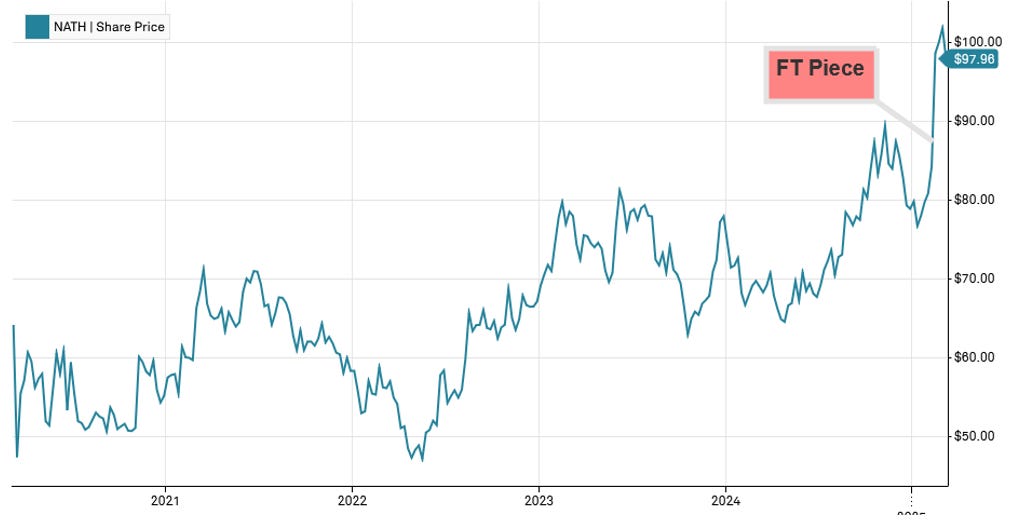

NATH $97/share. Market Cap: ~$400MM. Disclosure: Our newest position. We own this one.

Nathan’s Famous hot dogs started in 1916 and is now the most famous hot dog in the world. It has been steadily growing brand value and cash flows, primarily through its licensing and branded products, while de-levering their balance sheet. It also happens to have a key owner that we think wants to sell and a newly public key partner looking for stable cash flows that can afford to buy. A 25-50% offer above the current share price would not be unreasonable and appears like it could happen soon. Let’s dig in.

With all the Trump and tariff noise, we thought we would bring our readers some comfort food. Know what probably won’t change much under Trump’s Administration? Hot dogs.

I frequently get asked what will change in the next ten years, and while that is an interesting and common one. I almost never get the question what is not going to change in the next ten years. And I submit to you that the second question is actually more important of the two, because you can build a business strategy around the things that are stable in time. For example, in our retail business, we know our customers want low prices, and I know that will still be true ten years from now. They want fast delivery and a vast selection, and it is impossible to imagine a future ten years from now where a customer says, "Jeff, I love Amazon, but I just wish the prices were a little higher," or "I love Amazon, but I just wish you delivered a little more slowly." Impossible. – Jeff Bezos

Table of Contents

Rumours

Nathan’s Famous Business

The Strategic Buyer – Smithfield Foods NASDAQ: SFD

Smithfield Quick History

Smithfield’s Economics

Why Now? Key man Chairman combined with Smithfield’s new mandate of stable cash flow

Background Research – Nathan’s annual hot dog eating contest

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Rumours

Rumours of the sale of Nathan’s first appeared in the Financial Times in February, but we prefer Swineweb’s coverage. What provides the real meat to the story is a part not covered; it is the actions the Chairman and key owner has been taking with his other business interests (See Why Now?) - https://www.swineweb.com/latest-swine-news/nathans-famous-explores-potential-sale-amid-market-changes/

Nathan’s Famous Business

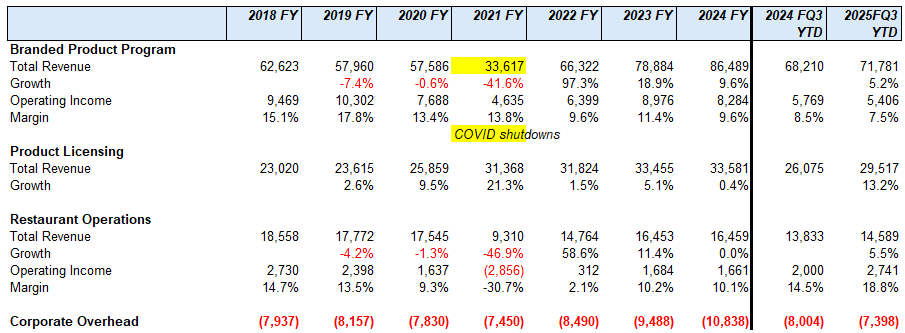

There are three business units, but the real hotdog and bun of the business is product licensing.

Branded Product Program – Revenue is generated from the sale of hot dog products to foodservice operators or distributors who resell to foodservice businesses.

Product Licensing – Earns royalties from licensing Nathan’s Famous branded products such as hot dogs, sausages, and frozen crinkle-cut French fries sold through retail supermarkets, grocery stores, and club stores. This business is largely with one key partner, Smithfield Foods.

Restaurant Operations – Revenue comes from sales at company-owned restaurants and from fees and royalties from franchised restaurants, including virtual kitchens.

The key takeaways are:

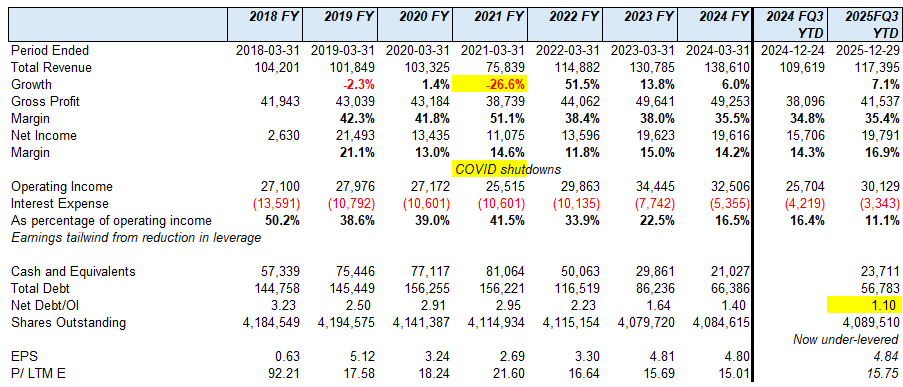

Topline growth has been reasonable and relatively stable (outside of the understandable COVID impact).

Product Licensing is key and there is one very important partner – Smithfield (see next). Branded Products are also important. The Restaurant Operations are largely breakeven, but could be valuable to the right buyer.

The Company has also de-levered over this period and are now under-levered and appear to be preparing for a sale. Leverage was originally due to the Company’s dividend recapitalization in 2015. Another indication is the recent withdrawal of their S&P Credit Rating (S&P B Stable prior to withdraw following the repayment of their rated notes in September 2024).

The Strategic Buyer – Smithfield Foods NASDAQ: SFD

Product Licensing is primarily with Smithfield Foods. Cash flow from the deal is significant and growing.

License royalties increased to $22,412,000 during the twenty-six weeks ended September 29, 2024, (“fiscal 2025 period”), as compared to $19,997,000 during the twenty-six weeks ended September 24, 2023. During the fiscal 2025 period, royalties earned under the retail agreement, including the foodservice program, from Smithfield Foods, Inc., increased 13% to $20,605,000 as compared to $18,303,000 of royalties earned during the twenty-six weeks ended September 24, 2023.

The key is in Nathan’s 2024 Annual Report.

Our licensing revenue and overall profitability is substantially dependent on our agreement with Smithfield Foods, Inc. and the loss or a significant reduction of this revenue would have a material adverse effect on our financial condition and results of operations.

We earned license royalties from Smithfield Foods, Inc. of approximately $30,067,000 in fiscal 2024 and approximately $29,998,000 in fiscal 2023 representing 22% and 23% of total revenues, respectively. As a result of our agreement with Smithfield Foods, Inc. which expires in 2032, we expect that most of our license royalties will be earned from Smithfield Foods, Inc. for the foreseeable future. Accordingly, in the event that (i) Smithfield Foods, Inc. experiences financial or operational difficulties, (ii) there is a disruption or termination of the Smithfield Foods, Inc. agreement or (iii) there is a significant decrease in our license royalties from Smithfield Foods, Inc., it would have a material adverse effect on our business, results of operations and financial condition.

Smithfield is also the main supplier of Nathan’s.

Nathan’s World Famous Beef Hot Dogs are primarily manufactured by Smithfield Foods, Inc. for sale by our Branded Product Program, our restaurant system, and at retail. Smithfield Foods, Inc. and another hot dog manufacturer supply the hot dogs for our Company-owned and franchised restaurants. All hot dogs are manufactured in accordance with Nathan’s recipes, quality standards and proprietary spice formulations. Nathan’s believes that it has reliable sources of supply; however, in the event of any significant disruption in supply, management believes that alternative sources of supply are available.

In addition, the Nathan’s website is actually run by Smithfield and presented as a Smithfield brand - https://nathansfranks.sfdbrands.com/en-us/

Per Smithfield:

In December 2012, we entered into a license agreement with Nathan’s Famous. The agreement expires in March 2032. Pursuant to the agreement, we have the exclusive right and obligation within the United States, Canada and Sam’s Clubs in Mexico (i) to manufacture, distribute, market and sell “Nathan’s Famous” branded hot dogs, sausages and corned beef and certain other ancillary products through retail channel, and (ii) to manufacture and distribute “Nathan’s Famous” branded hot dog and sausage products in bulk for use in the food service industry. The agreement also grants us the non-exclusive right and obligation to supply “Nathan’s Famous” natural casing and skinless hot dogs in bulk for use in the “Nathan’s Famous” restaurant system within the United States and to supply to Nathan’s licensees in foreign territories, where importation is permitted. We pay an agreed royalty rate based on a percentage of net sales, subject to a minimum annual guaranteed royalties in the case of subparagraph (i) above. We do not have any patents, licenses, or franchises, other than the license agreement with Nathan’s Famous, that are material individually or in the aggregate to our business.

We believe that registered and licensed trademarks have been important to the success of our branded fresh pork and packaged meats products. We consider these marks and the accompanying goodwill and customer recognition valuable and material to our business. Our brands are among the leaders across several of the largest packaged meats product categories in the United States.

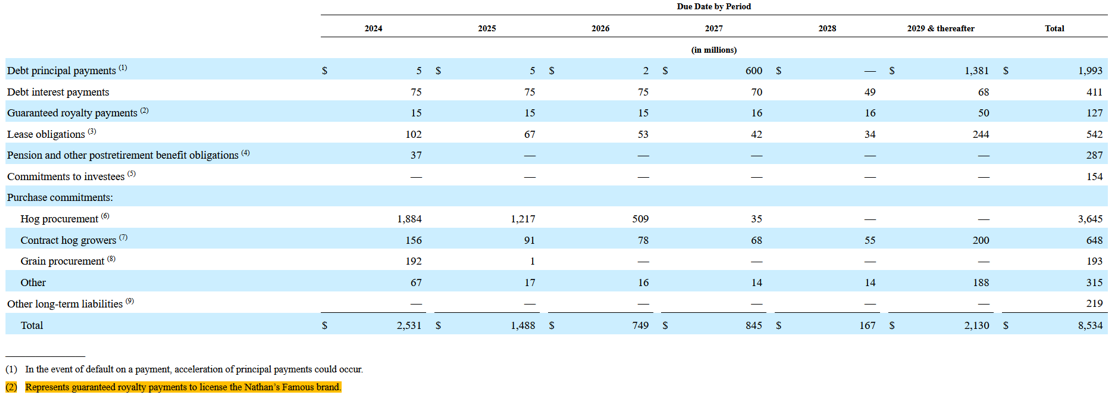

The contract includes minimum payments to Nathan’s of ~$15MM per year.

Smithfield Quick History

History & Corporate Structure

Founded in 1936 in Virginia as The Smithfield Packing Company.

Expanded through acquisitions since the 1980s, becoming the largest fresh pork processor in the U.S..

Acquired in 2013 by WH Group, a Hong Kong-based company, making Smithfield an indirect wholly owned subsidiary.

2024 European Carve-out: Transferred European operations to WH Group, now focusing on the U.S. and Mexico markets.

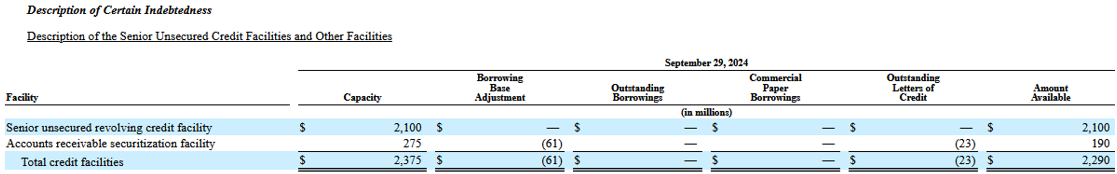

February 2025 – IPO. WH Group retained the majority of their shares and are the controlling shareholder. Market cap ~$8 billion, BBB- credit rating.

Core Business Segments:

Packaged Meats: Value-added processed pork products

Fresh Pork: Raw pork cuts sold domestically and exported

Hog Production: Reducing to improve cost structure.

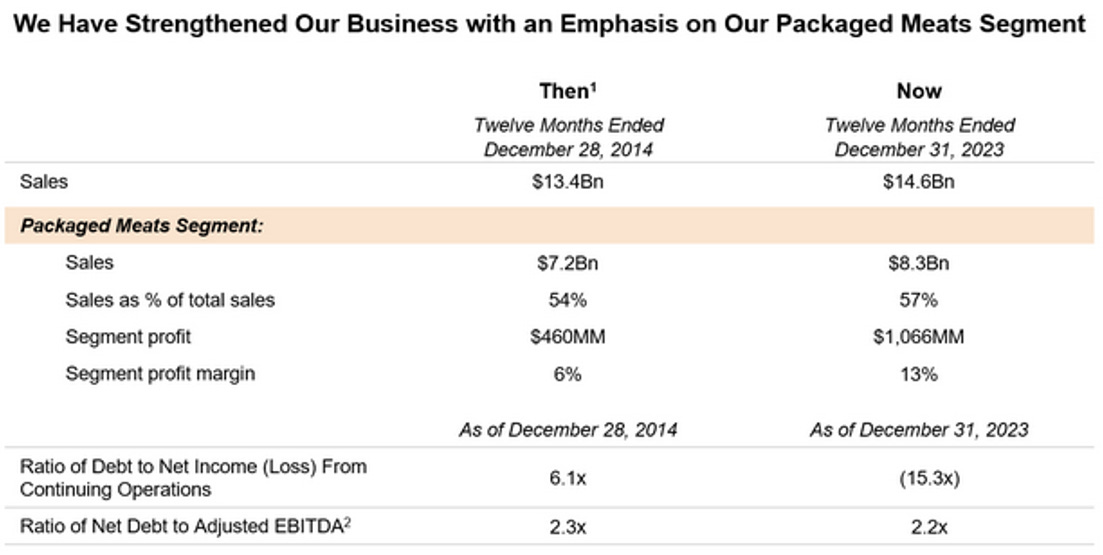

The Company had a bit of a rough patch from an industry-wide hog slowdown/cost inflation issue squeezed everyone. However, things have turned and Smithfield has also structurally improved their business. Smithfield free cash flow for 2025 is forecasted in the $600-800MM range based on estimates we have seen.

Most importantly, the Company’s plans verbatim:

The evolution of our business to value-added products with higher margins supports stronger cash flow generation, which is allocated toward investment in growth and shareholder return. Our capital allocation strategy is focused on:

•Driving top-line growth and achieving operational efficiencies by allocating $400 million to $500 million annually towards capital expenditures.

•Returning excess capital to shareholders in the form of a regular dividend after funding investments in our strategic priorities.

•We initially expect to pay dividends

•Conducting opportunistic and financially disciplined acquisitions, primarily focused on growing our Packaged Meats segment, with assets and capabilities that complement our robust manufacturing platform and strong brands and product offerings.

As part of going public, the thesis was pitched that Smithfield’s steps to reduce volatility from its profits are working as the Company shifts its focus from Hog Production to Packaged Meats while still maintaining some vertical integration. What a great way to emphasize growing stable cash flows by buying the royalty-like business of Nathan’s that you can just keep that margin you were paying to them for yourself?

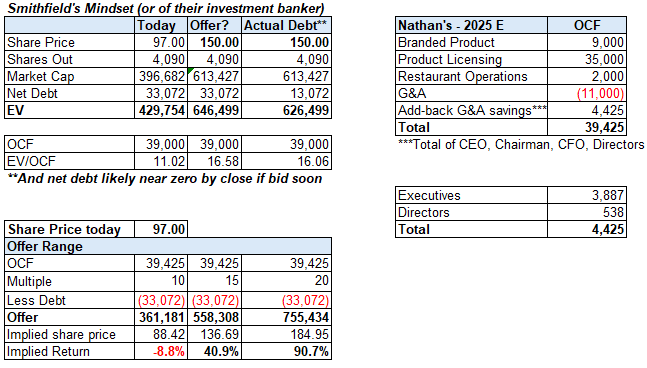

Smithfield’s Economics

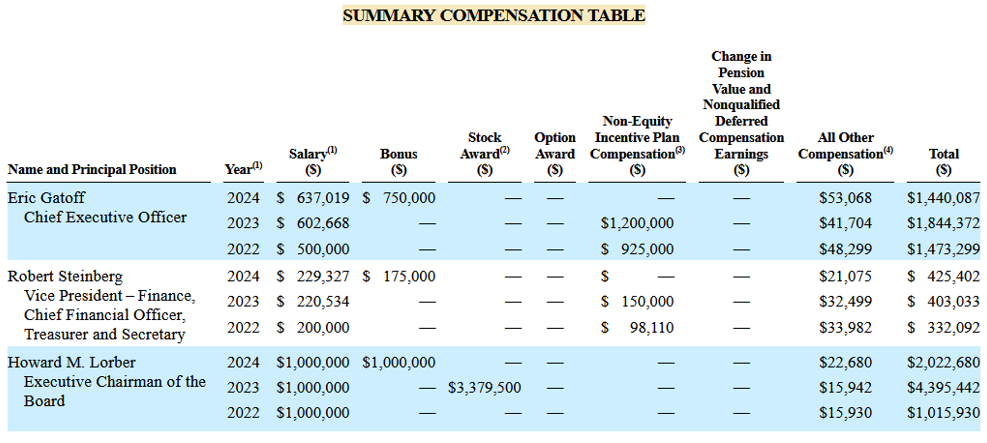

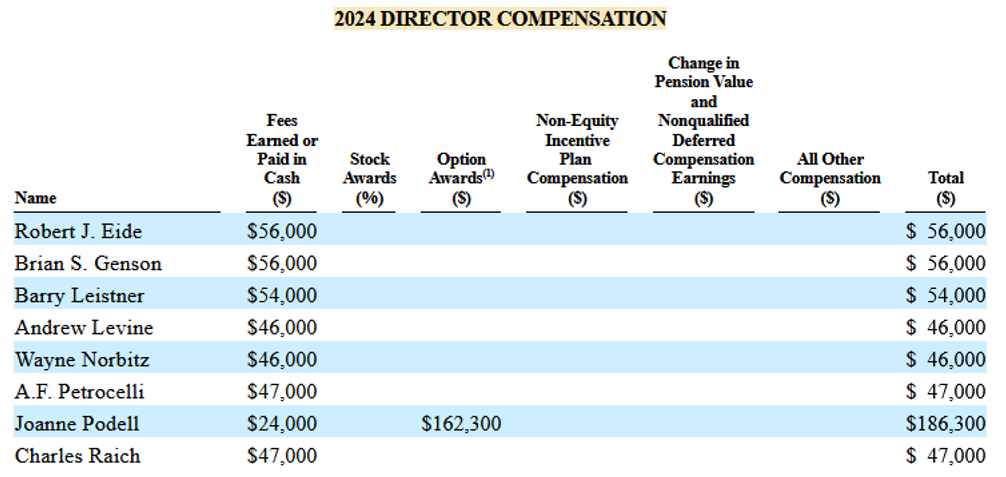

The value to Smithfield is clear. The contract is coming up in a few years, meaning Nathan’s negotiating power is increasing over time. Secondly, if acquired by Smithfield, Smithfield gets to save the licensing fees they were paying while gaining full control of the brand. If valuing just the licensing fees they would be paying a reasonable multiple, never mind the Branded Product, Restaurant Operations, and G&A savings. Executives and Board compensation is ~$4.5MM a year.

A particularly interesting scenario could be a stock component/issuance of Smithfield shares, providing capital while also creating liquidity to Smithfield’s stock, which is still largely privately held by their key owner. Smithfield itself seems reasonably valued and might be interesting in and of itself. An analysis for another day.

What is important is there appears to be a catalyst.

Why Now? Key man Chairman combined with Smithfield’s new mandate of stable cash flow

What will likely drive the sale now is the long-time key owner, Howard Lorber, Executive Chairman and ~25% owner of Nathan’s involved since the 1990s. He is 76 and has been stepping back and selling off other interests, most importantly:

Sold Vector Group to JT Group in August 2024. He was CEO and 4.25% owner involved since 2001, a key insider, and it was acquired for $2.4B = ~$100MM. The offer was ~30% above the 60-day moving average. https://vectorgroupltd.gcs-web.com/news-releases/news-release-details/vector-group-announces-agreement-be-acquired-jt-group

Retired from Douglas Elliman NYSE:DOUG (real estate) Chairman role in October 2024 and was actively selling shares at the end of last year. There are some allegations around Mr. Lorber’s personal behaviour that might have been a factor.

Nathan’s is in a position of strength to negotiate with growing sales, a strong balance sheet, and the clock ticking on its key licensing contract. As for Smithfield, the acquisition fully aligns with their mandate of focusing on more stable and higher margin parts of their business at a time when they have the resources to make a deal.

Or maybe a competitor or PE firm will come along and eat Smithfield’s lunch.

Background Research – Nathan’s annual hot dog eating contest

How many hot dogs does it take to be the world champion? No spoilers (see 8:45).