Leon’s Furniture TSX:LNF – Every lot is for sale, but the real story is about capital allocation

Disclosure: We own this one.

Leon’s is a fixture in the Canadian furniture market. The Leon’s brand has existed for over 100 years (since 1909 to be exact) and they were arguably the first to bring big box retailing to Canada at scale. They continued to grow until 2013 when they made a bet the farm acquisition of ~$700MM on The Brick (a successful competitor started in 1971) that actually had more stores than they did.

After the acquisition, they began to de-lever and now total debt approximates cash and while they reduced their share count by 14% over the past few years. Now they have $3 billion in system-wide sales (including franchises), warranty and insurance sales, and likely a bit more than a billion of real estate at fair value held on the books for ~$250MM. And they have announced that they plan to unlock the value of these significant real estate holdings. Interested?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

“This is like when Canadian Tire spun off their real estate” some might say, especially since Leon’s President and CEO Michael Walsh, and CFO Victor Diab both spent time at Canadian Tire. However, we think the situation is a lot more interesting than a simple real estate multiple play. But first, what did Canadian Tire actually do?

The Canadian Tire Spinoff

The formal announcement was on May 09, 2013:

Canadian Tire will create a $3.5-billion real estate investment trust to unlock the value of its property holdings, with an initial public offering expected later this year.

Canadian Tire says the properties, totalling about 18 million square feet, have an approximate market value of $3.5 billion.

"We are executing a strategy that reinforces the strength of our company while pursuing new growth opportunities organically and through acquisition," president and CEO Stephen Wetmore said in a statement.

"Today's announcement regarding a REIT would increase CTC's financial flexibility, providing us with the ability to access funds at an attractive cost of capital as we continue to invest in and grow our business."

…

CTC would retain a significant ownership interest of 80 to 90 per cent of the REIT with the remainder of the REIT's units offered to the public via an initial public offering anticipated in the fall.

On October 23, 2013 the transaction closed:

TORONTO, Oct. 23, 2013 /CNW/ - Canadian Tire Corporation, Limited ("Canadian Tire" or the "Company") (TSX: CTC) (TSX: CTC.a) announced today that CT Real Estate Investment Trust ("CT REIT") (TSX: CRT.UN) has completed a $263.5 million initial public offering of trust units (the "Units"). In connection with the closing of the initial public offering, Canadian Tire sold a portfolio of 256 properties (the "Portfolio of Properties") indirectly to CT REIT for a total purchase price of approximately $3.5 billion.

At closing, Canadian Tire holds an approximate 85.0% effective interest in CT REIT (and will hold an approximate 83.1% effective interest if the over-allotment is exercised in full) on a fully diluted basis through ownership of 59,711,094 Units and all of the Class B limited partnership units of CT REIT Limited Partnership (the "Partnership"), which are economically equivalent to and exchangeable for Units. In addition, Canadian Tire holds all of the outstanding Class C limited partnership units of the Partnership.

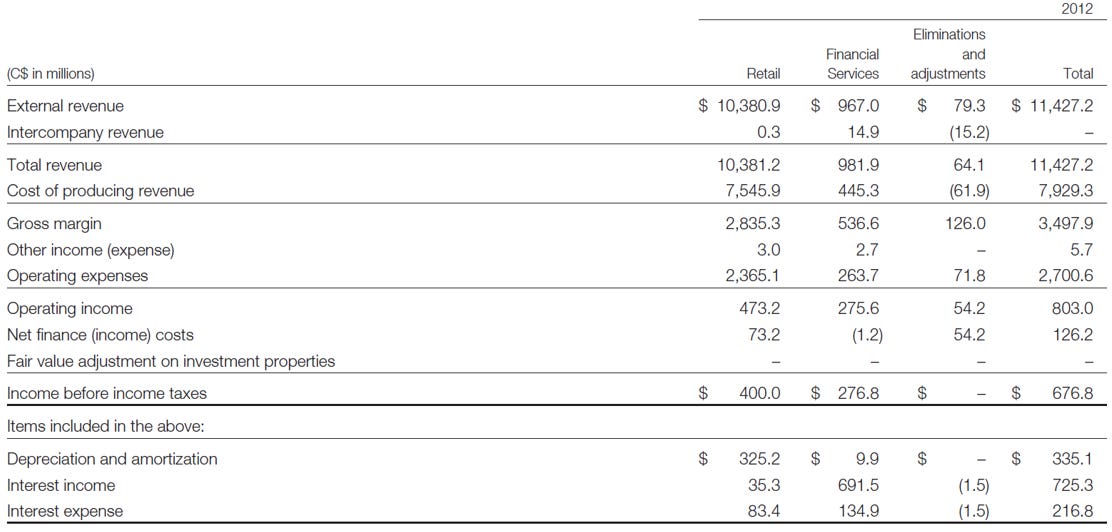

Here is the last full year before the split out (2012) vs the first full year after (2014), with it having limited immediate financial impact given the structure. It did provide some opportunities for development – “During 2014, CT REIT completed 13 property acquisitions (including seven purchases from CTC, or “vend-ins”), six intensifications, two development land acquisitions, and two developments, all of which comprise approximately 1.5 million additional square feet of gross leasable area.”

Since the transaction, Canadian Tire has performed reasonably well. If you had continued to hold the stock since the date of closing, you would have received about $45 in dividends to-date and another $60 in share price appreciation for an IRR of about 8%. We think that they have faced Canadian Tire-specific operational issues, but that is for another post.

CT REIT Valuation

As for valuation of their assets (which are not just Canadian Tire properties), the current fair value assumptions per their financials are as follows (effectively a ~7% cap rate). The implied market derived cap rate is similar. https://www.ctreit.com/English/properties/default.aspx

For those curious, another example not covered is Loblaw’s (TSX:L) spin out of their real estate in 2013 (Choice Properties, TSX:CHP.UN).

The Leon’s Story

Although the store count has stayed relatively stable since the acquisition, they have done a lot under the hood focusing on Leon’s/Brick integration, including implementing a company wide sales system in 2016 and consolidating distribution (including a new B.C. distribution center in 2017 supporting both brands) among other initiatives.

Their other levers

They have done a good job of building out their repair and warranty/insurance businesses. The warranty business has served as a source of float, and can continue to do so (particularly if warranty sales are growing). However, if improperly priced this could create a very real future liability. The track record seems good, but this needs to be monitored. They now break out insurance (see Additional notes – Warranty/Insurance for detail).

Their repair division Trans Global Services (“TGS”) is their growing in-house repair company that also supports some manufacturers as well now. The original creation of business was driven by The Brick per their 2013 AR.

The acquisition of The Brick has also given us the opportunity to improve the way we provide warranty service to our customers. While Leon’s warranty work was previously outsourced, we now own a separate service company that is generating profit by handling the service work of our combined operations as well as third-party clients.

The goal is to create a better more comprehensive service for their customers, increasing loyalty and the value of each sale. Management provided good context at a recent conference.

I mean, for people that don't understand what we've done over the years, it's interesting to kind of go back and say everything that we've done within our ecosystem has been to facilitate more of a sale to a customer that wants to buy product. So you come in, you buy an appliance, you want installation. We can do that. You want warranty, we can do that. You want to finance that, we can do that. You want to protect the financing in terms of credit insurance. We can do that. We can deliver it with our own people and make sure that it's a good experience.

Once you get to a sizable amount in terms of scale across that ecosystem, in order to reduce your cost, you have to look at how do you monetize those assets in other ways. And that's what we've done with our insurance business. The deals that we've struck with our retail financing partner, Flexiti Financial, that's currently owned by Questrade, is a prime example of that. You know, we offer our insurance, credit insurance to them as a white label. Our warranty business is is very, very well-executed internally. We're going to be turning that into a third-party business and offering that could be sold to other retailers.

…

We [have] boots on the ground in Asia. And so think of it in terms of quality control. We go direct to the factories. We don't use a middleman. In most cases we use First Oceans. And so they're literally in a factory when the it comes off, they're sitting in it. So instead of most companies have to send samples back and forth from Canada to Asia, we have somebody that is there that knows exactly what the buyer wants. And it gives us great opportunity in the future to turn that into somewhat of a design centre and expand it. So, I think it gives us a competitive advantage, and for sure it did during the pandemic.

The real estate

The real estate portfolio was first really brought to attention in their 2017 annual report, specifically point #5… the last point.

REAL ESTATE. Many of our stores in our retail network occupy company-owned commercial real estate that are situated in the heart of Canada’s largest and fastest growing metropolitan areas. This 4.2 million square foot real estate portfolio is carried on Leon’s balance sheet at historical cost. Over the past year, we have been working with industry consultants to more accurately determine the market value of our real estate, identify the most promising development opportunities and evaluate different scenarios for value creation.

In 2018 it received a bold header.

REAL ESTATE

At the end of 2018, LFL Group owned a commercial real estate portfolio of 4.2 million square feet, most of it located in the heart of Canada’s largest and fastest growing communities. While this portfolio is carried on Leon’s balance sheet at historical cost, we are fully aware that it represents billions of dollars in potential residential and mixed-use development. Over the past year, we have continued to assess properties for their potential and explore opportunities with prospective development and investment partners to monetize the value of our real estate portfolio. One such property, the 40-acre site that is home to our head office and showroom in west Toronto, has been an obvious focal point in our considerations. This is a deliberate process with many facets, including necessary approvals, but we look forward to sharing any news on this front when the time is appropriate.

Finally, it was formally announced on November 8, 2023. “LFL's Board of Directors approved the Company's resolution to create a Real Estate Investment Trust (REIT) via initial public offering (IPO). The timing is subject to prevailing market conditions and receipt of required regulatory approvals.”

Today you are a bit late to the party, but we do not think the party is over.

They have built quite the real estate book:

The Company’s total owned and leased real estate portfolio consists of 12.2M square feet. 5.6M square feet is owned real estate including the full square footage in two Distribution Centre properties that are held at 50% ownership interest. The Company’s owned real estate is comprised of mixed-use retail and industrial space. The company’s industrial space is substantial including a mix of Distribution Centers and large warehouses attached to retail stores. The owned portfolio is diversified across Canada with Ontario representing 41% of the total square footage, Alberta 27% and British Columbia and Quebec at approximately 9% each. The Greater Toronto Area represents 22%.

In aggregate, the Company’s owned portfolio of retail stores, warehouses and distribution centres sit on a total of 430 acres of land, which includes a significant amount of excess and undeveloped land. In the first quarter of 2024, the company announced a 40 Acre High Density Mixed-Use Development in Toronto at the Crossroads of Highways 401 and 400 as part of its multi-pronged strategy to unlock the value of its substantial real estate holdings.

LFL Group’s Board of Directors also approved the Company’s resolution to create a Real Estate Investment Trust (REIT) via initial public offering (IPO). The timing is subject to prevailing market conditions and receipt of required regulatory approvals.

They expanded on this in March:

Traditionally we've purchased land in areas that have developed into industrial nodes. Everybody knows the value that has been ascribed to industrial properties these days and rents. So I would say that, you know, in order for us to be in a position to feel that a window opens up, that would be predicated on a different rate environment. And to see a bit of a closure between discount to NAV as it relates to the industrial assets that we have. But it's definitely something that we're viewing in the short term rather than the medium term.

Given their store count and expected cap rate for those properties combined with the development opportunities, it is quite possible, if not likely, that the real estate portfolio is worth in excess of a billion dollars, while the business itself trades at a reasonable price. For context, Sleep Country Canada was just acquired by Fairfax Financial for ~17x earnings or ~9x EBITDA, well in excess of Leon’s and without a real estate portfolio like Leon’s.

However, we think this is missing the point and this is more than a short-term trade. The real question is what will they do with capital in general?

Capital allocation is key

We note that the CEO, Michael Walsh, was appointed in 2021 and is the first non-family member to run the business. This is still a Leon’s family party though, with ~66% ownership.

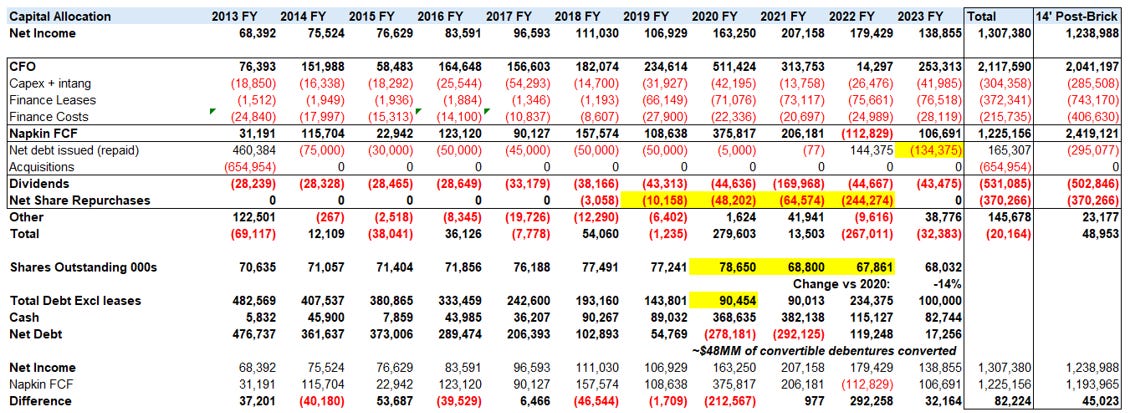

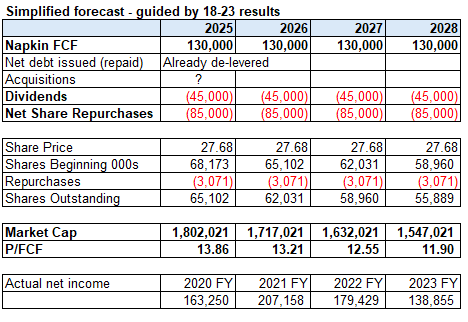

However, they have been good stewards of capital. Since the acquisition of The Brick (see Additional notes - Brick transaction background: Betting the farm) they have done a very good job of repaying debt while also buying back shares. They also navigated a very volatile COVID period and managed to avoid excess/mismatched inventory issues, unlike some competitors. As we noted above, they have net debt of effectively zero today while having reduced share count by ~14%.

Back in March 2024 they said:

If you look back over the last decade, our focus has been integrating the Brick acquisition that we did in 2013 that has allowed us to generate a significant amount of cash flow from operations to the tune, where over the last decade, I would say that we've returned in aggregate close to one billion between special dividends, repurchases of shares and regular dividend.

We constantly look at making sure that whatever money we do have, there's a place for us to reinvest in the business. And there's really only a few options for us; it's either buyback our shares, invest in the business, pay a special dividend or increase the regular dividend. So we've done quite a bit in all areas as we continue to build out our DC footprint, we've added close to about just over about a 1 million square feet of DC space between what we built in Vancouver currently what's being built in Edmonton and what we built on the East Coast and Dartmouth, Nova Scotia. So that in itself is a big lift for us to be able to fund from operations. So the ideal amount of leverage is dependent on the opportunity that's in front of us.

So if we need to increase our square footage and we need to take on some debt, we'll do that. Luckily, we've been able to fund everything from operations. When we bought The Brick, we took on close to CAD 500 million worth of debt, paid that down rapidly. Even though we came out of the gate with 4.5 turns. Today our balance sheet after last year paying down about CAD 135 million in debt that we took on to do our SIB where we eliminated about 9 million shares.

I think it's getting pretty clear that our balance sheet is getting to a position where we can do a lot of different things. And that's exactly where we want it to be because we have flexibility to intensify our real estate development, look at potential acquisitions as well as increase the regular dividend depending on how operations go going into 2024.

What about another Brick-like acquisition?

Unfortunately, the scale in Canada doesn't afford us the opportunity to redo the Brick at the level that we did in 2013. But I think there's still tremendous opportunity in Canada to grow organically because our business is predicated on a fragmented industry. You have a lot of independents, a lot of retailers that have built sizable businesses in their regions that we constantly compete with on a day-to-day basis. And when you think about the fact that we're number one in furniture, number one in appliances, number two in mattresses, and we're still sub 20% of the market, you can see how much more organic growth we can actually achieve. And that's the balance. It's do you focus on organic growth where you have immediate increases in profitability because same store sales go up? Or do you look at acquisitions where there's not as much of a fast payback, but is strategic in terms of increasing the footprint for future growth? So that's what we're constantly weighing against.

As Charlie Munger used to say, always invert. What happens if they do nothing?

Even without any growth, no real estate angle, or acquisition, they could do just fine through continued repurchases. But they do have excellent real estate with a lot of optionality and a pristine balance sheet. In fact, we would actually prefer they were less vocal about the real estate. The quiet sale of a few existing properties and a development or two with proceeds used for repurchases could have been quite the coup for patient shareholders. But at least the benefit of the approach they are taking is that they are transparent and appear to be thoughtful of minority shareholders.

With interest dropping, the timing appears to be right to finally unlock the value of their real estate. Instead of getting caught up in analyzing a short-term multiple play though, we plan to give them a chance to execute.

Note: 2017 and 2020 included conversion of debentures that were issued as part of The Brick transaction.

On March 28, 2013 (the “Issuance Date”), the Company closed an offering in which the shareholders of The Brick purchased $100,000 principal amount of 3% convertible unsecured debentures due on March 28, 2023

…

During the year ended December 31, 2017, a portion of the convertible debentures with a stated value of $49,858,000 was converted to 3,945,113 common shares, at the holder’s option

…

During the year ended December 31, 2020, convertible debentures with a stated value of $49,583 were converted to 3,924,426 common shares, at the holder’s option.

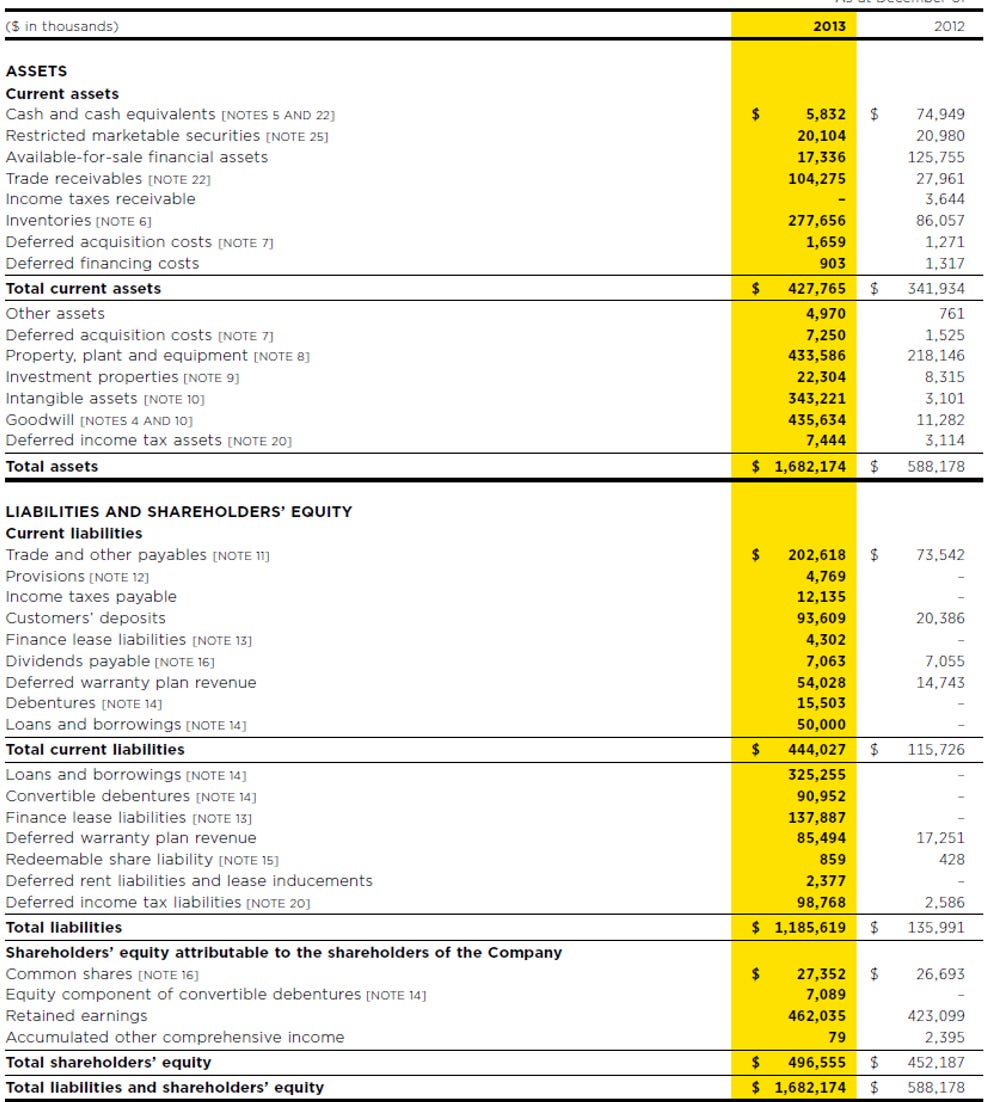

Additional notes - Brick transaction background: Betting the farm

The transaction:

Leon’s acquisition of The Brick in March 2013 marked the latest step in a journey that began 105 years ago. It was then that a poor but industrious Lebanese immigrant named Ablan Leon opened a small dry goods store on King Street in Welland, Ontario and founded the A. Leon Company. As the business prospered, Ablan and his wife Lena went on to raise 11 children who all took part in running the store. In the decades that have passed since then, Leon’s has become a true Canadian success story. Following the death of Ablan in 1942, son Lewie began his tenure as President and CEO of the company. He was a natural leader whose vision and energy fuelled Leon’s rapid expansion across Ontario and the rest of the country. Lewie was succeeded by another outstanding President and CEO—Ablan’s son Tom Leon—who had the foresight to introduce “big-box” retailing to Canada in 1973 and create the Franchise division in the early 1980s to accelerate Leon’s growth.

The Brick - Founded in 1971 as a single store in Edmonton, Alberta, in 1982, The Brick opened stores in Calgary and Fort McMurray and two years later began its expansion across Canada with two new stores in the Toronto market. By 1999, the first of The Brick’s franchise stores opened in Hinton, Alberta. In the years that followed, The Brick would go on to purchase United Furniture Warehouse and Midnorthern Appliance, and ultimately create a retail store network with 231 locations across the country.

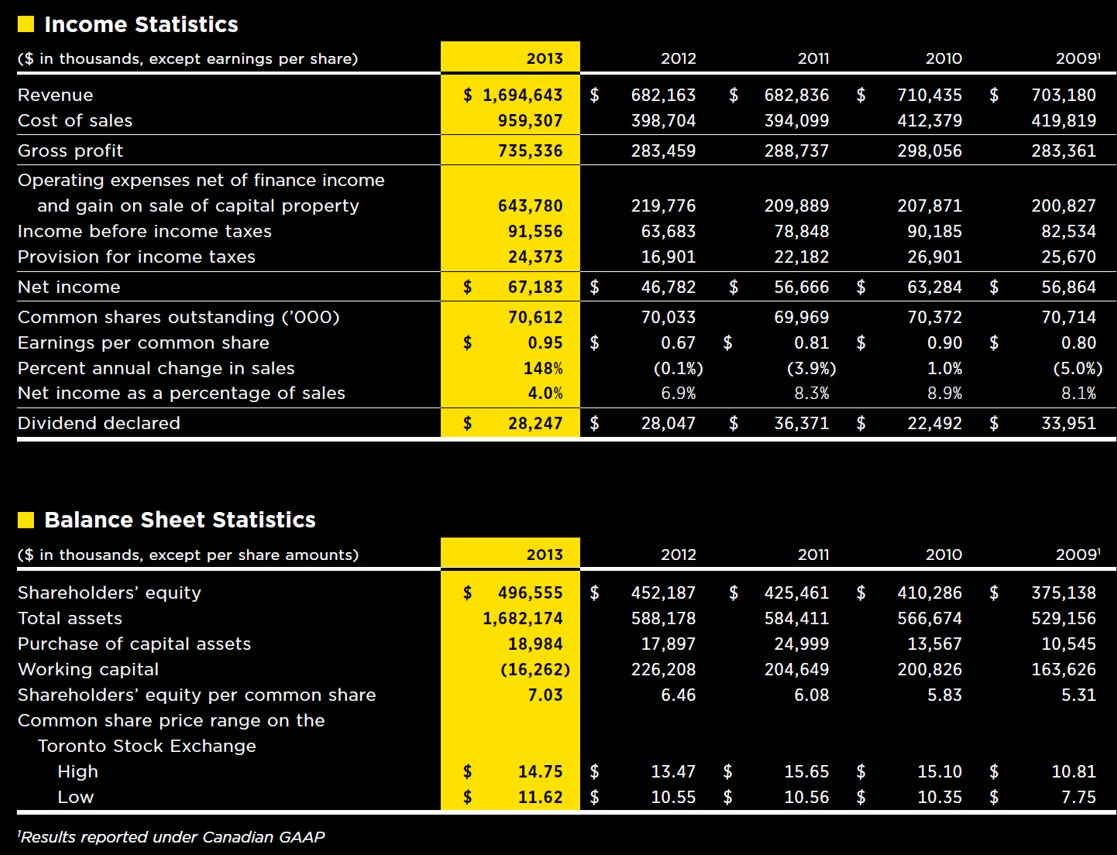

Betting the farm indeed. Pre and post-acquisition performance.

Additional notes – Warranty/Insurance

The disclosure changed in 2023 to break out insurance vs warranties, with 2022 restated.