Is Koninklijke Philips (NYSE:PHG, AS:PHIA) a wonderful Christmas gift, or a lump of coal?

Disclaimer: One of us owns this at an average cost of US$14.98. We always note that you should do your own due diligence and that this is not financial advice. Given the complex legal issues with this particular company, we reemphasize this and advise an abundance of caution. Actual performance could differ significantly from historical results and the outcome from the CPAP recall discussed below could be significantly worse than the scenarios contemplated.

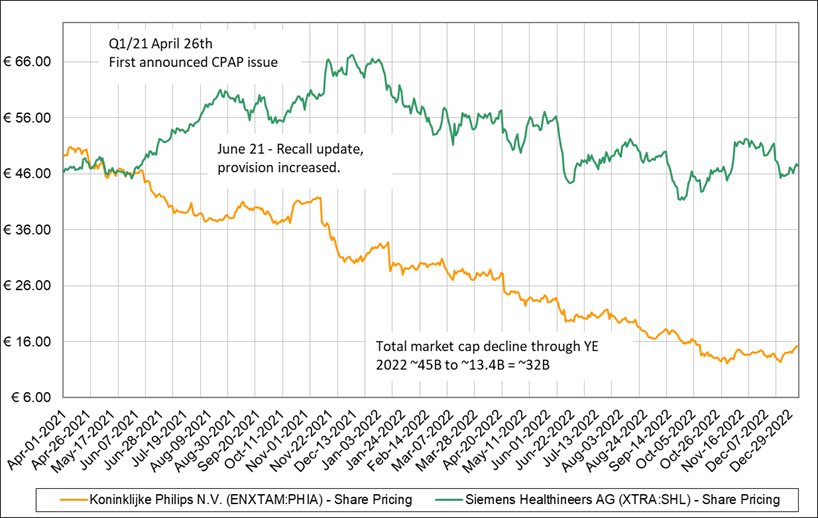

What a stock chart. Philips is a name that you are bound to know. What you might not know is that they are in the middle of a major recall of their sleep apnea CPAP machines and their stock has declined dramatically due to potential ranges of the final total costs, compounded by ongoing supply chain disruptions affecting the whole business. We think Philips is trading at a great value, even under a bearish scenario, and could be considered a bargain purchase in a few years.

Our thesis:

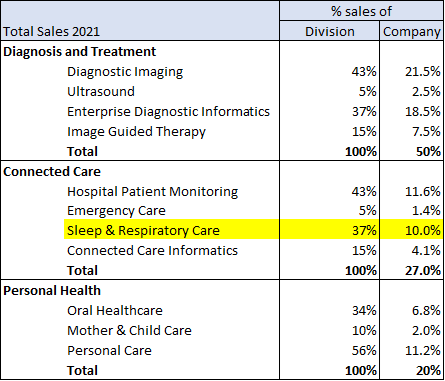

Philips just finished a decade-long refocusing of their business, transitioning from a diverse conglomerate to a focused healthcare company, only to be hit with a massive recall problem in their sleep apnea CPAP machines (part of the Connect Care business unit).

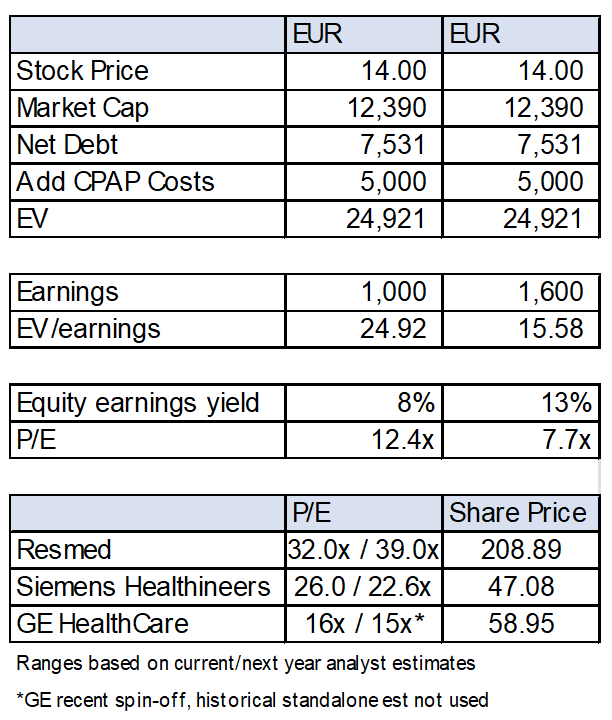

The CPAP recall is a real serious problem with potentially very significant legal liabilities. The stock has declined materially since the initial announcement, with the market cap declining from EUR 45 billion (~EUR 50/share) to EUR 13.4 billion (EUR ~15/share) at time of writing, with the decline being driven by relative concerns of Philips rather than the industry segment as a whole.

However, even in a reasonably bad scenario, Philips remains cheap. Secondly, the recall is unlikely to materially affect customer perception of other product lines, while Connect Care is material but still only 10% of Philips revenue. It also seems that the worst-case scenario for the recall is unlikely.

The New Philips

To shorten a very long story, Philips is the Dutch General Electric (funny enough, GE just spun off its healthcare business - GE HealthCare Technologies Inc NASDAQ:GEHC). Philips made MRI machines, lightbulbs, deep fryers, televisions, and even helped get Taiwan Semiconductor (covered by us in a previous article) started. However, unlike GE, they never got into disastrous highly leveraged lending backed by short-term financing. As a side note, we highly recommend the book Lights Out: Pride, Delusion, and the Fall of General Electric.

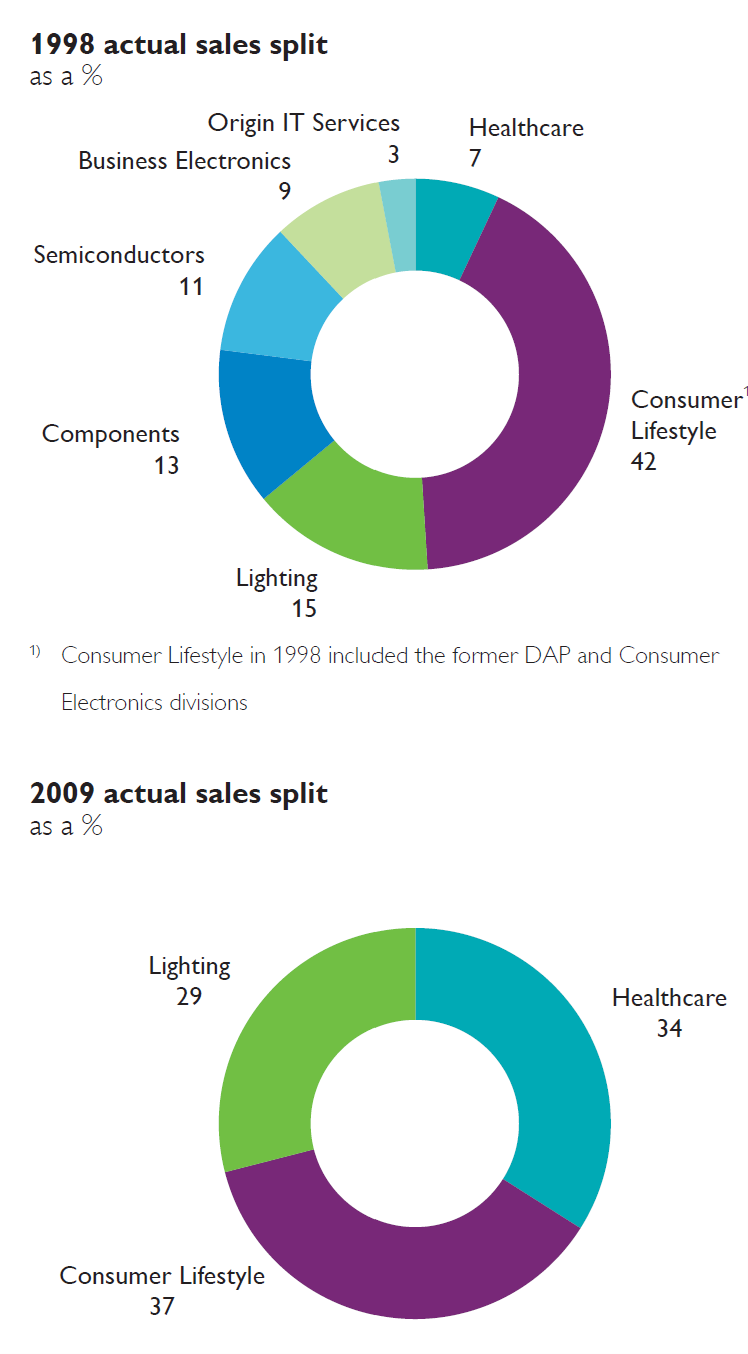

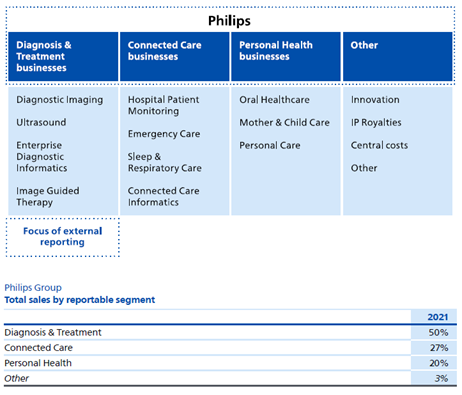

To quickly explain, here is the sales split before (1998), part way (2009) and now today.

Reading through their annual reports back to the early 2000s was a fun exercise. Much like World War Two, you know the ending, but how did they get there?

In the case of Philips, they continually “sharpened their strategic focus”, selling off divisions while building up the remaining. They sold a number of divisions by the late 2010s and were left with three “core” businesses.

However, they then decided to continue.

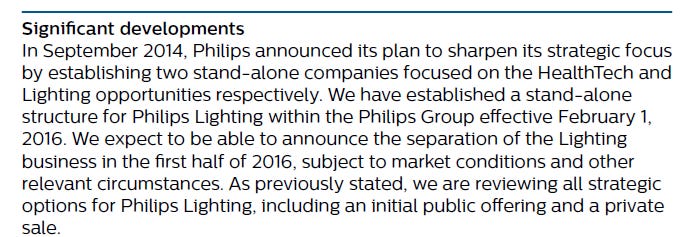

In 2014, Philips announced its plan to sharpen its strategic focus by establishing two standalone companies focused on the HealthTech and Lighting opportunities respectively. After establishing a standalone structure for the lighting activities within the Philips Group, Philips Lighting (renamed Signify in 2018) was listed and started trading on Euronext in Amsterdam under the symbol ‘LIGHT’ on May 27, 2016. Through a series of Accelerated bookbuild offerings (in total five) and open market sales in the course of 2017, 2018 and 2019, Philips’ shareholding was reduced to nil in September 2019.

Philips then went on to dispose of its appliance business, and (in our view)

Philips today – this isn’t your mom’s Dutch Stroopwafel

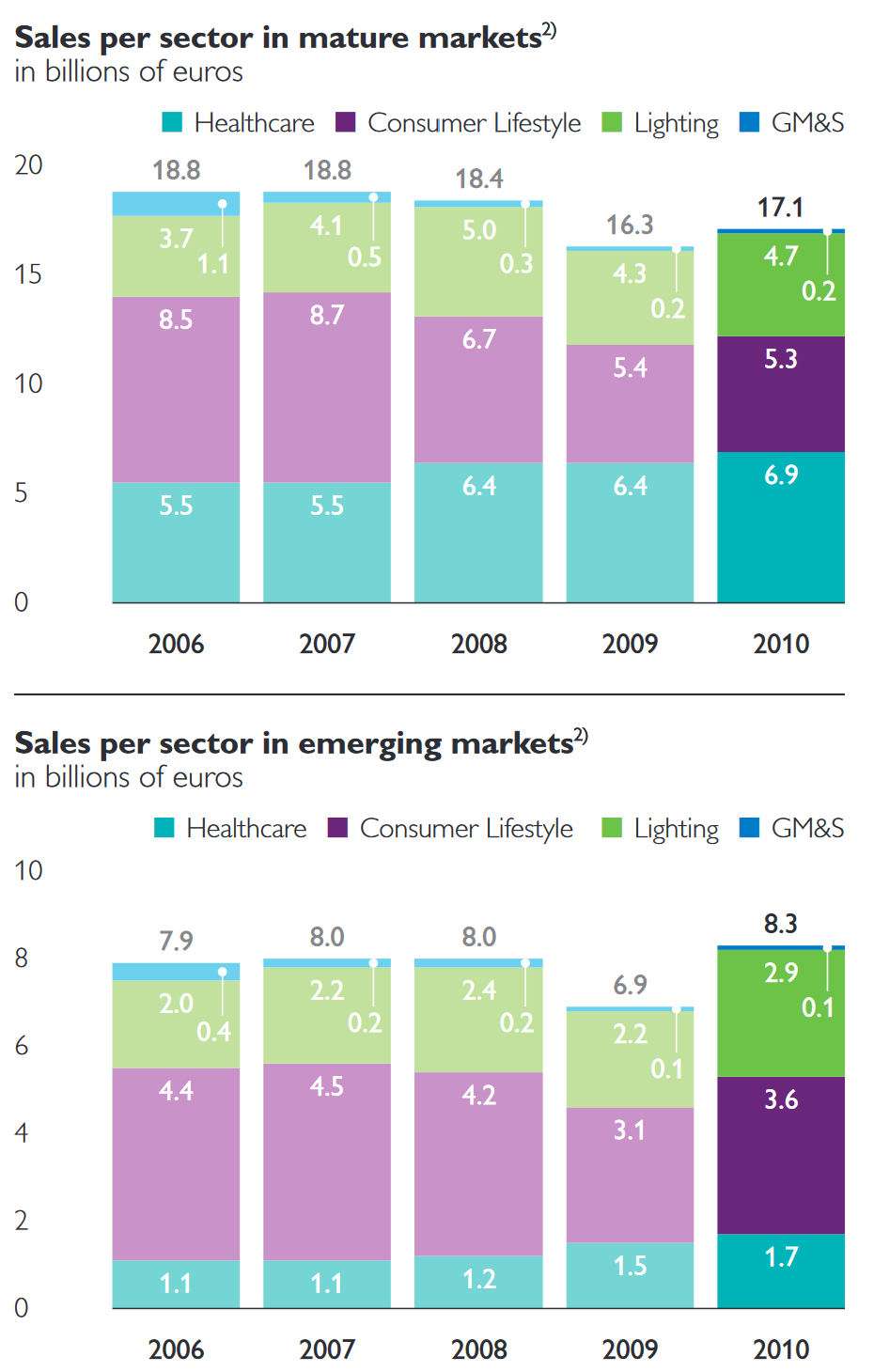

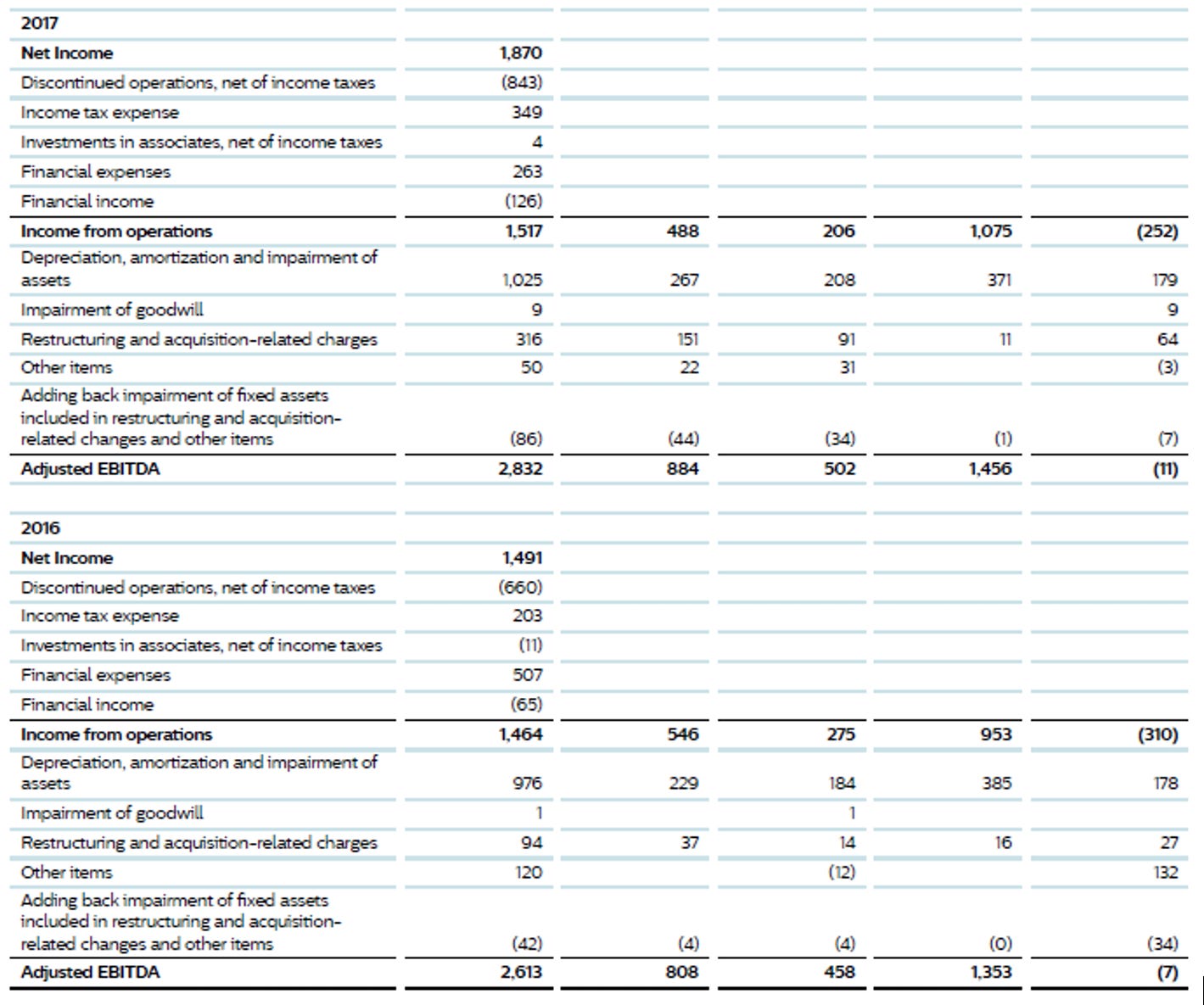

We argue that Philips’ retained healthcare assets are a relatively good business. For context, here is their performance back in the financial crisis.

Philips today.

One sidenote that is particularly interesting is that Philips was one of the original investors in TSMC.

https://semiwiki.com/semiconductor-manufacturers/tsmc/1539-a-brief-history-of-tsmc/

They did well on the sales of their interests (staggered process), but if they kept the originally owned 28% of TSMC, it would be worth about $100 billion today, dwarfing the remaining Philips healthcare business.

Along the way they were making relatively meaningful repurchases while maintaining low leverage. Share count went from 956MM in 2017 to 879.4MM in July 2022, a decline of 8%, and significantly below 2005 at ~1,300MM.

On January 29, 2019, Philips announced a EUR 1.5 billion share buyback program for capital reduction purposes. Approximately half of the program was executed through open market purchases during 2019 and the first quarter of 2020. The other half was executed through individual forward contracts. The last settlement under such contracts took place in December 2021 and the program was completed.

On July 26, 2021, Philips announced a new EUR 1.5 billion share buyback program for capital reduction purposes. Philips entered into a number of forward transactions in the third quarter, covering approximately half of the program, with settlement dates in 2022, 2023 and 2024. The remainder of the program was executed through open market purchases taking place in Q4 2021 and Q1 2022. [The forward purchase program is interesting, and is actually considered debt in their financial statements]

Philips is no longer saving the world via their airfryers (2013 annual report).

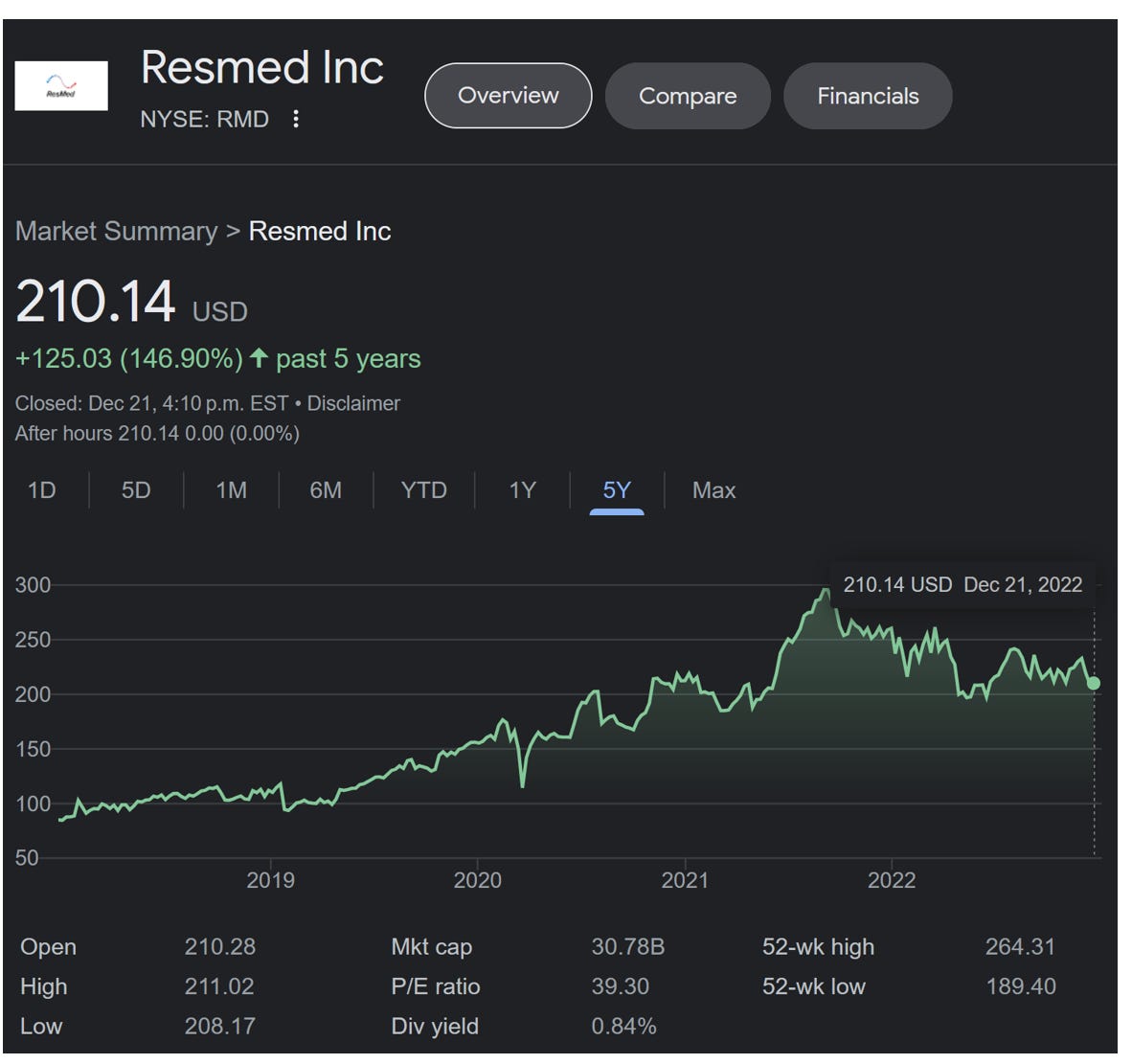

Philips’ remaining healthcare-focused divisions provide products and services to hospitals (e.g. MRI machines, healthcare providers (CPAP machines for sleep apnea that are then sold to individuals as part of care), and oral health (Philips Sonicare). Certain product lines are oligopolies, with market share controlled by a few key players and often have high switching costs. The best example is their imaging business. Philips focuses on higher end MRI/CT scanners that require significant capital costs and staff training, making switching difficult. Philips competes with Siemens and GE. CPAP machines worldwide are dominated (80%) by Philips and ResMed (with ResMed being in the lead).

CPAP Problems

For not familiar, “sleep apnea is a potentially serious sleep disorder in which breathing repeatedly stops and starts.” https://www.mayoclinic.org/diseases-conditions/sleep-apnea/symptoms-causes/syc-20377631 The most popular form of treatment is CPAP (continuous positive airway pressure) machine and mask worn while the person sleeps. The two most popular brands are ResMed followed by Philips.

Showtime – we recommend Goliath on Amazon Prime starring Billy Bob Thornton. His character, a brilliant but heavy drinking lawyer, suffers from sleep apnea. This is not a key plot point.

In April 2021 Philips disclosed that sound abatement foam in certain CPAP models was at risk of breaking down (i.e. disintegrating) and could potentially cause serious health problems. The stock chart below compares Philips to Siemens Healthineers, their most relevant public comparable.

They then expanded the recall.

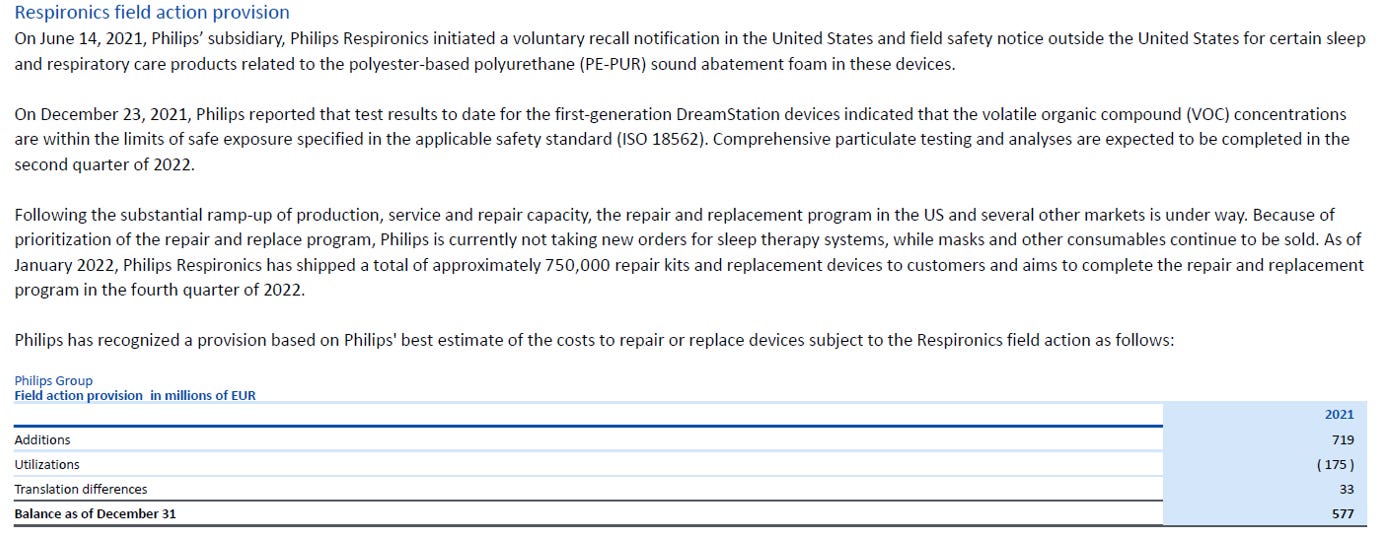

Following a comprehensive patient and customer outreach program, Philips Respironics expanded the eligibility of certain older devices in the interest of patients and in alignment with the relevant competent authorities. Consequently, Philips Respironics now expects to remediate a total of around 5.2 million registered devices globally and is increasing the field call provision by around EUR 225 million, mainly due to this higher volume of units now requiring remediation and increased supply cost to do that.

The full FDA recall can be found here.

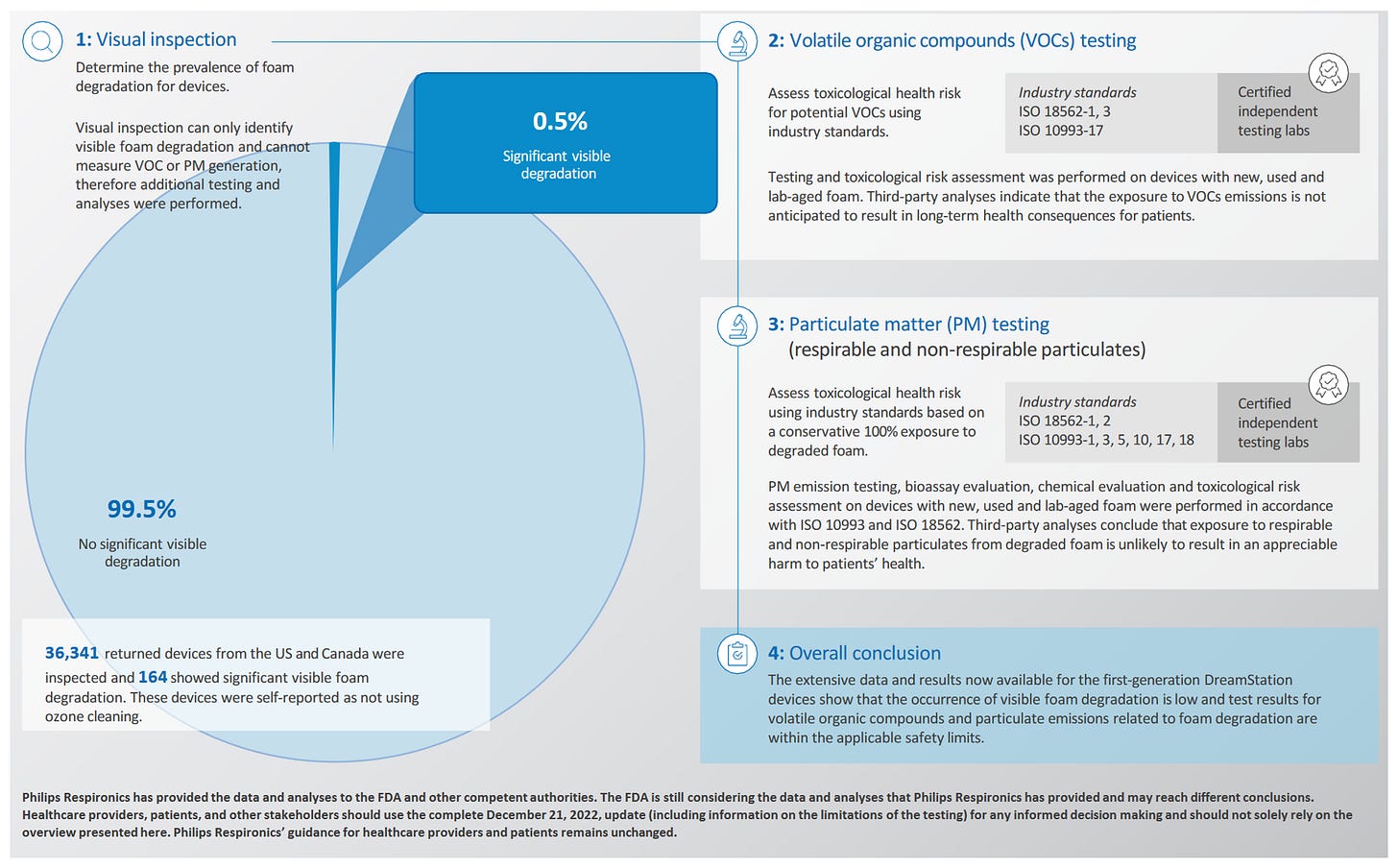

The foam used in the DreamStation 1 (the most numerous product unit affected) was an FDA approved product and supplied by a third-party manufacturer and also used by other companies. It appeared early on that the breakdown in the foam is partly driven by some users themselves, using ozone to clean (a non-FDA approved cleaning process) their masks.

The list of issues is indeed scary and overall, the issue seems similar to what Bayer had with Roundup, namely risk of additional future cases/lawsuits, potential cancer resulting in high settlement costs, and connection/causation proof is challenging for claimants. Background on Bayer can be found here - https://www.lawsuit-information-center.com/roundup-mdl-judge-question-10-billion-settlement-proposal.html We note that Roundup first came to market since 1974.

The ambulance chasers arrive

You can find many law firms seeking to help their clients with this issue, such as this firm’s website complete with stock-ticker-like update of lawsuit wins.

https://www.chaliklaw.com/philips-cpap/what-are-the-chances-of-getting-cancer-from-cpap/

As part of our research, we spoke with clinics and doctors, as well as finding some expert calls/interviews. Here are the highlights from our notes. This research was done prior to Philips’ update on December 23, 2022 (discussed below). We have also gone through their call transcripts for relevant information and are including as a separate file given the length. Key points below.

Clinics/Doctors Highlights

When calling one clinic, they had an automated message “if you are calling regarding the Philips recall, please visit our website for instructions”. [Not great for the brand…!].

Do I need to be concerned? – “Tiny black specks inside the machine were going into the hose. If you haven’t had any health issues already, I wouldn’t be concerned.”

Do you still sell the Philips models? – “No. They are still out of stock, and we are focusing on ResMed.”

U.S. Sleep Specialist Interview from 2021

Views risk of medical harm as low and encouraged all of his patients to continue using their DreamStation devices as usual following this recall…dangers of not using a device can be greater than the risks being highlighted in this recall. However, they expect some physicians to be more cautious, particularly with mild sleep apnea cases.

Supply constraints have been a major problem with it taking some clients 6-9 months oto get replacement devices.

Ozone cleaning has been stated as a potential cause of the issue in the recall, in his view it is not the only driver, and could also be caused by differences in temperature and central airing of the device.

Market share impact likely, but expects long-term recovery given Philips software data quality, desire of physicians to not end up in a monopoly with ResMed, and that choice of equipment is typically physician driven rather than patient.

Key notes from company calls

Note: We put together our notes from calls into a PDF for our readers as well as the financials back to 2009. See end of article.

2021Q1 = - Chairman of the Board of Management & CEO

Yes. That, we do. We have tested [the impact of ozone cleaning], and we see a 40x factor of acceleration of degradation when ozone is being used. And that’s on an average use of ozone cleaning. And if people do that every day, of course, it goes even faster, right? But the acceleration factor caused by ozone cleaning is very, very significant, right? And otherwise, we would not call it out. It’s a very aggressive cleaning method that should not be used on medical devices at all.

2021 Q4 - Now on your question of legal action. We have about 100 class actions, about 120 personal injury suits, all right? And then otherwise -- this is in the United States; and then outside of the U.S., not many, 1 or 2, let’s say, in Australia, Canada, and similar nature as in the U.S. And then we have the SEC claim as well from the -- from a shareholder suit. So that is the situation. It’s really very early to classify this. And as you know, we are very, very determined to provide, let’s say, the data such as with the VOC testing…We have also made organizational changes throughout 2021, which include onboarding new top management in the Sleep & Respiratory Care business; and further strengthening our quality and regulatory affairs leadership for the group, the Connected Care and the Sleep & Respiratory Care businesses…

2021 Q2 - Then the revenue impact. So we are dedicating our production capacity in sleep to the repair and replace action, right? And that takes also then into account this assumed proportion of repair and replace of -- we replace 2/3, repair 1/3. If we can go faster there, of course, that would be helpful. But for now, we have taken into account that we would lose the revenue for at least 12 months after the start of the field action. And Abhijit has, I think, at some point, already said that or we have said that the sleep business is EUR 1.1 billion, of which approximately 60% is systems and 40% is masks and consumables. So then you can do your math and take out the 60% of the systems as lost revenue. And of course, we compensate that lost revenue by strength in our other businesses.

FDA Guidance

As we noted above, FDA guidance is clear on ozone cleaning and Philips never recommended ozone cleaning – “CPAP Machine Cleaning: Ozone, UV Light Products Are Not FDA Approved “

Provisions at year-end 2021 were as follows. Provisions are related to the recall and not potential lawsuits.

During our research we came across estimates of the potential litigation costs. Unfortunately, we cannot share the reports given their non-public nature, but can note estimates for this debacle were in the range of $1-5 billion, with the high-end being quite bearish.

Subsequent to our analysis, Philips provided an update on December 23rd, what we are calling the Christmas Update. This appears to be better than the worst-case scenarios contemplated and better than the company’s initial guidance (extrapolated from early reports before lab analysis). The full report can be found here - https://www.philips.com/c-dam/corporate/newscenter/global/standard/resources/healthcare/2022/respironics-update/philips-respironics-update-on-pe-pur-testing-results-and-conclusions-available-to-date-complete-update-21122022.pdf

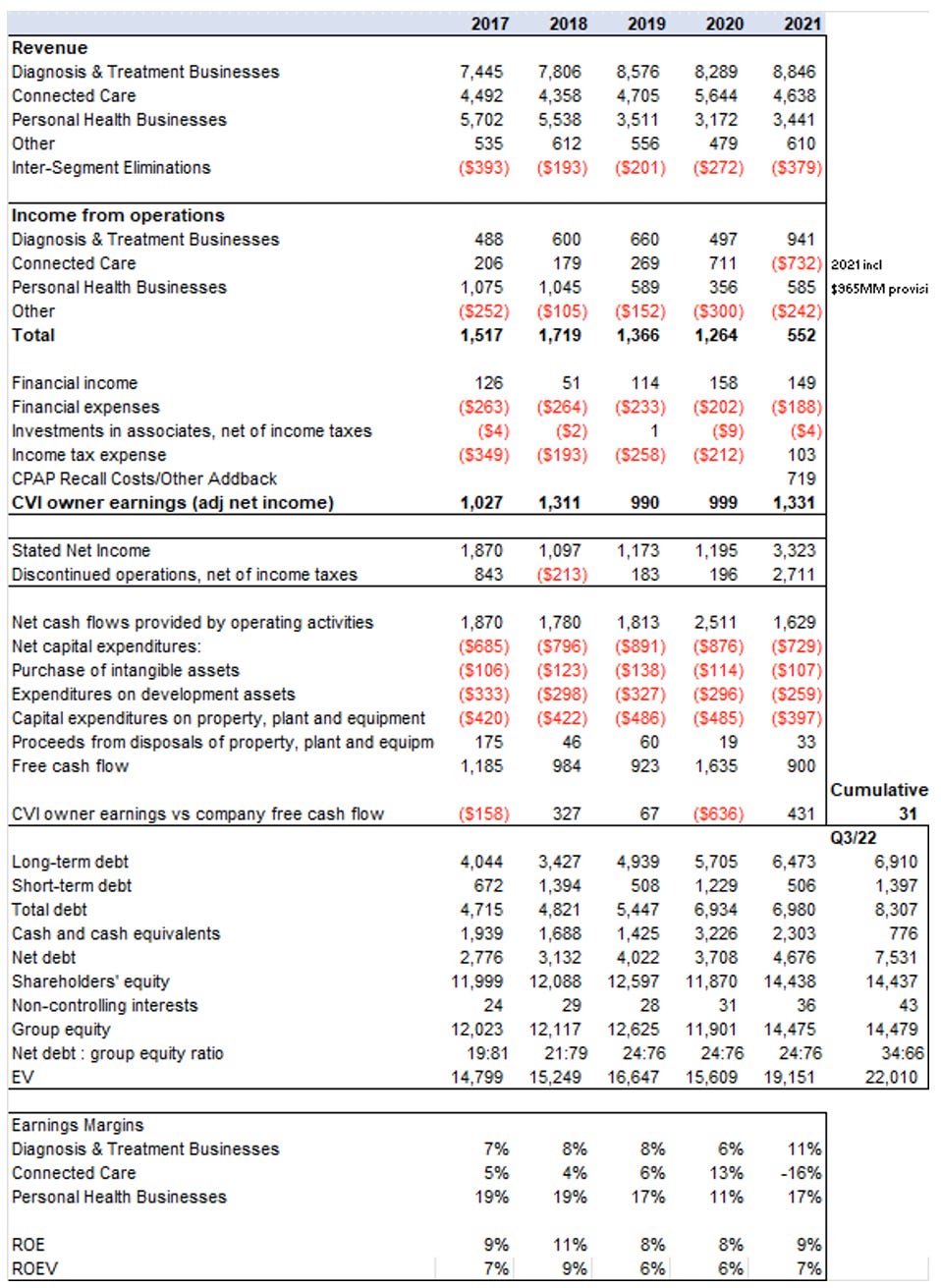

Financials

It does take quite a while to parse out what is happening with the business. Even though it is much simpler today than it was 15 years ago, it is still challenging to really know how individual product lines are doing.

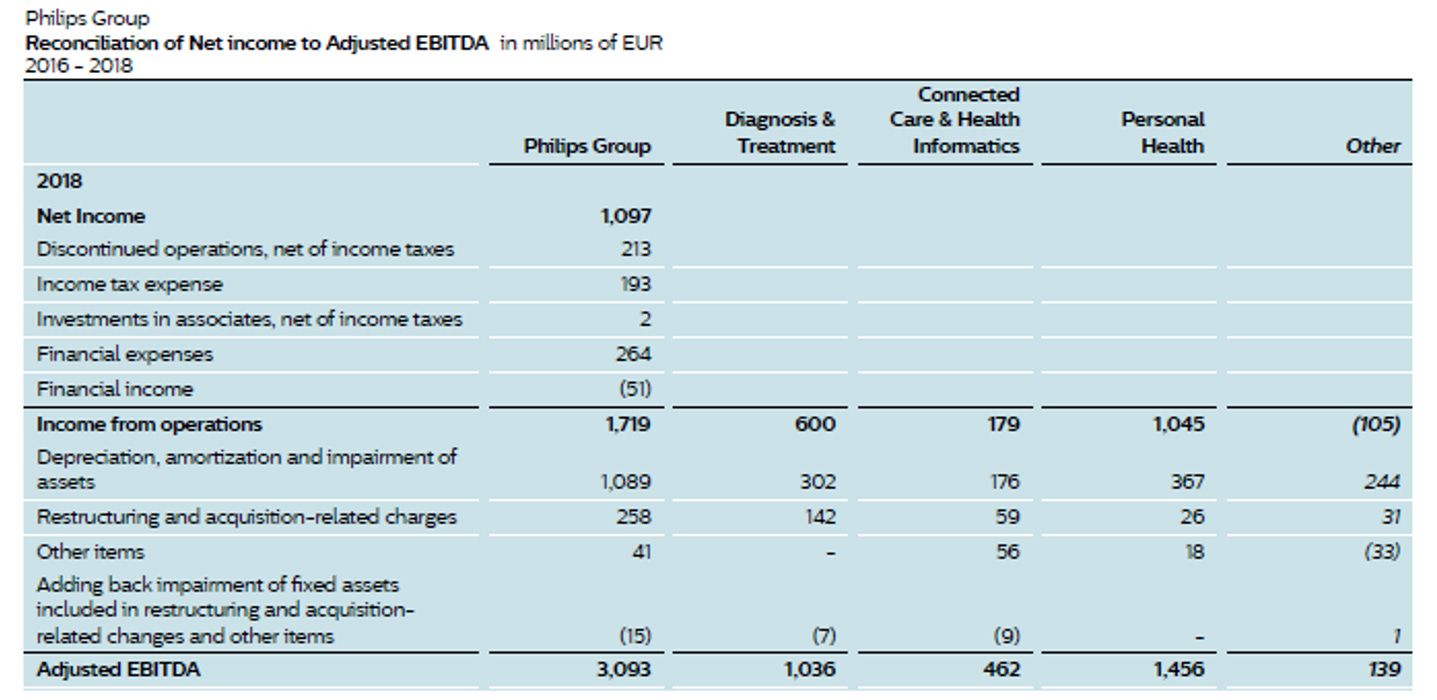

One thing we note is continued restructuring costs. They have indeed been doing major restructuring, and the costs are real, but they are also occurring every year. In turn, we are not adding back in these costs, unlike management.

Behind the scenes Philips has been quite busy. They have focused on reducing their manufacturing footprint, consolidating their plants from ~50 to ~35, while making facilities more flexible to manufacture a wider number of products with the goal being to make overall manufacturing more resilient. They have also been making acquisitions along the way, some being quite material including the 2021 acquisitions of BioTelemetry (remote cardiac diagnostics and monitoring ) and Capsule Technologies (medical device integration, clinical surveillance and patient monitoring) for EUR 2.8 billion.

Unfortunately, the Company has been facing very real supply chain problems due to COVID-19, which has exacerbated the CPAP problem, but has also affected other business lines. Inventory days have worsened since 2018 (~100->120) as has the overall cash conversion cycle (~90-130) since 2018. This has eaten up about a billion of capital. It is not getting worse, and some of this will be unwound, but we think that some of this might become permanent to make the business more resilient.

The table below shows the performance of the business but does not make adjustments to account for COVID-19 impacts or pro-forma performance of acquisitions prior to their purchase.

Hidden Value. Relative Value

Based on our research, we do not think the CPAP problem will materially impact the brand overall. CPAP users we know were unaware of this issue, never mind toothbrush buyers and MRI machine procurers who are in a completely different business line. However, we do think that there is a chance that the CPAP business unit will be permanently impaired (the buyers of machines are really clinics, who are definitely aware), and this will benefit ResMed, or at least want to assume this will be the case to be conservative.

There is concern over the credibility of management, which we are also cautious about. The Company has a new CEO at the top as of last fall as well as new leadership in the Connected Care team. This coupled with clarity of the recall costs and supply chain disruptions should reduce market concerns over time. If they have another major issue though, we would question whether Philips might instead facing serious systemic problems within the company. Time will tell.

The combination of acquisitions/dispositions and related restructurings, COVID-19 impacts, and the CPAP recall have obscured the performance of Philips. The recall issue is real, but we think the current market cap more than fully takes into account a conservative downside scenario and is arguably oversold. We also have not incorporated further share repurchases, but that is a factor to consider as well.

It is interesting to note that ResMed’s market cap is ~US$30 billion and trades at quite the frothy multiple. They do appear to have a better product and are benefiting from the recall, but we cannot get our heads around the price.

Our time horizon is 3-5 years. We expect the ride to be rocky in the meantime as the company goes through various lawsuits. Also, unless there is a material improvement in underlying operations we would likely seek to sell around EUR 30 (depending on other opportunities at the time of course). Although there are opportunities we have that are cheaper absolute value, this analysis is with relative value in mind.

The Philips brand is also apparently worth US$12 billion or so, though we do not put any quantitative weight into this sort of analysis - https://www.philips.com/a-w/about/news/archive/standard/news/articles/2022/20221103-philips-increases-brand-value-in-interbrand-s-2022-best-global-brands-report.html

Caveat emptor.