Hunting for ideas in 2024, and iRobot’s lost decade

Here is the latest from Canadian Value Investors!

Hunting for ideas

iRobot’s lost decade: What are regulators thinking?

Hunting for ideas

Welcome to 2024! We are back in the saddle hunting for new investment ideas. We still think (and will likely always think) that small caps are the best hunting ground, but it is also important to look at larger caps and overseas markets. This is not always for investments (though some do work like PBR noted below), but also to do a relative value check of “small cap bargains” we find and to build general knowledge, particularly about what companies are not doing well and why.

Here are some fun areas of the market we are looking at.

Pricing politics

What are you paying for the average company in Canada, compared to the U.S., Mexico, and Brazil? iShares ETF’s give a quick practical portfolio. One of these is not much like the others. Brazil is interesting and we have written extensively about Petrobras NYSE:PBR.A, our favourite relative and absolute value oil and gas company in the world at the time (see archives). It remains our largest hold. Is Brazil higher risk? Yes, but we think it was mispriced, at least for our tolerance. Our cash-in-hand-yield on PBR since last January is now over 20%, while it has performed quite well in a bad macro-oil environment. It seems like improving sentiment of Brazil is outpacing negative sentiment of oil; here is Petrobras (PETR in Brazil), Chevron, and Exxon.

Maybe Canadian MicroCap Buyouts?

There were a number of buyouts in Canada last year and Planet Microcap had a great interview about it.

Mathieu Martin, Portfolio Manager at Rivemont Investments / Stocks and Stones Newsletter: I'm approaching the market right now from what I've seen recently. If you make the hypothesis that institutional money is coming down into small caps and perhaps private equity keeps buying small caps I think the 100 million to 300 million market cap range is the place.

There are currently only about ~90 companies that make this list (excluding mining and a few other pockets we do not like), so it is possible to go through the whole list.

The cannabis compost pile

Calling the cannabis segment of the stockmarket a graveyard did not seem like the right word, but the bubble pop sure has been bad. A lot of professional firms and investors now call it “uninvestable”, which means it is probably a good hunting ground for ideas. We have no positions at the moment.

Some value folks have been talking about various ideas.

Paul Andreola (Small Cap Discoveries) tweeting some press releases -

https://twitter.com/paulandreola/status/1742202067689590805

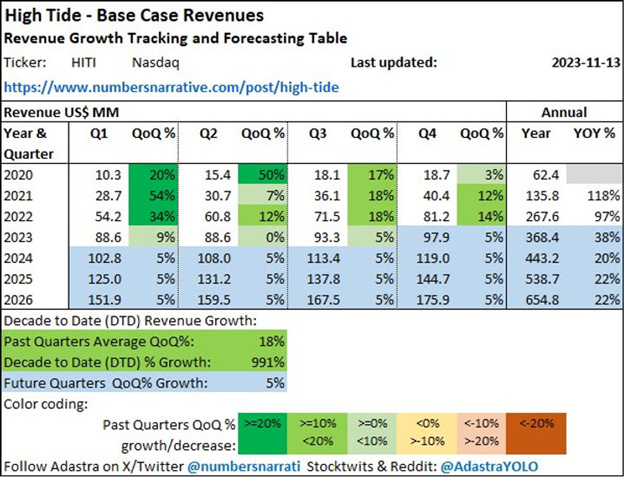

And then posts like this. - https://www.numbersnarrative.com/post/high-tide

It is important to keep in mind how bad the crash has been.

The Dogs

The Globe’s dogs are always an interesting hunting ground. https://www.theglobeandmail.com/investing/article-stocks-that-lit-up-your-portfolio-and-ones-that-chewed-up-your-returns/

Their top dogs for 2023 were as follows with a TLDR from us:

Moderna Inc. – A great case study – part of the pandemic investing boom and bust.

Laurentian Bank of Canada - Laurentian Bank's like the lonely heart at a speed dating event, failing to attract any buyers despite a big sale effort, while HSBC Canada got all the attention.

S&P Global Clean Energy Index - Clean energy's having a tough time, like rich kids messing up despite loads of support – think scrapped overbudget projects and turbine fires – even with huge government backing and a growing demand for renewables.

Match Group Inc. - Turns out making big bucks from love isn't easy.

Park Lawn Corp. - Park Lawn Corp., a big funeral biz, had a COVID boom but now faces challenges with normal death rates and pricier loans.

BRP Inc. - In 2023, the Quebec company BRP had a tough time selling their noisy outdoor toys like Sea-Doos thanks to higher interest rates and inflation hitting their sales and profits hard.

iRobot’s lost decade: What are regulators thinking?

We have talked a few times about the noise regulators are causing for M&A mergers, particularly the Federal Trade Commission. Another problem merger is iRobot. Amazon announced the acquisition of iRobot in August 2022, only to get caught up in both U.S. and European regulatory reviews. We have no position, but thought our readers would be interested as it is a great case study of: 1) How much uncertainty and pain regulatory reviews are causing, and 2) how market expectations of a business over time can change.

Regulatory Shenanigans

Longer-time readers will recall Activision Blizzard (a previous long hold that worked out):

-The FTC tried to block the merger and lost - https://www.bloomberg.com/news/articles/2023-07-12/ftc-to-appeal-judge-s-go-ahead-for-microsoft-activision-deal

-The FTC tried to appeal, and was blocked https://www.bloomberg.com/news/articles/2023-07-14/ftc-loses-appeals-court-bid-to-pause-microsoft-activision-deal “Court ruling is a blow to the US agency and Chair Lina Khan” – We agree. It is probably better that the FTC focuses on more important things than many gaming consoles kids can play Call of Duty on.

-Much more happened (including U.K. regulatory noise), but the deal ultimately went through.

Strange things beyond the ATVI merger include FTC’s Khan overruling her own staff to sue META. https://www.bloomberg.com/news/articles/2022-07-29/ftc-s-khan-overruled-staff-to-sue-meta-over-virtual-reality-deal

Then there’s the ongoing JetBlue/Spirit merger (we are long SAVE; see previous posts and much better coverage by others including https://mercercapital.com/article/jetblue-airways-corporation-announces-acquisition-of-spirit-airlines-inc/

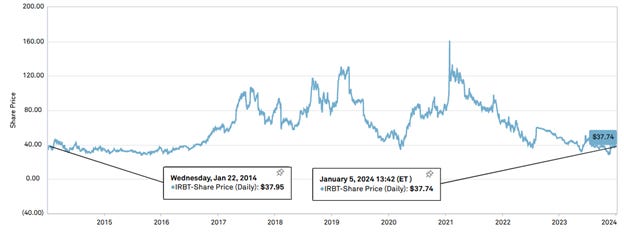

What about iRobot? The lost decade

If you bought the stock back in 2014, you would have broken even, and that is with Amazon’s offer hanging in the wind and likely holding up the company.

Regulatory Review Process: Following the announcement, the acquisition underwent regulatory review. Authorities in the United States and possibly other jurisdictions examined the deal to assess its compliance with antitrust laws and its potential impact on competition and consumer privacy. Key concerns centered around antitrust issues, like the risk Amazon might prioritize iRobot on amazon.com to the detriment of competitors.

United States: The Federal Trade Commission (FTC) in the United States started its antitrust investigation into the acquisition on September 20, 2022. https://www.theregister.com/2022/09/21/ftc_amazon_irobot_one_medial

European Union: In the European Union, antitrust regulators opened a full-scale investigation into the deal on July 6, 2022. https://www.reuters.com/markets/deals/eu-antitrust-regulators-investigate-amazon-irobot-deal-2023-07-06

Amended Offer: The Company and Amazon tweaked their original merger plan on July 24, 2023, because things were taking longer than expected, and they were starting to run low on cash and had to take out a $200MM term loan. They changed their agreement so that each share of common stock will now be swapped for $51.75 in cash when the merger finally happens, a 15% haircut from the original $61.00 per share deal. Apart from this change in the payout, the rest of the merger deal is still the same. On October 12, 2023, the company's shareholders voted to support the plan.

Given the underlying business… what does the FTC think iRobot’s plan B should be?

iRobot is facing increasing pressure from competitors in all markets, revenue has stumbled, and margins are shrinking. What confuses us about the FTC is that without this merger it is not clear to us what iRobot should do. These fights the FTC is crusading are not the Standard Oil oligopolies of bygone days. Similar to Spirit Airlines, the underlying business is having serious trouble, the mergers are driven by other factors important to the acquirer, and it is not clear what their plan B is if the merger fails.

With the stock at ~$38, the spread is big enough to run a lost Roomba through it. We are on the sidelines for now.