GrafTech NYSE:EAF - The niche business... turning around?

December 2024 Update

Disclosure: We own this one.

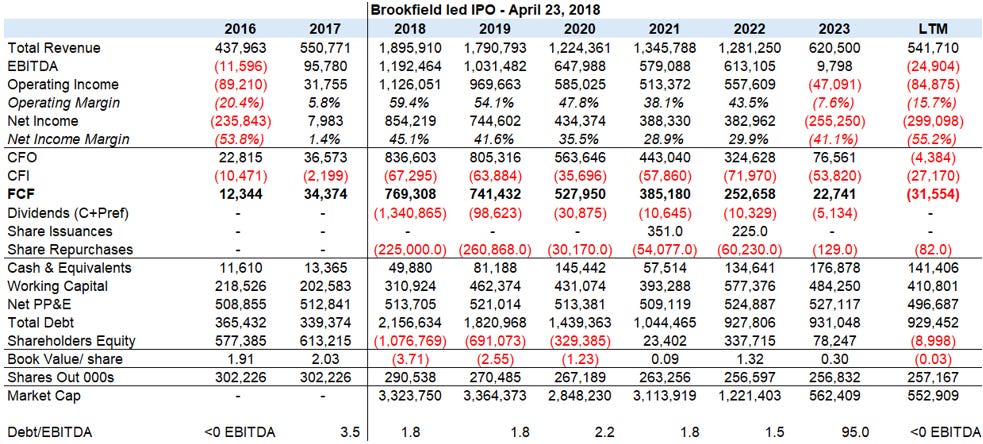

In 2019, we first wrote about GrafTech International, the IPO’d “niche business that the market forgot”. They are one of a few companies that manufacture graphite electrodes, necessary for manufacturing steel with electronic arc furnaces. They are also the only one that is vertically integrated with its own standalone petroleum needle coke (Seadrift). We started following it more closely this year after spot prices remained low while the company struggled to recover from its Monterrey plant strike. Cash flow dried up, a new CFO came in, and a restructuring seemed to be on the horizon. The company’s market cap collapsed to a few hundred million, a far cry from the $4 billion market cap it had around the 2018 IPO by Brookfield.

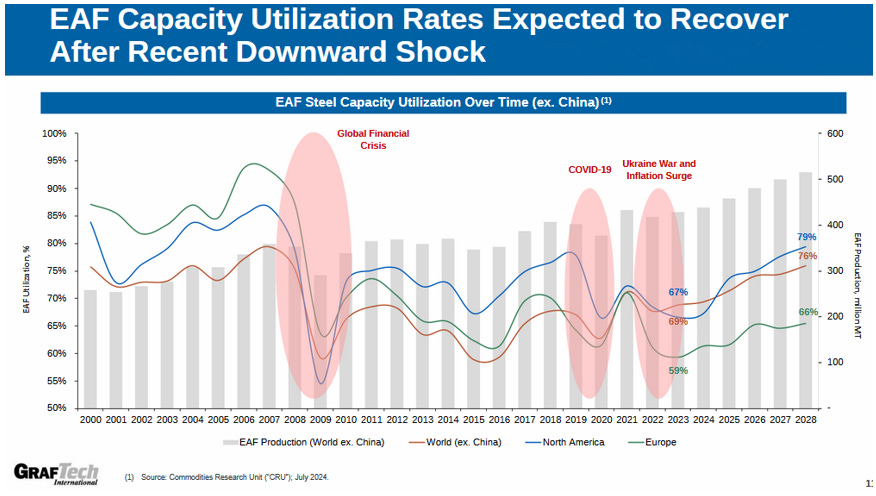

Then this November, they announced a new comprehensive financing that greatly improves liquidity. The long-term demand for graphite electrodes for EAF steel mills continues to look rosy, but spot prices remain suppressed. Do they have enough liquidity to get through, or has their business become structurally worse than it was at the last downturn?

Getting grounded: The business today

Boardroom brawl update

New CFO

New key shareholders

Competition – Big picture remains similar, though slightly worse

Graphite Electrodes - The long-term macro demand picture remains good, and prices appear to be at a trough

To sum up the problem

Appendix – Selecting the right electrode

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Getting grounded: The business today

If you are not familiar with GrafTech, we suggest you read our 2023 article first that covers what graphite electrodes are, Brookfield’s pitch for the 2018 IPO, and the Monterrey Mexico plant strike that had a significant impact on the business. https://www.canadianvalueinvestors.com/p/GrafTech-nyseeaf-analysis-may-2023

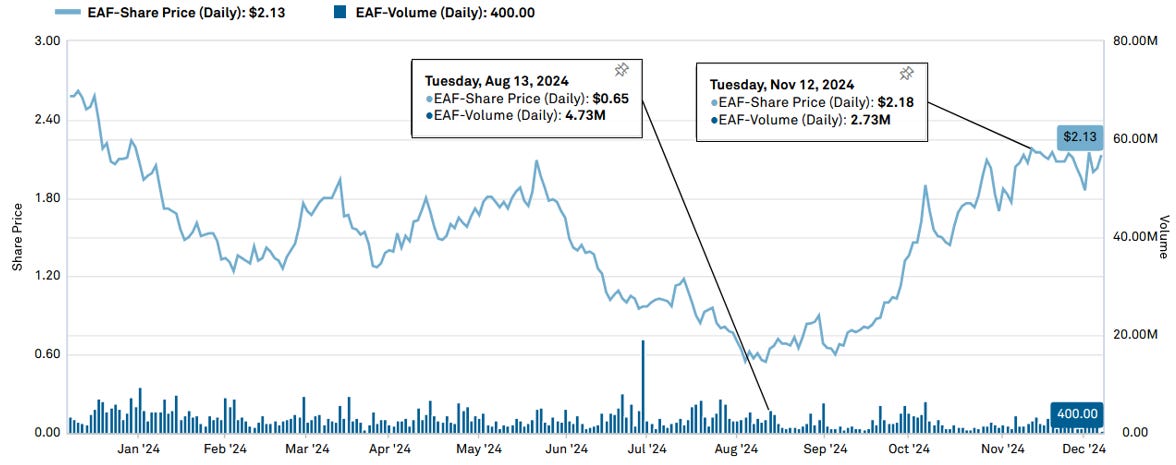

We first want to acknowledge just how painful things have become. Cash flow has dried up and the market cap today at ~$500MM is less than the total of recent repurchases, though the stock is above the bottom earlier this year (share price today of ~$2 vs 52 week low of $0.52).

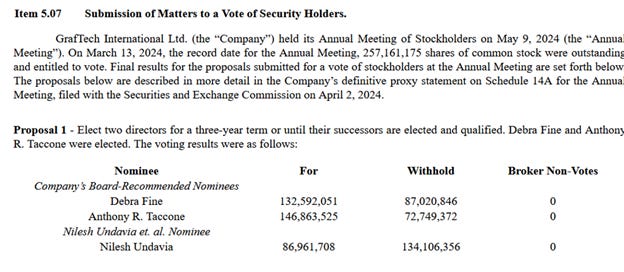

Boardroom brawl update

As we noted in April, a popcorn-worthy boardroom battle was heating up. It started with a fellow named Nilesh Undavia making some noise. https://www.canadianvalueinvestors.com/i/143582050/GrafTechs-boardroom-brawl-eaf

A LETTER FROM NILESH UNDAVIA March 15, 2024

Dear Fellow GrafTech Stockholders:

I am a significant investor in GrafTech International, Ltd, a Delaware corporation (“GrafTech” or the “Company”), and I along with certain family trusts (the “Undavia Group” or “we”) own in the aggregate 15,318,517 shares of common stock of the Company, representing approximately 5.9% of the outstanding shares of common stock. The Undavia Group believes that the Board of Directors of this Company (the “Board”) needs significant change to ensure that the Company is being run in the best interest of all shareholders. We have thus nominated me to be elected to the Board of Directors at the upcoming Annual Meeting of Stockholders, to be held virtually at 8:00 A.M.Eastern Time on May 9, 2024.

After a few dramatic letters and a management (white) vs Udavia (blue) proxy battle, the effort was ultimately not successful. However, some changes have been made.

New CFO

New CFO August 13th

Refinancing plan announced November 12th

Management is a little different than when we wrote about GrafTech in May of 2023.

Timothy K. Flanagan is now CEO as of March 2024 and served as its Interim Chief Executive Officer before that starting November 2023. He joined GrafTech International Ltd. in November 2021 and was formerly the CFO and Treasurer. We do not fault him too much for the capital structure as it was a Brookfield driven process.

There is a new CFO and he has been around a few restructurings. He left Signet right before restructuring while Covia was starting one itself it seems.

GrafTech Announces Appointment of Rory O’Donnell as Chief Financial Officer

Aug 13, 2024

BROOKLYN HEIGHTS, Ohio--(BUSINESS WIRE)-- GrafTech International Ltd. (NYSE: EAF) (“GrafTech” or the “Company”) announced today that the Company’s Board of Directors (the “Board”) has appointed Rory O’Donnell to the position of Chief Financial Officer and Senior Vice President of the Company, effective September 3, 2024. Mr. O’Donnell will serve as a member of the Company’s executive leadership team and report directly to Chief Executive Officer and President Timothy Flanagan. He will be responsible for overseeing all financial aspects of the Company.

“I am pleased to announce Rory’s appointment as the Company’s Chief Financial Officer and welcome him to GrafTech,” said Timothy Flanagan, Chief Executive Officer and President. “With his extensive financial expertise and numerous leadership positions, we look forward to benefiting from Rory’s experience and knowledge as we move ahead.”

Mr. O’Donnell previously served as Senior Vice President, Controller and Principal Accounting Officer of Covia Corporation, a provider of mineral-based and material solutions for the industrial and energy markets, since February 2019. While at Covia Corporation, he also served as Interim Chief Financial Officer from August 2022 to July 2023. Prior to Covia Corporation, Mr. O’Donnell served as Senior Vice President, Controller at Signet Jewelers Limited (NYSE: SIG), a retailer of diamond jewelry, from 2014 to 2019. Before joining Signet Jewelers Limited, Mr. O’Donnell served as Director, Accounting & Reporting at Cleveland-Cliffs Inc. (NYSE: CLF), a North America-based steel producer. Mr. O’Donnell began his career at KPMG LLP, a professional services firm. Mr. O’Donnell has a B.S. in Accounting from the University of Dayton and is a Certified Public Accountant licensed in Ohio.

2020 - Covia Successfully Completes Financial Restructuring and Emerges from Chapter 11 https://www.coviacorp.com/news-releases/posts/covia-successfully-completes-financial-restructuring-and-emerges-from-chapter-11/

Reduced obligations by over $1 billion

Improved operational flexibility to better serve customers and other stakeholders

Strengthened competitive position of high-quality assets

Emerges with approximately $175 million of total liquidity

INDEPENDENCE, Ohio, December 31, 2020 (Globe Newswire) – Covia today announced that it has successfully completed its financial restructuring and emerged from Chapter 11. Through the restructuring, Covia has reduced its long-term debt by approximately $750 million and its fixed costs, including railcar obligations, by an additional $300 million.

Separately in 2019

Signet Jewelers pushes forward with restructuring amid falling sales – April 2019

Global jewelery retail group Signet Jewelers Limited announced declining fourth-quarter sales and earnings which nonetheless edged out analysts’ expectations on Wednesday, as the company continues with its Path to Brilliance restructuring strategy. https://ww.fashionnetwork.com/news/Signet-jewelers-pushes-forward-with-restructuring-amid-falling-sales,1085588.html

The GrafTech restructuring begins

The restructuring was not unexpected. Their bonds were trading in the 60s-70s earlier this year. What we are surprised by is what they have been able to put together. It is a lot better than we thought they would be able to achieve, providing significant incremental liquidity (~$500MM now) and another year of term.

November 12, 2024 - BROOKLYN HEIGHTS, Ohio--(BUSINESS WIRE)-- GrafTech International Ltd. (NYSE: EAF) (“GrafTech” or the “Company”) today announced that it has entered into a commitment and consent letter with lenders holding all of its existing revolving commitments, an ad hoc group that holds over 81% of its existing secured bonds to provide new debt financing on competitive terms and extend maturities of its existing debt, and Barclays Bank plc, as a fronting lender.

Pursuant to the terms of the commitment and consent letter, GrafTech expects to (i) incur $175 million of new senior secured first lien term loans on the closing date of the transaction (the “Closing Date”), and obtain commitments with respect to $100 million of new senior secured first lien delayed draw term loans that are available to the Company for 19 months following the Closing Date, all of which would mature five years after the Closing Date; (ii) launch offers to exchange its outstanding 4.625% senior secured notes due 2028 and its 9.875% senior secured notes due 2028 for new 4.625% second lien notes and new 9.875% second lien notes, respectively, which would mature in 2029; (iii) launch a consent solicitation to eliminate substantially all covenants and events of default with respect to its outstanding senior secured notes due 2028, and release the collateral securing such notes; and (iv) enter into a new revolving credit facility that, among other things, would replace GrafTech’s existing revolving commitments with up to $225 million of new first lien revolving commitments and extend the maturity date from May 2027 to November 2028, subject to a springing maturity date based on inside maturities of existing debt (collectively, the “Transactions”). The consummation of the Transactions is subject to the satisfaction or waiver of a number of customary closing conditions. On an as adjusted basis after giving effect to the Transactions, the Company’s liquidity as of September 30, 2024 would have increased from $254 million to $529 million.

Summary of Transactions for New Capital

-$175 million of new senior first lien term loans, funded at transaction closing.

-Commitments to fund an additional $100 million of new senior first lien term loans, which are available to be drawn for 19 months following transaction closing.

-New senior term loans, both initially funded and subject to delayed draw, will bear interest at a variable rate of SOFR plus 600 basis points and will mature in December 2029.

-An exchange offer will be launched for all of the Company’s outstanding $950 million senior secured notes due December 2028 for new second lien notes due December 2029.

-The Company’s existing $330 million senior secured revolving credit facility maturing in May 2027 will be replaced with up to $225 million of new first lien revolving commitments maturing in November 2028.

We must note that the debt is viewed as increasingly distressed. Their S&P rating was downgraded from BB- to B+ in November 2023, then further downgraded three times to get to CC today. Upon completion of the debt exchange it will likely be viewed as technically a default and be downgraded to D, which would already be known by the noteholders.

New key shareholders

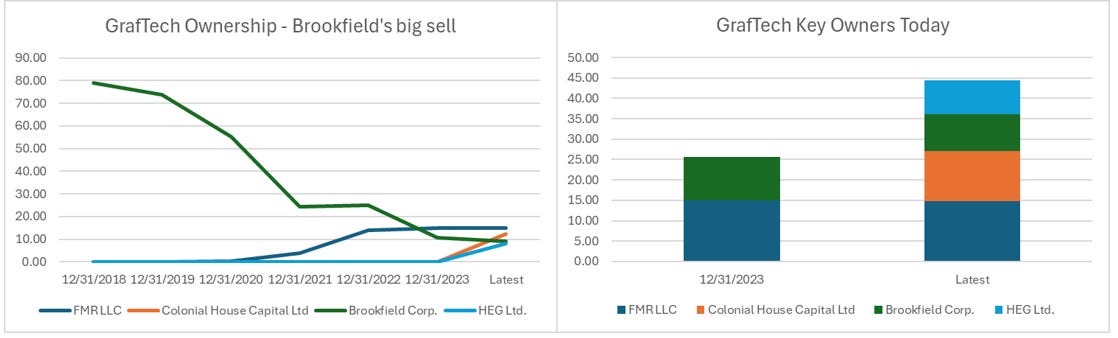

We have to say that Brookfield sure did well with this investment given the timing of their sales. They have sold down from ~80% and now maintain a relatively small position of ~9%, while two meaningful owners have come into play. Colonial House Capital Limited is a family office located in Toronto. More interestingly, HEG Ltd., a key competitor in India discussed below, recently made purchases of the stock indicating they feel it is undervalued (we think additional consolidation in the industry is unlikely, but you never know).

Competition – big picture remains similar, though slightly worse

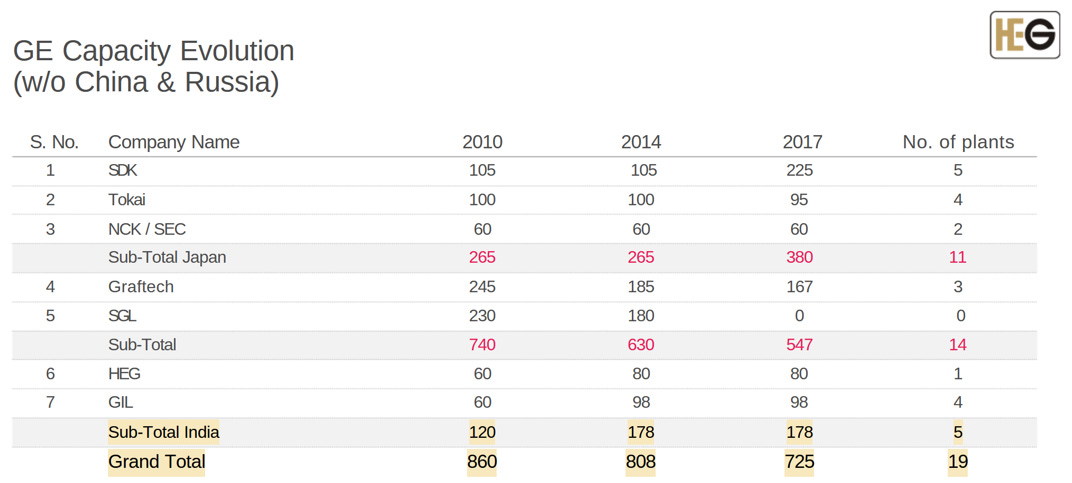

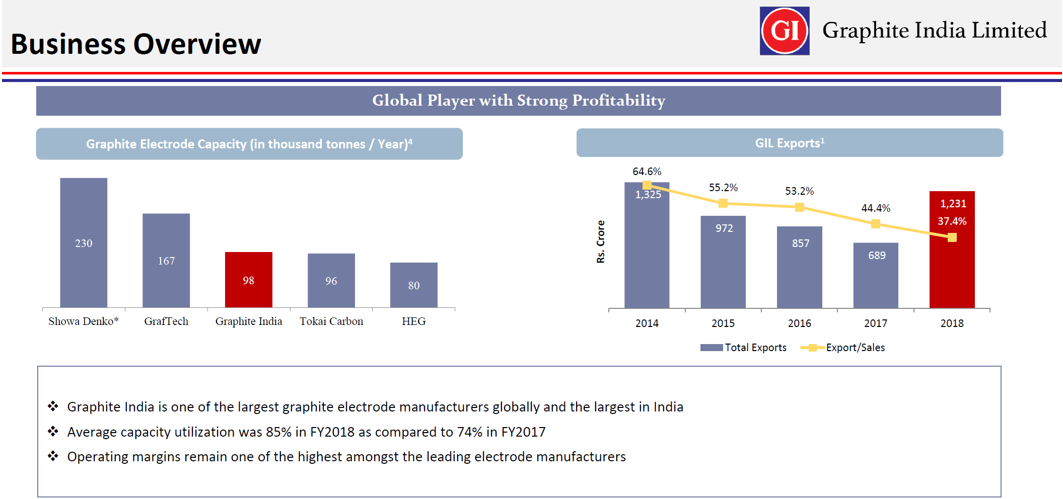

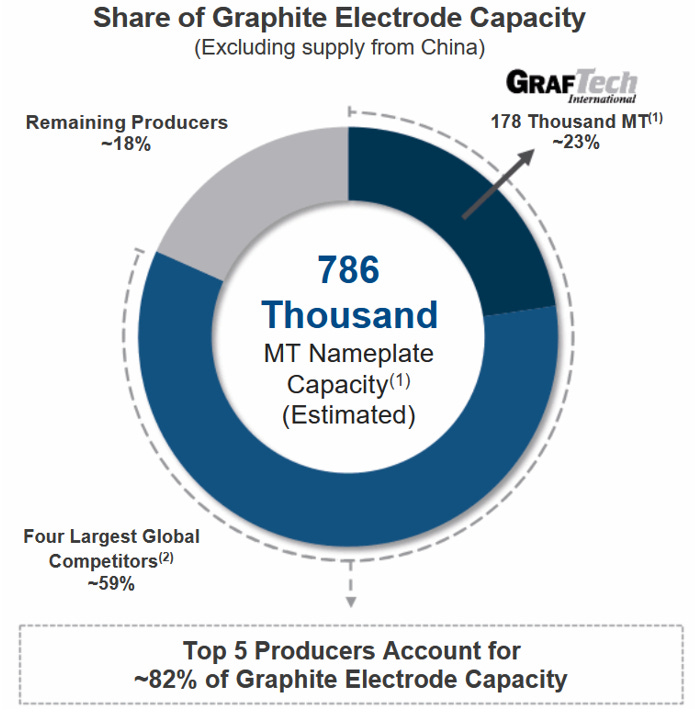

In the graphite electrode space there are really four key players outside of China besides GrafTech, being Graphite India, HEG, Tokai Carbon, and Resonac Holdings (a small division of a very large company). GrafTech is the only one that is vertically integrated with their own petroleum needle coke facility. There was real consolidation/rationalization in the 2010s. Since then, things have been relatively stable; see various tables from Graphite India, HEG, and Graftech that all align with each other below. However, competitors have not been idle. HEG is the best example (see next).

2 - Represents combined capacity for four largest non-Chinese competitors, which are Resonac Holdings Corporation, HEG Limited, Tokai Carbon Co., Ltd. and Graphite India Limited.

HEG and GIL benefited greatly from temporarily high spot prices while GrafTech’s results reflected the long-term contracts they negotiated. As we noted previously, we exited in November 2020 because of concerns about them being able to recontract these great contracts. They were not able to, and no wonder.

HEG turns up the heat

The changes at HEG sum up the challenges GrafTech is facing. Competitors are getting slightly better and slightly bigger while overall industry demand remains very soft.