Graftech (NYSE:EAF) – Scuttlebutt, and tail risks, and value traps, oh my

A few years ago, we wrote up an article about Graftech International, the spin-off “niche business that the market forgot”. It was (and possibly is) an interesting business trading at cheap multiples, but we ultimately did not hold it for long and this turned out to be the right decision. Subsequent to our investment, they had a major regulatory hiccup at their key facility in Mexico (temporarily shut down completely; #awkward). Was this foreseeable? Maybe this is this a good business after all, and it is time to buy? We find post-mortems extremely valuable. Secondly, this is a good example of using scuttlebutt in a modern world. And finally, we still might take action on this depending on how their issues get resolved…

What is Graftech? Brookfield’s turnaround pitch.

What did we decide?

Chapter 2: The strike scuttlebutt - Scuttlebutt in practice in a modern world

Chapter 3: The long tail (risk)

Graftech and Graphite Electrodes 101

“So what would you say you do here?”

Graftech describes itself as “a leading manufacturer of high-quality graphite electrode products essential to the production of electric arc furnace (or EAF) steel and other ferrous and non-ferrous metals.”

The gist – Produce niche product graphite electrodes, which are essential to make EAF steel.

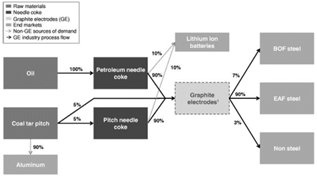

They are one of the few if only vertically integrated manufacturers that also makes the main input to graphite electrodes, petroleum needle coke.

It was a Brookfield Asset Management baby taken private, turned around, and then taken public 2018.

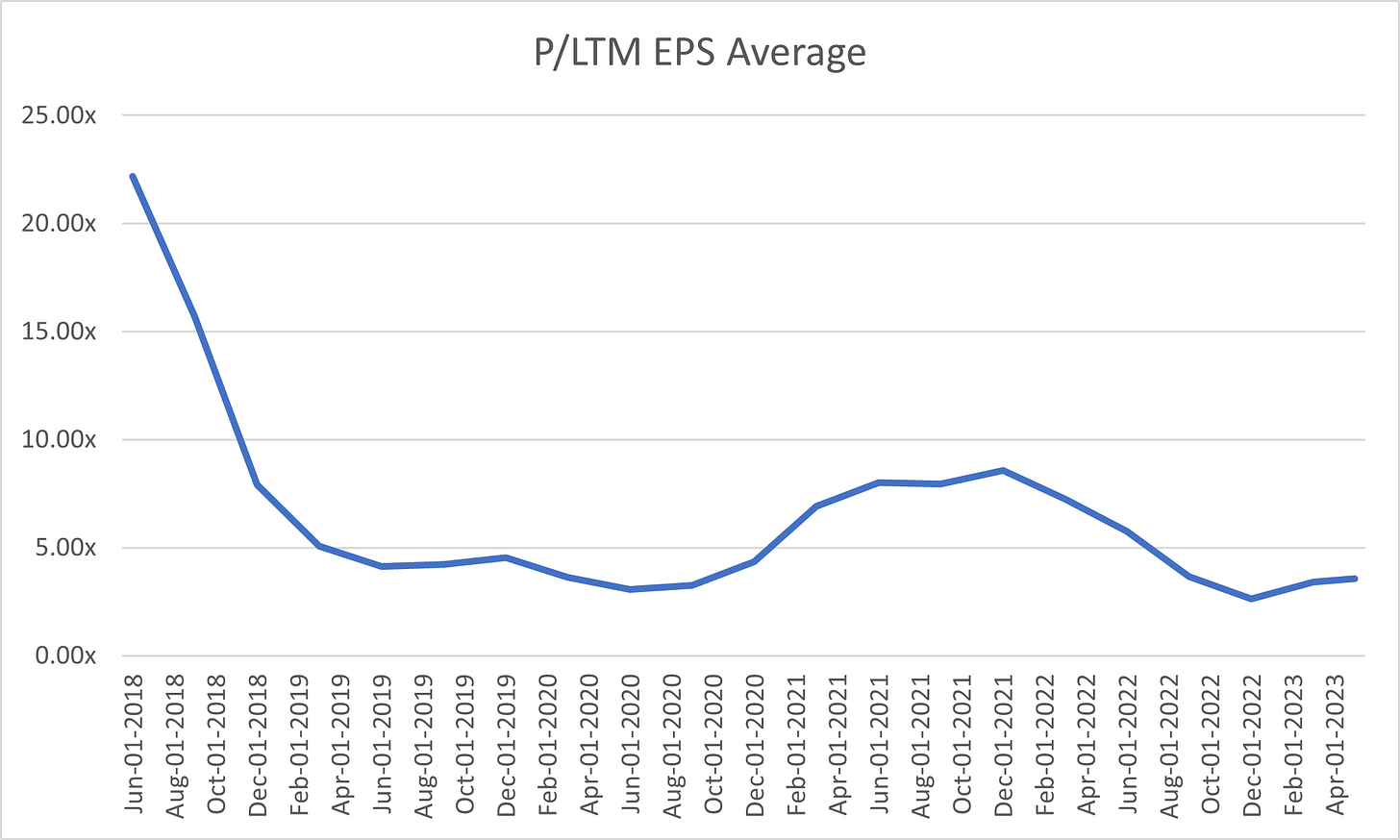

It was trading at 4-5x free cash flow when we found it in 2019.

What are graphite electrodes?

Petroleum needle coke is a high-quality form of coke derived from oil refinery byproducts.

It is called “needle coke” because of its long, needle-like structure, which is essential for producing high-quality graphite electrodes [that have] a unique combination of high thermal conductivity, low coefficient of thermal expansion, and high mechanical strength.

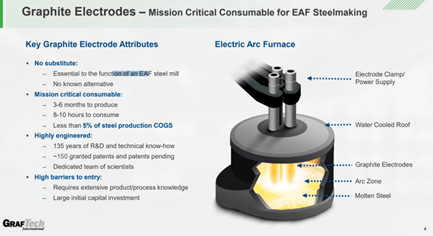

Graphite electrodes are typically made from high-purity graphite and are used as conductive elements in EAFs to generate high temperatures required for melting scrap metal and other raw materials. These electrodes are highly resistant to heat and can withstand the extreme conditions of the EAF, which can reach temperatures of up to 3,000°C.

How graphite electrodes fit in

The table below summarizes the process well. Effectively, electrodes are a small but absolutely essential part of EAF steelmaking. Quality is also paramount and they are relatively hard to manufacturer (at least the highest grades are); if they fail/are low quality/fail prematurely, this can cause expensive operational problems and downtime. They argued that this made for sticky customers who are willing to pay for quality, so long as you are actually high quality and reliable…

Brookfield’s turnaround pitch

Brookfield acquired Graftech for $1.25 billion and put it through their turnaround process.

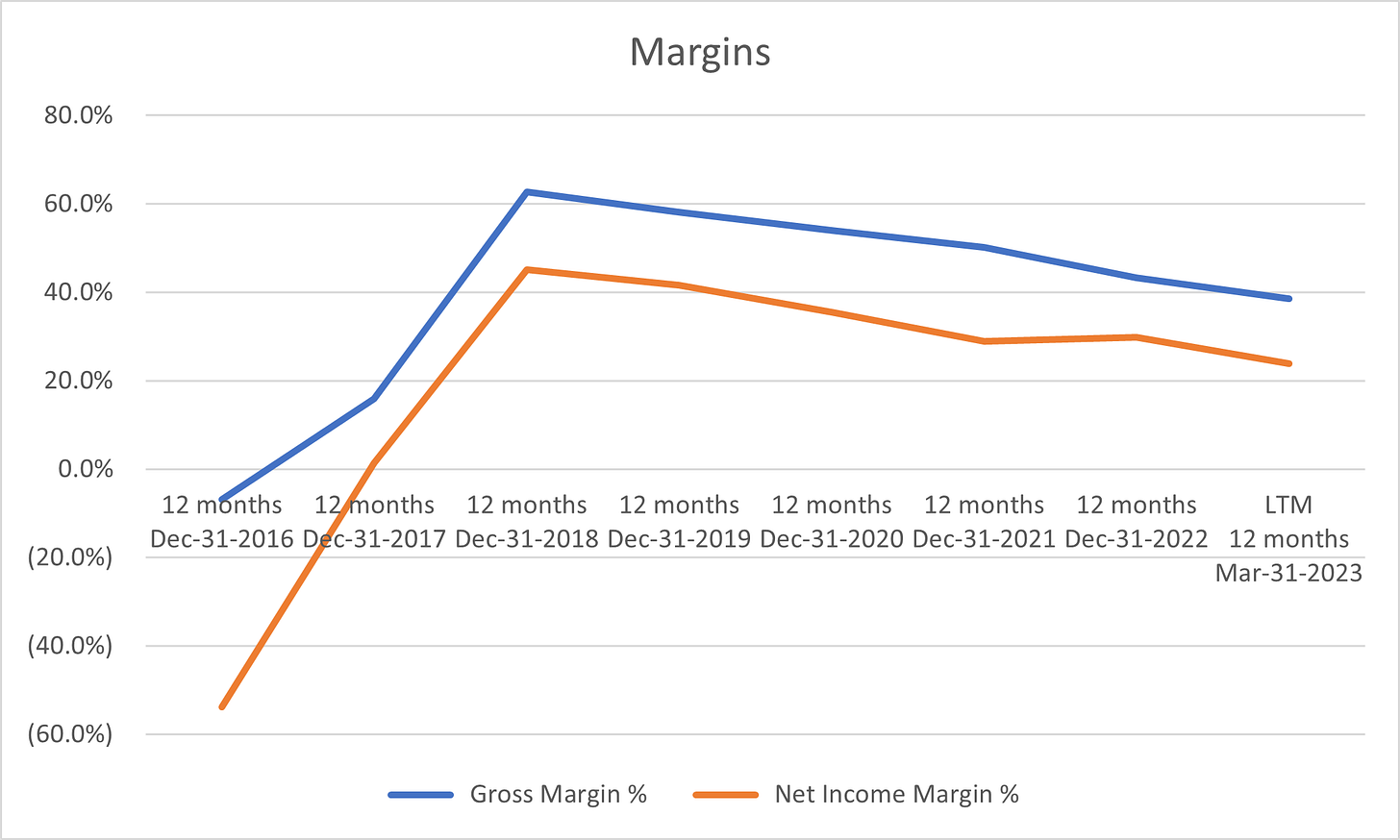

”We have achieved annual fixed manufacturing cost improvements and capital expenditure reductions of approximately $190 million since 2012, while also improving the productivity of our plant network We have strategically shifted production from our lowest to our highest production capacity facilities to increase fixed cost absorption.”

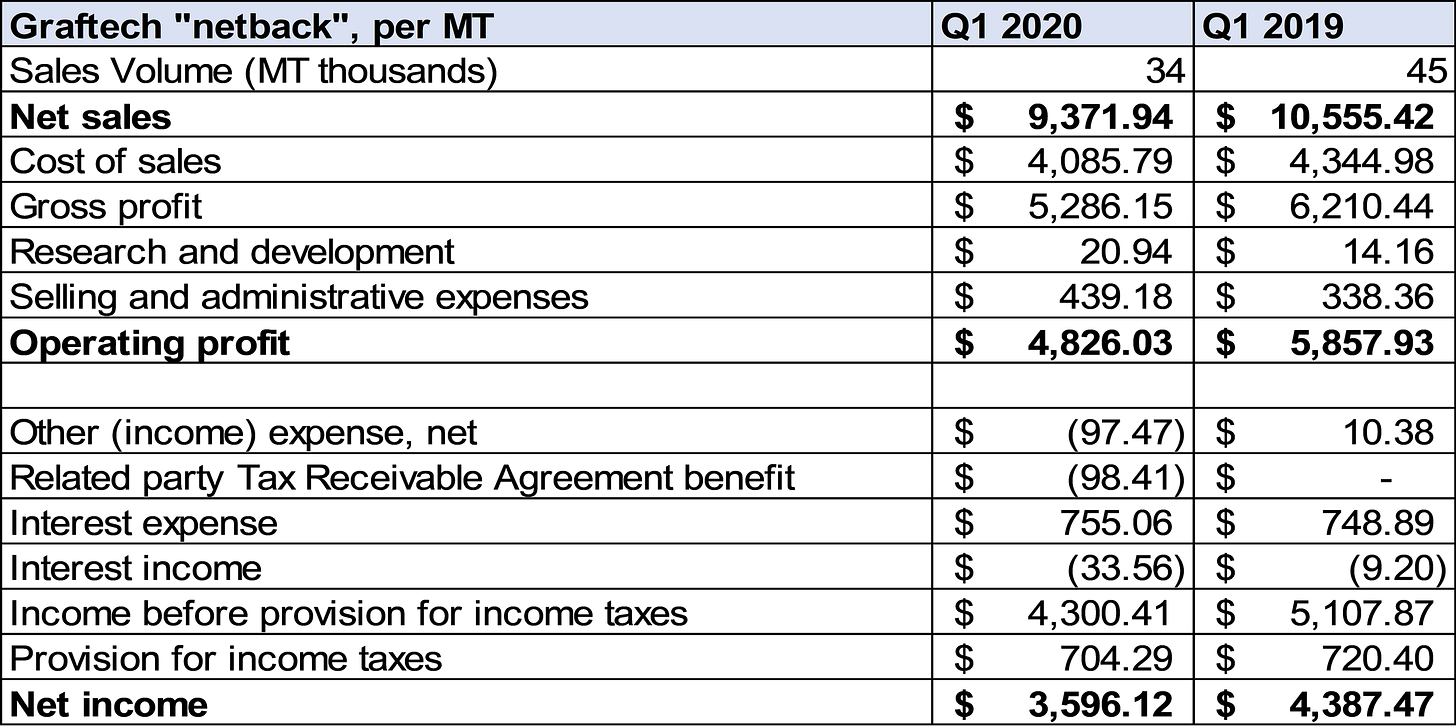

Graftech “netback”

We have covered oil and gas quite a bit, and the term “netback” refers to the profitability of a barrel of oil or natural gas after deducting all associated cash operating costs, such as transportation, processing, and marketing expenses (not accounting for the cost to find a barrel; a discussion for another day). For Graftech, you can do a similar analysis. Here is what it looked like when we did our first check.

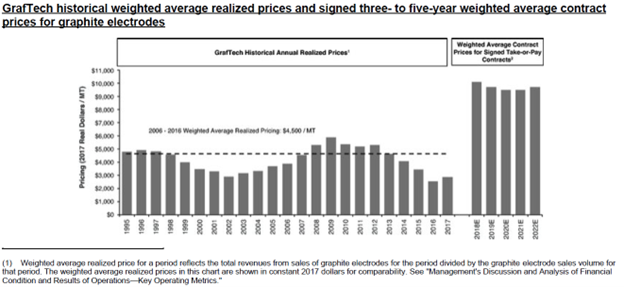

This looks great when compared to their long-term contracted rates, but not so great when compared to historical rates or spot rates. “Where were those new contract renewals” we wondered? Maybe they will come.

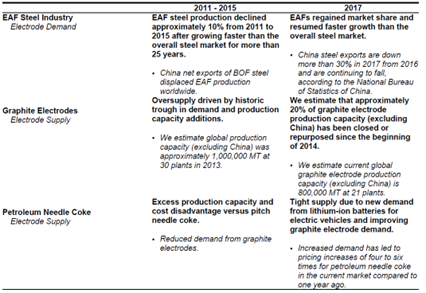

Measuring price and success since 2015 acquisition by Brookfield

(with the benefit of hindsight and more data than our original purchase)

What did we decide? It was time to buy!

We bought in December 2019 because:

Lollapalooza - Essential product, difficult to produce, small part of cost of overall production, concentrated producers, high risk from bad product.

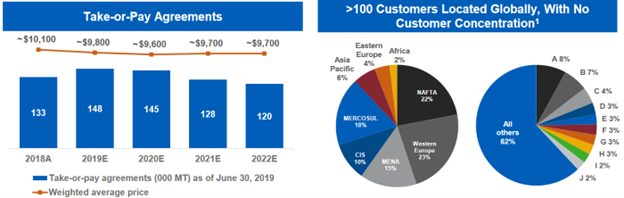

Low multiples and delevering plans in place supported by long-term fixed price contracts.

Targeting significant cash flow to shareholders including repurchases (“50-60%”).

But we ultimately sold out in November 2020 because:

The Company unable to sign new contracts, high price old ones running off/getting renegotiated. COVID was not helping this and we worried they might have to even renegotiate existing contracts, never mind not be able to find new ones.

Spot prices were ~$5,500MT with further downward pressure.

Even with OK pricing the Company still has high leverage at reasonable prices of $7-8,500 w/ high P/CF multiple of $1.75B to ~$200MM =9X @ $7,000 MT

Brookfield was still selling, causing sell down pressure (and the nagging feeling that you are buying from a smart counterparty that has much more knowledge than you).

Chapter 2: The strike scuttlebutt - Un problema grande