I love Goooooldmoney TSX:XAU – Turning gold into a pile of real estate on sale

Buying Goldmoney instead of gold

Disclaimer: We own this one with recent purchases at ~$10.

To be clear, we are not gold bugs here at Canadian Value Investors. We might be fretting about inflation… well, we are, and that is a discussion for another day. But, what if there was a gold storage business printing fiat cash, repurchasing a pile of shares, and also owns a pool of marquee UK real estate that roughly equals its current marketcap? Here’s the story of Goldmoney.

The core business has long been precious metals storage and related trading with other ideas/ventures along the way. These generally did not work out, but were not expensive. They pivoted the strategy in 2023 to 1) stop these ventures, 2) reduce exposure to precious metals to reduce performance volatility, and 3 ) opportunistically purchased interesting properties in UK.

While this has been happening, the price of gold has increased significantly, benefiting their gold storage business that earns fees as a percentage of the price of the underlying precious metals.

Our thesis? At current prices ~$10 ~$126MM market cap, the price is undemanding and an asymmetric bet. The real estate portfolio is very likely currently worth roughly this never mind future development opportunities, repurchases are significant, and the storage business could have very real tailwinds with the run up in gold as fees this business earns are a percentage of the underlying precious metal. So, we are long and let us tell you why.

The strategy reset

The storage business

The property business

Mene

Thinking about valuation

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious bias and conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. In addition, no one guarantees the accuracy of any information provided and none of the information should be construed as investment advice or any other kind of advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose, except for entertainment (and we hope you enjoy).

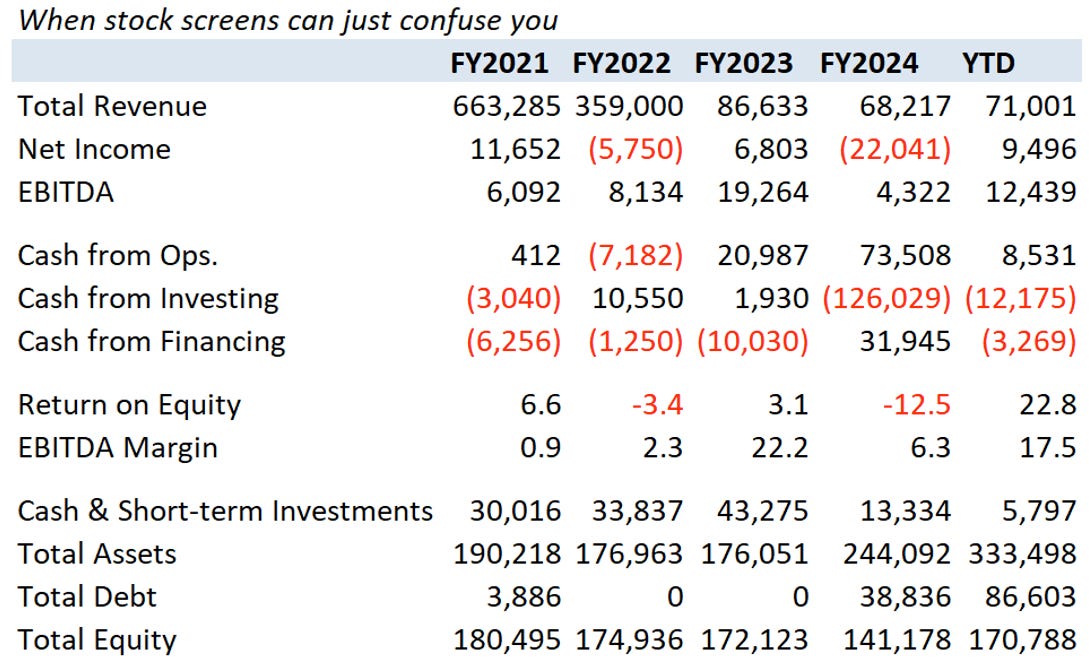

Trying to explain the business

If you pull up Goldmoney in a screen, you would likely be confused immediately. However, the noise can be explained. There are three pieces to the business:

Goldmoney.com – Precious metals storage business

Ownership in Mene – Online jewelry store selling 24k gold and platinum investment jewelry. Very weak performance.

UK real estate

There were other ventures that have been wound down/sold, like Schiff, as we get into later and these decisions seem like the right ones.

The financial statements are presented well we believe, but are noisy given all of the recent changes and the odd mix of business as well as their own precious metals holdings which used to be much larger (~$6MM today). Other noise includes some write offs, and client assets including cash are fully segregated and need to be removed from any analysis.

The strategy reset

The key to understanding Goldmoney is to understand how they got here. Is this scattershot management? We believe it has actually been quite thoughtful and the rationale along the way has been explained by the Company’s key man and founder, Roy Sebang. His background is a value investor turned precious metals / real assets investor. He has previous interviews but has been less active recently. His annual letters are at times quite philosophical and might feel like reading an excerpt from Ayn Rand’s Atlas Shrugged, but the thoughts about the business are grounded.

The key reset and demonstration of a new direction was when they sold Schiff, and then reduced precious metals exposure to buy real estate.This all goes back to 2022/2023:

“Since November of 2022, the Board of Directors has been reviewing strategic options for Schiff Gold that would allow Goldmoney to focus on its core business strategy of generating sustainable earnings per share. Following this strategic review, we have made the decision to return the business to Peter Schiff, from whom we acquired it in 2016, and Peter has agreed to return to Goldmoney the securities which were originally issued to him at that date. We believe this decision will further simplify our operating structure and provide shareholders with a better understanding of our long-term economic results.”

In the 2023 letter – they sold gold for buybacks:

Last year, I mentioned that our goal was to reach $1 a share of precious metals value. By mid-December 2022, we had surpassed this level and decided to crystallize some of our precious metal gains for the rare opportunity to purchase a block of Goldmoney Inc. shares. Over the course of the fiscal year, we realized $10 million of gains on our precious metal position. We reduced the company’s outstanding share count by nearly 8%, while ending the fiscal year with a precious metals position that was, in fiat money terms, slightly higher.

…

No more long shots.

As part of this process to systematize our balance sheet activity, we have made an important decision to rule out new long-shot entrepreneurial activities. We have learned a great deal by building companies in the financial, technology, manufacturing, and asset management space, but just because we can technically do something, doesn’t mean it is worth doing – particularly now in 2023.

And now less metals.

This brings us back to precious metals and the role they will play within the balance sheet side of our business activity. We have been addressing this question: is it still desirable for Goldmoney to have such high allocations to precious metals on our balance sheet?

[changing because of]

I. Generational Shift in Risk-Free Interest Rates - On June 5, 2013, the one-year risk-free interest rate for US dollars was 0.14%. Seven years later, on June 5, 2020, coordinated central bank action in response to Covid-19 artificially forced the one-year risk-free interest rate for U.S. dollars back to 0.14%. Last year on June 5, 2022, the risk-free rate had increased to 2.11% or 17-times greater than the 2020 level. Finally, as I write (June 5, 2023), the one-year rate has held firm trading at 5.22%, double the level of one year ago.

…

In light of this generational shift in interest rates, our new range for the balance sheet capital allocation in precious metals is 20-30%. This would mean that a 20% decline in the precious metals over any given year, would only reduce our projected cash flows by around 30-50%, allowing us to keep compounding, as the metal portfolio bounces back over time. This redeployment of assets is not just a prudent step; it is also timely as explained by the second reason:

2. Radically Changed Investment Landscape

The generational shift in the risk-free interest rate environment has radically changed the investment landscape. There are now significant opportunities that have not existed since 2001 to acquire long-duration real assets. These are assets with contracted inflation-protected cash flows at attractive rates of return that exceed our estimation of long-run inflation.

To be specific, I am speaking of commercial property, infrastructure assets, and, to a lesser extent, farmland. Many of these real assets, which form the built-up environment that powers the real and service economies, are now priced at unlevered yields that provide a payback in under 10 years.

I have been waiting my whole career for the investment landscape that is now upon us. For the first time in decades, investors with liquidity can acquire real assets at attractive real yields without needing to develop an exit strategy. At Goldmoney, we are now ready to make such investments and have spent much of the past year preparing the corporate infrastructure to make them.

And this resulted in the launch of:

Goldmoney Properties Limited

In May of 2023, we prepared the foundation for investing in the UK property market through the establishment of our wholly owned subsidiary, Goldmoney Properties Limited.

We seek opportunities where, upon acquisition, the value of the contracted income stream is greater than 80% of the property’s acquisition price. Such opportunities, as I have already mentioned, have not existed for more than two decades. We will be acquiring physical assets that are difficult to replace and which provide Goldmoney with long-term exposure to the real economy, either through specific tenants, or via regional markets that benefit from unique natural fundamentals.

…

The UK is the only western economy that meets our 25-year investment horizon. Because of 1) Food Economy 2) Independent Central Bank and Fiat Currency and 3) Rule of Law and Liquid Markets for Real Assets. [See his letter for a detailed explanation]

And also did a reverse split.

Reverse Split

The Board of Directors has decided to enact a reverse split of our common shares by a ratio of 1:5. We have been contacted by institutional investors who are precluded from investing in our shares because the share price is below $5.

Expectations? $20MM a year in CF.

The biggest opportunity in Fiscal 2024 will be the establishment of a new income stream for Goldmoney Inc. that grows our group’s long-run earnings power above the sustainable level, which I personally believe to be circa $10 million a year. This is based on the assumption of long-run adjusted earnings for our operating businesses minus precious metal revaluation gains. It is our hope that within three years, further capital deployment will result in an additional $10 million of sustainable earnings power from Goldmoney Properties Limited. This is based on the assumption that we deploy up to 70% of our liquid tangible capital in real assets that will provide us with a second stream of inflation-protected income.

With both streams at a consistent, inflation-protected $20 million, public markets may begin to price a multiple on those earnings in excess of tangible book.

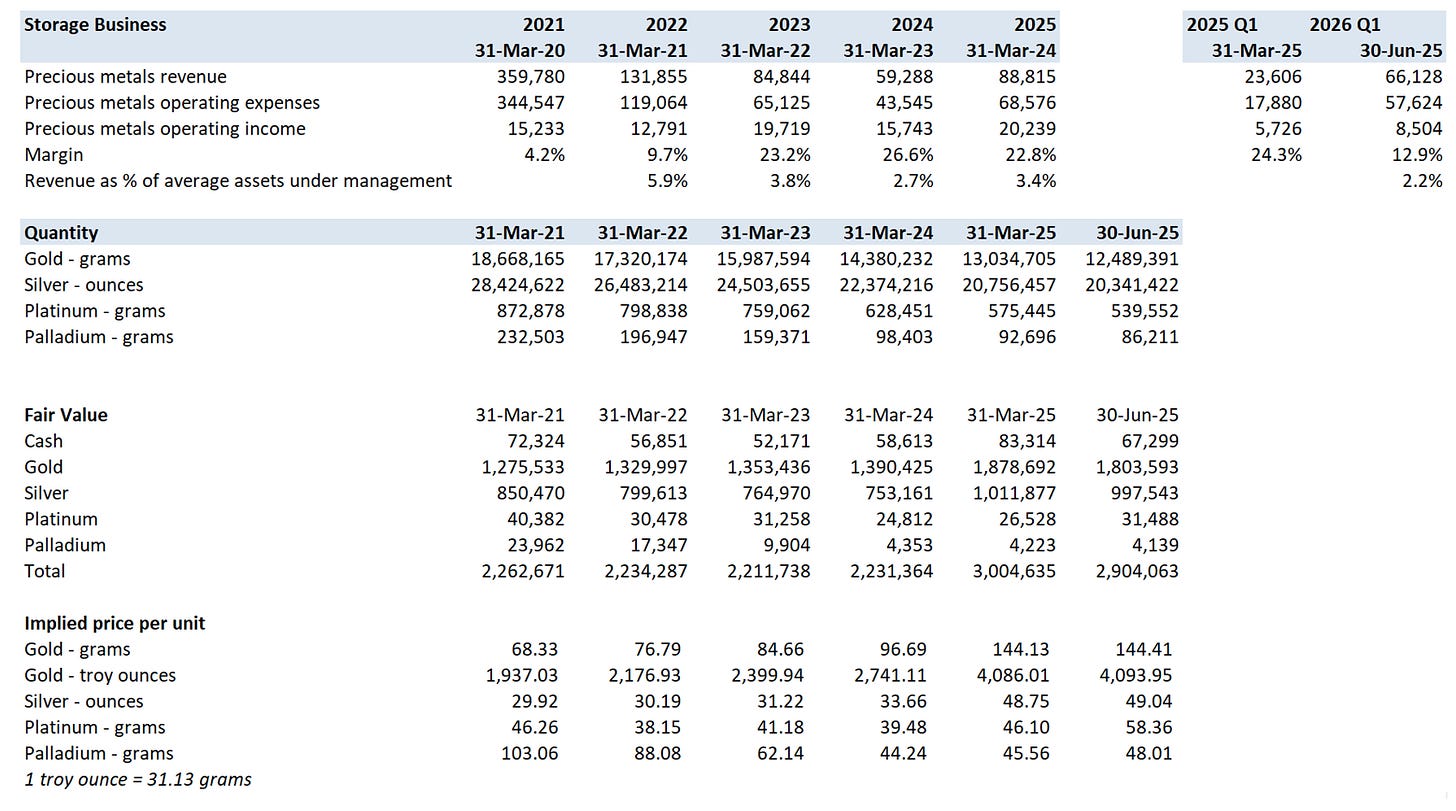

The storage business

The storage business is quite simple. You set up an account and then can store gold and other precious metals at vaults around the world run by reputable third parties like the Canaidan Mint and Brink’s. Revenue is from storage and also customers buying and selling precious metals. The customer pricing model for both is based on a percentage. It seems unlikely that the total storage business costs would increase in line with increases in precious metals prices, except for insurance which would increase. A breakdown of the actual costs for the trading and storage business is not available.

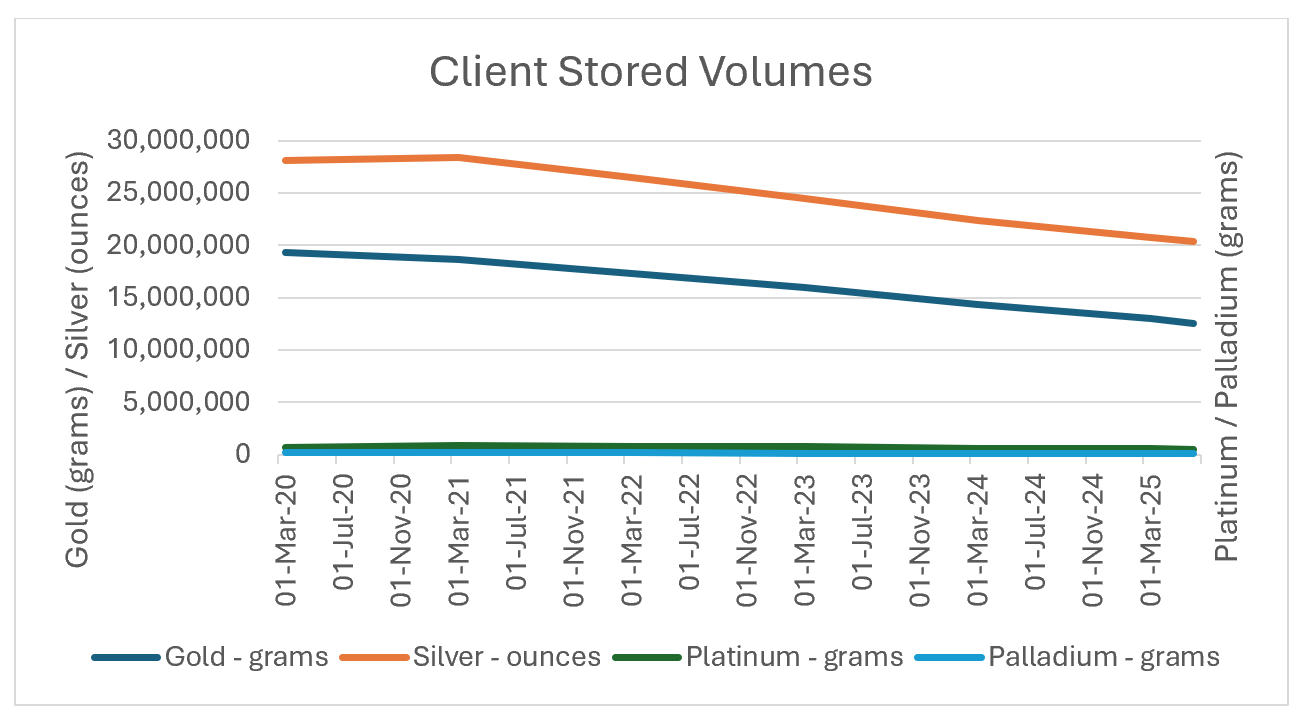

There has been erosion in this business with total quantities stored declining, offset by precious metals price increases.

Overall storage volumes have been declining and we think some of this is actually intentional.