Galaxy Gaming Inc. GLXZ – Will the acquisition by Evolution go through? And passing on CROX and AMCX

Or at least a case study in how high-cost debt can destroy cash flow

Here is the latest from Canadian Value Investors!

Galaxy Gaming Inc. GLXZ – Will the acquisition by Evolution go through? Who cares! (Maybe it would be a good thing if it fails)

Half baked: Ideas that do not make the cut – CROX, AMC Networks

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Half baked: Ideas that do not make the cut

We try to stick to writing about what we own, but we have received a few questions recently on things we have passed on. Today we highlight two fun ones.

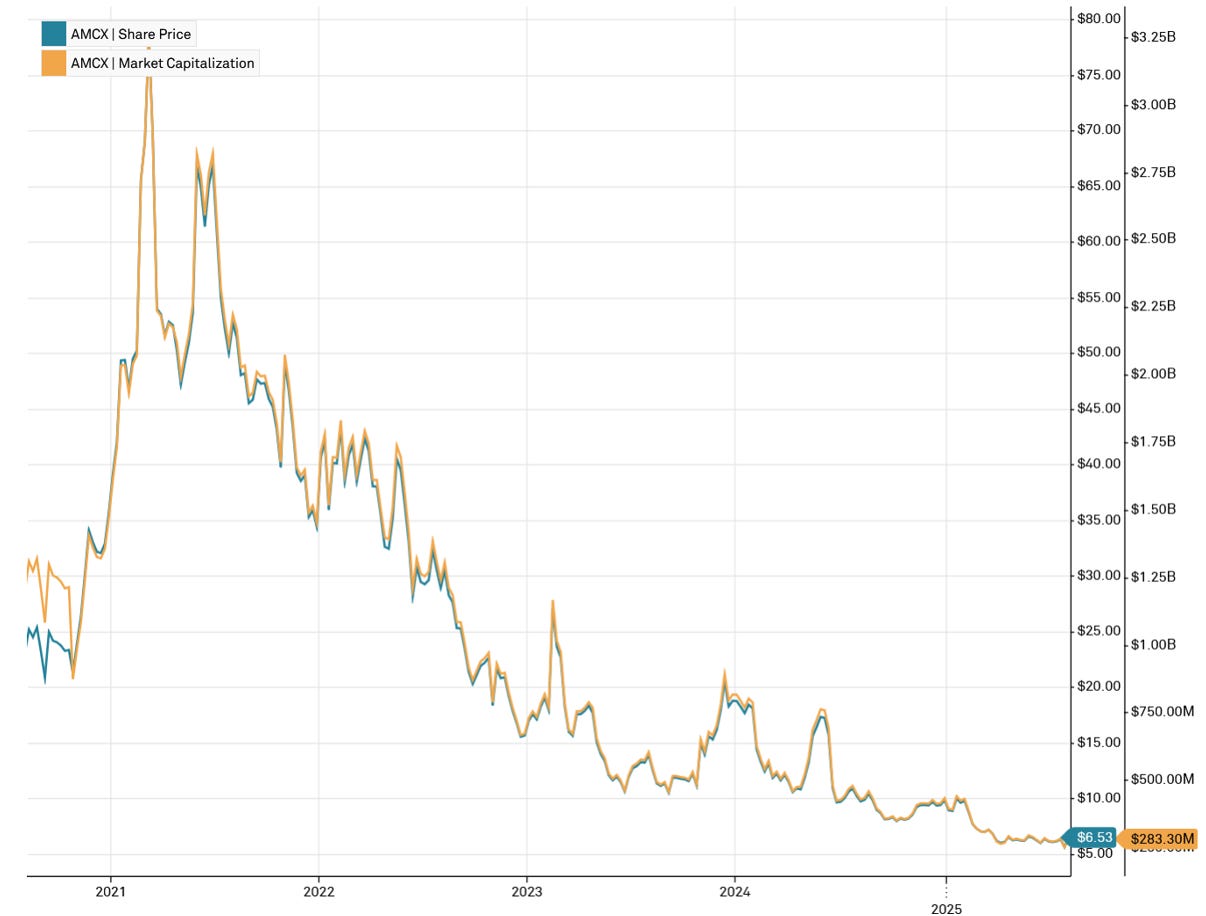

AMC Networks

AMC Networks $AMCX – known for developing hits like Walking Dead, Breaking Bad, and Mad Men - has been coming up on our screens for years. High FCF/market cap yield, but too much debt and an uncertain outlook for new content. So far it has been a... trap! Now it is almost a stub equity with a market cap of just under $300MM, less than their 2020 share repurchases. In fact, their repurchases over the last few years are 6x their current market cap.

Maybe this time it is different...! Any longs? No position.

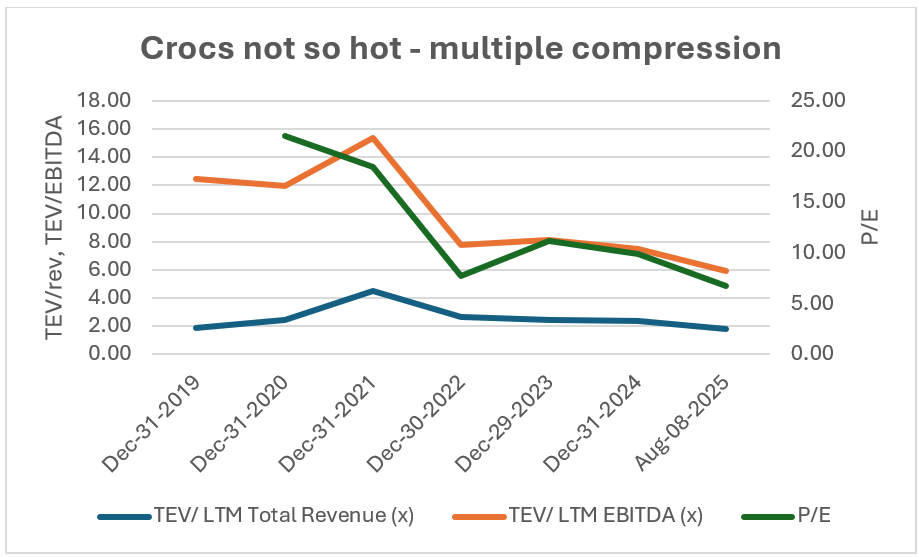

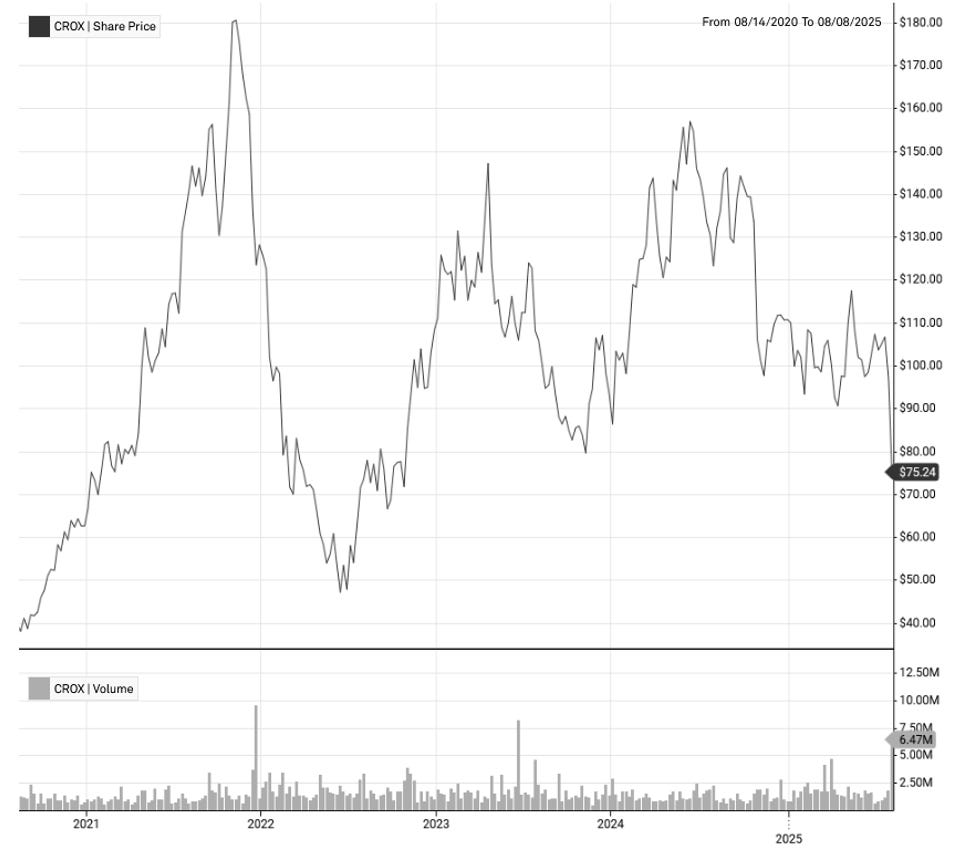

CROX

Another controversial name in the value space is Crocs, the maker of rubber shoes you either love or hate. There is a lot of money in these. Multiples have continued to decline and they have repurchased ~23% of the shares outstanding since 2018.

Q2 2025 revenues reached $1.1 billion, a 3% increase year-over-year, gross margins improved by 30 basis points to 61.7%, and adjust operating margin was approximately 27%, supporting adjusted diluted earnings per share of $4.23, a 5% increase year-over-year. Outcome? A ~30% decline in the stock price. Maybe it is because they have been losing some shelf space and are facing tariff headwinds. Maybe the $737MM write down on HEYDUDE intangible assets did not help.

Crocs CEO Andrew Rees –“ I think, what is different about us is the – we sell at a very democratic price points on both brands, right? So – and that democratic price point means that we appeal to a particularly broad consumer base. There are other brands that are absolutely performing much better in this marketplace because they are focused on a – exclusively on a high-end consumer. The low-end consumer is a consumer that we believe is most sensitive to price increases, is most nervous, and, in some cases, is not leaving the house.”

But, they are still the #1 shoe brand on Tiktok shop. Much like the shoes (sandals?), we do not know what to do with the stock.

Galaxy Gaming Inc. GLXZ – Will the acquisition by Evolution go through? Who cares! (Maybe it would be a good thing if it fails)

Or at least a case study in how high-cost debt can destroy cash flow

Disclosure: We own this one. Position size: Small

Galaxy Gaming (GLXZ) is one of those fun businesses where you have probably seen their product, but have not realized it. They are a B2B supplier to the gambling industry. They design, develop, acquire and license proprietary table-game content and table technology to real world casinos and legal online operators. Casinos need to pay licensing fee to offer certain games. Specifically, Proprietary Table Games used alongside public-domain games, such as Side Bets (e.g., 21+3®, Lucky Ladies®, Bonus Craps™, EZ Baccarat) and Premium Games (e.g., Heads Up Hold ’em®, High Card Flush®, Cajun Stud®, Three Card Poker®). They also offer Enhanced Table Systems that add progressives/bonusing and capture wager data, i.e. a Bonus Jackpot System. Maybe this reminds you of your last trip to Las Vegas?

We were aware of the Company but did not own it when Evolution came along with a US$3.20 per share offer. The deal was subsequently approved by shareholders. At the offer the stock jumped to ~US$2.80 and has been stuck around there since for a year, defying the Efficient Market Theory or at least making an interesting Time Value of Money final exam question. The wrinkle is it requires approval from a number of jurisdictions and the process is opaque. Although the closing timing has slipped (see deal timing below), the final outside day is January 2026. Will the deal close? A ~10% spread, or ~20% IRR implies there is a risk to close.

We recently purchased it. Will the go through? Perhaps, but perhaps it does not actually matter with a new debt deal and new licensing agreement in hand… Maybe it would even be better if it fails.

The original deal

The deal tea leaves

Trangulating the debt problem

The new debt deal

What happens if it fails - The Stabilized company

The original deal

LAS VEGAS, July 18, 2024 (GLOBE NEWSWIRE) -- Evolution AB wholly owned subsidiary, Evolution Malta Holding Limited, (“Evolution”) has entered into an agreement to acquire Galaxy Gaming, Inc. (“Galaxy Gaming”) (OTC:GLXZ) for a total equity value of approximately $85 million (the “Transaction”), payable in cash.

Transaction highlights and strategic rationale

Galaxy Gaming, a leading developer and distributor of innovative casino table games and enhanced gaming technology solutions, continues to revolutionize the casino industry with its state-of-the-art products and exceptional service. With a diverse portfolio of cutting-edge games, Galaxy Gaming has established itself as a trusted partner to casinos worldwide.

The acquisition is in line with Evolution’s strategy of being the world’s top provider of casino games, supplying its customers with the best gaming content. With the acquisition of Galaxy Gaming, Evolution solidifies its presence in the US market and enhances its position as a leading licensor of proprietary tables games to the online gaming industry.

“We are thrilled to announce the acquisition of Galaxy Gaming, which represents a significant milestone in our mission to provide unparalleled gaming experiences to our customers. Galaxy Gaming’s exceptional products and technology complement our existing portfolio and strengthen our strategic position.” – Martin Carlesund, CEO Evolution AB (publ)

“Evolution intends to retain the management and employees and also plans to operate Galaxy Gaming as a separate and independent business unit,” added Carlesund

“We believe this transaction represents the opportunity to unite two world-class, customer-focused teams in a way that will benefit all stakeholders. It combines Galaxy Gaming's thriving land-based business, driven by our industry-leading games and progressive technologies, with Evolution's global reach and innovative online gaming leadership. For years, our collaboration has successfully delivered popular games like 21+3® and Lucky Ladies® to millions of players in regulated iGaming markets globally. This acquisition by Evolution empowers Galaxy to sustain and maintain its independence while continuing to focus on growth and expanding its operations, leveraging Evolution's operational and financial strength to facilitate product sharing and drive cutting-edge omni-channel innovation.” – Matt Reback, President and CEO, Galaxy Gaming

Galaxy Gaming has provided guidance of $29.0 - $30.0 million in Net Revenue and $12.0 - $13.0 million in Adjusted EBITDA for fiscal year 2024.

Consideration and financing

Pursuant to the Merger Agreement, Evolution has agreed to acquire all of the outstanding shares of common stock of Galaxy Gaming for $3.20 per share in cash, which represents a premium of 124% to Galaxy Gaming’s closing share price on July 17, 2024, the last trading day prior to the announcement of the Transaction. The Transaction values Galaxy Gaming at a total equity value of approximately $85 million, and approximately $124 million including net debt. The consideration will be financed with cash on hand.

Conditions and time plan for the acquisition

The Transaction has been approved by the board of directors of Galaxy Gaming. Galaxy Gaming board members holding approximately 14% of Galaxy Gaming’s common stock have entered into support agreements to vote their shares in favor of the Transaction.

The Transaction is subject to customary closing conditions, including Galaxy Gaming stockholder approval and certain required gaming regulatory approvals. The parties currently expect the closing to occur in mid-2025, subject to satisfaction of those closing conditions.

Advisors

Evolution has engaged J.P. Morgan SE as exclusive financial advisor and Kirkland & Ellis LLP as legal advisor in connection with the Transaction. Galaxy Gaming has engaged Macquarie Capital as exclusive financial advisor and Latham & Watkins LLP as legal advisor in connection with the Transaction.

Now closing has slipped. Latest deal timeline:

As previously reported, pursuant to the terms of the Merger Agreement, if the Merger has not been consummated by July 18, 2025 (the “Initial Outside Date”), either Galaxy or Evolution may terminate the Merger Agreement; provided that such date shall be automatically extended to October 18, 2025 (the “First Extended Outside Date”) if, on the Initial Outside Date, all conditions to the Merger would have been satisfied or waived if the closing had taken place on the Initial Outside Date, other than the closing conditions related to the absence of certain legal constraints, or the receipt of certain gaming regulatory approvals (the “Gaming Approval Closing Condition”).

As of July 18, 2025, all conditions to the Merger would have been satisfied or waived if the closing had occurred on such date, other than the Gaming Approval Closing Condition. In accordance with the foregoing terms, on July 18, 2025, the Initial Outside Date was automatically extended to October 18, 2025.

Galaxy and Evolution continue to be actively engaged with gaming regulators to secure the approvals required to satisfy the Gaming Approval Closing Condition, and the parties expect the closing to occur in the second half of 2025, subject to satisfaction of all closing conditions.

Pursuant to the terms of the Merger Agreement, if, on the First Extended Outside Date, all conditions to the Merger would have been satisfied or waived if the closing were to take place on the First Extended Outside Date, other than the closing conditions related to the absence of certain legal constraints, or the satisfaction of the Gaming Approval Closing Condition, then such date will be automatically extended to January 18, 2026.

The deal tea leaves

For Galaxy, it has been quite quiet (at least in disclosures and filings we have access to).

Per Evolution:

Evolution 2024 YE – “Closing is expected in mid-2025, Galaxy Gaming Inc. is therefore not yet included in the consolidated accounts.”

Evolution 2025 Q1/Q2 filings – “Closing is expected in the second half of 2025; Galaxy Gaming Inc. is therefore not yet included in the consolidated accounts.”

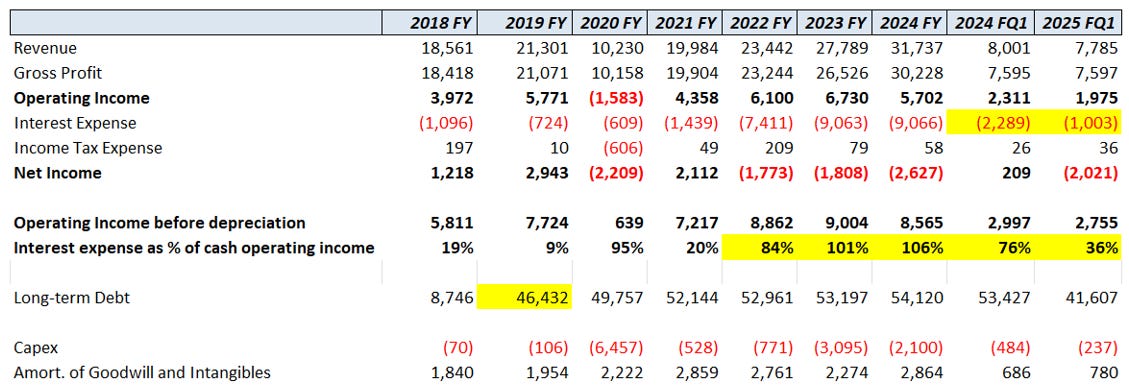

Triangulating the debt problem

Galaxy had a nice niche business, but the forced takeout of a large block of shares owned by the founder created an interest burn problem two years later.

On May 6, 2019, we redeemed all 23,271,667 shares of our common stock held by Triangulum Partners, LLC (“Triangulum”), an entity controlled by Robert B. Saucier, Galaxy Gaming's founder, and, prior to the redemption, the holder of a majority of our outstanding common stock.

The redemption of Triangulum’s shares was given effect pursuant to our Articles of Incorporation (the “Articles”), which expressly provide that if certain events occur in relation to a stockholder that is required to undergo a gaming suitability review or similar investigative process, we have the option to purchase all or any part of such stockholder’s shares at a price per share that is equal to the average closing share price over the thirty calendar days preceding the purchase.

The average closing share price over the thirty calendar days preceding the redemption was $1.68 per share.

As consideration for the redemption, we issued a promissory note payable to Triangulum in the face amount of $39,096,401 (the “Triangulum Promissory Note”).

The original interest rate and terms? Favourable to Galaxy.

The Triangulum Promissory Note has no mandatory amortization, is scheduled to mature on May 5, 2029, and bears interest at 2% per annum, with accrued interest payable annually in arrears.

It is unsecured and is subordinated to our existing and future indebtedness in accordance with its terms. We may prepay principal and any accrued interest in full or in part at any time.

However, to make a long story short, this was not what Robert Sacuier wanted, and a lawsuit ensued. It was expensive. For example,

In 2020, the Company incurred $652,198 in expenses associated with the Triangulum Lawsuit and $20,058 of severance expense.

Triangulum tried to force the reissuance of shares but was denied by the district court in July 2019, and the Nevada Supreme Court affirmed on March 26, 2021, effectively blocking any reissuance. https://caselaw.findlaw.com/court/nv-supreme-court/2119738.html

This dragged on until October 2021, when:

LAS VEGAS, Oct. 07, 2021 (GLOBE NEWSWIRE) -- Galaxy Gaming, Inc. (OTCQB: GLXZ) (“Galaxy” or the “Company”), a developer and distributor of casino table games and enhanced systems for land-based casinos and iGaming, announced today that it entered into Settlement Agreement with its former Chairman and Chief Executive Officer, Robert Saucier (“Saucier”), and Triangulum Partners LLC (“Triangulum”) on October 7, 2021.

The Settlement Agreement is conditioned upon the Company paying Triangulum and Saucier $39.1 million plus interest accrued at 2% per annum from May 6, 2021, through the date of actual payment. The Company has retained Macquarie Capital (USA) Inc. to assist it in raising funds for the settlement. The Settlement Agreement allows the Company until December 31, 2021, to complete its fundraising and pay the settlement amounts to Triangulum and Saucier.

This did not give Galaxy much time to find a lender and led to what seems like a shotgun wedding with Fortress, with terms (most important being high interest, cash sweep) outlined below. The refinancing was expensive at effectively LIBOR + 7.75%. And then to compound the problem at the worst possible timing, LIBOR went from ~0% to 5% in the great run up of 2022/2023.

Fortress Credit Agreement. On November 15, 2021, the Company entered into a senior secured term loan agreement with Fortress Credit Corp. (“Fortress Credit Agreement”) in the amount of $60.0 million. The proceeds of the loan were used to (i) pay approximately $39.5 million to Triangulum as full payment of the settlement amount due under the previously filed settlement agreement between Galaxy Gaming and Triangulum, as set forth above; (ii) repay approximately $11.1 million due and owing to NSB under the MSPLP and under the Amended and Restated Credit Agreement, dated as of May 13, 2021, made between Galaxy Gaming and Zions Bancorporation, N.A. dba Nevada State Bank, a Nevada state banking corporation, and (iii) approximately $4.1 million was used to pay fees and expenses. The remaining approximately $5.3 million was added to the Company’s cash on hand and used for corporate and operating purposes.

The Fortress Credit Agreement bears interest at a rate equal to, at the Company’s option, either (a) LIBOR (or a successor rate, determined in accordance with the Fortress Credit Agreement) plus 7.75%, subject to a reduction to 7.50% upon the achievement of a net leverage target or (b) a base rate determined by reference to the greatest of (i) the federal funds rate plus 0.50%, (ii) the prime rate as determined by reference to The Wall Street Journal’s “Prime Rate” and (iii) the one-month adjusted LIBOR rate plus 1.00%, plus 6.75%, subject to a reduction to 6.50% upon the achievement of a net leverage target. The Fortress Credit Agreement has a final maturity of November 13, 2026. The obligations under the Fortress Credit Agreement are guaranteed by the Company’s subsidiaries and are secured by substantially all of the assets of the Company and its subsidiaries. The Fortress Credit agreement requires, among other things, principal payments of $150,000 per quarter and includes an annual sweep of 50% of excess cash flow commencing in April 2023 based on results for fiscal 2022.

The new debt deal