Fallen Darlings– Thinkific Labs Inc. (TSX:THNC)

The key to a happy life is low expectations

Disclosure: NEW position. We own this one, with recent purchases around ~$2. Position size: Small

The SmallCap Discoveries 2025 conference was an excellent event. It is not very often that you get to spend a few days in a room filled with great management teams and investors.

But the important question is, were there companies worth investing in?

There were many interesting companies, but we are focusing on a few that we spent time with and think are at a particularly interesting juncture. The list this year is long enough that we are breaking it up into three groups:

Cannabis Corner

The Scalers

Fallen Darlings

Here is part 3.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious bias and conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. In addition, no one guarantees the accuracy of any information provided and none of the information should be construed as investment advice or any other kind of advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose, except for entertainment (and we hope you enjoy).

Part 3: The Fallen Darlings - Thinkific Labs Inc. (TSX:THNC)

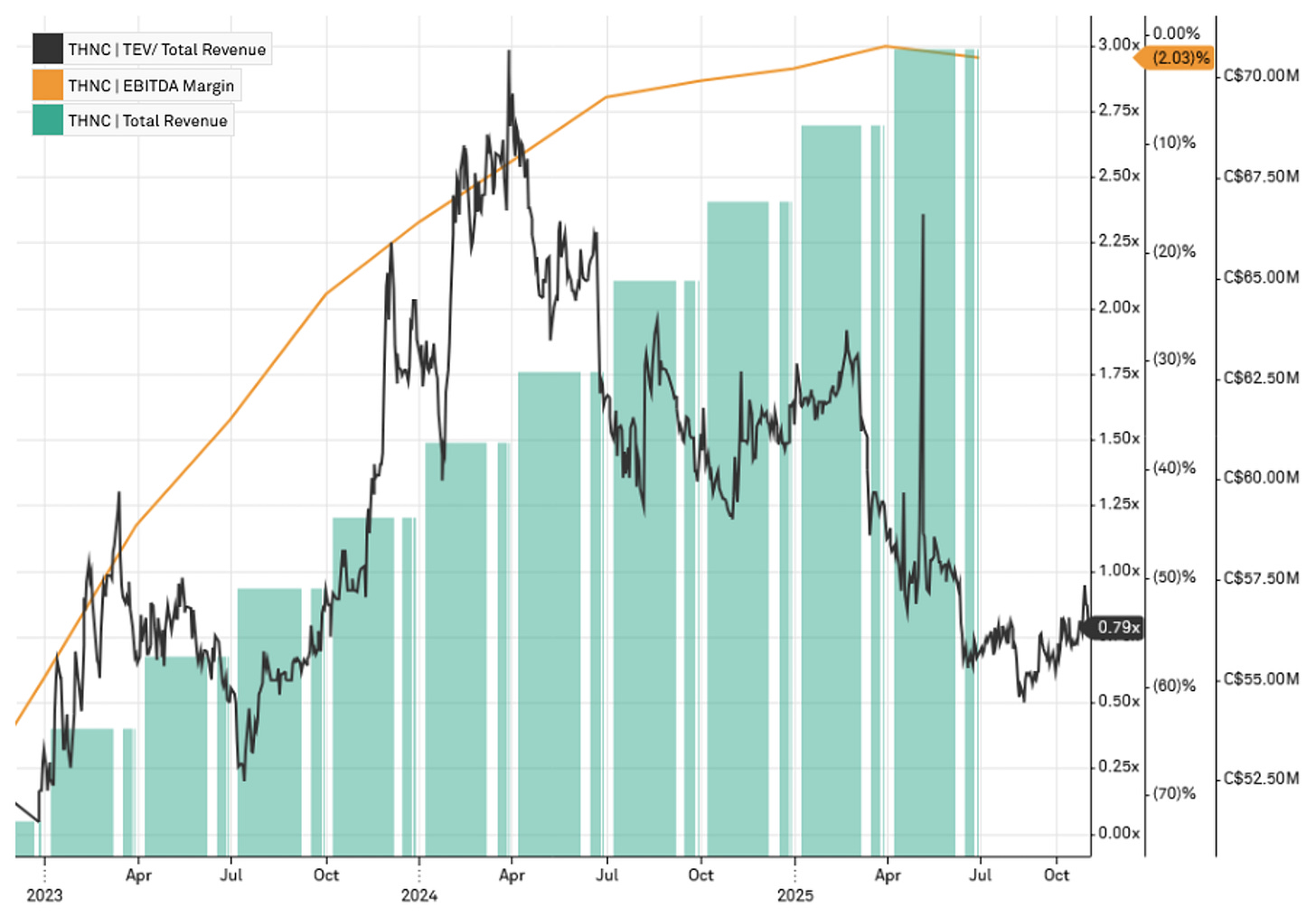

Thinkific has been a wild ride for investors. The online course platform started in 2012 when the co-founding brothers wanted to solve a problem for themselves; how do you make it easy to sell a course online? Fast forward to 2021 and the business was growing fast, supercharged by COVID-19. Expectations were sky high with a market cap of over a billion dollars. Unfortunately, an overbuild of staff combined with reasonable-instead-of-rocket growth caused the valuation to collapse. This has been aggravated by a key pre-IPO venture shareholder selling as the fund reaches end of life. We find that EV/revenue sometimes useful as a barometer of how bullish or bearish the market is. What a chart.

However, we think the market has swung too far the other way. Thinkific is cash-rich ( approximately half of market cap covered by cash, note that they report in USD) and a reset of the management team and business strategy is starting to show progress. Expectations are at rock bottom and we think it is time for the market to notice Thinkific again.

The Thinkific Today

Let’s start with where Thinkific is today. It is a learning-commerce platform that sells software subscriptions to create, market, and deliver online courses and communities, and, more recently, it monetizes checkout via embedded payments (“Thinkific Commerce”). This is not like Coursera or Udemy, instead it lets individuals and companies own the customer and helps them manage and scale their courses. It is similar to Shopify and actually integrates with that platform.

They have continued to improve their product and have been transitioning to focus on higher value Self Serve larger Plus customers. A key strategy/benefit is their ability to integrate with other platforms and services their customers are using to facilitate internal reporting and sales development.

It appears that the market did get a bit too excited with this IPO. However, is the market now too pessimistic about this cash-rich business showing underlying improvements? Despite recent improvements in revenue, customer mix, and margins, the market has not cared, yet.

To really understand Thinkific, you have to go back to the IPO.

The IPO

We always find it helpful to approach a Company like a history class, and seems particularly appropriate for a company that is largely driven by learning. Thinkific’s story started long before the COVID boom in 2012 when Greg Smith, co-founder and CEO, started the online learning platform he started with his brother, Matt Smith. Greg was teaching LSAT prep courses in-person and later online course. He wanted a product that could help him sell his course, and this led to the creation of Thinkific.

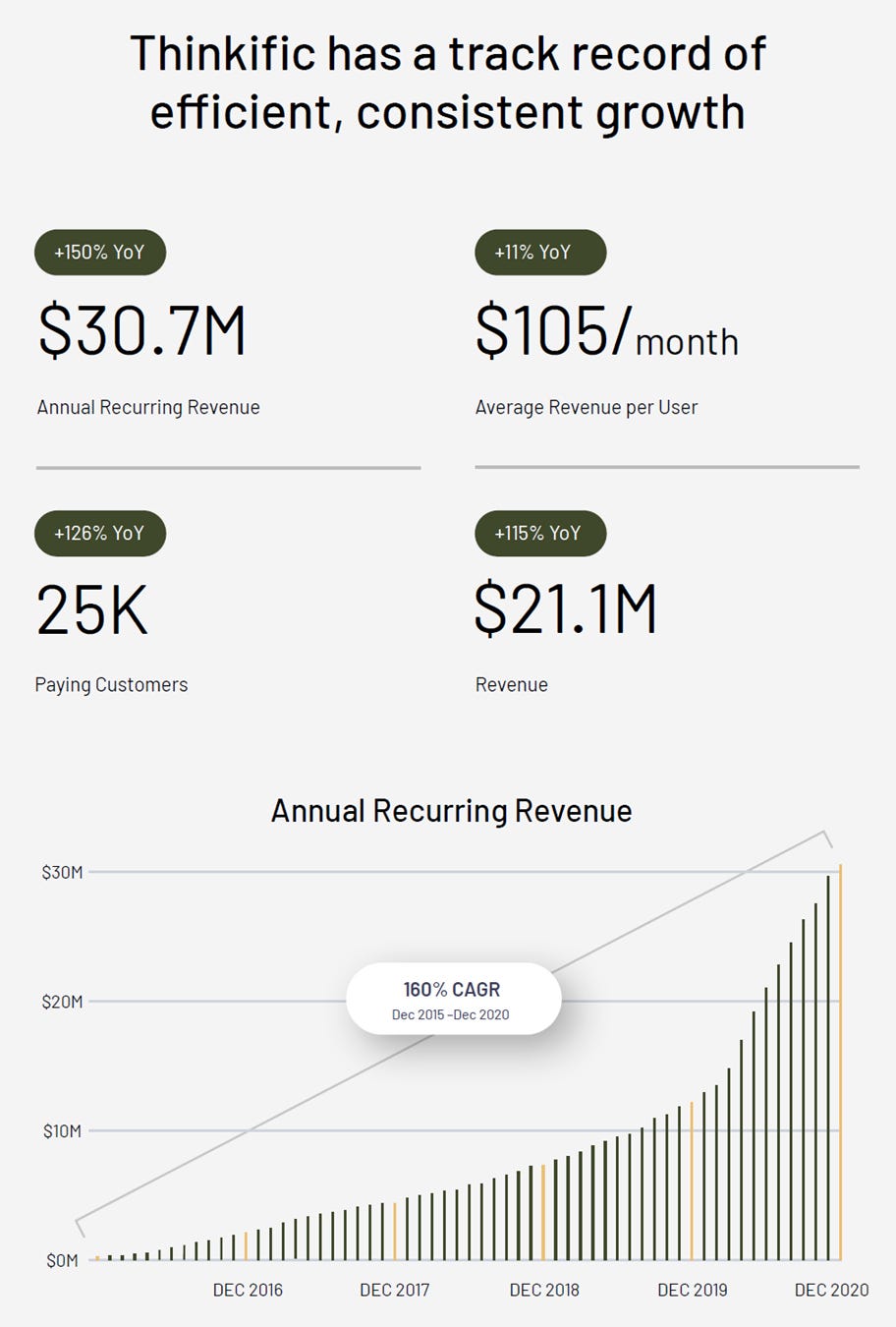

Fast forward to 2020, things were going well, with significant real growth pre-COVID, and then subsequently super charged by the COVID boom. Remember when we were all going to live online forever? The growth was real and the business was around long before the COVID boom *unlike many… “opportunities” around that time).

Unfortunately, there were a few issues, namely:

IPO hype and subsequent abandonment by market – From an IPO perspective, it was the right company at the right time to go public. Our understanding is that it was 7x oversubscribed and management elected not to increase as they did not need the funds.

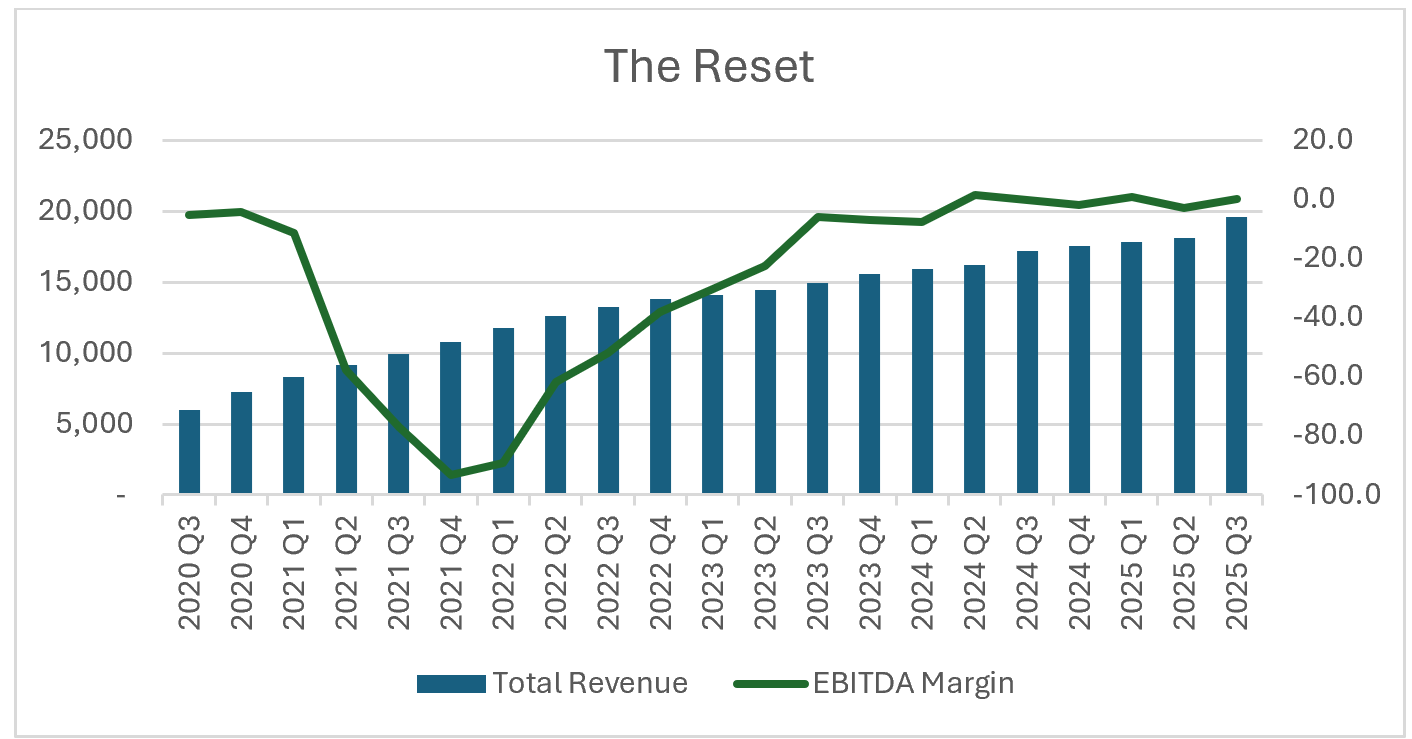

IPO overbuild - market expectations were too high and there was the real problem of overbuilding. Their headcount ballooned, and they subsequently went through two painful rounds of layoffs.

And then more recently, a key seller – Rhino Ventures invested in Thinkific pre-IPO and also participated in the IPO. Our understanding is that the fund is near the end of its life and began selling in Q2 of this year. Share count per filings reduced from ~16.3MM shares or 24% of outstanding to 9.6MM or 14%. Yikes. That is a lot of shares for the market to digest.

The Reset

There are a few key items that have piqued our interest:

Conversion to single voting common share structure – In April, the Company removed the founder-owned Multiple Voting Share structure, which we view as good for common shareholders. “We believe all shareholders will benefit from the elimination of the dual-class share structure by aligning voting rights with economic interests.” said Greg Smith, CEO and founder of Thinkific. “The dual-class structure was established to support the Company’s early growth as a public entity. With a four year track record as a public company and confidence in our team, strategic vision, and path forward, the extra voting provisions are no longer necessary.

Refreshed management – A management and Board refresh began in 2024. Recent changes include a new Chair of the Board in September 2024, Russ Mann from Diversis Capital (B2B SaaS) and is also on a few other boards including NYSE:OOMA. Management-wise, there is a new VP of Program Management/R&D Michael McQuade (Hootsuite), new CPO Elise Stribos (Jungle Scout), new Chief Revenue Officer Amanda Malko (G2, Mailchimp) in 2024, new Chief Product & Technology Officer Ryan Donovan (Hootsuite) in 2024, and a new Head of Thinkific Commerce Clovis Cuqui (Shopify) in 2024. Recent changes have led to…

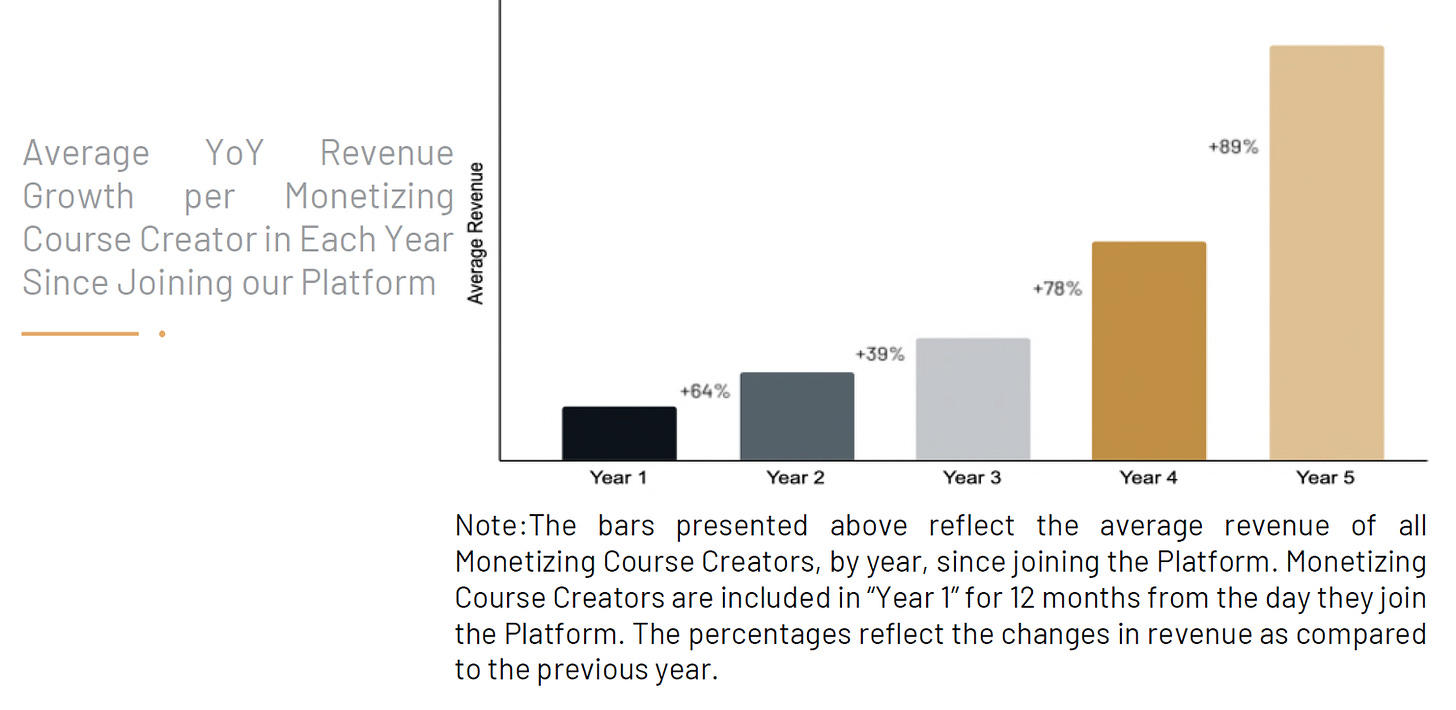

Growing sales, stickyish ARR – The strategy to de-emphasize growth of small self-starters (reflecting high churn, failure rate) to medium size enterprises appears to be the right approach. In addition, their payments flywheel appears to be working with volumes and penetration up.

Plus (higher value larger customers) appears to be working – The majority of new deals are multi-year.

Pressure from key shareholder selling - Rhino Ventures recent sales have put downward pressure on the stock price while their reason for selling (fund life) is disconnected from recent business performance. We view that as an opportunity, though we note that when their lockup ends in December it could lead to further selling. As part of their sale of 6.4MM shares in a secondary offering in June, they agreed to a six month lock up in December. https://www.newswire.ca/news-releases/thinkific-announces-closing-of-secondary-offering-of-approximately-c-14-5-million-of-rhino-group-s-shares-847998319.html

And then there is the underlying improvements in the product. Besides the focus on improved tools for enterprise users to manage their business (e.g. better permissions, etc), there is also the use of AI. This potentially has the benefit of significantly improving the quality of classes by helping providers scale their engagement, while providing Thinkific with another source of revenue from their customers.

Some of the things we’re focused on now, communities and connected learning, just seeing a huge trend towards – especially with AI that just the one to computer consumption of information is not as exciting as engaging in a community of others who are learning. So we’ve made significant investment there. AI enabled, they talked about the teaching assistants, but there’s a whole bunch of other areas where we’re now expanding our AI functionality, just giving people tools to manage their business at scale. So agents that can working on agents that can help you manage the back end of your business, as well as manage the teaching front side, and then, of course, commerce and selling.

As we go forwards, the metrics I’m watching the closest and sort of in order in terms of where I think we’re going to see success leading to growth, the first is average revenue per user right now, $169 per month per user. But obviously with the addition of more commerce functionality and larger customers, that average price point is over $2,000 a month, there’s an opportunity to bring this up significantly as we invest more in that area. That, in turn will bring up our average revenue or our annual recurring revenue, ARR. And finally, the more lagging metric is as more of these customers come on and launch their programs, we see their growth in these sales they do, which is GPV, gross payments volume, and we do have a take rate on that. So that produces an additional revenue line item for us over time.

As per their Q3 2025 call:

Teaching Assistant is a solution designed to help our customers scale their businesses while saving them time, and it will also create additional revenue opportunities for our customers while providing a more interactive, personalized and valuable learning experience to their learners. The positive feedback we have been receiving confirms we’re hitting the mark. In addition to these teaching assistants, there are other avenues we plan to add significant value for our customers through the use of AI.

Understanding the customer