Ensign Energy (TSX:ESI): A guide on how to engineer a liquidity crisis

When companies are trading at free cash flow yields over 50%, there is usually an interesting story behind it. Ensign Energy is no exception.

Disclosure: We own this one and added very recently.

Here is the latest from Canadian Value Investors!

When companies are trading at free cash flow yields over 50%, there is usually an interesting story behind it. Ensign Energy is no exception.

Ensign Energy Services Inc. (TSX: ESI) is one of Canada's largest oilfield services companies, specializing in land-based drilling, well servicing, and directional drilling since 1987. Headquartered in Calgary, Alberta, it operates a diversified fleet across Canada, the U.S., and international markets (notably the Middle East, Latin America, and Australia).

It is trading at a high free cash flow yield, below book value, but appears over-levered and has nearly no liquidity on its line. Are we worried? No. It can be explained by an ill-timed acquisition and one key man. This is the story of Ensign.

Ensign – A bit of history

Trinidad Drilling – The ill-timed acquisition

And then another crash

Liquidity – Running lean

Why does this situation exist?

Competition dynamics and anecdotes

Thinking about the industry outlook

Ensign today

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Ensign – A bit of history

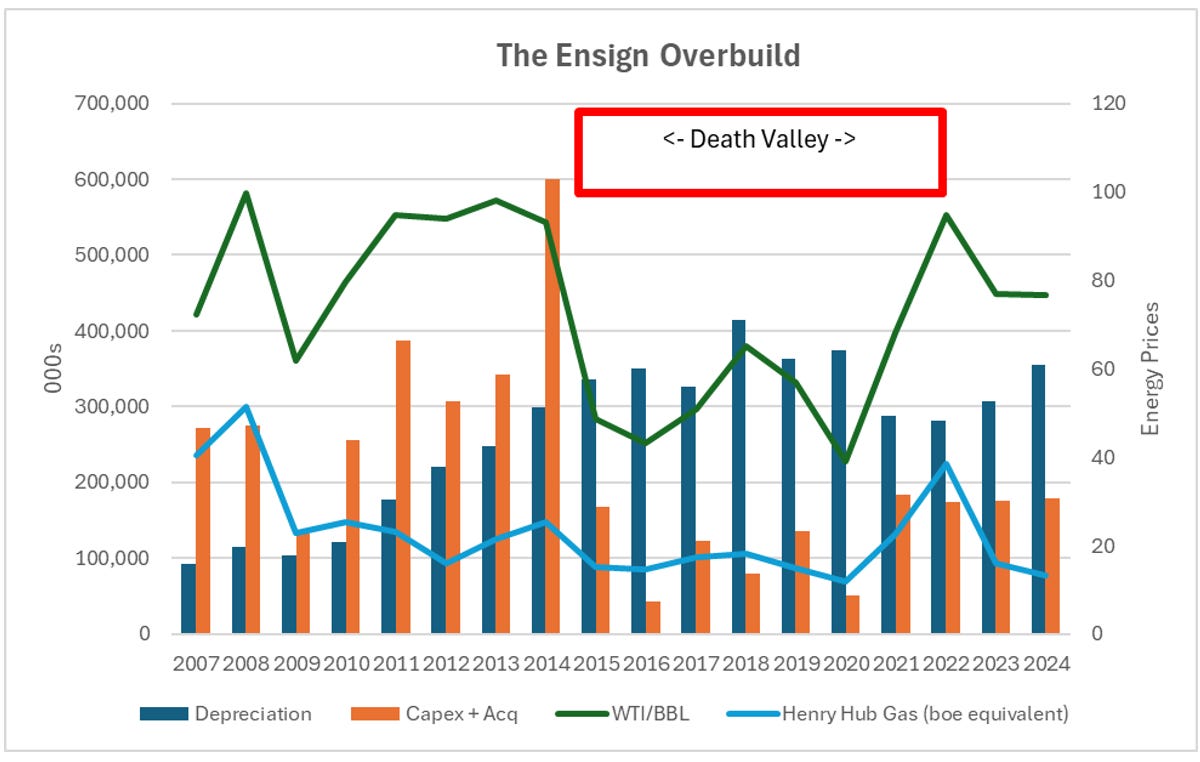

Ensign is a perfect case study of what has happened to the oil and gas service industry. In the early 2010s, the industry was booming. WTI oil prices floated around $100 and natural gas prices were not so bad either. It caused Ensign, along with the rest of the industry, to spend significant amounts on growth capex. At the same time, lenders were supportive and willing to lend loosely to support this growth long before ESG targets existed.

Unfortunately, a perfect storm came. The price of oil crashed in late 2014 into 2016 driven by oversupply – over-drilled U.S. shale production grew by 4MM/day in a few years – combined with weak demand growth. WTI crashed from ~$100 in 2014 to the $40s for three years resulting in significant reductions in capital spending. We refer to this period as Death Valley. The subsequent dramatic cuts in oil and gas capital spending devastated many service companies but impacted each sub-service in oil and gas differently. In the case of drilling, the rig overbuild was so big that the industry effectively did not require any growth capex for the last decade. However, Ensign survived to go on and make a major hostile acquisition in 2018.

Trinidad Drilling - The ill-timed acquisition

In August 2018, Ensign launched a hostile all-cash offer for Trinidad Drilling Ltd., valuing the company at approximately ~$947 million, including debt. By November 27, 2018, Ensign had secured 66% of Trinidad's shares, enough to gain control, and subsequently reaching 100% as detailed below. This acquisition added drilling rigs in Canada, the U.S., and internationally through the Trinidad Drilling International joint venture. The acquisition made sense strategically, at least we think. Unfortunately, the timing was not ideal.

2019 AR BUSINESS COMBINATIONS

During the fourth quarter of 2018 (the "Effective Date") the Company initially completed the acquisition of 56.4 percent of the issued and outstanding common shares of Trinidad Drilling Ltd. ("Trinidad"), a publicly traded oilfield service company. Following the initial acquisition of control, the Company extended the period for the tender of additional Trinidad shares, and subsequently acquired 89.3 percent through a series of transactions for total consideration of $410,197. During the first quarter of 2019, the Company acquired the remaining 10.7 percent of Trinidad common shares, resulting in a total acquisition price of $459,411. The strategic business combination was completed to increase the Company's presence in the North American drilling market and certain international markets.

The Trinidad acquisition was funded from the Company's cash resources and available debt facilities.

And then

Effective July 16, 2020 (the “Effective Date”), the Company completed the acquisition of Halliburton’s 40 percent ownership interest of the TDI joint venture…with cash on hand for US $33,400. With the acquisition, the Company now owns 100%...The strategic business combination was completed to enhance the Company’s international presence with three long-term contracts in the Middle East.

As a reminder, it was a hostile acquisition.

Trinidad Board of Directors Recommends Shareholders Reject Ensign's Hostile Offer and Do Not Tender Shares, Trinidad Operations Continue to Perform Strongly

M2 Communications

CALGARY - Trinidad Drilling Ltd. (TSX: TDG) ('Trinidad' or the 'Company') today announced that the Board of Directors (the 'Board') has unanimously determined that the hostile offer from Ensign Energy Services Inc. ('Ensign') to acquire all of the issued and outstanding common shares ('Common Shares') of Trinidad for cash at a price of $1.68 per Common Share (the 'Ensign Offer') is not in the best interest of the Company or its shareholders ('Shareholders').

The Board's determination followed careful consideration, including advice from its financial and legal advisors, and the recommendation of the Special Committee. The Board believes the Ensign Offer significantly undervalues Trinidad and unanimously recommends that Shareholders REJECT the Ensign Offer and NOT TENDER their Common Shares. To reject the Ensign Offer, simply take NO ACTION. If you have tendered your Shares in error and wish to withdraw, simply ask your broker or contact D.F. King to assist you with this process.

And then another crash

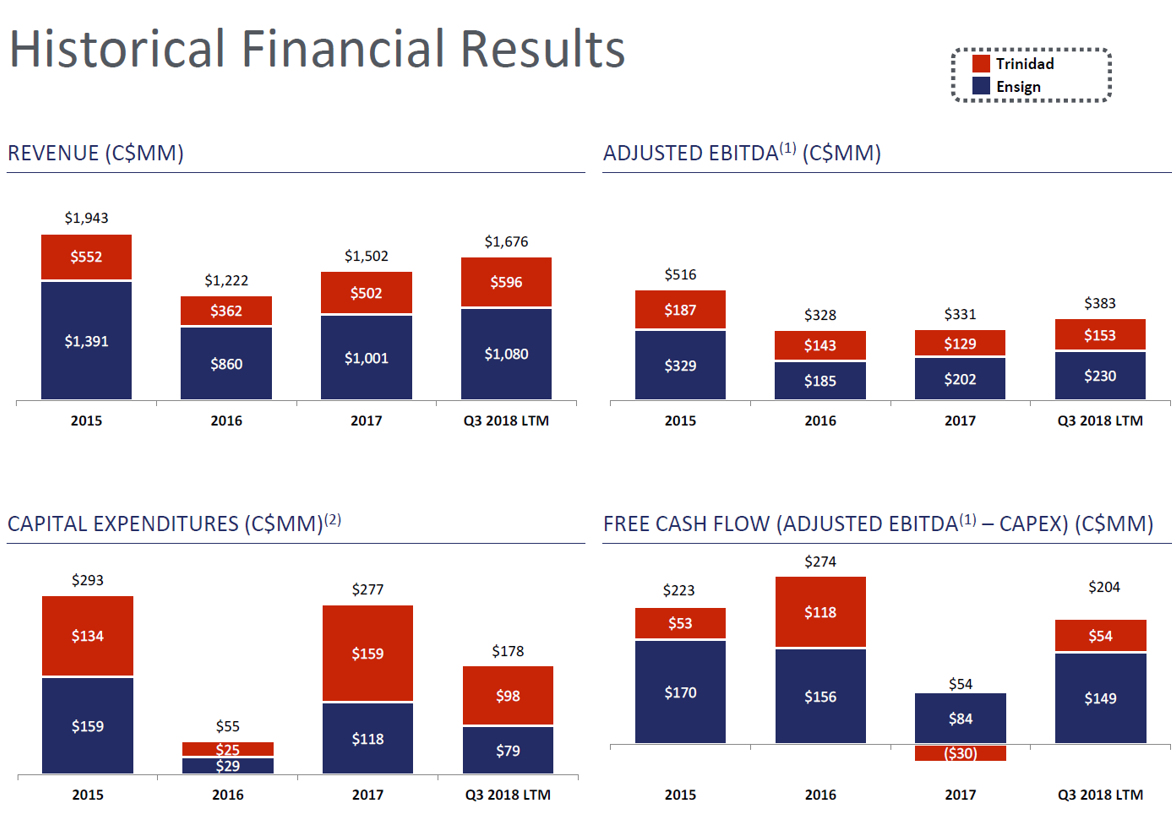

Although the major crash was 2014-2016, we think it is important to keep in mind how bad the 2018/19 crash was. For context, a major broker at the time was forecasting 2019/2020 revenue of $1.9B / $2.0B and EBITDA of ~$410MM /$430MM. Actual results? $1.6B / $1.8B and $380MM / $214MM, i.e. EBITDA was cut in half. Compounding the problem was the acquisition funding. Net debt went from ~$700MM in 2017 to $1.6B in 2018 when they acquired Trinidad. The acquisition cashflow just did not offset the leverage put on to get the deal done given the macro blow up.

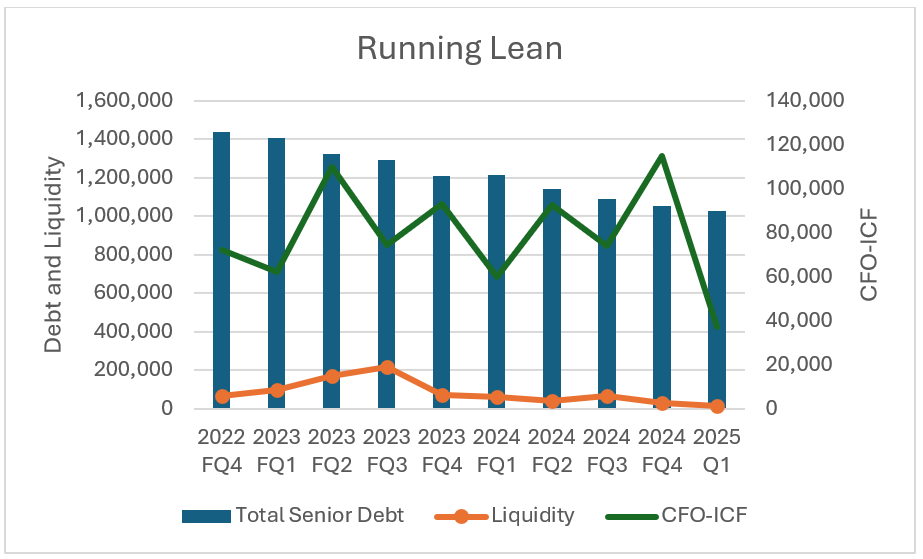

Liquidity - Running lean

Ensign began deleveraging along with the rest of the industry and have been making good progress. However, the headline liquidity will likely give many value investing analysts pause; “is this company about to be tipped over?” It has also bothered energy analysts with report headlines like “[ESI] operating too close for comfort”.

The liquidity situation was exacerbated by the Company’s 2023 repayment of all of their externally rated notes with all senior bank debt. The transaction included a term loan with aggressive step-downs. Questions remained, but then new letter of credit facilities were created, a small year-end convertible was issued, and step-downs changed… All remains well because of their key shareholder.

CALGARY, AB, April 15, 2025 /CNW/ – Ensign Energy Services Inc. ("Ensign" or "the Company") announced today an amendment to its Credit Facility, demonstrating its ongoing commitment to prudent financial management and enhanced liquidity. The available borrowings under the Credit Facility were originally scheduled to be reduced by $75.0 million on June 30, 2025. The Company has had the terms of its Credit Facility amended so that there will be a phased reduction of $25.0 million on June 30, 2025, $25.0 million on September 30, 2025, and $25.0 million on December 31, 2025. This reduction plan will bring the available borrowings under the Credit Facility to the final size of $700.0 million at December 31, 2025.

The original facilities they put in place were as follows.

On October 13, 2023, the Company amended and restated its existing credit agreement with its syndicate of lenders, which provides a revolving Credit Facility and $369,000 Term Facility. The amendments include an extension to the maturity date of the $900,000 Credit Facility to the earlier of (i) the date that is six months prior to the earliest maturity of any future Senior Notes, and (ii) October 13, 2026. The amended and restated Credit Facility includes a reduction of the facility by $50,000 at the end of the second quarter of 2024, a $75,000 reduction at the end of the fourth quarter of 2024 and a further reduction of $75,000 million by the end of the second quarter of 2025. The final size of the amended and restated Credit Facility will then be $700,000.

The Term Facility requires repayments of at least $27,675 each quarter beginning in the first quarter of 2024 to the fourth quarter 2025; and then repayments of at least $36,900 each quarter from the first quarter 2026 to the third quarter 2026

On October 13, 2023, the Company amended and restated its existing credit agreement with its syndicate of lenders, which provides a revolving Credit Facility and $369,000 Term Facility. The amendments include an extension to the maturity date of the now $775,000 Credit Facility to the earlier of (i) the date that is six months prior to the earliest maturity of any future Senior Notes, and (ii) October 13, 2026. The amended and restated Credit Facility includes a reduction of the facility of $75,000 by the end of the second quarter of 2025. The final size of the amended and restated Credit Facility will then be $700,000.

The Credit Facility has the following financial covenant requirements, whereby Consolidated EBITDA and Interest expense are determined on a trailing twelve-month basis:

• A Consolidated Net Debt (defined below) to Consolidated EBITDA ratio as at the end of each fiscal quarter shall not exceed 4.00:1.00, provided that in any fiscal quarter in which material acquisition is completed, the Consolidated Net Debt to Consolidated EBITDA ratio as at the end of such fiscal quarter and the next fiscal quarter shall not exceed 4.50:1.00 and 4.00:1.00 for each fiscal quarter thereafter.

• The Consolidated EBITDA to Consolidated Interest expense as at the end of each fiscal quarter shall not be less than 2.50:1.00.

• The Consolidated Net Senior Debt (defined below) to Consolidated EBITDA ratio shall not exceed 2.50:1.00, provided that in any fiscal quarter in which a material acquisition is completed, the Consolidated Net Senior Debt to Consolidated EBITDA ratio as at the end of such fiscal quarter and the next fiscal quarter shall not exceed 3.00:1.00 and 2.50:1.00 for each fiscal quarter thereafter.

Why does this situation exist? One key man: