D-Box TSX: DBO and Solitron SODI Updates, and what is Mene anyway?

Thank you for subscribing to Canadian Value Investors! Today we cover:

D-Box shaking more seats

Solitron Devices, Inc. SODI Quick Update – Bookings start to build

Goldmoney TSX:XAU - What is Mene anyway?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious bias and conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. In addition, no one guarantees the accuracy of any information provided and none of the information should be construed as investment advice or any other kind of advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose, except for entertainment (and we hope you enjoy).

TSX:DBO D-Box shaking more seats

Disclosure: We remain long.

D-Box has been on a tear this year. We were a bit late to the party, but it is hard to complain about it. See our initial August post here - https://www.canadianvalueinvestors.com/p/d-box-inc-tsxdbo-and-the-d-box-beat More importantly, the underlying business is doing well.

Another interesting thing to note is that it has been a soft year for theatres. A core piece of the thesis is theatres are using D-Box to get more revenue out of a few seats, and D-Box seats have a much higher occupancy than seats overall.

Per their last quarter (off-cycle): “Second quarter royalty revenues reached a second consecutive quarterly record at $4.5 million. This is an increase of 40% year over year and compares extremely favorably to the gross domestic box office which declined 11.1%¹ in the same period.”

Here is how the year is stacking up. You can see how theatres are dealing with the combined pressure of alternative entertainment and COVID putting gasoline on the fire. Theatre companies are doing everything they can to get more value out of every customer… Maybe a few more D-Box seats is a good idea.

Source: https://www.boxofficemojo.com/

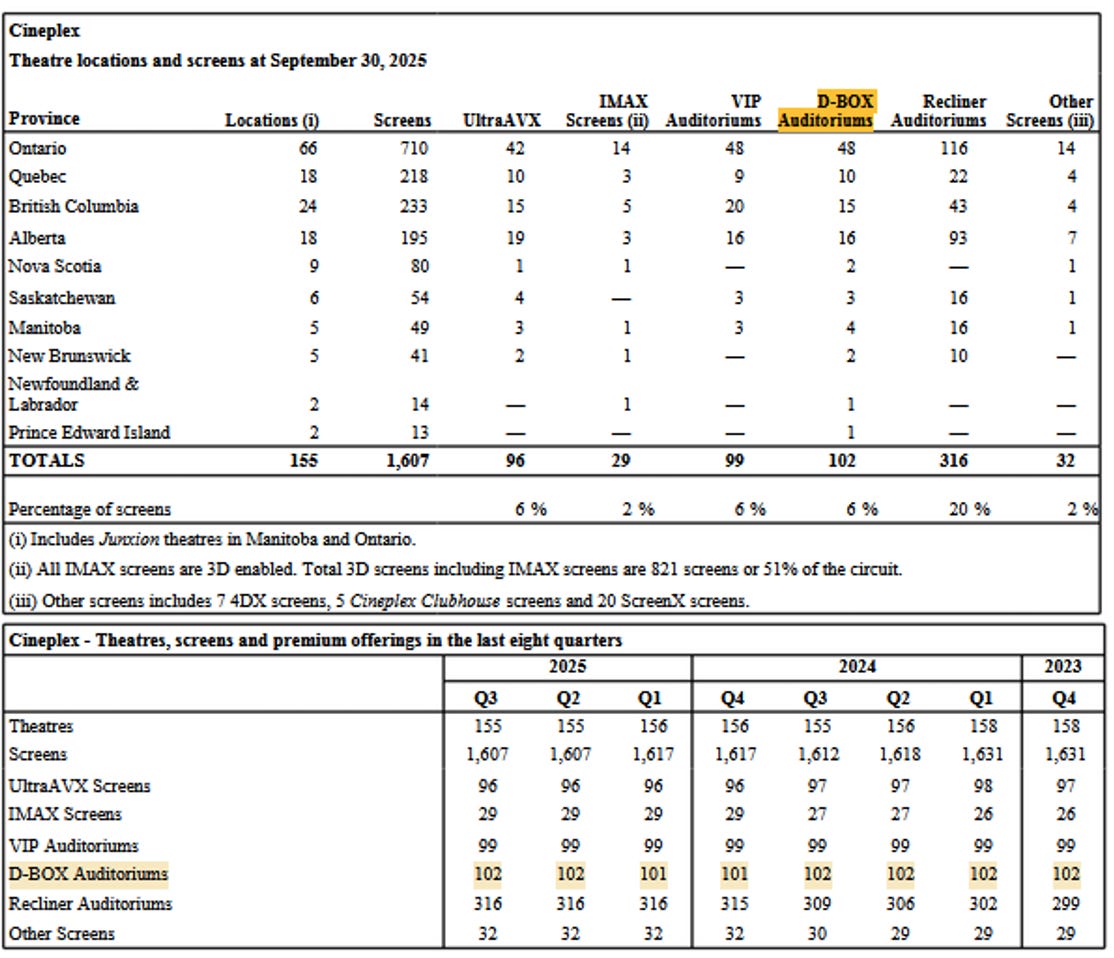

In fact, “D-BOX continued to expand its market presence, achieving a 13.5% year-over-year increase in screen footprint worldwide, bringing total active screens to 1,084.” They will never be in every screen, but a threatre location can put them in a few. Cineplex is about 6% at the moment and they are happy.

As per Cineplex:

“Cineplex continues to focus on providing guests with a variety of premium viewing options through which to enjoy the theatre experience. These premium-priced offerings, which include UltraAVX, VIP Cinemas, IMAX, D-BOX, 3D, 4DX, Cineplex Clubhouse and ScreenX generate higher revenues per patron and expand the customer base. Cineplex believes that these premium formats provide an enhanced guest experience and will continue to charge a ticket price premium for films and events presented in these formats. Cineplex will continue to expand those offerings throughout its circuit for the reminder of 2025 and beyond.

With about 200,000 screens worldwide, D-Box has a nice long runway. The contract with HOYTS in Australia will help (Australia’s second largest cinema operator adding 539 D-Box seats). There is legitimate pushback by analysts about whether seats can work in regions with much lower ticket prices. The funny thing is that life, contrary to new reports, is improving in many regions of the world. We personally had a very nice experience at a surprisingly expensive in-seat-service Cinepolis in Mexico (and we were the only gringos in the theatre at the time). We hope the decide to try using D-Box going forward, instead of Lumma the Argentinian alternative besides 4DX (a very different all-screen solution).

We have also been pleasantly surprised by D-Box’s non-theatrical sales. With growing EBITDA and net cash, the Company is still trading at a single digit multiple. We should have bought more, and maybe we should still buy more. It remains ones of our largest holds.

Solitron Devices, Inc. SODI Quick Update – Bookings start to build

Disclosure: We remain long.

Solitron is a company we have been following since 2022. See full coverage including full overview of the business here - https://www.canadianvalueinvestors.com/t/sodi

As a reminder, their core manufacturing business is power transistors and control modules primarily as a small but absolutely essential input into various weapons systems. It was historically run out of one leased facility, but in 2021 (under new leadership) they decided to find and purchase their own facility. They built up stock, closed down the old facility, and moved the equipment to the new facility. The move was done in the three months ending November 2022, or Q3 FY2023 (year-end is February to add to the confusion).

Note: If you are not familiar with Solitron, the full background post is essential.

The much talked about military stockpiling/re-stockpiling of various weapons systems appears to finally be coming. We note that SODI is at the end of the chain. First, a government orders from one of the big prime contractors and then primes get the subcontracts going with entities that are approved for that specific program, like Solitron. It is helpful to keep in mind that the DoD has an Office of Small Business Programs (OSBP) as we discuss in our original article. https://business.defense.gov/About/Mission/

Mission: To modernize the defense industrial base, accelerate acquisitions, and reestablish deterrence by reducing barriers for small businesses to supply our Warfighters with innovative solutions and critical services.

The slow pace of firm orders coming through has actually been quite concerning from a “how safe are we really” standpoint, as the underlying orders and demand are obviously there. There are several weapons programs where it is going to take years to get back to pre-Ukraine-war stockpile levels, a terrible war but also a terribly small one in the context of world wars. It makes us wonder how resilient Western defense really is, but that is a problem for another day and blog.

Cedar Creek’s Q3 Letter provides additional context:

Solitron Devices (otc: SODI) - the bid price for shares increased from $15.75 per share to $16.40 per share during the third quarter. As a reminder, the fund manager is CEO and a board member of Solitron. The fund owns 11.6% of Solitron’s outstanding shares and the fund manager owns 2.5% personally.

While reported earnings have been soft the last few quarters due to lower revenues owing to timing of receipt of orders, Solitron started seeing a material uptick in orders beginning in the November 2024 quarter. In the fiscal third quarter ending November 30, 2024, bookings were $8.0 million in the quarter, versus sales of $3.4 million. That quarter included a large order for HIMARS (High Mobility Artillery Rocket System) components from L3Harris – Solitron’s second largest defense customer. In the fiscal fourth quarter ending February 28, 2025, Solitron did even better. Bookings in the February 2025 quarter were $8.9 million versus sales of $3.1 million, and included over $5 million from Solitron’s largest defense customer, RTX (formerly Raytheon) for AMRAAM (Advanced Medium-Range Air-to-Air Missile) components. In the May and August quarters bookings exceeded sales despite no orders related to HIMARS or AMRAAM. Solitron expects the next AMRAAM order to be awarded soon.

Their subsequent press release:

SOLITRON DEVICES, INC. ANNOUNCES FISCAL 2026 THIRD QUARTER TO DATE BOOKINGS OF $13.8 MILLION

WEST PALM BEACH, FL – Solitron Devices, Inc. (OTC Pink: SODI) (“Solitron” or the “Company”) is pleased to announce the Company has record breaking bookings for fiscal 2026 third quarter which have already exceeded $13.8 million. The Company’s third quarter starts on September 1st and continues until November 30th. The Company anticipates it will receive additional bookings during the month of November that will be included in its third quarter bookings total.

Bookings in the fiscal 2026 third quarter to date are approximately $13.8 million as compared to approximately $8.0 million in the fiscal 2025 third quarter. Bookings in the first nine months of fiscal 2026 to date are approximately $20.9 million as compared to approximately $11.8 million in the first nine months of fiscal 2025.

Backlog as of today for the fiscal year 2026 was approximately $29.0 million as compared to approximately $12.3 million as of November 30, 2024 for fiscal year 2025.

Next year should be busy for SODI.

Goldmoney TSX:XAU - What is Menē anyway?

Disclosure: We remain long TSX:XAU. No position in TSXV:MENE except indirectly through XAU.

Back in September, we wrote about Goldmoney TSX:XAU – “Turning gold into a pile of real estate on sale”.

As we noted in the article, one of their interests is in Menē, which is co-founded by and a venture of the CEO of Goldmoney, Roy Sebag. Menē is publicly listed on the TSX Venture with Goldmoney owning ~30% equating to ~US$9MM of value, while CEO Roy owns 35%. While not core to our Goldmoney thesis, it is part of the sum of parts (Goldmoney market cap: ~$140MMM). And so, what is Menē anyway? We decided to make an order from this luxury pure gold jewelry company. Was it wife approved?

Menē – A bit of history