Clarke Inc. Special Situation(s)

Here is the latest from Canadian Value Investors!

Clarke Inc. TSX:CKI Special Situation(s)

Astrotech Corporation NSADAQCM:ASTC Special Situation – Shotgun acquisition

Clarke Inc. TSX:CKI Special Situation(s) – Sailing on the go-private ferry

Disclosure: We are long this stock and their debentures.

Clarke Inc. TSX: CKI is a neat collection of businesses and assets. It’s also probably being taken private shortly and has a special situation trade for you in the meantime. What’s the deal?

It is trading at below its stated book value (which seems reasonable and likely has suppressed value).

They are several years into a business simplification. They have sold off/dividended-out various public holdings (TerraVest – their case study at end – and Trican; both interesting investments) and are now focusing on their three business units.

They have been consistently repurchasing shares for the last three years (15% cumulatively) and just renewed their NCIB. Now that they have cleared up the convertible debentures (see next), it is likely that they are going to be taken private soon.

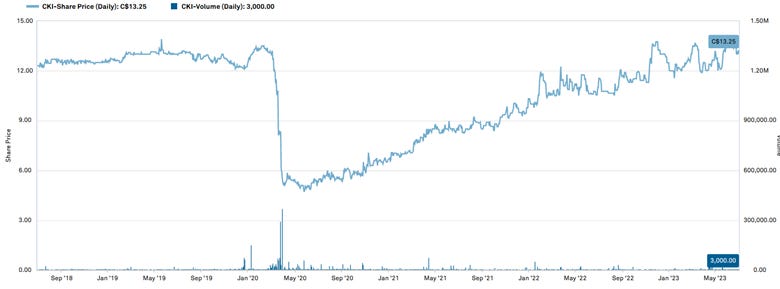

We looked at Clarke back in 2021. Unfortunately, we did not buy, and it went straight up ~100% since. At the time their operations were messier and the majority of their business at the time (hotels and a ferry) were severely impacted by COVID.

They key 75% shareholder, G2S2 (run by Clarke’s Chairman) just put in the funds to repurchase the debentures. This is his party – “On June 30, 2020, Michael Rapps, former President and Chief Executive Officer of the Company, resigned and George Armoyan, Clarke’s Chairman, was appointed President and Chief Executive Officer.”

The only other large shareholder is 13% owner Letko Brosseau & Associates Inc. This might provide some comfort for small shareholders getting a fair deal (unless they also continue holding with G2S2 in a go-private transaction).

First - The short-term trade: