Canlan Ice Sports Corp. (TSX: ICE) Ice cold cash flow and valuable real estate to boot

Have you ever dreamed of owning your own sports arena? Here’s your chance to own (a piece)

Disclaimer: We own this one. Position type: Interesting business, fun story, and a small but possibly growing position.

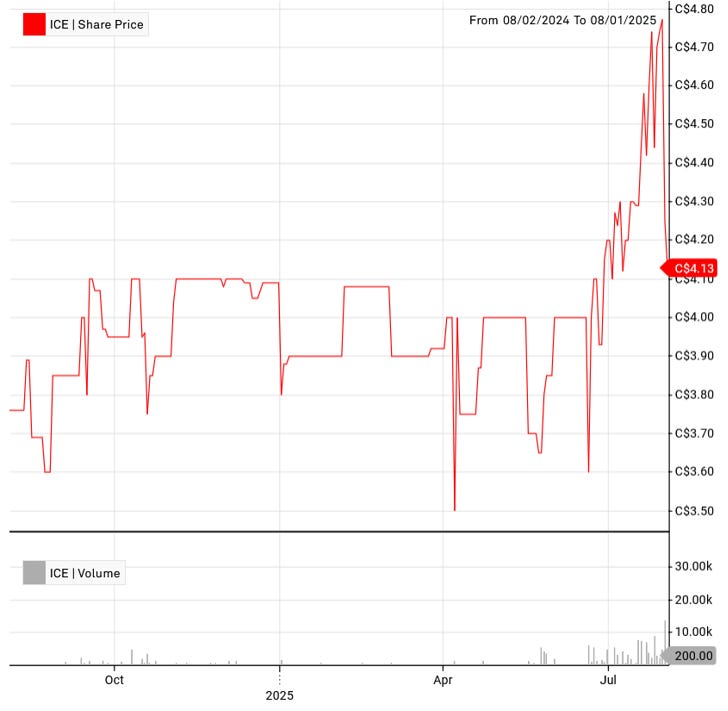

Stock price: $4.13 Market Cap: $56MM EV: $86MM

Canlan Ice Sports Corp. (TSX: ICE) has been quietly operating ice rinks for over 35 years, and longer privately. It is one of North America’s largest owners and operators of recreational ice and multi-sport facilities. They have been growing revenue and cash flow consistently (except for COVID-times), are trading at reasonable multiples and might seem quite sleepy with only a cursory view. But they are sitting on a pile of real estate in strong markets bought decades ago, have made a string of prudent acquisitions, they own and run the largest hockey league in North America, and have an investment in a growing start up hiding in the footnotes. Oh, and they also have a bit of insurance-like float.

Here is the story of Canlan.

The Business

Canlan’s real estate

The hidden asset

All together, detailed financial performance

Where are we going from here? Capital allocation

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The Business

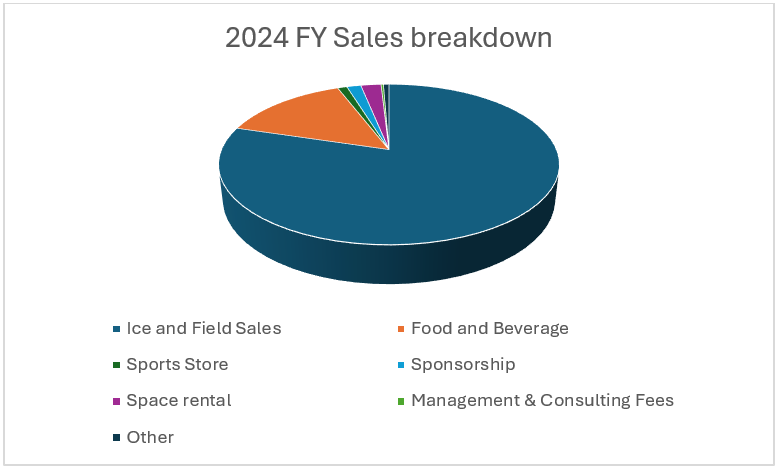

As you would expect, most of their sales are related to the rink and field rentals. Performance has on the surface been stable outside of COVID, but behind the scenes they have been busy. Ice sales are underpinned by their ownership and management of the Adult Safe Hockey League (ASHL, the largest in North America with over 60,000 members), facilities have been upgraded to improve looks and energy efficiency, the Company selected a restaurant partner – Wild Wings – across their facilities, and they partnered with an interesting start-up that is helping to maximize bookings. They also did all of this while paying dividends, paying down debt, and no equity being issued for a decade.

Before we dig too deep into the financials, it is important to understand the real estate.

Canlan’s Real Estate

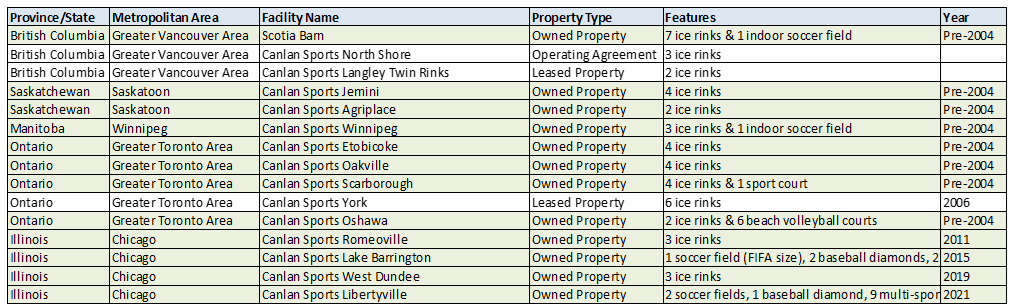

The company operates 19 sports complexes with 75 individual playing surfaces across Canada and the United States. Some are just operated or leased, but the majority of them are owned and in strategic urban locations. Across twelves facilities they have 1.4 million square feet and 170 acres.

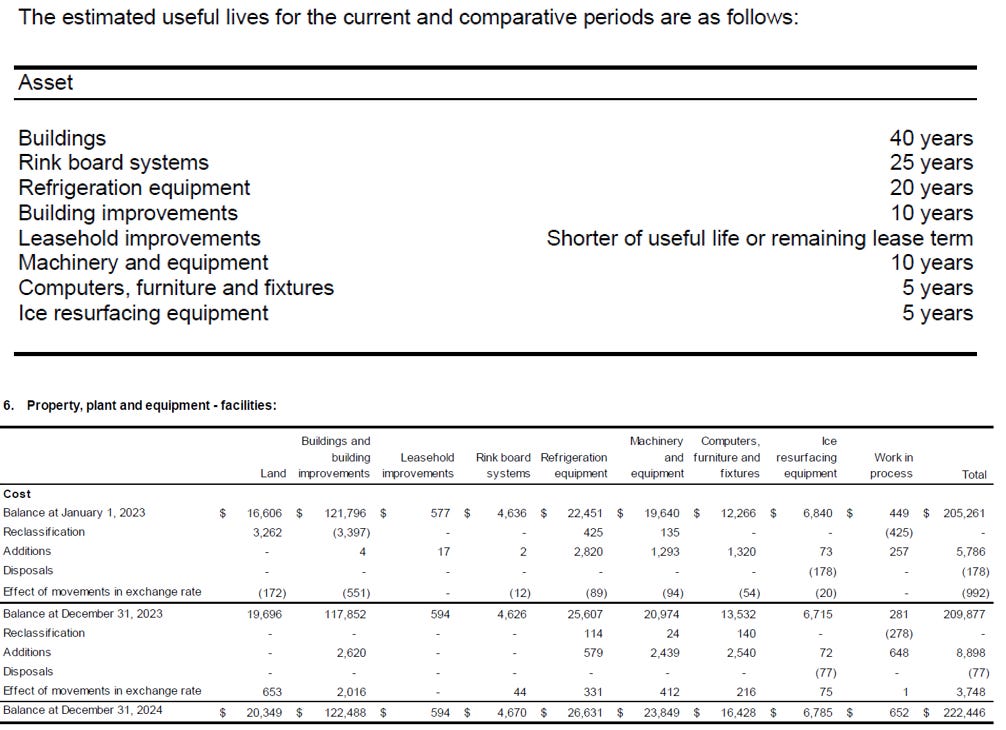

We want to remind readers that their market cap is ~$57MM, enterprise value is currently less than $90MM and also note that real estate is held at book value, with land at the original purchase price and other assets depreciated as shown below. But, you could not rebuild Canlan today for what it is trading for. In fact, you would not rebuild Canlan today, because some developer would outbid you for a higher (condo tower) use.

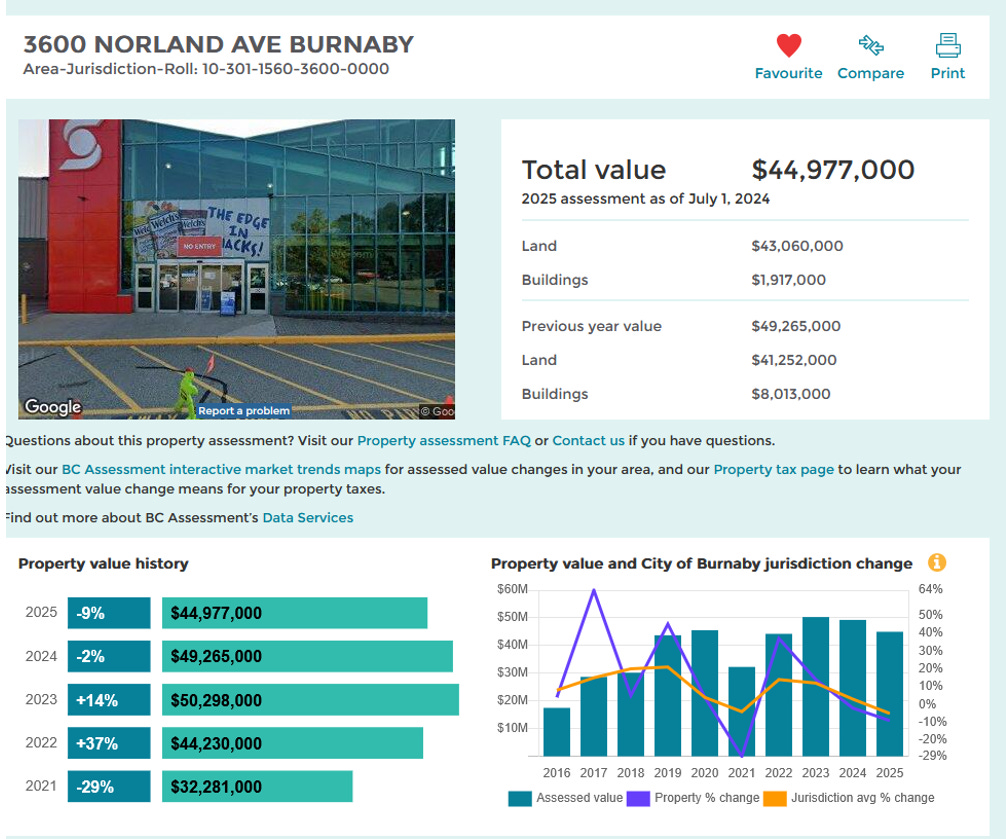

Scotia Barn

The British Columbian gem in the real estate portfolio is easiest to reasonably estimate (at least in its current use). Well located in Vancouver, the 250,000 square foot facility features six NHL-sized ice rinks, one indoor soccer field, and one dedicated figure skating rink, and a Wild Wing restaurant. One nice thing about Vancouver is the fact that the municipality allows you to look up assessments of any property. Their estimate? $45MM in its current use as shown below.

The Toronto Book

The Toronto book is another group of gems. The history is a bit confusing, but Canlan ultimately acquired full ownership of the properties in ~2004 and implied value at the time of ~$25MM (we think).

In May 2004 the Company successfully negotiated the acquisition of the minority interests in our two Ontario subsidiaries, Adult “Safe-Hockey” Leagues Ltd (“ASHL”) and O & O Development Corporation (“O&O”). These companies owned four Ice Sports facilities operating in the Toronto area. Prior to the transaction, Canlan directly owned 75% of the outstanding shares of ASHL and indirectly owned 56.25% of the outstanding shares of O & O.

The total purchase price was $7.9 million, of which $4.6 million was paid on completion and the remaining $3.3 million is to be paid by making 6 semi-annual installments, beginning January 1, 2005.

Unfortunately, Toronto does not provide easy access to valuations. However, there are clues.

Pushed out of Mississauga lease

One clue is their Mississauga lease. They were pushed out by the lessor and were paid $4.5MM in compensation for the early surrender.

Original deal - Canlan Sportsplex Mississauga – “A multi-sport facility in Mississauga with a lease term that began on April 1, 2012 and will end on October 15, 2023 with two five-year renewal options.”

…

And in 2022 – “while we had to unfortunately sunset a leased sportsplex operation earlier than anticipated due to the burgeoning real estate market in southern Ontario, we did receive cash consideration of $4.5 million to compensate for the early-surrender our lessee position of the sports complex in September 2022.”

You can find a bit more information here https://www.mississauga.ca/apps/#/property/view/property-details 3360 Wolfedale Rd, Mississauga, ON L5C 1W4

Cornwall clue

A better clue is an empty lot listed for $8.75MM; significantly smaller than Canlan’s nearby property which has 4 NHL-sized rinks and… another Wild Wing restaurant (see a theme?). https://www.realtor.ca/real-estate/28290878/2395-cornwall-road-oakville-qe-queen-elizabeth-1014-qe-queen-elizabeth

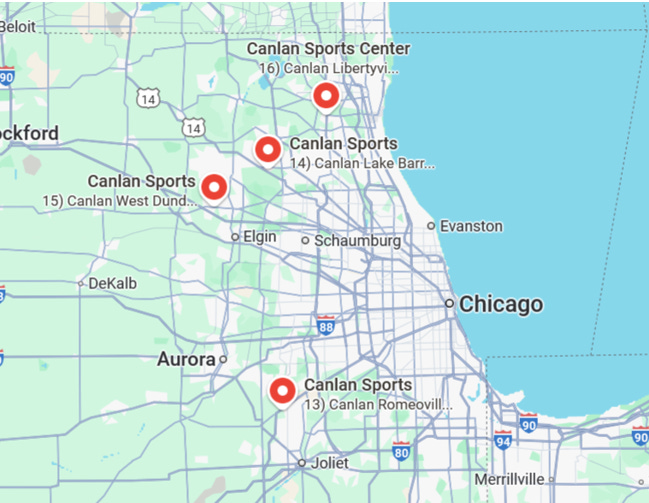

Shrewd in Chicago

The Chicago portfolio is particularly interesting because of the way it came about; distressed sales due to owners having excessive leverage and/or loss of patience. This 2015 article gives good context (our notes [in brackets]).

Seven Bridges [not Canlan’s] is at least the third big ice complex in the Chicago suburbs to run into financial trouble after taking on more debt than it could carry. Its story is strikingly similar to the other two, starting with a big bond sale and ending in foreclosure. One of the other properties, a three-rink facility in Romeoville [Canlan bought], sold for nickels on the dollar in a 2011 foreclosure sale, while the second, a three-rink building in West Dundee [Canlan bought subsequently], has been stuck in bankruptcy for more than two years.

At Seven Bridges, the Mission borrowed $13.7 million in 2011 to finance its $13.5 million acquisition of the property and a renovation. The debt included about $9.6 million in taxable bonds and a $4.1 million loan from the seller of the ice complex at 6690 S. State Route 53, implying the Mission put in little if any equity.

…

The foreclosure suit already has attracted the interest of Canlan, the Canadian sports facilities owner. The company has shown a healthy appetite for failed sports facilities in the area, and would be a logical buyer for Seven Bridges. It paid $3.7 million in 2011 for the Romeoville ice complex, now known as Canlan Ice Sports—Romeoville, just a fraction of the $17.3 million in debt used to build it. More recently, it paid $5.6 million in January for the Lake Barrington Field House, a sports complex in foreclosure that had been built using $28.5 million in bonds issued in 2007.

“It surprises me that they were able to buy this place with very little equity,” said Michael Gellard, chief financial officer of Canlan Ice Sports, the Canadian company that bought the Romeoville ice complex in 2011.

…

It paid $3.7 million in 2011 for the Romeoville ice complex, now known as Canlan Ice Sports—Romeoville, just a fraction of the $17.3 million in debt used to build it. More recently, it paid $5.6 million in January for the Lake Barrington Field House, a sports complex in foreclosure that had been built using $28.5 million in bonds issued in 2007.

Libertyville was also distressed; they took over operations via a lease after it being closed during the pandemic and subsequently purchased it through a purchase option in the contract. It was built by the community and dreams were big. As per a long-ago Village memo: “The Libertyville Sports Complex (LSC) is owned and operated by the Village. The LSC was built on 48 acres of land purchased by the Village in 2000. A fund was established in 2001 to account for the revenue and expenditures associated with the LSC. The facility opened in June of 2002. The LSC 'campus' features an indoor 160,000 square-foot recreation, sports and event facility with an Indoor Events Center with two (2) multi-purpose indoor turf fields, eight (8) multi-use basketball courts, Conference and Party Rooms, a full service Fitness Center and other amenities.”

The Board of Trustees decided to sell after an extended closure due to COVID caused them to run out of patience. It is now Canlan owned for the agreed US$3.75MM (technically run through a lease-related financing cash flow on the statements if you are looking).

ORDINANCE NO. 21-0-27: An Ordinance Approving a Lease Agreement with Libertyville Sportsplex, LLC (Canlan Sports USA Corp)

President Weppler reported that on March 13, 2020, the Indoor Libertyville Sports Complex was closed due to the COVID-19 pandemic. Over the past year, Staff and the Village Board have been diligently evaluating various scenarios for future operation of the Sports Complex, balancing the need to provide ongoing recreational services to the community safely while mitigating the high cost to operate the facility, which was further exacerbated by COVID-19 capacity restrictions.

As part of the Village's due diligence, the possibility of leasing the Sports Complex to a private operator was considered. Canlan Sports, a Canadian firm that owns and operates sports complexes and ice rinks across Illinois and Canada, engaged with the Village and expressed interest in operating the Indoor Sports Complex facility. Canlan owns and operates the nearby Lake Barrington Sportsplex, the Leafs Ice Center in West Dundee, and a large ice sports facility

in Romeoville. The Lake Barrington Sports Complex, in particular, hosts many of the same organizations that previously utilized space in the Libertyville Sports Complex before it closed. Canlan Sports is a highly regarded company in the indoor sports industry, has been in existence since 1956, and is publicly traded on the Toronto Stock Exchange.

Under the structure of the proposed lease, Canlan would assume all profit and loss risk associated with the Libertyville Sports Complex. The proposed lease also gives Canlan an option to acquire the facility within two years, based on an agreed-upon purchase price of $3,750,000. This price was determined by a qualified appraiser and complies with the 80% requirement of 65 ILCS 5/11- 76-4.1. Other notable lease provisions are as follows:

-A twenty-four (24) month operating lease beginning July 1, 2021 and ending June 30, 2023, which encompasses the future Lot 4 of the Sports Complex subdivision (the Indoor Complex, parking lot, softball field, and hockey rink)

-Canlan to provide monthly renumeration in the amount of $20,000 to the Village after a five-month abatement period in recognition of COVID-19 capacity restrictions and startup costs

-Canlan will pay for all utilities and general maintenance costs. The Village will only be responsible for major repairs during the duration of lease

-Village to retain control of the preschool and dance wing of the Indoor Sports Complex under a sublease to be approved by the Village Administrator, the rent for which will be abated for five months

-The lease document guarantees. the Village preferential scheduling for in-house programs it may continue to offer in the future

-Canlan has agreed to meet with the Village formally at least semi-annually to coordinate program offerings in order to avoid duplication or gaps in programming

-Canlan will meet and confer with the Village to discuss implementing a Libertyville resident subsidy for Canlan's in-house programs

The hidden asset: Catching