Atlas Engineered Products TSXV:AEP – Framing the future

Will consolidation and automation pay off?

Disclosure: We own this one. Recent purchases ~$0.70.

Today we cover our latest purchase, Atlas Engineered Wood Products TSXV:AEP. A darling a few years ago, they suffered from the recent general slowdown in Canadian housing, much like the rest of the industry, and analysts and the market have become fatigued. At the same time, the Company has continued its consolidation strategy of trusses and engineered wood products and is advancing to a major step change with their first automated truss facility coming online this year. This is our kind of story.

We have covered building products before through our coverage of Taiga Building Products (still neat, though not a material hold at time of posting and subject to change). Full coverage here - https://www.canadianvalueinvestors.com/t/tbl

Atlas has piqued our interest because:

They are consolidating in a very fragmented industry facing structural labour shortages and structural demand from population growth, leading to…

Advantages for companies that are very good operators who save time/money for homebuilders, who are facing their own cost challenges, labour shortages and coming wave of retirements, leading to interest in…

The automation of the industry, which we have seen play out upstream wood trusts in the actual lumber industry, and is just starting in trusses, and importantly…

There might be better long-term economics in trusses vs lumber, given the limited capital available to most truss companies due to their small size and regional nature of truss manufacturing.

Is the market’s pricing right, or might AEP be a bargain?

The Products

Labour Shortages

How Trusses Fit In

Macro Background: Housing starts greenshoots

The AEP Business Model

Acquisition History

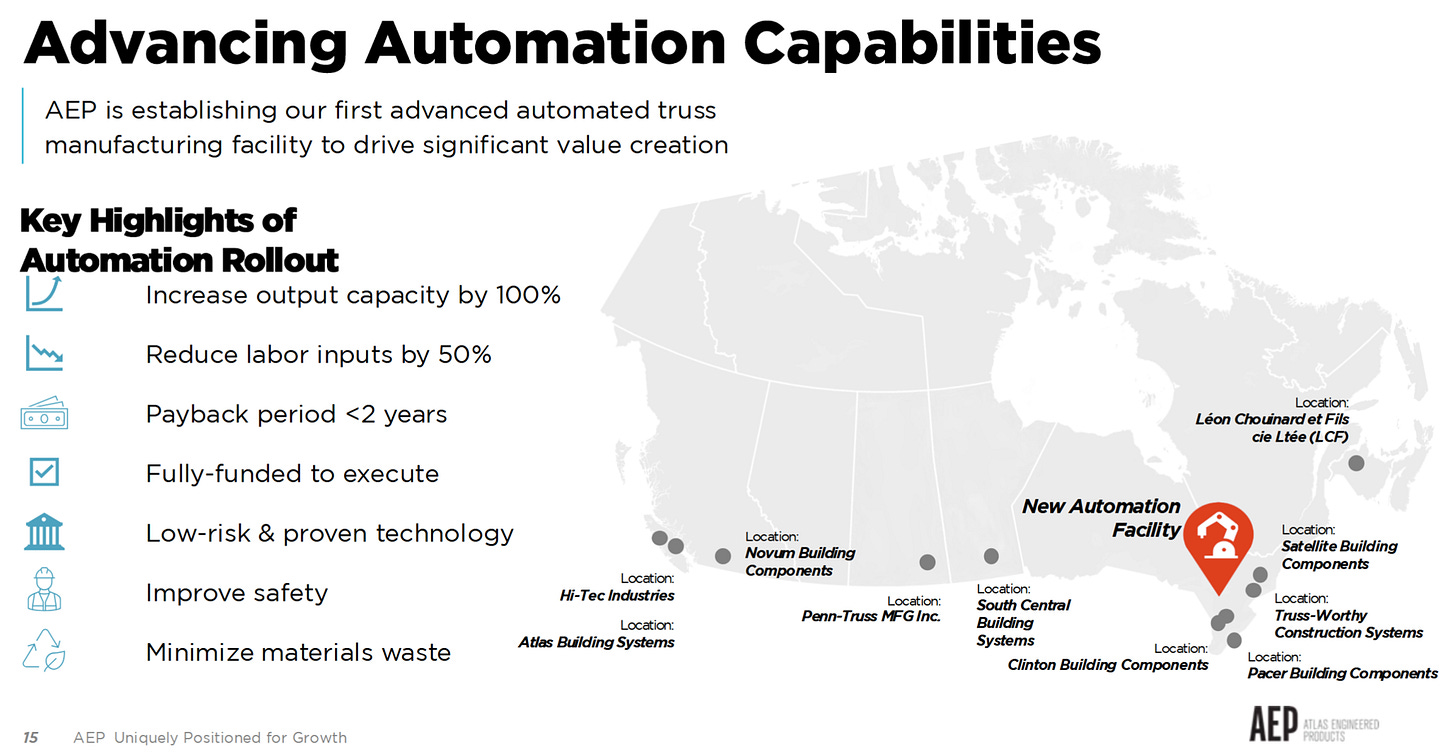

Automation and the Big Bet on Clinton

Clinton and… Who is Trussmatic Anyway?

Building a Lumber Mill Today: Will Canadian trusses be different?

The Long-Term Vision

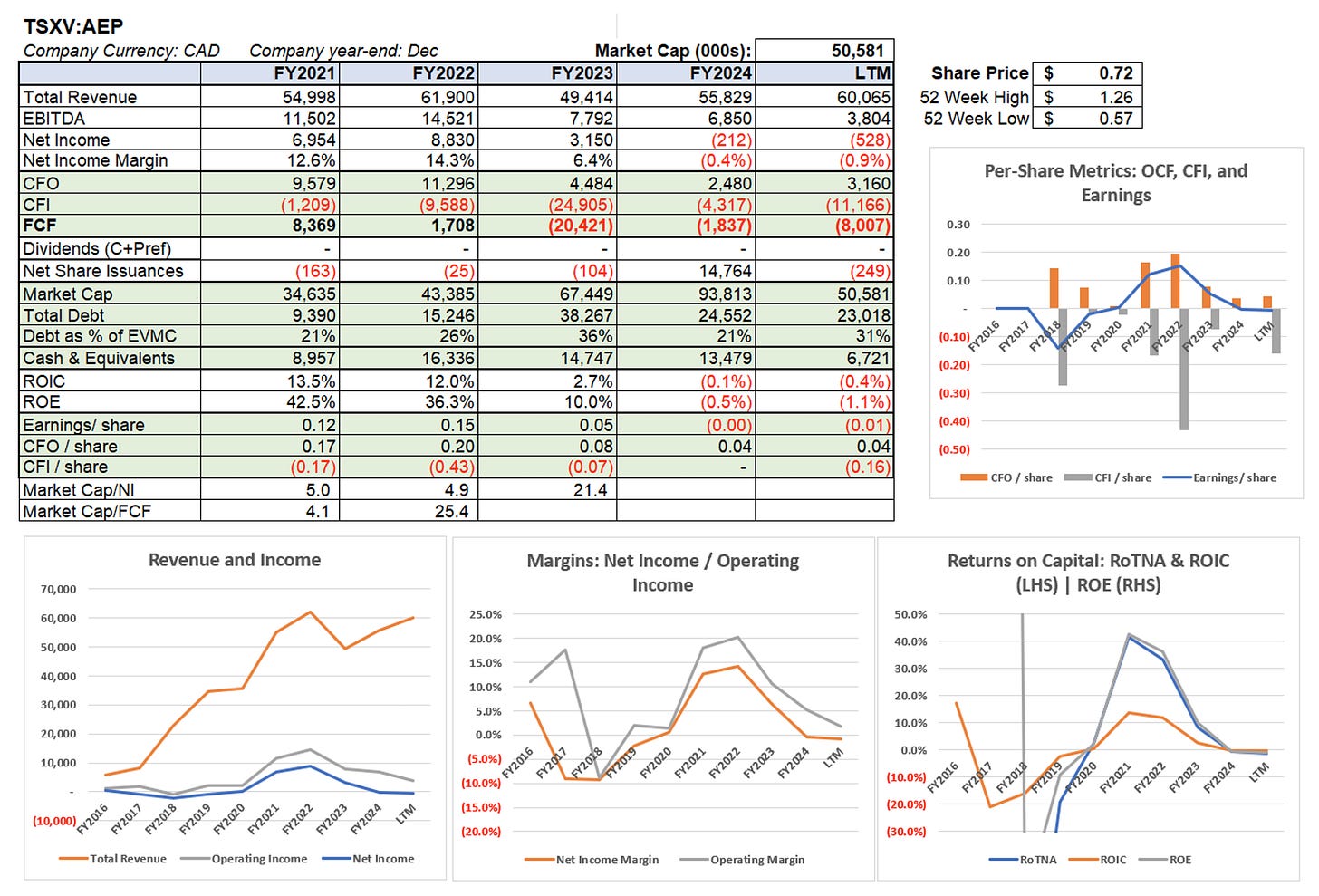

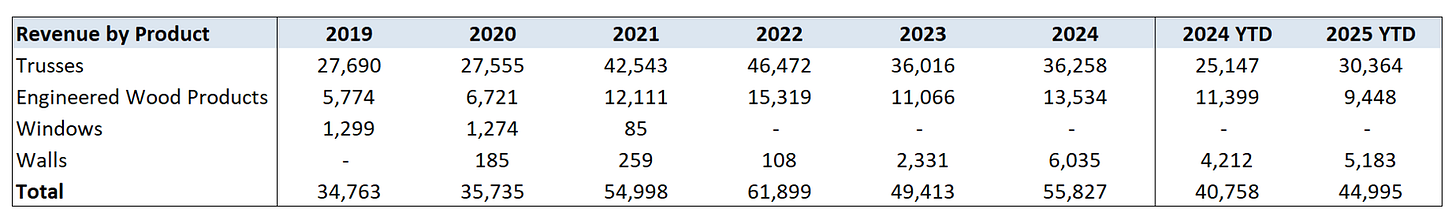

Financials

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious bias and conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. In addition, no one guarantees the accuracy of any information provided and none of the information should be construed as investment advice or any other kind of advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose, except for entertainment (and we hope you enjoy).

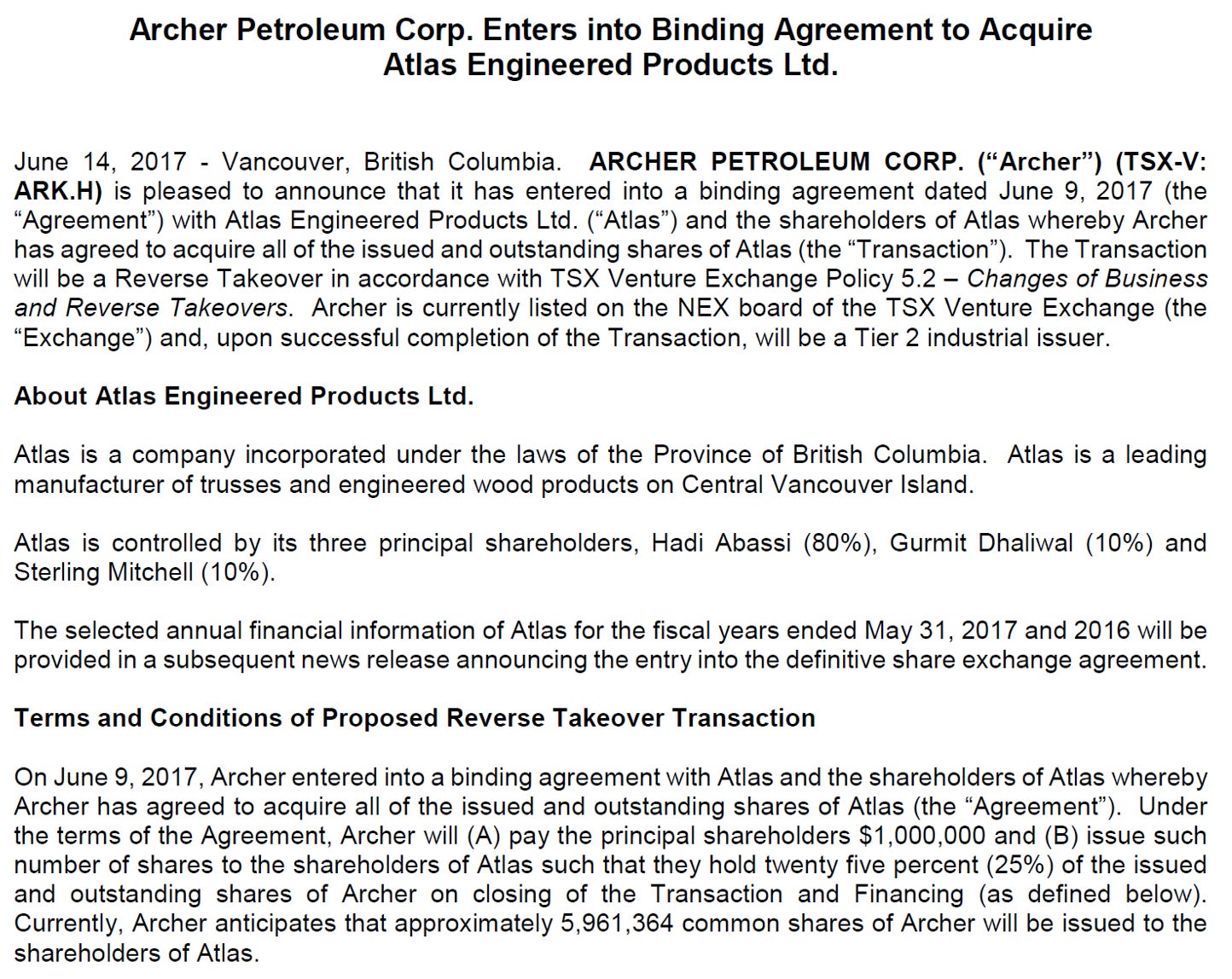

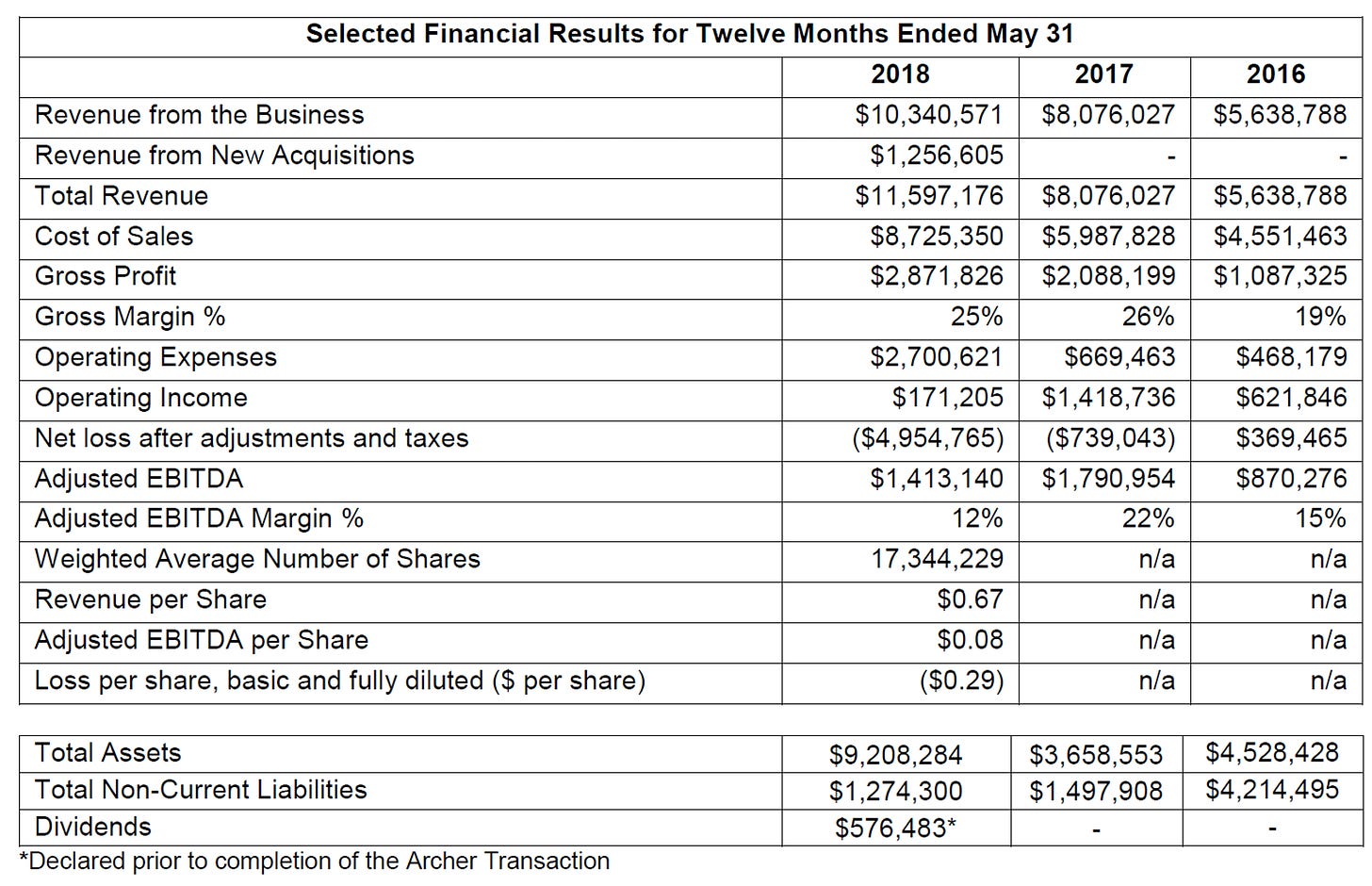

Atlas Engineered Products – A brief history

We always enjoy looking back at the history of a company. For Atlas, their public venture started in 2017 through a typical reverse takeover with a long-troubled unrelated entity called Archer Petroleum Corp. (it was a shell by this point). However, the history of Atlas dates back to 1999 and has always been based in Nanaimo, B.C. The key person from the start is the current CEO Hadi Abassi. He stepped away from the leadership position in 2018 (never fully stepped away), but was brought back in 2021.

After going public, the Company completed a number of acquisitions, which we will get into later.

The Products

Atlas started in roof trusses and it remains the core of the business, but the long-term vision of management is grander. But first, trusses.

When building a wood framed structure, you can either build the roof rafters on site or use pre-fabricated trusses. Trusses date back to the 1950’s and the key innovation was the metal connector plates.

They have a… structural advantage that has become more important over time:

Speed / schedule certainty and lower site labour risk - Trusses arrive ready to install and are integrated with the design and inspection process, simplifying and accelerating on site construction. They reduce the need for skilled labour on site and the overall cost can be 50% cheaper than building rafters on site depending on the market, never mind the time savings.

Engineered performance and reduced waste - Trusses are designed for specific spans/loads (snow/wind), with consistent quality control versus field-built assemblies. Factory cutting reduces scrap and rework and this has been continually improved through increased automation.

Trusses are widely accepted and the preferred method of building in Canada. There are established standards and fun organizations like The Canadian Wood Truss Association - http://www.cwta.net/

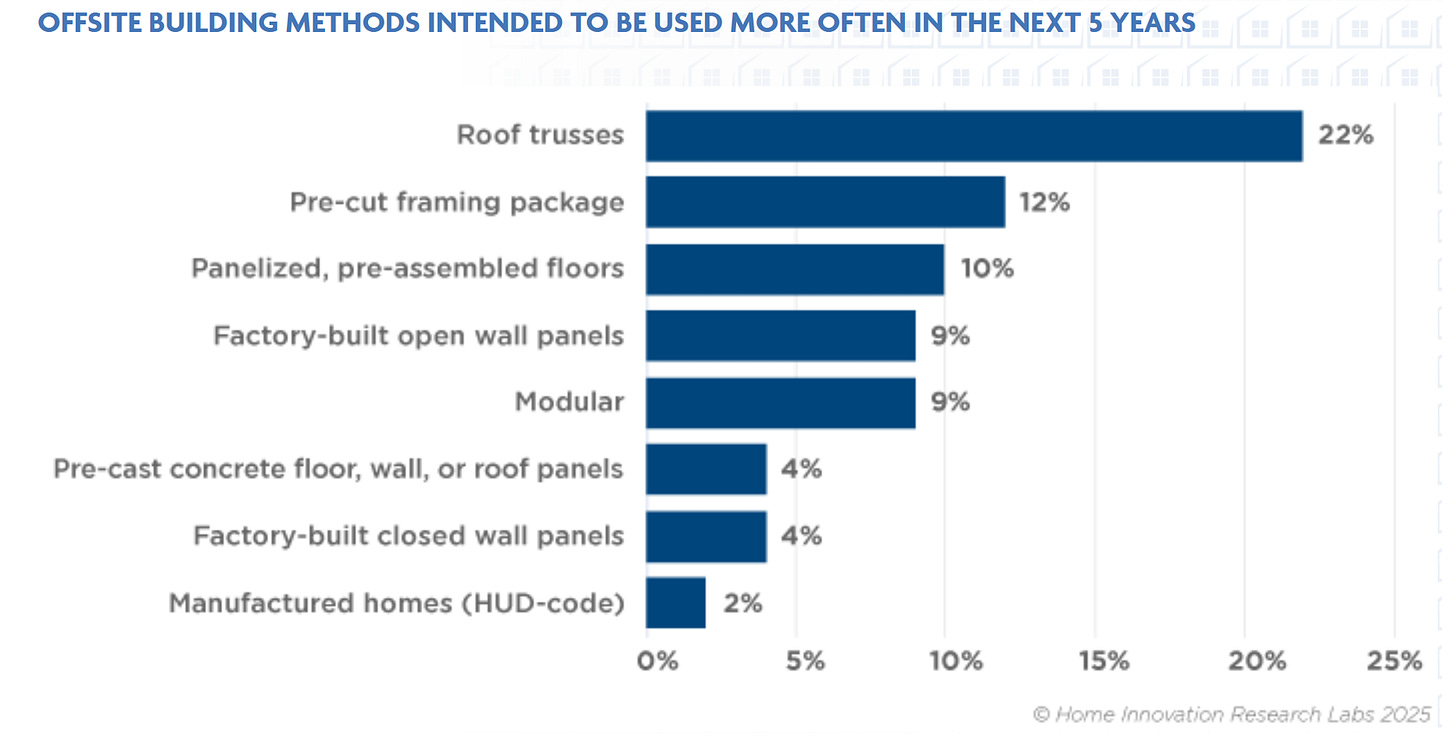

Canadian-specific industry data is not great, but the U.S. provides helpful indicators. In general, the use of trusses is inversely related to labour supply and their use has been directionality increasing in all markets. Trusses always have a speed advantage, but if on-site labour is cheap and build time is not a high priority, on-site labour can be used. Canada already uses trusses extensively and this was accelerated in all of North America by COVID.

Roof trusses topped the list for intent to increase use in the future—not unexpected since most builders are comfortable with trusses. About 70% of all new homes are constructed with roof trusses presently. Following at a distance, however, was pre-cut framing, coming in ahead of the other options offered: open- or closed-wall panels, floor panels, modular, precast concrete, or manufactured homes.

Labour shortages

It is widely understood that Canada has a very severe shortage of skilled labour and it is going to get much worse. The pressure to manage costs and save time provide very strong tailwinds for those that can help. The numbers are quite concerning.

Growth in construction demands over the forecast period is projected to require the labour force to expand by 111,600 workers. When this growth is added to projected retirements, the industry’s overall hiring requirement rises to 380,500 workers by 2034.

Based on historical trends, much of this requirement can be met by the expected recruitment of approximately 272,200 new entrant workers under the age of 30 during this period. However, even at these heightened levels of recruitment, the industry may face a shortage of as many as 108,300 workers by 2034.

As a side note, we expect the replacement cost of buildings to continue to increase significantly, and view companies that can take advantage of this, like Mainstreet Equity (still long), as long-term beneficiaries. https://www.canadianvalueinvestors.com/t/meq

How Trusses Fit In

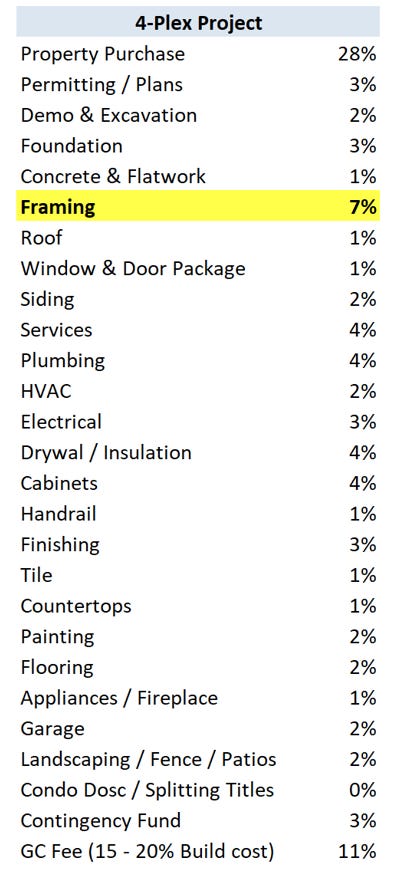

As part of our research, we talked to home builders and watched a house get built. By using floor trusses, roof trusses, and wall panels, the framing took only a few days.

Truss pricing is effectively a derivative of overall lumber prices. For those that did renovations during COVID, we are sure they recall the unprecedented volatility in lumber prices during that time. It accelerated the use of trusses.

To give you context, here is how framing fits into the cost for a 4-plex build out based on discussions we had with a home builder.

Macro Background: Housing starts greenshoots

The key piece of macro information for Atlas is housing starts, which is a derivative of population growth and natural replacement as homes reach end of life.

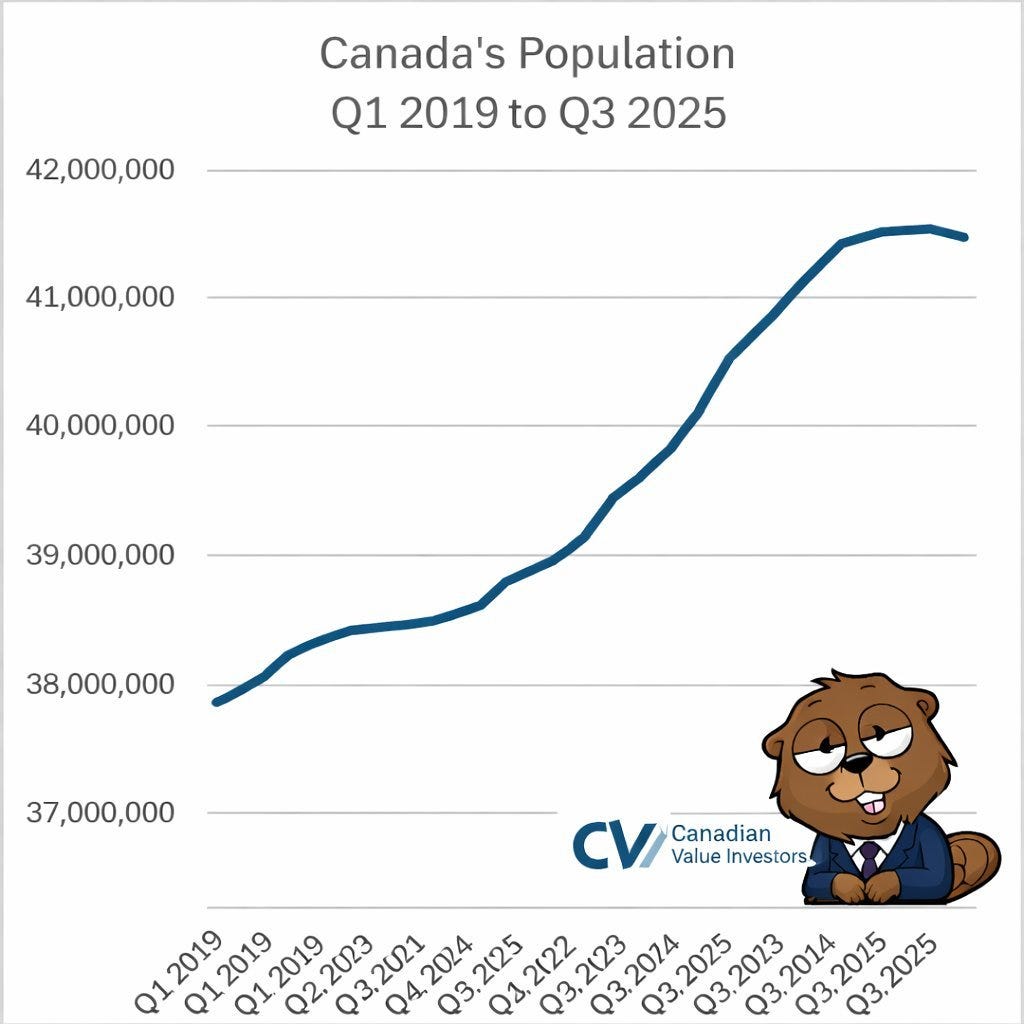

A Globe and Mail front page headline a few months ago might give you pause - “CANADA REPORTS RECORD DROP IN POPULATION” 🙄 https://www.theglobeandmail.com/business/article-canada-population-decline-third-quarter-statistics-canada/

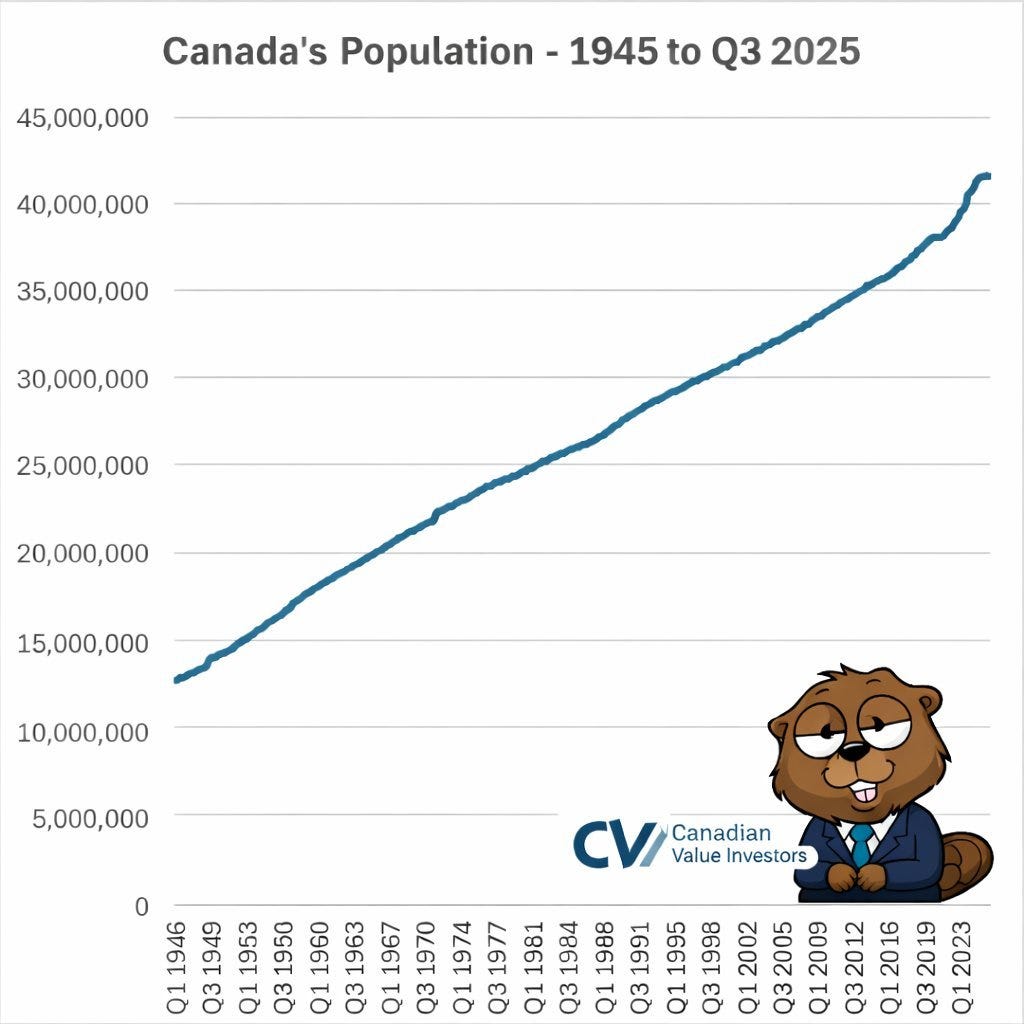

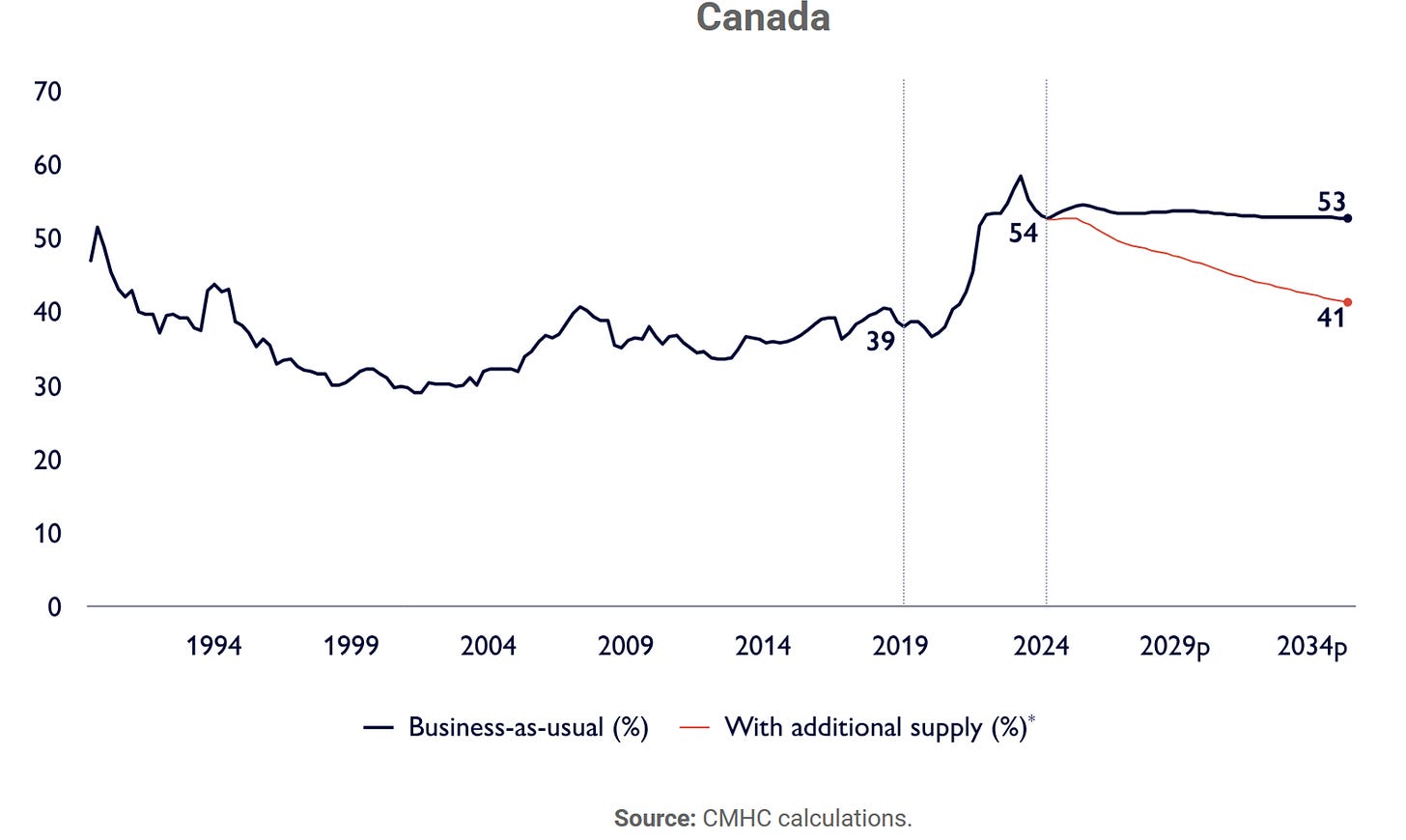

Every once in awhile we get annoyed enough to make some charts. Today is one of those days. The “record drop” is a blip and, when looking back to 1945, we have been well above trend for the last few years driven by immigration policies. We are still very short of houses. According to Canada Mortgage and Housing Corporation,

We now estimate that housing starts must nearly double to around 430,000 to 480,000 units per year until 2035 to meet projected demand. This will require action by everyone to change how we build homes.

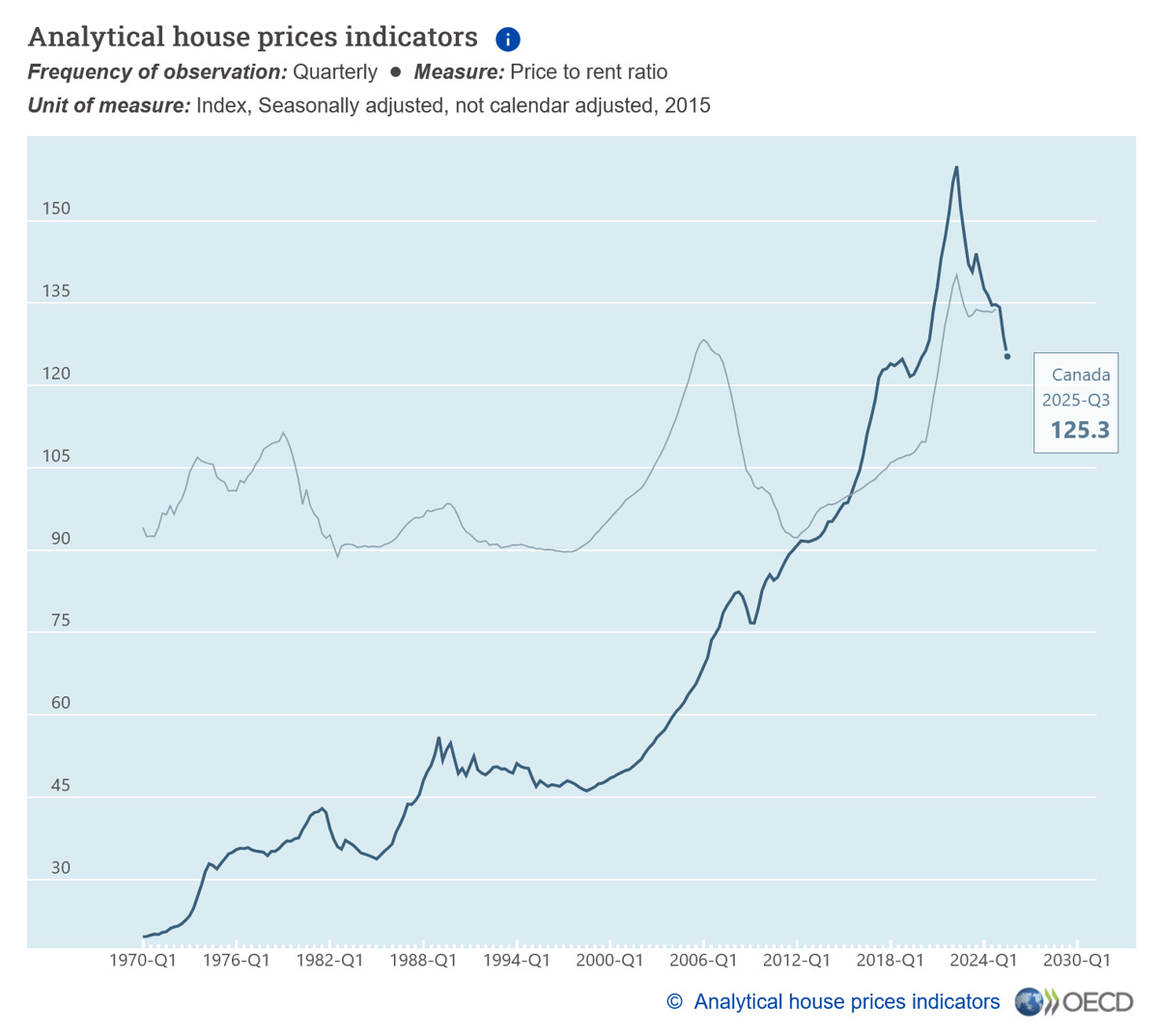

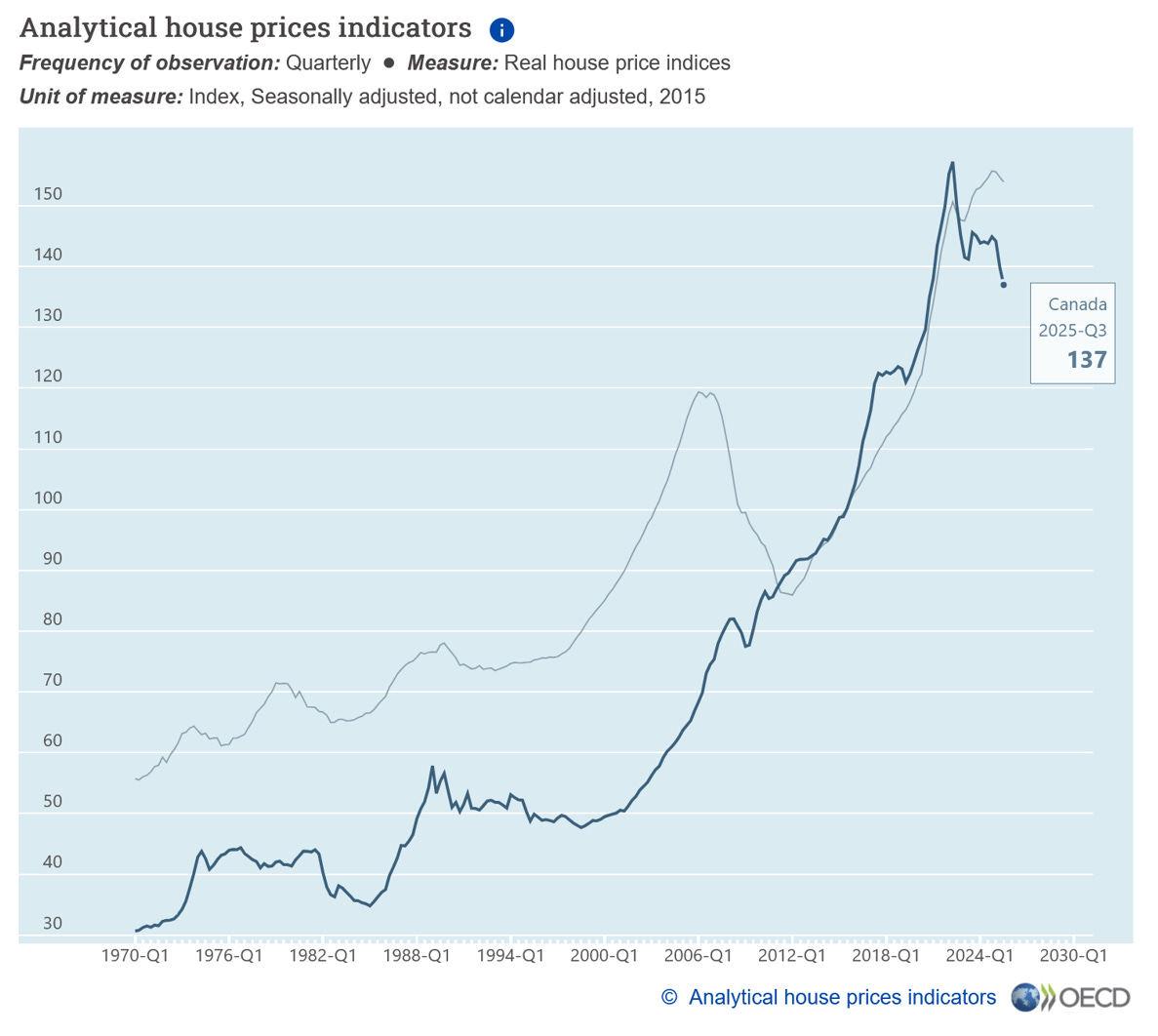

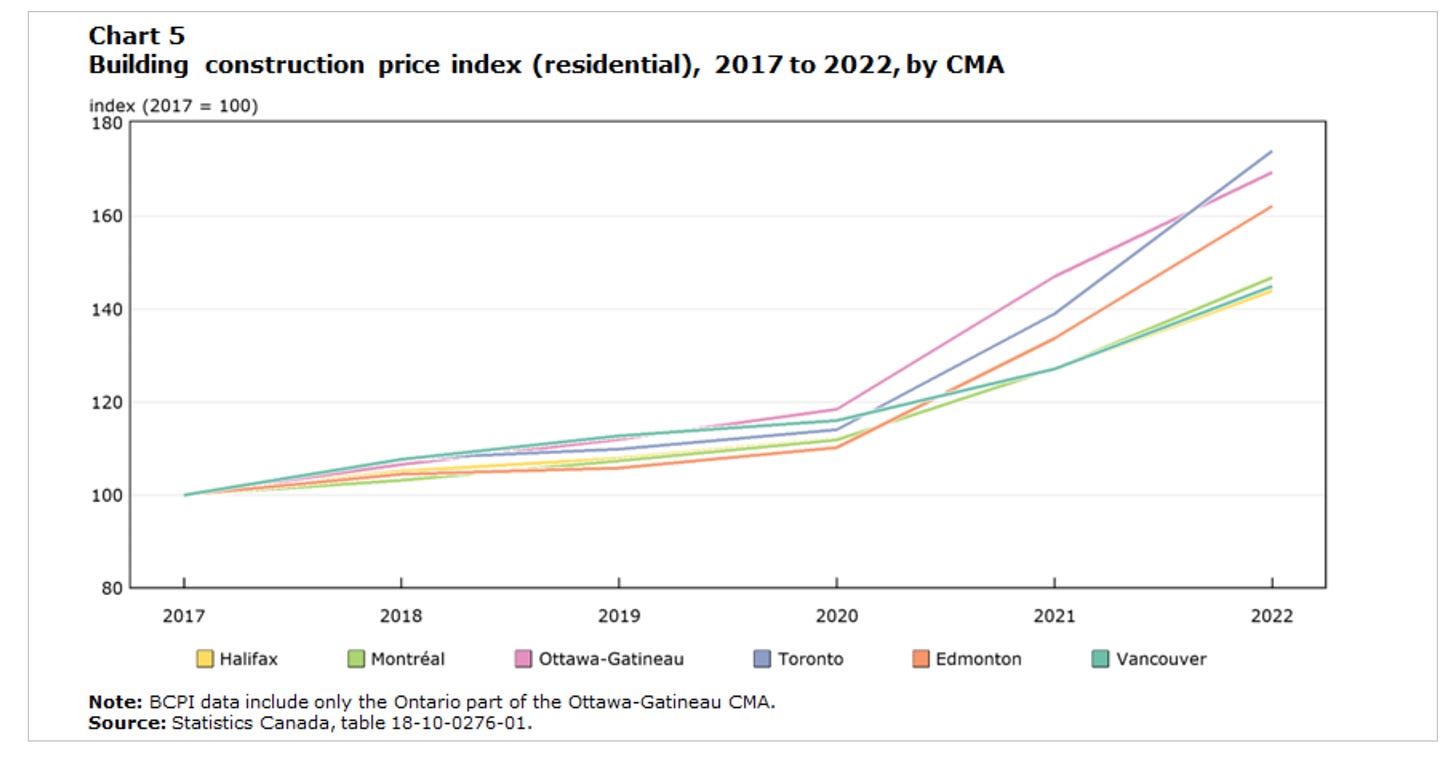

Secondly, affordability remains a major challenge, with OECD charts telling the story. According to Statistics Canada, construction costs in some markets have increased by over 70% since 2017.

Sources: Statistics Canada, OECD

Housing Starts

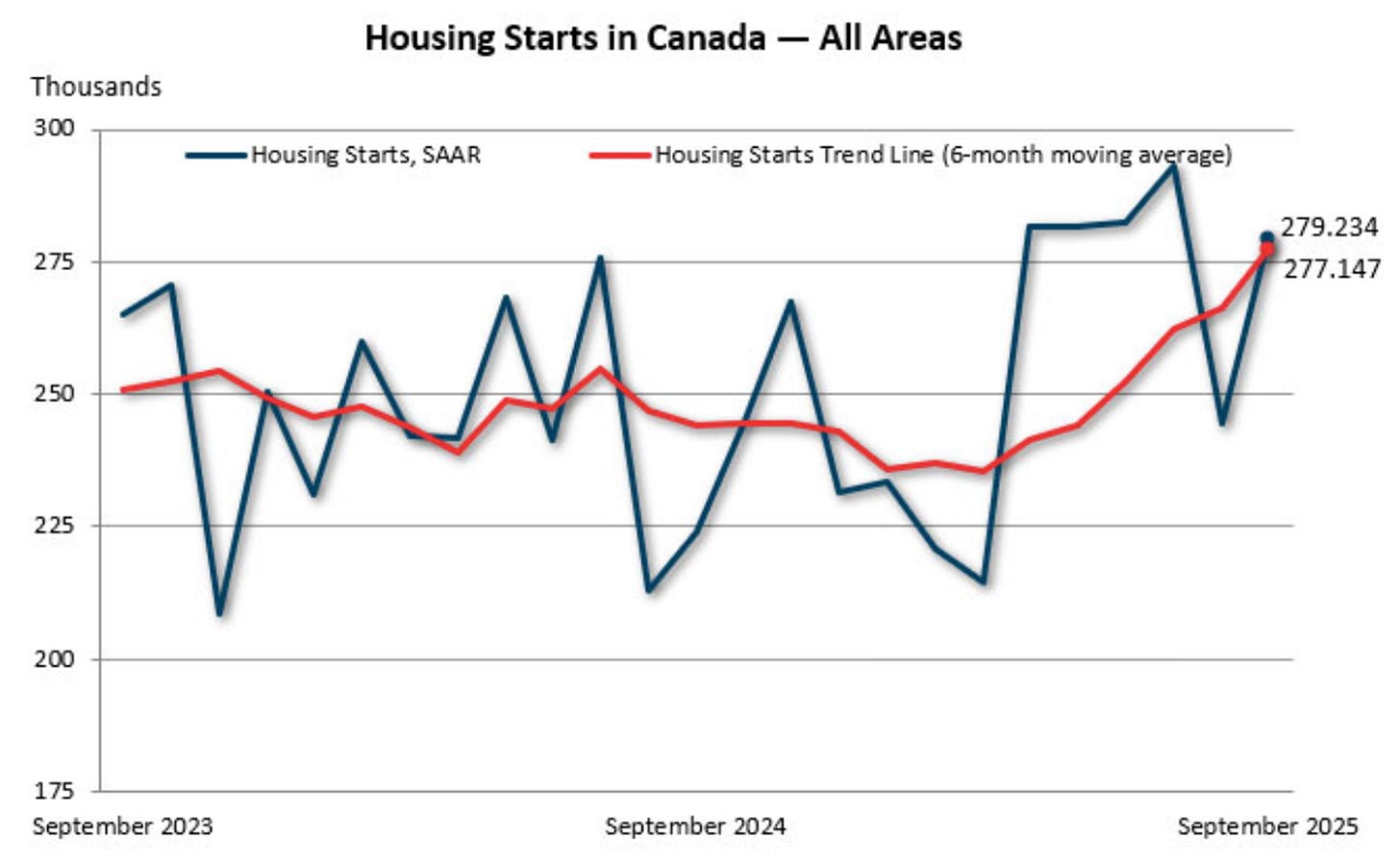

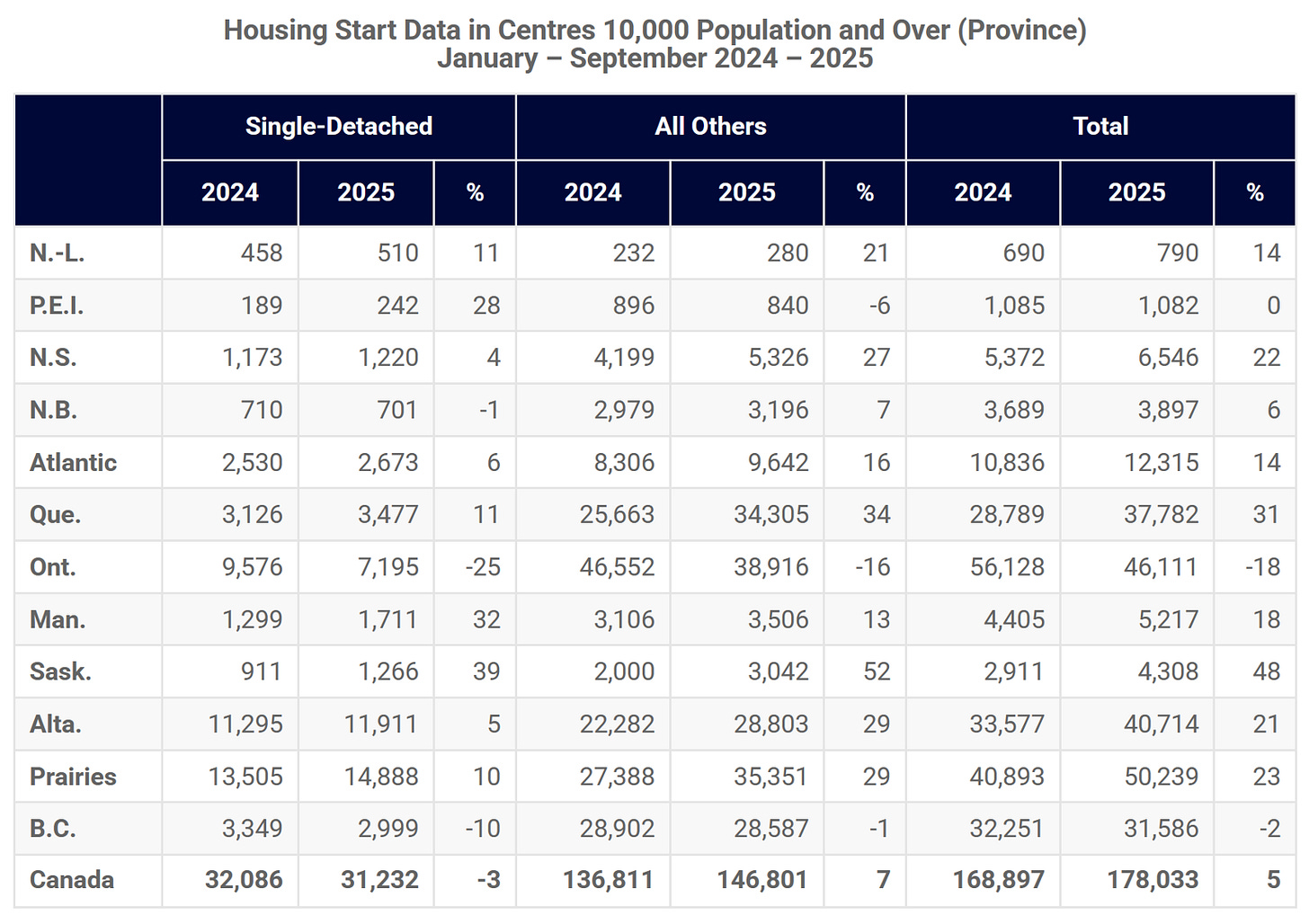

With this backdrop, housing starts in Canada increased 5% year-over-year in 2025 to 259,000 units. Atlas has also noted that quoting activity has improved over the last few quarters.

We should note that the national headline number does not tell you the full story. Canada is not one housing market and truss mills actually serve micro-markets (typically what can be covered within a day’s drive given transportation costs). Ontario and B.C. remain weak, and even this oversimplifies.

https://www.cmhc-schl.gc.ca/media-newsroom/news-releases/2025/housing-starts-september-2025

In the background, the key political parties view housing as key parts of their platform. For example, the Liberals recently announced their Build Canada Homes program. Ironically, announcements so far have likely hurt housing starts as builders delay projects, awaiting details on the nature of any support. https://www.pm.gc.ca/en/news/news-releases/2025/09/14/prime-minister-carney-launches-build-canada-homes

We are highly skeptical of these plans, but do not view any of this potential as being priced in. And it just might happen.

Here is additional background reading on understanding housing supply: https://www150.statcan.gc.ca/n1/pub/46-28-0001/2023001/article/00003-eng.htm

The AEP Business Model

They aim to have a “decentralized corporate structure with regional hubs supported by a lean parent office to provide the most effective means of managing a geographically diverse operation.” What this means in practice is each facility is given significant operational autonomy to execute, but is also benchmarked against others, while aspects like accounting, finance, benefits, procurement, and IT are centralized. Buying power kicks in.

The core thesis is to grow and lower costs through scaling via acquisitions and automation.

Acquisition History

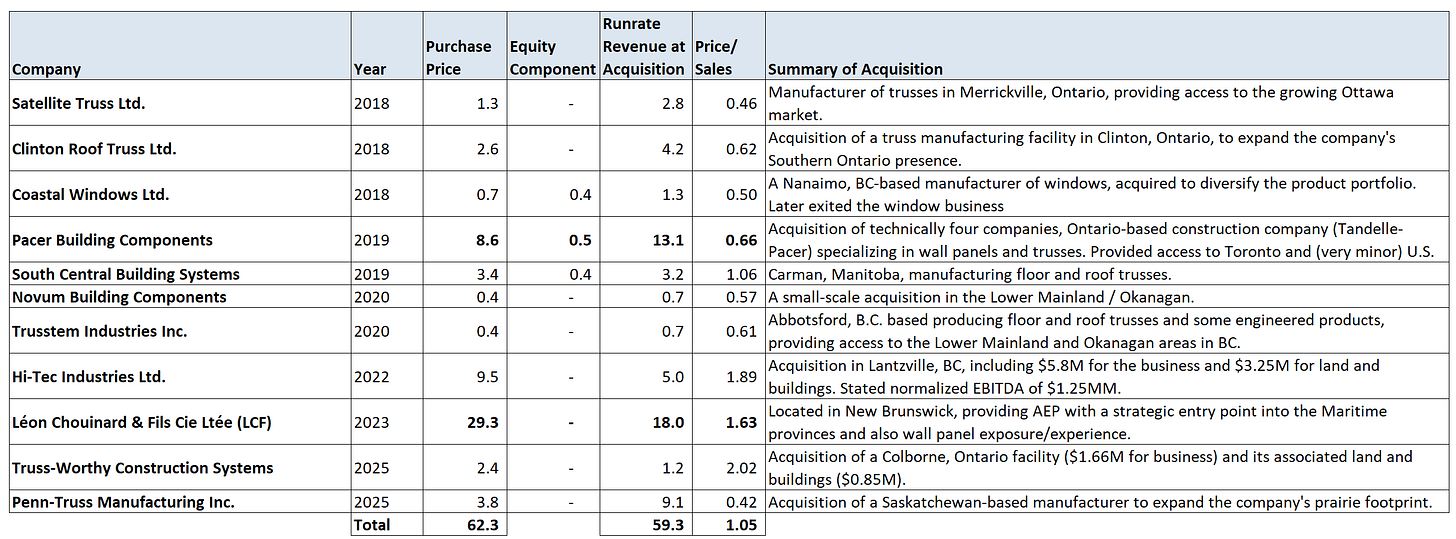

Their strategy has been quite thoughtful, focusing on concentrating facilities in less competitive markets. They take on one to two acquisitions a year, though interestingly 2024 was quiet as sellers likely wanted to be priced off of COVID sales and margins while they were digesting LCF and capex spend was ramping up. They have been able to make acquisitions at very low EBITDA multiples. LCF was a major acquisition, albeit coincided with a challenging market nationally. This has hid high utilization of these assets.

In general, they have largely been successful, with the odd acquisition failure being their venture into windows.

As of February 2021, the Company no longer manufactured windows. Atlas Building Systems Ltd. (“ABS”) (formally Coastal Windows Ltd.) has transitioned to wall panel manufacturing which is more aligned with the Company’s core products in the wood products industry. The window production equipment and inventory has been transitioned to assets held for sale at their carrying value. The carrying value at the time of transition was $94,078 in production equipment and $170,209 in inventory.

Overall, this provides some comfort that management is focused and will pivot when something does not work.

Automation and the Big Bet on Clinton

The second piece to Atlas’ plan is automation. They have been investing in automation for years, such as using saws like these. However, this latest push is different.