Aliababa NYSE:BABA – Hitting the Great Wall of China, Todd Combs, and ideas from around the world

Tickers BABA, TOY, LSXMA, HIBB, FIH

Here is the latest from Canadian Value Investors!

-Ideas from around the world

-Todd Combs of Berkshire Hathaway - “Keep your head down”

-Petrobras Update: Things chug along

-Alibaba – Hitting the Wall of China

Ideas from around the world

Overlooked Alpha – Paw Patrol owned by Spin Master Corp TSX:TOY

Disclosure: No position at time of posting.

Those out there with kids obsessed with Paw Patrol might be surprised to learn that the show is a Canadian success story. “Ten years after its release, PAW Patrol remains one of the most popular children’s shows in the world. Yet shares of its producer, Spin Master, are actually negative over the past five years.”

Clark Street - Liberty SiriusXM Group: Tracking Stock, Merging with SIRI http://clarkstreetvalue.blogspot.com/2024/01/liberty-siriusxm-group-tracking-stock.html

Disclosure: We own LSXMA.

“In December, Liberty Media reached an agreement to formally split-off their stake and merge it back with SIRI, creating a simplified one-class share structure at the satellite radio provider… Using the current share prices, the spread is approximately 44.1%.

Add planet microcap interview company. Did advertising in store.

John Hempton and Value Investing Substack - Hibbett NASDAQ:HIBB

Disclosure: No position at time of posting.

“The company has been well managed for decades and has over the decades grown and repurchased shares. Between 2001 and 2020 the share count roughly halved and revenue went up five-fold. Even after all this it remained a relatively small business and with a market capitalization below half of a billion dollars.”

and

Value Investors Club (free account required) - Fairfax India TSX:FIH; a note on Bangalore airport value

Disclosure: We own this one. See our article: https://canadianvalueinvestors.substack.com/p/fairfax-india-holdings-corp-tsxfih

https://www.valueinvestorsclub.com/idea/FAIRFAX_INDIA_HLDGS_CORP/5333839892/messages/214113

Todd Combs of Berkshire Hathaway - “Keep your head down”

If you just keep your head down and focus on the process, things will work out.

Big swings that didn’t work? 29:50 You absolutely get things wrong. If you try and be perfect… If you think you are batting 1000 you are probably wrong. Secondly, you need to think about your opportunity cost and what you are missing.

I think of things in concentric circles. I knew banking and insurance. You don’t jump to technology. He moved into industrials like Cat and Harley. If you can understand their finance arm their industrial arm is generally easier. He grew concentric circles from there.

You try to avoid path dependencies. People almost always overestimate their abilities and the complexity of a task. Say someone thinks something has a 90% chance. When you break it down into its parts, say there’s 20, and each part has a 90% chance of failure you are now well below 50% chance of success. This approach has helped him to mostly avoid huge mistakes.

Petrobras PBR Update: Things chug along

Disclosure: We are still long this one at time of posting.

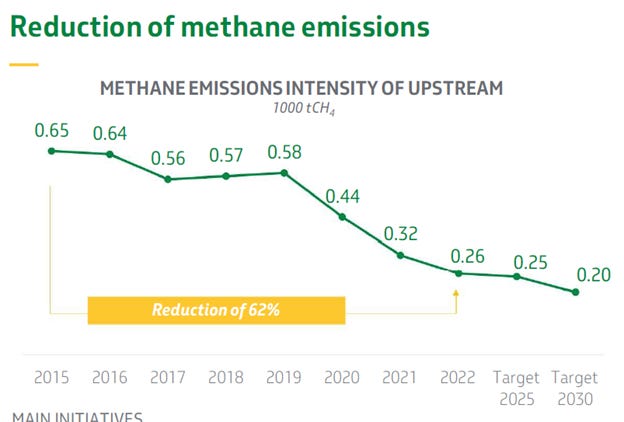

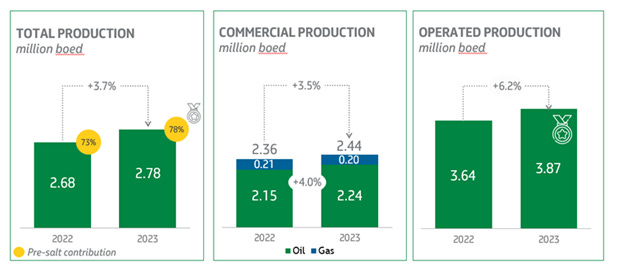

As we come up to the anniversary of our first post of Petrobras last February, we thought it was time for an update. Things continue to chug along and it remains our largest hold (specifically, PBR.A). Highest production ever with growing reserves. Emission intensity dropping. Leverage just fine. The new five-year plan that seems OK, and Goldman Sachs upgraded it to a buy last summer (they are a bit more cautious than us).

The stock price has had a nice run (and 20%+ in dividends), but it has not really gone anywhere if you take a longer-term view, driven by lower multiples across the board on every metric we have checked. We guess the cashflow is just not worth what it used to be.

Petrobras informs that, in 2023, it reached total oil and natural gas production of 2.78 MMboed, 3.7% higher than the production recorded in 2022. Commercial production of oil and natural gas was 2.44 MMboed and oil production 2.24 MMbpd. These results exceeded our Strategic Plan 23-27 guidances and were in line with the production forecast revised in November 2023, within the range of ± 2.0%.

As a highlight of 2023, the company achieved an annual record of total own production of oil and natural gas in the pre-salt, with 2.17 MMboed, surpassing the previous record of 1.97 MM boed in 2022 and representing 78% of our total production.

A detail for those that look at oil and gas reserves reporting: “Petrobras also estimates reserves according to the ANP/SPE (National Agency of Petroleum, Natural Gas and Biofuels / Society of Petroleum Engineers) definitions. As of December 31, 2023, the proved reserves according to these definitions reached 11.1 billion barrels of oil equivalent (boe). The differences between the reserves estimated by ANP/SPE definitions and those estimated using SEC regulation are mainly due to different economic assumptions and the possibility of considering as reserves the volumes expected to be produced beyond the concession contract expiration date in fields in Brazil according to ANP reserves regulation.”

Alibaba (NYSE:BABA) – Hitting the wall of China