Here’s the idea - #1 Take your existing team that already invests in India, #2 Start a new company, focused on India that combines your money and a bunch more public money, #3 Scale to more profits.

Prem Watsa - sometimes referred to as the Canadian Warren Buffet - is the interesting character who founded Toronto-based Fairfax Financial. He has quite the following, to the point of one of the larger value investing forums is named in admiration of Warren Buffett and him - www.cornerofberkshireandfairfax.ca

Now we won’t get caught up in the Fairfax history (side note: It’s quite an amazing story but sometimes their investments are a bit too macro for us). Today we’re focused on Fairfax India Holdings Corp (“FIH” or “Fairfax India”). Over the past year the stock, along with the Indian market in general, has taken quite a dip. And of course we here at CVI like dips (but prefer panics).

A Bit of Background

Fairfax India initially went public in 2015 as a US$1 billion IPO at US$10 (less fees of $0.50 for net $9.50 to the entity). Per the IPO prospectus, Fairfax’s initially investment was US$300M. The entity is guided by a few rules, namely it must own a minimum of 6 projects, with up to 20% in an individual project (up to 2 @ 25% each). Also, the maximum amount of leverage that the Company may employ at any time will not exceed the greater of 50% of its Total Assets and 100% of the Net Asset Value of the Company (currently about $545.8M of debt vs $2.57 billion of assets or ~21% of Total Assets).

Fairfax India Investment Strategy

As we cover in Value Investing 101 (http://www.canadianvalueinvestors.com/value-investing-101/) we believe that you need to concentrate your investments into your best ideas to have a chance at beating the overall market, otherwise might as well be in an index fund.

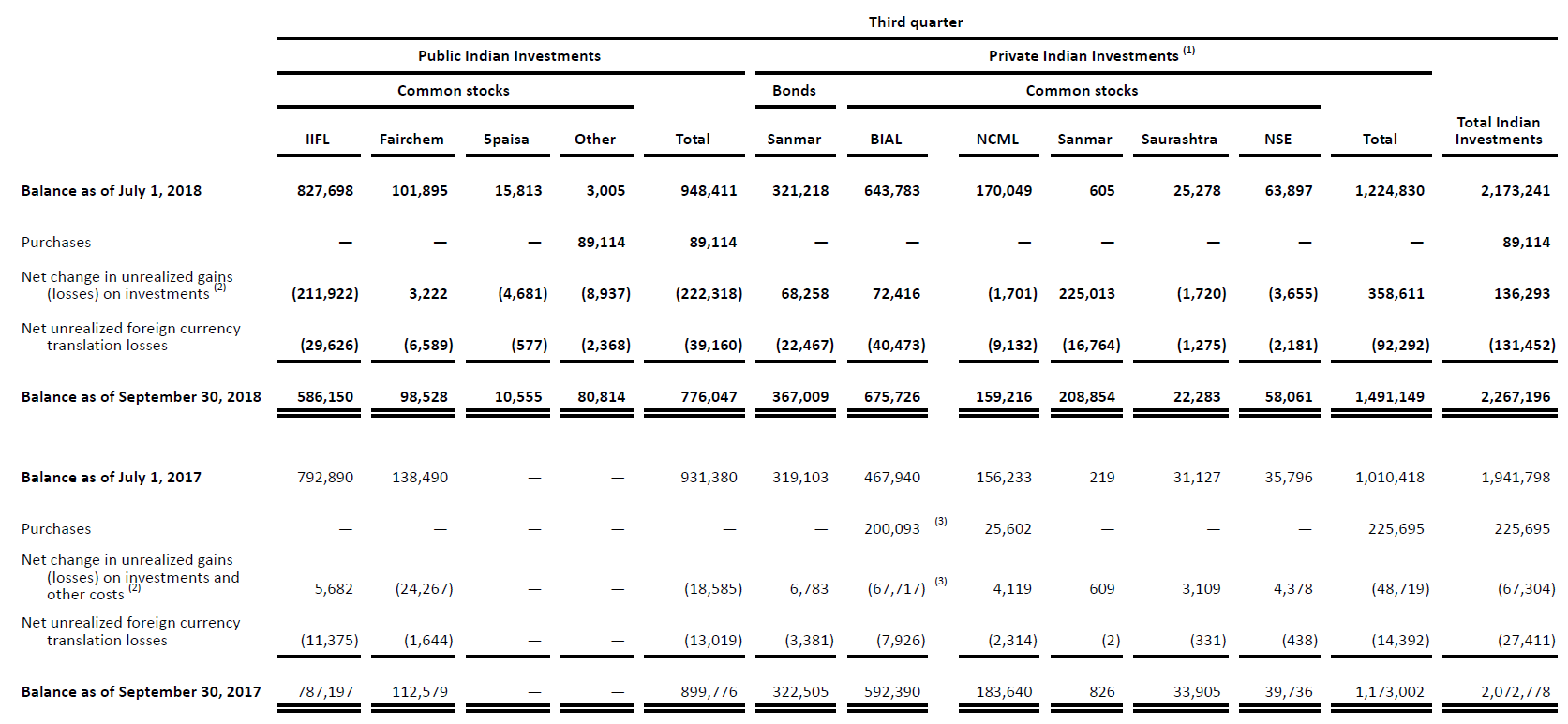

They are completely focused on India and take concentrating seriously. As per their Q3 2018 report just 9 ideas make of 96% of their investments.

The portfolio of investments is an interesting mix of companies and situations, where their ownership in the actual company is typically high as well. For example, they own 26.5% of IIFL Holdings Limited. This is a publicly traded financial services company that is in the middle of a plan to split into three separate entities (a plan hatched after they acquired their share), splitting into a loans/mortgage business, a wealth management business, and an investment brokerage/banking business.

An interesting example of their investing approach is their private investment in the Bangalore International Airport Limited, which operates the International Airport Bengaluru. The airport is the first greenfield public-private airport partnership project in India, being developed under a concession agreement with the Indian government that last until 2038 (with the right to extend another 30 years). It is not just a simple airport. It has a massive expansion plan (see this article: https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/bangalore-airports-second-runway-to-be-operational-next-year-bial/articleshow/63701017.cms ) but the agreement also included an option for significant additional value via large grants of land around the airport that is earmarked to be developed later into offices, entertainment and hotels.

Fairfax’s actual purchase strategy is interesting too. In 2017 Fairfax purchased 48% of the airport for US$585.6 million via three separate transactions, and then purchased an additional 6% in 2018 when they took out Siemens Project Ventures GmbH for US$67.391 million. They effectively picked away at a diverse syndicate that owned the airport to become the majority owner.

Performance To Date

From the IPO to 2017 the compound annual growth rate in the book value per share was 13.5%.

However, you need to go back past the IPO to get a better feel for the management team, where most have been involved with Fairfax for a long time. For example, the CEO of Fairfax India is Chandran Ratnaswami who has been there since 1993.

As per the IPO Prospectus (on SEDAR):

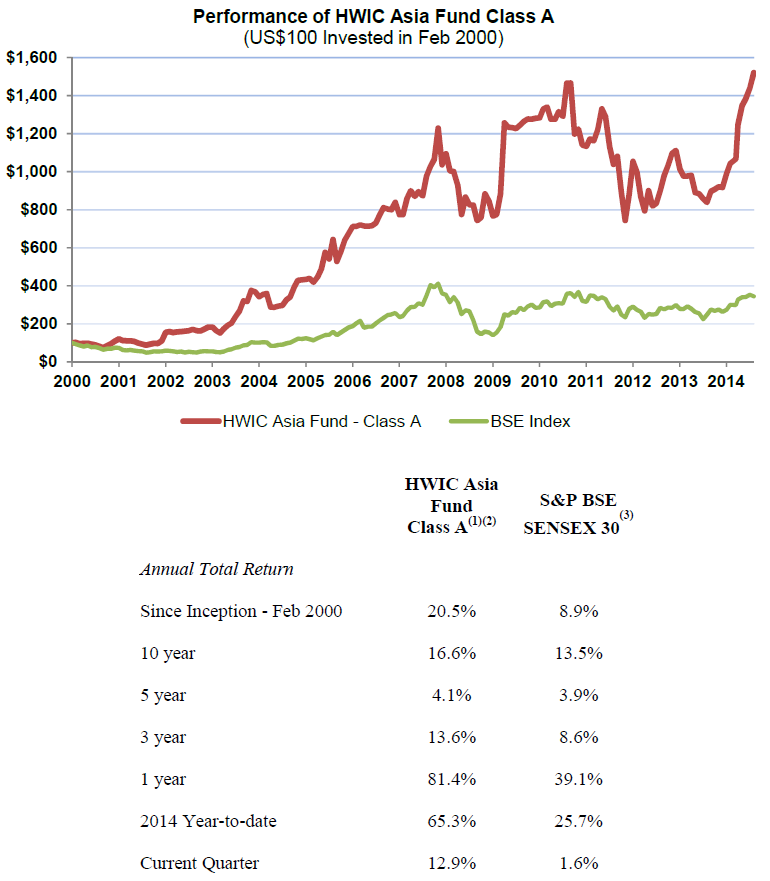

The Investment Manager - As at September 30, 2014, the Portfolio Advisor managed in excess of US$680 million of Indian investments for Fairfax through various classes of HWIC Asia Fund, including HWIC Asia Fund Class A which had assets under management of approximately US$130 million, approximately US$100 million of which were invested in Indian investments. The only investors in the HWIC Asia Fund are affiliates of Fairfax.

Here’s their pre-FIH performance…. Where a 20% compounded return since inception is not too shabby (to us anyway).

Ownership and Fund Manager

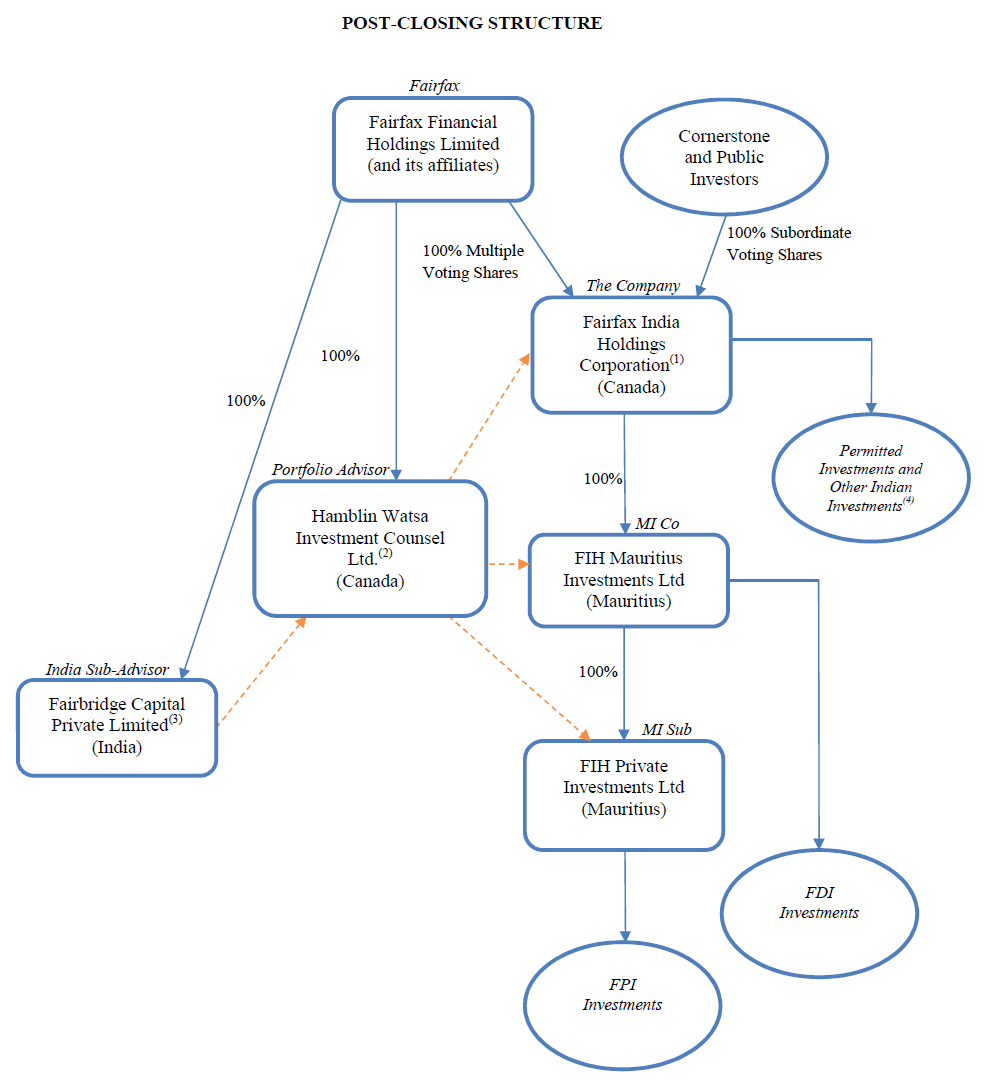

To be clear this is a Fairfax show and you’re just along for the ride:

At September 30, 2018 Fairfax, through its subsidiaries, owned 30,000,000 multiple voting shares and 21,558,422 subordinate voting shares of Fairfax India. Fairfax India’s subordinate voting shares trade on the Toronto Stock Exchange ("TSX") under the symbol FIH.U. The multiple voting shares of the company are not traded. At September 30, 2018 Fairfax's holdings of multiple and subordinate voting share represented 93.7% of the voting rights and 33.5% of the equity interest in Fairfax India (December 31, 2017 - 93.6% and 30.2% respectively).

Now, for those that like org charts here is the IPO post-closing structure.

The “Investment Advisor”

· Investment ideas not exclusive - The investment advisory and portfolio administration services of the Portfolio Advisor and Fairfax are not exclusive and nothing in the Investment Advisory Agreement will prevent the Portfolio Advisor, Fairfax or any of their affiliates from providing similar investment advisory or portfolio administration services to other clients, including Fairfax and its affiliates or other investment entities (whether or not their investment objective, strategies and policies are similar to those of the Company) or from engaging in other activities.

o Insurance first to Fairfax - the Company will agree that any investment opportunities with respect to Indian insurance and reinsurance businesses will be first offered to Fairfax.

· The Portfolio Advisor uses the services of Fairbridge, as a sub-advisor, to assist the Portfolio Advisor in sourcing and advising. Per the IPO Prospectus: “Since 2011, as sub-advisor to the Portfolio Advisor, Fairbridge has played an active role in the sourcing of and advising with respect to several investments in India, including Thomas Cook India, IKYA and Sterling Resorts.”

Advisor Compensation

The performance fee is pretty straightforward – the managers get 1) a Management Fee of 1.5% of Net Asset Value of the Company less the fair value of Undeployed Capital and 0.5% of Undeployed Capital (equity capital not invested in Indian Investments). 2) A Performance Fee of 20% of return over Hurdle Rate (~5% p.a.) subject to a non-resetable High Water Mark; calculated and paid at end of consecutive three year periods.

How they can game

One thing that is worth watching closely is the growth rates and discount rates they use to value their private investments. Management by definition has to make assumptions about the value of a given private investment, and these estimates are subjective by nature. Given that their value drives management compensation there is a natural agency issue, where a manager hoping to buy their partner a Tesla or two for Christmas might consciously or subconsciously use more generous assumptions. This is very important to watch over time as managers change and if the proportion of private investments remains high or grows (private investments are currently ~65% of NAV).

Here’s an example of their assumptions on the Bangalore airport investment:

At September 30, 2018 the company estimated the fair value of its investment in BIAL [Bangalore Airport] using a discounted cash flow analysis based on multi-year free cash flow projections with assumed after-tax discount rates ranging from 11.1% to 12.5% and a long term growth rate of 3.5% (December 31, 2017 - 10.4% to 11.7% and 3.0%, respectively) for BIAL's two business units and the estimated fair value of the monetizable leasehold land (approximately 460 acres) based on third party valuations with an assumed 20.0% discount factor (December 31, 2017 - 20.0%) for the leasehold nature of the asset.

Net Asset Value

The dive in the stock is due to 1) the decline in the stock prices of their public holdings and the Indian market in general and 2) the decline of the Indian Rupee vs the U.S. Dollar.

For example. IIFL has had quite a painful second-half of 2018...

This is a book value stock, i.e. the important questions are how quickly can they grow book value and at what price can you get the current investments at. At Q3 2018, their Net Asset Value per share was approximately US$13.16 (assets minus debt on the balance sheet, so the drop in the stock is actually tracking their stated book value pretty well.

It is an interesting way to invest in India using value investing and concentrated investing principles, as frankly it is a terribly hard market to invest in yourself. Never mind the cultural and accounting differences; It took Guy Spier (of Aquamarine Capital fame) two full years to just open up a trading account. But India is a very fascinating country where they have a very young population in the midst of the government taking a more business-friendly/less wasteful approach to managing their economy, led by Prime Minister Narenda Modi. That said, you have to ask yourself: 1) Do you want to be invested in this market, and 2) Do you want to have Fairfax managing your “Indian portfolio” and taking a cut?

Food for Thought

As a next step, here’s an interesting interview of Guy Spier and Mohnish Pabrai where they talk about how they see India as a place to invest. https://www.valuewalk.com/2018/12/value-investors-mohnish-pabrai-and-guy-spier/

If you are seriously thinking about this your should also go through the IPO documents, which have a lot of background on the overall strategy and thinking behind the IPO. These can be found on SEDAR. https://sedar.com/search/search_form_pc_en.htm