Happy holidays from the Canadian Value Investors Team!

As the year draws to a close, we reflect on the incredible investing journey we've shared with all of you. Your support and lively engagement have been the cornerstones of our success. It's been a year of forging new relationships, sparking meaningful conversations, and sharing joyful investing moments.

Let’s take a stroll down memory lane. We covered a lot of interesting situations like:

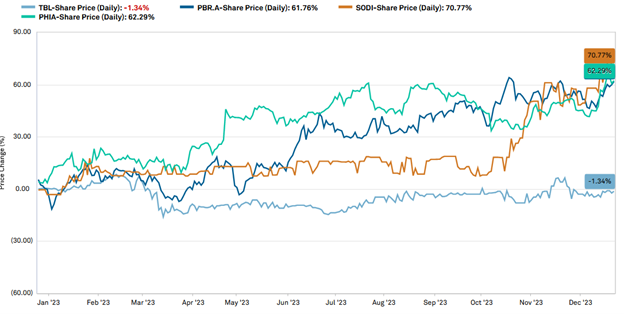

PHG (Jan 8): Our analysis "Is Koninklijke Philips a wonderful Christmas gift, or a lump of coal?" hit the bullseye, as PHG shares turned out to be gold.

Petrobras PBR.A (Feb 13): The portfolio shift from MEG to PBR.A, covered in "Petrobras – Thinking about Pricing Political Risk," paid off brilliantly.

Solitron SODI (June 22): In "Solitron Devices: Is Tim Eriksen building a baby Berkshire?", it seems like he just might.

We also covered companies like SENEA, ACIC, ATVI (cheers to the Federal Trade Commission!) and had enough odd lot trades throughout the year to generously fill our Christmas stockings.

Of course, not every venture was smooth sailing and not all news was great. Taiga Building Products presented a tumultuous journey that ended up yielding a negative -1.34% return before dividends and positive 6% only after the surprise November dividend. We also spent time navigating through macroeconomic stories like FRC and banking sector turbulence, when there were much simpler paths to investing success. As Buffett says, in investing “you don't get any extra points for the fact that something's very hard to do.” Sadly, this year we bid farewell to legendary investors Charlie Munger and Sam Zell, whose wisdom and spirit continue to inspire us.

As we look towards 2024, our spirits are high and our goals ambitious. We're on the hunt for the next tenbagger with all of you, fueled by optimism and value investing principles.

In the words of Charlie Munger, “spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day—if you live long enough—like most people, you will get out of life what you deserve.”

Here’s to a prosperous 2024!

Happy Holidays!

Fairfax India Holdings Corp (TSX:FIH) – A journey through India on coattails: 2023 Update

Here is the latest from Canadian Value Investors!

A framework for spotting value traps – Eagle Point Capital

Odd lot trade – DCBO $500 upside

Fairfax India Holdings Corp (TSX:FIH) – A journey through India on coattails: 2023 Update

What’s up in India anyway?

A Framework for Spotting Value Traps

https://eaglepointcapital.substack.com/p/spotting-value-traps-the-anti-compounders

Beware of value traps. How to avoid them? Here’s a case study from Eagle Point.

I like to look at ten year increments and add up how much cash came into a business from all sources - operating cash flow, debt issuance, and share issuance - versus how much cash left the business via debt repayments, share repurchases, and dividends. Add the two together and you get the dollar amount of cash retained (from all sources) over that time period.

Next, we look at the cumulative profits over the same time period to get an idea what the reinvestment rate is as a percentage of total operating profits. Finally, by looking at the change in operating profits (often this requires some normalization) over the time period and dividing by total retained profits we can assess incremental returns on retained capital (incremental ROIC or I-ROIC). If profits grew by $1B and it took $5B of retained capital to generate that extra $1B, I-ROIC is 20% ($1B/$5B). Reinvestment rate and I-ROIC, in conjunction with shareholder yield, tell me roughly how the business has compounded in value on a per share basis.

…

The point I’m making is, by assessing the economic fundamentals of a business whose stock may look cheap, you can implement guard rails as to whether or not you may be looking at a value trap. I’m skeptical of any stock that looks cheap but has flunked the cash-in, cash-out test over a many-year period. This filter at least gives us some hope of not fooling ourselves when we are enamored only by a cheap purchase price.

Odd Lot Trade – Docebo Inc. DCBO ~$500 upside

Disclosure: We own this one.

The Company announced a $100MM share repurchase with odd lot provisions. Holders of 99 shares or less will receive full payout while other holders could be pro-rated. At current share price of ~US$50 and tender price of US$55 represents a return of ~US$500 in a few weeks, easily covering the Canadian Value Investors membership. High risk, including risk that terms will change or offer will not be completed; talk to your own financial advisor. IBKR tender election shown below.

Fairfax India Holdings Corp (TSX:FIH) – A Journey Through India on Coattails: 2023 Update

Disclosure: We have a small position in FIH.

We are fascinated by the change and growth that is happening in India. But, unfortunately, the domestic stock market is largely off limits to foreign investors (see “What’s up in India anyway?” below). What if you combined a public investment vehicle available to North American investors and concentrated investing in thoughtful long-term investments (our favorite approach)?

Prem Watsa - sometimes referred to as the Canadian Warren Buffet - is the interesting character who founded Toronto-based Fairfax Financial. He has quite the following, to the point of one of the larger value investing forums is named in admiration of Warren Buffett and him - www.cornerofberkshireandfairfax.ca Now we do not want to get caught up in the Fairfax history (side note: It’s quite an amazing story but sometimes their investments are a bit too macro for us). Instead, we are focused on Fairfax India Holdings Corp (“FIH” or “Fairfax India”). Since we last looked at FIH in 2018, a lot has changed. It caught our attention again as it was trading below book value (and what is book value anyway?) while key underlying businesses seem to be growing and improving.

This is the Fairfax idea: #1 Take your existing team that already invests in India, #2 Start a new company, focused on India that combines your money and a bunch more public money, #3 Scale to more profits. Now, Fairfax India is still trading below book value and buying back shares. How have they been doing, and is this the time to invest in India?

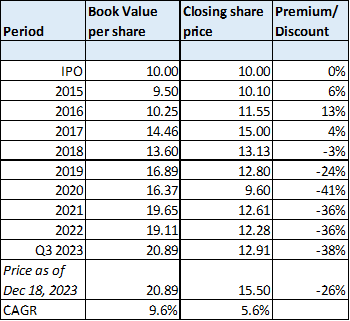

Fairfax India initially went public in 2015 as a US$1 billion IPO at US$10 (less fees of $0.50 for net $9.50 to the entity). Per the IPO prospectus, Fairfax’s initial investment was US$300M. Performance to-date has been a reasonable 10% IRR in book value in U.S. dollar terms (all of their reporting is in U.S. dollars). What’s in the portfolio?

Fairfax India Investment Portfolio

As we cover in Value Investing 101 (http://www.canadianvalueinvestors.com/value-investing-101/) we believe that you need to concentrate your investments into your best ideas to have a chance at beating the overall market, otherwise you might as well be in an index fund.

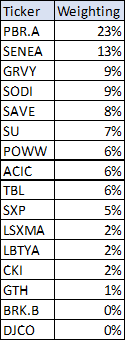

They are completely focused on India and take concentrating seriously. The portfolio of investments is an interesting mix of private and public investments, and their ownership in the actual company is typically high as well. Since we last looked in 2018, several new investments have cropped up while a few have grown in both size and ownership, most importantly the Bangalore airport BIAL. As of Q3 2023, their portfolio is as follows, with their top four investments making up almost 80% of fair value.

Investments - Bangalore Airport BIAL

Watsa with Modi at the airport.

The best example of their investing approach is their private investment in the Bangalore International Airport Limited (“BIAL”), which operates the Kempegowda International Airport Bengaluru ("KIAB") through a public-private partnership. The airport is the first greenfield public-private airport partnership project in India, being developed under a concession agreement with the Indian government that last until 2068 (extended from the original 2038). It is not just a simple airport. It has a massive expansion plan (see this article for 2018: https://economictimes.indiatimes.com/industry/transportation/airlines-/-aviation/bangalore-airports-second-runway-to-be-operational-next-year-bial/articleshow/63701017.cms ) but the agreement also included an option for significant additional value via large grants of land around the airport that is earmarked to be developed later into offices, entertainment and hotels.

Fairfax’s actual purchase strategy is interesting too. In 2017 Fairfax purchased 48% of the airport for US$585.6 million via three separate transactions, and then purchased an additional 6% in 2018 when they took out Siemens Project Ventures GmbH for US$67.391 million, and today own 57%. They effectively picked away at a diverse syndicate that owned the airport to become the majority owner.

For context, “the airport handled domestic passenger traffic of 24.4 million and international passenger traffic of 3.3 million in the first nine months of 2023, representing year over year growth of 46% and 57% respectively.” The Calgary airport is handling ~18 million or so passengers a year. https://www.yyc.com/en-us/media/factsfigures/passengerstatistics.aspx

When we see world class airports we always think of Calgary’s LINK shuttle system, which is still boasted as the first of its kind in the world, and - to the surprise of only the creators of it - it remains the only one in the world. #innovate

When we see world class airports we always think of Calgary’s LINK shuttle system, which is still boasted as the first of its kind in the world, and - to the surprise of only the creators of it - it remains the only one in the world. #innovate

Other investments continue to grow as well. Over the last ten years Fairchem’s sales “have grown on average 20% per year, net earnings have grown on average 25% per year, and the average annual ROE was around 23%.” After Fairchem’s demerger from Privi Speciality Chemicals, Fairfax India owned a 67% stake in Fairchem for an investment since inception of $37.5 million. In November 2021, Fairfax India sold 14% of Fairchem for $45.6 million, recouping more than its entire investment while still owning 53% of Fairchem, valued at $111.1 million on December 31, 2022.

Key KPIs for key holdings shown below.

IIFL is a financing company that offers home loans, gold loans, loans against property, digital loans and microfinance, in addition to its non-core segments of loans for construction and real estate finance and capital market finance.

IIFL Securities is a publicly traded independent full-service retail and institutional brokerage, along with being a leading investment advisory firm providing diversified financial services and products such as financial planning, equity, commodities and currency broking (both cash and derivatives), depository participant services, investment banking, portfolio management as well as distribution of mutual funds, bonds and other products.

CSB Bank is a full-service bank offering retail banking, non-resident Indian banking services, small-to-medium enterprise and wholesale banking services through 649 branches and 512 automated teller machines across India.

Fairchem Organics manufactures oleochemicals used in the paints, inks and adhesives industries, as well as intermediate neutraceutical and health products.

Performance To Date: What is “fair value”?

Two key related issues with Fairfax India are the issues inherent with fair value estimates and the fee structure. Specifically, you are reliant on assumptions of the fair value of their private investments, which make up the majority of the value (albeit decreasing over time), and their fees are driven by these assumptions. Management by definition has to make assumptions about the value of a given private investment, and these estimates are subjective by nature. For example, here is how the airport assumptions work.

At September 30, 2023 the company estimated the fair value of its investment in BIAL using a discounted cash flow analysis for its three business units based on multi-year free cash flow forecasts with assumed after-tax discount rates ranging from 12.6% to 16.5% and a long term growth rate of 3.5% (December 31, 2022 - 12.4% to 16.1%, and 3.5%, respectively). At September 30, 2023 free cash flow forecasts were based on EBITDA estimates derived from financial information for three business units prepared in the second quarter of 2023 (December 31, 2022 - second quarter of 2022 for two business units and fourth quarter of 2022 for one business unit) by BIAL's management.

…

BIAL is an infrastructure investment that is currently in a period of capital expansion, and as a result a significant amount of its fair value is driven by expected growth in passenger traffic in the later years of the forecasting period once various capital projects are complete. BIAL's aeronautical revenues are primarily driven by UDFs charged to airlines and passengers, which are set by the Airports Economic Regulatory Authority of India ("AERA") in five-year control periods and are fixed in a manner to generate a 16.0% per annum return on invested equity for the airport operator. As the tariff setting mechanism adjusts for periods of underperformance, it is expected that underachievement in aeronautical revenues will be substantially recovered through, among other factors, higher UDFs in future control periods.

These assumptions matter because of the performance fee, which is substantial. “The performance fee is accrued quarterly and is calculated, on a cumulative basis, as 20% of any increase (including distributions) in book value per share (before factoring in the impact of the performance fee for the current calculation period) above a 5% per annum increase less any performance fees settled in prior calculation periods.”

Are book value assumptions relatively consistent over time? Yes, they appear to be, and this is good. Changing discount rates is a simple way to game an evaluation. But, at the end of the day generous assumptions would catch up to management.

Secondly, since we looked at them in 2018 they have successfully monetized several investments and several are publicly listed (see portfolio value in NAV discussion below). The track record actually precedes the IPO as well as shown in the second table below… not too shabby (to us anyway). The track record actually precedes the IPO as well as shown in the second table below… not too shabby (to us anyway).

Finally, most of this issue would get resolved if they IPO their Anchorage entity, which holds the airport investment, and (if completed) the proportion of the publicly listed investments in Fairfax India would increase from ~40% to ~80%.

Ownership and Fund Manager

To be clear this is a Fairfax show and you are just along for the ride:

At September 30, 2023 Fairfax, through its subsidiaries, owned 30,000,000 multiple voting shares (December 31, 2022 - 30,000,000) and owned and/or exercised control or direction over 28,504,470 subordinate voting shares (December 31, 2022 - 28,504,470) of Fairfax India. At September 30, 2023 Fairfax's aggregate ownership, control and/or direction of the subordinate voting shares and multiple voting shares represented a 95.2% voting interest and a 43.1% equity interest (December 31, 2022 - 95.0% and 42.3%) in Fairfax India.

Growing NAV per Share

One conundrum is that it has consistently traded below book value for the past several years. The spread was particularly large earlier this year, but recently closed part of the gap with the recent run-up. Management also believes that it is trading below intrinsic value and has repurchased ~11% of shares outstanding since 2018/19. Also, with a larger part of their portfolio now being ownership of publicly listed entities in India, you can pull out those values as shown below.

Overall, this remains the most interesting way we have found to invest in India, albeit high risk, high fees, and potential agency issues noted above. This is definitely not for everyone (and, as always, consult your own financial advisor).

What’s up in India anyway?

https://www.bloomberg.com/news/articles/2023-08-24/china-and-india-s-moon-rovers-take-different-paths-on-historic-missions After making history by becoming the first nation to successfully send a spacecraft near the moon’s south pole, India is one of only two countries with active rovers on the lunar surface.

A CFA’s Take

The Calgary CFA Society did a great interview with “Sunil Singhania, CFA, Founder of Abakkus Asset Manager LLP. Abakkus is an independent, Mumbai-based equities specialist founded in 2018. Today, Abakkus manages equity AUM of $1.6 billion USD broadly under two diversified strategies by following a fundamental, research-driven, bottom-up investment process. Sunil was previously CIO Equities of Reliance Nippon Life Asset Management overseeing $11 billion USD in equity assets and consistently rated among the top fund managers in India.” This is a good India 101 - https://cfasocietycalgary.libsyn.com/investing-in-india-with-sunil-singhania

“Modi’s “one India” goal is good for the economy, but not for politics” https://www.economist.com/leaders/2023/09/14/modis-one-india-goal-is-good-for-the-economy-but-not-for-politics

His critics say this is a power grab that will upset a delicate regional balance. Although Mr Modi dominates national politics, his Hindu-nationalist Bharatiya Janata Party (bjp) does not control any states in the more prosperous and dynamic south: in May it lost control of Karnataka, India’s tech hub.

Another podcast - Ep. 244 - Why Now is the Time to Get Exposure to Indian Equities with Gautam Baid, Founder and Managing Partner at Stellar Wealth Partners, LLC https://microcapnewsletter.substack.com/p/ep-244-why-now-is-the-time-to-get

Strattec Security – Hidden value of their JV unlocked.. now what? (Copy)

Here is the latest from Canadian Value Investors!

Wisdom of the crowds

Talking your book – what do they do?

Portfolio update

Charlie Munger’s last interview

Strattec Security – Hidden value of their JV unlocked.. now what?

Wisdom of the Crowds

[2021] Brian Feroldi https://x.com/BrianFeroldi/status/1417460154078011400?s=20

I asked, “What company is worth less than $10 billion today but you think could be worth $500+ billion in a few decades?”

I received 710 answers

It is an amazing list to have shorted in 2021. Here is a stock chart of the top 10 to-date. To be fair, they all still have a few decades to turn it around. Top ten details at the end. TLDR; a lot of money would have been lost if you held the top ten shown below.

E.g. #3: Beyond Meat - $BYND

2021 market cap: $7.9 billion

What it does: Plant-based meat

Current market cap: $0.6 billion

Talking your book – What do they do exactly?

One of our top five investing interview moments.

https://www.instagram.com/reel/C0eWdGYAJGN/

https://youtu.be/E_YIZyVzymA?si=n4HABeLsZ81-E00u

Portfolio update

Since our last update we have reduced our positions in both SU and PBR. They had a good run, but were quite overweight in a high political risk industry and declining price environment. Or, in other words, we do not want to rely on high prices for the positions to make sense. SAVE and Liberty-family holds make up our new positions. Speaking of SAVE, here is another summary of the latest - https://youtu.be/xSsHqqW9Z48?si=CYYuL8VTgImETbxS

But, maybe the recent pullback in oil is just a hiccup and things have changed. They seemed to have for coal. https://x.com/mfwarder/status/1731689434431574443

Charlie Munger’s last interview

Rest in peace Charlie.

https://youtube.com/watch?v=MOJ8pCCN6rs&si=y6lgskZWuXxFt_Jc

Strattec Security Corp NASDAQ:STRT – Hidden value of their JV unlocked.. now what?

Disclosure: We do not own this at time of publication, but are evaluating and – as always - might own in the future.

Have you ever wondered where the start button or the lift gate of your car comes from? It might be from Strattec! Back in 2021 we looked at this; it had a growing joint venture – VAST – hidden underneath their business that was probably worth something, and all together the business seemed like it might be cheap. But, we continued to worry about supply chain issues and the auto industry in general and so we passed. Fast forward to today – They have sold VAST and an activist investor - GAMCO, an investment firm founded by Mario Gabelli - has come in to unlock value. Is there something here? The following is our 2021 views followed by our view today.

What did Strattec look like in 2021?

Strattec has been a separate public company since 1995 when it was spun off from Briggs & Stratton. The Company primarily makes car door handles and locks, but more recently powered lift gates. GM recognized them for their collaboration on the powered lift gate for the Silverado - https://www.vastglobal.com/General-Motors-Honors-STRATTEC--as-Winner-of-Coveted-Supplier-Innovation-Award-_6982.aspx

The models they are supplying are quite stable with customers weighted heavily to U.S. automakers and models (see 2012 vehicles supplied vs 2021 below). They contribute to some high-volume models like the Chevrolet Silverado. https://www.caranddriver.com/news/g36005989/best-selling-cars-2021/

Here’s the recent financial performance. Note the material capex for facility expansions in both the U.S. and Mexico, and noise from pension wind up. We were concerned about how inflation would work its way through, and it did turn out to be a problem. Fixed price contracts and rising input costs put a major squeeze on financial performance. However, there has been some relief – e.g. the Company noted in Q1 FY2024 $10.8 million in revenue renegotiated pricing relief, of which $8.0 million was one-time retroactive pricing.

The Company cleaned up the tail risk of its pension plan in 2018/19.

Additionally, during the three months ended December 30, 2018, we entered into an agreement with an insurance company to purchase from us, through a series of annuity contracts, our remaining obligations under the Qualified Pension Plan and, as a result, we settled the remaining obligations under the plan for the remaining participants utilizing funds available in the Qualified Pension Plan trust. No additional cash contributions to the trust were required to settle the pension obligations. As a result of these actions, a non-cash pre-tax settlement charge of $31.9 million was recorded during fiscal 2019. A non-cash compensation expense charge of $4.2 million was also recorded during fiscal 2019 related to the future transfer of the excess assets in the Qualified Pension Plan to a STRATTEC defined contribution plan for subsequent pay-out to eligible STRATTEC employees based on a plan approved by the Board of Directors in June 2019. An additional $4.8 million non-cash compensation expense charge related to the final transfer and pay-out of the excess Qualified Pension Plan assets was recorded during our fiscal 2020. During fiscal 2020, the excess Qualified Pension Plan assets were transferred to our defined contribution plan and distributed to eligible STRATTEC employees, which completed the full termination of the Qualified Pension Plan.

What made this particularly interesting in 2021 though was the VAST joint venture, which is included in equity earnings of joint ventures.