Toys R Us – A Series Of Imprudent Events, and the Promising Story Of Its Canadian Subsidiary

Toys R Us Canada CCAA #SaveGeoffreytheGiraffe

Important documents

Sept 2017 - Proposed Monitor Report

Sept 2017 - CCAA Application Record (affidavits: pg96 Canada President Teed-Murch & pg151 US CEO Brandon)

Jan 2018 - Third Monitor Report

March 2018 - Motion for DIP Amendment

NOTE: This CCAA restructuring is ongoing. This article is current as of March 30, 2018.

“Innovate or die” might explain some retail bankruptcies, but Toys R Us is a more nuanced story of “Keep servicing US$5.3bn of debt which by the way severely impacts your ability to innovate, Maintain supplier terms during the holiday inventory buildup, Don’t have all your debt maturing in a 4-year period, and Make sure nothing bad happens to your profitable Canadian subsidiary (or die).”

The last point is least covered, and today we will be focusing on Toys "R" Us (Canada) Ltd. Toys "R" Us (Canada) Ltee (“Toys Canada” or the “Company”), the profitable Canadian subsidiary of the broader Toys R Us company.

As quick background, on September 18, 2017, Toys R US-Delaware (“Toys Delaware”, or the “Parent” company of Toys Canada) filed for debtor relief under Chapter 11 in the US. The following day on September 19, Toys Canada filed for and was granted a stay of proceedings under the Companies’ Creditors Arrangement Act (“CCAA”), with Grant Thornton acting as CCAA Monitor (“Grant Thornton” or the “Monitor”).

However, Geoffrey The Giraffe – the iconic Toys R Us mascot, for those who never had the joy of walking into a store – still has some fight left in him, as Toys Canada is seeking buyers that might keep this profitable gem running.

History and Overview of Toys R Us

Events Leading Up to CCAA/Chapter 11 Filings

In mid-2017, Toys Delaware hired a financial advisor to explore – as they say – “strategic alternatives.” It looked like financing the 2005 purchase of Toys with 80% debt wasn't the best idea in hindsight. Unable to find any suitable buyers or investors, the focus shifted to contingency planning, and in the late summer began seeking proposals for possible DIP financing.

The term “bank run” refers to a situation where a bank’s customers withdraw their money because they are worried the bank may be insolvent. This creates a liquidity drain, since banks have long-term assets such as loans which cannot be immediately repaid. How do you go bankrupt? Slowly, then all at once.

This essentially happened to Toys R Us. On September 6, 2017, news reports emerged that Toys R Us was considering a Chapter 11 filing; within the next week, 40% of its suppliers demanded cash-on-delivery (as opposed to the standard 60-day payment period, which allows for store sales to take place) in the midst of its holiday inventory buildup, which created immediate liquidity needs of US$1bn. Less than 2 weeks later, Toys R Us filed for creditor protection.

Toys Canada Business, Assets Overview

Toys Canada is headquartered in Concord, Ontario, where its primary corporate distribution centre (“Canada HQ”) is also located. As of the CCAA date, Toys Canada had ~3.8k employees, of which 635 were full-time (196 located at head office in Concord, Ontario).

The Company had 5 product categories: Baby (under 4 years), Core Toy (action figures, dolls), Entertainment (video games/electronics), Learning, and Seasonal. “Toys Canada has also developed omni-channel capabilities in recent years through the integration of its retail stores and e-commerce business to provide customers with a full range of shopping, payment and product delivery options.”

Like many other retailers, Toys Canada normally generates a significant portion of its annual revenues from the October – January holiday season (~40%) . To support these sales, the Company would typically build-up its inventory from August – November.

Although Toys Canada dealt with over 700 individual suppliers, its top 10 accounted for a significant percentage of its merchandise. Below is a breakdown of its top 10 suppliers as of the CCAA date.

Note: This was done during a quick VLOOKUP, and therefore might understate creditor exposures (due to oddly-named supplier subsidiaries and such)

~15% of its retail locations source inventory directly from its suppliers, while the remaining ~85% are sourced from its Canada HQ, and a third-party logistics provider. This logistics provider provides fulfillment services for most of Toys Canada’s E-Commerce sales.

The Company has 82 stores across Canada, and owns the land for 22 of these properties. Prior to the CCAA in July 2017, Toys Canada entered into a sale-leaseback for the Canada HQ whereby it sold the land and building for $73.4MM to a third-party.

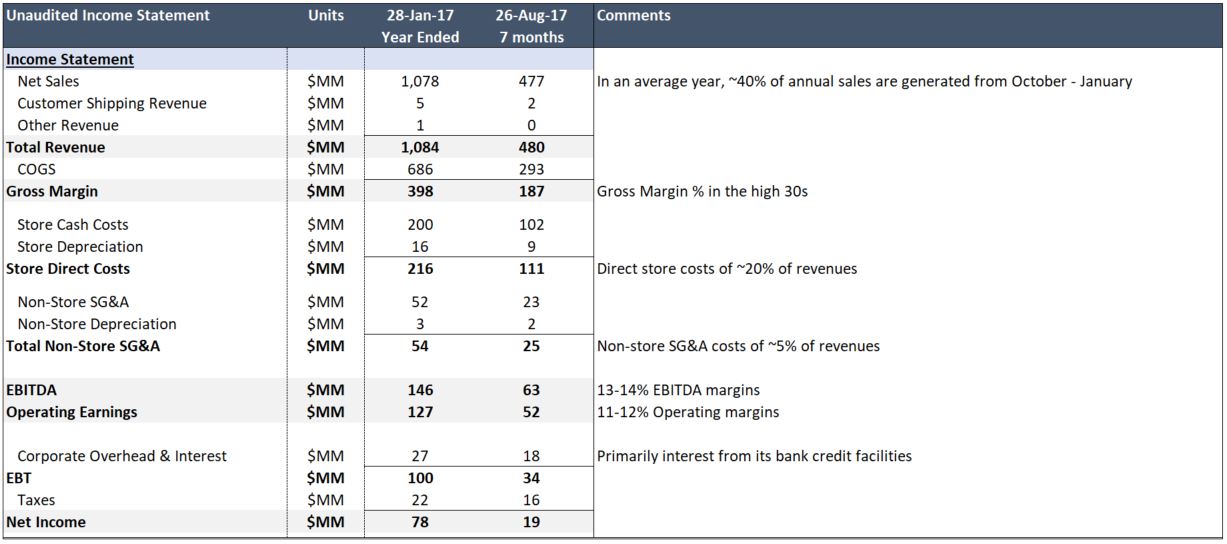

Below are Toys Canada’s unaudited (i) FY January 2017, and (ii) Trailing 7-month August 2017 financial statements.

Note: The Teed-Murch September 19 Affidavit noted Toys Canada’s 2015-2017 revenues grew at a 5% CAGR.

The first thing that stood out was Toys Canada’s profitability.

*Gasp* Yes, that is right – we said it. A brick and mortar retailer is somehow growing profits in the age of “Amazon is killing all retailers.” And not only that, it appears Toys Canada had an extremely strong holiday season while in CCAA.

Toys Canada only had $4MM of paid-in capital, and it has been off to the races since. Return on Equity is extremely high (and basically infinite when you reduce Shareholders’ Equity by the Intercompany Loans, which effectively were dividends to the Parent company).

Leverage appears to be manageable as well. A credit analyst should adjust debt for off-balance sheet operating leases, but recall that 22 of Toys Canada’s 82 locations are owned, and any unprofitable leases can be disclaimed/assigned in a CCAA. In short, it appears Toys Canada is a diamond in the rough. Actually, it is more like a diamond in an insolvent family.

Toys Canada Performance During CCAA Period

Let’s see how Toys Canada did during the critical 2017-18 holiday season. In CCAA or receiverships, the accounting focuses on cash, and therefore we have had to make some estimates and adjustments based on the information provided.

Bear with us – the below parts are a little complicated, but being bankers we simply couldn’t help but go overboard.

First, we wanted to estimate what going-concern EBITDA and Net Income would have been (ie, excluding any additional legal and professional costs related to the CCAA).

This appears to be a very strong holiday season, and it is worth repeating that September – January sales were 7.5% (+$35MM) better than initially expected at the beginning of the September 2017 CCAA process.

Additionally, Gross Margin % appears to be approximately in line with pre-CCAA, so it appears the Company has done a decent job ensuring stable supplier relationships. Other non-COGS cash costs also appear to be below the pre-CCAA run-rate, which has increased cash flows.

Second, we have tried to piece the (i) Trailing 7-month August 2017 actuals with the (ii) September 2017 – January 2018 CCAA cash receipts and disbursements.

All of this adds up to a strong FY January 2018 period, and is further evidence that Toys Canada is a valuable business.

Now to be fair, we do not know exactly what is driving Toys Canada’s anomalous profitability versus its sister companies, or other dinosaur retailers.

Perhaps their E-Commerce strategy is working (the better-than-expected holiday sales were “particularly related to e-commerce sales during the holiday retail season”), maybe Canadians have a stronger affinity towards the Toys R Us brand (#SaveGeoffreytheGiraffe), possibly they’ve garnered enough scale from its suppliers…who knows? We certainly don’t. What we do know is it’s probably worth looking into any company that generates near-infinity ROE with moderate leverage, and that Toys Canada seems to have “something to it.”

Toys Canada Supplier Treatment in CCAA

It seemed that large portion of trade payables are considered critical, and that these pre-CCAA payables were paid even if they were technically unsecured. For pre-CCAA trade payments to be made, the following criteria must be met:

- Goods/services are integral to the business, and the Company does not have sufficient inventory on hand

- Pre-filing liabilities are appropriate (ie, no disputed amounts)

- Pre-filing payment is required for the uninterrupted supply of goods/services, and the Company’s ongoing operations and ability to restructure will be impaired if it is unable to obtain the supply

- Grant Thornton approves any pre-filing claim payments

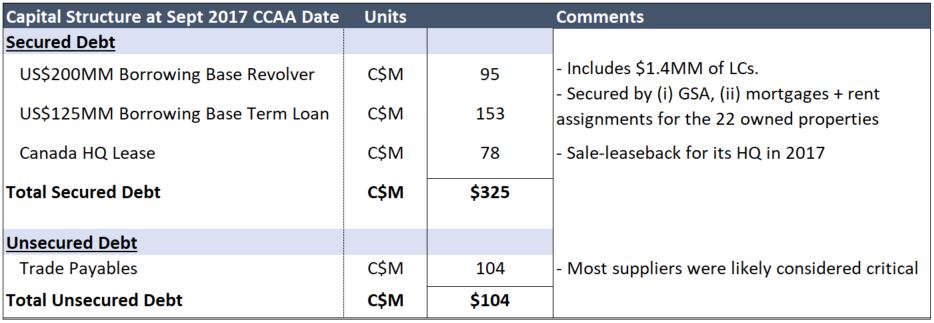

Toys Canada Capital Structure Pre-CCAA

Toys Canada’s loans were tranches under its Parent’s credit facilities. There were no other material secured obligations other than shown below.

We’d like to quickly discuss the timing of the June 2017 $72.65MM dividend payment to the Parent, and the July 2017 Canada HQ sale-leaseback which netted $73.4MM. From Jan-Aug 2017, Toys Canada extended an additional $31MM in intercompany loans to the Parent as well. As shown above, Toys Canada’s loans were secured by a GSA and mortgages over all its owned properties (presumably, the Canada HQ building was included prior to its sale).

Clearly, there weren’t proper restrictions on dividends/intercompany loans to the Parent. To be fair, it does not appear the loan agreements were changed since October 2014, but can you say “lesson learned”? Perhaps, perhaps not. Banks are run by friendly sales folks, after all. Borrower scores 1, Bank 0.

But in our humble outsider-view, Toys Canada’s pre-CCAA credit facility terms also seemed a little odd. Toys Canada was “only obligated with respect to the liabilities and obligations relating to the Canadian Loans. Toys Canada is not an obligor (whether as borrower, guarantor, or otherwise) with respect to the obligations of the U.S. Borrowers” and the “security interests and collateral granted by Toys Canada…secure only the Canadian Loans. Conversely, repayment of the Canadian Obligations is guaranteed by the U.S. Borrowers and the Facility Guarantors and secured by the security interests and collateral granted by such parties.”

We read this as saying, Toys Canada (i) was not liable for, and (ii) did not provide security for any of the other Toys R Us debt, but in turn still benefited from guarantees and security from the US subsidiaries and assets. Not a bad deal, so maybe the score is even at Borrower 1, (Canadian) Bank 1.

Nevertheless, the Toys Delaware Chapter 11 proceedings was an event of default and acceleration event, so this made all the Toys Canada credit facilities immediately due.

J.P. Morgan DIP Financing of Toys Canada

Note: As the revolver is subject to a borrowing base calculation, the whole facility amount is not actually available to the borrower

Just like in the old days, J.P. Morgan (“JPM”) came in to save the day, acting as agent to provide the syndicated DIP financing, replacing the pre-CCAA agent bank, Bank of America. JPM also provided the DIP financing for the US Chapter 11 proceedings.

The DIP loans would repay the pre-CCAA outstanding loans, and provide additional financing for the required holiday inventory build-up; this was the primary reason JPM was chosen as DIP lender.

Essentially all the other DIP proposals, which were either less than the existing debt outstanding and/or did not provide for additional funding, required priming liens on the pre-CCAA lenders’ security, which would have likely resulted in intense objections from pre-CCAA lenders (and therefore hinder and damage the likelihood of a successful restructuring).

It is worth noting the US Chapter 11 DIP Loans are secured by a 2nd-lien on (i) 65% of Toys Canada’s voting shares, and (ii) 100% of Toys Canada’s non-voting shares.

As was the case in the pre-CCAA loan, Toys Canada would continue to only be liable for its own debt, and not the rest of the Toys R Us company.

And all of this was provided at a cost “only slightly higher marginal rates than the existing” loans. What a deal! Oh right – we almost forgot! Plus $20.7MM in closing fees.

Next Steps in CCAA

A court date has been set to authorize several amendments to the Toys Canada DIP loans. As there have been “multiple non-binding offers for the acquisition of” Toys Canada, a sale seems likely, and therefore, milestones will be put in place to advance and close a transaction.

In the last Motion Record of the Applicant Returnable March 28, 2018 (this may be amended, as the court date was rescheduled to April 16, 2018), the loan amendments included:

- Lender consent for Toys Canada’s business to be sold, providing full repayment

- Purchase & Sale Agreement executed by April 30, 2018

- Court approval for the PSA by May 15, 2018, and transaction close by May 31, 2018

- Toys Canada DIP Term Loan to be fully repaid by June 30, 2018; any incremental DIP Revolver borrowings will require lender approval

How much is Toys Canada worth?

Assuming our numbers are correct, the business generated LTM EBITDA of $203MM. With current average retailer EV/EBITDA multiples of ~7-10x, this would imply a total enterprise value of $1.4 - $2bn. With total debt of ~$0.3bn, there could be a good $1bn of equity value left.

To be sure, there might be some “CCAA discount”, but there should also be some real estate value. Perhaps (similar to the July 2017 $73.4MM Canada HQ sale-leaseback) there could be a REIT-type way to unlock additional value. In 2005, a bunch of MBAs and CFAs got Toys R Us into this mess when they thought it would be a good idea to 80% debt-finance a retail company, and by golly, MBAs and CFAs today should be able to think of creative ways to unlock some real estate value. With rumours that Toys Canada may be packaged with some profitable US stores as well, there are certainly a lot of moving parts.

But it sure looks likely that Geoffrey the Giraffe will survive after all (or at least his Canadian offspring).